Spanish fiscal support measures: Boosting corporate liquidity in response to COVID-19

Although the Spanish government has introduced significant deferrals of state taxes and social security contributions, the scale and reach of these deferrals is smaller relative to some other EU-15 countries. Consequently, the government could consider expanding its commitments to provide a stronger foundation for Spain’s future economic recovery.

Abstract: Current forecasts for the Spanish economy suggest that the COVID-19 pandemic will result in an economic contraction of between approximately 7% and 13% in 2020. Faced with that scenario, the government has passed a raft of employment, fiscal and financial measures to mitigate the destruction of jobs and businesses. One of the most significant initiatives is the deferred payment of state taxes and social security contributions by six months. That deferral option is longer than the two to four months granted in some other European countries. However, the scale and reach of the initiative in Spain are significantly smaller than its equivalent in Germany, France, Italy, Denmark and Belgium, for example. In addition, these countries have offered direct grants or subsidies to firms, not just tax deferrals. One of the reasons for that difference is the fact that in Spain, taxes can only be deferred by companies with revenue of less than six million euros in 2019. For this reason, the government may want to consider a more decisive commitment to prop up corporate liquidity and pre-empt job losses. While this would inevitably result in a higher deficit over the short-term, it could pay off in the long-run by providing the economy with a stronger foundation upon which to stage a recovery after the health crisis has abated.

Economic backdrop

Spanish GDP grew by 2% in 2019, down 0.6 percentage points from 2018. It is in this context that the Spanish government presented its macroeconomic forecasts on February 11

th, 2020. While these forecasts called for growth of 1.6% in 2020 and 1.5% in 2021, the OECD warned less than a month later that growth in 2020 would be nil or even negative, as a result of the expansion of the COVID-19 virus.

[1]

Just a few days after the state of emergency was declared on March 14

th, Funcas estimated that the Spanish economy would contract by 3%, assuming that the effects of the pandemic did not extend beyond April.

[2] However, the paralysis of all non-essential activities decreed between March 30

th and April 9

th further exacerbated the sharp deterioration of the Spanish economy already sustained in the first quarter as a result of the lockdown.

[3] For this reason, the contraction estimated by various institutions over the course of April, including those compiled by the Spanish government, has been steadily increasing. Those forecasts currently point to a contraction ranging between approximately 7% and 13%, depending on the speed of recovery in the second half of the year (Bosca, Doménech and Ferri, 2020; CEOE, 2020a; Funcas, 2020; Bank of Spain, 2020, IMF, 2020 and Government of Spain, 2020).

Against that backdrop, companies’ sales have been plummeting, eroding their cash balances. The Bank of Spain’s Business Survey regarding the impact of COVID-19 reveals that 80% of all businesses have seen their sales drop as a result of the pandemic (Bank of Spain, 2020). Spain’s employers’ association, the CEOE (2020b), has similarly found that liquidity is one of the areas of business management most severely impacted by COVID-19. This liquidity issue is particularly worrying in Spain given the relatively small average size of its enterprises, which leaves them highly vulnerable to financial restrictions (Bank of Spain, 2020).

The government has passed numerous executive orders with specific measures aimed at mitigating the pandemic’s economic ramifications. The goal is to minimise the damage caused by COVID-19 to the business landscape using several different instruments. These measures include the deferral of taxes and social security contributions, government-sponsored furlough schemes (ERTEs for their acronym in Spanish), official credit (via the ICO) and moratoriums on business rent and lease agreements. According the Bank of Spain’s survey, the highest rated policy tool is the tax deferral scheme, followed by the furlough arrangements and state guarantees. Over 70% of businesses experiencing a reduction in sales have positively rated the deferral of taxes, while close to 50% positively rated the furlough schemes.

This article focuses on the deferral of taxes and social security contributions approved for SMEs and the self-employed at the state level.

[4] These measures allow the deferral for six months of personal income tax (PIT) payments by self-employed individuals, valued added tax (VAT), corporate income tax (CIT) and social security contributions (SSC). Deferral, as a means of supporting businesses’ liquidity, releases funds that can be used to pay salaries and suppliers. This in turn reduces the risk of bankruptcy. For that reason, tax deferral is one of the measures being used most widely in Europe, as we will demonstrate at the end of this article.

Deferral of payment of tax and social security contributions in Spain

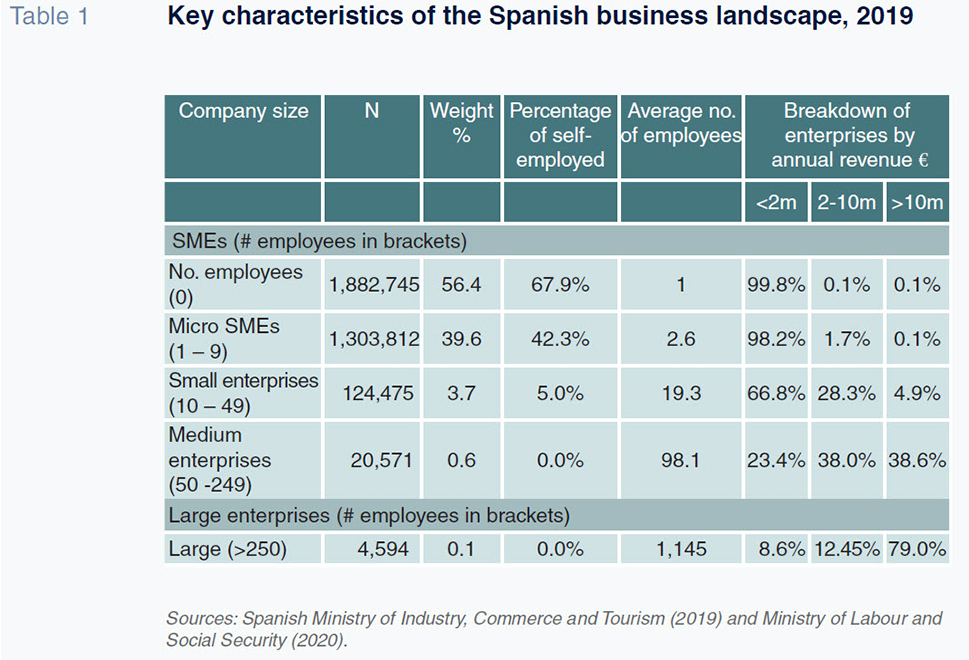

The tax deferral measures approved in Spain are targeted specifically at the self-employed and very small-sized enterprises. Before delving into the measures introduced, Table 1 provides a brief synopsis of the composition and basic characteristics of the Spanish business landscape. Note that the self-employed are unincorporated small- and medium-sized enterprises that tend not to have employees. As a result, their earnings are taxed via PIT rather than CIT.

According to Spain’s central companies database, DIRCE for its acronym in Spanish, there are around 3.3 million enterprises in Spain, of which 3.1 million are SMEs with between 0 and 9 employees. Specifically, 56.4% are SMEs without employees, of which 68% are self-employed. The remaining 39.6% are micro enterprises (between 1 and 9 employees) with 2.6 employees on average, of which 42% are self-employed. The vast majority of SMEs without employees and micro enterprises fall under the revenue threshold of 2 million euros per annum. Additionally, 66.8% of small-sized enterprises, 23.4% of medium-sized enterprises and 8.6% and large enterprises fall into that category (Spanish Ministry of Industry, Tourism and Commerce, 2020).

Deferral of taxes

The tax payment schedule normally requires SMEs, regardless of whether they are self-employed, to pay

[5] PIT withholdings in respect of their employees quarterly, together with their VAT returns.

[6] The self-employed also have to make advance payments towards their own PIT.

[7] Lastly, enterprises have to make advance payments towards CIT in the months of April, October and December.

[8]

By way of illustration, we provide a brief overview of the taxes borne by the self-employed as a benchmark for a very small company. The data presented by the tax authorities show that the annual average net earnings of all self-employed taxpayers was 10,892 euros in 2017, while the advance payments towards PIT during the year averaged 2,087 euros, which is equivalent to approximately 500 euros a quarter (AEAT, 2020a).

[9] Meanwhile, the VAT tax returns of the companies filing under the simplified regime yielded an average payment of 1,033 euros in 2018, equivalent to an average of 258 euros per quarter (AEAT, 2020b). What this shows is that a self-employed taxpayer has to pay approximately 750 euros every quarter for advance payments towards PIT and VAT. If they have any employees, they must also pay PIT withholdings and social security contributions of at least 300 euros.

To cushion the liquidity pressures generated by those cash outflows, particularly for smaller-sized companies, the measures passed in response to COVID-19 allow the self-employed and SMEs to defer their PIT, VAT and CIT payments for six months. According to government estimates, that deferral could boost their liquidity by almost 14 billion euros. This fiscal policy is well designed in that it permits the deferral of tax payments until the second half of the year, when the economy is expected to start to recover. However, it comes with restrictions on the payments eligible for deferral in terms of maximum amounts and the maximum size of the beneficiary entities. Those thresholds could significantly undermine the liquidity relief the deferral was intended to provide. The restrictions imposed on the use of the deferral scheme are the following:

- It is limited to those payments due between March 12th and May 30th. That period is insufficient considering that the state of emergency will remain in place until at least the end of May. Moreover, economic activity will take many months to fully recover, especially in certain sectors, making it advisable to extend the deferral of payments due past May 30th in order to provide businesses with ongoing liquidity relief.

- Deferral applications are capped to a total sum of no more than 30,000 euros.

- The deferral scheme is limited to companies with revenues of less than 6 million euros in 2019. [10] As shown in Table 1, SMEs with between 0 and 9 employees will nearly all qualify for this measure, as their annual revenue is less than 2 million euros. However, it would leave out bigger SMEs and even some large companies, which could be facing potentially severe liquidity constraints, particularly in the hospitality and food services sector.

- The beneficiaries must start to pay interest from month three of the deferral. Most other European countries have not introduced a similarly designed penalty.

Additionally, on March 14th, the tax payment schedule was modified to delay April payments by one month. However, that postponement measure was only provided for taxpayers with revenue of less than 600,000 euros in 2019 thereby benefiting just the smallest of firms. The government estimates that this measure will provide liquidity relief to businesses equivalent to 3.56 billion euros.

Lastly, on April 21st, the government said that those subject to the self-employed tax under the objective method would be allowed to calculate their tax under the direct method of estimation. In other words, they can start to pay tax on the basis of their actual earnings rather than by reference to fixed indicators, such as their number of employees, electrical power capacity or the size of their premises in the case of restaurants. In the current environment, direct estimation is more favourable for the self-employed as the probability of incurring losses in the coming quarters is very high, which would make their PIT very low, if not nil. The government estimates that this measure will benefit around 300,000 self-employed taxpayers who currently use the objective method of estimation and that the budgetary impact of this measures will be 1.13 billion euros. (Government of Spain, 2020).

Deferral of social security contributions

Before we analyse the deferral of social security contributions, it is important to note that they are paid monthly in arrears. In the case of the self-employed, the contributions payable in 2020 range from a minimum of 286 euros to a maximum of 1,233 euros.

[11] The contribution level selected determines the benefits received in the event of business interruption, sick or accident leave and retirement. Nevertheless, over 60% of the self-employed opt voluntarily to pay in at the minimum level (Ministry of Labour, Migration and Social Security, 2019). For other enterprises, contribution levels are determined by employee job categories. The average contribution per employee ranges between approximately 340 euros in the hospitality sector to 650 euros in the manufacturing industry (Social Security Treasury, 2019).

The government has introduced a six month deferral of social security for enterprises facing business interruption as a result of the state of emergency. There are two mutually incompatible deferral alternatives: deferral by instalment or by moratorium. Deferral by instalment allows tax payers to pay their contributions in instalments over a period of six months, while under the moratorium, the amounts unpaid are settled in full at the end of the six month deferral period. The deferral is available from April to June and the moratorium from May to July. Approval of the moratorium request is automatic following a simple online application, however is not permitted for businesses in every sector. Deferral by instalment, however, must be approved by the government. In order for it to be approved, taxpayers cannot have deferred any taxes prior to March. The moratorium is free of late-payment interest or surcharges whereas the deferral by instalment route carries late-payment interest, albeit at a low rate of 0.5%. The government has estimated the budgetary impact of this measures at 691.2 million euros (Government of Spain, 2020).

The design of the social security contribution deferral scheme is different from the tax deferral scheme in two significant ways. Firstly, there are no revenue-related thresholds. The prerequisite is that applicants have had to cease their business activities on account of the state of emergency. Secondly, there is no limit on eligible payment volumes, unlike in the tax deferral scheme.

International comparisons

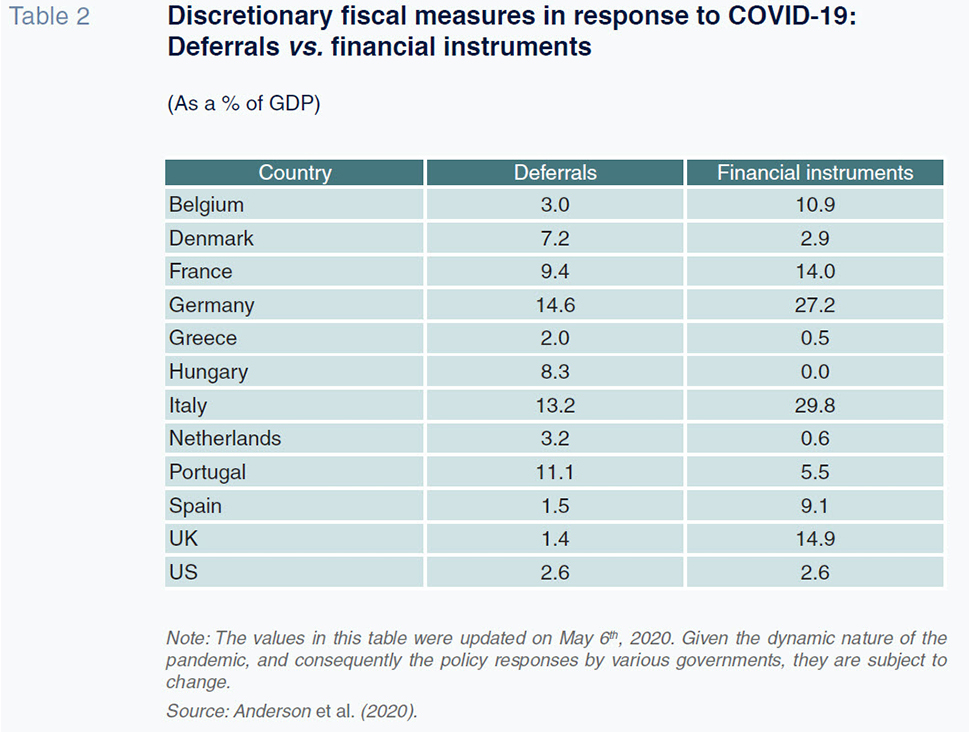

Relying on Anderson

et al. (2020), Table 2 presents the funds earmarked to deferrals and other liquidity measures and guarantees (‘financial instruments’) in response to COVID-19 expressed as a percentage of GDP for a selection of countries. It shows how financial instruments are dominant in Germany (27.2%), France (14.0%), Italy (29.8%) and the UK (14.9%). In contrast, Denmark (7.2%), the Netherlands (3.2%) and Hungary (8.3%) have opted to earmark a higher percentage of funds to deferrals. Spain has given greater weight to financial instruments, mobilising public funds equivalent to 9.1% of GDP to these arrangements, compared to 1.5% for deferrals. However, that 1.5% is far below the funds allocated in neighbouring economies such as Belgium (3.0%), Denmark (7.2%), France (9.4%), Portugal (11.1%), Italy (13.2%) or Germany (14.6%).

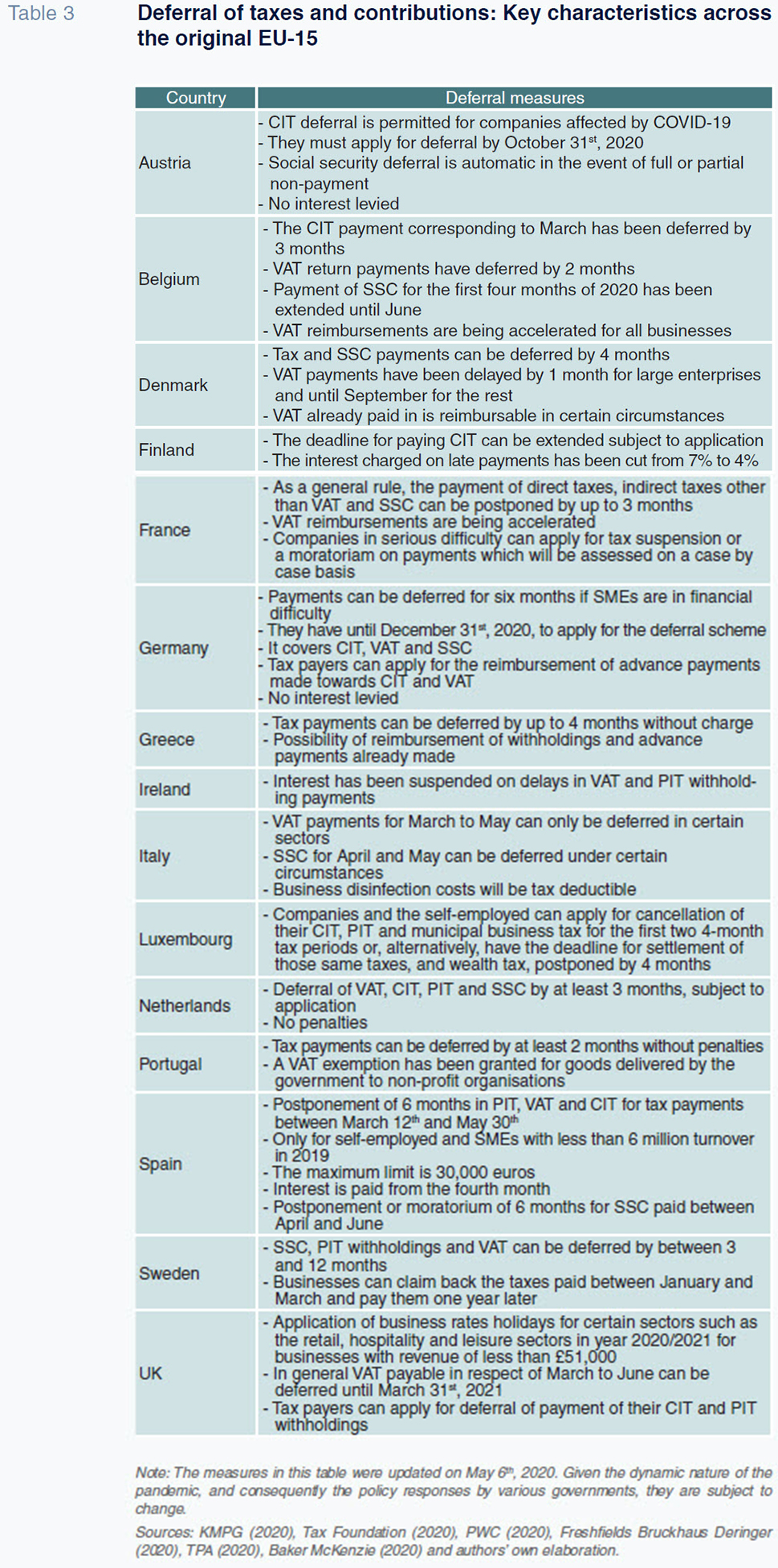

Table 3 provides a synopsis of the key characteristics of the deferrals rolled out in the original EU-15 member states. The table provides information about the taxes and contributions affected by the deferral schemes, the periods applicable, the key characteristics of the measures and whether or not they entail late-payment interest or other charges. The information provided in Table 3 yields the following conclusions:

- Most countries allow the deferral of CIT, VAT, PIT and SSC although some limit their coverage to just some of those taxes. For example, in Finland, only corporate income tax can be deferred.

- The deferral term set up in Spain is longer than the period of 2 to 4 months allowed in several of its European counterparts. However, it is shorter than is permitted in the UK and Sweden, where taxes can be deferred for as long as 12 months.

- In addition to the deferral, some countries, such as Denmark, Greece and France are allowing the reimbursement of taxes already paid.

- Deferral is allowed in general for all companies whose sales have been affected by COVID-19 irrespective of their size, with Spain as an exception.

- Lastly, in most cases there are no penalties for deferring taxes or contributions, with Spain an outlier in this respect, too.

In short, the deferral period of 6 months in Spain is above the 2 to 4 permitted in most European countries. However, the limits placed on deferrals (caps on volume of payments deferrable and on revenue for qualification) put Spain at a relative disadvantage, which should be reconsidered. We believe that the sharp correction Spain is set to face in 2020 requires that the deferrals be as generous as possible in terms of amounts and duration in order to minimise both business and job destruction. In March alone around 100,000 companies closed. A more decisive commitment to propping up business liquidity by redesigning the deferral scheme would probably drive the deficit higher in the short- term. However, it would pay off in the long-term by giving the economy a stronger foundation for its future recovery.

Notes

The first case was confirmed in Spain on January 31st, 2020.

Royal Decree 463/2020, of March 14th, 2020, declaring a state of emergency to manage the health crisis triggered by COVID-19 (published in the Official State Journal on March 14th, 2020).

Hospital and homeland security services, the production and disruption of healthcare and food products and financial and telecommunication services.

Excludes the Basque region and Navarre, which operate under their own regional tax regimes. The regional authorities have also established different formulae for deferring the payment of taxes they collect both directly and indirectly.

In April, July, October and January of the following year.

There are a number of VAT regimes, including several special regimes and the simplified regime, designed specifically for self-employed individuals with annual turnover of less than 250,000 euros.

The percentages of PIT to be paid on account depend on whether the self-employed taxpayer files under the direct or objective estimation regime. For those under the direct estimation regime, 20% of net earnings is withheld, net earnings being calculated by factoring in all income and expenses. Under the objective estimation regime, the percentage ranges between 2% and 4% of earnings, the latter calculated using a procedure that relies on different indicators of business activity.

The CIT advance payment is 18% for enterprises with annual revenue of less than 10 million euros and 23% if revenue is higher.

There are, however, significant differences between the direct and objective estimation regimes. Specifically, the average amount of net earnings estimated using the direct method was 14,337 euros in 2017 and the sum of advance payments towards PIT was 2,522 euros. In contrast, average net earnings under the objective estimation method were 10,340 euros that same year, and the amount of payments made in advance averaged 1,106 euros.

Specifically, 6,010,121.04 euros.

Contribution payments are determined by applying a rate to the contribution bases, the minimum and maximum amounts of which are regulated each year in the state budget. In 2020, the minimum base is 944.40 euros and the maximum base is 4,070.10 euros. The general contribution rate is 30.3%.

References

AEAT. (2017).

Statistics on income from economic activities. Statistics for 2017. Online publication retrievable from:

https://www.agenciatributaria.es/AEAT/Contenidos_Comunes/La_Agencia_Tributaria/Estadisticas/ Publicaciones/sites/rae/2017/jrubik209bf9b54f1f09c7bdef3bc16ab522f22907d943.html— (2020b).

VAT statistics broken down for 2018. Online publication retrievable from:

https://www.agenciatributaria.es/AEAT/Contenidos_Comunes/La_Agencia_Tributaria/Estadisticas/ Publicaciones/sites/ivapartidas/2018/jrubik16075d08f12046e7c1d77be8bd73475c10fa3197.htmlANDERSON, J., BERGAMINI, E., BREKELMNS, S., CAMERON, A., DARVAS, Z. and DOMÍNGUEZ, M. (2020).

The fiscal response to the economic fallout from the coronavirus. Bruegel Dataset. Online publication retrievable from:

https://www.bruegel.org/publications/datasets/COVID-national-dataset/BAKER MCKENZIE (2020).

Overview of the (para) fiscal measures in Belgium. Online publication retrievable from:

https://www.bakermckenzie.com/en/insight/ publications/2020/03/overview-para-fiscal-measures-belgium-COVID19BANK OF SPAIN. (2020). Reference macroeconomic scenarios for the Spanish economy after COVID-19.

Economic Bulletin 2/2020. Online publication retrievable from:

https://www.bde.es/f/webbde/GAP/Secciones/SalaPrensa/COVID-19/be2002-art1.pdfBOSCA, J. E., DOMÉNECH, R. and FERRI, J. (2020).

The macroeconomic impact of COVID-19. Update of 6 April 2020 Online publication retrievable from:

https://www.bbvaresearch.com/en/publicaciones/the-macroeconomic-impact-of-COVID-19/CEOE. (2020).

Escenario Económico – Especial Impacto Coronavirus [Economic Scenario - Coronavirus Impact Special]. Online publication retrievable from:

https://contenidos.ceoe.es/CEOE/var/pool/pdf/ publications_docs-file-787-escenario-economico-especial-impacto-coronavirus-8-de-abril-2020.pdfFRESHFIELDS BRUCKHAUS DERINGER. (2020).

COVID-19 and German Tax. Online publication retrievable from:

http://knowledge.freshfields.com/en/Global/r/4111/COVID-19_and_german_taxGOVERNMENT OF SPAIN. (2020).

Stability Programme Update, 2020. Online publication retrievable from:

https://www.hacienda.gob.es/es-ES/CDI/Paginas/EstrategiaPoliticaFiscal/Programasdeestabilidad.aspxINTERNATIONAL MONETARY FUND. (2020).

World Economic Outlook, April 2020. IMF: Washington. Online publication retrievable from:

https://www.imf.org/en/Publications/WEO/Issues/2020/04/14/weo-april-2020KPMG. (2020).

Reports of tax developments in response to the coronavirus (COVID-19). Online publications retrievable from:

https://home.kpmg/xx/en/home/insights/2020/04/taxnewsflash-coronavirus-COVID-19-developments.htmlSOCIAL SECURITY TREASURY. (2019).

2019 contribution basis and rates. Online publication retrievable from:

http://www.seg-social.es/wps/wcm/connect/wss/113b46b8-3123-4b6-9e5f-7ec50173bd5e/BASES+ MEDIAS+PF+ DICIEMBRE+2019.pdf?MOD=AJPERES&CONVERT_TO=linktext&ContentCache=NONE& CACHE=NONE&CACHEID=ROOTWORKSPACE.Z18_9H5AH880M8TN80QOV0H20V0000-113b46b8-3123-4b96-9e5f-7ec50173bd5e-n68epCU

SPANISH MINISTRY OF INDUSTRY, ENERGY AND TOURISM. (2019).

SME statistics. Data as of January 2019. Online publication retrievable from:

http://www.ipyme.org/es-ES/ApWeb/EstadisticasPYME/Documents/CifrasPYME-diciembre2019.pdf— (2020).

Portrait of Spanish SMEs. DIRCE as of 1 January 2019. Online publication retrievable from:

www.iypme.org.

SPANISH MINISTRY OF LABOUR, MIGRATION AND SOCIAL SECURITY. (2019). Self-employed natural persons contributing to the social security. Full report for the fourth quarter. Online publication retrievable from:

http://www.mitramiss.gob.es/ ficheros/ministerio/sec_trabajo/ autonomos/economia-soc/autonomos/estadistica/2019/4TRIMESTRE/Publicacion_diciembre_2019.pdf— (2020).

Labour Statistics Bulletin. Online publication retrievable from:

http://www.mitramiss.gob.es/estadisticas/bel/welcome.htmTPA. (2020).

Austria: COVID-19 virus relief measures. Online publication retrievable from:

https://www.tpa-group.com/en/cee-news-en/austria-COVID-19-virus-relief-measures/

Desiderio Romero-Jordán. Rey Juan Carlos University and the Funcas Public Finance Observatory (OFEP)

José Félix Sanz-Sanz. Madrid’s Complutense University and the Funcas Public Finance Observatory (OFEP)