Capital and liquidity relief in response to COVID-19: Implications for the Spanish banks

The economic constraints associated with the COVID-19 crisis have prompted regulatory and supervisory authorities to provide Spanish banks with ‘relief’. In particular, the temporary release of capital and liquidity buffers, flexibility regarding asset impairment losses, and the expansion of eligible assets as collateral for liquidity auctions will have varying implication for the Spanish banking sector.

Abstract: Regulatory and supervisory authorities have adopted temporary measures to shore up banks in advance of the expected rise in defaults and in recognition of their key role in the transmission mechanism for financial aid. Banks will be able to operate below the capital conservation buffer (CCB), the Pillar 2 Guidance, and liquidity coverage ratio. In Spain, the sum of the CCB and average Pillar 2 Guidance would release around 58 billion euros for the Spanish banking system. Regulators have also relaxed collateral measures, such as lowering the minimum size threshold for domestic credit claims from 25,000 euros to zero. This will provide liquidity to support additional measures, such as public guarantees used to ensure credit flows to SMEs and the self-employed, which is especially important in Spain given that SMEs account for over 99.9% of all companies. Additionally, the ECB’s decision to accept less than investment grade debt is significant given the potential for ratings downgrades and the fact that sovereign debt accounts for approximately 10% of the Spanish banks’ total assets. However, since Spanish banks are predominately retail focused, regulatory loosening that targets market risk and volatility in financial markets will have less of an effect on the industry.

Introduction

The intense economic crisis triggered by policies designed to halt the spread of COVID-19 places Spain’s banks in the eye of the storm. Banks are the main sector affected by the chain of defaults resulting from the economic restrictions adopted in response to the pandemic. Additionally, banks are the chief transmission mechanism for channelling the financial aid, mainly in the form of guarantees, being rolled out by the authorities to prevent the collapse of a large number of businesses, particularly SMEs and the self-employed.

In light of that dichotomy, the regulatory and supervisory authorities have conceded considerable relief in terms of capital requirements and the accounting treatment of the adverse effects on the economic cycle and on banks’ credit risk. Although this relief is highly targeted, authorities have signalled that it will be of a limited duration.

Capital and liquidity relief

Against that backdrop, the European Central Bank’s Single Supervisory Mechanism announced on March 12th temporary capital requirements relief for all banks under its supervision. Specifically, banks will be allowed to temporarily operate below the level of capital defined by the capital conservation buffer (CCB), the Pillar 2 Guidance (P2G) and the liquidity coverage ratio (LCR). In addition, the authorities have recommended deactivating the countercyclical capital buffer in the countries in which it had been activated. Notably, this had not been activated in Spain. As well, the ECB will allow banks to issue Additional Tier 1 (CoCo) and Tier 2 instruments (subordinated bonds) to help them meet their Pillar 2 Requirements (P2R).

Similarly, both the ECB and the EBA have sought to alleviate the operational aspects of banks’ regulatory obligations. The supervisors have rescheduled on-site inspections and the implementation of remediation actions as well as postponed the 2020 stress tests and resulting recapitalisations.

By announcing these measures in the early stages of the COVID-19 crisis, the European supervisor has attempted to give the banks considerable flexibility and the ability to respond to potentially highly adverse scenarios without damaging their solvency and, by extension, their ability to fund the real economy.

In exchange for this relief, by way of a quid pro quo, the European supervisor has urged the banks to refrain from using breathing room provided by these measures to pay dividends for 2019 or engage in share buy backs. The only exception contemplated relates to banks that are legally obliged to pay dividends, e.g., the dividends associated with participating shares in some cooperatives and dividends already ratified by shareholders in general meeting, which if not paid, could give rise to legal claims.

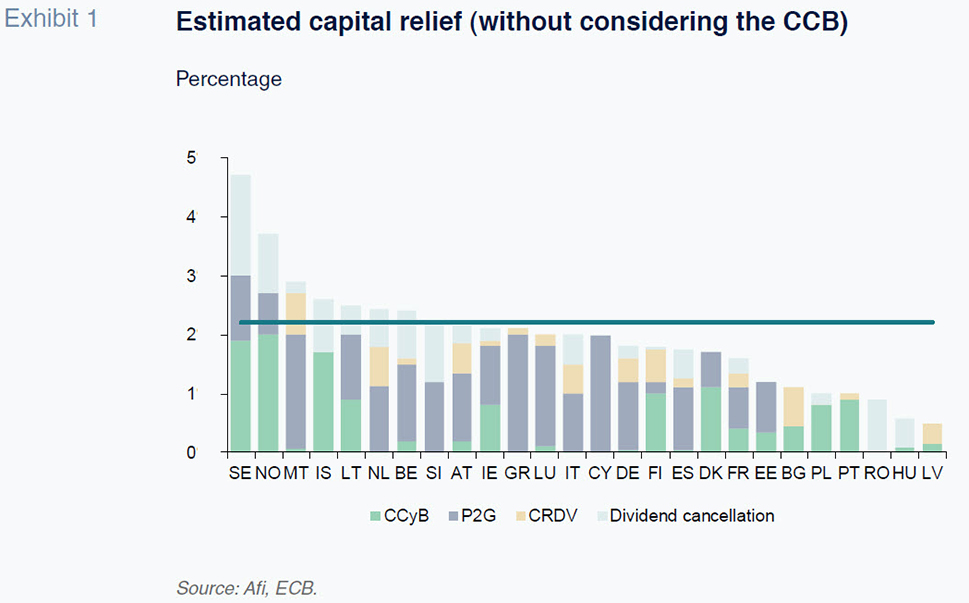

The goal of these measures is to create a significant capital buffer for absorbing potentially intense impairment losses without jeopardising the solvency of the European banking system. Based on the data published by the EBA, we estimate that the capital relief granted by the ECB could represent a release in terms of CET 1 capital of 2.2 percentage points, albeit varying widely from one country to the next, as shown in Exhibit 1. Notably, this is without considering the use of the CCB, which implies considerable restrictions on the payment of dividends and CoCo coupons not only in the current year but also in subsequent years in order to replenish it.

On the basis of these preliminary estimates, we ran the numbers for Spain, layering in the ability to use the CCB in full, despite restrictions on future dividend payments until that buffer is replenished.

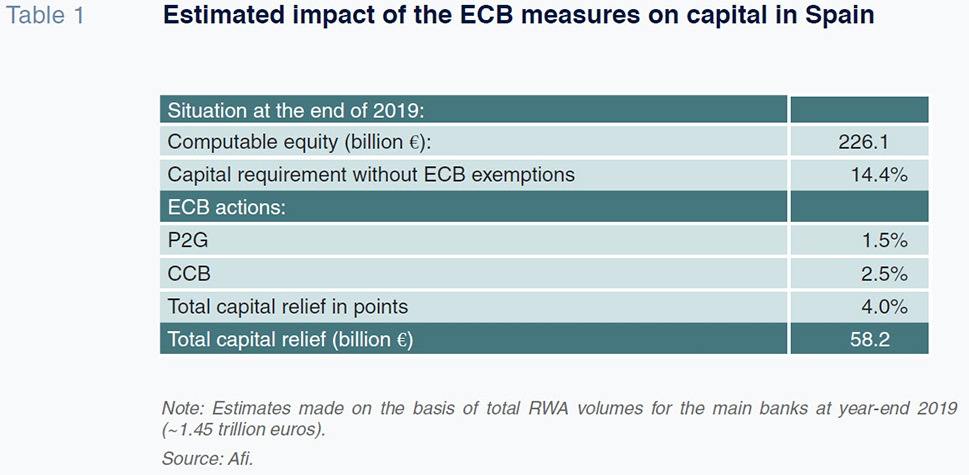

As shown in Table 1, the sum of the CCB and the average Pillar 2 Guidance (P2G) requirement reduces the banks’ capital requirement by 4% on average, releasing total capital of approximately 58 billion euros for the Spanish banking system as a whole.

That release of capital will serve as a line of defence for absorbing the potential asset impairment losses generated by the crisis. The total volume of capital released (58.2 billion euros) represents a truly sizeable percentage (nearly 15%) of the total stock of credit extended to the real economy. This creates a significant safety buffer, especially given the flexibility in accounting for non-performance, which will allow the banks to spread out the impact of their impairment losses, thanks to the non-application of excessively pro-cyclical assumptions in particular.

In addition to the capital requirement relief measures, the European regulatory authorities have eased the criteria for accounting for asset impairment losses with the aim of cushioning the impact of this presumably temporary crisis. Those measures were announced by the SSM and EBA and later echoed by the Bank of Spain. The actions taken can be summarised as follows:

- Exposures covered by legally imposed payment moratoriums related to COVID-19 will not be classified as non-performing.

- Provisions for debtors classified as unlikely to pay and who qualify for government guarantees will benefit from the preferential treatment provided in the Guidance for NPLs.

- The ECB has provided the banks with guidance on the use of forecasts to avoid excessively procyclical assumptions in expected credit loss (ECL) estimations in their IFRS 9 accounting practices.

Notwithstanding the accounting flexibility permitted by the European regulators, the banks have taken a very prudent approach in their first-quarter 2020 earnings presentations, recognising provisions that are far in excess of those corresponding to a literal interpretation of the accounting standard. By way of illustration, the Spanish banks that have reported first-quarter earnings to date have recognised provisions that more than double the average quarterly asset impairment allowances in 2019. Given that the actual increase in non-performance has been significantly lower so far, the evidence suggests that the banks are prudently anticipating far more adverse future scenarios.

Collateral easing measures

To further complement the capital relief and accounting flexibility measures, the ECB has also rolled out a package of measures designed to facilitate access to liquidity, significantly expanding the range of credit claims that can be used by the banks as collateral for the ECB’s liquidity providing operations, subject to the corresponding valuation haircuts (which have been reduced). The ECB has also lowered the credit rating threshold for eligible government debt assets to below investment grade (below BBB-, i.e., high-yield bonds).

In terms of eligible collateral, perhaps the measure of greatest relevance to Spain within the ECB’s announcement of April 7

th [1] is the lowering of the level of the minimum size threshold for domestic credit claims from 25,000 euros to zero to facilitate the mobilisation of SME/self-employed loans as collateral. Other measures include a temporary increase in the risk tolerance level of credit operations through a general reduction of collateral valuation haircuts by 20% and the introduction of a waiver for debt issued by Greece.

These measure will provide liquidity to support additional measures, such as public guarantees, introduced to ensure credit flows to the segments hit hardest by the crisis: SMEs and the self-employed. Spain’s guarantee policy has been evolving in tandem with the measures targeted at SMEs. The first tranche of 20 billion euros was divided 50/50 between SMEs and the self-employed, on the one hand, and all other companies, on the other. The second tranche, also a 20 billion-euro line, was earmarked entirely for SMEs and the self-employed, a pattern expected to be repeated in upcoming tranches.

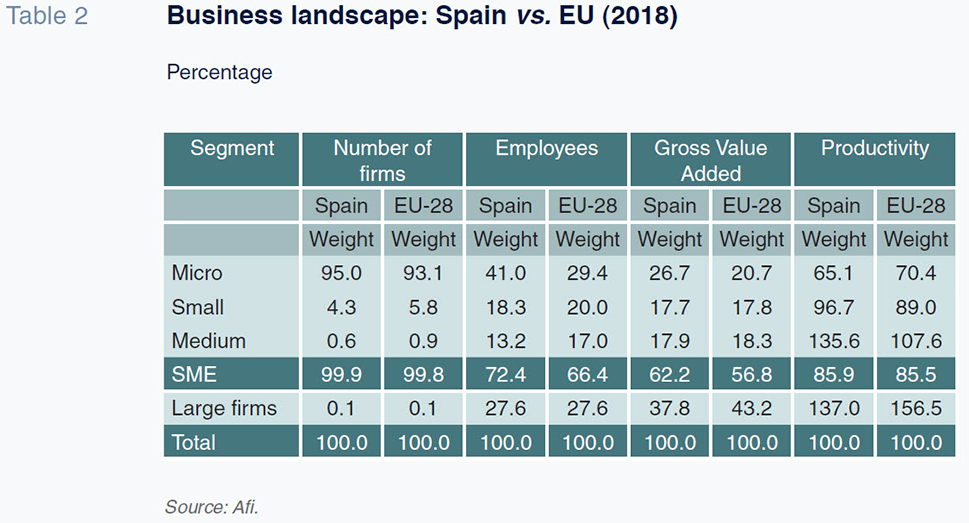

All of this is particularly important in Spain where, as shown in Table 2, SMEs account for over 99.9% of all companies and their contribution to GVA and jobs is above the European average.

In addition to easing collateral requirements on April 22

nd, the ECB announced it would accept debt rated at less than investment grade (below BBB- and down to BB for all assets and to BB+ for asset-backed securities),

i.e., high-yield bonds, as collateral.

[2] Although this measure does not relate to government debt only, government debt makes up the most of the banks’ fixed-income holdings, as shown in Exhibit 2. Sovereign debt accounts for approximately 10% of the Spanish banks’ total assets (compared to 15.1% in Italy and lower percentages in Germany and France). The move is aimed at avoiding potential procyclical dynamics as a result of possible ratings downgrades, which during the last crisis impeded the use of the public debt of certain countries as collateral.

Moreover, the decision to accept high-yield government bonds as collateral aligns with the approval during the last week of April of a new liquidity programme, dubbed PELTRO (Pandemic Emergency Long-Term Refinancing Operations), to complement the traditional TLTRO programmes (aimed at stimulating bank lending to the real economy) and the weekly LTRO auctions.

This new programme, which has been designed without a specific credit transmission objective, unlike the TLTRO programme, is aimed at the repurchasing of banks’ sovereign debt holdings with the goal of mitigating any widening in sovereign yields, together with other actions already taken by the ECB.

In addition to these measures aimed at providing relief for the banks, and related to the easing of ratings requirements for eligible sovereign bonds and use of the PELTRO programme, it is worth highlighting one last capital relief measure related to market risk requirements even though its impact on Spanish banks will be much lower due to their relatively low exposure to market risks (on account of their markedly retail banking profiles).

Given the potential for error in those estimates, particularly in respect of correlations, the supervisor adds an incremental factor to capital that must be set aside for the market risk deriving from those quantitative estimates.

In the context of the COVID-19 crisis, the relief measure is intended to compensate for the fact that these quantitative estimates have risen sharply, due to widespread volatility in all markets and higher correlations across assets.

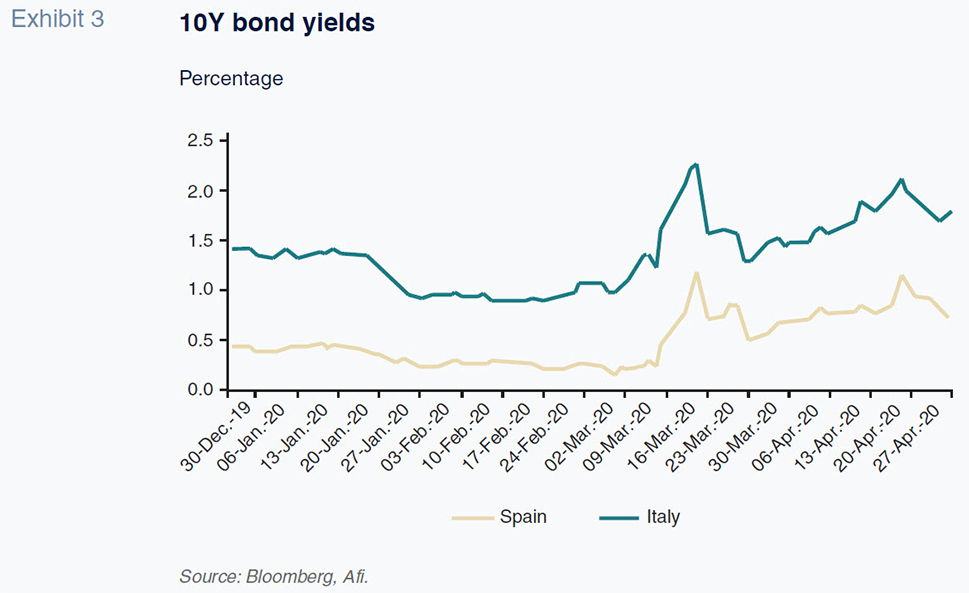

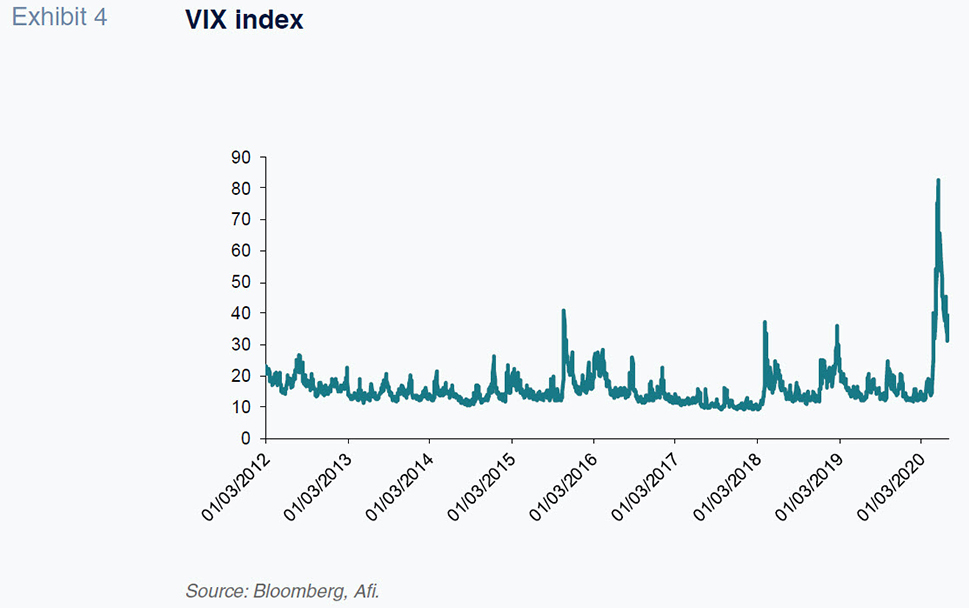

As illustrated in Exhibits 3 and 4, the data on sovereign bond yields and volatility reveal a considerable increase in the correlation between assets, particularly in yields on peripheral sovereign bonds, while the index that measures market volatility –VIX– has multiplied by around four.

In that context, in which the quantitative estimation parameters point to readings that are much higher than deemed normal, it no longer makes sense to layer in a multiplier.

With this measure, the ECB is pursuing an additional objective: preventing disruption in segments of the financial markets in which the banks could be discouraged from participating as intermediaries and above all as market makers as a result of high associated capital requirements.

Notwithstanding the favourable effects of this measure on market operations, it is likely to have only a small effect on the Spanish banks, strongly oriented toward retail banking relative to market intervention, which means that their market risk accounts for a relatively low percentage of their risk-weighted assets.

Conclusion

As analysed in this paper, the raft of measures rolled out in Spain and Europe provide the banks with significant relief in terms of their capital and liquidity requirements, helping to mitigate the impact of this crisis and enabling them to play a meaningful role in lending financial support to the real economy. We believe, therefore, that the well-intentioned measures reflect an attempt to align the banks’ requirements with the exceptional situation being navigated.

It is important to note that all of the measures are temporary in nature, in line with the expected transitory nature of the crisis in which we are engulfed. It would make sense, therefore, that the longer the effects of the crisis are felt, the longer the regulatory and accounting relief measures should be left in place.

Notes

References

EBA. (2019).

Transparency Exercise. ECB. (2020).

ECB supports macroprudential policy actions taken in response to coronavirus outbreak. — (2020).

ECB Banking Supervision provides temporary capital and operational relief in reaction to coronavirus. IMF. (2020).

Global Financial Stability Report. April.

MUS. (2020).

ECB Banking Supervision provides further flexibility to banks in reaction to coronavirus. OFFICIAL OF THE EUROPEAN UNIONL109I:

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=OJ:L:2020:109I:TOC

Marta Alberni, María Rodríguez and Fernando Rojas. A.F.I. - Analistas Financieros Internacionales, S.A.