Spain’s housing and mortgage markets

Despite an adverse economic climate, house price growth is proving resilient in Spain, fuelled by wholesale and non-resident demand, in addition to retail and residential demand, eroding affordability metrics. Focusing resources on enhancing access to affordable, quality housing, fostering an efficient rental market and increasing housing supply could help to curb this trend and facilitate more equitable access to housing.

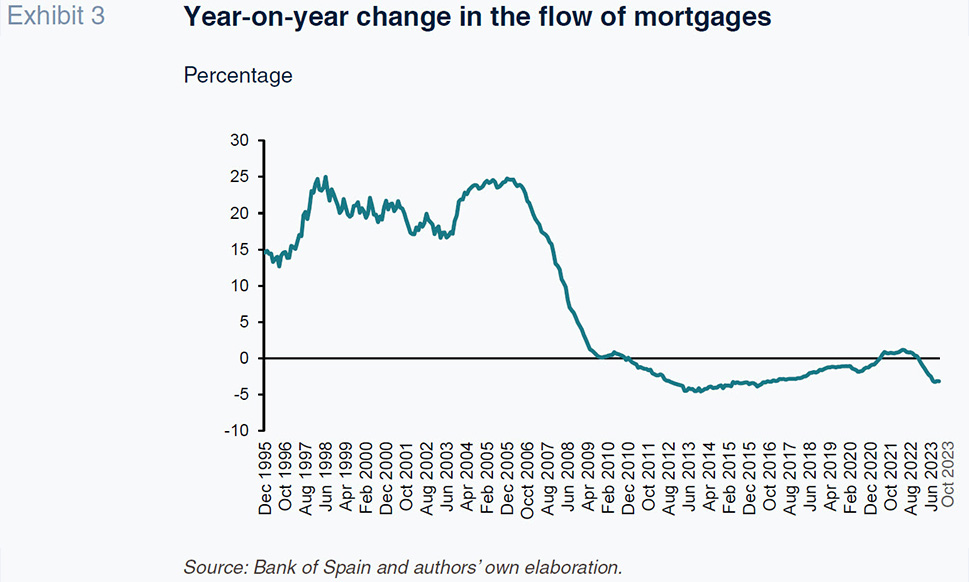

Abstract: Despite an adverse economic climate, house price growth is proving resilient in Spain, fuelled by wholesale and non- resident demand, in addition toretail, residential demand. Indeed, just 38.9% of house sales are completed with mortgages. Although the data do not enable comprehensive identification of the underlying reasons, a number of circumstantial factors may be affecting these metrics, including a higher incidence of mortgage-less purchases in touristic areas and in inland Spain, whether by foreign buyers or as second homes. At any rate, the clearest interpretation of this phenomenon is that overall market volumes are largely being shaped by investment transactions, which are driving up prices. As for mortgage activity, in the aftermath of the pandemic, volumes started to rise again, at year-on-year rates of around 1%. Since December 2022, however, volumes have been contracting, by 3.1% year-on-year in October 2023, the last month for which this information is available. Spain has yet to find a point of equilibrium in the mortgage market between the heady rates of the financial and property bubble and those corresponding to a more normal monetary environment. These dynamics have eroded Spain’s affordability metrics, particularly since the financial crisis and pandemic, when prices recovered swiftly, outpacing wage growth. Factors such as inadequate long-term land policies and growth in demand have exacerbated the problem, increasing inequality between home-owners and those unable to get a foothold on the housing ladder. Focusing resources on enhancing access to affordable, quality housing, fostering an efficient rental market

–without interventions that ultimately inflate rents– and increasing housing supply (including more public housing options) could help to curb this trend and facilitate more equitable access to housing.

Monetary environment

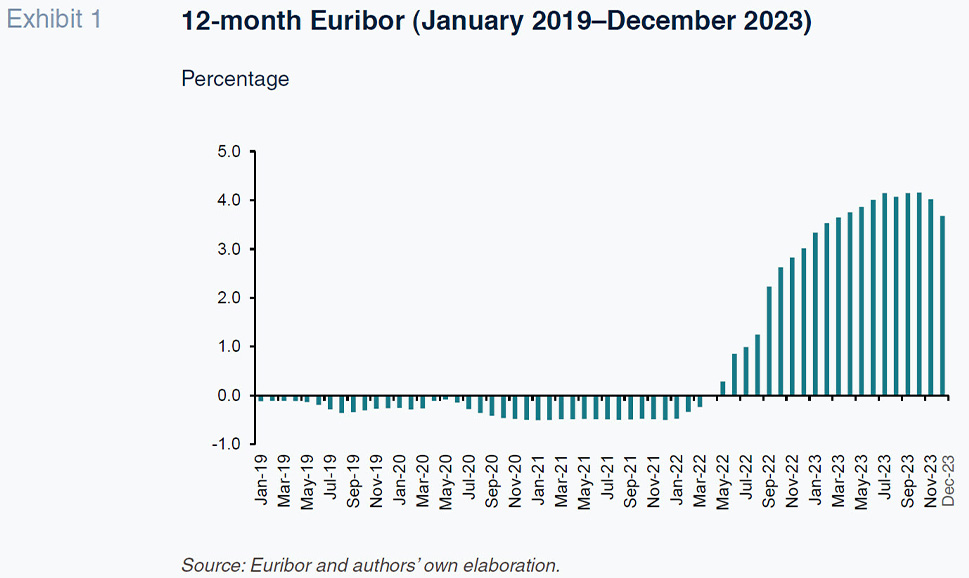

Housing is an essential part of the life cycle, as well as a constitutional right. However, access to housing has become a problem in many countries, including Spain. In the current environment, marked by high interest rates, the cost of mortgages has risen sharply compared to 18 months ago. As shown in Exhibit 1, market interest rates (using 12-month Euribor as our proxy) were in negative territory until May 2022, when they started to rise, peaking at 4.2% in September 2023 and ending the year a bit lower, at 3.7% (Exhibit 1). That year-end drop in market rates signals that the market is expecting the European Central Bank to cut its official rates in 2024.

It is a little soon, however, to categorically state that rates will be cut this year, although it is looking probable. The ECB has been insisting that it has finished raising rates while cautioning that it remains watchful as inflation is still considerably above its target level. In parallel, however, the ECB has lowered its inflation forecasts, suggesting that its measures are having a bigger effect than expected, or at least a swifter impact. After its meeting on 25 January 2024, the ECB decided to keep the three key interest rates unchanged. As stated in the press release, “the incoming information has broadly confirmed its previous assessment of the medium-term inflation outlook. Aside from an energy-related upward base effect on headline inflation, the declining trend in underlying inflation has continued, and the past interest rate increases keep being transmitted forcefully into financing conditions. Tight financing conditions are dampening demand, and this is helping to push down inflation.”

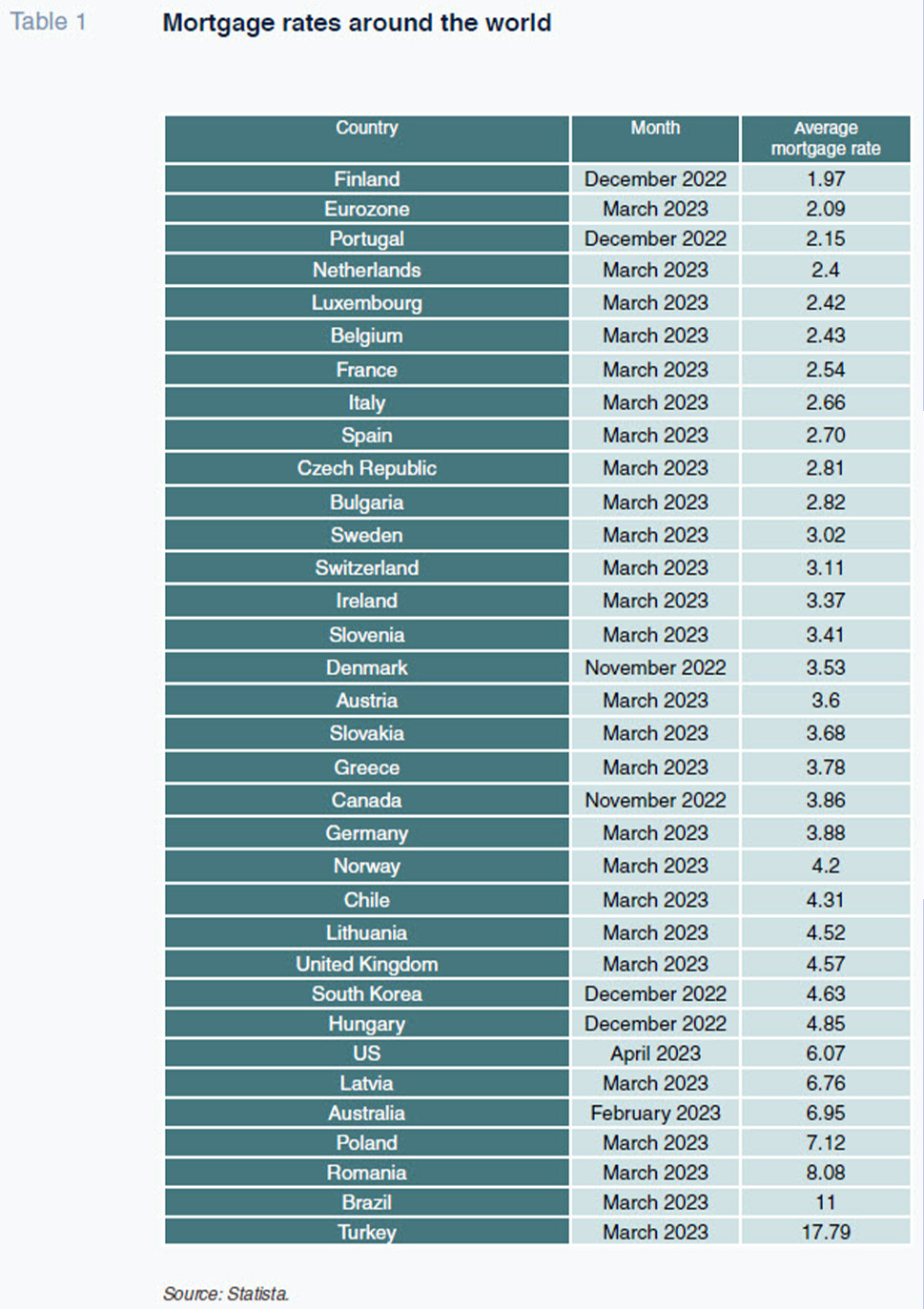

It is important to note, as shown in Table 1, that mortgage rates vary considerably around the world, even within the same monetary area, as is the case in the eurozone. This means that although ECB policy is a key determinant of mortgage costs, other market, banking, and macroeconomic risk factors likewise come into play. For example, the average cost of a mortgage in Spain was 2.7% in March 2023, compared to averages of 2.09% for the eurozone, 4.57% in the UK and 6.07% in the US.

Prices and the mortgage market

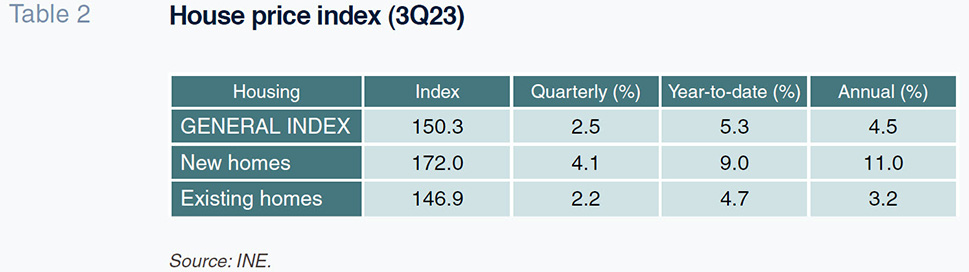

Although house prices were expected to ease tangibly in 2023, they remained surprisingly strong all year, particularly during the second half (pending release of the year-end numbers). The house price index published by the national statistics office, INE, for the third quarter of 2023 revealed year-on-year growth of 4.5%, shaped by growth of 3.2% in existing homes and of 11% in new homes.

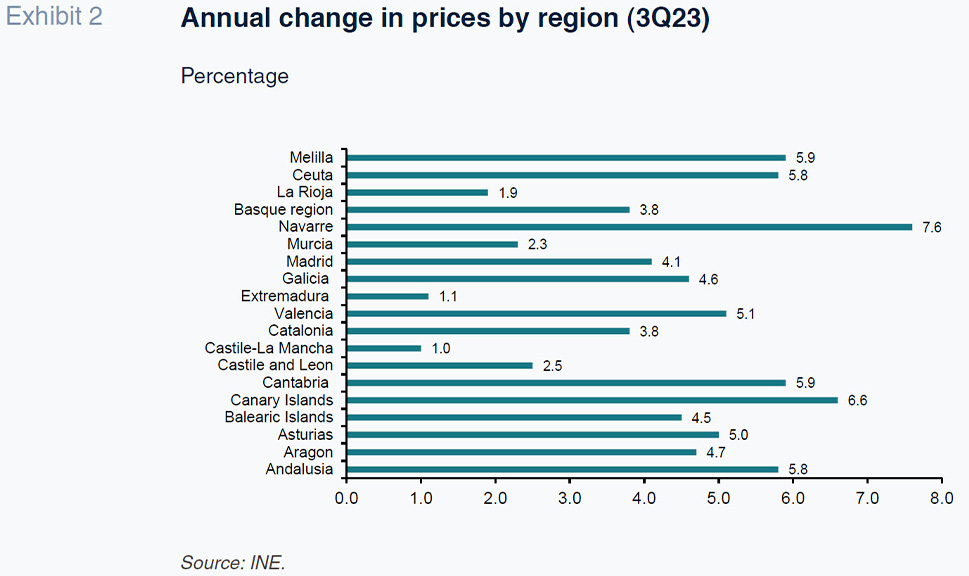

It is important to stress, in any event, that there are many housing markets within Spain, as there is significant dispersion in price growth and affordability metrics from one region to the next. Using the same timeframes, we note that prices increased by 7.6% in Navarre in the third quarter of 2023 and by 6.6% in the Canary Islands but by just 1% in Castile-La Mancha and 1.1% in Extremadura (Exhibit 2).

The persistence of the price increases does not appear to fully tally with prevailing macroeconomic conditions as demand would be expected to be adversely affected by the sharp increase in interest rates and slowdown in economic growth. Considering current inflation, however, the growth in real prices is considerably lower. At any rate, the problem lies with supply. The Bank of Spain signalled some of the long-term issues in a report in 2023, [1] flagging land management in particular and indicating the need to revise how developable land is managed in order to respond to housing needs more effectively. That suggests that the current policies and regulations could be limiting the availability of land apt for the development of new homes.

In parallel, the pandemic, along with the war in Ukraine and current bout of inflation, are having long-term effects on both supply and demand in the property market. During the pandemic, new homes under construction were paralysed and not resumed at the same pace as demand, creating a shortfall of supply. In addition, the high cost of construction materials has also impeded the start of new property developments, further reducing the supply of new homes. The shortage of supply is evident in the data offered on some of the online platforms, such as Casavo, [2] which indicates that 8 out of every 10 Spanish capitals experienced a reduction in their stock of existing housing in 2022, marked by significant decreases in Madrid and Barcelona. The stock of unsold housing is also being adversely affected by the fact that the successive waves of global economic uncertainty and episodes of inflation have eroded confidence in embarking on new real estate projects.

The forecasts for housing prices in Spain in 2024 point to a slowdown and even correction; however, the Spanish property market is characterised by diverse trends by city and region.

In general, house prices are expected to continue to notch up moderate growth, shaped mainly by a healthier job market. However, the Spanish property market is characterised by diverse trends by city and region. In the biggest cities, such as Madrid and Barcelona, demand is expected to remain stronger, translating into considerable growth in prices.

Sales volumes and mortgages

It is important to analyse how house purchases are financed in Spain. The INE publishes some simple statistics that nevertheless provide some interesting insight. Between January and October 2023 (the last figures available), transaction volumes totalled 832,756, with 323,998 of those transactions financed via mortgage. That indicates that just 38.9% of house sales are completed with mortgages. Although a number of circumstantial factors may be influencing these metrics, the clearest interpretation of this phenomenon is that overall market volumes are being largely shaped by wholesale and non-resident investment transactions, which are driving up prices. Another considerable percentage of these mortgage-less transactions is concentrated in touristic regions and is accounted for by second homes for Spanish and international buyers. However, this phenomenon is also being observed in inland cities, highlighting the purchase of homes (wholesale and retail) as (non-residential) investments. This may also be impeding access to first homes for residential usage by feeding price growth even in environments in which the economic fundamentals would normally foreshadow price corrections. Remember that during the prolonged period of ultra-low and even negative rates from the financial crisis until the end of 2021, housing emerged as a compelling investment alternative due to the lack of other pathways to earning returns, a phenomenon which has had long-term effects, even as interest rates have moved higher.

Lastly, it is worth looking at what is happening in home mortgage demand and supply. Exhibit 3 provides an allegory of sorts for the mortgage market paradigm in Spain. The year-on-year flows in home mortgages (new transactions, not stock) have not revisited pre-financial crisis levels. The exhibit goes right back along the Bank of Spain’s full series, to 1995. Mortgage flows were registering annual growth of over 15% at the end of the 90s and in the first decade of this century continued to rise, peaking at growth rates of almost 25% between 2004 and 2006, which is when the property bubble was at its most inflated. After that bubble burst, so too did the flow of mortgages, which registered contractions for more than a decade, between November 2010 and April 2021. In the aftermath of the pandemic, volumes started to rise again, but only by around 1%. Since December 2022, however, volumes have been contracting, by 3.1% in October 2023, the last month for which this information is available. These figures suggest that Spain has yet to find a point of equilibrium in the mortgage market between the heady rates of the financial and property bubble and those corresponding to a more normal monetary environment.

Conclusion: Affordability issues linger

This analysis of the housing market in Spain shows that price growth has proven resilient relative to the levels augured by the prevailing economic cooling and slump in demand. The gap between the total volume of housing transactions and the number financed using mortgages suggests that the large majority of properties are being purchased as wholesale, non-residential investments, a phenomenon which is pushing prices higher and impeding access. The figures also reveal the complexity of the mortgage market which has yet to strike a balance between the double-digit growth observed prior to the financial crisis and subsequent negative rates.

Regardless, housing affordability is a fundamental issue for sustainable economic and social development. In recent years, affordability has deteriorated in Spain and other countries and emerged as a particularly controversial topic in the wake of the financial crisis and pandemic, as the episodes of price corrections have been short-lived and followed by periods of sharp price recovery, above the levels of wage growth. This is attributable to a series of factors, including a shortage of land, growth in demand for housing and wholesale and non-resident investing activity in the property market. That means that households with average income levels need to work more hours to be able to buy a house. The impairment of housing affordability exacerbates inequality by benefitting home-owners and harming renters and households that cannot afford to buy a home. Home affordability issues also have adverse consequences for social mobility. Lower income households that cannot afford to buy a home may be obliged to live in areas that offer fewer job and education opportunities. Certain zoning policies, particularly those that do not work in favour of increasing the supply of homes for residential usage, have helped erode the affordability metrics.

Policy responses to the affordability issues have tended to take the form of loan relief and help with mortgage restructuring. However, that strategy has not always delivered the expected or desired results. Often, government support measures have failed to effectively cushion episodes of price correction and in some cases have even contributed to prolonging the bubbles. Policymakers could rethink how they encourage home ownership to ensure inclusive access to quality homes. That would include supporting an efficient rental market (abandoning interventions that only drive rents higher) and boosting housing supply, including a bigger stock of public housing.

Notes

Santiago Carbó Valverde. University of Valencia and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas