AI and the banking sector: Initial considerations

The rise in chats powered by artificial intelligence (AI) places this new development at the heart of the debate about the application of technology in the banking sector. In an environment in which competition will be increasingly digital, it is essential that the traditional banking sector digitalise by making more intensive use of artificial intelligence.

Abstract: Despite having been in development for some time, it seems as if AI’s moment has arrived. The European banking sector has widely embraced the new technology. According to the European Banking Authority (EBA), 83.3% of European banks currently use artificial intelligence for a range of purposes. That incidence has been rising consistently since 2018. Indeed, the EBA estimates that by 2025, all European banks will have implemented solutions powered by AI. Artificial intelligence is already being used in a myriad of ways. For now, its use is concentrated in the development of solutions that improve the user experience, facilitate performance of the banks’ compliance obligations and enable more efficient management of banking risks. Following the success of ChatGPT, the banks are moving to transform their virtual assistants into intelligent digital assistants capable of providing personalised service in real time to their customers, as well as their employees. Going forward, the banks will have to continue to invest in AI to ensure its usage translates into lasting competitive advantages.

The advent of artificial intelligence (AI) in the banking business

The use of the so-called “new bank technologies”, which notably include artificial intelligence, blockchain technology, big data capabilities, cloud computing and biometrics, has increased in recent years and accelerated remarkably since the COVID-19 pandemic (Carbó, Cuadros and Rodríguez, 2021). All this new technology is revolutionising the way in which financial transactions are carried out, making them safer and more efficient and enhancing the customer experience.

Within this universe of technologies, artificial intelligence (AI) has been coming to the fore in the financial sector. The recent development of conversational AI, such as ChatGPT (OpenAI) and Bard (Google), has placed AI at the forefront of the technology debate in the banking industry. The sector sees this language processing tool as having more potential than other technologies. In fact, according to the data presented in the EBA’s 2022 Risk Assessment of the European Banking System, use of this technology is growing rapidly.

In the broadest sense, the advent of AI has marked a significant milestone in the banking business, emerging as a disruptive technology with a significant impact on the way banks operate and provide service. AI stands out for the ability to process vast volumes of data, analyse complex patterns, and generate original information for input into real-time decision-making. Its application in the banking business is opening up new possibilities for improving how banking services are provided.

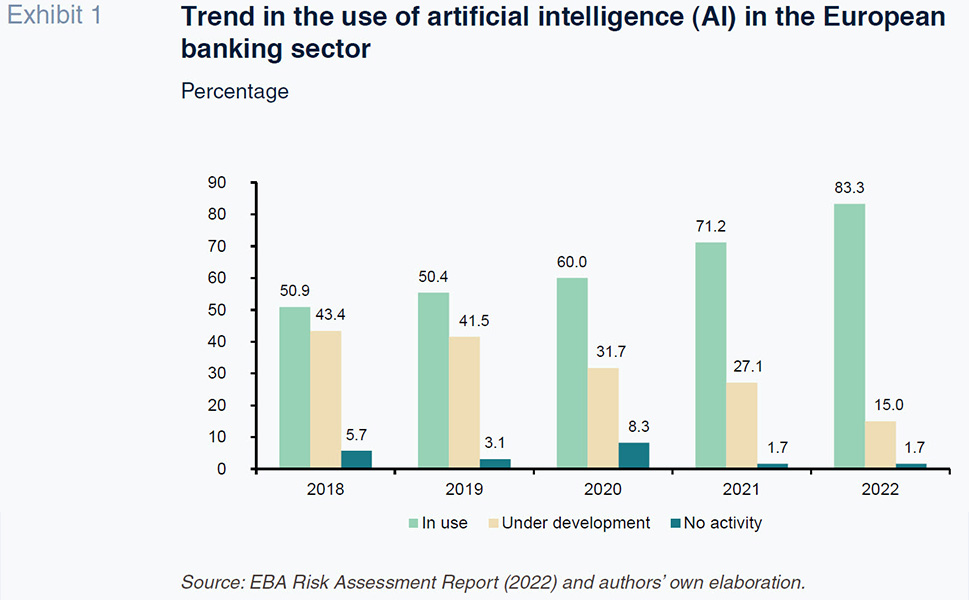

AI’s significant potential for use in the banking business is evident in the trend in its application by the European banking sector. As shown in Exhibit 1, the percentage of European banks using AI has increased continuously since 2018. In 2022, 83.3% of the European banks were using AI for different purposes. That percentage rises to 98.3% layering in the European banks that are in the process of pilot testing or developing AI. In 2018, just 50.9% of European banks were using it, implying growth of 32.4 percentage points in just four years. The pandemic accelerated its deployment significantly. Between 2020 and 2021, its penetration jumped a noteworthy 11.2 percentage points. Exhibit 1 also suggests that as the banks explore the potential of AI via pilots, they tend to then adopt it in the following years. Hence, the successive growth in usage coincides with a reduction in the percentage of banks in the testing phase. If the rate of growth remains stable over time, the EBA figures suggest that the entire European banking sector will be using AI by 2025.

How artificial intelligence is being used in the banking sector?

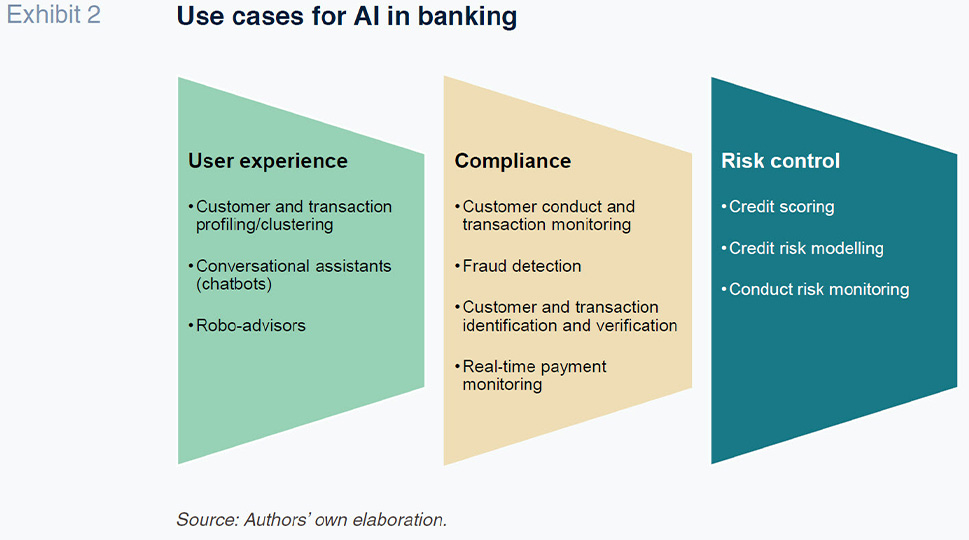

AI’s potential utility in the banking sector is also explained by the broad diversity of use cases in the business. Although there are many different ways in which the banks can use AI, they can be grouped into three main categories (Exhibit 2):

- Improving the user experience: In this category, one of the most noteworthy applications is the use of virtual assistants, or chatbots, that provide customer service 24 hours a day, seven days a week, enhancing the customer experience and speeding up enquiries and transactions. Moreover, AI makes it possible to identify common patterns and behaviours so as to better understand customer profiles and needs. And by developing automated investment advisors, known as robo-advisors, it is also possible to offer customers personalised and automated recommendations about how to manage their investments.

- Compliance: IA can help alleviate the high cost of regulatory and legal compliance. For example, AI is being used to monitor customer behaviour and transactions, helping to detect and prevent fraud and money laundering. It can furthermore be used to speed up and automate customer identification and verification processes and detect and prevent fraudulent or suspicious activities immediately via real-time payment monitoring.

- Risk control: AI is too being used to deliver more efficient management of various classes of banking risks. For example, it is widely utilized to evaluate customer creditworthiness, permitting more informed and faster loan approval decisions. It is also being used to manage financial risks by optimising modelling and analytical processes.

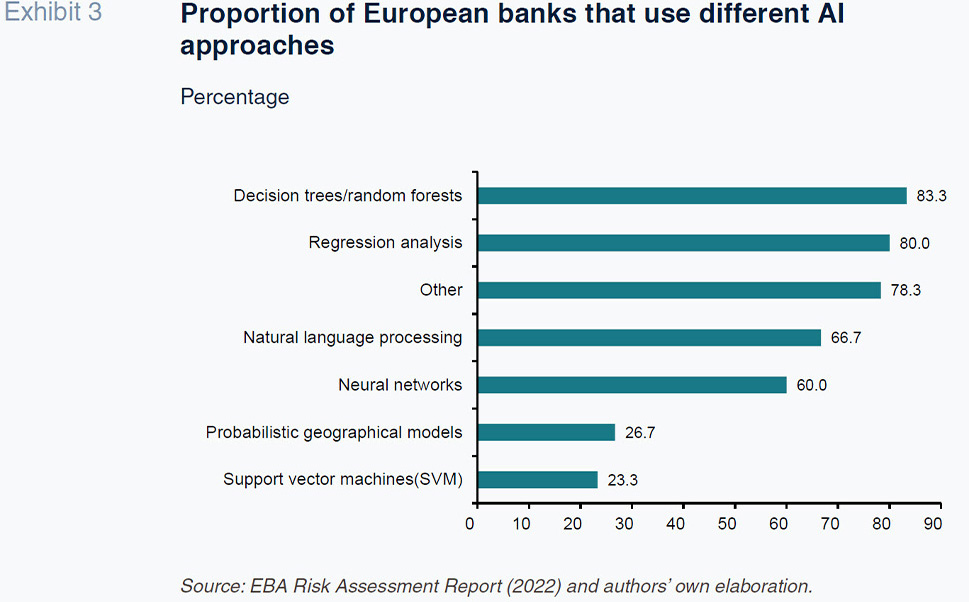

Elsewhere, there are different techniques or approaches for enabling effective development of AI in the banking business, ranging from neural networks to decision trees and natural language processing tools. Each technique has unique characteristics that make them more or less suited for different uses. According to the data provided by the EBA, the European banks stand out for their use of decision trees and random forests (83.3%), regression analysis (80%) and natural language processing (66.7%). In general, decision trees and random forests are used for credit scoring as they are particularly reliable at accurately determining the probability that a customer will honour his or her financial obligations. At any rate, the variety of techniques is pretty high, as 60% of the European banks using AI use other approaches than those monitored by the EBA.

ChatGPT and conversational AI in the banking sector

The advent of ChatGPT, a conversational AI tool that has seemingly limitless potential, has marked a watershed moment for the impact of AI in banking. Following the success of ChatGPT, many banks have embarked on the process of enhancing their own virtual assistants in order to tap AI to offer their customers a better user experience. In fact, the banking industry is focusing strategically on transforming its virtual assistants into intelligent digital assistants (IDAs). Whereas basic chatbots are limited to a catalogue of frequently asked questions, IDAs receive prior training which includes learning about customers’ financial history and behavioural patterns, giving them a more comprehensive conversational base for addressing specific user needs, covering a breadth of experiences, languages, and terms.

Moreover, IDAs are intended to go beyond resolution of consumers’ basic transaction-related enquiries. The aim is to turn them into banking experts capable of providing the banks’ customers with advice about their financial activities. These chatbots, such as the advanced generative AI model, ChatGPT, are capable of understanding and answering user enquiries and requests in a natural manner, providing personalised and real-time customer service. Thanks to their ability to process natural language, these intelligent assistants can hold fluent and context-appropriate conversations, providing accurate and complete responses to complex questions. And they can adapt and learn from each interaction so as to continuously improve their performance and the experience they provide. By introducing chatbots underpinned by generative AI, the banks can speed up and automate processes, enhancing customer service and freeing up resources for more strategic tasks.

Elsewhere, the use of these chatbots is not limited to customers. Some banks are increasingly using these intelligent conversational assistants to provide direct support to their employees, effectively transforming their chatbots into just another member of their teams. This application can be very compelling in circumstances in which neither the employees nor their colleagues have ready answers for what their customers are asking.

Conclusions: Implications for the banking sector

The banking sector is in the midst of significant digital transformation fuelled by the adoption of new technologies. AI has emerged as the technology darling of the banking world. Its ability to process vast volumes of data, analyse complex patterns and take decisions in real time has positioned it as a disruptive force that is having a significant impact on how banks operate and provide services. The onset of AI nevertheless has a series of implications for banking business development:

- To ensure sustainable competitive advantages in the future, the banking sector needs to invest proactively in implementation of this new technology. In an increasingly digital environment, investing in AI will be essential to remaining competitive in a constantly changing climate.

- The neobanks and big tech firms are penetrating the banking business with digital solutions powered by AI. This is intensifying competition for the traditional banks and pushing them to adapt and innovate to stay relevant in the market.

- The use of AI can significantly alter the way in which banks do business. Managers needs to prepare their organisations and employees to change the way they are currently executing some of their tasks. For example, laborious manual processes, such as document verification, fraud detection and credit scoring, can be automated to a degree.

- Increased use of AI, and other new technologies, must not compromise security at financial institutions. Greater reliance on this technology could expose the banks to greater cybernetic risk. It is essential that digitalisation of the banking business does not come at the cost of comprising the high levels of cybersecurity currently boasted by the banking system.

References

Santiago Carbó Valverde. University of Valencia and Funcas

Pedro Cuadros Solas. CUNEF University and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas