The Spanish economy: Recent developments and forecasts for 2017

Spanish economic growth exceeded expectations over the past two years and remains above the eurozone average. Recovery remains on track for 2017, albeit at a slower pace due to less supportive external and domestic conditions.

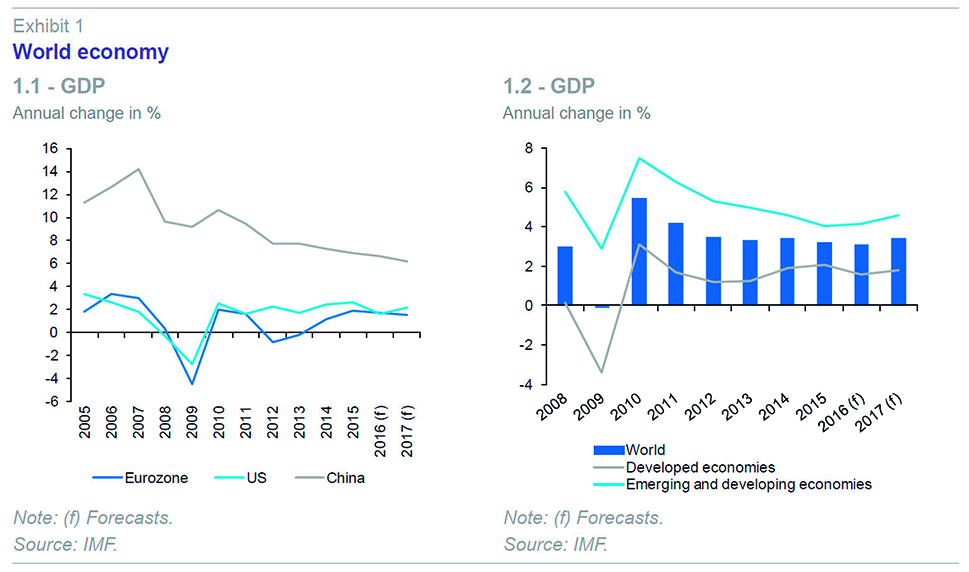

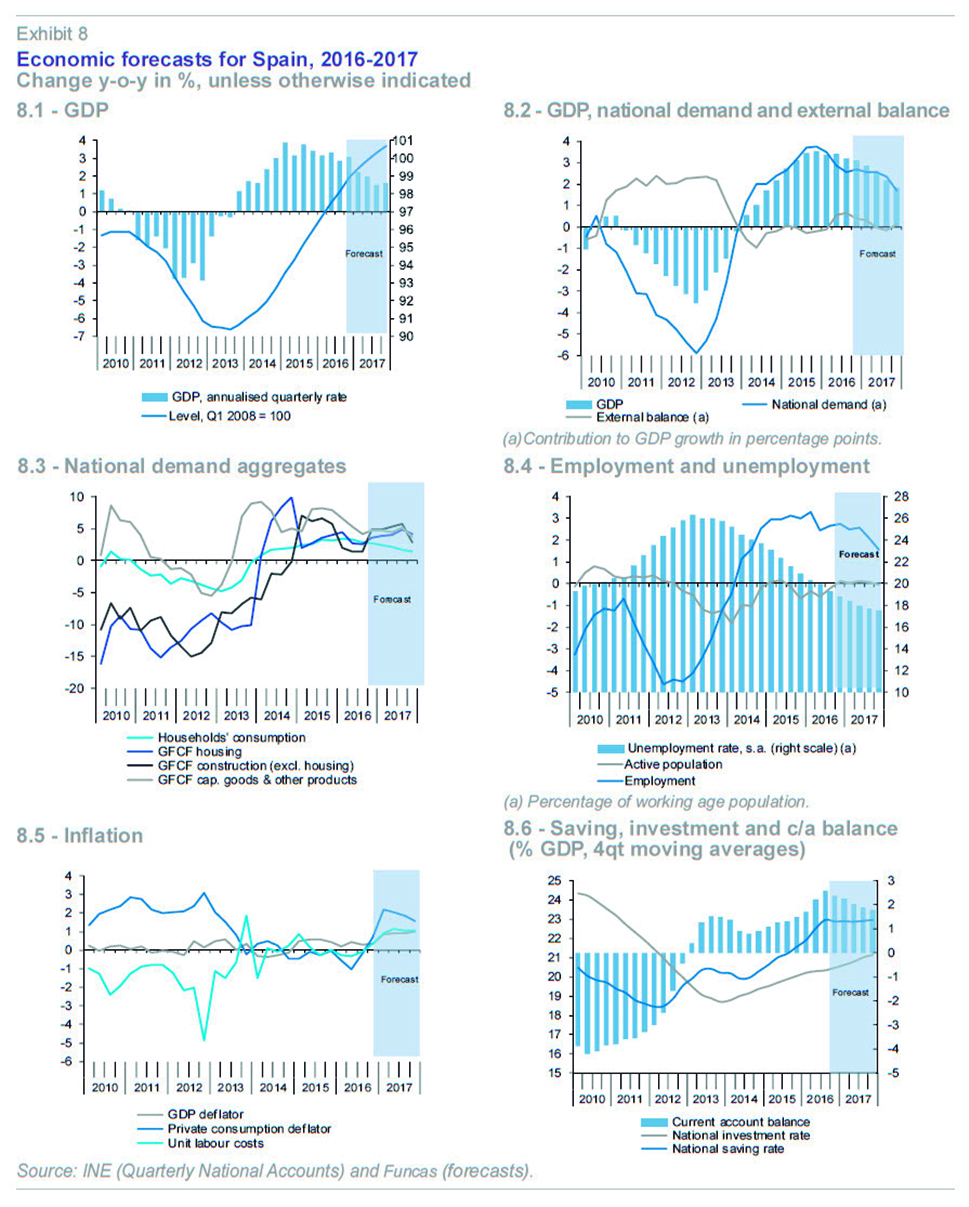

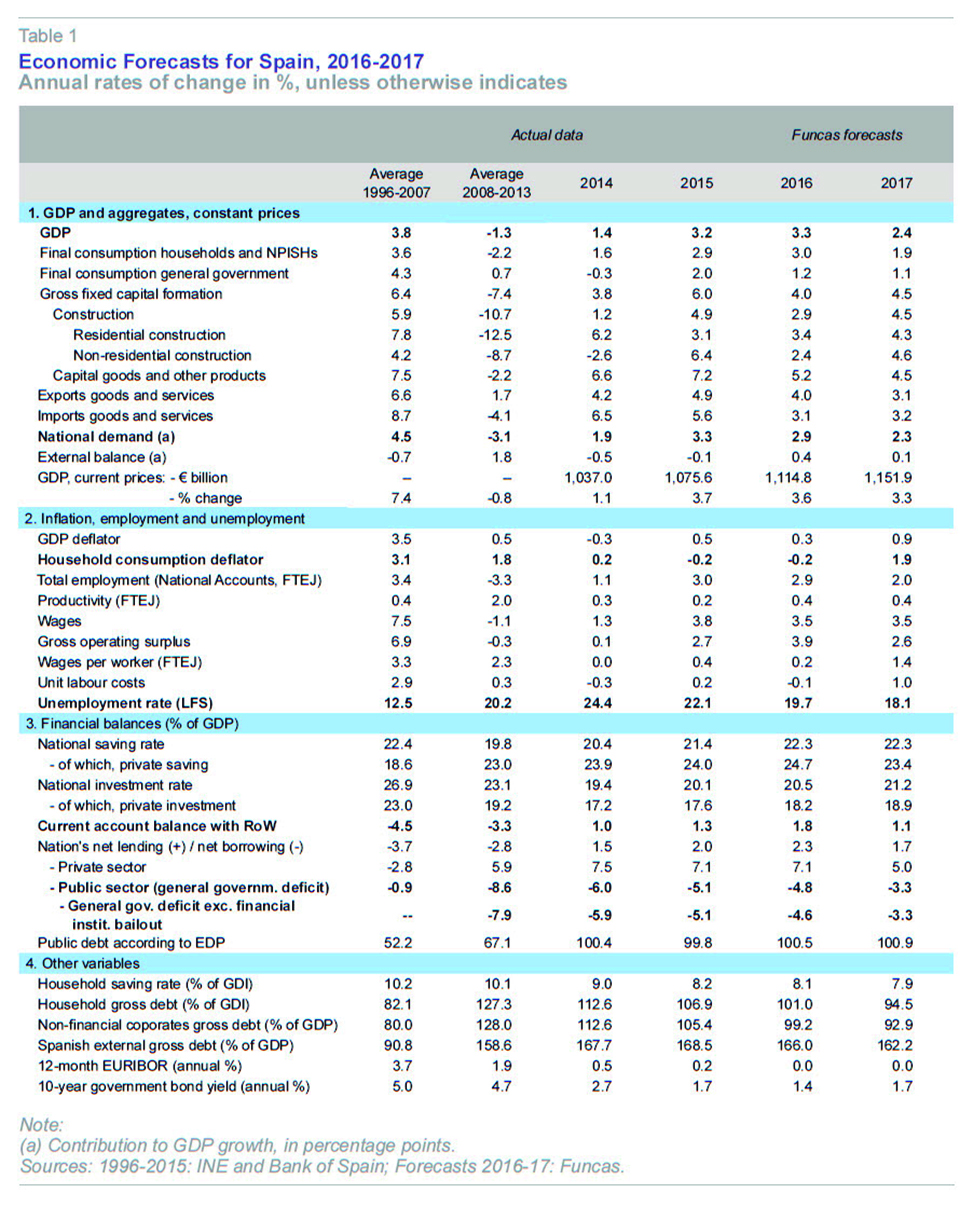

Abstract: The Spanish economy is at a turning point. Growth has exceeded 3% in the last two years, outperforming the majority of forecasts and approximately doubling average eurozone growth. In contrast to earlier recovery episodes, growth has not generated external imbalances. For 2017, most of the main pillars of the economic recovery remain in place. However, tailwinds supporting the recovery – such as tax cuts, falling oil prices, and a renewed decline in interest rates – have run out of steam and the external environment has become more uncertain. In this context, growth is expected to slow to 2.4% in 2017, slightly above the previous projection and still one percentage point above the eurozone average. Yet, unemployment and public debt will remain significantly above pre-crisis levels.

The Spanish economy in 2016

In the absence of a full set of data for the fourth quarter of 2016, the Spanish economy looks to have grown by 3.3% in 2016, 0.1 percentage points faster than the previous year. This outturn, which is the fastest amongst the main eurozone economies, has surpassed growth forecasts, which in September 2015 pointed to a slowdown in growth to 2.8%.

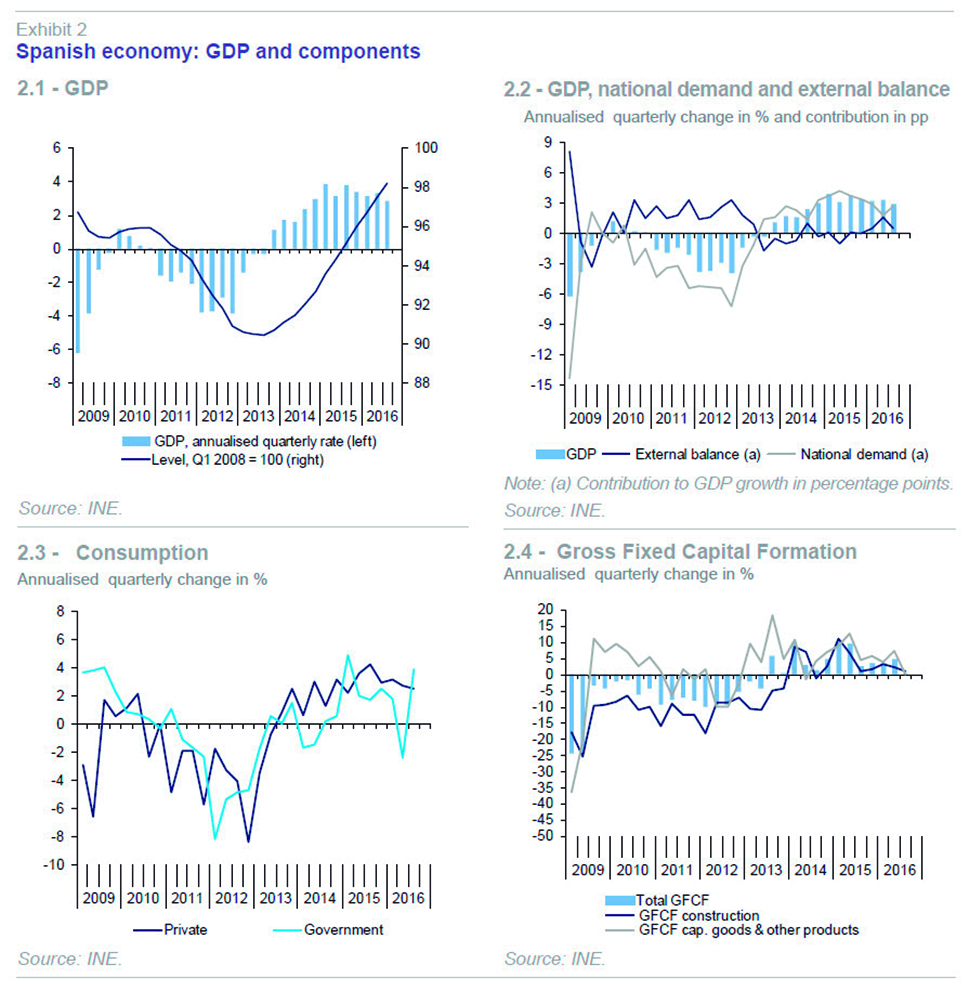

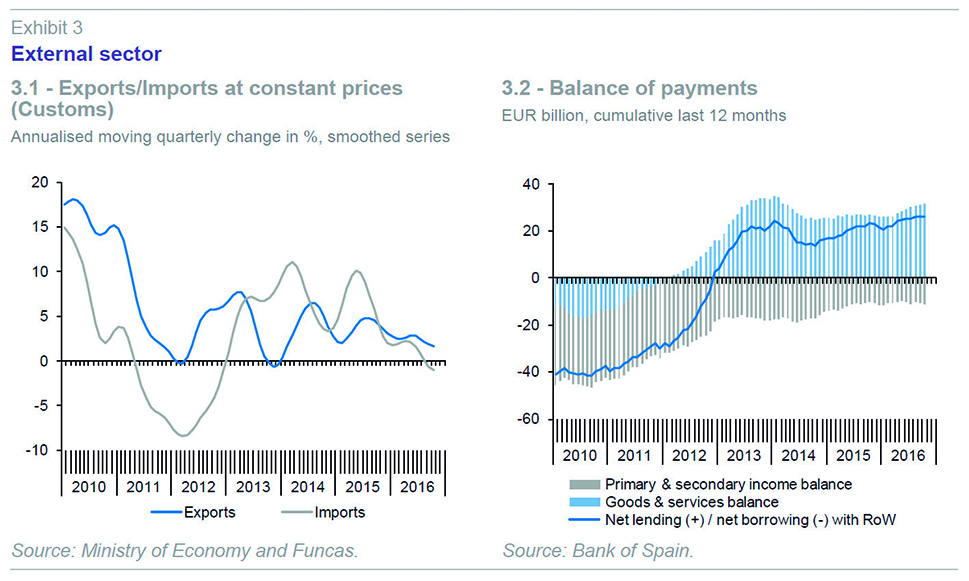

Better than expected growth is primarily the result of the strong performance of the external sector, which instead of shaving off a few tenths from growth, has contributed positively to GDP growth (Exhibit 2.2). Exports have performed well. Goods exports increased by 3.5%, in excess of growth in global trade in goods, enabling the Spanish economy to once again increase its share of global exports. But the main surprise factor has been exports of tourism services. Foreign tourist arrivals rose by 10%, the highest rate of growth since current records began in 1995. The terrorist attacks that took place in various European and Mediterranean countries influenced this exceptional result.

Nonetheless, the most important factor has been more subdued growth in imports, which has been significantly below what would be expected when applying typical domestic demand elasticities. It is still too early to make definitive conclusions, but this behaviour could be a sign that the elasticity of imports to domestic demand is reducing, which – if confirmed – would imply a significant structural change for the Spanish economy. This moderation of import growth is the main factor explaining the positive contribution from the external sector to GDP growth in 2016 (Exhibit 3.1).

According to preliminary estimates, domestic demand contributed 2.9 percentage points to growth. Private consumption accelerated slightly to around 3% (Exhibit 2.3). As was the case in the previous year, dynamic consumption growth was supported by the labour market recovery, the boost to household purchasing power from the decline in oil prices, the reduction in households’ financial burden due to lower debt levels and declining interest rates, and tax cuts.

Investment in capital goods slowed in 2016 compared to the strong rates of growth registered in the previous year (Exhibit 2.4). After four consecutive years of growth, this is the only domestic demand component that is now above pre-crisis peaks, both in nominal and real terms. Capital goods investment now accounts for 10% of GDP, one percentage point above its share in GDP in the pre-crisis expansion years. Growth in this component of domestic demand has been based on cost competitiveness gains and a recovery in business profitability rates. In regards to the latter, it is particularly worth highlighting the industrial sector, which according to the Bank of Spain’s Central Balance Sheet Data Office, stood at 8.7% during the first three quarters of 2016, representing its highest level since 2007.

Construction investment also slowed, focused on the non-residential sector and largely a reflection of the slowing in public works procurement after an increase in 2015 associated with the election cycle. By contrast, residential construction grew somewhat more strongly than in the previous year.

The manufacturing sector registered more modest rates of growth in 2016 in comparison to the previous year’s exceptional result. Even so, it was the fastest growing sector, together with market services. The overall recovery in construction GVA, which was barely noticeable in 2015, gained momentum in 2016.

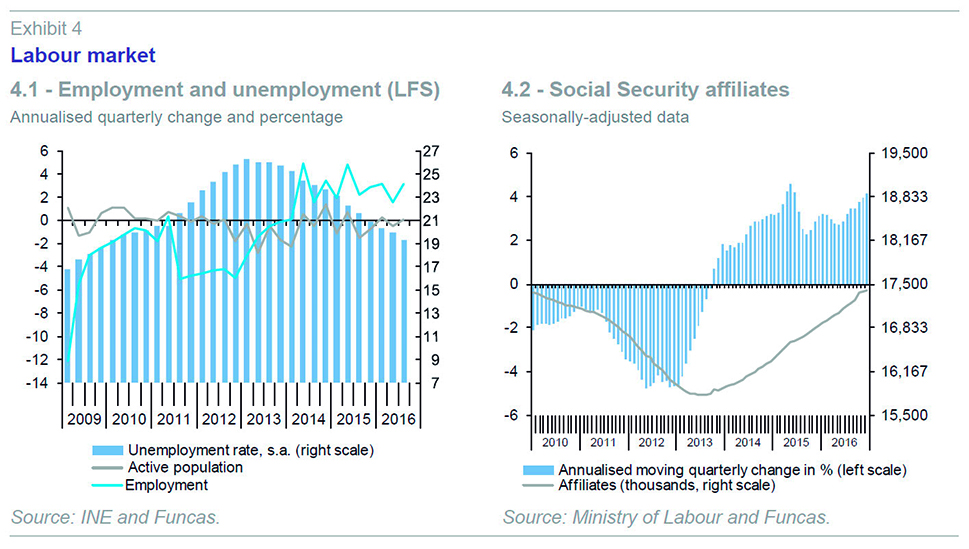

Employment growth, on a full-time equivalent basis, is estimated at around 2.9%, representing an increase in employment of around 495,000. Meanwhile the number of social security registrations increased by 3% on an average annual basis, the equivalent of 513,000 new registrations.

According to the Labour Force Survey, and applying estimates for the fourth quarter, the active population diminished for a fourth consecutive year in 2016. This is the result of a decline in the working age population, given that the activity rate was broadly unchanged compared to the previous year. The number of unemployed fell by 11%, putting the average annual unemployment rate at 19.7%, 2.4 percentage points lower than the previous year. As has been the case in previous years, 2016 saw stronger growth in temporary employment than permanent employment (Exhibits 4.1 and 4.2).

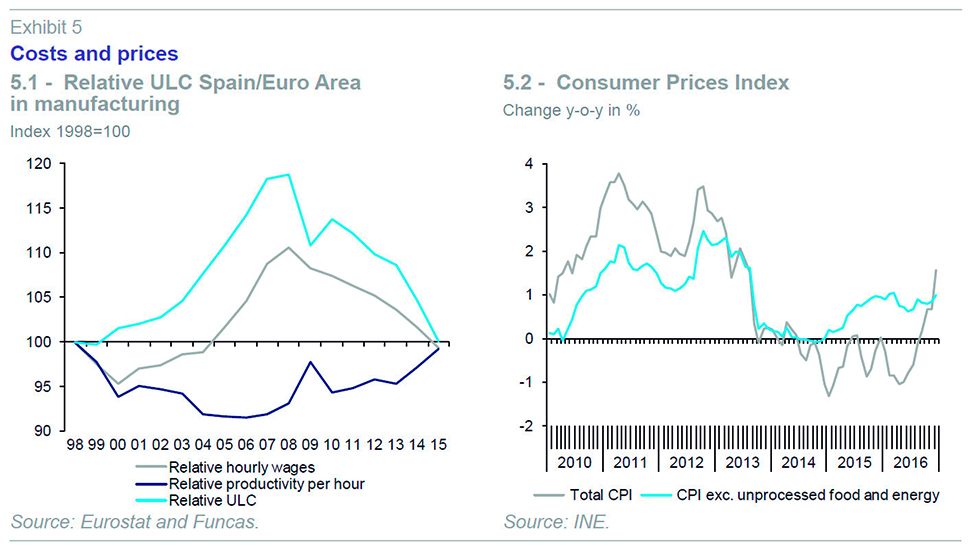

Remuneration per salary earner grew somewhat more slowly than in the previous year at 0.2% and well below the 1.1% agreed through collective bargaining. Even so, salaries did not lose purchasing power, given that consumer price inflation was negative. Growth in salary remuneration was below the increase in productivity, meaning that unit labour costs registered a small reduction, allowing the Spanish economy to continue improving its cost competitiveness (Exhibit 5.1).

Average annual inflation stood at -0.2%, in negative territory for a third consecutive year, reflecting the decline in energy prices, which in turn is a result of the fall in oil prices. Core inflation was 0.8%, above the previous year due to strong consumption and modest Euro depreciation. The last months of the year saw a sharp increase in headline inflation to 1.6% in December, due to a rise in the cost of energy prices over the period (Exhibit 5.2).

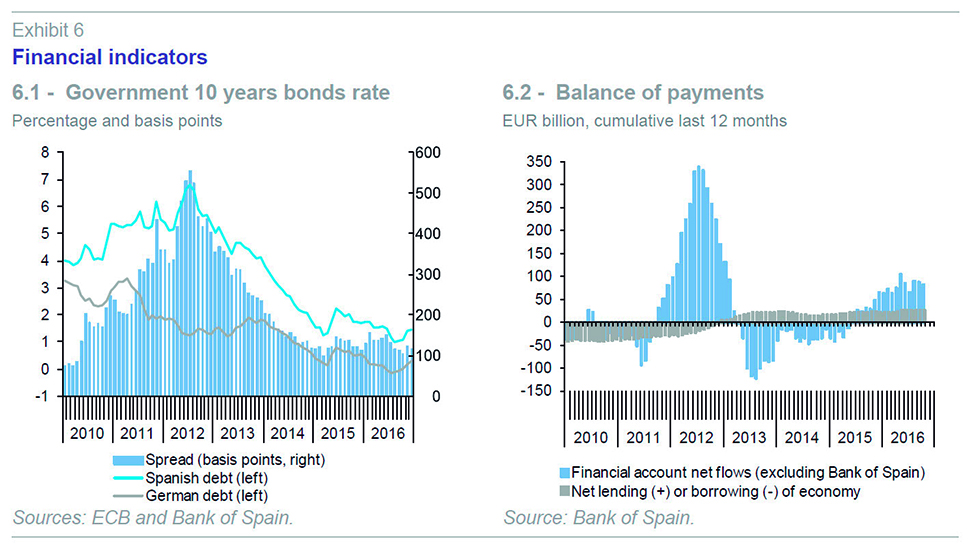

The current account registered a surplus of 15.6 billion euros between January and October, compared to 9.6 billion euros recorded for the same period last year. It is likely that the current account surplus reached 1.8% of GDP at the end of the year (Exhibit 3.2). By contrast, the financial account deteriorated from January to October in comparison with the same period last year (Exhibit 6.2).

The consolidated Public Sector accounts, excluding local corporations, registered a deficit of 29.9 billion euros between January and October this year – excluding support to financial institutions – or 2.68% of GDP. This is 5.4 billion euros less than the same period last year. The overall end of year target for the Public Sector as a whole is 4.6% of GDP, which suggests the target could be met, even taking into account negative seasonal effects in the last months of the year. However, it is important to bear in mind that the original target was 2.8%, which was subsequently relaxed by the European Commission in July.

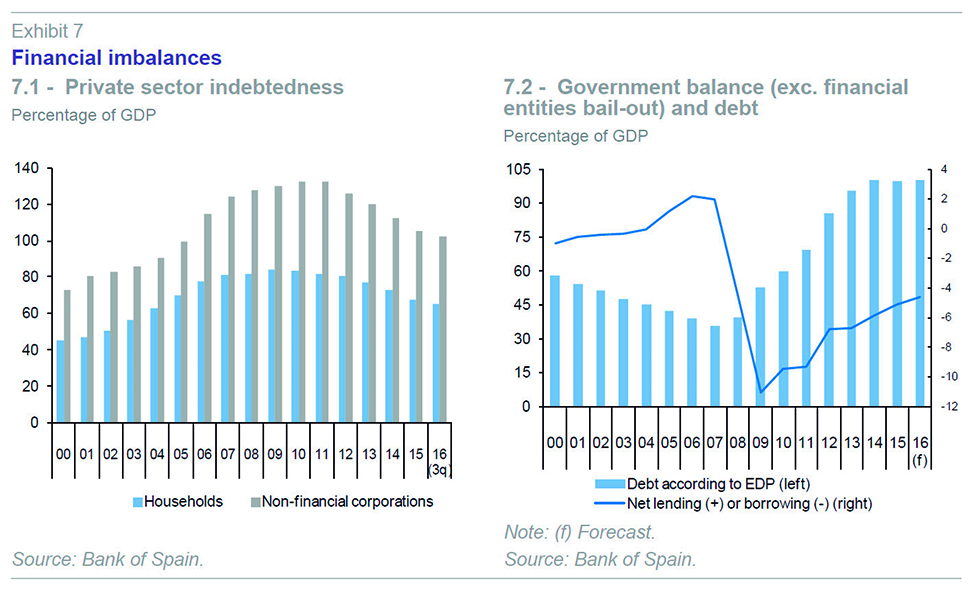

Particularly notable is the good performance of the Regions, which registered an aggregate deficit of 0.3% of GDP to October, significantly below the 0.7% of GDP target for the year as a whole. This is due to the increase in revenues resulting from the favourable ex-post liquidation of the 2014 regional financing system, as well as an increase in payments on account for 2016. It is also worth highlighting the increase in social security contributions to the Social Security Fund, which were up 3.4% to October, compared to last year when they grew by just 1.8%. Meanwhile, public debt is estimated to have reached nearly 101% of GDP at the end of the year (Exhibit 7.2).

Household gross disposable income rose 2.6% to the third quarter of 2016 in comparison to the same period last year, thanks to an increase in the wage bill – due to higher employment – and a reduction in household debt interest payments. Household savings once again exceeded investment, meaning that households registered a financial surplus of 1.2% of GDP over the period.

As in previous years, this surplus was partly used to acquire financial assets and partly to reduce debt, with the latter standing at 103.5% of gross disposable income in the third quarter, almost four percentage points below the previous year (Exhibit 7.1).

Non-financial corporations also posted a net lending position, equivalent to 2.9% of GDP, and in excess of the same period last year, despite the increase in investment. Company indebtedness fell to 102.3% of GDP in the third quarter, five percentage points below the previous year. In other words, investment was financed entirely from company profits, instead of through debt.

Yields on 10-year sovereign debt fell from an annual average of 1.74% in 2015 to 1.39%, while the risk premium increased slightly to 125.5 basis points. The first months of the year saw debt yields rise in line with tensions on international financial markets, but then drop back following the European Central Bank’s decision to expand its asset purchase programme both in quantitative and qualitative terms. However, Trump’s victory in the American elections has exerted upward pressure on long-term rates in the United States in anticipation of a more expansive fiscal policy. This may, in turn, translate into higher borrowing costs in Europe. Spanish yields closed the year at around 1.35% (Exhibit 6.1). Short-term interest rates also declined in 2016; specifically, 3-month Euribor fell to an annual average of -0.26%.

Overall, growth in GDP in 2016, as was the case in 2015, was driven by a series of one-off factors, such as tax cuts, falling oil prices and a renewed decline in interest rates. In contrast to pre-crisis boom years, growth has not generated imbalances. Growth has not led to an external deficit, nor an increase in private debt, nor a loss of cost competitiveness. Another important aspect is the key role played by the industrial sector in this recovery. The relatively limited growth in imports in the context of a vigorous recovery in domestic demand is particularly encouraging. However, a more worrying aspect is the continual rise in public debt, which is above 100% of GDP. Finally, economic growth is very job-intensive, but the pattern of strong temporary job creation, with very negative productivity and social implications, continues to be one of the defining characteristics of the Spanish labour market.

2017 forecasts

The main pillars of the recovery remain in place in 2017. Companies are facing better financing and competitiveness conditions, which is enabling them to take advantage of export and investment opportunities. The non-financial sector, in particular, has deleveraged and is posting relatively significant operating surpluses. Unit labour costs have declined with respect to other countries such as Germany, closing the gap that emerged between 2000 and 2007. A cleaned-up banking sector is in a position to provide lending to support growth, while avoiding the emergence of new bubbles. Meanwhile, households have a growing capacity to consume and purchase houses, thanks to labour income and deleveraging over the last six years.

Furthermore, the current account registered a significant surplus to the end of the year, which suggests that stronger growth in Spain than in other European countries is sustainable. This favourable situation is in sharp contrast to previous recovery phases, which were hampered by a current account deficit.

Even so, a deceleration in growth is expected for next year. Firstly, the external environment has become more uncertain. Export market growth is set to be weaker. And there are downside risks, depending on the trade policy adopted by American President Trump (see box). Moreover, oil prices are increasing and they are expected to increase further as a result of the recent agreement between OPEC countries. The average price of a barrel of Brent is set to be 58 dollars in 2017, 15 dollars more than in 2016. The result is a significant deterioration in the terms of trade, a rebound in inflation and a decline in consumer purchasing power.

Secondly, the budgetary stance will be moderately restrictive, so as to comply with deficit targets. Revenue-to-GDP is expected to rise in contrast to the decline registered in the last two years. The forecasts reflect new measures to tighten corporation tax and increase excise duties.

Meanwhile, monetary policy should remain ultra-expansive, in line with the ECB’s decision to extend the public and corporate debt purchasing programme (TRLTRO II) and negative interest rates. However, the reduction in the volume of TRLTRO II and, especially, rebounding inflation foreshadow a gradual increase in long-term interest rates. As such, yields on 10-year sovereign debt will reach 1.7% in 2017, 0.3 percentage points above 2016. The euro-dollar exchange rate will remain at current levels of 1.08.

Overall, GDP will grow by 2.4% in 2017, 0.1 percentage points more than previously forecast and one percentage point above the eurozone average. The slowdown will come primarily from domestic demand, especially private consumption. Public consumption will also grow more slowly than in 2016. However, investment will continue to provide conflicting signals: on the one hand, residential investment, which collapsed during the crisis, is set to accelerate and take advantage of improved credit conditions. On the other hand, investment in capital goods is set to slow. The external sector will continue to make a slightly positive contribution to growth, despite the slowdown in exports - resulting from a weak international environment and a relatively more modest increase in tourism inflows after a record year.

The slowdown will have a knock-on effect for the labour market in 2017. Employment will grow by 2% after 2.9% in 2016. The unemployment rate will continue its downward path, albeit more slowly, reaching an annual average of 18.1%.

Inflation will touch 2% due to the increase in oil prices and depreciation of the euro against the dollar. Unit labour costs are forecast to remain contained, facilitating continued cost competitiveness gains.

The current account should remain in surplus albeit shrinking due to an increase in the price of imports. External debt will slowly reduce, but remain a key vulnerability.

Finally, whilst the public sector looks largely on track to comply with the deficit target agreed upon with the European authorities, the approved adjustment measures do not look to be sufficient to reduce the deficit to a target of 3.1% of GDP in 2017. In the absence of new measures, with the State Budget still to be adopted, a 0.2 percentage points deviation from target is forecast for 2017.

Box. The anticipated economic impact of the Trump administration

During his campaign, the President promised public infrastructure investments and tax cuts aimed at increasing competitiveness and reindustrialisation. Top rate income tax is expected to be lowered, as well as corporation tax, which at 35% at the federal level is relatively high. Tax advantages will be offered to companies that bring activity back on shore and repatriate profits. Furthermore, as a candidate, Trump set out a protectionist stance – a hardening of trade policy in relation to low-cost countries such as China and Mexico; incentives to produce and export from the United States; immigration barriers and evictions of already established immigrants.

The programme is far from clear-cut, for example, budgetary incentives conflict with the target of reducing public debt. Likewise, it appears difficult to reconcile fiscal and social cuts with promises to fight inequality. And the introduction of tariff barriers would provoke retaliatory measures, undermining exports.

In the short-run, it is probable that fiscal stimulus measures will raise growth in the US by a few tenths. Further out, the impact of Trump’s measures is much more uncertain. Public debt looks certain to rise, which could provoke a reaction from a Congress seeking to rein in debt. Inflation is set to increase, which will raise potential tensions between Trump’s stimulus policies and Federal Reserve objectives. Interest rates will rise this year.

Unemployment, currently around 4.7%, has little room to fall. Restrictions on immigration will not help. Immigrants hold jobs in sectors such as personal services, hospitality, catering and retail, where local manpower is relatively scarce.

Meanwhile, significant changes are expected to access conditions for social protection. Proof of this has been the questioning of the Obamacare health reform and support programmes for families with children. It remains to be seen how public opinion, sensitive to inequalities, will respond.

There is a real risk of the American economy overheating. The increase in oil prices, the low rate of unemployment together with incipient salary pressures, and economic stimulus measures, as well as immigration restrictions point to a spike in inflation. This could reach around 3%, a level which would require the Federal Reserve to act with a degree of forcefulness, potentially provoking new financial market turbulence.

It remains to be seen whether Trump’s statements on foreign affairs will moderate as President. If not, a period of de-globalization could be about to begin. In all probability, the majority of protectionist measures will ultimately not be enacted and political activism will instead bear down on fiscal and immigration policy. All of this would lead to an increase in US interest rates, increased capital inflows and dollar appreciation. Emerging Latin American and Asian economies are the most vulnerable to these changes. The impact for Europe will be relatively limited.

However, the European and global economy would be deeply affected by a trade war provoking the application of protectionist measures.

In this context, it would be desirable to reinforce the eurozone, which continues to flag in the face of concerns about the state of the Italian banking system, anaemic domestic demand growth and the absence of real capacity to act at the European level to tackle possible crises. In Spain, a broad consensus around pensions, regional financing and employment policy would be particularly useful in such an uncertain environment.

Raymond Torres and María Jesús Fernández. Economic Trends and Statistics Department, Funcas