Spanish economic forecasts panel: September 2017*

Funcas Economic Trends and Statistics Department

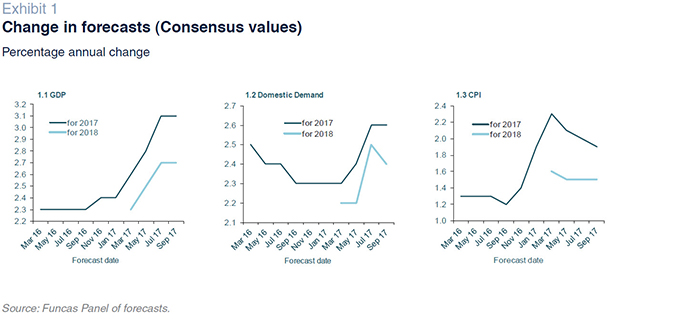

The consensus forecast for GDP growth in 2017 is unchanged at 3.1%

GDP growth accelerated by 0.1 percentage points in the second quarter of the year to 0.9%, in line with consensus. Private consumption rebounded, while public consumption - which saw a notable upward revision to first quarter growth - and capital goods investment slowed. The external sector made a larger contribution to growth than in the previous quarter — the figure having been revised downwards.

Latest available indicators foreshadow a slowdown in the current quarter. Consensus forecasts 0.8% growth in the third quarter, unchanged from the previous panel (Table 2).

The average annual growth forecast remains at 3.1%, with no changes from the July panel. The expected breakdown also remains unchanged, with the external sector set to contribute 0.6 percentage points to growth and domestic demand 2.5 percentage points. However, on average panellists have revised up their expectations for public consumption and lowered their investment outlook. Export and import growth forecasts have also been shaved.

Growth of 2.7% forecast for 2018

The consensus forecast for GDP growth in 2018 is unchanged at 2.7% with barely any changes to the expected composition. The external sector is again set to contribute positively to growth. The annual forecast for 2018 is underpinned by a stable 0.6% quarterly growth path throughout the year (Table 2).

Spike in inflation in 2017 and moderation in 2018

Headline inflation has remained around 1.5-1.6% in recent months, well below the 3% reached at the start of the year. In recent weeks, the oil price has climbed above 50 dollars, though this has been partially offset by Euro appreciation.

Headline inflation is now forecast to come in at an average annual rate of 1.9% in 2017, 0.1 percentage points below the July panel, and is expected to ease to 1.5% in 2018. Core inflation is forecast to be 1.2% in 2017 and 1.4% in 2018. Year-on-year inflation rates in December are predicted to be 1.1% this year and 1.6% in 2018 (Table 3).

Slowing employment growth

According to Social Security registrations, employment growth slowed significantly in July and August in comparison to the previous quarter, especially in market services and construction. However, employment growth has remained stable in the industrial sector.

Consensus continues to forecast employment growth of 2.7% for 2017, while the outlook for 2018 has been raised slightly to 2.4%. Based on consensus estimates for GDP, employment and wage remuneration, it is possible to obtain an implicit forecast for growth in productivity and unit labour costs (ULC). Productivity is set to grow by 0.4% this year and 0.3% next year, while ULC are forecast to increase by 0.2% in 2017 and 0.9% in 2018.

The annual unemployment rate is on track to fall to 17.2% in 2017 and 15.2% in 2018; in both cases the forecast has been lowered.

Solid current account surplus maintained

The current account posted a cumulative surplus of 3.570 billion euros to June, smaller than the surplus of 5.750 billion euros registered over the same period last year. The deterioration is due to a worsening of the trade balance. According to Customs data, this was because of a pick up in the price of energy products as well as increased import demand for these products. By contrast, the non-energy balance improved relative to the previous year.

Consensus forecasts a surplus of 1.8% of GDP for the year as a whole and 1.7% in 2018.

Public deficit will continue to miss targets

The public deficit, excluding local corporations, to June was 6.500 billion euros smaller than the same period last year, thanks to an increase in revenues and stable spending. The State and Social Security system both improved their results, but the regional outturn worsened.

Consensus sees the public deficit coming in at 3.2% of GDP, 0.1 percentage points above target. That said, eleven of the sixteen panellists who forecast this variable, now believe the deficit will come in on target. The deficit is forecast at 2.4% of GDP in 2018, which would also be above the current target.

Global economic outlook is favourable

Recent developments point to a relatively favourable external outlook. The main international organisations have revised up their forecasts for economic growth and world trade. The revisions are particularly significant for the Eurozone.

A large majority of panellists see the external environment as being favourable, especially in the European Union. The prevailing view is that that it will remain that way over the coming months. None of the analysts expect the situation to deteriorate in the EU. However, two panellists now believe the global environment could weaken, while none did in the previous panel.

Long-term interest rates ticking up

3-month Euribor (interest rate indicating the cost of short-term interbank lending) has remained stable in recent months at around -0.33%, a record low. Nearly all panellists regard the current level as being low and most expect favourable conditions will be sustained over the near term.

The yield on long-term term debt (10-year sovereign bonds) has ticked up since the start of the month to 1.54%. However, it remains below the levels reached at the start of July. The panellists consider this to be favourable considering current momentum in the Spanish economy. However, most expect this yield to increase over the coming months.

Euro continues strengthening

The cyclical improvement in the Eurozone together with an expected ECB announcement of new measures to normalise monetary policy have driven up the Euro. The Euro is now trading at above 1.20 dollars, representing an appreciation of 15% since the start of the year.

Most panellists consider the Euro to be trading at close to equilibrium, compared to the previous panel which regarded the Euro as being below equilibrium. Even so, more analysts see the Euro continuing to appreciate than those who expect a depreciation.

Fiscal policy is neutral and monetary policy expansive

The panellists have not changed their view of the macroeconomic policy stance since the last panel. A majority see fiscal policy as neutral and judge this to be appropriate. All analysts regard monetary policy as being expansive. As was the case in July, none of the analysts see monetary policy becoming restrictive over the coming months.

The Spanish economic forecast panel is a survey of seventeen research services carried out by Funcas and presented in Table 1.The survey has been undertaken since 1999 and is published every two months during the first fortnight of January, March, May, July, September and November. Panellists’ responses to this survey are used to create consensus forecasts, which are based on the arithmetic mean of the seventeen individual forecasts. For comparison purposes the Government, Bank of Spain and main international institutions’ forecasts are also presented; however, these do not form part of the consensus.