Outlook for the Spanish economy in 2024-2025: Navigating an uncertain international backdrop

Compared to its European peers, the Spanish economy has weathered the inflationary storm and geopolitical tensions of recent years relatively well, buoyed by its strong competitive positioning. In the near-term, however, a slowdown is anticipated in light of the weak external environment and contractionary turn in macroeconomic policy, with fiscal dynamics remaining a key vulnerability.

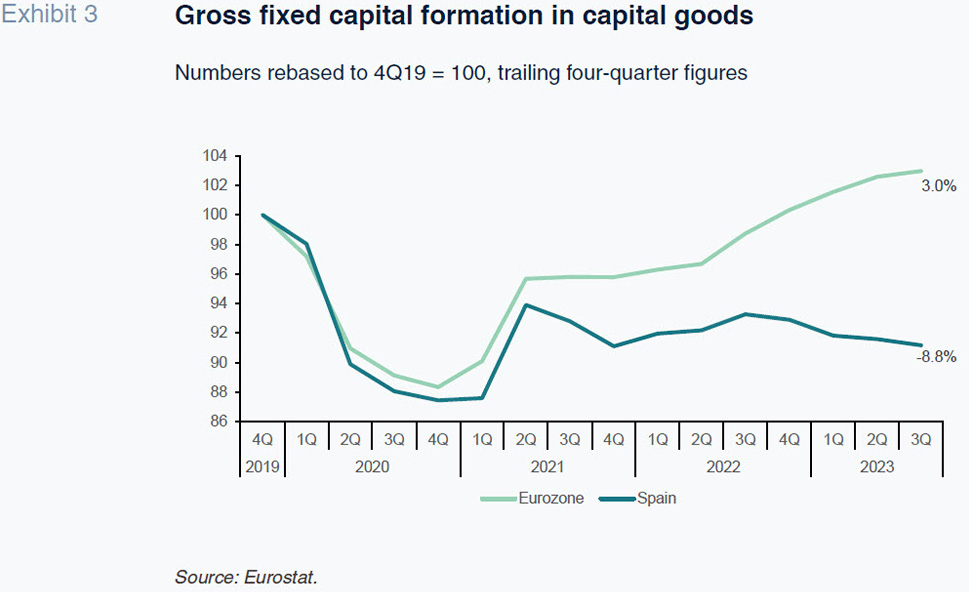

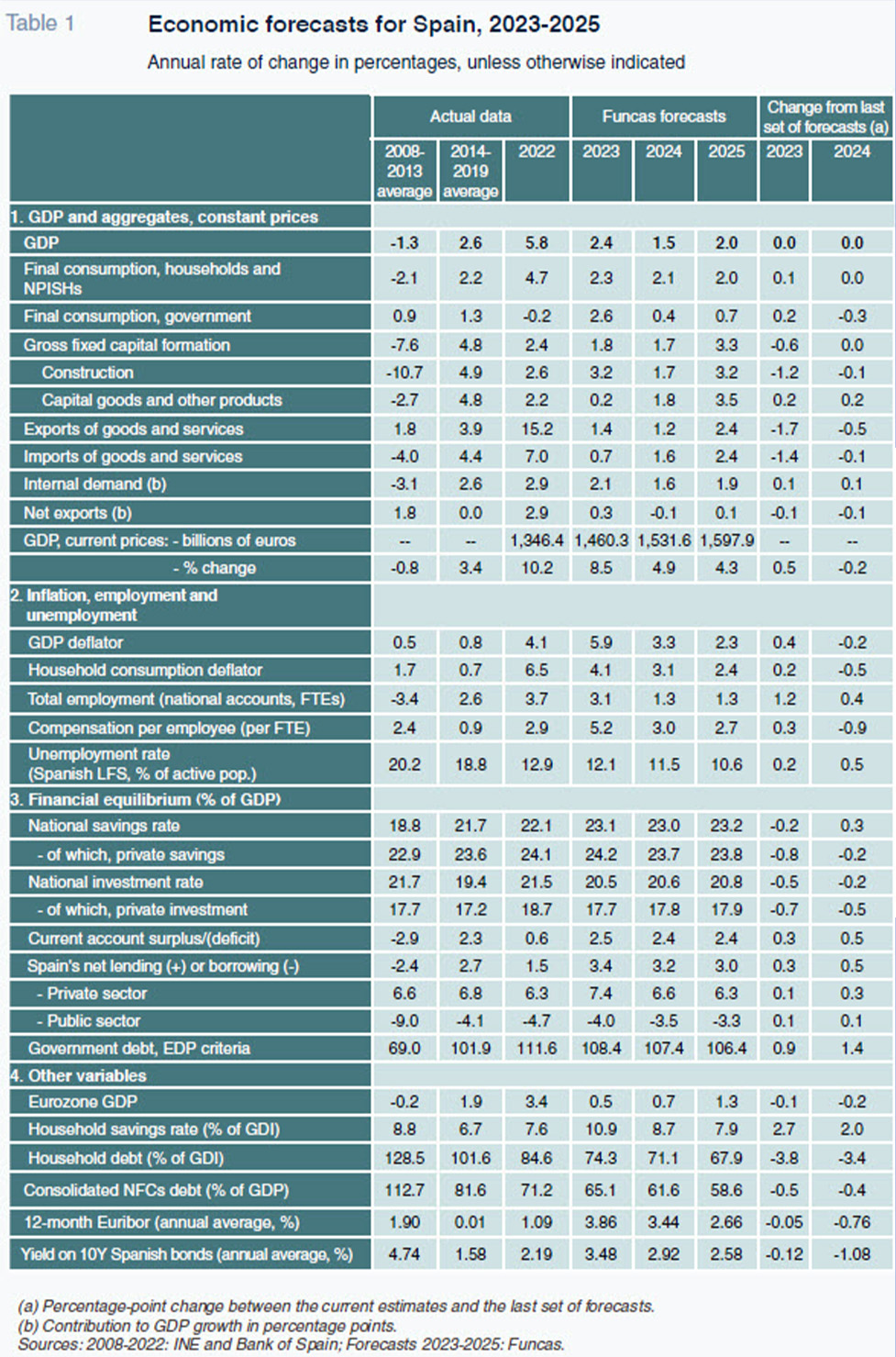

Abstract: Compared to its European peers, the Spanish economy has weathered the inflationary storm and geopolitical tensions of recent years relatively well, buoyed by its strong competitive positioning. GDP growth is estimated at 2.4% in 2023, which is nearly two whole points above the eurozone average, with the current account surplus hitting an all-time high. In the near-term, however, a slowdown is anticipated in light of the weak external environment and contractionary turn in macroeconomic policy – both fiscal and monetary. We are forecasting GDP growth of 1.5% in 2024, which is nevertheless above the projection for the European average. Elsewhere, investment in capital goods remains 8.8% below pre-pandemic levels, a trend that does not bode well for productivity in the medium-term and poses a challenge in terms of maximizing the impact of the European funds on the Spanish economy. Lastly, the public deficit is set to remain above the thresholds required by Brussels, even if growth recovers as expected in 2025.

Recent developments

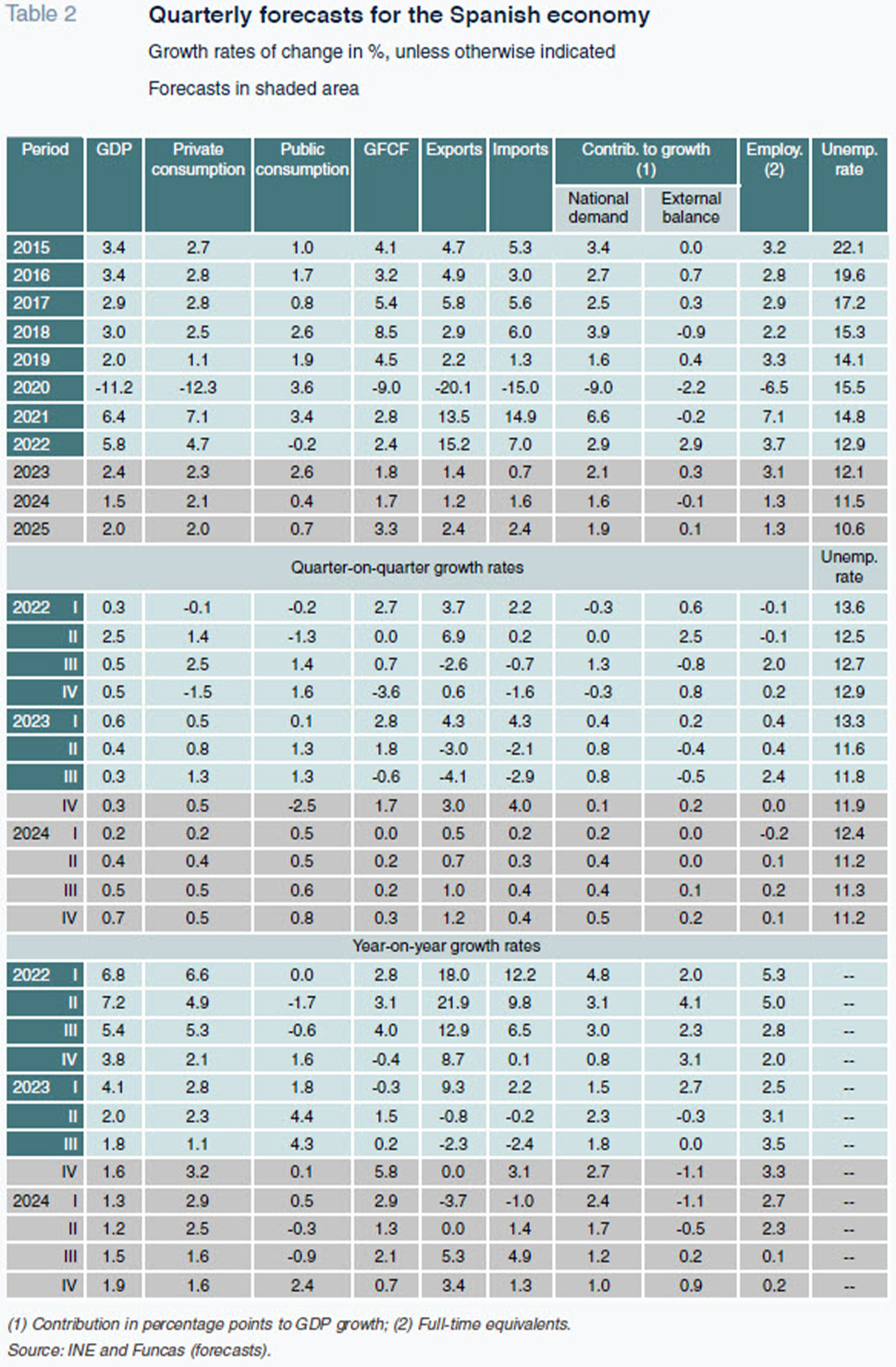

The Spanish economy performed better than expected in 2023 (Torres and Fernández, 2023), albeit showing signs of slowing in recent months. According to the revised quarterly national accounts, GDP inched just 0.3% higher in the third quarter of 2023, continuing, however, to clearly outperform the eurozone average.

Third-quarter growth was driven by a positive contribution by domestic demand of 0.8 percentage points, more than offsetting the slump in external demand, which detracted from growth 0.5 percentage points, as exports contracted by more than imports. Among the components of domestic demand, the momentum came from consumption, both public and private. In contrast, investment contracted, dragged down by construction, which more than offset the growth in investment in capital goods and intangible assets. As for the external sector, exports contracted –as they had in the second quarter– having notched up almost interrupted growth since the end of the health crisis. Imports likewise shrank and remain below pre-pandemic levels.

Employment, measured in hours worked, continued to improve. Although employment on aggregate topped pre-pandemic levels by the second quarter of last year, several sectors continue to lag that threshold, namely the primary, manufacturing, construction, financial and insurance, professional activities and retail, transport, and hospitality sectors.

In the first three quarters combined, the number of hours worked increased by 1.6%, whereas the number of people in employment increased by 3%, implying a drop in hours worked per person. Productivity per hour fell slightly in the third quarter to leave the growth accumulated during the first three quarters at 1%.

Fourth-quarter indicators point to similarly solid GDP growth. Although the manufacturing PMI remained under 50 and below the third-quarter readings, it was well above the eurozone average. In services, on the other hand, a raft of indicators (PMI, overnight stays, and tourist arrivals) point to ongoing momentum. Lastly, in construction, the key indicators (permits and tenders) foreshadow a slowdown.

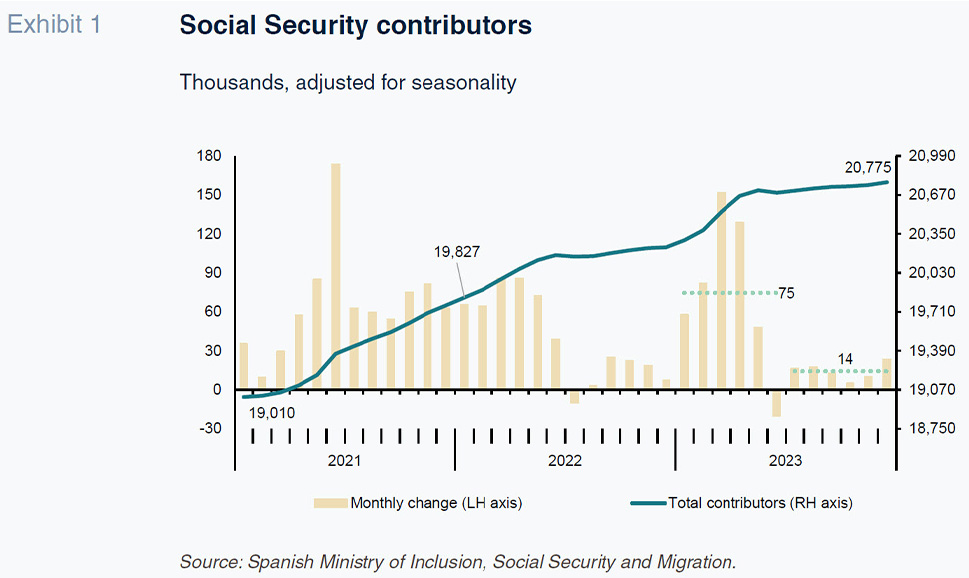

Social Security contributors increased at the same pace in the fourth quarter as in the third quarter –0.2%– trailing the growth recorded in the first half of the year. Despite this slowdown, the job market remains resilient and there are no signs of a shift for now. In 2023 as a whole, contributor numbers increased at an annual rate of 2.7%, which means half a million new contributors, having added over 1.2 million during the two previous years (Exhibit 1).

The strength of the job market, coupled with increases in wages and benefits (particularly pensions), has fuelled household disposable income, compensating higher debt service burdens. Stripping out the effect of inflation, it is estimated that household income increased by 6.1% in 2023, an all-time record. That in turn explains the strong performance in private consumption with savings remaining relatively high.

The headline inflation rate, picked up from its trough of 1.9% in June (largely reflecting base effects) to 3.5% in September and October, before falling back to 3.1% towards the end of the year. Core inflation, meanwhile, has been trending lower since June and ended the year at 3.8%. These figures suggest that the let-up in inflation across the major components appears to be continuing. Inflation, while remaining on a downward trend in 2024, will be affected by the withdrawal of the anti-inflationary measures introduced by the government.

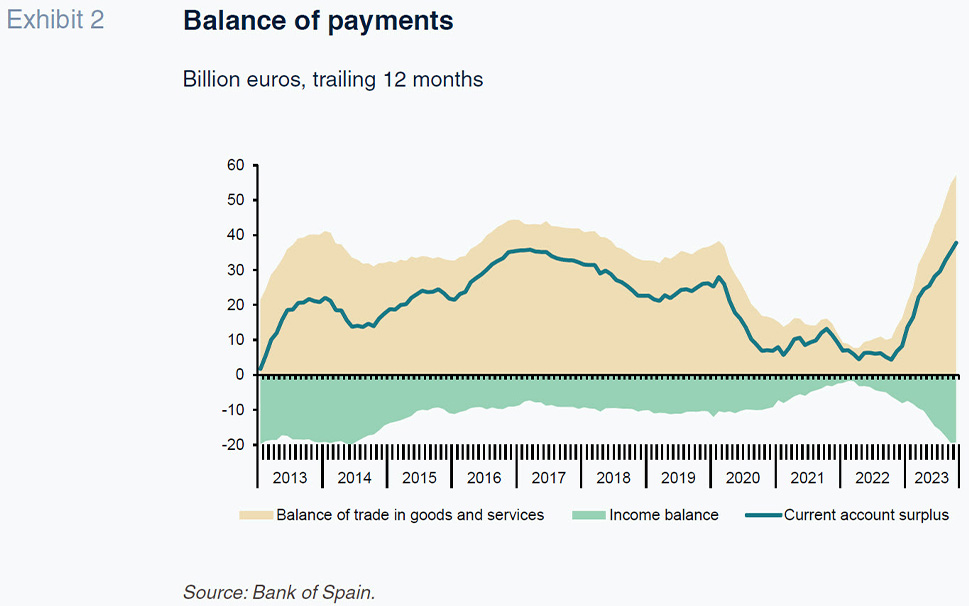

The correction in oil and gas prices in 2023 made energy imports cheaper and the prices of non-energy imports also fell, while export prices remained broadly unchanged. Thanks to that improvement in the terms of trade, and the healthy trend in the volume of net exports, the current account recorded a record surplus of 32.7 billion euros in the first 10 months of the year. That performance was driven by the reduction in the goods trade deficit and sharp increase in the services trade surplus (lifted by both tourist and non-tourist services), which more than offset a worse income balance (Exhibit 2).

Lastly, the public deficit remains significant. As of September, the overall deficit was broadly flat year-on-year (25.42 billion euros versus 26.58 billion euros in 10M22). The very slight improvement is being driven by revenue, particularly receipts from new taxes, personal income tax, corporate income tax and social security contributions. Public expenditure, meanwhile, continues to register strong growth, especially expenditure on intermediate goods, interest, wages, and benefits, particularly pensions. Real growth in tax revenue is estimated at 9% between 2019 and 2023 (i.e., discounting inflation), with primary spending increasing by 11.8%. These are magnitudes that will be hard to sustain.

Corporations and households are using their surpluses to repay debt

One red flag in the Spanish economy’s recent performance is the stagnation in investment in capital goods, which remains below pre-pandemic levels, in contrast to the growth observed across the eurozone as a whole, where investment is back above that benchmark (Exhibit 3). Taking investment accumulated over the last four quarters as our measure, Spain is the EU country where investment in capital goods has contracted the most since 2019. By comparison, investment in Greece, Italy and Portugal has registered double-digit growth. Germany has yet to revisit its pre-pandemic level but is still ahead of Spain.

And that is despite the fact that: (i) Spain is the second-biggest recipient of European funds; and, (ii) Spanish firms are less leveraged than their European counterparts, which has left their earnings less exposed to the increase in interest rates, giving them more room to invest.

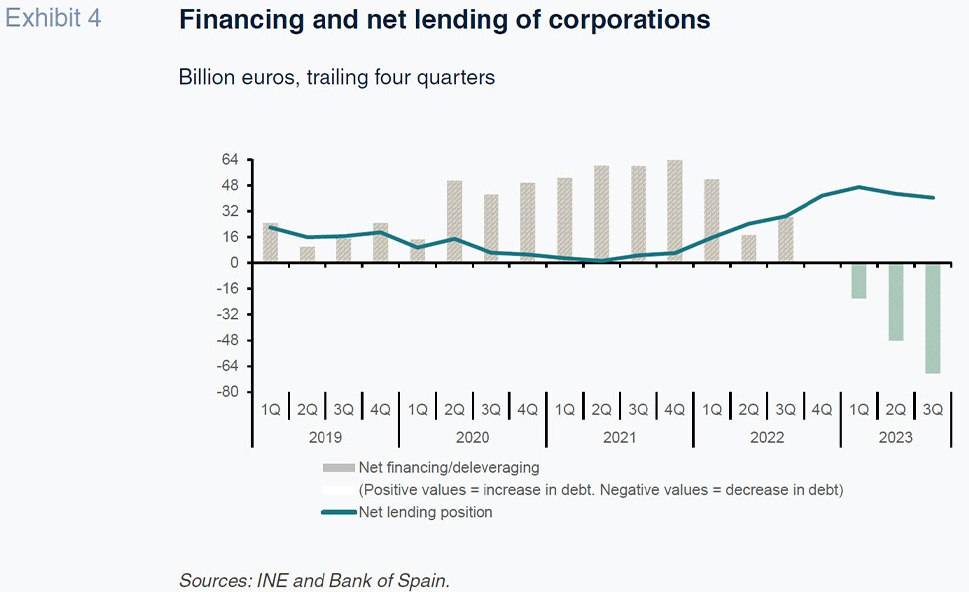

The volume of investments by non-financial corporations in 2022 and until the third quarter of 2023 (the latest figure available) was significantly below their undistributed earnings or disposable income. That has implied the accumulation of a sizeable financial surplus, higher in relation to GDP than that generated by the eurozone corporations on average.

That surplus has been used to repay debt. In the four quarters to 3Q23, Spain’s non-financial corporations repaid a net 68.5 billion euros of debt (net repayment of 29.2 billion euros on a consolidated basis,

i.e., excluding intercompany loans). In fact, firms also reduced their financial asset holdings in order to pay down debt (Exhibit 4). On the other hand, in the eurozone as a whole, until the second quarter, net borrowings were on the rise. In other words, in contrast to their Spanish counterparts, corporations in other European countries continue to take on more liabilities to finance their investments.

The volume of outstanding debt owed by Spanish corporations remains above 2019 levels in nominal terms due to the spike in debt taken on during the pandemic. However, the picture changes relative to GDP: the debt-to-GDP ratio stood at 65.5%, the lowest reading since 2002. By comparison, the eurozone average (as of 2Q) was 68.8%. Among the region’s main economies, Denmark and the Netherlands stand out with corporate leverage ratios of over 100%. German and Italian corporations are less leveraged than their Spanish counterparts, and French businesses, more so.

Note, however, that the situation is highly uneven across the universe of Spanish corporations, as gleaned from the Bank of Spain’s Central Balance Sheet Data Office (Bank of Spain, 2023a). Also, the ICO (Spain’s Official Credit Institute) statistics reveal that some corporations are in arrears on the repayment of the loans awarded during the pandemic, indicating important exceptions to the general trend of corporate deleveraging. ICO loans classified as non-performing amounted to 30% as of June 2023 (Bank of Spain, 2023b).

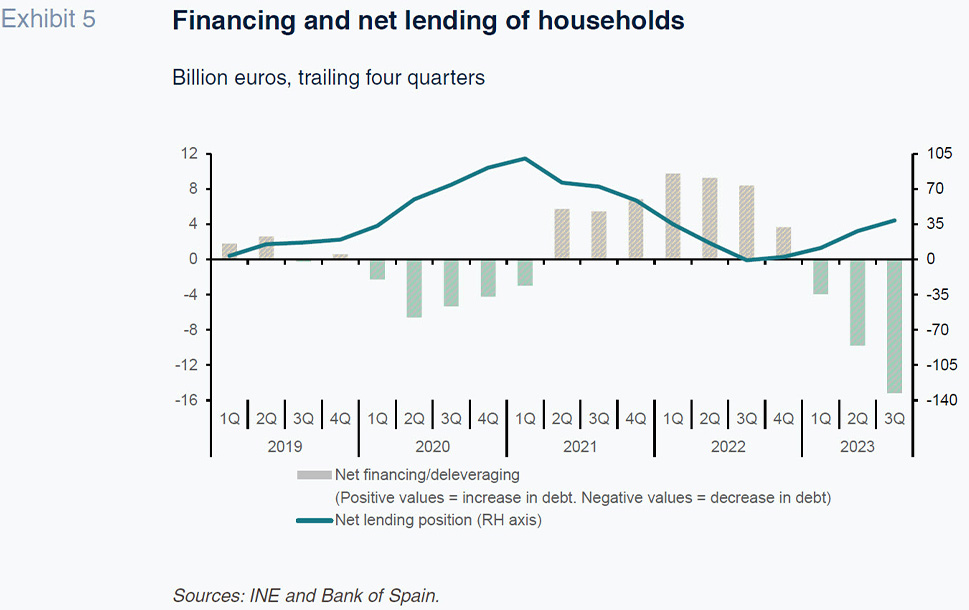

Households, meanwhile, continued to present high savings levels as of the third quarter, higher than before the pandemic, which has translated in sharp growth in their financial surplus. Their trailing four-quarter net lending position stood at 38.8 billion euros as of the third quarter, the highest in the entire series if we leave out the pandemic (when savings reach extraordinary levels due to the “forced” savings component). Relative to GDP, that position represented 2.7%, which is very similar to the position built up by European households as a whole during that same timeframe. Within the eurozone, German and French households recorded noteworthy net lending positions of 5.8% and 4.6% of GDP, respectively. In Italy, households net lending position was nil.

Some of the surplus has been used to repay debt (net repayment in the 12 months to September of 15.2 billion euros) and some to purchase financial assets (Exhibit 5). European households, in contrast, increased their borrowings in the 12 months to June, albeit with waning intensity. Spanish household debt accounted for 48% of GDP as of the third quarter, similarly the lowest level since 2002. The eurozone average was 55%. Among the major European economies, only Italian households were less indebted. The most indebted households were the Dutch.

Forecasts for 2024-2025

For 2023, growth is estimated at 2.4%, unchanged from the previous projections but significantly better than anticipated at the start of last year. The result was driven by strong momentum during the first half of the year, with GDP slowing in the second half.

For this year, our forecasts start from the premise that energy prices will stay around current levels. In other words, the price corrections enjoyed last year will not reverse. We also assume that macroeconomic policy will be more restrictive than in the recent period: in addition to monetary tightening (the successive interest rate hikes will have their maximum impact in the months to come), fiscal tightening looms, leaving behind the expansionary stance of recent times (the European funds likely the only support to be left in place). Our forecasts also assume the reversal of some of the anti-inflation measures of prior years, such as VAT and other tax cuts. Lastly, the international climate is expected to remain relatively unfavourable, shaped by lethargic global trade and the persistence of intense geopolitical uncertainty.

Framed by these assumptions, the slowdown is expected to continue in the near-term. We are forecasting GDP growth of 1.5% in 2024 (unchanged). The slowdown will be driven in part by domestic demand, which is expected to contribute 1.6 percentage points, down 0.5 percentage points from 2023. Consumption is expected to decline notably, more so public spending but also private spending, underpinned by flagging job creation and the wage moderation agreement. Residential investment is also expected to weaken, undermining the slight rebound anticipated in investment in capital goods, as the European funds trickle through to the real economy.

External demand is likely to suffer from broader international weakness, detracting from growth by 0.1 percentage points. The export markets will also suffer from the weak state of the European economy, with Germany on the verge of recession. Imports, on the other hand, are expected to recover, having slumped last year, returning to the elasticities of recent years.

In light of the demand slowdown and assuming the absence of a fresh energy shock, disinflation should take hold in 2024 albeit without reaching the ECB’s target until at least 2025. The GDP deflator, a proxy of the underlying trends, is forecast at 3.3%, down 2.6 points from 2023. The reduction reflects relative moderation in both wage costs and business profits. Disinflation is expected to be less pronounced in terms of CPI, which we are forecasting at 3.1% this year, down 0.4 percentage points from 2023. The reversal of the current anti-inflation measures will translate into an increase in consumer prices (estimated at 0.6pp) without directly affecting production prices. In 2025, we expect the GDP deflator and CPI to converge towards the target of 2%.

Disinflation should provide fertile ground for interest rate cuts from the summer. It is predicted that the ECB will bring its deposit facility rate to 3.25% by year-end and we are forecasting Euribor at 3%. While these are still contractionary levels, the turnaround should foster a gradual improvement in the economic outlook over the course of the year in Spain and the rest of the eurozone alike.

All of which should create momentum for 2025, when we are projecting GDP growth of 2%. Investment dynamics should improve once interest rates start to moderate, helped by corporations’ low leverage. Exports are also expected to rebound as the eurozone economy begins to recover. The Spanish economy is nevertheless expected to continue to grow faster than the European average.

Its outperformance is underpinned by two important sources of resilience: the job market and the international competitiveness of Spain’s corporations. The job creation cycle is expected to continue, bringing unemployment down to an estimated 11.2% by the end of 2024, still very high by comparison with the rest of Europe. We are now forecasting higher unemployment than previously but that is attributable to an upward revision to our active population projections, mainly due to the arrival of foreign workers. In 2025, we expect unemployment to come down further, to 10.6%.

The external surplus, another source of resistance, is expected to remain intact throughout the entire projection horizon thanks to the competitiveness of Spanish exports. We are forecasting a current account surplus of close to 2.5% of GDP and an even higher overall net lending position (arrived at by adding the European funds to the current account surplus).

The slowdown in the economy in 2024, coupled with the increase in debt service costs generated by the increase in interest rates will make it hard to correct the current budget imbalances. In the absence of further deficit-cutting measures, we are estimating a deficit of 3.5% in 2024, with public debt at over 107% of GDP, above the levels permitted under the European fiscal rules. The recovery in growth forecast for 2025 will help bring the deficit down to 3.3%, with public debt expected to come down by one percentage point.

Risks

The risks to the above projections are still mainly on the downside. In the near-term, intensifying tensions around the Red Sea could unleash fresh disruption in global supply chains and trade, hindering the disinflation process. Shipping costs have already surged 3.4-fold in the last two months. If this persists, we would be looking at a new production cost shock. Faced with the risk of an interruption in disinflation, the ECB might stick with its current monetary stance, putting on hold rate cuts assumed in this set of forecasts. A more pronounced increase in the cost of money than estimated in the baseline scenario would also raise the probability of non-performance in the more vulnerable sectors and with it the risk of financial market stress.

Medium- and longer-term, the persistence of a high public deficit is a source of vulnerability for the Spanish economy with the European fiscal rules about to come back into force and the ECB withdrawing support in the form of rates and debt repurchases.

Elsewhere, whereas private sector debt has fallen to low levels on aggregate, some companies and sectors face high financial burdens, built up during the years of monetary easing, for the current high-rate climate. More fundamentally, the lethargy in productive investment is a concern as it does not bode well for future productivity growth in Spain and represents a challenge in terms of putting the European funds to work for the economy.

References

Raymond Torres, María Jesús Fernández and Fernando Gómez Díaz. Funcas