The ECB’s new monetary playbook

In 2024, the European Central Bank (ECB) introduced a “new monetary playbook,” emphasizing the transition from a rigid rulebook to a more adaptive and flexible operational framework to address today’s complex economic landscape. While not without risks, this “new monetary playbook” marks a new era, in which the ECB continually fine-tunes its approach in response to evolving economic conditions, holding fast to its commitment to long-term stability and growth.

Abstract: In 2024, the European Central Bank (ECB) introduced a “new monetary playbook,” emphasizing the transition from a rigid rulebook to a more adaptive and flexible operational framework to address today’s complex economic landscape. This new strategy relies on calibrated interest rate adjustments, reduced reliance on extraordinary liquidity measures, and a targeted communication strategy to better manage market expectations and reinforce confidence. Key shifts include lowering the deposit facility rate to 3.25% and adjusting the other main benchmark rates in tandem, as well as narrowing the spread between deposit and refinancing rates to encourage bank participation in short-term refinancing operations. These adjustments reflect the ECB’s goal of balancing inflation control with economic growth in a volatile and globalized world, where inflationary pressures, energy stability, and fluctuating market conditions require a dynamic policy response. The next review of the ECB’s operational policy is scheduled for 2026. While not without risks, this “new monetary playbook” marks a new era, in which the ECB continually fine-tunes its approach in response to evolving economic conditions, holding fast to its commitment to long-term stability and growth.

Strategic shifts in the ECB’s monetary policy

The ECB’s monetary policy has evolved in response to an increasingly complex and challenging economic environment. Historically its efforts focused on controlling inflation and supporting financial stability using conventional tools such as interest rates and short-term refinancing operations. However, the ECB has been making significant adjustments to its operational framework in 2024, evidencing its transition to a more balanced and adaptive approach in an attempt to reconnect with classical principles but with the flexibility required by current conditions.

As part of this transition, it has implemented specific changes to its interest rates to facilitate transmission of its monetary policies and keep inflation in check. In October 2024, it cut its deposit facility rate by 25 basis points, to leave it at 3.25%, reducing the rates on its main refinancing operations to 3.4% and its marginal lending facility to 3.65% in parallel. This series of adjustments, embarked on mid-year, reflects a staggered strategy designed to mitigate inflationary pressures, which have in turn eased on the back of the recent let-up in wage increases and broader economic growth. Christine Lagarde, president of the ECB, has said that the monetary authority plans to continue to take a prudent stance, evaluating each step as a function of the economic data, to avoid commitments that could limit future flexibility.

In addition to lowering its rates, the ECB has modified its operational framework to optimise liquidity and reduce volatility in the money markets. One of the key changes was the decision to reduce the spread between the deposit facility and main refinancing operations rates from 50 basis points to just 15 basis points. This change, which took effect in September, is designed to give the banks an incentive to participate more actively in the ECB’s weekly refinancing auctions, so reducing their dependence on less stable instruments and fostering closer alignment with conventional monetary policy tools. The rationale for these adjustments is to get the main refinancing operations to play a central role again, allowing the ECB to have a more direct influence on the system’s financial stability.

Communication is also a crucial component of this “new playbook” being written by the ECB. Lagarde and the Governing Council are stressing the importance of transparency and clarity of message in avoiding misinterpretations that could destabilise the markets. In this vein, the ECB has announced that it will revise its operational framework in 2026, staying open to the possibility of fine-tuning its policies if so warranted by economic conditions. This “data-dependent” approach lets the ECB adapt to market fluctuations without committing to a rigid rate policy, so earning the public’s and investor community’s confidence in the effectiveness and flexibility of monetary policy.

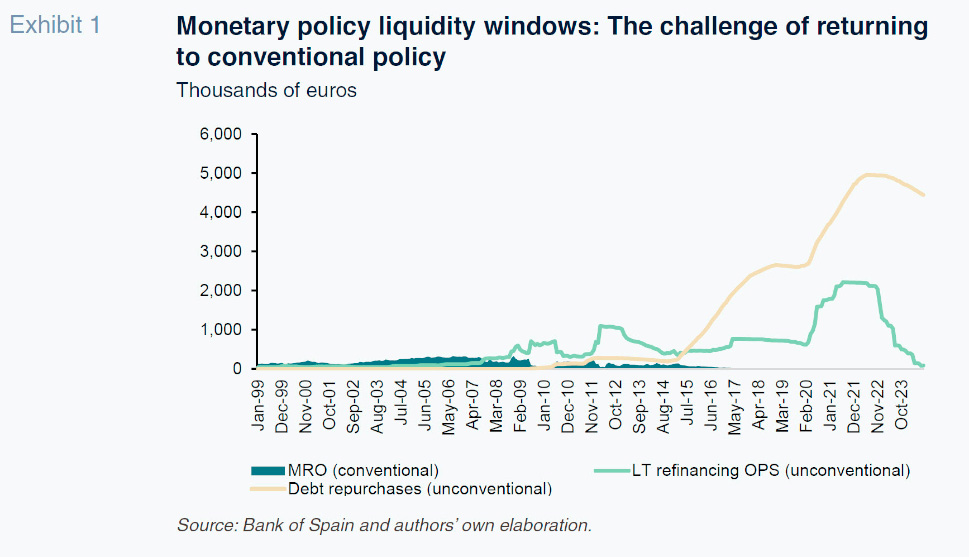

Exhibit 1 illustrates this tricky transition graphically. More specifically, it illustrates the growing influence of the deposit facility rate instead of the main refinancing operations (MRO) rate since implementation of mass-scale bond repurchase programmes in 2014. These programmes, designed to inject liquidity and stability into the markets during episodes of crisis, entrenched the use of the deposit facility and minimised the banks’ need to resort to the MROs to raise short-term funding. Today, after years of dependence on quantitative easing (QE) instruments, the ECB faces the challenge of restoring the MROs to their long-standing importance in its monetary policy. The return to the classical operational framework will not be either immediate or simple, as the banks have adapted to a system in which the deposit facility rate plays a dominant role. Beyond the trend in interest rates, this exhibit therefore symbolises the difficulty in “returning to the old playbook”. This transition requires gradual adjustments and a strategic approach.

The paradox and dilemma of modern monetary policy

The recent shift in the ECB’s monetary policy has not only affected interest rates. It has also exposed a core aspect of how economic policy is handled: the need to adapt the conventional tools for a financial system characterised by excess liquidity and extreme sensitivity to market movements. Against this backdrop, the ECB has had to tackle the paradox of how to apply effective measures in an economy that, despite its growth cycles, is proving markedly volatile, with inflationary pressures that are defying traditional monetary policy.

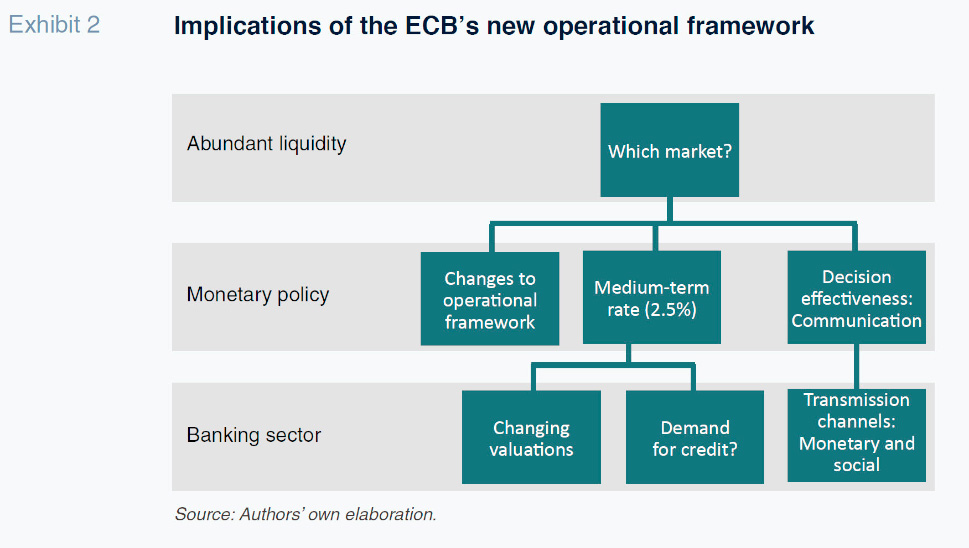

The goal now is to refocus its efforts on maintaining a balance between controlling inflation and propping up growth in an environment that has become increasingly complex. The ECB’s decisions, particularly its decision to cut the deposit rate and modify its main refinancing operations within its operational framework (Exhibit 2), evidence a deliberate attempt to stabilise the money markets and reduce reliance on extraordinary instruments, such as the long-term refinancing operations that characterised the past decade. The rationale for this shift is to reinforce the role played by the main refinancing operations and deposit facility as cornerstones of its monetary policy, providing more influence over the flow of credit making its way to the real economy.

The paradox of monetary policy today is also evident in the correlation between inflation and interest rates. In contrast to other periods of monetary easing, when rate cuts were introduced in response to weak demand, in 2024, the ECB had to adjust its policies in an environment of uncertainty around inflation, coming off a period of rampant price growth. Navigating this new territory has required meticulous planning and exhaustive analysis of the market so as not to fuel inflation by injecting too much liquidity, while providing households and businesses with borrowing terms and conditions they can afford.

The ECB’s role in managing expectations has also taken on outsize importance. Market volatility and extreme investor sensitivity to any sign of change has meant that ECB communication has ceased to be a complementary tool and is now playing a key role in delivering the authority’s stability goals. On several occasions, Christine Lagarde has stressed the importance of clear messages that guide market expectations towards the long-term, avoiding excessive oscillations. The narrative around rate decisions, for example, has carefully emphasised the fact that monetary policy will follow a data-dependent approach, allowing the ECB to respond to abrupt changes in the economic scenario. At present, the expectation is that rates will fall to a neutral level of 2.5% by the end of 2025.

The interest rate dilemma

The ECB’s interest rate policy faces complexities in the current economic climate in which rate cuts have broader, and often contradictory, effects on the financial system. The recent rate cuts were motivated by the desire to alleviate borrowing costs and stimulate the economy. However, the move also poses the risk of rekindling inflationary pressures if the rate cuts are not doled out carefully and in harmony with the economic indicators. The ECB has decided to take a gradual approach, lowering the rate on its deposit facility by small increments so as to avoid sudden changes and foster stability around market expectations. In a context of excess liquidity and high rates, the aim is to maintain control over short-term rates without stimulating undue growth in credit that could fuel inflation. Moreover, the ECB has adopted a “data-dependent” approach to its rate decisions whereby each decision takes stock of the most recent data around core inflation, economic growth and job market conditions.

Unlike other cycles of rate cuts, this one was not prompted solely by a slump in demand or imminent recession, but also the need to stabilise an environment marked by slow growth and still-uncertain inflation patterns. This cautious approach to its rate policy reflects what the ECB has learned about the limits of its traditional tools as excessive cuts could have unintended consequences, such as pronounced depreciation of the euro or debt overload. International market volatility, shaped by geopolitical events and the impact of factors exogenous to inflation, constitutes another risk the ECB has to manage.

This approach to rate policy has also had direct consequences for consumers and businesses. For households with floating-rate mortgages, official rate cuts can bring relief, as Euribor, the rate used as the benchmark for many loans, has begun to reflect the cuts. However, the effect on mortgage costs is not always immediate and depends, largely, on loan terms and conditions (such as the timing of rate resets). For businesses, lower rates can also create space for new investments and growth, to the extent that financial conditions remain stable and predictable.

Towards more flexible monetary policy

In recent years, the ECB has had to embrace the fact that monetary policy can no longer be articulated around rigid rules or inflexible rulebooks. In a global environment marked by rapid economic fluctuations, geopolitical tensions and market volatility, the ECB has opted to pursue a flexible strategy that combines conventional tools and new approaches. This flexible approach responds to the need for monetary policy not only to control inflation but also to stand ready to tackle structural shifts in the European and world economies.

One key characteristic of this adaptive policy is the ability to adjust interest rates and refinancing operations more responsively, considering a wide range of macroeconomic data, including core inflation, labour market metrics and general financial stability. This more flexible vision allows the ECB to move faster in the event of unanticipated developments, without relying exclusively on predictive long-terms models that may prove insufficient in today’s volatile environment. As part of this transition, the ECB has sought to rely less on extraordinary tools such as the massive repurchase of assets, focusing more on effective use of its interest rates and liquidity operations. Whether or not these policies are transmitted in the intended manner and with the desired intensity and timeliness is another matter entirely.

In addition to recalibrating its toolbox, the ECB has factored external factors into its analysis. Unlike prior policies that concentrated on internal indicators, this new flexible monetary policy takes stock of new inputs such as energy stability, commodity prices and fluctuations in key currencies. This allows the ECB to anticipate more accurately the possible impacts of international events, from trade wars to energy shortages, and respond with specific measures that mitigate the identified risks more effectively.

Another important component of this flexibility is the ability to revise the operational framework periodically. This process of continuous fine-tuning means that the ECB will evaluate the effectiveness of its policies and redefine the parameters it considers central to its monetary strategy at regular intervals. For example, the next revision of its operational framework is scheduled for 2026. During that exercise it will analyse the results of the decisions taken since 2024 and make any adjustments needed to reinforce stability in the long-term.

Conclusions

The ECB has demonstrated in recent years that monetary policy, in an increasingly interconnected and volatile world, requires constant fine-tuning. This “new playbook” does not represent a return to what worked in the past but rather a recalibration that combines the lessons learned with tools redesigned to tackle the contemporary challenges. From rate adjustments and the operational framework to the importance of clear and strategic communication, the ECB has taken significant steps towards a policy that can address both stability demands and the need for economic growth.

This flexible model is not a definitive solution and there are no guarantees of unimpeded success. To the contrary, it marks the start of a path in which a permanent attitude of prudence and adaptability is needed to tackle global challenges, from geopolitical fluctuations to financial market transformation. In a climate in which every decision can have deep and far-reaching implications, the ECB appears to be committed to a strategy that prioritises stability and public trust.

This “new monetary playbook” is, in essence, a declaration of the ECB’s ability to evolve. In a context in which certainties are increasingly scarce, the ECB is saying that its mission is to be as dynamic as the times it is navigating and that monetary policy, far from a closed book, should be rewritten tirelessly in response to unfolding, prevailing challenges.

Santiago Carbó Valverde. University of Valencia and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas