Evolution of NPLs at the European level: A flows perspective

The still high volume of doubtful assets across the European banking system remains one of the main issues of concern among European and international institutions. Given their negative impact on profitability, reducing NPLs will be a key objective for the coming years.

Abstract: In the context of an already challenging earnings climate for the European financial sector, reducing the high volume of non-performing loans is of vital importance to banks, as has been recognised by European and international authorities. Spain’s NPL ratio spiked during the recession, primarily due to the country’s real estate crisis. However, there has been a significant improvement in credit quality since 2014, supported by improved macroeconomic fundamentals, including reduced unemployment, which has significantly slowed the pace of inflows of new NPLs. At 5.7%, Spain’s NPL ratio stands just slightly above the 5.1% EU average. This, together with an improvement in recovery processes and the still relevant role played by foreclosures, has led to a significant reduction in the NPL ratio. However, there are signs of a slight slowdown in outflows, which looks set to continue in coming years, resulting from fewer foreclosures and write-offs. Thus, there is still much to be done both at the Spanish and European level in order to lower the close to 1 trillion euros of doubtful assets on bank balance sheets to more acceptable levels, which would be amenable to improved profitability.

IntroductionAccounting for some 900 billion euros as of end 2016, non-performing loans (NPLs) remain one of the principal obstacles impeding earnings in the European banking sector. Different European organisations have recently stressed the importance of addressing this issue, proposing various solutions to reduce the weight of non-performing loans on bank balance sheets. The IMF, in its preliminary findings

[1] for Spain’s 2017 Article IV, noted that although the Spanish banking sector has made significant efforts to clean-up these assets, they remain high in a few banks. The IMF’s comments are in line with statements from other organisations in recent quarters.

Against this backdrop, we analyse the evolution of non-performing loans in the Spanish banking sector, looking at inflows and outflows in order to identify as precisely as possible, which factors have played the biggest role in the improvement in asset quality seen in recent years and what we can expect in the coming years.

The main conclusions from the analysis are as follows:

- Inflows of doubtful assets have fallen sharply (-15% YoY in 2016), consistent with an improvement in the economic cycle and a reduction in the unemployment rate. We expect this trend to continue on aggregate over the coming years.

- Foreclosures and write-offs continue to account for the bulk of outflows (65% in 2016).

We forecast the following for 2017 and 2018:

- Inflows of non-performing loans (NPLs) will continue to decline in line with the improvement in the cycle, albeit more slowly than in previous years, as lending takes off, though new leading could lead to an increase in the default rate in some segments.

- Foreclosures and write-offs will also gradually reduce.

- In aggregate terms, the decline in non-performing loans will continue to be a key source of solace for banks’ income statements.

Concern at an institutional levelNon-performing loans have been on the receiving end of attention from different European and international organisations in recent months. In particular, on July 11

th, the European Council adopted an action plan aimed at reducing non-performing loans

[2]. Two days later, the European Parliament issued a briefing on the state of play on NPLs across the EU

[3].

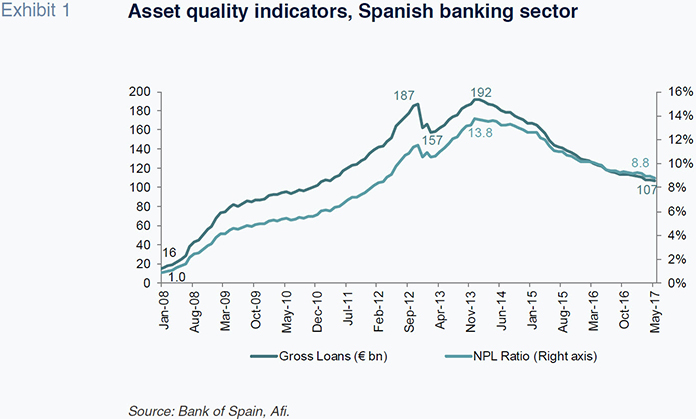

Although by no means the worst culprit in the European Union, Spain’s NPL ratio is above the EU average (5.7% compared to 5.1%). This ratio is based on the consolidated accounts of Spanish banks. The NPL ratio calculated on the basis of individual accounts is higher, reaching 8.8% in May 2017 and, if foreclosed assets are included, the ratio rises to 14.8% − a peculiarity which reflects Spain’s real estate crisis.

The issue is a key problem for the European banking sector as a whole, which requires an appropriate solution − not only looking backward but also forward given that large volumes of non-performing loans hamper banks’ ability to generate earnings.

Some of the measures that have been proposed range from overall improvements to supervision to the creation of an efficient secondary market incorporating asset management companies (such as SAREB in Spain) to facilitate the transfer of these assets.

The main initiatives that have been adopted by EU bodies are in line with the action plan approved by the European Council and can be summarised as follows:

- The European Commission has launched a public consultation on the development of secondary markets for non-performing loans.

- The Single Supervisory Mechanism (SSM) launched a review of non-performing loan regimes in euro area countries and has issued guidance on the management of doubtful loans.

- The European Systemic Risk Board has published a report on possible solutions, including five high-level principles.

Given the characteristics of the European banking system, concern about non-performing loans extends beyond the confines of European institutions to international organisations as well. For example, the Basel Committee on Banking Supervision

[4] has recently issued guidance on common definitions of doubtful risks, while the International Monetary Fund has published various reports on the state of play of the issue in different EU

[5] countries.

Non-performing loans in the Spanish banking system

A quirk of the Spanish banking system is that non-performing loans are divided into doubtful assets (as in the rest of Europe) and foreclosed assets, reflecting the important role that the real estate market has played in Spain.

An asset is classed as non-performing after 90 days have passed since non-payment of instalments on the principal of the loan or outstanding interest. The overall volume of non-performing loans has fallen very significantly in recent years for the Spanish banking sector as a whole, after increasingly sharply in the financial crisis.

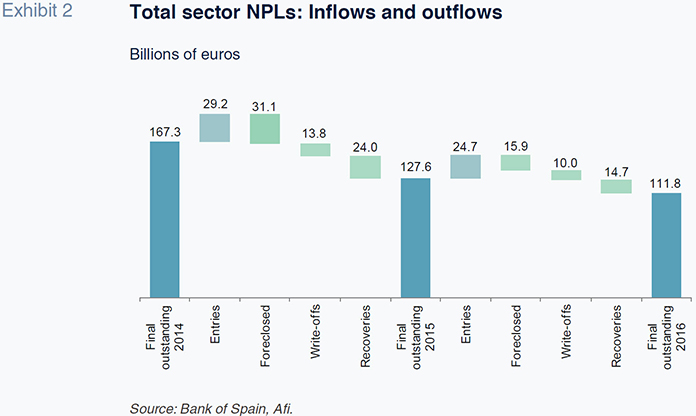

Non-performing loan volumes increase due to inflows of non-performing loans − i.e., new loans in arrears for more than 90 days during the period under analysis − and fall with outflows, meaning that:

Initial volume = gross inflows - gross outflows = final volume

Outflows can happen in four different ways, due to: (i) recoveries, this is the most positive way to reduce the overall volume of non-performing loans and consists in restoring a loan which is in arrears back to a normal situation, (ii) foreclosure, i.e., mortgage loans with collateral where the bank takes ownership of the real estate asset by invoking the guarantee, (iii) sales of non-performing loans, i.e., portfolios that banks decide to sell to a third-party (usually at a significant discount on book value) and thus remove these assets from their balance sheet; and, (iv) write-offs, when banks believe that an unpaid loan is unrecoverable and they strike it off the balance sheet, bearing 100% of the loss.

During the worst years of the crisis, Spain’s overall non-performing loans increased mainly on the back of new inflows, reflecting the dire economic situation and the increase in the unemployment rate, which is very closely linked to defaults. Initially, the bulk of outflows occurred due to foreclosures or write-offs, implying that non-payments were not actually reducing and that the improvement was solely because loans were being written off the balance sheet once fully provisioned (with the bank assuming 100% of the loss) or due to foreclosures on properties and land in mortgage and construction loans, respectively.

However, since 2014, the NPL ratio has fallen significantly (the NPL ratio is measured as total non-performing loans over total gross lending). This reduction has not come about due to an increase in the denominator – gross lending is still not growing – but rather due to a decline in the nominator, i.e., the volume of non-performing loans. New inflows have gradually slowed in recent quarters in line with the improvement in the economic cycle and the reduction in unemployment, according to data published by the banks, while outflows remain strongly influenced by foreclosures, write-offs and occasional sales of portfolios. Recoveries have a lesser weight, although they also began to pick up in 2016 in line with the economic recovery.

Inflows and outflows

In light of the above, in this article we analyse the sector in terms of inflows and outflows of these types of assets in recent years, using individual information in the absence of aggregate statistics.

Our analysis of NPL flows considers the following aspects:

- The analysis is granular, looking at different lending segments of the Spanish banking sector.

- This analysis uses information from the statement of Credit Risk Distribution provided by the fourteen largest banks.

- Banks’ non-performing loans by segment are estimated using the sector NPL ratio as a starting point, taking account the structural effect (the composition of the loan portfolio for each bank).

- Using the biggest banks’ annual and quarterly reports, we obtain:

- Inflows of NPLs: estimating the Probability of Default (PD) using banks’ Pillar III Disclosure reports.

- Outflows of NPLs: foreclosures, write-offs and recoveries of doubtful assets. The analysis also incorporates the following assumptions:

- Foreclosed assets originate from collateral in housing, construction and real estate development loans.

- Write-offs relate to non-collateralised lending segments and the excess value of mortgage loans relative to property appraisal value.

The results of applying these assumptions are illustrated in the following exhibits, which show movements in inflows and outflows for the overall sector and resulting NPL ratios both at an aggregate level and for different segments.

As highlighted above, inflows have come down in recent years due to the improvement in macroeconomic fundamentals, while outflows have also contributed to a reduction in non-performing loans. However, there are signs of a slight slowdown in outflows, which looks set to continue in coming years. This reflects the fact that the volume of non-performing loans is shrinking, resulting in a slower pace of property foreclosures and longer organic recoveries given that remaining non-performing loans are of the worst quality and therefore the hardest to recover.

In this sense, after analyzing the evolution of doubtful assets, there is evidence that the NPL ratio has been reduced in a generalized manner in all segments, especially highlighting the fall in real estate corporations as well as those related to other sectors.

It should be noted that this reduction is mainly due to the positive economic cycle and the macroeconomic variables, which have led SMEs and the real estate sector to partially recover their asset quality, that was severely damaged during the financial crisis.

Conclusions

Against the backdrop of the earnings challenge brought about by low interest rates, reducing the high volume of non-performing loans is of vital importance to banks, as has been recognised by European and international authorities.

Spain’s NPL ratio spiked during the recession, primarily due to the country’s idiosyncratic real estate crisis. However, there has been a notable improvement in credit quality since 2014 on the back of the improvement in macroeconomic fundamentals and the labour market, which has significantly slowed the pace of inflows of new NPLs. This, together with an improvement in recovery processes and the still important role played by foreclosures, has led to an important reduction in the NPL ratio.

However, there is still much to be done both at the Spanish and European level in order to lower the close to 1 trillion euros of doubtful assets on bank balance sheets to more acceptable levels, which would be amenable to improved profitability. This is set to be the main focus of supervisory efforts over the coming years.

Notes

“Council conclusions on Action plan to tackle non-performinf loans in Europe” http://www.consilium.europa.eu/press-releases-pdf/2017/7/47244662559_en.pdf

“Non-performing loans in the Banking Union: state of play” http://www.europarl.europa.eu/RegData/etudes/BRIE/2017/602072/IPOL_BRI(2017)602072_EN.pdf

“Prudential treatment of problem assets – definitions of non-performing exposure and forbearance” http://www.bis.org/bcbs/publ/d403.pdf

David Ruiz Castaño and Fernando Rojas Traverso. A.F.I. - Analistas Financieros Internacionales, S.A.