Wages, productivity and corporate management

The Spanish economy faces major challenges to sustainably and significantly raise productivity. Improving corporate management quality could help smaller Spanish industrial companies to boost productivity and ultimately wages.

Abstract: Companies which are better managed offer superior remuneration to their workers, perhaps as a mechanism for retaining talent, or to spur, or at least to compensate, greater engagement with the company’s objectives, which is essentially an expression of good quality management. In Spain, there is a notable and sizeable deficit in terms of the quality of corporate management among industrial SMEs which contributes significantly to their lower levels of productivity relative to their counterparts in other large European countries. Reducing this deficit should be an urgent priority, not just for the companies themselves, but also for business organisations and certainly for industrial policy.

Introduction

The recovery in the Spanish economy has reopened a debate on the desirable path for wages. Initially, the focus has been on the minimum wage − which in Spain is further from the average than in other European economies − resulting in a notable increase (in a European context) of 8% in 2017. This was the result of a tug of war between the Government, which proposed a smaller increase, and some opposition groups, who advocated somewhat higher increases, aimed at bringing the minimum wage in line with other member states.

Meanwhile, in the crucial area of collective bargaining, the latest proposals from trade unions do not look to be excessively exorbitant − setting a range for wage increases of between 1.5% and 2.5% in 2017. These demands reflect both the expected pick up in inflation and probably quite a substantial part of the small anticipated increase in labour productivity. Slow progress on the latter is undoubtedly the key factor preventing wages from rising more rapidly. Wages and productivity need to move in unison to avoid calling into question Spain’s current advantage in unit labour costs, and by extension prices, which arose out of the sharp downward adjustment in employment and wages (Myro, 2015).

Fortunately, there is significant scope to improve productivity, because the dominant group of companies in Spain − those with fewer than ten employees − have lower levels of output per worker than their peers in other countries (Costa, 2015; Serrano et al., 2017). Nor do companies with 10 to 50 employees fare significantly better.

Boosting productivity depends on the accumulation of tangible and intangible assets. The latter is taking on increasing importance in advanced economies (Corrado et al., 2006) but has surprisingly very little prominence within Spanish companies, especially the smallest ones. Innovation, training and specialisation of company workers, digitalisation and brand creation are all important elements of intangible assets.

However, corporate management quality is a particularly salient aspect, representing an asset which can be defined and measured in a variety of ways and which is gaining increasing attention in economic literature (Andrews and Westmore, 2014; Bloom et al., 2017). The importance of this factor in Spain lies in the fact that the smallest companies are precisely those with the largest shortcomings in terms of management (Huerta and García, 2014; Yagüe and Campo, 2016). Some academics go even further, attributing the problem of the small average size of Spanish companies to poor quality corporate management (Huertas and Salas, 2014).

Based on the above, the main focus of this article is to measure and evaluate the impact of corporate management quality on company productivity. The second key focus is to go a little further, in an attempt to identify a positive and direct influence from management quality on wages, beyond the indirect effect through improved productivity. The hypothesis underlying this approach is that companies which are better managed offer superior remuneration to their workers, perhaps as a mechanism for retaining talent, or to spur, or at least to compensate, greater engagement with the company’s objectives, which is essentially an expression of good quality management.

In line with the above, this article explores the relationship between the quality of corporate management in industrial companies and productivity and wage levels over five years during the height of the crisis (2009-13), using data from the Survey on Business Strategies (ESEE) put together by Fundación SEPI. In doing so, this article starts by using an indicator of good corporate practices taken from Yagüe and Campo (2016) and provides an initial assessment of management in Spanish industrial companies. It then moves to estimate the impact of corporate management on productivity and wages. If it turns out that quality of corporate management is a factor which clearly influences productivity levels and worker remuneration, this will provide a robust basis for trade unions to consider adopting what is currently an uncommon strategy in Spain: encouraging workers and their highly-qualified representatives to become more involved in the management of the company. Doing so, would not only enable unions to improve the living standards of their members, but also boost the competitiveness of the company employing them.

Good management practices in Spanish industrial companies

The quality of company management includes a variety of different inter-related aspects, making it a challenge to measure, even more so given available data. That said, various attempts have been made to assess this variable. Among these is the model proposed by Yagüe and Campo (2016), selecting various aspects considered by the literature to be important for company management and for which ESEE provides information. Their measure is also very strongly related to company size, the degree of internationalisation, the legal form of a limited company, spending on training and foreign involvement in share capital. This is the approach used in this article, since it draws from information provided by ESEE, which is the database used.

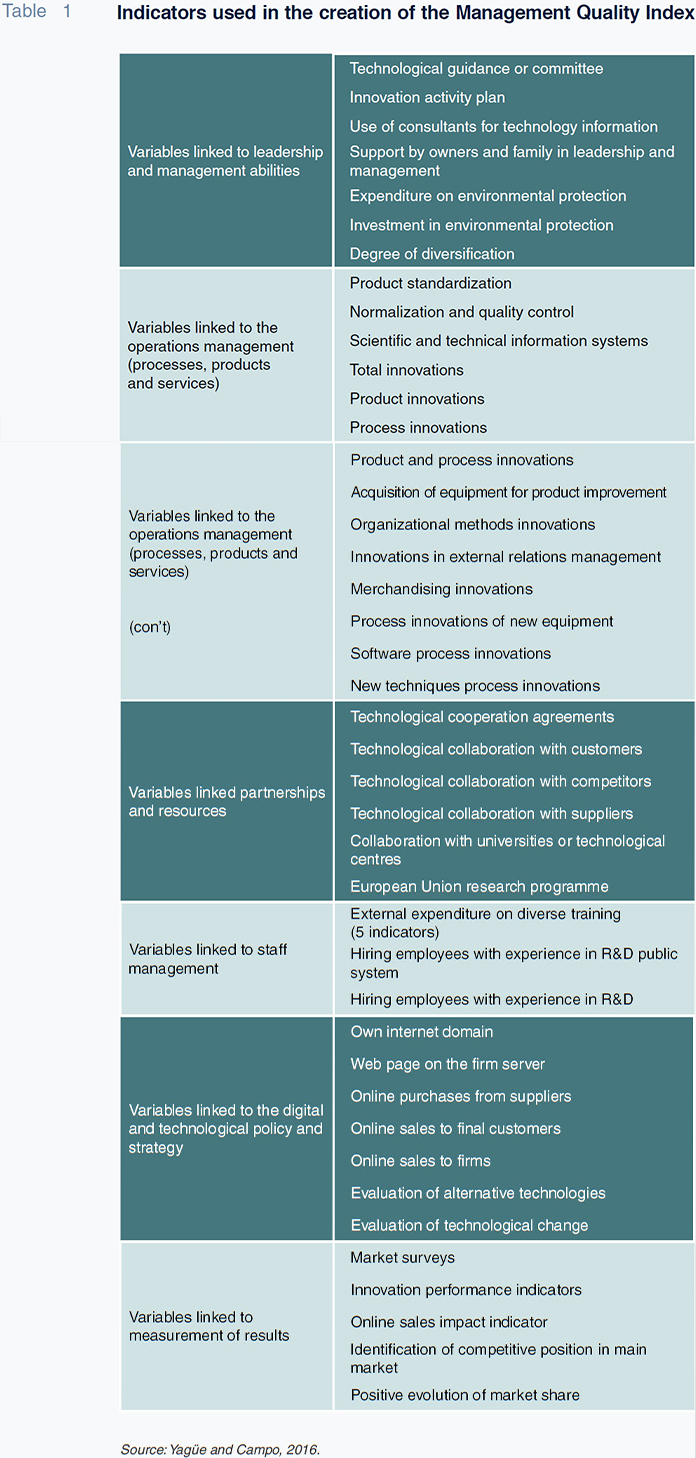

The good management practices measured by Yagüe and Campo are grouped into six sections

[1]. Table 1 provides information on the content of each practice.

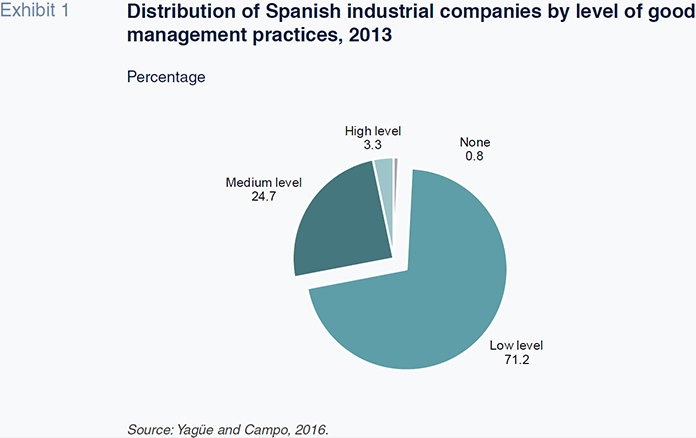

As can be seen in Exhibit 1, according to the above measures, the quality of smaller Spanish industrial company management is generally low. 71% of Spanish industrial companies follow few or none of the good management practices, failing to register on over 12 of the 46 practices contained in Table 1, and only 3.3% engage in 25 or more good practices, which is the threshold for high quality management. Differences between Autonomous Regions are relatively limited, with a variation coefficient of 0.14, with companies in Aragon and Catalonia performing relatively better and companies in the Balearic Islands, Andalusia and Extremadura performing the worst. Dispersion is considerably greater in terms of sectors. Companies working with basic metals, machinery, transport materials and chemicals tend to engage in more good practices, compared to companies involved in wood, furniture and metal products at the other extreme (Yagüe and Campo, 2016).

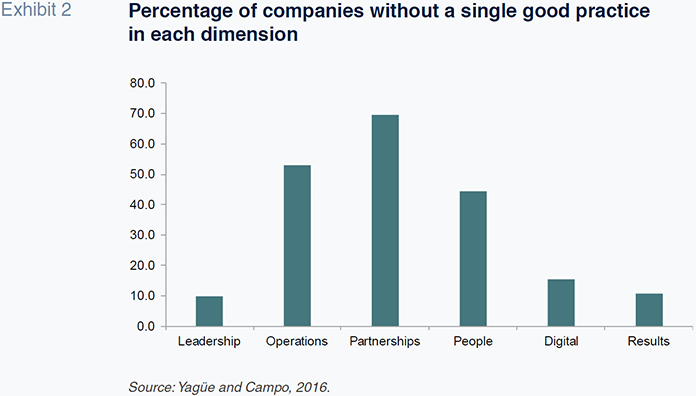

In terms of the different groups of good management practices, it is particularly surprising to see that many companies fail to follow even one of each of them, as illustrated in Exhibit 2. The perspective offered by this exhibit is even more negative when considering that in the leadership area, good practice focuses and improves over time only in the realm of family leadership, or that in terms of digital strategy, there are only significant signs of progress in relation to the internet domain (online purchases for suppliers also improve moderately), or that companies put little emphasis on market share and innovation in their measurement of results.

Either way, the greatest shortcomings are found in operations, partnerships and people. The latter two categories are especially relevant for labour productivity. Partnerships form the basis for company networks which are one of the crucial mechanisms through which innovation is created and technologies are spread. This is one explanation for the widening of the gap in terms of productivity between large and small companies, which is not specific to Spain and is a cause of general concern at present. Human capital, and particularly spending on training, affects employee productivity, engagement with the company and their ability to adapt to new tasks and necessities.

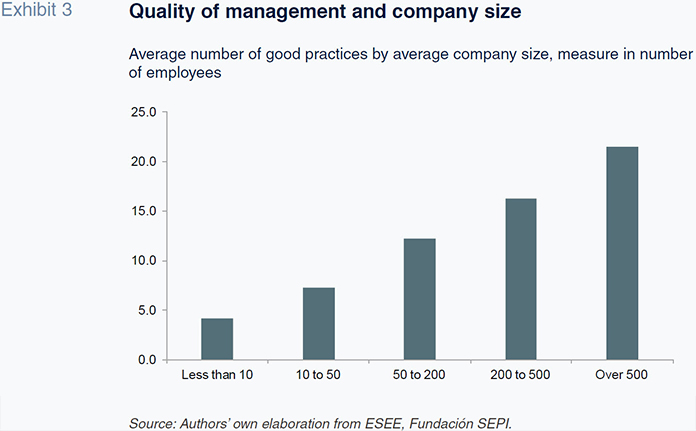

Finally, there is a clear relationship between good management practices and company size. Companies with more than 500 companies engage in five times the average number of good practices adopted by companies with less than ten employees, which only engage in slightly over four (Exhibit 3).

Based on this information, there is considerable scope for Spanish industry to improve management practices. This is a conclusion that emerges out of international work in this area, albeit less starkly. The World Management Survey assesses the management quality of Spanish companies − not just industrial companies − assigning it a score of 2.5 out of 5. This somewhat more upbeat assessment relative to the conclusions arising from this analysis of the data is due to the fact that the former relies on opinions from managers in large companies and is extended to all Spanish companies. By contrast, Yagüe and Campo’s indicator is constructed on information provided by each of the companies included in the ESEE.

The influence of corporate management on productivity and wages

This section of the article seeks to assess the effect of good management practices on the productivity and wages of Spanish industrial companies.

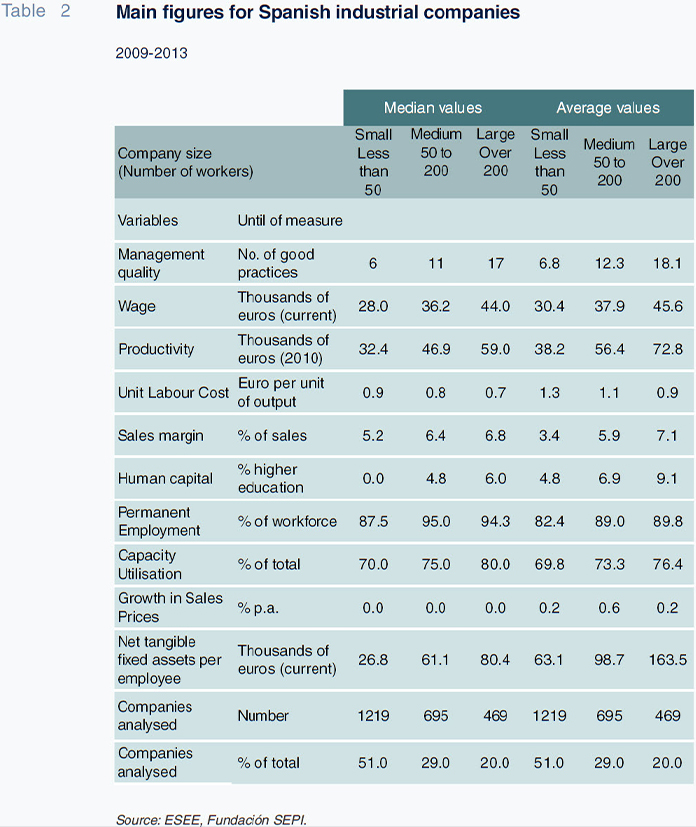

Table 2 provides a preliminary snapshot of the relationship between these three variables and some others which influence or are influenced by them. The information is grouped by company size

[2], presenting median values –those which leave 50% of companies above and 50% below – as we consider them a better expression of the distributions of the variables’ values than mean ones.

In line with the indicator of good management practices, the variables included in this table which measure efficiency and intangible assets − labour productivity, wages, human capital, permanent contracts, sales margin, use of productive capacity and net tangible fixed assets per worker

[3] − increase as mean company size rises. But unit labour costs fall with size, because as size increases, wages increase to a lesser extent than productivity, meaning that the ratio between wages and productivity declines, and explaining why profit margins grow.

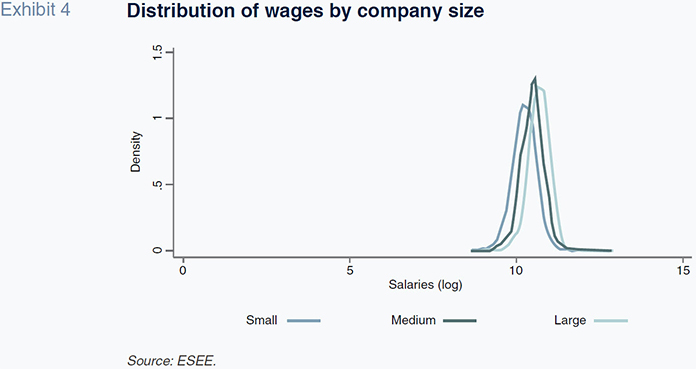

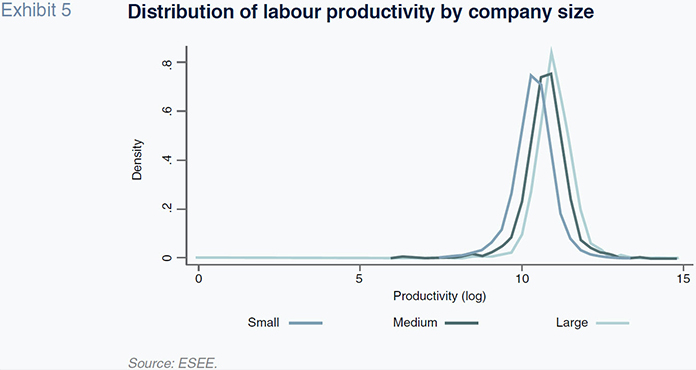

Therefore, essentially, as shown in Exhibits 4 and 5, wage distribution is less sensitive to company size than productivity. In other words, larger companies stand out more for higher productivity in relation to smaller companies than for higher wages.

At the same time, the distribution of wages is more bunched relative to central values than for productivity. This might relate to the existence of minimum wages, resulting from the automatic general application of collective agreements, and also suggests that larger companies pass on a smaller proportion of productivity gains to wages. Thus, their labour costs are lower and margins are higher.

The difficulties that larger companies seem to have in passing on productivity gains to wages could suggest insufficient remuneration of more qualified workers, which are used relatively intensively by these companies. This would also help explain the limited wage gap between the highest and least skilled workers (Puente, 2011).

We now turn to look at the effect of corporate management quality on productivity, keeping in mind the relationship of both variables to company size. In order do so, various equations have been estimated based on panel data analysis. These equations attempt to explain labour productivity in terms of corporate management quality, company size and other explanatory variables such as physical capital per worker (net tangible fixed assets per employee). Dummy variables have been included in the estimates to eliminate effects from different industrial sectors and regions.

Our results, not included here, indicate that good management practices have a positive, statistically significant impact on productivity. A 10% increase in good management practices leads to a 0.81% increase in labour productivity. We also consider the power of wages as an explanatory variable for productivity, since productivity can increase due to wage incentives, in line with the efficiency wage hypothesis.

The results speak for themselves in terms of the relationship between corporate management quality and wages, which is the main focus of this article.

Wages are related exclusively to corporate management quality, human capital and the percentage of permanent contracts. An increase of 10% in the number of good management practices results in a 0.33% increase in wages.

However, since company management quality has a positive impact on productivity, it might be assumed that the effect on wages is simply an indirect reflection of the former. That is not the case. Including productivity reduces the impact of management quality on wages but it remains high and significant − in fact, half the impact that productivity has on wages. Thus, companies which are better managed pay their workers more handsomely. Improving corporate management has an appreciable impact on wages, probably because good corporate management leads to increased worker engagement in the company and recognition of their contribution.

In brief, the complete results of our estimates suggest that an increase in corporate good management practices of 10% increases productivity by around 0.81% and wages by 0.33%. Furthermore, since productivity and wages are mutually intertwined, it is likely that the final wage increase is even larger, not only due to the direct impact but also because of the indirect impact of improvements in corporate management quality.

Conclusions

The Spanish economy is facing a major challenge to sustainably and significantly raise productivity. This is the only sure way to strengthen competitiveness and deliver sustainable increases in wages and income per capita, which drive increases in output and employment. There is significant potential to boost productivity, especially among the multitude of very small companies in Spain, which have relatively reduced levels of comparable efficiency.

Wage earners will always be the first to benefit from increases in productivity, meaning that it should be a first order concern for them. Several intangible factors are important for increasing productivity, ranging from innovation to employee skills. However, corporate management quality − a complex, multi-faceted asset − appears to play a particularly crucial role among intangible factors. The results presented in this article show that both productivity and wages would stand to gain if companies were to increase their management quality.

Current management of Spanish industrial SMEs suffers from a number of notable shortcomings across the board, ranging from leadership to partnerships between companies and worker training. There is enormous scope for improvement in company management quality in Spain, which requires significant attention and major public and private sector investment. Private companies and their associations should be the most interested in making progress in this area. But public administrations should also support improvements in this intangible factor, which undeniably has positive externalities that are hard for the smallest companies to obtain by themselves. They should drive the creation of cooperation networks between companies, business associations and private and public organisations specialised in strategic and management consulting and technological transfer. Such networks are a key vehicle for disseminating new technologies and good management practices. Public administrations should also demand quality and capacity in terms of management of their procurements from companies and others who aspire to receive public support, instead of simply rewarding - as frequently happens - the companies which offer the cheapest price based on low wages.

Trade unions also have a useful role to play here, which has barely been given consideration until now. They could demand to have greater involvement in steering, control and improvement committees which exercise real influence over company management. Not only would this help the company to function more effectively but it would also increase the remuneration for their endeavours. In reality, their involvement is necessary - not just for the benefit of workers, but for society as a whole.

Notes

All the variables have a value of 1 or 0, which relates to positive or negative responses to the questions posed to the company. In a few isolated cases the variables are continuous, but these have also been transformed into binary answers for the purposes of standardisation.

The smallest companies are significantly underrepresented in ESEE’s distribution by company size. Especially companies with less than 10 workers, the majority in the population. The median size of small companies is 18 workers and the mean is 21.5.

This close relationship to company size does not mean that size drives variables such as productivity, wages, or management quality. By contrast, greater size could be the result of greater productivity, as explained by Moral Benito (2016), or better management quality, as shown by Huerta and Salas (2014).

References

ANDREWS, D. and B. WESTMORE (2014), “Managerial Capital and Business R&D as Enablers of Productivity Convergence,”

OECD Economics Department Working Papers, No. 1137, OECD;

http://dx.doi.org/10.1787/5jxx3d441knr-en BLOOM, N.; BRYNJOLFSSON, E.; FOSTER, L.; JARMIN, R.; PATNAIK, M.; SAPORTA-EKSTEN, J. and J. VAN REENEN (2017), “What drives differences in management?,”

NBER working paper, nº 23300.

CORRADO, C.; HULTEN, C. and D. SICHEL (2006): “Intangible Capital and Economic Growth,”

NBER Working Paper, no. 11948.

COSTA, M. T. (2015), “La empresa española”, in GARCÍA, J. L. and R. MYRO (dirs.),

Lecciones de Economía Española, Aranzadi, Navarra: 77-89.

HUERTA, E. and M. C. GARCÍA (2014), La Capacidad de Dirección en las Empresas Españolas y el debate de la Productividad, in FARIÑAS, J. C. and FERNÁNDEZ DE GUEVARA, J. (eds.),

La Empresa Española ante la Crisis del Modelo Productivo. Productividad, Competitividad e Innovación, Fundación BBVA: 129-160.

HUERTA, E. and V. SALAS (2014), “Tamaño de las empresas y productividad de la economía española. Un análisis exploratorio,”

Mediterráneo Económico, no. 25, 167-191.

MORAL-BENITO, E. (2016), Growing by learning: firm-level evidence of the size-productivity nexus,

Documentos de Trabajo, 1613, Bank of Spain.

MYRO, R. (2015),

España en la economía global, RBA.

PUENTE, S. (2011), Los rendimientos salariales y la evolución reciente del nivel educativo,

Boletín Económico, Bank of Spain, July-August: 108-115.

SERRANO MARTÍNEZ, L.; PÉREZ GARCÍA, F.; MAS, M.; URIEL, E.; BENAGES, E. and J. C. ROBLEDO, (2017),

Acumulación y productividad del capital en España y sus comunidades autónomas en el siglo XXI, Fundación BBVA, Madrid.

YAGÜE Guillén, M. J. and S. CAMPO (2016), “La formación de capital humano y de capital directivo,” in R. MYRO (dir.),

Una nueva política industrial para España, Consejo Económico y Social, chap. VII: 99-114.

Rafael Myro and Javier Serrano. Madrid Complutense University (UCM)