Assessing the range of government guarantees: State support for the MARF

The third tranche of Spain’s government-backed guarantee scheme in response to Covid-19 will include the allocation of 4 billion euros to secure commercial paper issued on the alternative fixed-income market (MARF for its acronym in Spanish). The idea is to provide new stimulus for tapping the capital markets, helping to close the long-standing gap between Spain and the main European, as well as Anglo-Saxon, economies.

Abstract: The Spanish government has introduced a 100 billion euro guarantee scheme, dispersed across successive tranches that are being adjusted based on the experiences of previous disbursements. The first tranche (20 billion euros) was allocated evenly between SMEs (including the self-employed) and large enterprises, while the scheme’s second tranche was earmarked in full to the SME segment (including self-employed individuals). Of the total guarantees extended as of early May, 66% had secured SME loans, while 34% supported large enterprise loans. A key novelty of the third tranche is the addition of 4 billion euros to underwrite fixed-income securities (commercial paper) issued by companies listed on Spain’s alternative fixed-income exchange, the MARF. This initiative will be applicable to commercial paper with terms of maturity of up to 24 months. The guarantees provided for commercial paper issued on the MARF have a maximum size of 70%, implying a leverage effect of 143%, such that 4 billion euros of guarantees could drive total commercial paper issuance of around 5.7 billion euros.

The tranche-based guarantee scheme: Smart evolution

The 100 billion euro guarantee scheme approved by the Spanish government is being dispersed in successive tranches, the characteristics of which are fine-tuned on the basis of the experience gained in prior tranches in order to align supply and demand.

The first two tranches involved a total of 40 billion euros of bank loan guarantees. However, these loans were structured differently in terms of the types of businesses they targeted.

The first tranche (20 billion euros) was allocated evenly between SMEs (including the self-employed) and large enterprises. That 50/50 split mirrored the breakdown of the stock of bank loans outstanding at year-end 2019, composed of SME and large enterprise loans in equal amounts.

In fact, the original idea was to use that SME vs. large business loan product mix as of year-end 2019 (in the overall stock of outstanding loans and the various banks’ presence in each of the segments) as the criteria for allocating the guarantees among the various banks.

That said, the criteria of outstanding balance of SME and large business loans could have been complemented by additional criteria. For instance, Spain’s smallest companies are far more vulnerable financially and have fewer alternatives compared to their larger counterparts, which may warrant increased access to the guarantee scheme.

While framed by a similar line of reasoning, and influenced by the fact that the balance of the first tranche allocated to the SMEs was consumed much faster, the scheme’s second tranche was earmarked in full to the SME segment (including self-employed individuals).

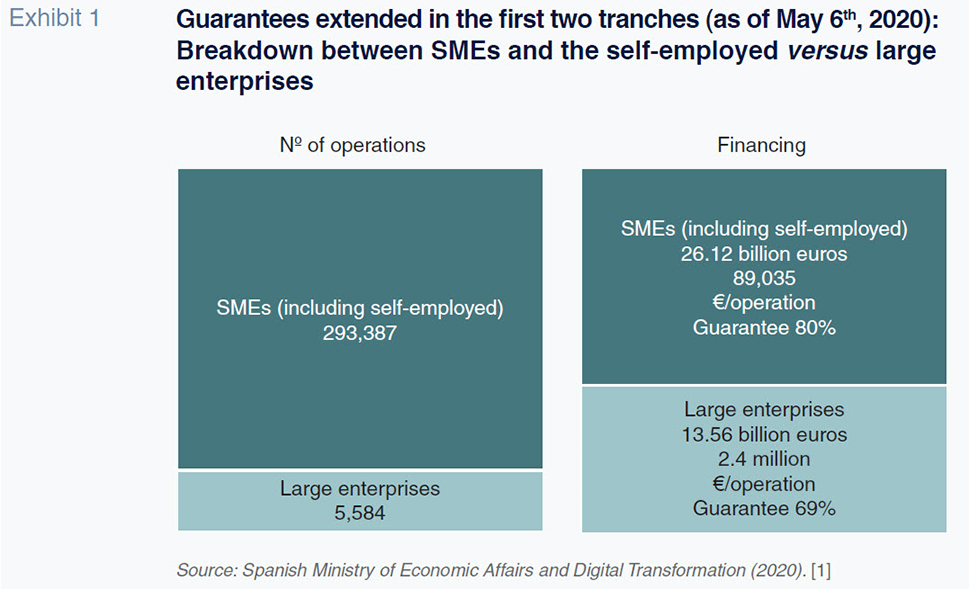

That reformulation of objectives for the second tranche has shaped an overall breakdown more in favour of the SME segment, as evident in the synopsis published by the Spanish government (Exhibit 1), summarizing the experience of those first two tranches. That experience has served to guide the disbursement of the third tranche, which we address later in this article.

Of the total guarantees extended as of the publication date of that synopsis, 66% had secured SME loans, while 34% supported large enterprise loans. In both segments, it is worth highlighting the high number of transactions guaranteed and the very low average size of the guarantees extended per transaction (89,000 euros in the SME and self-employed segment and 2.4 million euros in the large enterprise loan segment).

In both segments, the average amounts guaranteed suggest that businesses have used the loans to cover a few months of their working capital needs. This is especially likely for new loans as opposed to refinancing.

The small size per transaction may also signal a surplus demand relative to supply, prompting the banks to allocate the guarantees pro rata in an attempt to partially satisfy as many applicants as possible.

Regardless of whether this is the case, the speed at which businesses are requesting the guarantees (and banks are granting them) places pressure on the government to quickly activate the next tranches. Indeed, the government has already dispersed the third tranche and the next tranches will likely follow soon.

The portion of the third tranche earmarked to bank loan guarantees (20 million euros) has been equally allocated between SMEs and large enterprises. Although that might seem a step back with respect to the second tranche, it may reflect the speed of guarantee concession, which is unquestionably faster at the larger banks, as well as possibly the fact that those same banks have already used up their share of the guarantees. At any rate, if demand for the third tranche indicates the need to support smaller firms, the next tranches could be recalibrated to favour the SME segment once again.

The other key novelty, and the development on which we are going to focus, is the addition of 4 billion euros allocated to underwriting fixed-income securities (commercial paper) issued by companies listed on Spain’s alternative fixed-income exchange, the MARF.

This development could be a step towards incentivizing companies to step up their presence in the securities markets, an area in which the Spanish financial system is lagging other advanced economies.

The MARF: History and development

The MARF was created in October 2013 to facilitate access to the fixed-income capital markets for medium-sized enterprise. Until its creation, businesses of that size faced notable obstacles in tapping the Spanish capital markets.

The creation of the MARF stemmed from the commitments assumed in July 2012 as part of the Memorandum of Understanding on financial sector policy conditionality. Specifically, article 27 stipulates: Non-bank financial intermediation should be strengthened. In light of the high dependence of the Spanish economy on bank intermediation, the Spanish authorities will prepare, by mid-November 2012, proposals for the strengthening of non-bank financial intermediation including capital market funding and venture capital.

That gave rise to the creation of an exchange, which is part of the so-called ‘alternative fixed-income markets’ that are characteristically unregulated but managed by official exchanges. Specifically, the MARF is managed by the AIAF fixed-income exchange run by BME, the company that manages Spain’s regulated securities markets.

These alternative markets consist of multilateral trading facilities (MTFs), which gives them greater flexibility and allows them to tailor their rules and procedures. As a result, they can adapt the issuance process to make it faster as well as less costly in terms of red tape for potential issuers, while staying in line with the standards required for securities admission. The MARF is governed by and operated under its own set of rules and a series of circulars.

By the time the MARF was created in Spain, there were already alternative markets in other European economies (e.g., Nordic ABM in Norway created in 2005). Its design features as well as the timing of its creation have been key to the success and growth of the MARF. One of those design attributes is the fact that only qualified investors can invest in MARF-listed securities, which means that the capital raised via this marketplace comes from professional investors, who typically support a ‘buy-and-hold’ philosophy, which helps injected stability into the securities.

A high degree of selectivity at the beginning in terms of the securities admitted to listing has also helped underpin their favourable performance. To date, none of the securities issued has been prepaid due to default.

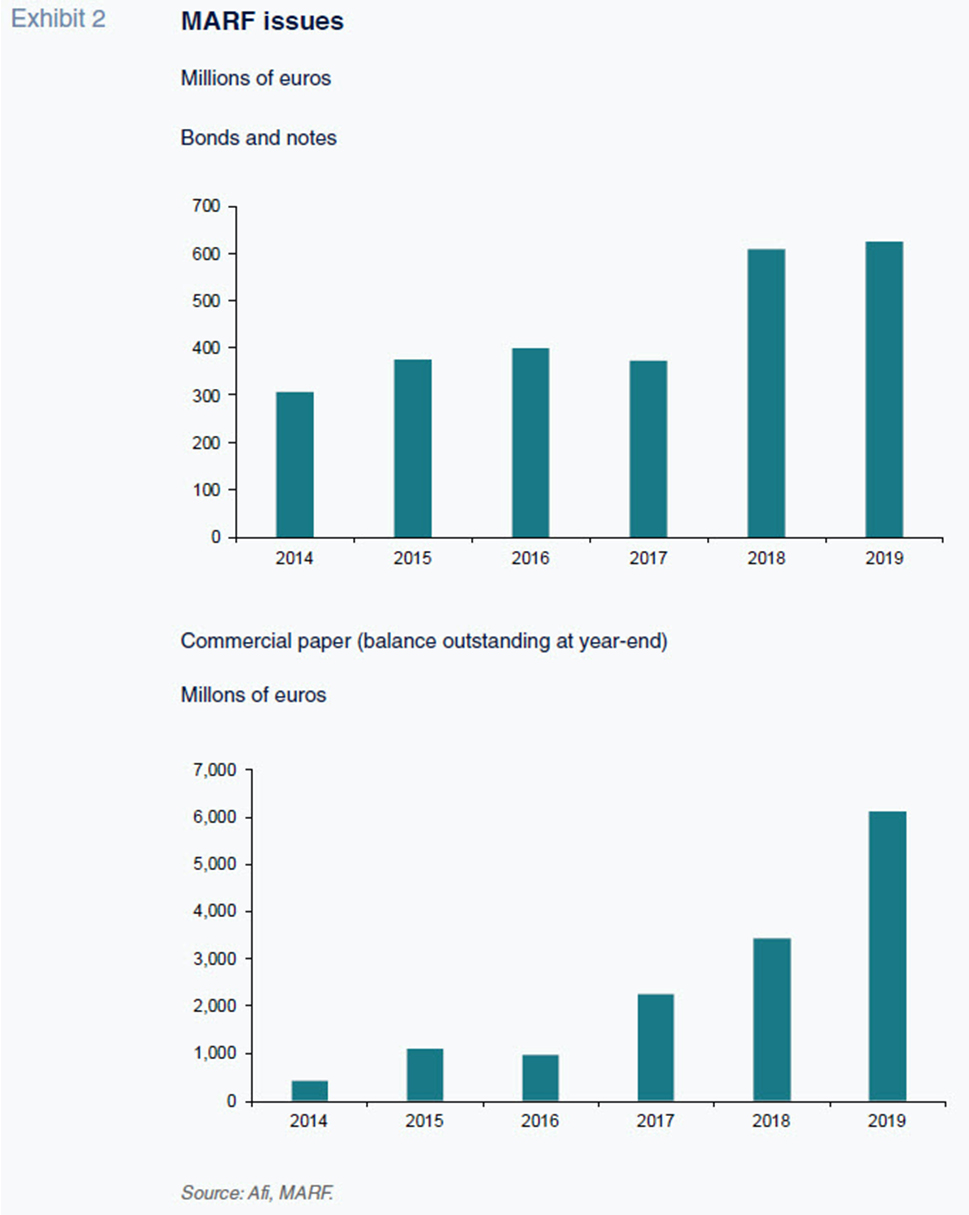

Issuers can list both long-term fixed income securities (notes and bonds) and short-dated paper (commercial paper) to cover their liquidity needs on the MARF. Both segments have been highly dynamic. Since its creation, the number of bond and note issues (some of which have since been repaid or refinanced) has totalled 59, with the issuers raising 2.82 billion euros.

As for commercial paper programmes, since the first company registered its first programme in March 2014, a total of 132 programmes have been listed. Note that each commercial paper programme has a term of one year. This means companies have a year to issue the full amount authorised under the programme. The issuers have tended to roll their commercial paper programmes over from one year to the next (with some companies already on their six commercial paper programmes). At present, 47 companies have registered commercial paper programmes with an aggregate maximum issuance limit of 6.47 billion.

It is important to distinguish between the volume of paper outstanding under the programmes and the total issuance limits. The companies tend to register sizeable programmes which are not used in full (similar to how businesses arrange their bank credit facilities so to have a buffer). However, given that companies are facing a liquidity crunch, it is likely that they will use up more of these programmes to ensure they have enough cash on hand.

As of May 13

th, 2020, the listed issuers had issued commercial paper with a face value of 1.91 billion euros (around one-third of the total volume of registered programmes). The commercial paper issues usually mature in less than 12 months (most commonly at 30, 60, 90, 180, 270 or 365 days), although some issuers with longer working capital cycles, such as construction companies, issue longer-dated paper (up to 24 months).

The issuers are highly varied in terms of sector and size. Sector-wise, the MARF has attracted issuers from over 17 different sectors, including the transportation, communication, retail, energy, water, environment, construction and real estate sectors.

As for company size, the issuer profile varies between bond issuers and commercial paper issuers, although it is increasingly common to see companies participate in both market segments.

By way of generalisation, companies that have listed long-term securities are more likely to hail from the medium-cap segment for which the MARF was designed, with average total assets of 1.2 billion euros (930 million euros if we layer in project financing) and average revenue of around 560 million euros (430 million euros counting project finance issuers).

In the commercial paper segment, large companies have participated frequently alongside medium-sized enterprises, such that average issuer assets climb to 2 billion euros in this segment and revenue, to 1.5 billion euros.

The MARF guarantee programme: Characteristics and impact assessment

Framed by the above assessment of the MARF, particularly its growing role in supportive the diversification of corporate sources of financing,

[2] the allocation of the specific tranche of the guarantee scheme to commercial paper issues could help deepen this segment of capital markets in Spain.

The government has allocated 4 billion euros to MARF issue guarantees, applicable to commercial paper with terms of maturity of up to 24 months. The cost will be 30 basis points for guarantees covering up to 12 months and 60 basis points for those covering paper with maturities of between 13 and 24 months.

The guarantees will be issued by Spain’s official credit institute, the ICO, in collaboration with BME, under a framework agreement to be executed with each of the non-financial corporates seeking a guarantee for their commercial paper issues and with the placement agents participating in the commercial paper issuance programme.

The guarantees provided for commercial paper issued on the MARF have a maximum size of 70%, implying a leverage effect of 143%, such that 4 billion euros of guarantees could drive total commercial paper issuance of around 5.7 billion euros. That figure is higher than the current volume of commercial paper outstanding and close to the total issuance volume permitted under the programmes currently registered (1.91 billion euros and 6.47 billion euros, respectively). Thus, the scheme should encourage companies already listed on the MARF to speed up the placement of new issues.

Notes

One of the key objectives of the Capital Markets Union (CMU) initiative.

Angel Berges and Irene Peña. A.F.I. - Analistas Financieros Internacionales, S.A.