Spanish banks’ preparedness for the COVID-19 crisis: A European comparison

Spanish banks’ key metrics, such as capital adequacy levels and liquidity buffers, have improved since the last crisis; however, the economic fallout from COVID-19 is projected to have an adverse impact on the sector. Therefore, it is essential that Spain’s banks continue their cost-cutting efforts and reduce their capacity, given the expected increase in provisions needed in the coming months to cover the anticipated rise in NPL ratios.

Abstract: With a capital adequacy level 4.2 percentage points higher than in 2008, Spanish banks appear better positioned to withstand the economic fallout from COVID-19 than during the previous financial crisis. Notably, Spanish banks boast above-average profitability and efficiency compared to their eurozone peers, their loan-to-deposit gap has improved, and they have a healthy buffer of liquid assets. That said, the IMF and the European Commission are forecasting a bigger contraction in GDP in Spain (8%-9.4%) than in the eurozone (7.5%-7.7%). Although government-backed guarantees, the aid rolled out to prop up business and household income and the easing of bank regulations may help cushion the impact of the crisis on the banks, a GDP contraction of that magnitude will drive non-performance higher and require the recognition of provisions. Moreover, although the Spanish banking sector’s solvency ratio is significantly above regulatory requirements, it is 2.3 percentage points below the eurozone average. Furthermore, even though a deep restructuring effort has left Spanish banks among the most efficient in Europe, efficiency has deteriorated in recent years. As a result, Spain’s banks will need to continue with their cost-cutting efforts and reduce their capacity even further in order to weather the COVID-19 crisis.

[1]

Introduction

In recent weeks, comparisons have been drawn between the COVID-19 crisis and earlier crises, such as the 2008 financial crisis (the Great Recession) and the Great Depression of the 1930s. Although significant uncertainty remains regarding the macroeconomic impact of the COVID-19 pandemic, a growing number of institutions are predicting a fallout not seen since the Great Recession. The IMF is forecasting a contraction in global GDP of -3% in 2020, which is far bigger than that observed in 2009 (-0.1%). The forecasts vary widely by country, with a far more significant impact anticipated in the advanced economies (-6.1%) than in the developing world (-1%). In the eurozone, the region of reference for Spain, the IMF is forecasting a contraction of a -7.5%, with all of the core EU member states likely to suffer a similar degree of economic decline: Germany (-7.0%); France (-7.2%); Italy (-9.1%); and Spain (-8%). The IMF is also forecasting a major contraction –of 6.5%– in the United Kingdom. The European Commission’s forecast also points to a drastic fall in GDP in 2020, specifically -7.7% for the eurozone and -9.4% for Spain. Meanwhile, the Bank of Spain is forecasting a correction of between -6.8% and -12.4% depending upon the scenario used.

The real economy and the financial sector are highly intertwined. The banks will not be immune to the consequences of the crisis as a result of several transmission channels: a) the impairment of asset quality which will require higher provisioning as non-performance rises; b) a drop in demand for credit as a result of the gloomier economic outlook on consumption and investment; and, c) a fall in business volumes, which will drive a reduction in non-interest income (e.g., banking fees and commissions).

Given the importance of the banking sector in providing businesses and households with financing, in line with the ECB’s forceful action to shore up liquidity and risk premiums, various European governments are introducing public guarantee schemes. These measures are intended to stimulate bank lending by financial institutions against potential losses. More than ever, the banking sector is an important part of the solution to this crisis; hence the need to protect it from having to absorb excessive losses.

Faced with a crisis of the magnitude forecasted by institutions, such as the IMF, the European Commission and the Bank of Spain, it is important to analyse the banks’ resilience. This will depend on their health at the onset of the crisis in terms of capital adequacy, profitability, liquidity, efficiency, NPL coverage, asset quality, etc. The better positioned they are based on those measures, the greater their ability to assume losses without eroding the capital they are required to hold by regulators.

The purpose of this article is to analyse the Spanish banks’ position compared to their European counterparts in order to illustrate their relative health for handling the economic fallout from COVID-19. To do so, we use the most recent information published by the ECB in its consolidated banking data

[2] (CBD) catalogue, grouping the variables into five categories: solvency, asset quality, profitability, efficiency and liquidity. Given the comparisons being made with the 2008 crisis, we also compare the European banks’ health today with that of 2008.

Solvency

Own funds are important for any business’ ability to assume potential losses. The same holds for the banking sector, where capital, reserves and other assets with loss-absorbing capacity ensure that the entities remain solvent. That is why it is important to analyse the European banks’ capital buffers, i.e., their own funds in excess of the minimum required under capital adequacy rules.

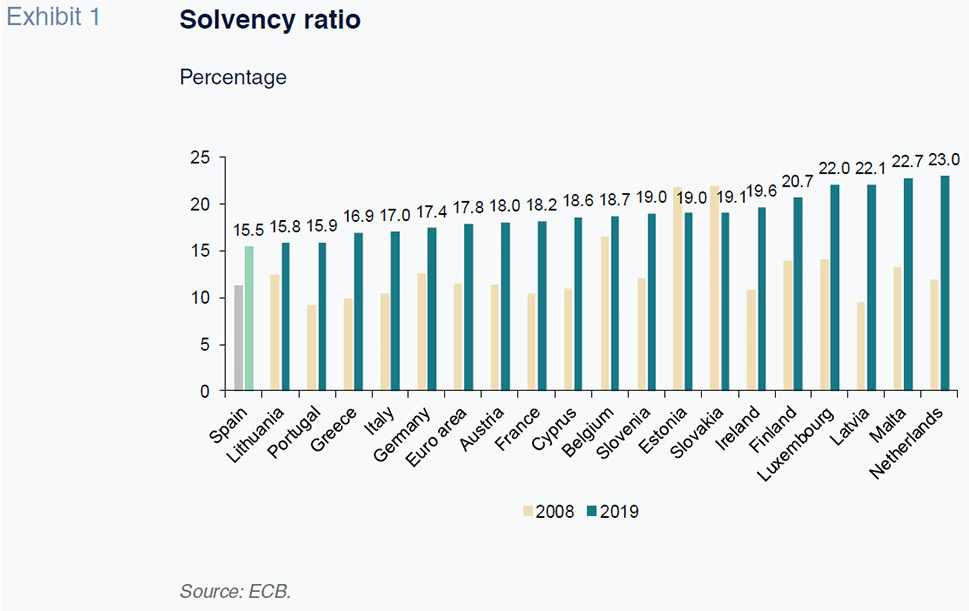

As shown in Exhibit 1, with the exception of two small countries in the eurozone (Estonia and Slovakia), all of the banking systems are significantly better capitalised today than they were in 2008. The solvency ratio averages 17.8% in the eurozone, which is 6.3 percentage points (pp) above the 2008 average. In Spain, the solvency ratio has improved by 4.2 pp, which is not only a smaller-than-average increase, it is lower than the main European systems’ recapitalisation efforts: Germany (4.8 pp), France (7.8 pp) and Italy (6.6 pp). At 15.5%, the Spanish banks solvency ratio is 2.3 pp below the eurozone average, making it the lowest in this peer group. Five eurozone member states (Finland, Luxembourg, Latvia, Malta and the Netherlands) boast a solvency ratio of over 20%. In sum, although the Spanish banks headed into this crisis with a much higher solvency ratio than in 2008, that ratio is the lowest in the eurozone (and the EU, according to the EBA numbers). This indicates that they also have a relatively smaller capital buffer. Note, however, that the Spanish banks’ solvency picture would improve if the asset risk weightings did not penalise Spain so heavily.

In terms of Spanish banks’ loss-absorbing capacity, it is important to analyse its composition, as not all assets are equal in that respect. Of all assets, common equity tier 1 (CET1) is the highest quality.

In Spain, the CET1 ratio (as a percentage of risk-weighted assets, or RWA) is 12.2%, the lowest in the eurozone and 2.3 pp below the eurozone average. This means that the highest quality assets –CET1– account for 79% of total own funds in Spain, 2.4 pp below the eurozone average. The minimum required level is 4.5%, so that the Spanish banks have a CET1 buffer of 7.7 pp of RWA.

Asset quality

History shows that the economic cycle is the key driver of non-performance at banks, making it likely that the anticipated contraction in GDP will push this indicator higher in the coming months. That phenomenon was particularly evident in Spain in 2008, when non-performance in the domestic banking sector rose from 1% at the start of that year, eventually peaking at 13.6% in 2013. Since then, buoyed by emergence from recession, the NPL ratio has been trending lower, standing at 4.8% today (February 2020).

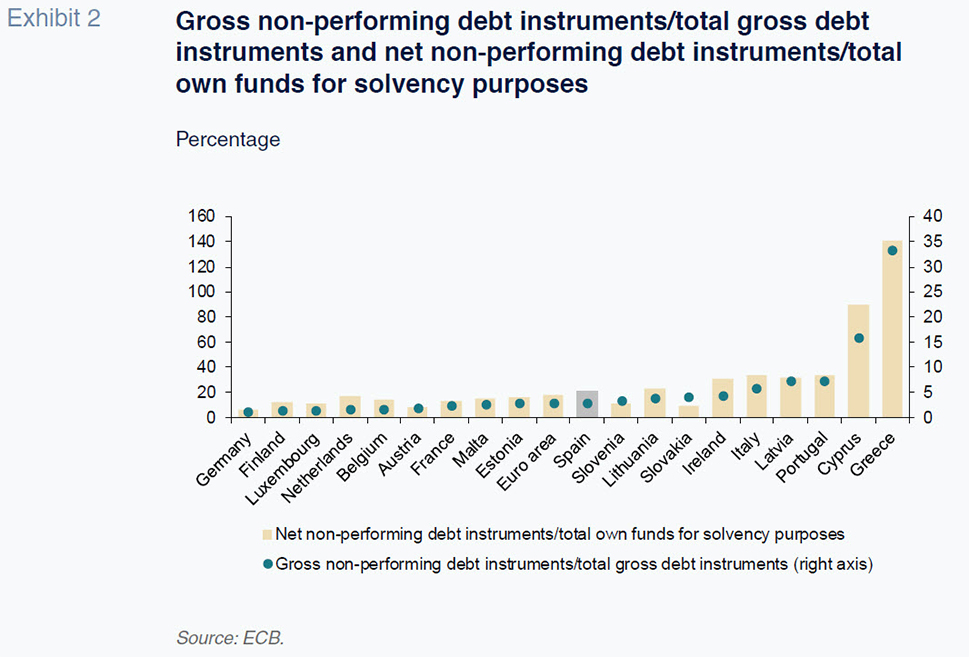

Looking at the business of the consolidated banking groups (which includes not only the domestic business but also the banks’ sizeable foreign operations), the overall NPL ratio (including loans and other exposures) stood at 2.94% as of the third quarter of 2019. This figure is very close to the eurozone average (2.91%) and just 0.4 pp higher than that of 2008. The Greek banking sector presents the highest non-performance ratio by far (33.3%). Among the major banking sectors in the eurozone, Italy’s (5.9%) is in the weakest position to withstand the COVID-19 crisis, whereas France’s (2.4%) and Germany’s (1.2%) present below average NPL ratios.

While starting from a high NPL ratio makes navigating this crisis difficult, not having a high enough NPL coverage ratio exacerbates the problem. In regard to the latter, Spain is in a relatively strong position. The Spanish banking sector has a non-performing loan coverage ratio of 63.5%, which is 3.1 pp above the eurozone average. Among the main European economies, the German banks are by far the best positioned by this measure, with NPL coverage of 88.2%. France also presents an above-average coverage ratio (65.5%), whereas coverage in Italy is 1.9 pp below the eurozone average (58.5%). The Greek banks’ situation is worrying as they present the highest NPL ratio as well as a relatively low coverage ratio (48.2%).

Another valuable indicator in analysing asset quality and banks’ overall health is the weight of net non-performing debt instruments relative to own funds for solvency purposes. If provisions are insufficient to cover actual losses, banks will have to earmark own funds to absorb the unexpected losses. By that measure, the Spanish banks are slightly less well positioned, as the amount of potential losses for which provisions have not been recognised represents 20.8% of own funds, which is 2.9 pp above the eurozone average. Germany is the best positioned by that count (non-provisioned potential losses would only absorb 5.8% of the German banks’ own funds), with Greece again of greatest concern (140.1%). The situation in France (13.5%) is better than in Spain and below the eurozone average, but Italy is worse off (33.8%). When interpreting this indicator, however, it is important to note that behind those non-performing assets there are guarantees, so that actual losses will vary as a function of the quality and value of those guarantees.

Profitability

European banks’ profitability has been suffering from a combination of factors for some time. These factors include: regulatory requirements (equity and anti-crisis debt is expensive to raise); pressure on net interest margins is huge with interest rates so low; business volumes have declined in the wake of private sector deleveraging; and, competition from other banks and non-banks (shadow banks and Big Tech) has been intensifying. The clearest signal of their depressed profitability is the fact that the banks are trading significantly below book value, with the sector’s ROE remaining below the cost of equity. That trading discount has widened since the onset of the COVID-19 crisis.

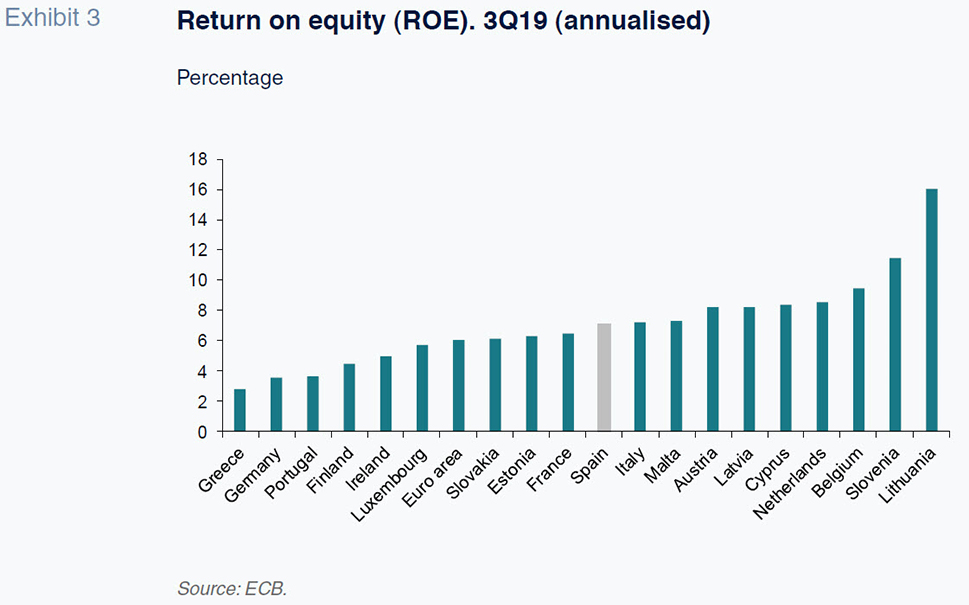

The most recent figures for the third quarter of 2019 (annualised) put the eurozone banks’ ROE at 6.1%, which is below their cost of equity. At 7.1%, the Spanish banks’ ROE is above the eurozone average and also higher than that of the banking systems of Germany (3.5%) and France (6.5%), and very similar to that of Italy (7.2%). Greece trails the sector (2.9%), echoing its high NPL ratio. In Spain, the banks’ ROE dipped in 2019 compared to 2018 (8.3%).

[3]

Efficiency

Managerial efficiency is a prerequisite if a company is to remain competitive. Efficiency is also a driver of profitability, which requires generating revenue at as low a cost as possible. In the current competitive environment of depressed returns, cost-cutting is a very important tool for boosting efficiency and, by extension, profitability.

Although the Spanish banks are highly efficient in the European context, their cost-to-income ratio has deteriorated in recent years despite the effort made to reduce costs by rationalising capacity (branches and employees). Their cost-to-income ratio in 2019 was 12.7 pp below the eurozone banking average (52.9% vs. 65.6%) and well below the ratio presented by the other major European sectors: Germany (74.8%); France (71.7%) and Italy (65.1%). From that perspective, Spanish banks are better positioned to tackle the crisis than their European counterparts.

However, Spanish banks’ cost-to-income ratios have increased 6.4 percentage points since 2008 (which implies an increase in the ratio of 13.6%), evidencing an erosion of their efficiency in recent years. The reason is that while gross margins have only increased by 2%, average costs have increased by almost 15.8%. It is therefore important that they reduce capacity in the coming years, all the more so in light of the anticipated decline in profitability due to the COVID-19 crisis. In the domestic market, there is still room for manoeuvre as the Spanish branch network remains among the densest in the EU and also the most fragmented in terms of employees per branch.

Liquidity

In times of uncertainty, the banks need to build enough of a liquidity buffer to see them through potential funding withdrawals. That is the purpose of the liquidity coverage ratio introduced a few years ago in response to the 2008 financial crisis. That ratio requires banks to hold sufficient high-quality liquid assets to withstand a 30-day stress period.

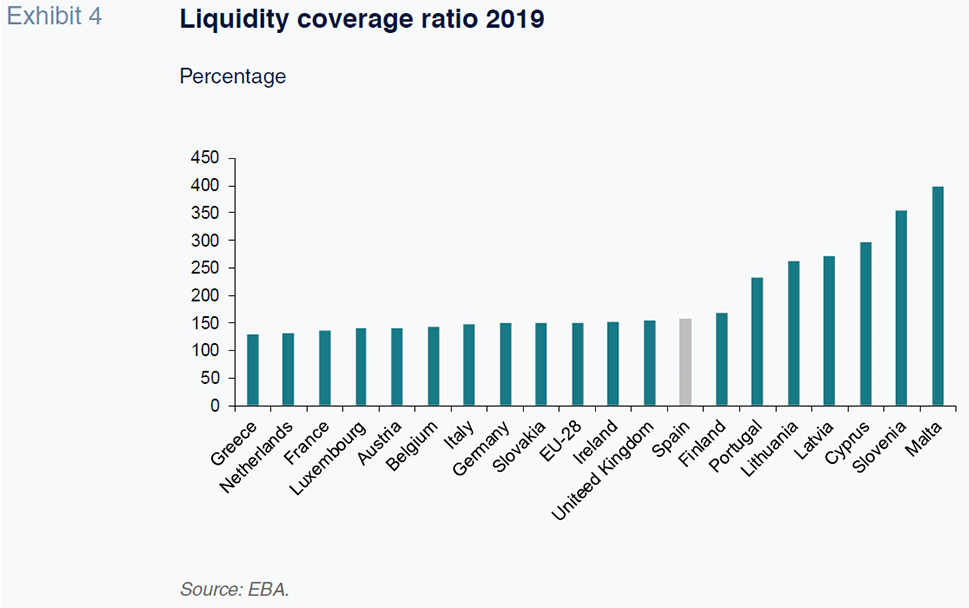

Using EBA data this time (as the CBD does not provide this information for all countries), we note that each EU banking system is in a comfortable position liquidity-wise, as their coverage ratios are well in excess of the required threshold of 100%. Spain ranks slightly above the EU average (158% vs. 150%), with Greece once again the laggard (130%). Malta tops this ranking (390%) while the Spanish banks’ liquidity buffer is greater than that of the major EU banking systems.

Following sharp deleveraging by the Spanish private sector, the stock of outstanding credit has declined sharply, so that the loan-to-deposit gap has narrowed. For all the consolidated groups, that ratio currently stands at 92.8%, so that the banks are no longer significantly dependent on the wholesale markets. The loan-to deposit ratio is below the eurozone average (99%), indicating that the liquidity gap is smaller in Spain.

A more recent indicator of how the banks are shoring up their liquidity in preparation for the challenge posed by COVID-19 is the volume of excess reserves held by the banks at the ECB. As of May 15th, eurozone banks’ excess reserves stood at a record high of 2.1 trillion euros. Adding in the liquidity deposited with the deposit facility, the figure rises to close to 2.4 trillion euros. The Spanish banks’ reserves also stood at a record high of 121.15 billion euros at the end of March, rising to 123.5 billion euros, if money in the deposit facility is included.

Conclusions

- The magnitude of the economic contraction predicted by the IMF and the European Commission (8%-9.4% in Spain and 7.5%- 7.7% in the eurozone, respectively) in the real economy will inevitably impact the banking sector. In the US, the major banks are expecting a sharp increase in non-performance, prompting them to recognise significant provisions in the first quarter of 2020. The same is true of Spanish banks, which between them have more than doubled their first-quarter credit loss provisions compared to the quarterly average in 2019.

- Fortunately, the Spanish banks headed into this crisis with far better capital ratios compared to the 2008 crisis. Their solvency ratio is 4.2 percentage points higher than in 2008 and their own funds are of significantly higher quality (most of their assets have loss-absorbing capacity). The capital buffer (the solvency ratio in excess of 8% of risk-weighted assets) currently stands at 7.5%, which is equivalent to over 110 billion euros. Therefore, even in a scenario so adverse as to imply losses of that scale, the banks would still present a solvency ratio above the required minimum of 8%.

- In addition to that sizeable capital buffer, a significant percentage of the financing being extended by the banks to support businesses affected by COVID-19 is secured by government-backed guarantees, so that the potential losses for the banks are limited on those loans (their exposure is capped at 40% in the case of loans to large enterprises and 20% in the case of SME and self-employed loans).

- Nevertheless, with a colossal GDP contraction looming, non-performance is bound to increase, affecting both corporate borrowers (certain sectors, such as the tourism industry, are being affected particularly hard and are expected to take months to return to any sort of normality) and the retail banking sector (as unemployment rises and disposable income shrinks). As a result, banks will have to increase their provisions against those losses, forcing them to intensify their cost-cutting efforts, one of the few ways in which they can shore up their profitability.

- The banks’ efficiency has deteriorated in recent years, due to both the difficulty in lowering costs and the erosion of gross margin. To gain efficiency, the banks will need to step up their efforts to pare back capacity in the coming years, including the closure of more branches. The recent lockdown experience drove an increase in demand for online banking services, which will encourage banks to revise and accelerate their branch closure plans.

- Spanish banks that start from lower profitability and solvency levels are more vulnerable to the fallout from COVID-19, potentially acting as a catalyst for banking consolidation via mergers and acquisitions.

- Focusing on the business in Spain, those banks that have greater exposure to the productive sectors more affected by COVID-19 (such as hotels and restaurants, wholesale and retail sales and transport) are also more vulnerable. These three sectors (140 billion euros) concentrate 26% of the loans to non-financial corporations and 12% of the loans to the private sector. Wholesale and retail sales is the sector with the highest non-performing loan ratio (8.2%) and the one that concentrates the most important part of the total exposure of these three sectors (56%).

- In addition to the direct impact of the COVID-19 crisis on GDP (lower demand for credit, higher non-performance and lower profitability), there are other indirect ramifications for the banks going forward. Reconstruction of Europe’s economies will oblige the ECB to keep rates ultra-low for much longer, implying a significant burden on the banks in their quest to eke out higher margins and returns, already depressed before the onset of COVID-19. Moreover, the risk premium will increase, and the higher cost of equity will make it more expensive to replenish capital. As a result, it will be hard to lift profitability above the return on equity demanded by investors, which is bound to weigh on the banks’ share prices.

- In contrast to the 2008 crisis, this crisis is more universal, with the pandemic affecting a large number of countries. Whereas geographic business diversification significantly cushioned the impact of the 2008 crisis for some banks (the biggest banks have very sizeable foreign operations), diversification will offer banks fewer advantages in this crisis, as the countries to which the Spanish banks are more exposed (UK, US, Brazil and Mexico) are also headed for intense economic crises.

Notes

This article falls under the scope of research project ECO2017-84828-R under the Spanish Ministry of the Economy, Industry and Competitiveness.

The most recent CBD information used in this article dates to the third quarter of 2019. Although the ECB publishes data as of year-end 2019 in its supervisory banking statistics, we have opted to use the CBD, which covers a higher percentage of each country’s banking systems. The EBA also offers information up until the fourth quarter of 2019, but the sample of banks used (those supervised by the SSM) is smaller than that of the CBD. Although the overall picture portrayed is similar irrespective of the source used, in the countries in which the percentages of assets analysed by the EBA and ECB (the banks supervised by the SSM) differ more notably from that covered by the CBD, some of the indicators deviate. For example, the ROE presented by the German banks is -0.2% according to the EBA (0.3% in 3Q19), 0.08% as per the ECB’s supervisory banking statistics and 3.5% using the CBD (data annualised using the 3Q19 number).

The figure reported by the Bank of Spain for all of the Spanish banks puts the 2019 ROE (using data up to December) at 6.8%, down 1.3pp from 2018. The EBA puts that figure at 7%, which is virtually the same as the annualised third-quarter number we use in this article based on the data gleaned from the CBD.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF