Spanish economic forecasts panel: May 2020*

Funcas Economic Trends and Statistics Department

GDP growth forecast for 2020 drastically cut to -9.5% due to COVID-19

Spain’s GDP contracted by 5.2% in the first quarter of 2020, according to the provisional numbers released by the National Statistics Office, the largest drop in the series. This contraction is due to the lockdown measures and business restrictions decreed during the second half of March in response to COVID-19. National demand detracted 5% from growth while foreign trade reduced GDP by 0.3%. Looking to the start of the second quarter, the leading indicators point to an unprecedented collapse in economic activity.

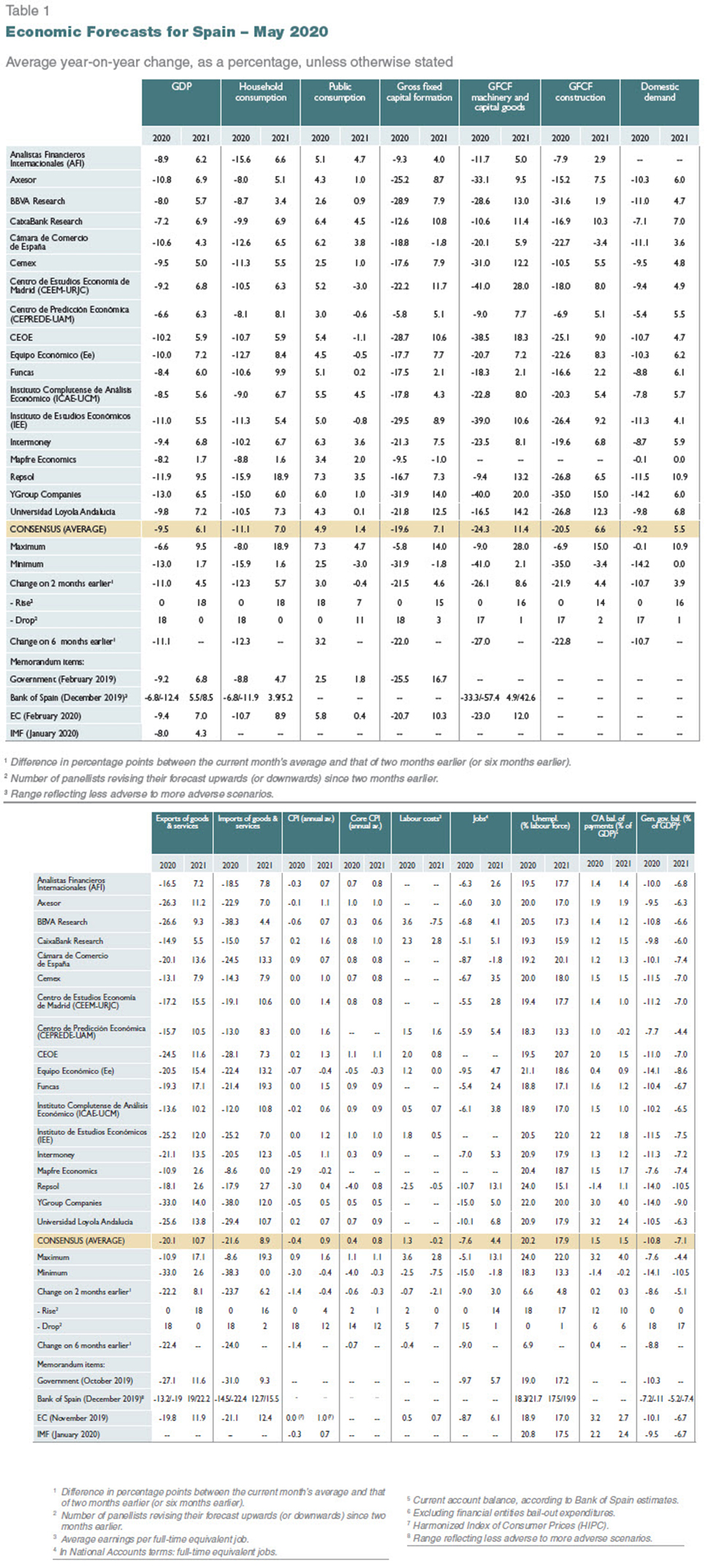

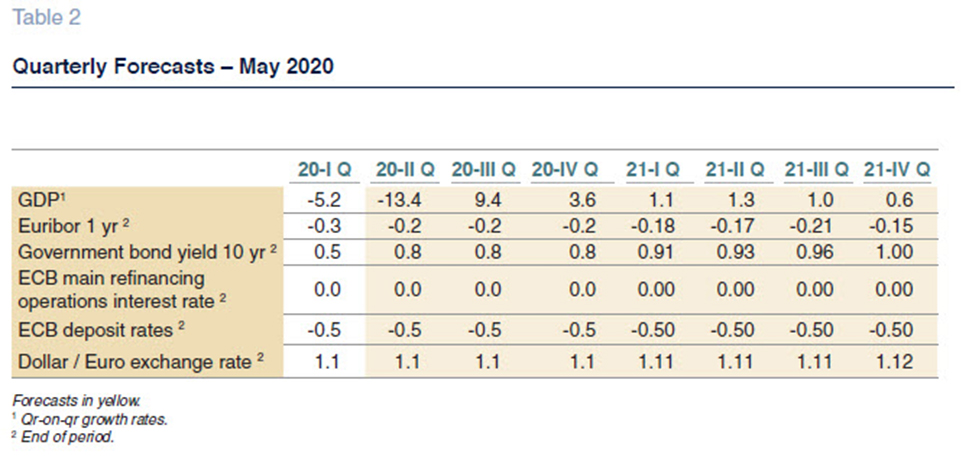

This is the first Panel since the state of emergency was declared. The consensus GDP forecast is for a contraction of the 9.5%; all of the analysts have drastically reduced their estimates (Table 1). The quarterly pattern forecast is as follows: -13.4% in 2Q20, +9.4% in 3Q20 and +3.6% in 4Q20 (Table 2).

The -9.5% forecast for 2020 is shaped by a GDP erosion of 8.9 percentage points as a result of the collapse in domestic demand and a loss of 0.6 points via trade. All the analysts agree that every component of private sector demand (consumption and investment) will contract sharply. International trade is similarly expected to shrink significantly. According to all the forecasts, the only component of GDP set to grow is public spending, thanks to the measures rolled out to shore up the economy.

The forecast for 2021 at 6.1%

The consensus forecast is that GDP will grow by 6.1% in 2021 (below the level forecast by the Spanish government and the European Commission), underpinned by growth of 1.1%, 1.3% and 1% in the first three quarters and 0.6% in the fourth (Table 2). Those numbers imply a partial recovery only, so that at the end of 2021, Spanish GDP would still be three percentage points below year-end 2019 levels.

The rebound in 2021 is expected to be driven mainly by a renewed domestic demand –forecast to contribute 5.4 percentage points to growth– with all components recovering except for public spending, whose growth is expected to ease. The foreign sector is expected to contribute 0.7 percentage points to growth in 2021.

Negative inflation in 2020

The global spread of the coronavirus has driven an unprecedented correction in crude oil prices, which has trickled through to inflation, which came in at 0% in March and -0.7% in April (compared to growth of close to 1% in the first two months of the year).

Inflation is expected to remain in negative territory until at least the middle of the third quarter, for an average annual rate of -0.4%. The forecast for 2021 is for inflation of 0.9%. Note, however, that there are significant differences in the various analysts’ forecast for inflation for both years.

The year-on-year rates forecast for December 2020 and December 2021 are -0.7% and 1.5%, respectively (Table 3).

Collapse in job creation

The Labour Force Survey revealed a 0.4% seasonally adjusted drop in employment in the first quarter. The rate of unemployment was 14.4%, 0.3 percentage points below that of 1Q19. Note, however, that those individuals affected by the COVID-19 furlough scheme (ERTE for its acronym in Spanish) are not included in the official unemployment figures.

The number of Social Security contributors declined by nearly one million between March 13th and March 31st, while the number of employees affected by the furlough scheme climbed to 3.3 million.

According to the consensus forecasts, employment, in full-time equivalent terms, will decrease by 7.6% in 2020 and increase by 4.4% in 2021. Using

the forecasts for growth in GDP, job creation and wage compensation yields implied forecasts for growth in productivity and unit labour costs (ULC): the former is expected to decrease by 1.9% in 2020 and increase by 1.7% in 2021, while ULCs are forecast to increase by 3.2% in 2020 and decrease by 1.9% in 2021.

The average annual rate of unemployment is expected to increase to 20.2% in 2020, 6.6 percentage points above the level forecast in the last edition of the survey, falling back to 17.9% in 2021.

Larger external surpluses forecast for 2020 and 2021

Spain recorded a current account surplus of 24.9 billion euros in 2019, up 7% from 2018. In the first two months of 2020, the trade balance improved year-on-year, while the income deficit narrowed, so that the current account deficit improved by 2.7 billion euros.

The consensus forecasts call for a current account surplus of 1.5% of GDP in 2020 (up 0.2 percentage points) and 1.5% in 2021 (up 0.3 percentage points).

Public deficit set to soar in 2020 and 2021

The public deficit in 2019 was 2.8% of GDP, up from the deficit of 2.5% recorded in 2018. The Social Security narrowed its deficit; the local governments recorded a smaller surplus; and the central government recorded a similar deficit in both years.

The analysts are forecasting an increase in the total deficit in the next two years: to 10.8% of GDP in 2020 and 7.1% in 2021. Those forecasts are in line with those of other institutions such as the Bank of Spain and the European Commission.

The global and European economies are similarly in recession

The main economic indicators point to an unprecedented global recession. The global and eurozone March PMI and confidence readings fell sharply and the April readings have gone on to plummet to levels not seen since comparable indicators were introduced. The service sector readings are down by more than the manufacturing sector equivalents, no doubt because the lockdown and business restriction measures decreed in response to the pandemic are hitting the sector –particularly tourism– harder.

Growth estimates for the first quarter confirm the trends portrayed by the leading indicators. GDP in the US and China, the world’s two largest economies, contracted by 4.8% and 6.8%, respectively, while the eurozone’s economy shrank by 3.8%.

In its spring forecasts, the IMF predicted a contraction in the global economy of 3% this year, which is significantly greater than the impact of the last financial crisis in 2009. It believes that the global economy will grow again in 2021, specifically by 5.8%. The IMF believes that the European economies will be hit particularly hard. That prognosis is endorsed by the European Commission in its most recent forecasts, which suggest that eurozone GDP will contract by 7.7% in 2020, going on to rebound by 6.3% in 2021.

Against that backdrop, the analysts all agree that the overall and EU-specific external environment is unfavourable for Spain’s economic outlook. However, half of the analysts believe that the international climate could improve in the months to come, a somewhat less pessimistic outlook than expressed in our last report.

Unanimous appraisal of the extraordinary expansionary monetary policy measures

In light of the extraordinarily complex situation, central banks have rolled out exceptional liquidity and state financing measures. The ECB has set up a new 750 billion euro government debt repurchase programme to cover the costs of the pandemic (the PEPP). It has also eased the restrictions on sovereign bond asset eligibility to make room for unforeseen contingencies. The rules for the use of corporate bonds as collateral by the banks have also been relaxed to include high-yield paper. Those measures, coupled with the rollout of government-backed guarantee schemes, which in Spain amount to 100 billion euros, are designed to curtail the liquidity issues facing businesses, particularly SMEs and the self-employed, and prevent a slew of bankruptcies.

Despite that arsenal, the markets have become more stressed during the state of emergency. 12-month EURIBOR has firmed to -0.1%, up nearly 0.2 percentage points from March. The yield on Spain’s 10-year government bonds has also increased, to nearly 0.9%, while the country risk premium (spread compared to the German sovereign bond) has doubled since our last report, to 135 basis points.

The analysts unanimously agree that monetary policy is expansionary and should remain so for the coming months. Although interest rates are still expected to climb gradually higher during the projection horizon, they are forecast to remain at relatively moderate levels, facilitating the funding of the measures taken in response to the pandemic.

Slight euro appreciation forecast

Since the March assessment, in the wake of the deterioration of the European economy and easing of monetary policy, the euro has depreciated slightly against the dollar. However, the analysts are expecting a slight recovery, to 1.12 by the end of 2021, appreciation of close to 0.3 percentage points from current levels.

Fiscal policy needs to prop up the economy

The last survey revealed an incipient rethink about the direction fiscal policy should take, a trend reinforced in this survey. Today the analysts agree that fiscal policy has turned expansionary. Moreover, all but two believe that this is the direction fiscal policy should take for the months to come. None of the analysts are calling for fiscal policy tightening at present.

*

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 18 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 18 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.