Spain’s real estate sector: Slow path to recovery and future outlook

The Spanish real estate sector is slowly recovering in the wake of the crisis and its contribution to Added Value (AV) is due to an increase in activity in public works rather than residential construction. However, even though recovery has taken place in a favourable macro context of low inflation and low interest rates, this has failed to stimulate residential markets due to credit constraints and still weak demand.

Abstract: This article focuses on the momentum in the real estate and construction sector in Spain, based on analysis of available supply, demand and investment indicators. The data point to a slow recovery in construction with demand factors driving increases in prices – specifically, there have been increases in transactions and localised prices in a few regions, associated with population mobility and rental access. Non-residential markets, on the contrary, show higher transaction activity with a significant presence of foreign investment, which registered increased inflows in 2015. Housing prices are growing slowly due to the existence of barriers affecting affordability, such as restrictive credit conditions, insufficient savings and labour market failures. Nonetheless, the recovery in transactions, positive price growth and the presence of foreign investment point to signs of a recovery in the sector, which – all being equal – is expected to continue in the upcoming quarters.

The construction sector has traditionally been important for the economy due to its contribution to Added Value, the significant investment it entails and because it is also a capital goods producer. Furthermore, the spillover effects of construction activity make it a vital sector for supporting economic growth. The collapse in housing activity after the Global Financial Crisis (GFC) and the above mentioned spillover effects could explain the modest growth in the Spanish economy (and in a good proportion of western economies) in the previous years. Very weak, or almost non-existent, activity in some branches of construction activity is a direct consequence of the sector’s role at the center of the financial crisis. As a result, the sector has experienced the most significant credit constraints since Spanish post-war years. The lack of construction seems to have reduced the sector’s ability to catalyse other areas of economic activity and, as such, an analysis of the momentum is key to identifying the sector’s potential for recovery and ability to augment future economic growth.

The construction sector is the supply side of the real estate market. Spain’s real estate markets have developed to differing degrees. The residential market is the most well-known and has played the biggest role in growth in the last two decades, both in terms of economic growth as well urban expansion. This importance stems from a period of intense construction activity, which led to the second largest cycle of building in recent history, during the period 1994 to 2007. The role played by house-building during this period has been a major factor behind the current configuration of Spanish cities and metropolitan areas. This cycle has been the largest in intensity since the sixties and it came about as the result of an overlapping of different sources of demand and a strong and prolonged construction response (to some degree unique in Europe), which supplied the different residential real estate markets: Primary housing, which absorbed the bulk of the units constructed in the last 15 years; second homes; temporary residences, demanded by both resident and non-residents; and tourism units. The combination of diverse residential markets, together with the Spanish geographic location (with a pleasant climate), specialisation in tourism and a flexible and ample supply of land, were the main factors – amongst others – behind this major upswing. Such diversification was symptomatic of the development of a mixed use of housing stock associated with higher levels of economic growth, as has occurred in other economies around the world.

In relation to non-residential sectors, such as offices, high levels of consolidation have been reached in Madrid and Barcelona.

[1] These are both cities with mature markets in direct competition with other European cities. The market for retail and warehouse space is expanding, especially for shopping centres, as well as the logistics market, linked to economic growth, firm creation and the proliferation of new urban areas, amongst other factors.

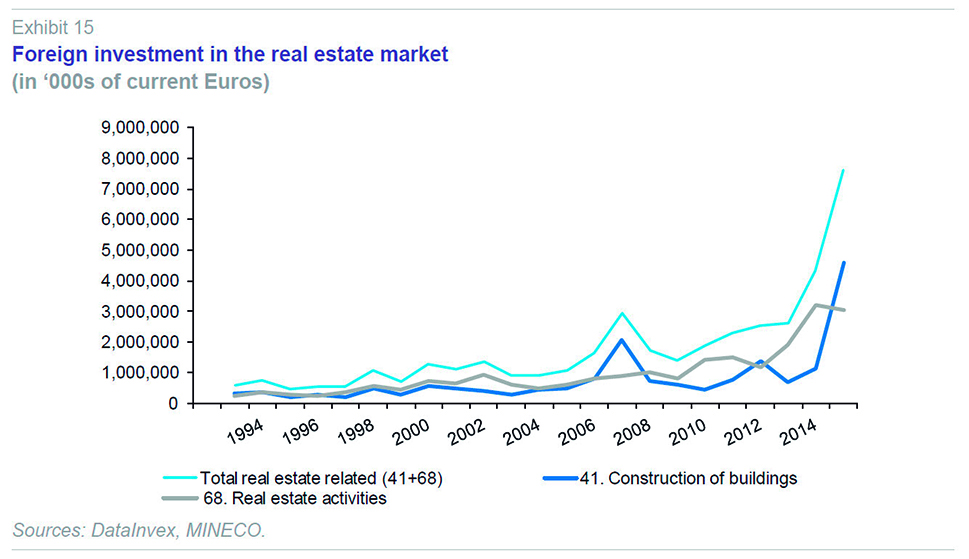

The whole sector experienced a major shock following the impact of the Global Financial Crisis (GFC). During the second phase of the crisis (2011-14), the sector received a range of economic stimulus, which varied according to the particular sub-sector. Non-residential activities have been subject to successive inflows of foreign investment, which have entered into and driven activities, such as logistics, shopping centres and the office market, amongst others. International investment inflows into the sector (less obvious in official aggregate figures than in international company statistics

[2]) have been significant and have tended to be more associated with specialised investments rather than opportunistic transactions, helping to spur competition in these markets in Spain. Meanwhile, the residential sector was the most affected by the crisis, with a generalised lack of investment, which still remains the case.

This report analyses the current state of the real estate sector from a market perspective, both from a supply side point of view (evaluating the state of the production response to market drivers), as well as a demand side perspective (profiling the development of factors underpinning demand). The analysis focuses to a large extent on the constraints to growth in the residential sector, although it also makes an allusion to other sectors with available data. The role played by the public sector as an investor in infrastructures is also addressed so as to provide a full explanation of the final figures on contributions to Spanish GDP.

The construction sector’s role in the Spanish economy and recent developments

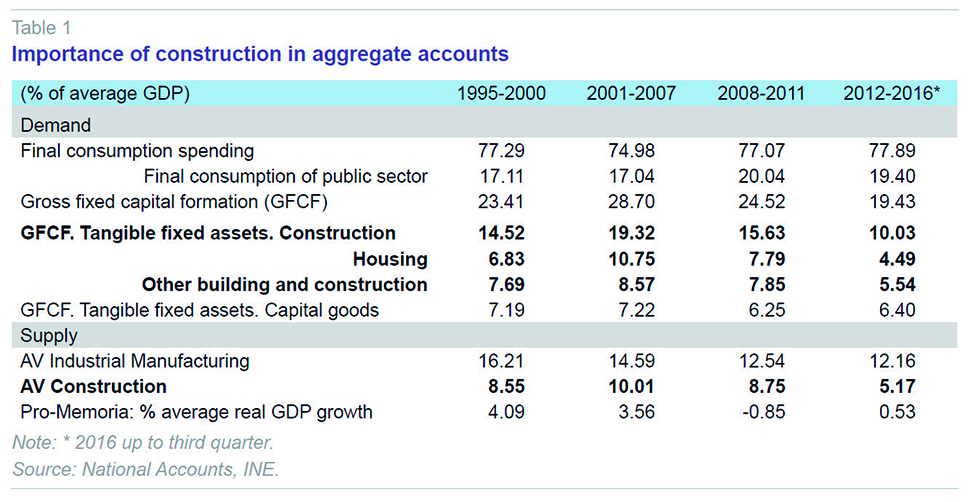

The contribution to GDP made by the construction sector in Spain is significant, as set out in Table 1. The sector accounts for a long-term average of between 60% and 65% of total investment in the economy (15%-17% of total GDP on average). Although this proportion can increase very significantly in expansive construction phases (as was the case in 2001-07).

During the most recent period from 2012-16, the sector barely accounted for 52% of total investment, which points to a still very serious crisis. Investment into construction is distributed between three large sub-sectors: Housing, non-residential building and infrastructures (civil engineering). National Accounting aggregates the latter two into the ‘other building and construction’ category. Table 1 shows that both groups make a similar contribution to the economy of between 7-8% of investment GDP. The investment data also show that during 2001-07 private investment in housing was the main determinant of the investment cycle, reaching more than 37% of total investment in the Spanish economy. The collapse of the housing market and infrastructure construction is reflected in the decline in investment until a half of its long-term contribution. Similarly, construction adds between 8% and 9% of total AV, exceeding over 10% in expansionary periods, generally linked to growth in the residential market.

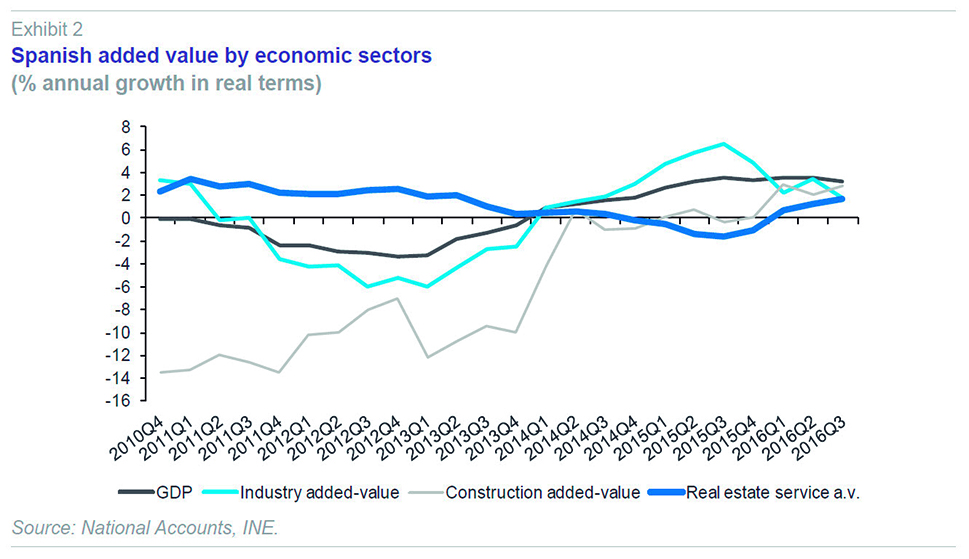

The situation in 2016 is consistent with a very tepid recovery following the deep crisis experienced since 2007. Exhibit 1 places the end of the construction AV decline in 2014, although positive growth rates (recovery from maximum crisis levels) were not registered until well into 2016, with both construction and real estate services appearing to record stable real growth rates of around 2%. This development is in clear contrast to the rest of industry, which has been growing and leading the Spanish economic recovery since 2013.

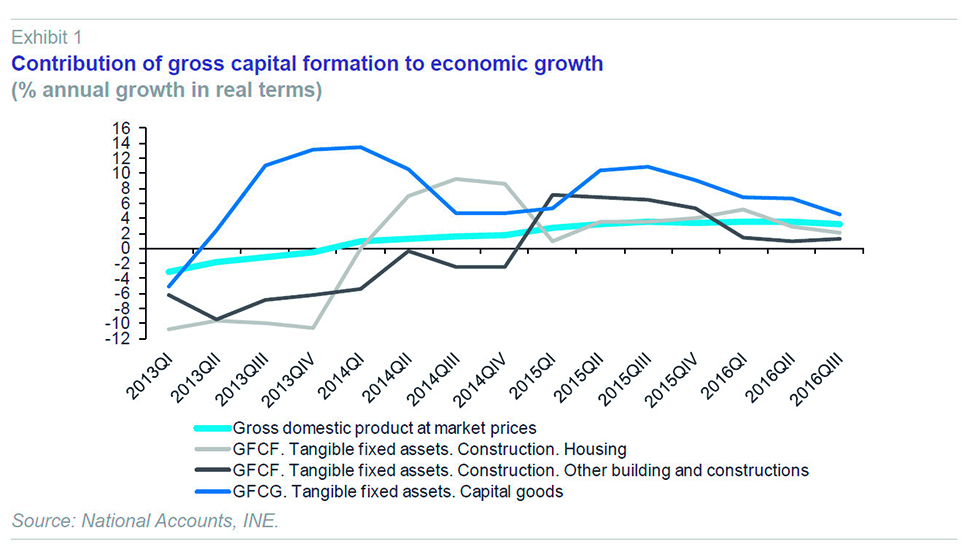

Such evolution is in contrast to the apparent revival in investment in the two construction sub-sectors (Exhibit 2), which have been growing since 2013 (first housing and then other building and construction), although this is not reflected in effective activity until well into 2015. During 2016 investment has moderated to growth rates of 2%, pointing to lower construction growth in the medium-term.

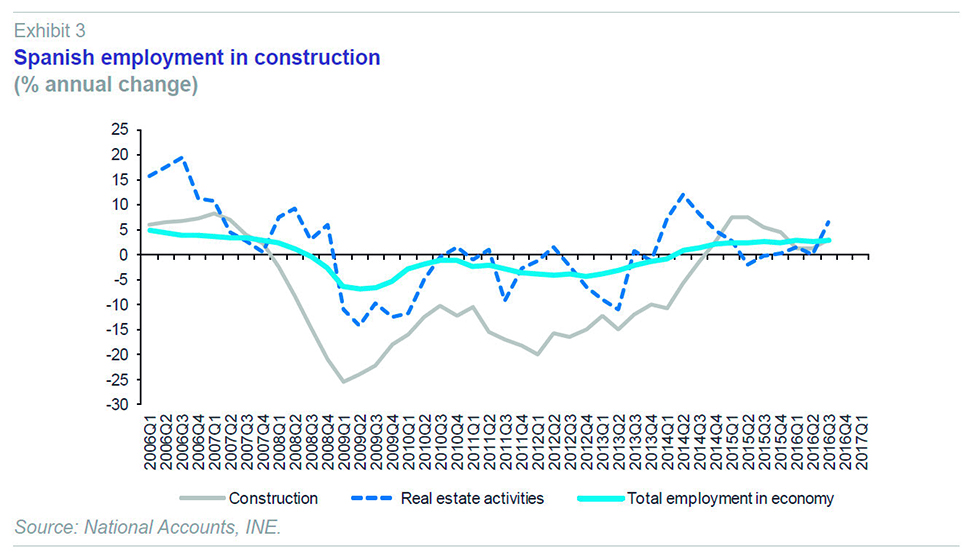

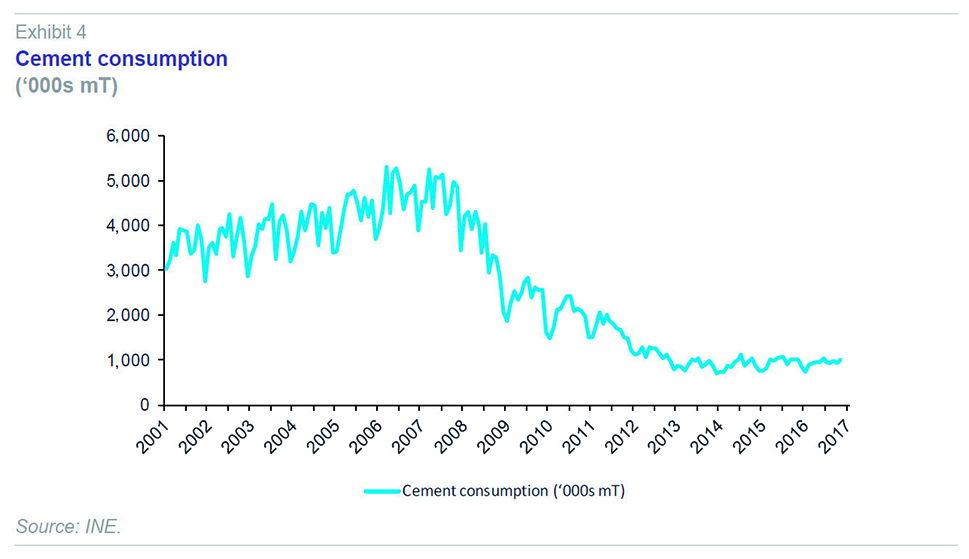

The apparent contradiction in these figures (strong investment that is not reflected in AV contributions for nearly two years), suggests the idea of very weak output, consistent with spending, employment, and consumption of basic construction materials (such as cement) data. In terms of employment (Exhibit 3), the apparent recovery in 2014 has slowed down, coming to a standstill in 2016. The same cannot be said for the consumption of the most basic construction material, cement, which remains anchored at historic lows without showing any signs of recovery. These figures suggest that effective production, if there is any at all, is either very recent, or is taking place in services rather than construction per se.

Given the expansion of GDP during the last year and a half, these data suggest that this is one of the few periods in the history of the Spanish economy when economic growth is not being accompanied by an expansion in the construction sector. The reasons behind this development are set out below, analysing the two main activity segments: Public works and related infrastructure spending, and building, mainly private investment in housing or non-residential buildings.

Construction from the supply side: Public works and building

Public works

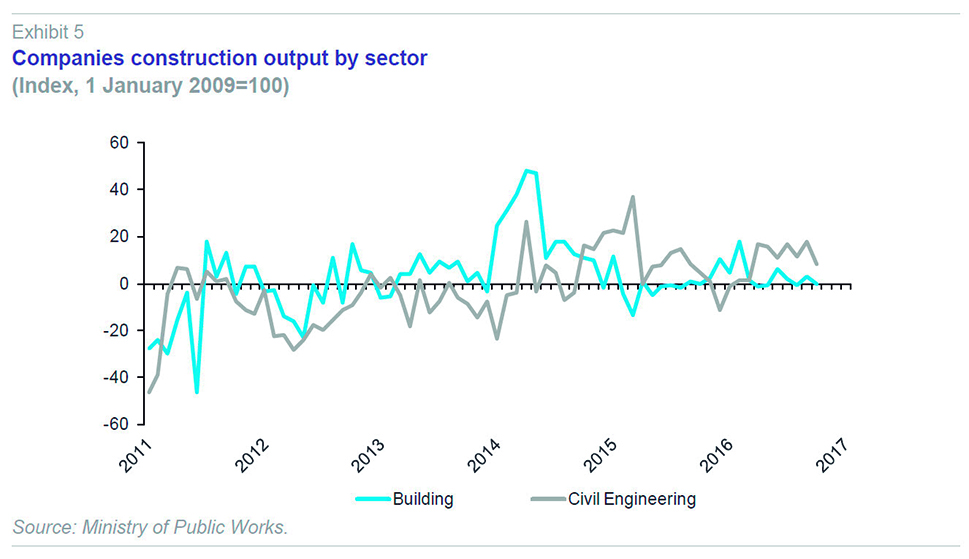

Output related to civil engineering accounts for around 40% on average of total AV in construction (Taltavull, 2015: 201) meaning that it is important to understanding the evolution of the sector as a whole. Spending on civil engineering can be traced through the Ministry of Public Works situation survey (Exhibit 5) and public procurement data (as a leading indicator of spending, Exhibit 6).

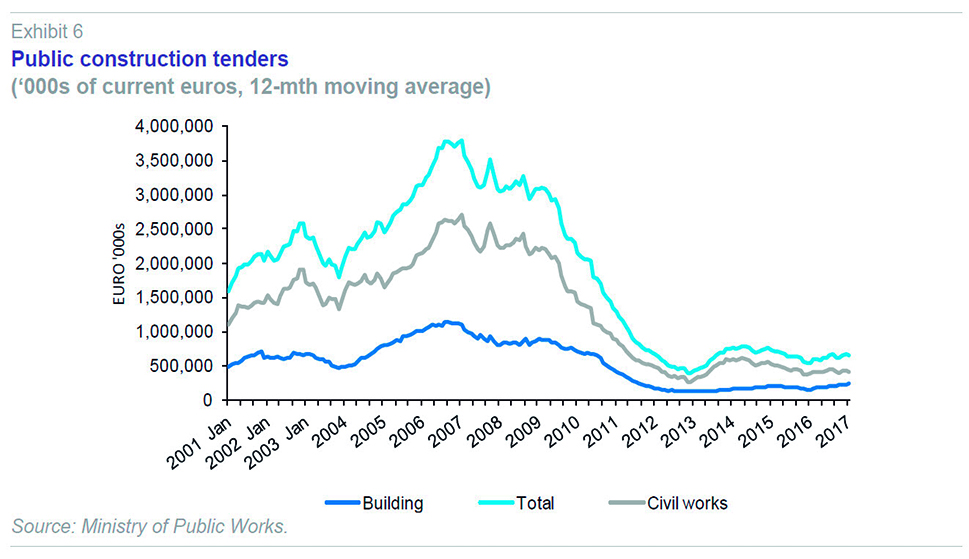

In both cases data clearly show how civil engineering is experiencing a significant rate of recovery (possibly in activities that do not require intensive use of cement, such as rail infrastructures) in 2015 and 2016. Specifically, public procurement has been rising since 2014 which would explain the increase in activity (registered in the Added Value) from the end of that year onwards. The latest data do not provide any signs of a further recovery in public works procurement, meaning that public works are unlikely to make a significant contribution to AV this year.

Exhibit 6 is especially illustrative of how this group of activities suddenly stopped contributing to construction AV in the years following the crisis with the total volume of investment falling by 17% from 2010 levels in only two years.

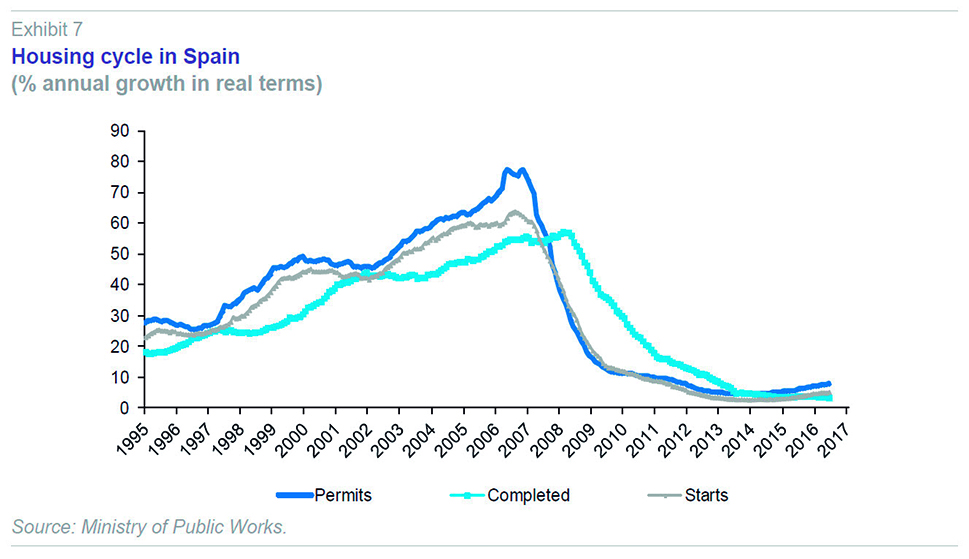

The building market: Supply-side response of housing and other buildings

As set out in Exhibit 6, indicators of works carried out have been consistently negative reflecting the dramatic evolution of the residential construction sector in Spain as the evolution of housing starts (indicator of new work initiated) in Exhibit 7 shows, which plummeted from 2007 (three years ahead of public works) to current levels. The deterioration in the residential market has been the most severe on record, with a dramatic adjustment in housing starts in two years (2007-09) from a high point of slightly more than 60,000 starts per month to around 10,000. This decline continued after 2010, reaching the lowest point since the 1950s, with 26,000 housing starts taking place in the entire 2014. Although the latest data point to a slight recovery, this appears to be far too weak to have any relevant impact on reactivating the sector in the medium-term.

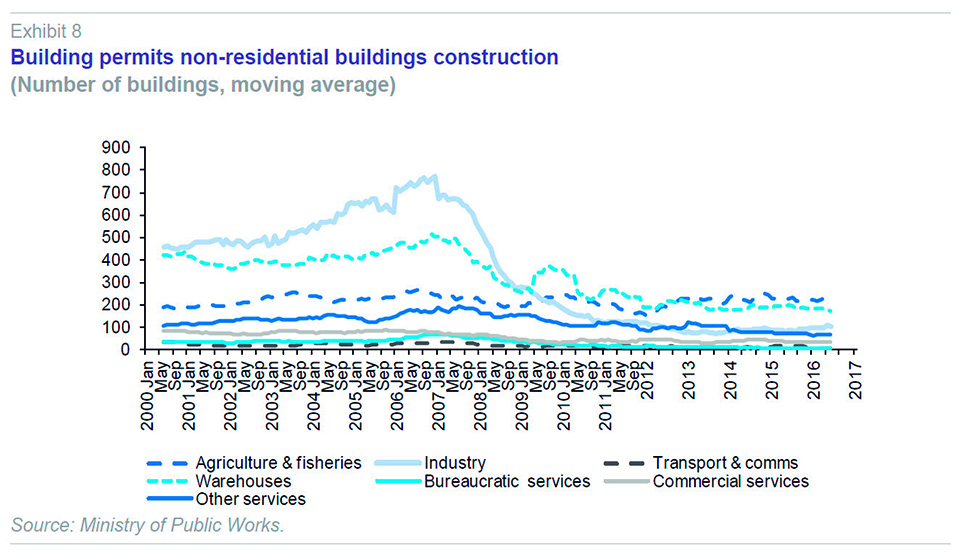

Other than residential building has seen a similar collapse in construction as a result of the crisis, particularly in the leading industrial construction sector. Sectors associated with logistics and distribution (warehouses, services) and agriculture have been less affected, registering relatively better activity rates. This data suggest that the strong industrial investment recorded in National Accounts since 2013 has not been related to building on adapted spaces (but rather warehouses and transport, amongst others).

As such, the increase in construction Added Value looks to be the result of public infrastructure investment, as a sign of a counter-cyclical policy muted by public spending constraints, and of building in some very specific real estate sectors. The lack of a strong market reaction through increased construction puts a limit on the extent of the economic recovery, as well as foreshadowing a change in the way the market is assigning resources. Thus the question arises, how is it possible that, in an environment of 3% growth in GDP and employment, construction has not recovered as would usually be the case? A response to this question can be found by looking at the constraints on the two main sources of demand: The fundamental (household) housing demand and the investment drivers.

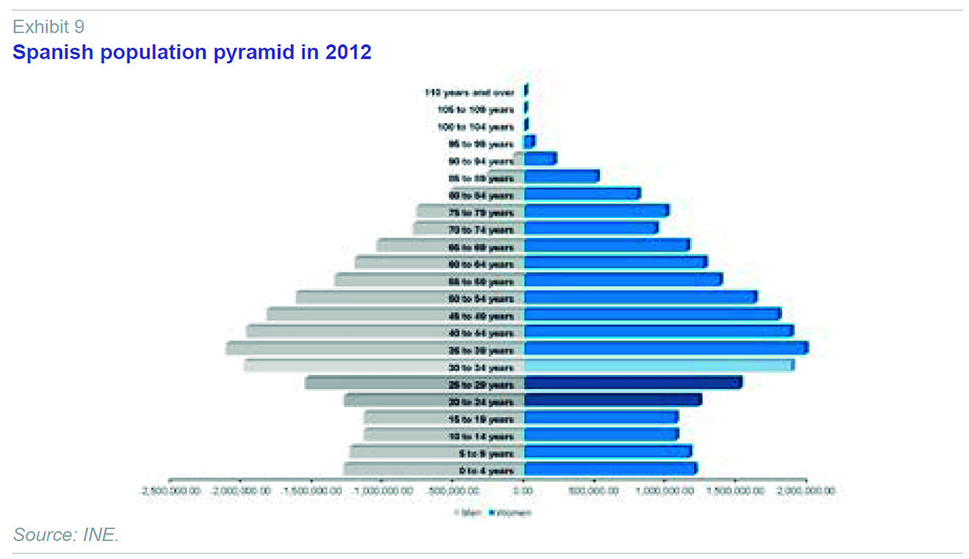

Fundamental demand driversThe main fundamental housing demand drivers are those related to the coverage of basic housing needs (demographics, income and financial factors), which determine the intensity and dynamic within each residential market. Empirical experience suggests that basic potential demand is associated with demographics and that this changes in line with: (1) the life-cycle of the population (with specific demands according to age group and household sizes); (2) changes to models of household formation and (3) population mobility. Factors (1) and (2) are not always easy to observe. Even so, the age structure provides an approximation of basic primary housing needs. The population pyramid contained in Exhibit 9 highlights the age cohorts that could form new households (and need a house) in the near future. This Exhibit shows that such demand in Spain will continue growing (albeit with fading intensity, see cohorts between 25 to 35 years old) over the next decade.

[3] The bulge in the upper cohorts points to the existence of a still strong pool of demand for replacement housing in the segment older than 35.

[4]

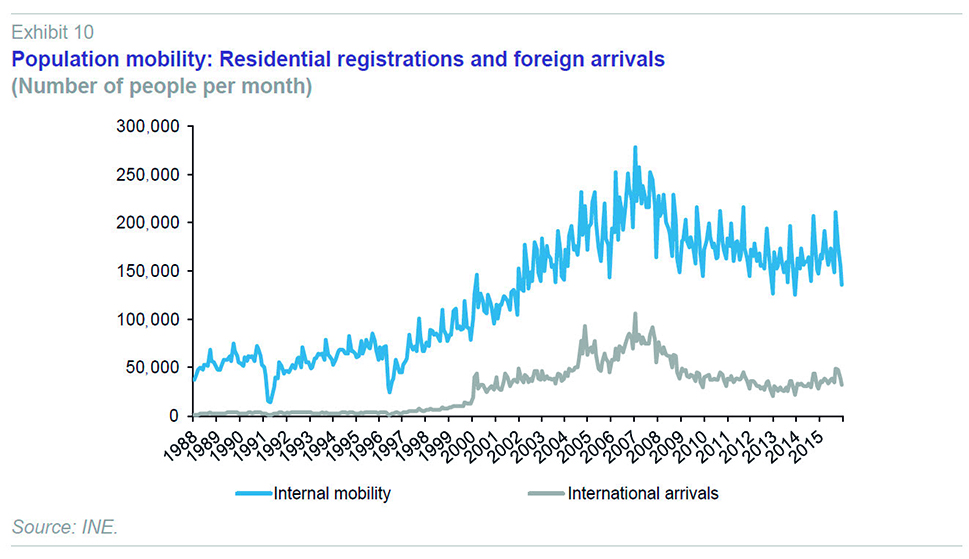

Population mobility (migration) modifies these figures as a result of the territorial relocation of households. Exhibit 10 points to the existence of elevated internal mobility within Spain

[5] and the continuation of immigration flows even in the recession years. These figures show that since 2007 an average of 160,000 people register each month in a given city in Spain, which undoubtedly creates a significant volume of transactions in the housing market where they relocate.

Such stable mobility trends suggest that demand tensions in residential markets which are recipients of new arrivals will be sustained for the medium-term, stemming both from mobility and the (slowing) formation of new households.

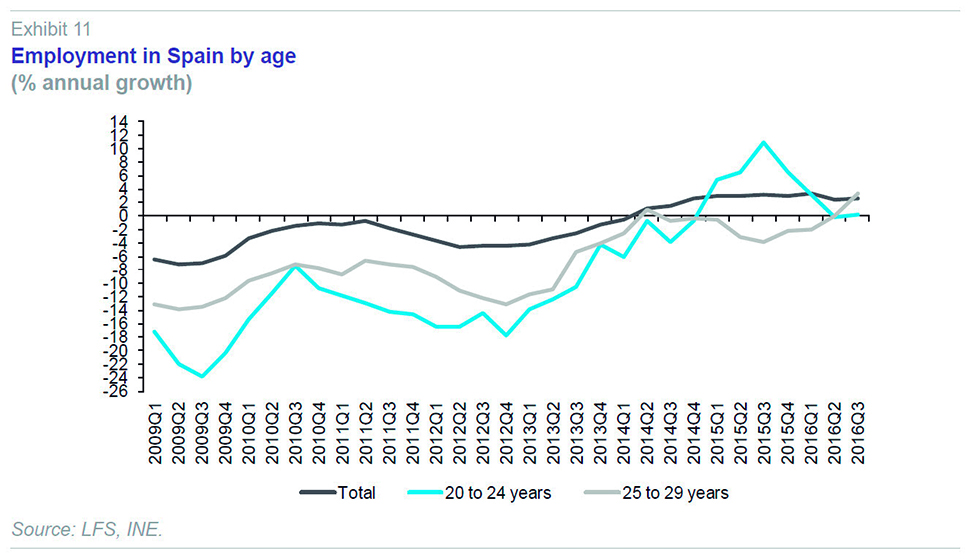

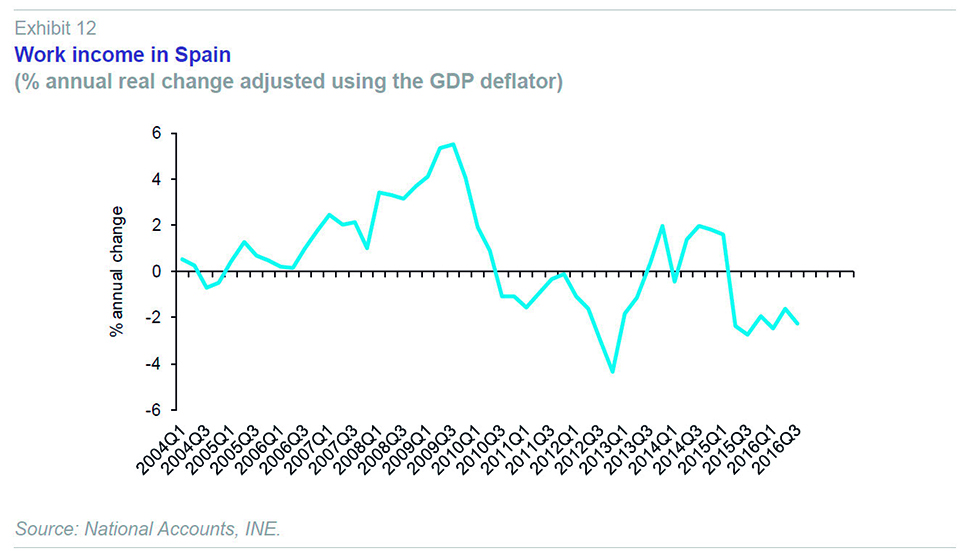

Potential demand becomes effective demand if it is has ability to pay, i.e. if it meets solvency requirements and has sufficient income to cover housing costs from buying/renting a property. Economic growth conditions have supported job creation and increased the new buyers’ ability to pay. Nonetheless, as can be seen in Exhibit 11, the increase in employment has been selective, penalising younger cohorts (precisely those who need a first house) whose employment rate has been declining systematically throughout most of the period analysed (1995-2015). Furthermore, the capacity of salary income to cover housing costs has also decreased (Exhibit 12), further reducing the affordability of potential homeowner-occupied households.

The overall result is that the Spanish residential market has strong potential demand but the groups with highest housing need have little access capacity due to the stymieing effect of labour market and income conditions. Prospects for improvement in the medium-term look to be limited. This difficulty to enter the market appears paradoxical given that conditions in the Spanish housing market are ripe for access: With prices having declined to very competitive levels and low interest rates.

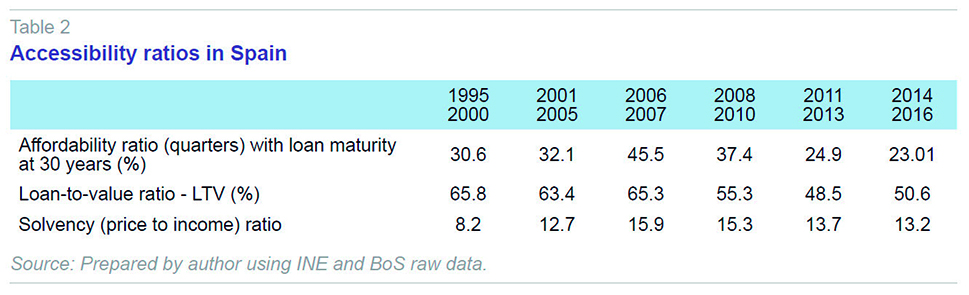

Indeed, it is precisely the current price and interest rate environment, which gives Spain a high level of accessibility even taking account of current income. However, affordability is a necessary but not sufficient condition for households to become homeowners. A combined analysis of three accessibility indicators shows the reason why. Table 2 contains an average estimate of each of the three ratios.

The first indicator, the affordability ratio,

[6] oscillates around 30% throughout the period, pointing to elevated capacity for ownership. The ratio only exceeded 35-40% in the period 2006-10, reflecting payment difficulties and loss of demand-side purchasing capacity (mainly due to the increase in interest rates); in recent years, the rate has fallen to levels that represent unprecedented affordable conditions for households with stable income, as previously mentioned.

The solvency ratio

[7] shows the amount of debt that households must face in order to become home-owners. The long-term average in Spain (since the seventies to the late nineties) used to be between 6 and 8 (it is usually 5 in other countries), but it has experienced a strong increase since the early XXI Century. The new expansion period is associated to a rise in Spanish households’ debt propensity per dwelling (on average) shifting the solvency ratio until 15.9 in the 2006-2007 period, followed by a subsequent reversion in this trend in recent years, which implies a fall in household average leverage (for housing purposes).

The LTV ratio

[8] points to average lending of around 65-70% of property values over the course of the period. This rate fell sharply in 2008 indicating that households wanting to buy a house had to contribute upfront savings of around 50% of the price, with lending only being granted to households (if they pass scoring) at 50.6% of property value on average (latest period). Underpinning this figure are severe credit constraints (also proven in Scanlon

et al., 2011) which limit the ability of solvent demand to access housing.

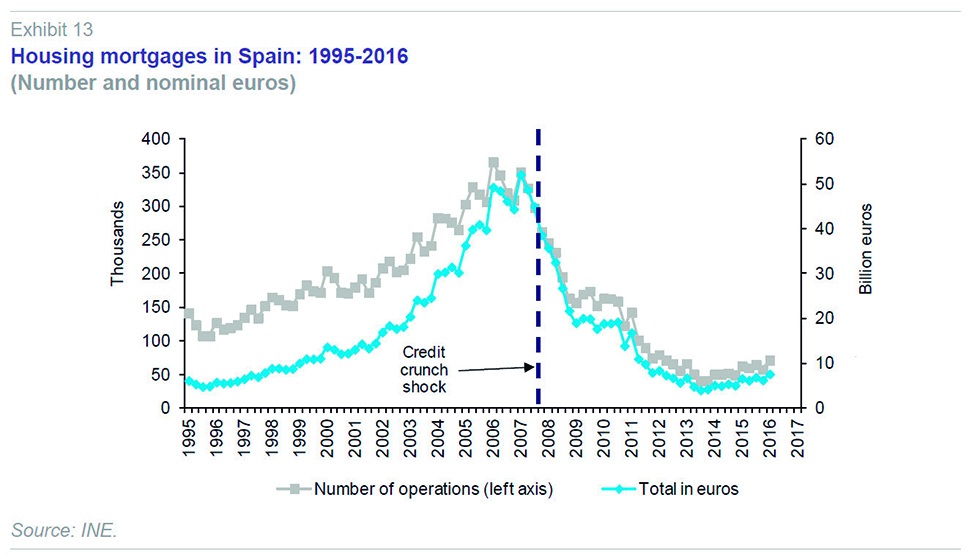

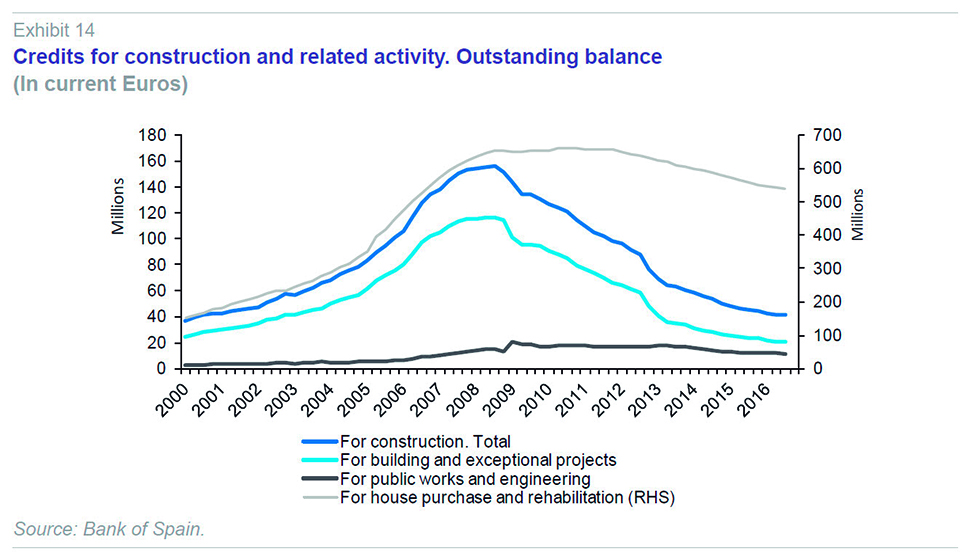

The sharp reduction in lending as a result of tight credit conditions is reflected in sharp declines in overall lending for house purchase, which started in the first years of the crisis and accelerated from 2010 onwards (Exhibit 13) The same was true for the construction sector as a whole, as can be seen in Exhibit 14, with a collapse in total lending for all activities since the start of the crisis, reaching a historical minimum for outstanding lending volumes. The scale of the credit crunch reached implies an absence of minimum funding necessary for the market to perform, distorting normal operating mechanisms and constituting an unresolved market failure, with no alternative financing sources having been made available to date.

Overall, the analysis of the ratios indicates the existence of extremely favourable access conditions but only for households with stable income and available savings ‒ given the lack of lending ‒ and the ability to borrow. In an environment characterised by still high unemployment, an eroded salary purchasing power and credit constraints, it is difficult to maintain or recover home-ownership. The only housing available to meet the needs of households without savings is rental properties. As a result, young Spanish households are not in a position to take advantage of the favourable conditions in Spain’s post-crisis residential housing market and they have to deal with a rental market that is insufficiently organized.

Reasons for investment [9]The evolution of real estate investment in Spain has responded to different factors during the period. On the one hand, the period of declining house prices has been sufficiently long, dissuading investors from investing in new projects, but on the other hand it has created purchase opportunities. The previously mentioned house market distortion has created negative incentives for domestic investors, while the overall economic situation has increased the need to unwind investments (selling real estate assets) to reduce company leverage ratios.

These apparent contradictions have been partly solved through the appearance of international actors, both in large-scale transactions in the non-residential sector, as well as through single purchases in the housing market. Since the start of the crisis, the non-residential housing market has been receiving investment flows going to very specific sectors, such as logistics, with potential for development in Spain. A large part of these investments are not observable, but some of them are registered in investment statistics (Exhibit 15), which point to a growing international investor position in real estate activities (since 2012) and direct investment in construction (since 2015). The acceleration in foreign investment towards the non-residential sector seen in recent years (Exhibit 15) is a reflection of expected return from this sector in Spain in the future.

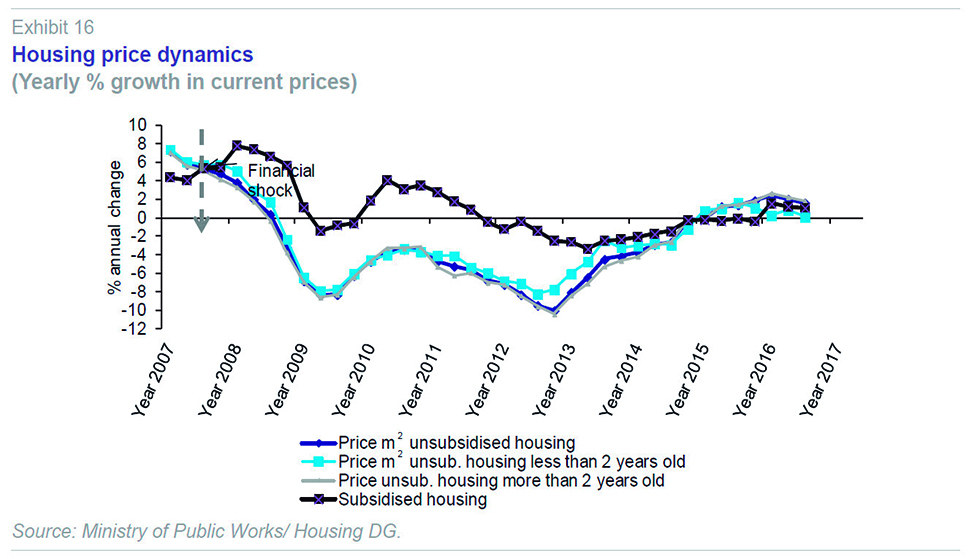

Meanwhile, investment in new housing is determined by the evolution of house prices and rental yields. Empirical evidence shows that price increases have been the leading factor affecting construction decisions in a large part of Spain (see Taltavull, 2014), and Italy, (see Taltavull and Gabrielli, 2015), as well as purchase decisions. As such, until house prices stopped falling (end of 2014), this incentive had been unable to reignite.

[10] Exhibit 16 indicates how residential house prices in Spain began to recover at the end of 2014 and are sustaining a moderate rate of recovery of around 2% in nominal terms (4% in real terms, given negative inflation), which should serve as an incentive for building new units.

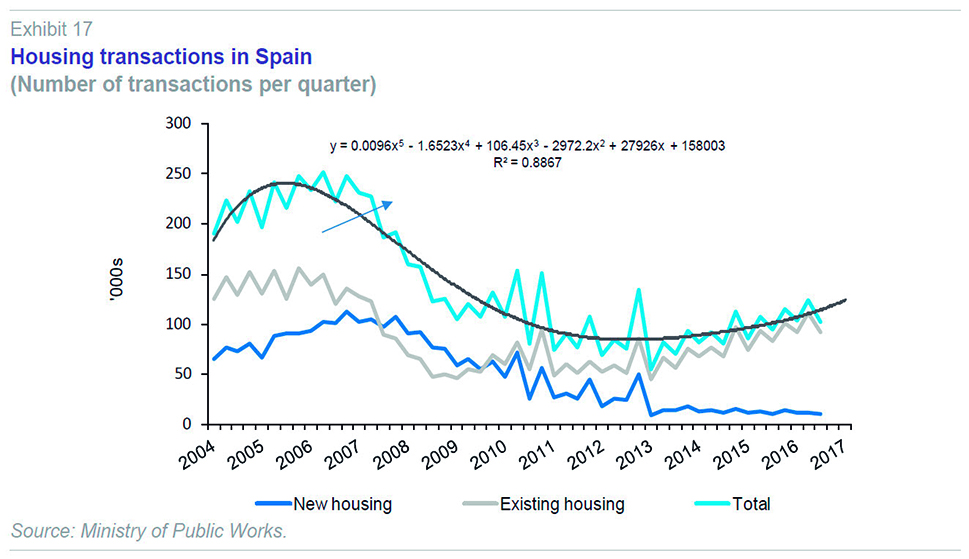

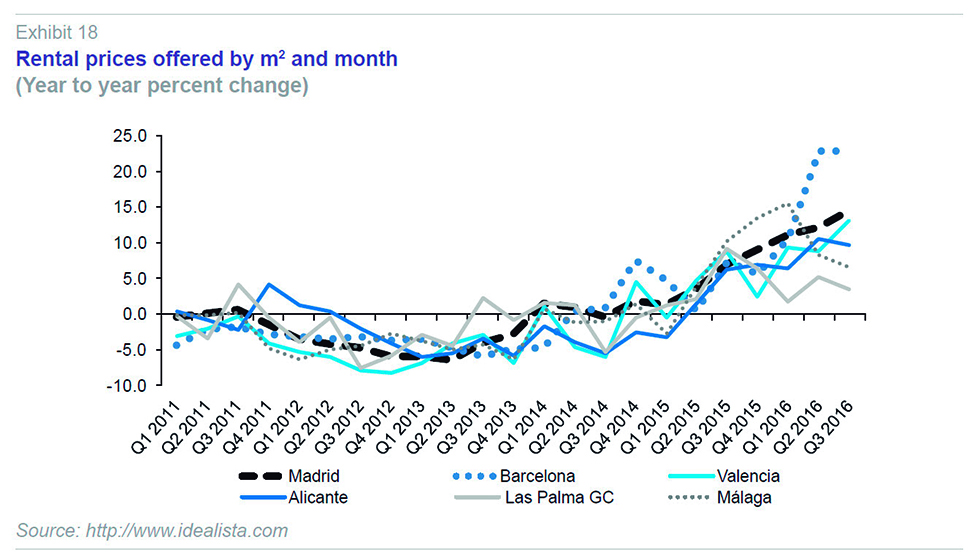

Residential transactions have responded to price changes with modest growth in the last year, compared to average transactions recorded during the crisis (Exhibit 17), but with signs of being on a clear upward path. Meanwhile, the lack of affordable conditions has increased rental demand with knock on impacts for prices as the economy recovers. Exhibit 18 shows the evolution of rental prices per m

2 in some cities where this seems to be happening;

[11] rental prices are registering stronger and more sustained growth than property prices since the end of 2014 which is a reflection of strong demand in the rental market since 2015.

The increase in transactions and rental prices, and the acceleration in foreign investment, are indicators of a demand-side recovery in the sector, although a pick-up in construction activity itself has yet to materialise.

Outlook and forecast

Given the data cited, it is possible to confirm that real estate sectors registered a slow but solid recovery over the course of 2016. So far this recovery does not appear to have given rise to generalised increases in property prices, although this has been the case for rental prices. The data also underline that the recovery is selective, taking place in economically dynamic areas, without extending to all markets.

The current situation points to a different type of market to what we have seen in the past, which typically saw construction (works) take off at the first sight of economic recovery. At the current point in time, Spanish residential housing markets are more mature and would have sufficiently large amounts of units to adjust the existing stock to demand tensions. This means that real estate demand could be met without the need for new construction, at least in the beginning. This is what price indicators appear to be showing. For the time being, available vacancies are sufficient to guarantee demand coming from increased mobility, which is much more intense in some geographic areas than in others. This demand is potentially being met through mixed access, with an increasingly important role for renting.

Solvent demand is focusing on refurbishment, replacement transactions or pure investment (for rental), but less so for speculative motives given that price incentives remain insufficient.

[12]

The recovery in homeownership demand requires addressing two important market failures. The first is credit constraints and the lack of alternative options for financing purchases of a primary residence. Any alternative system which enables new households to become homeowners could have an important stimulus effect on market activity. Other countries are applying and creating new instruments to deal with this realignment, given that this problem is not unique to Spain.

The second market failure affects the land market. Following the demise of lending to property developers (and the way in which this financing dried up at the start of the GFC), a very significant proportion of land now belongs to the financial system and is consequently tied up. As a result, any market incentive for construction faces limited access to land, which constitute a barrier for small developers likely impossible to overcome, although this is not the case for large investors.

[13]

In terms of the non-residential real estate market, large investment transactions (office buildings, shopping centres, logistics, etc.) are leading to systematic changes in ownership within the largest real estate segment. But the recovery of profitability in non-prime office areas, for example, is still slow and associated with the overall improvement in economic activity, meaning that it is unlikely that there will be new space constructions in the medium-term. The outlook in this sense is positive (given the out performance of the Spanish economy in Europe) but strongly dependent on global developments and more closely associated with the real estate mechanism than new building.

As a matter of fact, in general terms construction activity could still take some time to recover to reach long-term levels and thus increase its potential to generate spillover effects for the wider economy. Nonetheless, more pronounced new building activity could take place in areas with higher demand (main regional capitals and some coastal areas).

Conclusion

This article has assessed available indicators to provide an idea of the current state of play in the construction sector and the outlook for the medium-term.

The indicators reveal that the registered recovery in the contribution of construction to AV is a result of public works rather than residential construction, with the latter only initiating a very tepid recovery a few quarters ago. Meanwhile, demand factors are driving the recovery in prices through an increase on transactions within the real estate market itself. However, this is happening only in some regions (from 2015 onwards) and is associated with population mobility and focused only on some rental markets. Indeed, the increased recourse to renting (an element which is difficult to observe due to the lack of statistics) is in itself an important change for Spanish society. The increase in rental prices in some regions supports this interpretation.

By contrast, more muted growth in property prices could be a result of access limitations that still apply to young households in particular. This is not so much due to lack of payment capacity but rather due to very tight credit conditions, insufficient savings and the lack of a “steady” job. Housing prices will not robustly recover until basic demand is met for becoming a homeowner, which is the corollary of the lack of residential construction activity. This underlines the importance of addressing barriers to access. Nonetheless, the recovery in transactions, positive price growth and the presence of foreign investment, are signs of a recovery in the sector, which has now been going for the last year and a half.

Finally, non-residential markets have suffered a lesser impact from the crisis – with the exception of industrial construction – with international financing taking on a bigger role in some activities (logistics, offices, shopping centres).

The entire process of crisis and recovery has taken place in an environment of low inflation and interest rates, which have often been negative. But these conditions have failed to stimulate residential housing markets due to credit constraints and weak demand. The inflation environment is set to move towards more normal territory in which positive inflation will drive growth in the current value of assets while lowering the value of debt; but which could also precipitate increases in interest rates which will disincentive part of solvent demand. Depending on which effect prevails, there might be scope for a quicker recovery in prices.

Notes

See reports from the main management companies in the sector, such as, JLL.

See Real Capital Analytics, http://www.ranalytics.com

The estimated difference in the potential formation of new households, counting shaded cohorts at 50% (25% for those aged 30-34 years), would suggest that the number of households fell from 2.154 million to 1.905 million between 2002 and 2012 for the Spanish economy as a whole.

Opportunity for energy-related rehabilitation and retrofitting in replacement demand.

The data capture the number of people that change residence at each point in time. On an annual basis, since 2009 an average of around 1.9 million people changed their residence every year within Spain, of which around 400,000 came directly from a foreign country.

Also known as the debt/income ratio (30%), which measures a household’s capacity to pay back a loan with current income and in the absence of a change in economic conditions.

Or price/income ratio, is an indicator of excessive indebtedness.

Or LTV, % loan/price is a ratio that measures the risk of default.

Investment considered here does not take account of demand for buildings for business headquarters in non-real estate sectors.

To the extent that a fall in prices implies a loss of value of the final asset, investment will tend to exit when assets enter into a systematic devaluation both due to price expectations as well as difficulties in estimating future prices and their adjustment to current construction costs.

The recovery in prices is not generalised, but is only happening in specific cities from amongst which examples have been selected to appear in this exhibit.

Speculative investment appears when expected benefit exceeds transaction costs in the short-run. Given that the latter can be 10% greater than the price, revaluation has to be significant to attract these types of transactions.

We have to remember that the dynamism of housing construction in the past decade was due to the large amount of small developer companies building across Spanish housing markets.

References

EUROPEAN CONSTRUCTION SECTOR OBSERVATORY (ECSO)(2016), Report in Spain, available at: ec.europa.eu/growth/sectors/construction/observatory_en (accessed on 20/12/2016).

SCANLON, K.; LUNDE, J., and C. M. E. WHITEHEAD (2011), “Responding to the housing and financial crisis: mortgage lendng, mortgage products and government policies,” International Journal of Housing Policy, 11(1): 23-49.

TALTAVULL DE LA PAZ, P. (2014), “New housing supply and price reactions: Evidence from Spanish markets,” Journal of European Real Estate Research, 7(1): 4-28.

— (2015), ‘Sector de la construcción y mercado de la vivienda’, en GARCÍA DELGADO y MYRO, Lecciones de Economía Española, 12 ed, Thomson-Reuters:

199-210.

TALTAVULL DE LA PAZ, P., and L. GABRIELLI (2015), “Housing Supply and Price Reactions: A Comparison Approach to Spanish and Italian Markets,” Housing Studies, 30(7): 1036-1063.

Paloma Taltavull. University of Alicante