Spanish banks’ presence in Latin America: Opportunity, but not without risk

Structural conditions in Latin America and the latest operating results of Spanish banks in the region continue to support the strategy of growing the Latin American investment portfolio. Nonetheless, vast diversity of economic and political conditions in different countries in Latin America highlights the diverging trajectories for Spanish foreign investment.

Abstract: The growth of Spanish foreign investment in Latin America between the 1990s and the 2010s has outpaced that of all other countries, other than the United States. On a sector-specific level, Spanish international banking/finance seems to have pursued a successful strategy by growing in Latin America over the last two decades. The Spanish economic crisis has been, to some extent, cushioned by foreign investments made by the country’s big firms in Latin America, including its two global banks. Structural conditions, such as good demographics, low rate of banked population, high intermediation rates, and low correlation with the domestic economy continue to favor Spanish banks/financial firms investing in Latin America. The region showcases some of the best and some of the worst environments to invest in banking/finance. Incredible divergence across political-business cycles in the countries within the region make Latin America a relatively high risk/high reward (or loss) proposition for investors.

FDI in Latin America since the 1990s: Global and Spanish investment flows

The general story about FDI in Latin America since the 1990s is that it took off from a very low point reached during the 1980s, the so-called “lost decade” of growth and development in the region. The external debt crisis that caused such great economic and social destruction ended only after the United States government agreed, under the 1989 Brady Plan, to create a debt swap mechanism to inject liquidity, and restructure Latin American debts (of both public and private sector entities) vis-à-vis American banks and international official creditors.

Once those measures were in place, FDI to Latin America grew exponentially in the 1990s; it grew significantly in nominal terms and as a percent of GDP in the 2000s (with two external-induced contractions in 2000-2002 and 2008-2009); and has remained relatively stable at about 3.5% of total regional GDP in the 2010s.

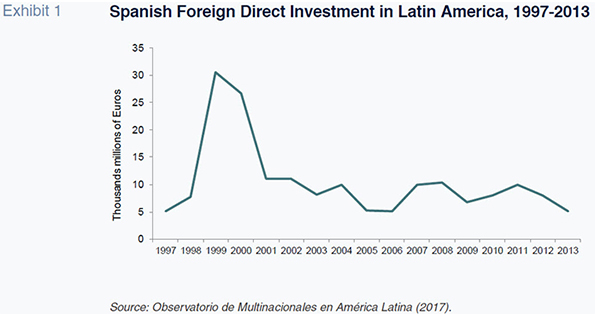

Similar to other relatively advanced capitalist economies, Spain started significant outward capital investments in Latin America during the 1990s. They skyrocketed during the late 1990s-early 2000s, and since then they have been sustained at higher than 5,000 million euros.

The data in Exhibit 1 are consistent with this narrative. Accordingly, there were many cheap, attractive investment opportunities around the region which big Spanish firms took advantage of, particularly during the period 1997-2002. These years were known in Latin America as the “half lost decade” due to low growth, high unemployment and recurrent financial crises in some of the major economies of the region, like Brazil and Argentina. The main big Spanish firms that invested in Latin America were Endesa, Repsol, Iberia, Telefónica, and the banks Santander and BBVA. Later, other big firms such as Iberdrola, Unión Fenosa, Gas Natural, and Aguas de Barcelona also entered these markets (Casilda, 2017). These firms are representative of big Spanish business across the largest sectors of Spain’s economy.

In spite of a material fall in Spanish foreign investment in Latin America after 2002, and upward and downward swings since then, the trend of FDI has been relatively stable within a band of 5,000-10,000 million euros total investment annually. Moreover, Spanish firms’ entrance to Latin American markets was anything but shy. For firms such as Endesa, its investments in Latin America in the 2000s represented 40% of total assets. Likewise, for Telefónica, as well as Santander and BBVA, they were about 30% of total assets (Casilda, 2017).

The year 1999 was the peak of total FDI to Latin America (not just from Spain but overall) as a percent of the region’s GDP (4.7%). During the so-called “commodity super-cycle” of 2004-2008 it hovered around 3%. The global financial collapse of 2008-2009 saw FDI to Latin America decrease to about 2.5%. Thanks to internationally coordinated fiscal and monetary stimulus, economic activity bounced back relatively quickly and FDI in Latin America has hovered with some fluctuations around 3.5% between 2010 and 2017 (ECLAC, 2017a).

The cooling of the commodity super-cycle since 2012-2013 hit the region significantly, and there has been growing divergence between good or steady performing economies (Peru, Colombia) and bad or worsening ones (Venezuela, Brazil), since then. Net flows to the region have decreased on a year-on-year basis since 2014, and in 2016 alone they contracted close to 8% vis-à-vis 2015 (around 167 billion dollars vs. 183 billion dollars the previous year) (ECLAC, 2017a).

However, in spite of continued uncertainty and tough credit conditions in most of the region’s countries, debt markets can be seen as a proxy for an improved perception of short and medium term growth in Latin America. Thus, both sovereigns and corporates in Latin America issued a large volume of bonds in the first half of 2017 (close to 75 billion dollars, “third highest half-yearly amount ever issued in the region”`[ECLAC, 2017b]) and in spite of still weak conditions (“sixteen sovereign downgrades from January to July, and six upgrades” [ECLAC, 2017b]) appetite for such debt has been high in international capital markets.

Reasons for this are the continued search for high-yields by international investors in the face of ultra-low interest rates in the U.S., Europe and Japan. Likewise, international financial institutions that monitor economic conditions like the IMF expect the business cycle to finally turn upward in 2017-2018, with some of the largest economies like Brazil and Argentina exiting recessions at the same time that others like Mexico, Colombia, Chile and Peru retain solid macroeconomic fundamentals (IMF, 2017).

The next section looks briefly at Spanish investments in Latin America compared to other advanced capitalist economies.

Spanish investment in Latin America in a global context

Latin American countries have been the natural bridge for Spanish foreign investments in ‘emerging markets’ since the 1990s, thanks to linguistic and cultural affinities. Other European countries have had a longer-term and bigger financial-economic presence in modern Latin America (in spite of lacking those affinities)

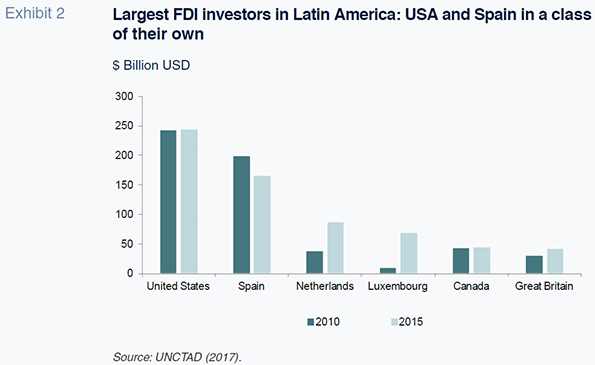

[1]. However, Spanish foreign investments’ growth between the 1990s and the 2010s in the region has outpaced all other countries except those of the United States (UNCTAD, 2017). Spain and the United States are in a class of their own in terms of the stock of investment in Latin America (100-plus billion dollars).

Aside from the big contrast in the size of investment in Latin America between the United States and Spain, and the rest, Exhibit 2 also shows that the United States kept its average investments constant during the period while some economies like the Netherlands and Luxembourg increased theirs, and smaller investors like Canada and Great Britain also remained constant.

The exception was Spain. The data is in line with the narrative according to which English-speaking countries and some northern Eurozone countries have done better on average compared to southern European countries since the Great Recession (2008-2009). As a consequence, countries that have done well have kept or increased their exposure to high-yielding/high-risk investments such as Latin America’s emerging markets. In contrast, countries or, more specifically, firms from countries hit hard by the Eurozone economic crisis since 2010 have been deleveraging, that is, they have been selling assets to pay down debts in order that their relative debts to income come down or are at least stabilized. This is the case of Spain, whose once thriving private sector has shrunk its activity and investments both at home and abroad.

Still, the fact remains that Spanish big firms’ expansion to Latin America in the 1990s-2000s was beneficial to them. In particular, no one had the foresight to expect the great negative shocks of the Great Recession and the Eurozone crises. Spain entered a period of over-indebtedness, crisis, austerity, and economic and social hardship as a consequence of these shocks. In the meantime, Latin America, on average, experienced a less aggressive Great Recession and certainly better growth record since then than Spain. While Spain was losing money in Europe, North America and Asia, it was making money in Latin America.

At the height of Spain’s economic crisis (2012-2013) ECLAC considered that “Latin America had been a salvation board for Spanish firms” (ECLAC, 2013). During these years, two-thirds of Spanish firms’ foreign assets were located in Latin America. They paid handsomely. In 2011-2012, more than half of the net profits for firms like Telefónica, Iberdrola, Ferrovial, Santander, and BBVA came from Latin America (Figueruelo, 2017).

Spanish banking/finance FDI in Latin America compared to other sectors

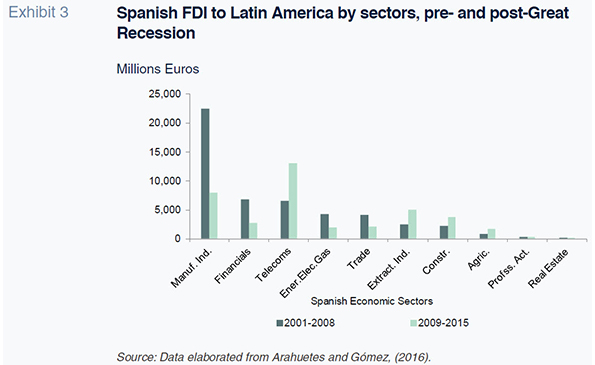

A first observation about the relative position of the Spanish banking/financial sector in terms of its stakes in Latin America is that in spite of its big presence and importance, the stakes of the sector in that region are smaller than those in other sectors.

Since Spain’s own economic crisis was in part a consequence of the Eurozone financial imbalances (the collapse of Southern European economies followed the debt crisis officially declared in Greece in 2010), Spanish banks/finance are ranked third or fourth in terms of their exposure and stakes in Latin America.

As Exhibit 3 shows, Spanish banking/financial investments in Latin America were more or less at a par with telecoms before the Great Recession as the second largest source of FDI after industrial manufacturing, which in turn was more than three times the size of either of these two sectors. After the Great Recession and the onset of the Eurozone crises, all sectors experienced very significant drops in FDI, except for telecoms, which saw an almost 40% annual average increase in 2009-2015, compared with 2001-2008, and agriculture, construction and professional services, which also grew in the second period but only marginally. In the post-Great Recession period, industrial manufacturing experienced the largest fall while energy/electricity as well as trade halved in value. Banking/financial activity was not spared the weakening of FDI during the post-Great Recession years. In fact the sector’s net worth in terms of inflows/outflows lost more than half of its value (Arahuetes and Gómez, 2016).

Whichever sector is considered, it is acknowledged that the fate of the Spanish economy in the world suffered a severe shock as a consequence of the Eurozone crisis. Ranked 6th globally for FDI before the start of the crisis in 2010, the country fell to 14th in 2016 (Arahuetes and Gómez, 2016).

A second important observation is that caveats are needed to properly understand the big fall in Spanish banking assets in Latin America pre- and post-Great Recession. The first period witnessed two huge purchases: BBVA bought Bancomer, Mexico’s largest bank, in 2000, and Santander, by acquiring Dutch ABN AMRO in 2007, who controlled the Banco Real do Brasil, entered the Brazilian market.

Once invested in Latin America, the two banks continued growing albeit at lower rates during the post-Great Recession years. Spanish banks found new opportunities during the crisis years after American (CITI) and British (HSBC) banks sold them some of their stakes in Latin America (Mendizábal, 2016). The reason for staying the course and continuing to try to find growth opportunities in Latin America by Spain’s two global banks is that, on average, they have found Latin American investments to be better than alternatives (i.e. the domestic economy; continental Europe; the United States; Asia). Giants that play a significant role in Spain’s economic growth like Telefónica, Santander and BBVA derive more than 50% of their total revenue from Latin American operations (Zanon, 2017).

Advantages for Spanish banks/financials maintaining investment in Latin America

All sectors that exported capital from Spain suffered significantly since the country’s own financial crisis (worst year was 2012) and very slow recovery (started in 2015-2016). As said above, unlike American or British banks, Spain’s two global banks have kept their investments in Latin America. This strategy has made sense in the light of their strong position in those markets (between 40–70% of total market share in the largest Latin American economies – Brazil and Mexico [Expansión, Franquicia Internacional, 2014]). Investing more in Latin America in spite of four mediocre years of growth in the region also continues to make sense given structural conditions:

- Compared to the median age of the population in Spain (43 years), Latin America’s is more promising for future growth (26 years);

- Latin America also possesses a low rate of banked people (i.e. individuals with checking/savings/investment accounts as a proportion of total population) compared with mature American, European or East Asian capitalist economies;

- Latin America has been characterized by relatively high intermediation rates globally since the 1990s;

- Spain and Latin America’s business cycles are lowly correlated so big banks and other internationally-operating Spanish firms can diversify risks by hedging in Latin America (Casilda, 2007).

These conditions remain in place in the late 2010s. Moreover, Spanish banking activity and its results up to the second half of 2017 continue to support the strategy of growing Latin American portfolios (not indiscriminately) but certainly gradually given the reasons mentioned above. In terms of long term horizons, both Spanish global banks have continued to grow their investment side of the business at the same time that they cover a significant amount of fixed costs through fee-related activities (Abril, 2017).

These structural advantages apply on average across Spanish economic sectors that engage in foreign financial investment. The catch is that “Latin America” is an artificial construct that includes nation states with incredibly different economic/political/social conditions. The last subsection concludes by assessing this diversity, highlighting the diverging trajectories that Spanish foreign investments have produced in different countries in Latin America.

Latin America: Great diversity of risk/return for foreign financial (and other) investments

Foreign investments by any company or sovereign in Latin America are attractive because they tend to produce higher rates of return in emerging markets than in mature capitalist economies. The accompanying trade-off is, of course, higher risk for investment.

The record for the Spanish banking/financial sector is mixed, although structural conditions favoring opportunities for high medium to long-term growth dominate.

Important divergence since 2013-2014 has been the result of, on one hand, a cooling of global commodity prices, which compounded with questionable macroeconomic management have resulted in recessions or depressions in countries of South America like Venezuela, Argentina and Brazil. As a consequence, in most cases Spanish foreign investments in these countries have not done well. On the other hand, mediocre but stable growth

– connected to the United States – in countries like Mexico, Central American nations, Colombia, and Peru has meant that Spanish foreign investment has done better, on average, in these countries than in the ones mired in recession.

Conditions have at least stabilized and promise potentially significant bounce-backs in Brazil and Argentina although the risk of underperformance due to conflictive political-business cycles hangs over those markets. In turn, those countries most closely connected to the United States will continue to track its growth and conditions. In relative terms, US economic growth has done significantly better since the Great Recession than the Eurozone countries, Great Britain or Japan. If the US continues to grow at 2-3% per year, Spanish banking/financial firms that have invested and want to keep growing in the area of Hispanics’ banking in the US, will continue to prosper (like BBVA’s investments in Texas which tap into the remittances market of Spanish-speaking workers in the US who send money monthly back to their home countries). This affirmation applies to any other industries (like telecoms or media) which connect people that speak Spanish in the United States with their countries of origin or with Spain.

In all, Spanish international banking/finance seems to have made a good bet by growing in Latin America in the last two decades. The Spanish economic crisis has been to some extent cushioned by foreign investments made by the country’s big firms in Latin America, including its two global banks. Structural conditions continue to favor investing in Latin America, although political-business cycles will continue to present this region as a relatively high risk/high reward (or loss) proposition for investors. Contextualized analysis of changing politico-economic conditions in the largest Latin American economies should guide banking/financial decisions from Spanish and other foreign investors. The region showcases some of the best and some of the worst environments to invest in banking/finance. This will continue to be the case, and it is therefore up to individual firms’ analysis and strategy to differentiate between risks and opportunities.

Notes

Great Britain, France and Germany were the dominant financial, industrial and extractive countries in Latin America in the nineteenth century. British banking in particular dominated the Latin American countries after their independence from Spain (by 1824 all continental Spanish-speaking Latin America had become independent) and Portugal (Brazil, 1822). Britain and France were the dominant forces until the 1870s-80s, after which time Germany, and to a lesser extent the United States, started competing with the older dominant European powers. It is acknowledged that London only lost its status as the ‘banking capital of the world’ as a consequence of the First World War (1914-1918), by which time New York, and consequently the United States became the banking leader in the world in general, and in Latin America in particular.

References

ABRIL, I. (2017), “Santander y BBVA disparan sus beneficios en banca de inversión,” Expansión, http://www.expansion.com/empresas/banca/2017/08/31/59a701dc468aeb40468b4679.html, accessed August 31th, 2017.

ARAHUETES, A. and G. GÓMEZ, (2016), “Las inversiones directas españolas en América Latina, 2009-16,” in Estudios de Política Exterior, n. 78, otoño, http://www.politicaexterior.com/articulos/economia-exterior/las-inversiones-directas-espanolas-en-america-latina-en-el-periodo-2009-16/, accessed August 4th, 2017.

CASILDA, R. (2007), “Internacionalización de la banca española: el caso de BBVA,” Ekonomiaz, 66, file:///C:/Users/fgonzal8/Downloads/12%20(2).pdf, accessed August 4th, 2017.

ECLAC (2013), Informe de Inversión Extranjera Directa.

— (2017a), Foreign Direct Investment in Latin America and the Caribbean, 2017, http://repositorio.cepal.org/bitstream/handle/11362/42024/1/S1700430_en.pdf, accessed August 30th, 2017.

— (2017b), Capital Flows to Latin America and the Caribbean: Recent Trends, http://repositorio.cepal.org/bitstream/handle/11362/42059/1/S1700767_en.pdf, accessed August 31st, 2017.

EXPANSIÓN, FRANQUICIA INTERNACIONAL (2014), “Latinoamérica: oportunidad para hacer negocios,” http://www.expansion.com/especiales/latam/un-puntal-para-el-beneficio-de-la-banca.html, , accessed, August 3rd, 2017.

FIGUERUELO, M. (2017), “América latina, la ‘salvación’ de las empresas españolas,” in elEconomista.es, http://www.eleconomista.es/empresas-eAm/noticias/4872423/05/13/America-Latina-la-salvacion-de-las-empresas-espanolas.html, May 31st, 2013, accessed August 4th, 2017.

IMF (2017), World Economic Outlook Update, July, https://www.imf.org/en/Publications/WEO/Issues/2017/07/07/world-economic-outlook-update-july-2017, accessed August 31st, 2017.

MENDIZABAL, A. R. (2016), “Santander y BBVA: modelo en Latinoamérica frente a bancos de Reino Unido y EEUU,” in Capital Madrid, https://www.capitalmadrid.com/2016/6/4/42491/santander-y-bbva-modelo-en-latinoamerica-frente-a-bancos-de-reino-unido-y-eeuu.html, June 4th, 2016, accessed August 4th, 2017.

OBSERVATORIO DE MULTINACIONALES EN AMÉRICA LATINA (2017), América Latina, http://omal.info/spip.php?mot12, accessed August 3th, 2017.

UNCTAD (2017), World Investment Report 2017: Investment and the Digital Economy, http://unctad.org/en/PublicationsLibrary/wir2017_en.pdf, accessed August 4th, 2017.

ZANON, A. (2017), “Spain’s ‘Reconquista’ of Latin America Comes with a Risk,” in Corporate Foreign Policy, https://corporateforeignpolicy.com/spains-reconquista-of-latin-america-comes-with-risk-f9942fa9adeb, June 13th, 2017, accessed August 31st, 2017.

Francisco E. González. Professor of Latin American Politics, The Johns Hopkins University School of Advanced International Studies (SAIS), Washington, D.C.