Spanish economic forecasts panel: July 2023*

Funcas Economic Trends and Statistics Department

2023 GDP growth estimate increased by four tenths of a percentage point to 2.1%

The National Statistics Institute (INE) revised upwards its GDP growth figures for the fourth quarter of 2022 and the first quarter of 2023. This last figure was also higher than expected in the previous consensus, which was published prior to the first advance of this data. The most notable results in both quarters have been the drop in domestic demand –especially in private consumption– and the high contribution to growth from net exports. More specifically, in the first quarter of this year, growth came almost entirely from exports of tourism services.

The growth forecast for the second quarter remains unchanged at 0.3%, and that for the second half of the year is unchanged or slightly lower than in the previous Panel. Despite this, the effect of the upward revision of the figure for the fourth quarter of 2022, together with the better-than-expected result in the first quarter of 2023, has led to an upward revision in the growth forecast for the year as a whole by four tenths of a percentage point to 2.1%.

The contribution of domestic demand has dropped to 0.8 percentage points (two tenths less than in the previous Panel). Conversely, the contribution of net exports has been revised upwards to 1.3 points (three tenths more).

The forecast for 2024 unchanged at 1.8%

The growth projection for 2024 remains unchanged at 1.8%. This figure is below the forecasts of the main national and international agencies. This result will come entirely from domestic demand. Specifically, both consumption and investment are expected to recover, so that the slowdown in GDP compared to 2023 will be the result of a slowdown in the external sector.

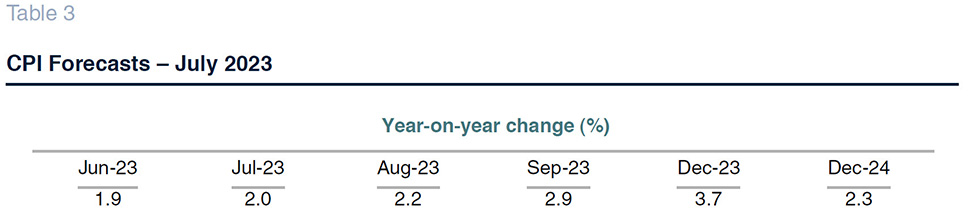

Downward revision of the inflation forecast

The overall inflation rate stood at 1.9% in June, less than expected by panelists in the previous consensus. However, this result could be the minimum for the year, since the outlook for the coming months is that inflation will rise again in year-on-year terms, reflecting base effects. All in all, the average annual consensus forecast has been lowered to 3.6%, and the forecast for next year remains at 2.9%.

As for the core inflation rate, the forecast for this year’s average is 5.7%, and next year’s has been lowered to 3.1%. The expected year-on-year rates for December 2023 and December 2024 are 3.7% and 2.3%, respectively.

Employment will continue to grow and the unemployment rate will fall to 12.2% in 2024, which is higher than the structural rate

Although at the time of writing, the results of the second quarter Labor Force Survey were not yet available, the evolution of Social Security enrollment suggests that job creation has maintained its positive momentum. In June, a slowdown was detected, but it is too early to know whether this represents a change in trend.

The average employment growth estimate for 2023 has been increased by one tenth to 1.4%, while the forecast for 2024 remains at 1.3%. As for the unemployment rate, an annual average of 12.6% is expected for this year and 12.2% for next year.

In this edition of the Panel, participants were asked an additional question regarding their estimate of the structural unemployment rate. The average response places it at 11.7%. The range of estimates is between 8% and 15%, with the majority concentrated between 10% and 11%. In short, according to most of the panelists, the unemployment rate is still above its structural level.

The implicit forecast for productivity and unit labor cost (ULC) growth is based on forecasts of GDP, employment and wage growth. Productivity per full-time equivalent job will grow by 0.7% this year and 0.5% in 2024, meanwhile ULCs will increase 3% in 2023 and another 3% in 2024.

Significant improvement in the trade surplus

The current account recorded a surplus of 10.323 billion euros in the first quarter, which represents 2.9% of GDP, the best result for a first quarter in the entire historical series. On the one hand, the goods trade deficit narrowed, thanks to the fall in energy prices and the shift from deficit to surplus in the non-energy balance. On the other hand, the surplus in the services balance increased sharply, with respect to both tourism and non-tourism services.

The consensus forecast for the current account surplus has been raised to 1.4% of GDP in 2023, and 1.1% of GDP in 2024.

Public deficit outlook largely unchanged

The General Government registered a deficit of 2.2 billion euros in the first quarter of 2023, compared to 6 billion a year earlier. The improvement was due to the strong growth in tax collection, especially in personal income and Social Security contributions.

The Panel foresees a reduction in the General Government deficit over the next two years, to 4.1% of GDP in 2023 and 3.5% in 2024, slightly lower than in the May Panel.

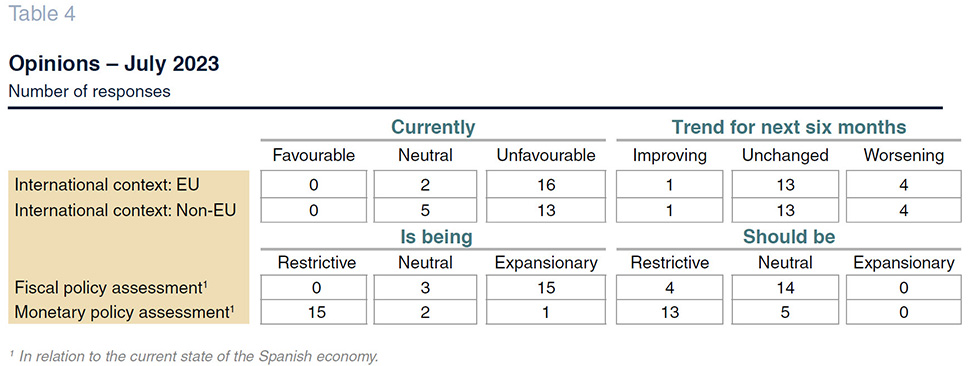

The international environment is unfavorable, especially in the EU

Recent trends point to a weakening of the international environment, especially in Europe. In June, the PMI for the eurozone fell to just below 50, pointing to a contraction in activity. The trend is also towards a slowdown in the US and China, albeit less pronounced than in Europe, with PMI indicators still in expansionary territory. In general, the slowdown is more significant in industry than in the service sectors, which could evidence a change in global demand patterns.

In its latest outlook, the OECD predicts global growth of less than 3% in both 2023 and 2024, a significant decline compared to 2022 which would be mainly due to the tightening of monetary policy. The economic weakening would mostly affect the eurozone.

In line with these forecasts, the majority of panelists consider the external environment to be unfavorable, especially in the EU (no major changes compared to the previous Panel). All but one consider that this context will either continue or even worsen in the coming months.

Monetary and credit tightening continues

At its last meeting, the ECB raised its main interest rates by 25 basis points, and statements from key monetary policymakers suggest that the tightening cycle is not over as yet. Although the headline CPI is moderating, its underlying components continue to grow at a rate still well above the price stability target, motivating the process of monetary tightening. On the other hand, the central bank is monitoring the possible emergence of second-round effects in terms of wages, with labor markets that continue to be stressed in most of the economies that make up the euro.

The ECB’s Financial Stability Report released since the previous Panel confirms that monetary policy is generating a significant tightening of financial conditions. The report also points to risks of disorderly market adjustments.

In this context, analysts maintain their forecast for monetary policy tightening. The ECB’s deposit facility is expected to maintain its upward trend until the end of the year, to close to 4% according to most panelists, and would start a downward path from the first quarter of next year. However, both the interest rate peak and its terminal value reached at the end of 2024 will reach higher levels than expected in the previous Panel.

Short-term market rates have also been adjusted compared to May’s valuations. The one-year Euribor could exceed 4% by the end of 2023 (a threshold that was not reached in the previous Panel), and subsequently follow a downward trend. As for 10-year Spanish government bonds, little change is expected compared to May’s consensus.

Euro appreciation against the dollar

The rate hike path is expected to last longer in Europe than in the US, where the Federal Reserve has paused its adjustments. Given the lower expected interest rate differential between the two sides of the Atlantic, analysts forecast an appreciation of the euro against the dollar in the coming months (Table 2), unchanged from the previous consensus.

* The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 18 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 18 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.