The strategic complementarity between competition and industrial policy

Despite broad-based agreement within economic circles regarding the drawbacks related to the application of industrial policies, recent global challenges have reopened the debate over their potential benefits. If public sector intervention is indeed necessary, it should be aligned to encourage competition and innovation.

Abstract: Economists have traditionally been skeptical over the use of industrial policy. However, tech progress, climate change and geopolitical tensions have once again placed industrial policy at the center of the political debate. Without taking a position in favor or against industrial policy, it is important to note that, if public sector intervention is indeed necessary, it should be done respecting competition policy and innovation, not least within the EU, where there is added pressure to execute NextGenEU. To achieve sustainable economic development and minimize negative impacts on the market, industrial policy should be limited to situations in which a market failure is identified and implemented through competitively neutral mechanisms, without discrimination regarding sectors, companies or technologies.

Introduction

By industrial policies, we should not only understand public sector actions aimed at the manufacturing sector. As defined by Juhasz, Lane and Rodrik (2023), industrial policy encompasses all public sector actions that aim to transform the economic structure with the aim of stimulating economic growth. By its nature, the scope of industrial policy may partially coincide with that of regional policy or economic development policy.

A fundamental characteristic of industrial policy is its discretionary nature. As it aims to reform the sectoral economic structure, it promotes certain sectors at the expense of others. Even when industrial policy tries to be “horizontal” and addresses problems that may be common to the economy as a whole, such as education or infrastructure, it will continue to have a “vertical” component, since not all sectors benefit in the same way.

Industrial policy can use different instruments with the aim of helping companies: from subsidies or favorable credit lines to tariff protection or import quotas, even reaching partial or total public firm ownership in sectors considered as “strategic”.

The debate about the benefits or harms of industrial policy has evolved over time. Juhasz, Lane and Rodrik (2023) group the favorable arguments into three categories: the existence of positive externalities (such as learning externalities, but they also include here the arguments related to national security or the provision of “good jobs” in the sense of Rodrik and Sabel, 2022); the solution of coordination problems (when two sectors are mutually dependent, so that neither develops if the other does not); and, the localized provision of certain public services (such as infrastructure) to promote regional development.

Criticisms of industrial policy rarely call these arguments into question but are based on two practical issues: the limitations of information with which the public sector must make these decisions and, additionally, the risk of it being captured by private interests. These criticisms are usually summarized in the argument that “the government chooses the winners”, which Tirole (2023) complements with the tagline “and the losers choose the government” to emphasize the risk of capture in the design and implementation of this policy.

Although the experience in the application of industrial policies can show successes (among which the case of South Korea is commonly cited, see Choi and Levchenko (2021), there are numerous failures of greater or lesser magnitude. Protectionist policies in Latin America with the objective of “import substitution” and helping the development of “infant industries” have not had the same effects as in Asia. In France, although the development of the Toulouse aeronautical hub around Airbus and Aérospatiale can be considered a success, projects such as Concorde, Thomson or Bull have been failures. In Spain, the policy carried out by the National Institute of Industry during the 1970s, consisting of the nationalization of companies in very diverse sectors (Myro, 1987), only allowed to save a very limited number of them with a high cost in terms of public funds.

At the end of the last century, the experience of failures in the application of industrial policy led to a consensus among economists in their critical consideration of it. Against this position, the one defended by authors such as Rodrik (2004) stands out, who argues that a well-designed and limited industrial policy is necessary: one which provides companies with the information that allows them to expand into new markets and resolves coordination problems. Mazzucato (2018) is also in favor of public sector intervention through long-term plans (“missions”) that promote innovative activities.

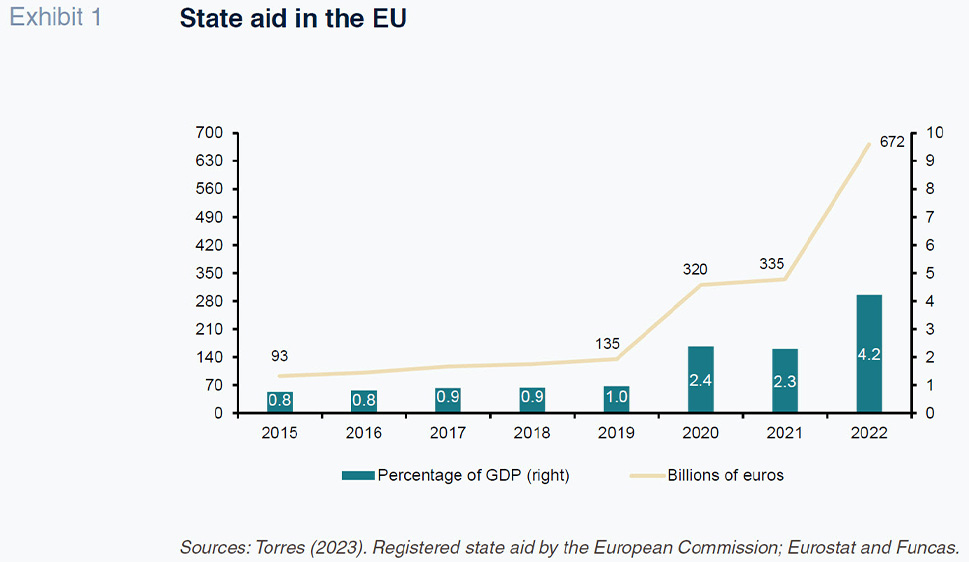

However, in recent years, there has been a radical change in the perception of the desirability of carrying out industrial policies because of the confluence of various factors. The main one is the perception that the benefits of international economic integration are undermined by the application of protectionist policies or support for certain sectors by countries such as China. In essence, these industrial policies differ in their magnitude from those carried out by other Far Eastern economies previously, but they have caused a rethinking of the rules of the game in international trade that also affects industrial policy. In parallel, the need to carry out large-scale coordinated investments to address challenges such as climate change or the digital revolution has put on the table, both in the United States and the European Union, the need to support “strategic” sectors. Added to this, in the European case, is the need to quickly execute the investments associated with the NextGenEU funds negotiated during the COVID-19 pandemic. Spending 750 billion euros (140 billion euros in the Spanish case) in a relatively short period of time can generate inefficiencies in the sectoral prioritization procedure. Torres (2023) shows the increase in state aid in Europe since 2020 (see Exhibit 1). Finally, in the case of the EU, it is necessary to take into account the debate that occurred following the decision of the European Commission not to authorize the merger between Alstom and Siemens in 2019, as this would have given rise to a monopoly situation in the supply of high-speed railway material. The governments of France and Germany, which had explicitly supported the merger, have since demanded a change in the rules of competition policy so that it becomes subject to the objectives of industrial policy.

For all these reasons, the point is not to position oneself for or against industrial policy, but rather to help it be designed in the best possible way. We run the risk that the conclusions of this debate call into question the progress that has been made in recent decades in the application of competition policy. Given that having more competitive markets clearly benefits society as a whole (the only harm is from those who obtain excessive rents as a result of their market power), competition is the best mechanism available to guarantee growth based on innovation and reducing inequality through access to a greater number of goods and services at lower prices. Therefore, preserving competition should be the axis in the application of industrial policy. Thus, in this article, we defend that industrial policy should be carried out with the objective of improving competition in the markets, using the criteria set out below.

Competition in the market: The ingredients and goals of the new European industrial policy

An example of the complex relationship between competition and industrial policy is provided by the growth of the electric vehicle (EV) market in China. In this case, the success of industrial policy based on government aid is also due to a very competitive internal market that acts as a driver of innovations in the sector. Chinese automobile manufacturing companies have grown very significantly in recent years. A combination of subsidies, favorable credit, protection of their market and public ownership has allowed them to completely dominate their EV market and compete successfully in the rest of the world. Aghion et al. (2015) empirically demonstrate the complementarity between market competition and the effectiveness of industrial policy. Using data from the Chinese economy, these authors show that public support has more positive effects the more competition exists in the sector to which it is directed. Their work also shows that subsidies can even be harmful when the level of competition is low.

The main implication of this analysis is that European industrial policy must serve to strengthen the internal market, avoiding putting at risk competition within it (Petropoulos, 2019). To achieve this objective, a first step is to make industrial policy compatible with the regulation of state aid, and particularly with its fundamental principle of limiting public subsidies to those situations in which there is a market failure (such as externalities, information asymmetries, etc.). Furthermore, this requirement should be interpreted as a necessary but not sufficient condition: if markets operate with sufficient competition, optimal conditions exist for innovation and the creation of value that benefits consumers, making intervention unnecessary. But if there is a market failure, we have to be sure that public intervention will improve the situation. In other words, the distortions associated with public aid must be sufficiently compensated by efficiency gains and/or the restoration of the competitive process. A corollary of the above is that government interventions should be limited to those strictly necessary to avoid market failures, reducing their impact as much as possible and minimizing distortions to competition.

A common argument to defend the application of industrial policy is the one based on the existence of positive externalities that, due to coordination failures, are not fully exploited or are exploited in an insufficient manner. This argument gives rise to interventions such as the generation of clusters, support for investment in innovation processes or emerging technologies, or even the development of new industrial sectors that, either due to the existence of increasing returns or other types of barriers, have not been developed. An successful example within this last category would be the case of Airbus, which, in addition to generating industrial activity, allowed competition to be introduced in the high-capacity aircraft market. Currently, the paradigmatic example of promoting industrial developments that the market does not generate on its own are microchip factories. The non-existence of microchip production in Europe was considered one of the main triggers of the industrial crisis associated with the breakdowns in the supply chain.

Although the analysis of this type of intervention should not consider possible distortions of a pre-existing market, it should take into account the opportunity cost of public funds as well as the equity criteria used in their allocation. To avoid misuse of public funds (including failed projects known as “white elephants”), Tirole (2023) proposes involving in decision-making both high-level experts and risk-taking private sector agents. It should be emphasized that these types of cost-benefit analysis of state intervention are complex. They must take into account the fact that if the market does not generate a certain type of industrial activity, it may be due to the existence of important limitations to its development.

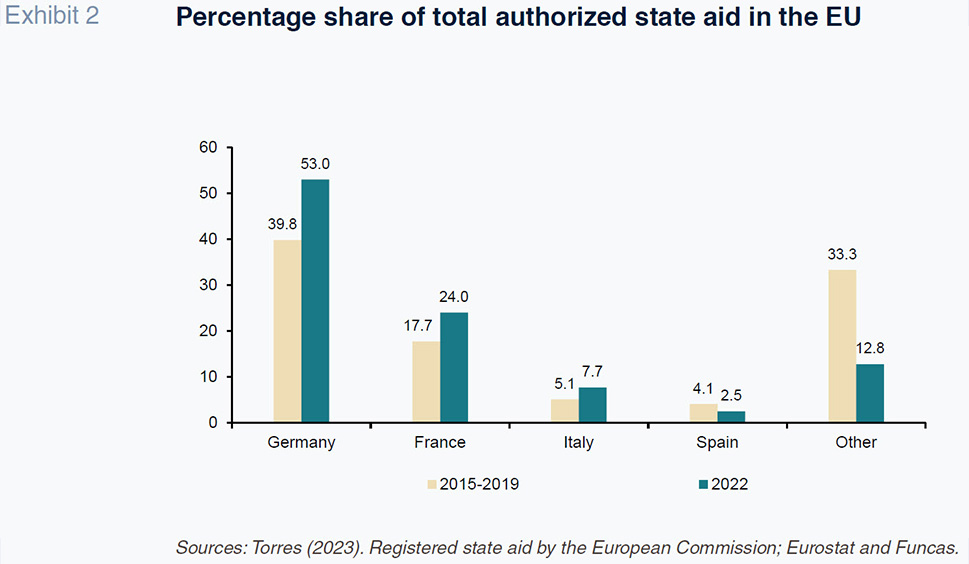

The problem of inequality in the allocation of funds for industrial policy can be analyzed from different perspectives. Geographically, it is necessary to prevent differences in the financial capacity of countries determining where new industrial activities are developed. This seems to a large extent to be the current situation. Torres (2023) shows that France and Germany account for most of the state aid, with the latter country accounting for more than half of it in 2022 (see Exhibit 2). Therefore, it would be desirable that decisions on the location of investments be made at the sector level and centralized for the whole EU. The decision process should consider, in addition to technical and efficiency criteria, positive discrimination factors that help the economic convergence of the different European territories.

Support to a given sector can be carried out using a wide set of instruments. Both to facilitate ex-post evaluations and to allow citizen’s democratic control, industrial policy must be transparent in showing what tools it uses. In this sense, both the impact of subsidies on public accounts and their opportunity cost are relatively easy to evaluate. On the contrary, indirect instruments such as the distortion of regulatory standards or allowing mergers that substantially increase market concentration, can give rise to significant distortions and costs, in terms of efficiency, that are not transparent. For example, in addition to harming consumers, increasing market concentration can reduce incentives for innovation and, therefore, harm the conquest of external markets in the long-term.

As shown by Miravete et al. (2018), the negative effects of distorting regulations to favor certain industrial sectors should not be underestimated. These authors analyze how in the 1990s the European Union favored European diesel car manufacturers, who had a technological advantage, by reducing taxes on that fuel and, mainly, reducing NOx emissions standards. Therefore, in the US (with stricter standards) cars with diesel engines had a marginal market share, while in most European countries they exceeded 50%. Given the evidence on the impact of NOx particles on the development and evolution of lung diseases, it can be considered that the industrial success of diesel in Europe occurred largely at the expense of the health of European citizens. Miravete et al. (2018) estimate that this regulatory distortion, invisible to consumers but with significant health costs, was equivalent to increasing trade tariffs on non-European gasoline car producers by between 200% and 300%.

Industrial policy must also be neutral in sectoral and technological terms. Governments should not bet on certain companies, technologies or sectors directly through vertical industrial policies. It is preferable to direct interventions directly to correct the market failure without prejudging technological or business solutions through horizontal industrial policies. For example, the reduction of emissions and the promotion of less polluting technologies can be incentivized without imposing a specific technological solution, as the EU’s Emissions Trading System does. In some cases, however, it may be necessary to allocate funds to specific companies or consortia to develop specific innovation projects, such as those aimed at the production of EV batteries. In these situations, funds must be allocated using non-discriminatory competitive procedures.

The crisis of multilateralism and the European strategic response

The existing consensus regarding the benefits of the multilateral growth model based on the development of international trade and multinational investment seems to be broken. A fundamental element of this model was to prevent industrial policies, and in particular, subsidies to companies, from generating distortions in trade relations. Thus, one of the functions of the World Trade Organization is to act as a forum to resolve disputes related to this issue. A good example of its usefulness is the EU-US agreement regarding the support that, explicitly or implicitly, both Boeing and Airbus received. That agreement avoided the extension of trade retaliation in the form of tariffs on goods that had nothing to do with that market, such as agricultural products.

The change in the views about such a development model has different causes. On the one hand, there is a general perception that a new main actor (China) does not play by the same rules and applies industrial policies that favor its firms. Additionally, the groups most harmed by globalization and the development of foreign trade have politically expressed their opposition to the model. For example, the loss of manufacturing jobs in developed countries has generated electoral support for protectionist policies. Finally, the need to carry out large-scale investments to make possible the decarbonization of production processes in practically all economic sectors also acts as a justification for greater public intervention. To this list we could add the request for the so-called “strategic autonomy”, which in economic terms implies a distrust of dependence on supplies located in other countries. Logically, this position is antithetical to that which defends specialization according to the theory of comparative advantage.

In the case of industrial policy, the most relevant event has been the implementation by the US of a business aid program (“Inflation Reduction Act”) that promotes issues such as the purchase of electric vehicles by conditioning the subsidy on the local manufacturing of a certain weight of components. In this way, it acts as a clear incentive for industrial relocation. The EU has reacted by relaxing its restrictive regulations on state aid and allowing national governments to allocate subsidies to companies that are at risk of relocating to the US. A very recent example of such aid has been the one that the German government has destined for the Swedish battery manufacturer Northvolt, which will receive 902 million euros in exchange for the construction of a new factory in north Germany.

Strategically, subsidizing national production or setting tariffs between countries is a problem very similar to the famous prisoner’s dilemma. It is a dominant strategy for each country to act non-cooperatively by implementing protectionist policies. However, this balance of high tariffs and subsidies’ war generates less welfare than a cooperative solution based on greater trade between countries. This is the logic and advantage of the multilateral model. However, the non-cooperative equilibrium re-emerges when countries such as China unilaterally deviate from the cooperative solution with subsidies that discriminate in favor of domestic production.

This has been the path chosen by the EU by opening the possibility that member countries can respond to the threat of a company relocating due to US subsidies with similar aid. This policy raises several questions, both regarding the location of aid and its magnitude. The internal market may be at risk if only countries with sufficient financial capacity can react to a possible relocation of their companies to the US.

Regarding the magnitude of the subsidy, it is surprising that the mechanism designed by the European Commission defines its maximum limit only as a percentage of the total investment.

[1] A more detailed analysis could calculate the minimum magnitude necessary to avoid relocation in each case, comparing it with the benefits that European society as a whole obtains in exchange for the aid. This analysis should consider both the distributional effects (in an extreme case it could happen that the only beneficiaries of the aid were the owners of the company) and the implications in terms of competition in the final markets.

Conclusions

Economists have traditionally been skeptical about the desirability of industrial policy. However, technological developments, the challenge of climate change and a different international relations environment have once again placed industrial policy at the center of the political debate. This article does not take a position in favor or against industrial policy, but rather advocates that, if it is implemented, it should be done respecting the principles of competition policy and not put the single European market at risk. Industrial policy should be limited to situations in which a market failure is identified and implemented through competitively neutral mechanisms, without discrimination regarding sectors, companies or technologies.

Notes

References

AGHION, P., CAI, J., DEWATRIPONT, M., DU, L., HARRISON, A. and LEGROS, P. (2015). Industrial Policy and Competition.

American Economic Journal: Macroeconomics, 7(4), pp. 1- 32.

CHOI, J. and LEVCHENKO, A. A. (2021). The long-term effects of industrial policy.

Working paper, 29263. National Bureau of Economic Research.

JUHÁSZ, R., LANE, N. J. and RODRIK, D. (2023). The new economics of industrial policy.

Working paper, 31538. National Bureau of Economic Research.

MAZZUCATO, M. (2018). Mission-oriented innovation policies: challenges and opportunities.

Industrial and corporate change, 27(5), pp. 803-815.

MIRAVETE, E., MORAL, M. J. and THURK, J. (2018). Taxation, Emissions Policy, and Competitive Advantage in the Diffusion of European Diesel Automobiles.

RAND Journal of Economics 49(3), pp. 504-540.

MYRO, R. (1987). La empresa pública en la economía española (1940–1985).

Revista de Historia Economica-Journal of Iberian and Latin American Economic History, 5(2), pp. 371-379.

PETRÓPOULOS, G. (2019). How should the relationship between competition policy and industrial policy evolve in the European Union? Bruegel.

https://www.bruegel.org/blog-post/how-should-relationship-between-competition-policy-and-industrial-policy-evolve-european RODRIK, D. (2004). Industrial policy for the twenty-first century.

Discussion paper, 4767. Center for Economic Policy Research.

RODRIK, D. and SABEL, C. (2022). Building a Good Jobs Economy. In D. ALLEN, Y. BENKLER, L. DOWNEY, R. HENDERSON and J. SIMONS (Eds.),

A Political Economy of Justice (pp. 61-95). Chicago: University of Chicago Press.

TIROLE, J. (2023). Competition and the industrial challenge for the digital age

. Annual Review of Economics, 15, pp. 573-605.

TORRES, R. (2023). La empobrecedora inflación de subvenciones en Europa. Funcasblog

https://blog.funcas.es/la-empobrecedora-inflacion-de-subvenciones/

Javier Asensio. UAB and IEB

Juan José Ganuza. UPF and Funcas