IFRS 9: A new model for expected loss provisions for credit risk

The entry into force of IFRS 9 next year marks a fundamental change in the provisioning paradigm for financial institutions, moving away from the actual, incurred credit loss model to an expected loss approach. The upcoming changes are anticipated to have material implications as regards increasing banks’ provisioning requirements, as well as decreasing their common equity tier one (CET 1) ratios.

Abstract: IFRS 9 Financial Instruments, the international financial reporting standard, substantially modifies existing procedures for expected loss provisions related to assets’ credit risk. The new accounting standard changes the current provisioning model, based on the recognition of actual, materialised losses (generally loans past due by 90 days), to one based on expected losses at the time loans are granted. The new approach requires banks to create or adapt their models and methodologies for estimating expected credit losses on their various portfolios. Moreover, estimations will need to factor in the requirement that expected loss provisions be conditional upon the foreseeable outlook for the economy and consider the residual lives of the various transactions. While the Basel Committee on Banking Supervision is currently assessing various arrangements to smooth IFRS 9 implementation, the initial impact study carried out by the EBA points to significant increases in provisioning requirements and decreases in CET1 ratios at financial institutions.

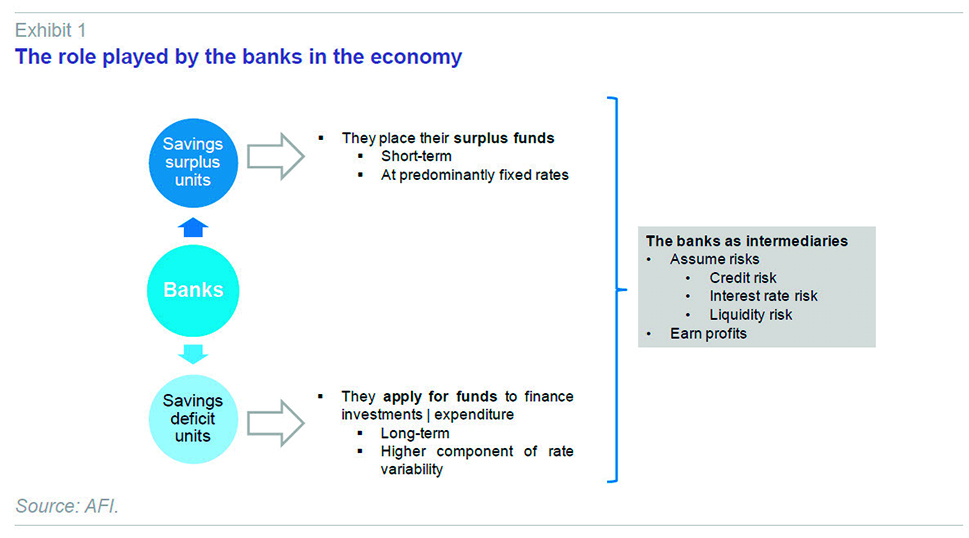

The chief role played by the banks in the economy is to channel savings from households and companies which hold surplus funds (savings surplus units) to households and companies which need funds for spending or investment purposes (savings deficit units). This intermediation role is crucial as the interests of the various surplus and deficit units do not necessarily coincide in terms of the maturities and rates at which funds are offered and solicited. It is up to the financial institutions to overcome this mismatch and to channel funds efficiently by accepting deposits (generally short-term and usually at fixed rates) and making loans to finance consumption or investment (usually medium‒ and long-term loans at rates which typically involve a higher degree of variability). As a result of this intermediation, a series of financial risks inevitably arise.

Due to differing interest rates and terms of maturity between funds received and those loaned, the banks assume two kinds of risks known as ‘structural balance sheet risks’: interest-rate risk and liquidity risk. Although these risks are significant and require due management, the biggest source of risk generated by this business is another: that related to the credit risk, namely the risk of non-payment or non-performance.

To safeguard the solvency of banks, which play a vitally-important role in the economy, there are a series of requirements related to capital and provision buffers which they must hold as a function of the risks they assume. To this end, a distinction is generally made between expected and unexpected losses. The Basel capital requirements have arisen in response to the latter concept. The purpose of the capital banks are required to hold is to cover their unexpected losses; the amount of this capital must be sufficiently high so that the entity will be able to tackle loss scenarios for which the probability of occurrence is very low but which, if they were to occur, would have a significant impact.

Accordingly, the logic behind the capital requirements is to cover unforeseen losses by means of capital buffers; foreseen losses, materialisation of which is considered highly probable, should be contemplated in profit and loss.

This highly reasonable logic is not, however, aligned with existing regulatory requirements. The capital requirements applicable to financial institutions are enshrined in the well-known Basel regulatory framework which has indeed been calibrated in an attempt to cover (with varying degrees of success) unexpected losses. Less well-known are the regulations which apply to impairment provisioning requirements. In Spain, the current provisioning regime is that stipulated in Appendix IX of Bank of Spain Circular 4/2004 (as recently amended by Circular 4/2016). These rules establish the criteria for classifying an asset as ‘doubtful’ (on account of borrower arrears or for other reasons) and the amounts to be set aside depending on the associated risk levels.

The amendments recently made to Appendix IX, which took effect on October 1st, sought to align the Bank of Spain’s requirements with the international accounting standard currently in force, namely IAS 39. This international accounting standard primarily follows an incurred loss model. This means that the banks have to recognise losses on loans extended essentially when they are realised, i.e., when the counterparty has already stopped complying with his obligations such that the loan is in default (understood as a loan in arrears by 90 days) or showing signs of significant impairment, i.e. an indication that the counterparty will not be able to repay 100% of his debt (‘doubtful for reasons other than borrower arrears’).

This logic will change from January 1st, 2018, when International Financial Reporting Standard (IFRS) 9 enters into force. The focus of IFRS 9 is to shift the model underpinning IAS 39 towards one in which entities have to provision for expected credit losses at the time of granting and then assess impairment with respect to expectations at the time of initial recognition.

Overview of IFRS 9

Development of IFRS 9 rounded out the International Accounting Standards Board’s response to the financial crisis of recent years.

As already noted, it is scheduled to enter into effect on January 1st 2018, as stipulated in Commission Regulation (EU) No. 2016/2067, published in the Official Journal of the European Union on November 22nd, 2016. This new accounting standard does not apply exclusively to financial institutions but to all manner of companies. Only insurance companies, as stated in the Regulation, are allowed to defer its implementation.

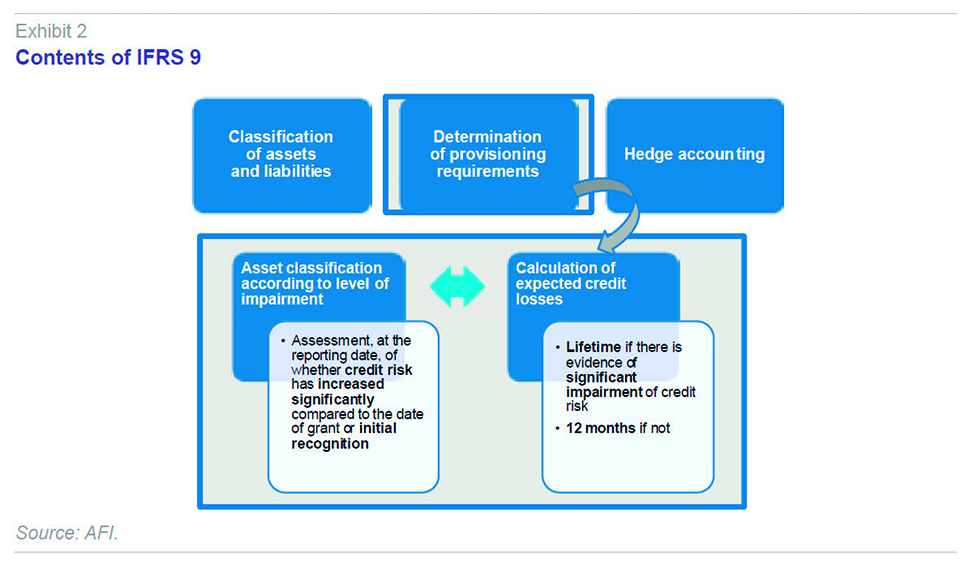

Chapter 1 of IFRS 9 stipulates that its objective “is to establish principles for the financial reporting of financial assets and financial liabilities.” Therefore, the standard is broader in scope than determination of provisioning requirements, although this is the area of the new standard expected to have the greatest impact on banks when they apply it for the first time next year. In addition to prescribing how to determine provisioning requirements, the standard also amends the former financial asset and liability classification and hedge accounting regimes.

Although the standard is broader in scope, it is worth noting that this article addresses the treatment of credit impairment for accounting purposes, as the other two areas of change, while implying modifications with respect to the current treatments, are not expected to have as significant an impact as the new provisioning model.

In order to delve further into the new accounting standard, the treatment of impairment provisions is broken down into two key aspects: the classification of assets by level of impairment and the calculation of expected loss.

Asset segmentation under IFRS 9

On the first matter, IFRS 9 prescribes classifying assets as a function of an assessment, at the reporting date, of a given transaction’s credit risk in comparison with the risk of a default occurring at initial recognition.

This approach is underpinned by transaction pricing theory. When a loan is granted, by setting the rate of interest to be charged on the transaction, the banks have to analyse the various “factors of production” used in order to extend it: the funding cost (internal and external), the general expenses they must incur to originate and maintain the position and the expected cost of credit risk, i.e., expected loss. As a result, transactions with different probabilities of default should be associated with different interest rates so that the higher the risk, the higher the rate of interest or spread charged.

When testing an asset for impairment, if it presents the same level of credit risk as it did when it was initially measured, albeit factoring in the transaction’s normal development over time, the interest rate established should continue to cover the corresponding expected credit losses. Therefore, just as entities will recognise the interest income received in profit and loss, the new standard stipulates the need to cover the associated expected losses from when the transaction is initially recognised.

If, in contrast, the transaction has sustained a significant increase in credit risk with respect to the granting or initial recognition date, the interest rate applied is no longer deemed sufficient to cover the potential risk and higher provisioning requirements are deemed necessary.

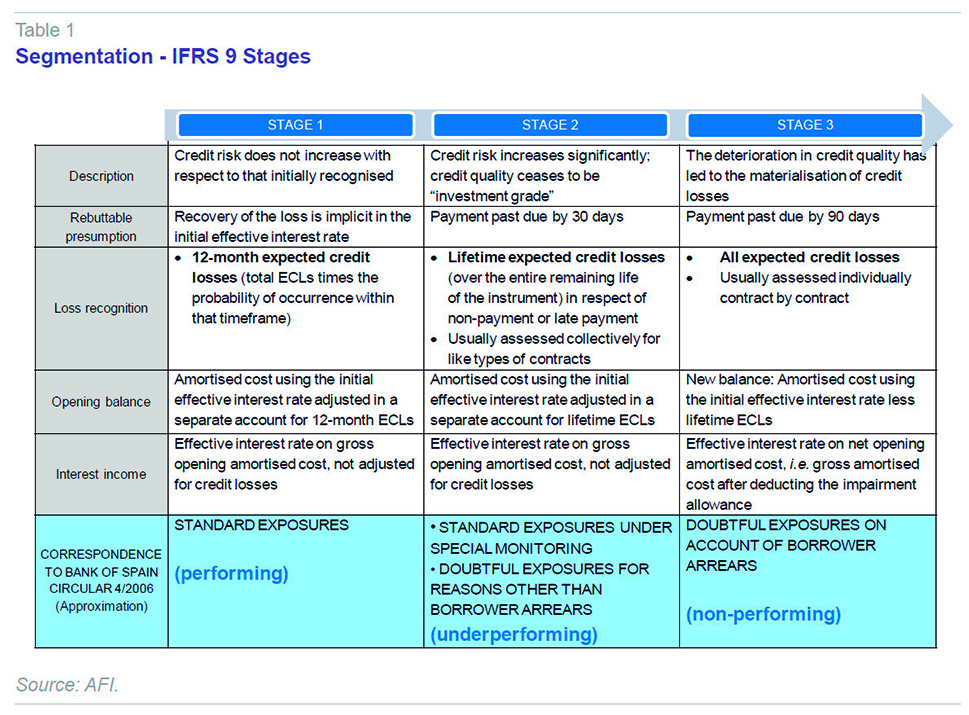

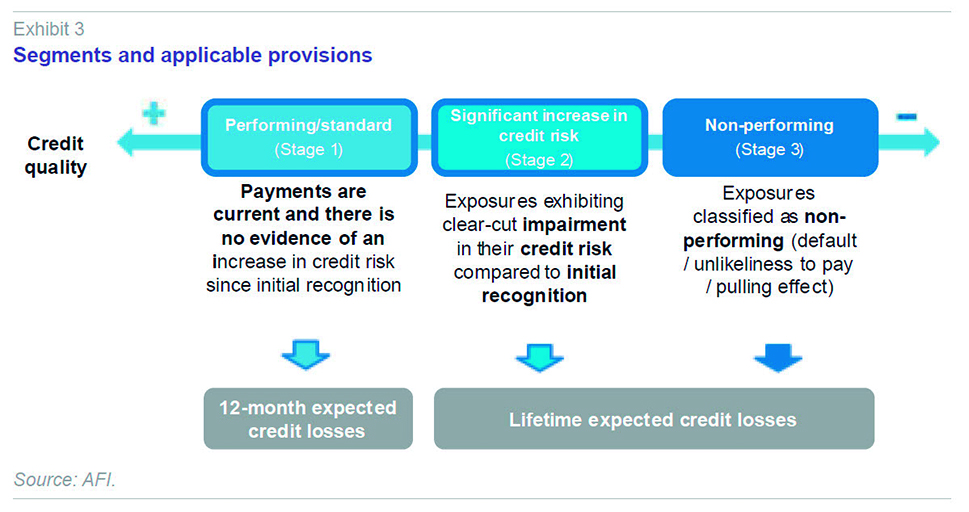

Following this pattern of deterioration in the observed credit risk of financial instruments, the standard categorises transactions into three groups: Stage 1, Stage 2 and Stage 3.

Stage 1 assets are those whose credit risk has not increased since initial recognition such that the interest rate established for the transaction in question embodies a reasonable estimate of the associated expected loss. The equivalent to this segment in current Bank of Spain nomenclature (as per the official translation) is that of a performing or ‘standard’ exposure.

Stage 2 assets are those for which credit risk has increased significantly since initial recognition, albeit without a credit event occurring. To assess whether such an increase has taken place, IFRS 9 provides operational simplifications such as a 30 days past due rebuttable presumption. Although not directly equivalent, this ‘bucket’ is roughly similar to exposures currently deemed ‘standard under special monitoring’ and ‘doubtful for reasons other than borrower arrears’. In sum, assets whose recovery is subject to question but which cannot yet be classified as non-performing or doubtful.

Lastly, Stage 3 includes transactions for which losses have already been incurred. Accordingly, this bucket can be considered similar to assets currently classified as ‘doubtful on account of borrower arrears’.

Determining impairment provisions (expected loss) under IFRS 9

As already noted, IFRS 9 changes the provisioning treatment paradigm, moving away from an incurred loss model to an expected loss approach. This means that the banks will stop recognising the bulk of their credit risk losses at default (past due by 90 days) and start to recognise a buffer to cover potential losses upon initial recognition. This makes sense insofar as the risk really exists from when the transaction is arranged and not from when non-performance begins.

Given that an asset’s expected loss is subject to change if macroeconomic conditions vary, IFRS 9 requires the use of economic forecasts for the modelling time horizon so long as the associated cost or effort is not disproportionate.

The general criterion is that for Stage 1 transactions, impairment provisions should cover 12-month expected credit losses (ECLs), while for asset classified as Stage 2 or Stage 3 exposures, the provisions should cover lifetime expected credit losses.

Potential impact of IFRS 9 applicationGiven that this is such a fundamental change in how the various assets and liabilities are accounted for, the European Banking Authority (EBA) has analysed the potential impacts of its application.

[1] The EBA has determined that the aspects of IFRS related to the classification and measurement of assets and liabilities did not particularly concern the banks, as application of the new criteria is not expected to have a major impact on their financial statements. In contrast, implementation of provisioning calculations based on an expected loss model, particularly the use of lifetime ECLs for Stage 2 assets, is expected to translate into a significant increase in total impairment provisions. Specifically, overall provision volumes are expected to increase by 18% on average (and by up to 30% for 86% of the respondents), while common equity tier 1 (CET1) ratios are expected to decrease by 59 basis points on average (and by up to 75bp for 79% of the respondents). Another relevant aspect detected by the EBA is the significant expected increase in income statement volatility.

Qualitatively, the aspect of greatest concern gleaned from the EBA’s study was the fact that a large number of entities were at an early stage of preparation for the new standard. More specifically, the smaller banks were lagging further behind, despite the likelihood that these entities need to make the greatest efforts to adapt to the extent they do not already have internal ratings-based (IRB) models to leverage for the purpose of developing expected loss models to calculate their provisioning requirements.

Meanwhile, on October 11

th, 2016, the Basel Committee on Banking Supervision (BCBS)

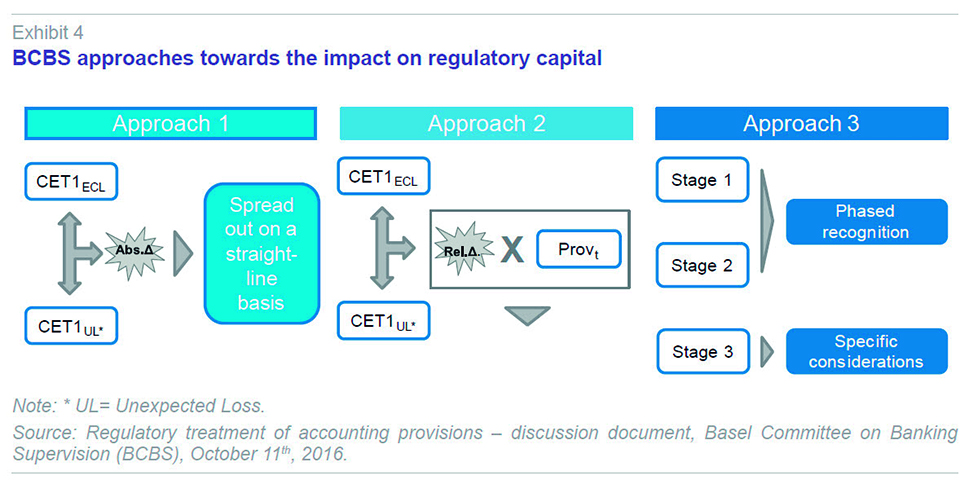

[2] released a consultative document to assess, from a policy standpoint, the potential interim approach and transitional arrangements in respect of the regulatory treatment of accounting provisions. In the event that the new ECL provisioning requirements have a high impact on the banks (to be determined on the basis of studies currently underway), this document paves the way for a transitional arrangement for the new accounting rules on regulatory capital. To this end, three possible approaches to how a transitional arrangement might be structured (over a three- to five-year period) are under consideration:

- Approach 1 - Day 1 impact on CET1: The first approach consists of evaluating the impact of the new accounting regulations on an entity’s CET1 in absolute terms and spreading that impact for regulatory purposes over the number of years specified by the Committee.

- Approach 2 - Impact in relative terms: The second approach consists of evaluating the capital adjustment linked to the proportionate increase in provisions and spreading that impact using this percentage of provisions figure.

- Approach 3 - Phased recognition of Stage 1 and 2 provisions: The third approach would directly phase in recognition of the provisioning requirements in respect of Stage 1 and Stage 2 assets for regulatory purposes over the transition period.

Challenges ahead for IFRS 9 implementation

The work to be performed to adapt provision calculations for the new international accounting standard should not be underestimated. In particular, one of the most novel aspects, and the one which implies the greatest burden of work, lies with the requirement to use internal models and estimates to calculate provisioning requirements. Although framed by the criterion of proportionality, this burden may be even greater at institutions which do not have advanced (IRB) models for calculating their capital requirements. Although the entities already using IRB models already have some of the parameter-defining work done, the criteria for estimating certain elements of credit risk (probability of default (PD), exposure at default (EAD) and loss given default (LGD)) are not the same, as the parameters used for capital calculations are subject to a series of restrictions and are average parameters through the cycle (or at the downturn in the event of LGD). To calculate provisions, the parameters must be adapted for each point-in-time and configured to make forward-looking estimates, factoring in macroeconomic forecast variables (and their probability of occurrence) for the years ahead. Moreover, it is necessary to assess the period for which these parameters need to be estimated such that they are compatible with the lifetime concept, which could have significant implications.

Notes

Pilar Barrios and Paula Papp. A.F.I. - Analistas Financieros Internacionales, S.A.