Spain’s housing sector: Situation and outlook

Despite the recovery in Spanish households’ housing demand, it is not being effectively transmitted into growth in home prices, but rather boosting rental prices. Stimulating the supply of housing would be the most effective means of resolving existing pressures in Spain’s rental market.

Abstract: An analysis of the current state of play of the Spanish real estate sector reveals a prevailing trend in house prices – the sharp growth in rental prices, while prices in the buyers’ market remain relatively stagnant. This phenomenon can be largely explained by looking at the key determinants of housing demand, which is not being efficiently transmitted to house price variables. Among the factors responsible for this is the lack of household access to financing, translating into weak demand in the buyers’ market (which is why prices in this segment are not rising). In fact, access is proving to be concentrated in the rental segment, where prices are accelerating, altering the long-run equilibrium between the two price variables. Growth in the supply of units for rent or for sale could eliminate the prevailing price tension in Spain’s residential markets.

Introduction

The state of the housing market and warnings about the potential formation of a fresh real estate bubble have been making their way into public opinion in Spain in recent months, accentuating interest in the trends in this market in all their economic and social manifestations. Numerous aspects of the housing situation generate highly controversial analysis. To name just a few: the issues associated with the need for housing, the lack of public incentives, the lack of access to housing; or, the apparently contradictory trend in prices. In this paper, we aim to provide insight, from a real estate economics perspective, into how the performance of the housing market and its current circumstances may be consistent with the trends being identified that are sparking this attention.

Housing is important to an economy for various reasons. The first and most important aspect relates to the availability of this good, which is indivisible from the household formation process and guarantees the smooth development of a society. A house, in terms of its use, is a basic good and its availability should be associated with the growth in its main users: households. This concept is the most important in explaining in economic terms the situation in housing in market economies: demand — basic or fundamental — represents households looking to cover their needs and insofar as it increases, these needs surface in the market. The market (supply) should in turn react and does so in different ways, either building new units or mobilising existing units (or via a combination of the two). When the supply-side reaction is not swift, or flexible, prices increase.

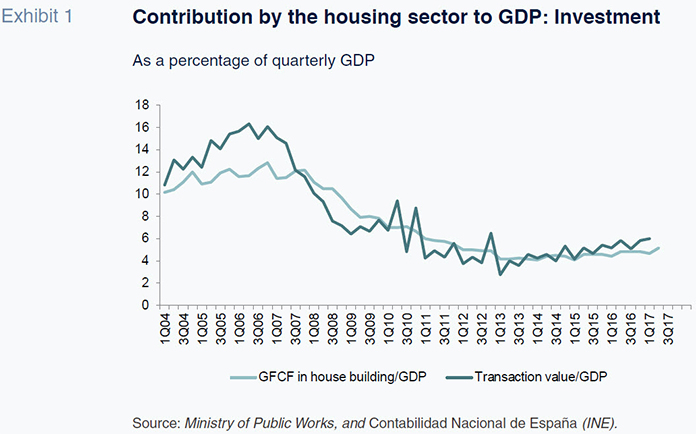

Secondly, housing is important for the economy as a whole. Specifically, housing construction and investment are an important component of GDP at any given point in time. The sector’s overall contribution to GDP, down sharply in recent years compared to the boom years, is well known: a little over 5% at present compared to 8% in times of normal growth and 12% in the boom years. Within this contribution, the Spanish statistics do not distinguish which portion corresponds to housing. Some estimates suggest that approximately 4% of GDP is accounted for by home-building during periods of moderate growth. On the demand side, the national statistics suggest that investment in housing has accounted for approximately 4% of GDP since 2011, again down sharply from prior years (Exhibit 1). This figure is gleaned from the gross fixed capital formation (GFCF) figures, which are underpinned by the reported value of housing transactions (housing that is not publicly subsidised) over GDP, the indicator widely used by analysts as the yardstick for the macroeconomic significance of this good. The exhibit reveals that the declared value of housing transactions reached as much as 16% of GDP in the boom years, from where it fell steadily towards around 5%, a level at which it has been hovering since 2013.

A third aspect of interest in the housing market from a macroeconomic standpoint is its knock-on effect, an aspect which, insofar as it relates to long-term structures, is not tackled here. There are other factors of interest, such as the impact house prices have on the channel for transmitting monetary policies, and also their relevance for urban growth and city competitiveness. These points briefly highlight the multiple effects the correct development of the residential market can have on the health of an economy.

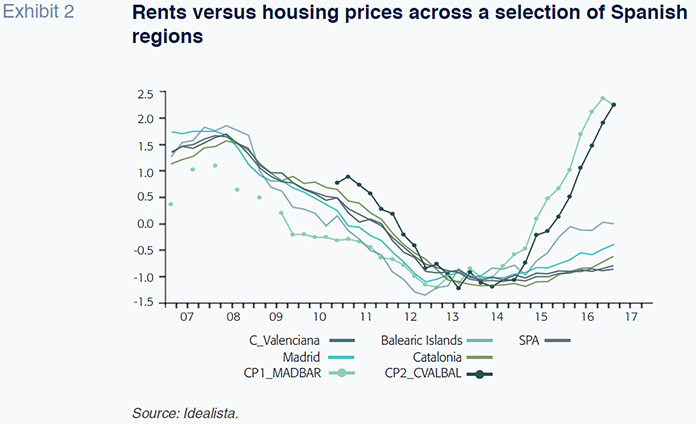

However, the recent attention on housing, alluded to at the beginning of this paper, is unrelated to this universe of factors but is rather a sign of concern about the trend in prices and the fear that a new bubble may be forming. Exhibit 2 depicts the reasons for this fear.

Exhibit 2 represents, on a harmonised access, the trend in house prices in a selection of regions (those that have sustained the fastest growth in recent years) and in rental prices in their capitals

[1], where CP1 represents Madrid and Barcelona and CP2 the cities of Valencia, Alicante and the Balearic Isands. The trend from 2014 on illustrates the source of the concern that the acceleration in rental prices could contaminate house prices (note the difference between the growth trend and the speed of growth in rental prices).

The reasons for this expansion are related with the trend in the determinants of demand. The models explaining the real estate economy endorse the idea that this reaction owes to market mechanisms, only that in this instance, residential prices are taking longer to react. The explanation fits well with the classic DiPasquale and Wheaton 4Q model (1996): Changes in demand for housing originating from changes in the market conditions that drive it have a direct impact on rental prices

[2]. The momentum in rents is transmitted to house prices depending on the sector capitalisation rate (which is related with returns on other investments) but any increase in rent results in the expectation that housing prices will increase and this affects construction decisions, this being the channel through which the attendant growth in the number of new housing developments is stimulated. The growth in the latter depends on how flexible the supply side is so that if the conditions in which the developer does business are flexible (no regulatory restrictions, no limitations on the availability of land, etc.), enough supply will come on stream to satisfy incremental demand and price growth will slow; to the contrary, if the supply side reaction is rigid or inflexible, price growth will accelerate.

In the case of Spain, the mechanism by which the first channel of influence (from rents to house prices) is transmitted would appear to have been disrupted, which means that because house prices are not reacting, new construction is not being stimulated, at least not proportionately. This is in essence what the price exhibit tells us: a distortion that has suspended the direct transmission between the price variables, affecting output as a result.

This can occur in a number of circumstances: 1) when the developers, despite receiving the market signal, cannot build due to a lack of one or more basic inputs, such as land or capital, or due to some form of restriction on supply in the form or regulations; 2) when there are no builders willing to build; 3) when the builders could build but do not because they are not identifying the existence of effective demand; or, 4) when there are factors of a financial nature that are mobilising capital towards another sector.

If there were effective buyers, house prices would rise quickly in times of limited supply, so that it would seem reasonable to rule 3) out. Elsewhere, with interest rates at low levels, nor would there appear to be a strong financial incentive not to build. As a result, the hypothesis used here is that the error in the price transmission mechanisms is the result of a combination of factors 1, 2 and 4: There are restrictions in basic inputs (mainly financing); there is a scarcity of builders (because they have disappeared in the wake of the sharp and prolonged crisis); and there are not enough buyers with sufficient purchasing power (mainly due to a lack of financing).

The corollary is that the demand (growing) coming on to the market that cannot buy, is opting to rent. In situations in which rentals are scarce (for various reasons) and demand in this segment surges (by far more than is usual, i.e., above the long-run equilibrium rate, because demand in the past was concentrated in the buyer segment) and macroeconomic fundamentals are recovering (jobs and income), rental prices soar.

Keeping these hypotheses in mind, there follows a description of how the indicators back up these identified ideas and trends.

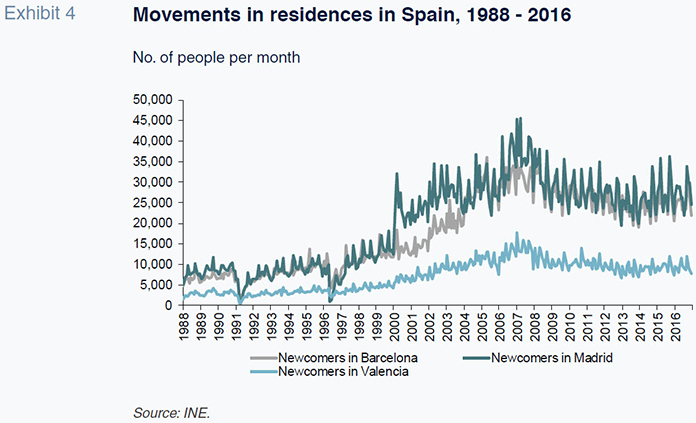

Recovery in market demandThe recovery in the components of demand is linked to economic momentum. The sustained and intense recovery in Spanish growth since 2014, marked by growth in GDP of around 3% (Exhibit 3, Panel A), coupled with the recovery in employment, now intense in the youngest segments of the job market (those who create new households the most, Exhibit 3, Panel B), clearly illustrate the factors driving the growth in demand for housing. Personal mobility (Exhibit 4), mainly for work reasons, has remained at high levels despite the crisis; this phenomenon also reflects the ongoing relocation of households in Spain, which is generating direct demand for homes. The fact that mobility is concentrated in the regions creating the most jobs (Madrid, Barcelona, the region of Valencia and the islands, among others) is the reason why some residential markets (namely these same markets) are seeing prices rise more significantly than others.

Perception that demand will not translate into home purchases

It would appear therefore that demand is coming on to the market and stimulating the growth in rental prices. Why is this not being followed by growth in house prices, like in the past? The answer lies with the factors curbing household access, which is evaluated in terms of accessibility, financing conditions and purchasing power.

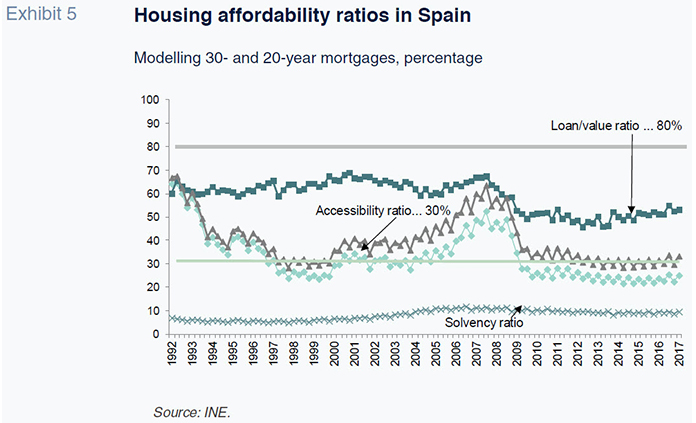

AccessibilityTheoretically, Spanish households with average income broadly equivalent to that of a full-time job should have access to the house market, as underpinned by the access ratio in Exhibit 5, which is very close to 30% of income, the threshold with interest rates at current levels.

This situation theoretically provides access to the households with income albeit not, as we will see later on, to the stock of households accumulating in the market. The access ratios shown in Exhibit 5 additionally reveal two important facts that help explain the difficulties facing households looking to get on the property chain. Firstly, the still-sharp credit crunch, reflected in the very low credit/house value readings. Although this has improved a little in the last year, this ratio averaged 53.25% in the first quarter of 2017, which implies that households must come up with 45% of the value of the houses they wish to buy in order to close a potential transaction, a level that requires a significant amount of prior savings. This requirement is, per se, a form of credit constraint.

Secondly, the solvency ratio shows that, on average, households that borrow to finance their home purchases leverage up to a significant degree (a ratio of close to 10 years)

[3], suggesting that the home purchase decision means accepting a high level of debt, potentially putting some households off in light of the widespread experience of households since the start of the recent global financial crisis.

Credit crunch

Restricted credit and high leverage levels affect purchase expectations and, by extension, house prices.

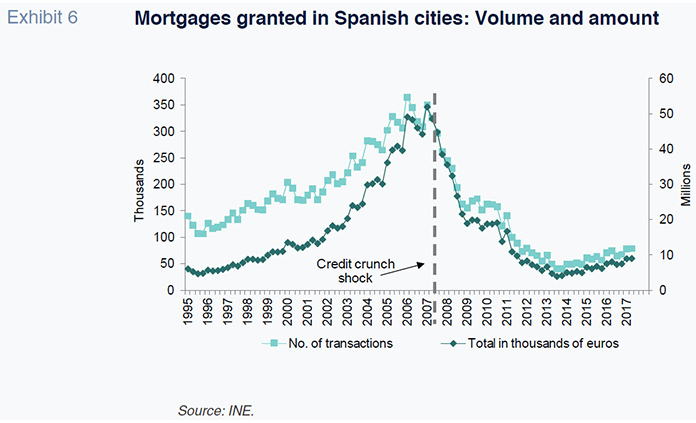

The proof that the credit crunch (or restrictions on transaction financing funds) is a reality is evident in Exhibit 6, which represents the number of mortgages and their amount granted to households in each time interval for the purchase of homes. Although there has been a slight recovery in the volume of loans extended (+16% year-on-year) in recent months, the level remains far below even half of the pre-crisis level, which means that demand is encountering scant support for getting on the property chain. The slight recovery apparent since 2013 is not strong enough to underpin a ”normal” flow of buyers into the market, but is rather consistent with the credit-to-value ratio commented on above.

It could be said that the lack of financing is converting households with reasonable accessibility, calculated using income levels, into households encountering issues in ultimately entering the ownership market.

Moreover, the credit crunch that took such a heavy toll on the sector since the start of the crisis affected both sides of the market simultaneously (curbing supply by all but eliminating developer loans and curbing demand, as a result of the drop in mortgages shown on the exhibit). A recovery in financing may be emerging on the supply side with the inflow of foreign capital taking advantage of prevailing favourable conditions (low prices for land and existing developments). However, without proportionate growth in demand-side financing (loans for home buyers), it is unlikely that the building cycle will recover.

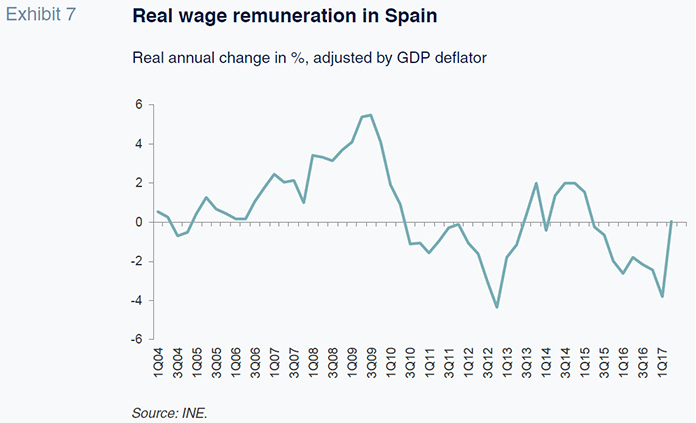

Purchasing powerIn addition, even if a household may be able to buy a house, its earnings have lost purchasing power, insofar as wage income has been registering negative real growth for much of recent times. Exhibit 7 confirms this thesis and shows how since 2011 real income has been falling with the exception of ad-hoc moments, confirming this gradual loss of purchasing power on the part of households looking to buy.

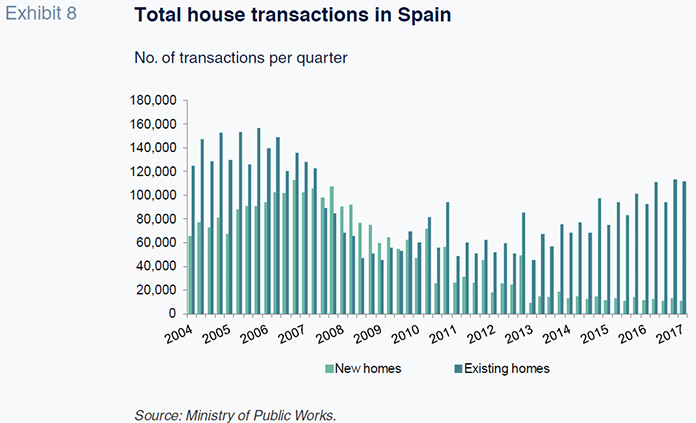

General house market situationThe figures above indicate the existence of access problems. However a certain percentage of households is entering the market. These households, which manage to overcome the limitations outlined, or do not use or need financing, have been getting into the Spanish property market consistently throughout the entire period. The percentage has been rising in recent quarters, as is shown in Exhibit 8, albeit not by as much as the population figures presented would suggest. Looking at the most recent figures, the volume of second-hand housing transactions has been following the same trend as in 2013. During the past year (2017) Spain has reached the levels (quarterly) of transactions (second-hand housing) that were observed during the first years of the crisis, although new housing is hardly generating any volume at all (because there are no new units). The transaction volumes point to a market size that is roughly half of that observed at the peak of the cycle.

Elsewhere, looking solely at existing-home transactions, the volume exchanged is only 20% below the 2007 figure, suggesting that houses are exchanging hands in the market at a similar level to that seen before the crisis and that what has gone away entirely are new house transactions.

The fact that demand is massively oriented towards existing homes (second-hand homes) may have to do with the fact that: (1) there are very few new homes left (restrictions on the supply side); (2) the markets are mature and there is sufficient existing supply to mop up effective demand; and, as a result; (3) the incentive to build is diluted because demand is oriented primarily towards existing units. If the last factor prevails then demand for new housing will be weak and this would explain why developers are not picking up the signal from the market to start to build.

However, the number of transactions captured in the Spanish statistics is not small (despite being half of the volume prevailing at the market peak) and is not correlated with loan volumes in recent times, suggesting that the figures may be reflecting purchases that did not require getting a loan from a Spanish bank. If so, the developers should identify the existence of solvent buyers and act in accordance with the transaction volume information shown in the exhibit.

Supply-side reaction: Restricted new house starts

The failure to sufficiently perceive the existence of effective demand implicit in the figures above would explain why the developers are not identifying demand despite the strong transaction numbers (existing homes), leaving the post-crisis production volumes at still-low levels. There are other reasons too: the disintegration of the universe of builders which in the past made the supply side flexible (not necessarily large firms but also small and medium sized enterprises) and/or the existence of restrictions of some sort on building (or a lack of incentives to build).

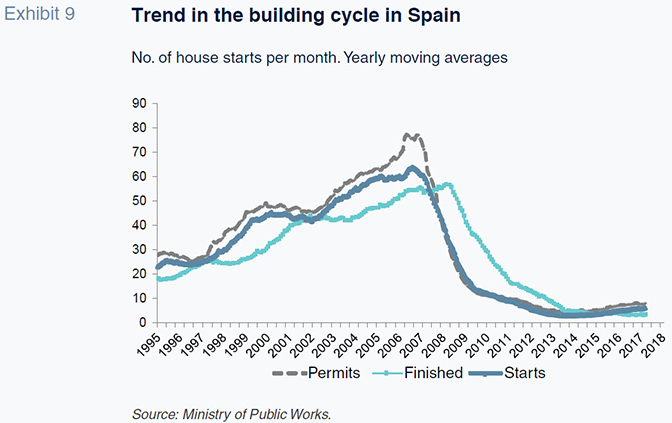

The residential cycle (Exhibit 9) evidences this pattern and reveals historically-low building levels. The most recent figures show how new home starts have yet to begin to recover at a pace that could drive a change in conditions in the housing market.

Since 2015, new house starts have only been increasing by a few units per year (although the noteworthy year-on-year increase of 20% in the last monthly reading for 2017 points in the other direction), which is not sufficient to resolve the issues caused by the lack of housing supply in the key markets in which demand is strong. Nor are the numbers sufficient to justify the high contribution by construction to GDP captured in the national accounts (having registered growth of 4.6% and 5.3% in real terms in the first two quarters of 2017).

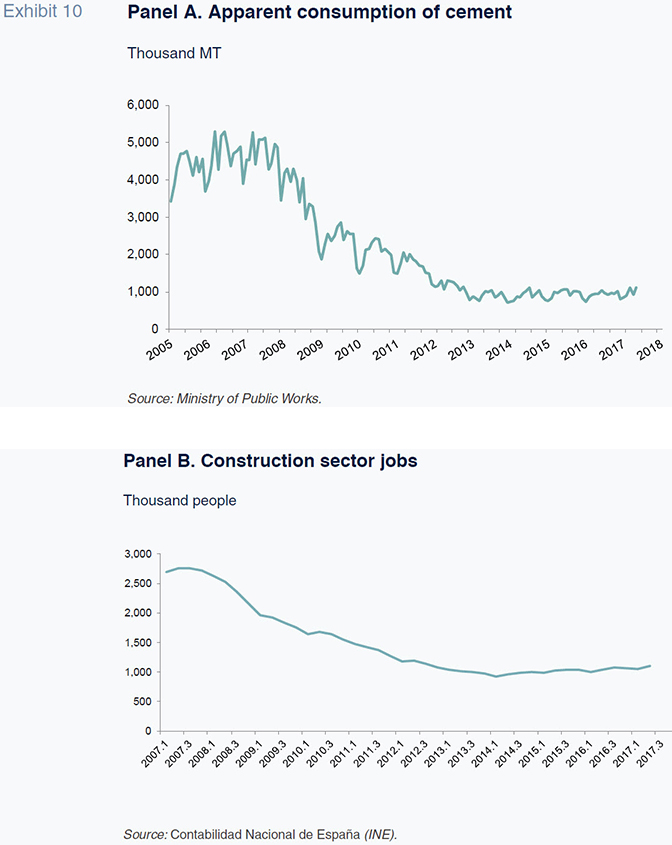

The lack of building activity is evident in the consumption of inputs and contracting volumes in this industry. Exhibit 10 depicts the trend in apparent consumption of cement (Panel A) and in construction sector jobs (Panel B). The first shows no growth whatsoever, while the second is registering modest growth of just over 5% in recent readings. Something similar is evident in construction loans, which continue to contract in all sub-sectors according to the latest published data (with construction loans contracting 9% and loans for the construction of standalone homes down by 12.9%; loans for public works registered a decline of 5.0%, loans for facilities and building finishings a contraction of 4.0% and loans for site preparation work, a drop of 6.17%), albeit contracting at a slower pace than in prior quarters, suggesting that the contraction may be nearing an end.

Accordingly, the lack of financing for new works can be considered a restriction on supply associated with a lack of inputs that is discouraging new construction and contributing to the paralysis of the housing cycle.

Lastly, the lack of sufficient developers to start new houses may also be putting a brake on market forces in the face of renewed demand. The development segment was hit hard by the crisis from the outset. A large number of construction firms were destroyed with just a small number surviving the seven years of recession

[4]. It is logical therefore to assume that they will not take on risk (to the extent they still exist) without sufficient incentives to do so.

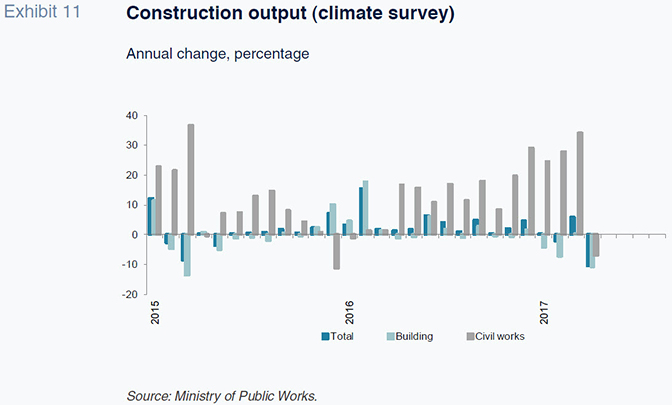

Elsewhere, the construction firms themselves have also been reporting small or shrinking volumes of works in recent times. Exhibit 11 corroborates the inputs and materials figures, showing how the players have seen their building works shrink throughout all of 2016 and 2017.

The exhibit provides a measure of the growth dynamics of two sub-sectors and the total construction sector. Since 2015, with the exception of just three quarters, works volumes in house building have been declining year-on-year, with this trend accelerating in 2017. This source does reveal an increase in civil engineering output during the period, suggesting that the contribution by the construction sector to GAV may be coming primarily from public works, in turn reflecting growth in public investment in this sector by way of counter-cyclical policy.

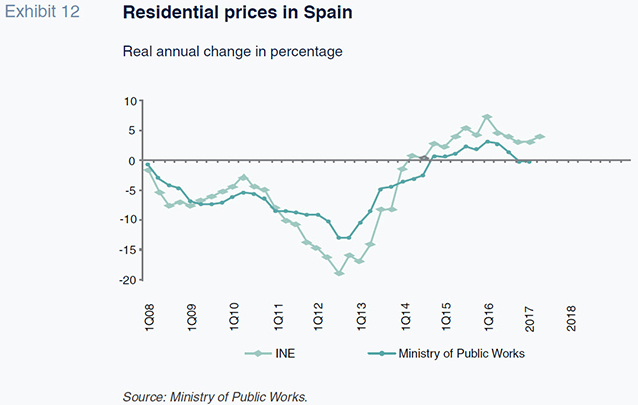

How prices are reactingThe upshot has been a very mild increase in housing prices in sharp contrast, as we saw at the beginning of this paper, with the trend in rents, which have been rising sharply in some cities. Depending on which source we use (the Ministry of Public Works or the INE), the pace of growth varies. Part of this difference (Exhibit 12) may be explained by the relatively greater volatility of the series built on the INE prices which is based on hedonic methodology making it more reliant on information regarding the type of transactions and characteristics of the units purchased.

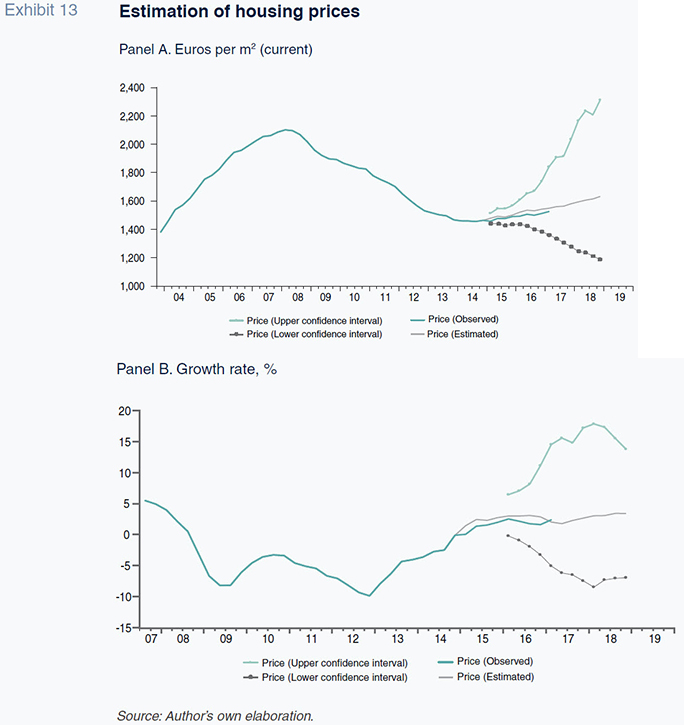

Leaving this matter aside, the growth in house prices in real terms would appear to have settled at low levels and current forecasts do not point to significant momentum in the coming quarters. As shown in Panels A and B of Exhibit 13, the estimates for future growth in house prices derived using a demand model

[5] point to moderate uninterrupted growth during the next six quarters, albeit market by a significant level of uncertainty (reflected in wide confidence intervals), which is how these models capture moments of change in economic cycles.

Conclusions and corollary

The economic recovery is translating into growth in demand for homes from households enjoying the benefits of the recovery or finding new work. As a result of the conditions in which the housing market was left in the wake of the crisis (barely any new production, a prolonged and sharp credit crunch and a diminished business landscape), the supply side appears to be failing to react to the market signals and the adjustment transmission mechanisms are taking longer to work, so that demand is pooling in the rental segment (due to lack of access to the buyers’ market), driving rents higher. Although this is happening in some regions of Spain and is not yet a nationwide phenomenon, it is sufficiently noteworthy to cause concern. The only way to ease rental prices is via growth in supply (in rental properties or properties for sale); other measures will only exacerbate the distortion.

One way to stimulate supply is to provide the construction sector with imaginative incentives. Having been penalised for years, the only way the construction firms will renew their activity is if there is some form of incentive to do so. In the past, this incentive came in the form of housing policy, such that a small effort to stimulate production (of public housing by the private developers) kick-started the building cycle and helped get the sector back on its feet. The knowledge about how this relationship between the public and private segments works could be used to restart the process and prevent the slowdown in the cycle (which is also affecting the public sector, particularly since 2013) from impeding the renewal of activity further.

Without new works there can be no new rental properties, all but guaranteeing further increases in rental prices. It is possible that the growth in the rental segment is generating the advent of overseas developers and real estate players specialised in rentals management; these firms claim to have great plans to build new houses, drawn by the sizeable and extraordinary profits in this segment. Their presence is necessary in order to modernise Spain’s residential markets, particularly the rental segment. However, it is worth recalling that this market has its limits, including regulatory deficits that have impeded greater growth in the past and a shortfall of supply to cover all income levels. A residential market cannot change quickly which is why the tightness in the rental market (note that the cities in which rentals are rising the fastest are the biggest in this segment) will only be overcome with time and it is not reasonable to expect rentals to substitute for ownership in significant proportions. Growth in supply, driven by market forces, is, in our opinion, the only solution to the sharp growth in rents.

Meanwhile, the two price benchmarks in the residential market − rents and house prices - are out of line with market equilibrium levels. This mismatch should resolve itself soon, according to the laws of economics, possibly with the arrival of new players capable of increasing supply. In addition to the new supply which appears to be arriving by way of foreign investors, growth in the supply of public housing (for purchase and rental) would help eliminate the price tension which is hurting lower income households the most.

Notes

To obtain the combined trend, the principal components were extracted from the rent prices of the referred series: Variables Madrid and Barcelona for CP1 and Valencia, Alicante and the capital of the Balearic Islands for CP2.

This is so because in the short term, supply is rigid. Refer to DiPasquale & Wheaton (1996).

This ratio means that if the household earmarks all its income to paying off their mortgages, it would take 10 years to do so. The higher this ratio, the more indebtedness associated with the mortgage.

The INE, Spain’s national statistics bureau, figures for the number of construction firms include real estate service providers, making it hard to accurately gauge the number of development and construction firms that have disappeared. According to the most recent figures, the number of firms (combined) has fallen from 102k units to a little over 67k economy-wide.

The demand model correlates real house prices and their determinants in the manner explained in the first quadrant of the DiPasquale & Wheaton (1996) model. The determinants modelled are the mobile population (Exhibit 4), average income derived from wage income (the figures underpinning Exhibit 7), mortgage rates and financing flows (Exhibit 6) and a proxy for the supply side reaction (calculated using the figures from Exhibit 9). Estimated using error correction methods to project future growth.

References

DIPASQUALE, D., and WHEATON, W. C. (1996), Urban economics and real estate markets, Englewood Cliffs, NJ: Prentice Hall.

Paloma Taltavull. University of Alicante