Intangible assets and competitiveness of Spain’s manufacturing industry: An international comparison

The intensity of the Spanish manufacturing sector’s investment in intangible assets is practically half of the European average and this gap has widened since the financial crisis. For the Spanish manufacturing industry to gain competitiveness at the international level, it must commit strongly to digitalisation, which requires closing the gap in investment intensity in intangibles relative to its competitors.

Abstract: The EU and Spanish governments’ strategic commitment to reindustrialisation, setting the target of having 20% of GDP come from manufacturing, requires increased competitiveness and, by extension, further progress on digital transformation. Digitalisation is underpinned by investment in intangible assets such as R&D, software, branding, design, employee training and organisational capital. In Spain, the intensity of the manufacturing sector’s investment in intangible assets is practically half of the European average (10.7% vs. 20% of GVA), a worrying trait that is repeated all across the various areas of manufacturing activity. In addition, at least since the financial crisis of 2008, the gap in investment intensity separating Spain from the EU has widened. As a result, if the Spanish manufacturing industry is to gain competitiveness at the international level, it must commit strongly to digitalisation, which requires closing the gap in investment intensity in intangibles relative to its competitors. In that context, the NGEU funds, whose aims include digitalisation, with specific financing for several strategic investment plans within the industrial sector, are a major opportunity.

Foreword

The European Union has been aiming to lift the weight of the manufacturing sector to 20% of GDP for many years. There are several factors driving this objective: the manufacturing industry is one of the cornerstones of European trade, accounting for the largest share of exports; it is more intensive in innovation than other sectors, as borne out by its share of total investment in R&D; it presents higher productivity levels per employee (and therefore higher pay), so that as its weight in the overall economy increases, so does the economy’s overall productivity; and it has important knock-on effects on other areas of the economy.

For those same reasons, the Spanish government wants the country’s manufacturing industry to represent 20% of GDP by 2030. As of 2022 (the most recent figure available) the sector was trailing well below that threshold, at 11.4% of GDP (15.9% including the energy sector). The EU’s 20% target (initially for 2020) was set down formally in the so-called General Guidelines for Spain’s New Industrial Policy to 2030, which establish a policy focused on reindustrialisation (the sector having lost relevance to the services sector in recent years) by leveraging innovation and digitalisation to gain competitiveness, while safeguarding the environment throughout. The reversal of globalisation in recent years (in a context of global supply chains strained by geopolitical risks) and the resurgence of protectionism to ensure national security are bringing the goal of increasing the weight of manufacturing in the economy even more to the fore.

To make the industrial sector more competitive, the Spanish government has defined 10 lines of initiative, the first of which is digitalisation. As specified in the Guidelines, the incorporation of technologies such as artificial intelligence, the internet of things, 3D printing and robotics into productive processes and industrial products is critical. And a key characteristic of all these technologies is the fact that they require investment in intangible assets such as R&D, software, databases, design, training, and organisational capital. Therefore, to achieve the 20% target and increase the competitiveness of the manufacturing industry, it is necessary to invest more in these assets.

Indeed, the richest and most productive economies are characterised by the intensity with which they use intangible assets. As astutely noted by the COTEC Foundation and the reports it sponsors on the intangible economy, [1] “intangible assets are characteristic of the knowledge economy and investing in them helps lift productivity and living standards”. That same message applies to manufacturing and hence the importance of supporting investment in these types of assets, which are the source of productivity gains.

That is the backdrop for this paper whose aim is to provide a comparative assessment of the intensity with which the Spanish manufacturing industry invests in intangible assets by comparison with other countries. That analysis is undertaken at the aggregate level for the overall manufacturing industry and by area of activity. In both instances (aggregate and by area of activity) we also analyse the breakdown of the stock of investment in intangible assets by asset type. The data encompasses the assets classified as investments in the national accounts (that are therefore included in GDP), as well as other assets that despite not computing as part of GDP are extremely important to boosting the sector’s competitiveness.

Investment intensity in intangible assets

Both the Spanish economy and its manufacturing sector suffer from low productivity by comparison with other developed economies and that low productivity partly explains the gap in GDP per capita with respect to those economies. In fact, GDP per capita in Spain is 18% below the eurozone average (2022 data in PPS euros), labour productivity (per hour worked) is 15% lower and in manufacturing, productivity is similarly 15% below the eurozone average.

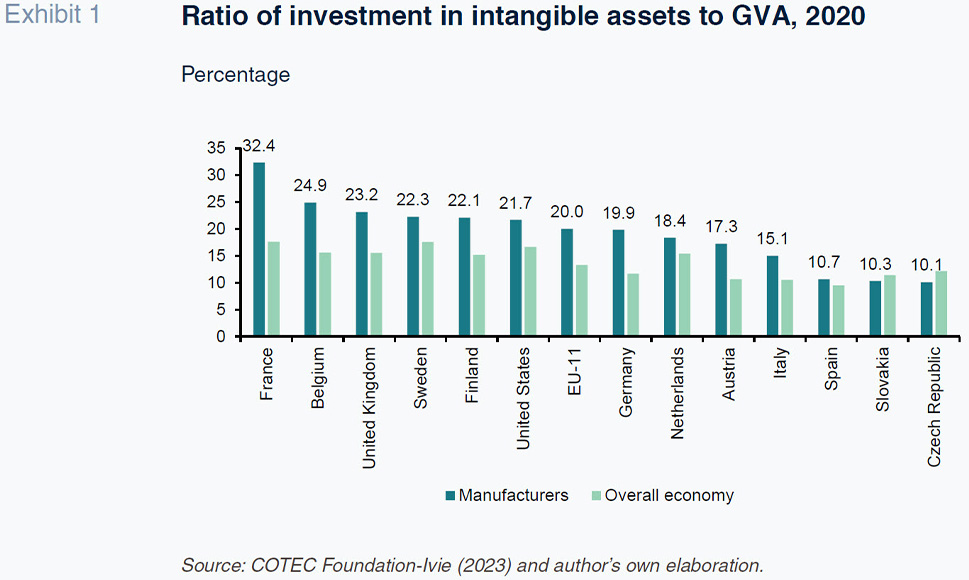

In order to increase productivity, and thereby competitiveness, Spain needs to advance in digital transformation, which requires investing in intangible assets. As shown in Exhibit 1, investment intensity in intangibles

[2] in the Spanish manufacturing industry is 10.7% (as of 2020, the most recent figure available), which is virtually half of the average for the European countries for which that same information is available (EU-11). Of those 11 countries, Spain ranks only ahead of Slovakia and the Czech Republic and by a very small margin. We are talking about investment/GVA ratios that bear no comparison with those of Germany (19.9%), the UK (23.2%) or France (32.4%), to name a few examples. With the exception of the two countries at the tail end of the intensity ranking, in the other countries, the manufacturers report investment/GVA ratios that are above their national averages. However, in Spain, the difference in investment intensity between the manufacturing sector and the overall economy is very small (10.7%

vs. 9.5%), at just 1.2 pp, compared to an average of 6.7 pp in the EU-11.

Another problem presented by the Spanish manufacturing industry by comparison with the European sector is the fact that the distance with which it lags in intangible investment intensity, far from narrowing, has actually widened in recent years, at least since the financial crisis of 2008. That year, investment intensity in Spain was 9.7%, 6.8 pp below the EU-11 average (16.5%). Twelve years later, in Spain that ratio has increased by just 1.2 pp, compared to growth of 3.5 pp in the EU-11. As a result, the gap has widened from 6.8 pp in 2018 to 9.3 pp in 2020. The 1.2 pp increase in intensity in Spain contrasts with increases of over 3.5 pp in Germany, France, the UK, and the US, for example.

Which areas of the manufacturing industry invest more in intangibles?

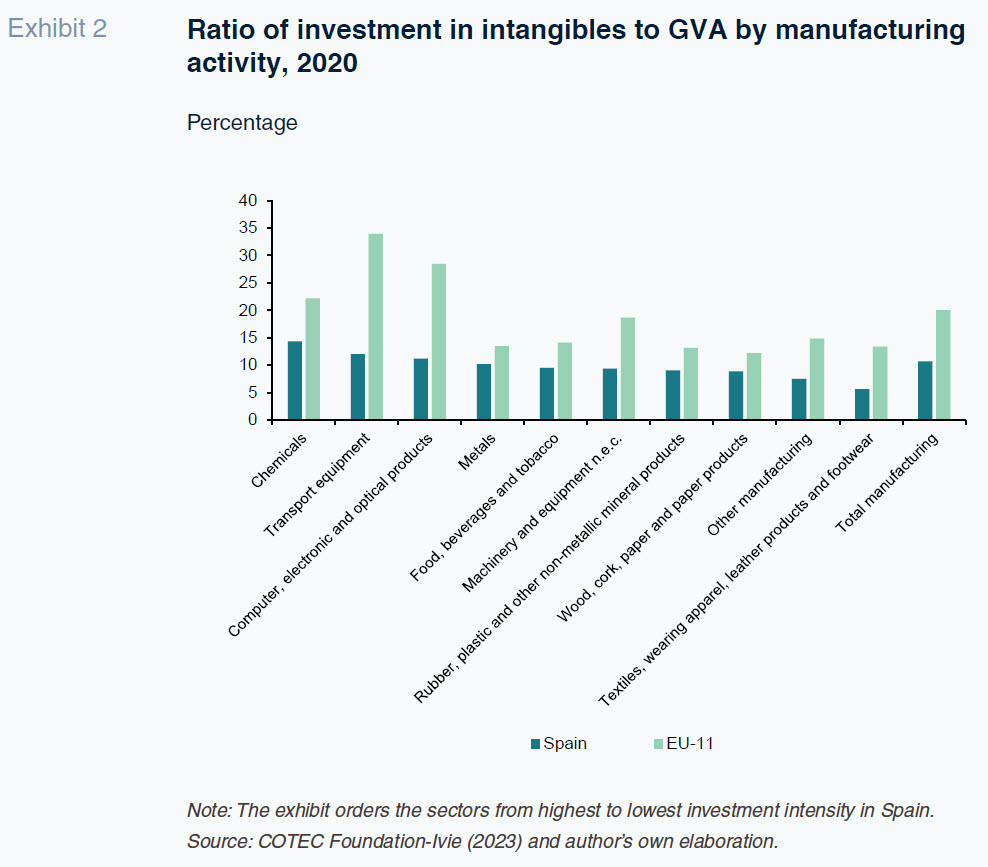

The information at hand allows us to break out the analysis to 11 areas of activity, as depicted in Exhibit 2. [3] Focusing on Spain, there are considerable differences in intangible investment intensity, ranging from a ratio of 14.4% in the chemicals industry to just 5.6% in the textiles, leather, and footwear sector. Above the national average of 10.7% lie, in addition to the manufacture of chemicals, the manufacture of transport equipment (12%) and the manufacture of computer, electronic and optical products (11.2%).

A worrying pattern is the fact that all areas of manufacturing in Spain invest less intensely in intangible assets than their European counterparts, with the EU-11 ratio virtually tripling Spain’s numbers in three activities: transport equipment (33.9% in the EU-11 vs. 12.0% in Spain), computer, electronic and optical products (28.5% vs. 11.2%) and textiles, leather, and footwear (13.4% vs. 5.6%). In the best performing sectors, the gap is still 3.3 pp: metals (13.5% vs. 10.2%) and wood, cork, paper, and paper products (12.2% vs. 8.9%).

Breakdown of investment in intangibles by asset type

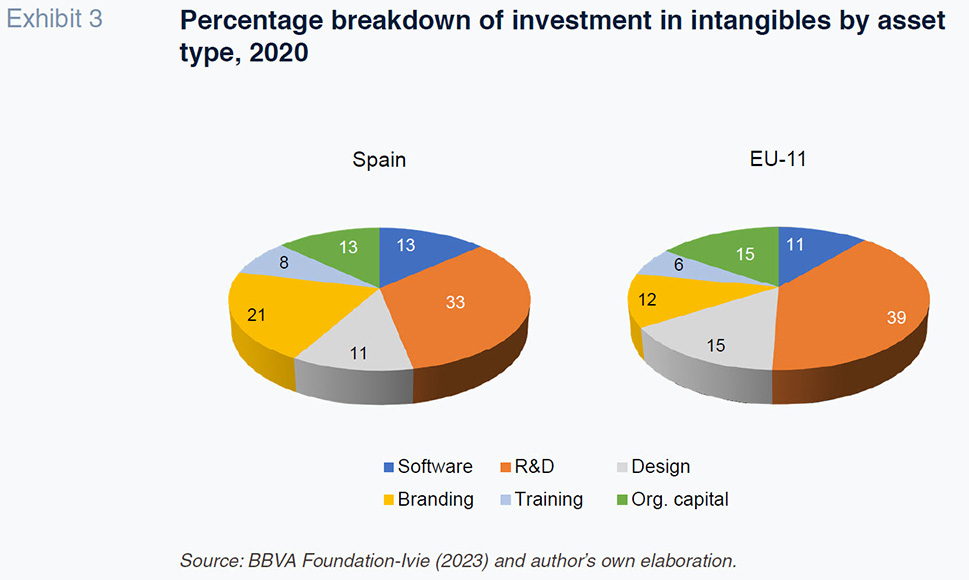

To analyse the composition of the stock of investment in intangibles by asset type, we use six categories: software, R&D, design, branding, employee training and organisational capital. R&D accounts for the highest share of the total for both the Spanish and European manufacturers: 33% of the total in Spain and 39% in the EU-11. The next most important category, at a considerable distance, is investment in branding (21% in Spain), whereas investment in design and organisational capital are the second most important categories in the EU-11 (15%). In Spain, investment in software and organisational capital account for similar shares of the pie (13% of the total apiece), while investment in design (11%) is a little higher than investment in employee training (8%). The biggest difference in the asset breakdown between Spain and the EU-11 is the relatively higher share of investment in branding in Spain compared to Europe (8.3 pp more). In contrast, investment in R&D is 6 pp lower in Spain.

Focusing on the Spanish manufacturing industry there are considerable differences in the make-up of that stock of investment from one activity to another. In most of them, investment in R&D tends to account for the biggest share, representing over half of the total in the manufacture of coke and refined petroleum products and the manufacture of chemicals. Branding is the most important asset class in the food industry, accounting for 32% of its investment in intangibles, which is more than in any other. The same is true of the textile, leather, and footwear sector, where investment in branding represents 29% of the total, ahead of investment in R&D, at 23%. In the manufacture of metals, investment in R&D takes the top spot (34%), as is the case in the manufacture of computer products (32%), equipment and machinery (33%) and transport equipment (27%). Investment in software is highest in the wood and cork sector (27%), whereas design reaches its maximum value in transport equipment (25%), branding in the food business (32%), training in transport equipment (11%) and organisational capital in textiles, leather, and footwear (18%).

Conclusions

If Spain wants to reindustrialise and lift the weight of its manufacturing industry to 20% of GDP (a target it is far from today), it should increase investment intensity in the intangible assets that are necessary to enable digital transformation and unlock productivity gains. The starting situation is not good as the ratio of investment to GVA is just 10.7% in the Spanish manufacturing industry, which is half the European average. This pattern is of particular concern as it is common to all areas of manufacturing activity. With no exception. In some areas, investment intensity is barely a third of the European equivalent. It is also worrying to note that the gap separating investment intensity in Spain from the European average has widened, at least since the start of the financial crisis of 2008.

Spain cannot afford to miss the digital transformation train and let the extraordinary financing opportunity presented by the Next Generation European Union (NGEU) funds escape its grasp. A significant share of those funds is targeted at digitalisation and some of that money is earmarked to manufacturing. Some of the NGEU funds have been articulated into strategic sector plans (akin to the Important Projects of Common European Interest concept and known as PERTEs for their acronym in Spanish); of the 12 PERTEs approved, several are specific to the manufacturing sector: the electric vehicle, renewable energy, food industry, ship industry and aerospace sector plans. A step in the right direction is the creation of support programmes such as the Connected Industry 4.0 initiative whose aim is to spur digital transformation across the Spanish manufacturing industry by means of broad joint and coordinated action from the public and private sectors.

Indeed, public-private partnerships are needed to boost investment in intangibles and create the right conditions for encouraging this class of investment (such as tax relief). One of the impediments to investment in intangible assets is the lack of access to financing (especially for SMEs) as these assets are harder to value for collateral purposes. Development of venture capital and the generation of expertise in valuing these assets in the financial sector are some of the ingredients needed to improve access to financing for investment in intangible assets.

Notes

Refer, for example, to Mas and Quesada (2019).

Since intangible assets include certain assets that the national accounts do not treat as assets, total investment is expressed as a percentage of adjusted GDP, i.e., GDP including investment in such assets.

The manufacture of coke and refined petroleum products is excluded on account of presenting negative GVA in 2020, so distorting the investment intensity analysis.

References

GOVERNMENT OF SPAIN. MINISTRY OF INDUSTRY, COMMERCE AND TOURISM. (2019). Directrices Generales de la Nueva Política Industrial Española, 2030 [General Guidelines for Spain’s New Industrial Policy to 2030].

MAS, M. and QUESADA, J. (2019). La economía intangible en España [The intangible economy in Spain]. COTEC Foundation-Ivie.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF