Spanish banks: Benefits of international exposure and geographic diversification

Spanish banks’ increased exposure to foreign markets has helped them offset the pain associated with the recent financial crisis and downward trajectory of eurozone interest rates. Going forward, significant progress on the EU’s Banking Union will be needed to support diversification within the eurozone.

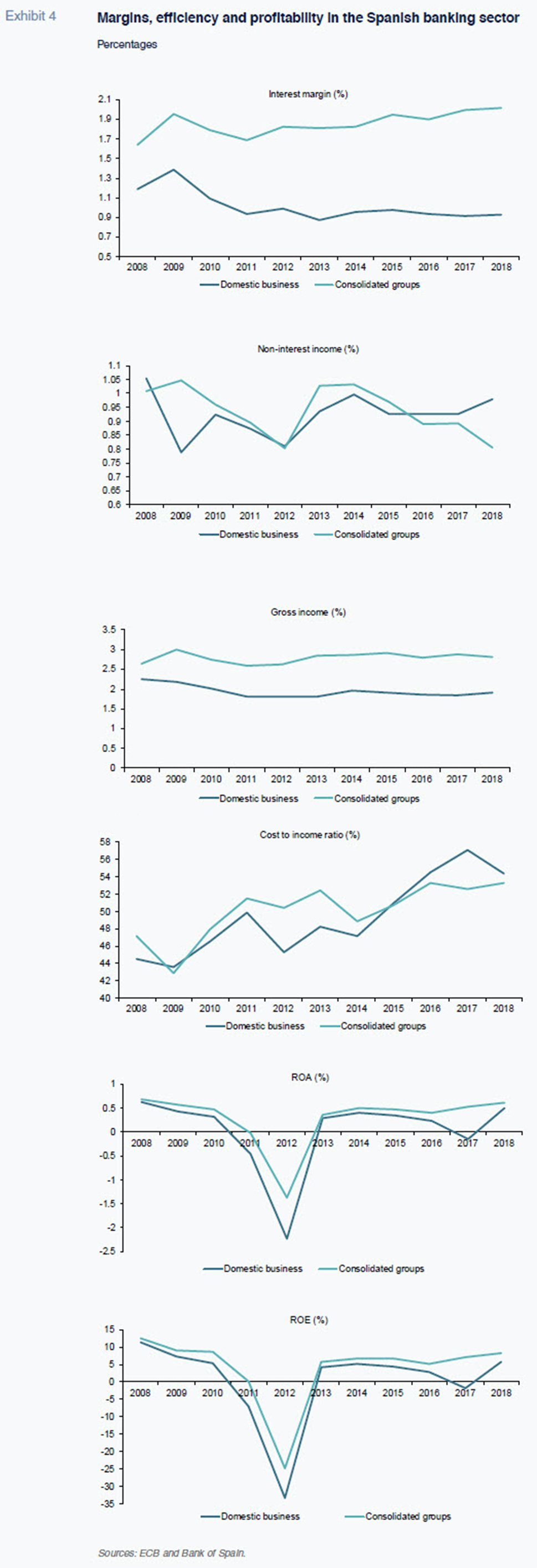

Abstract: The profitability of geographically-diversified Spanish banking groups is 43% higher than that of their domestic business, evidencing the advantages of an international strategy. The key factor explaining the profitability premium is the high net interest margin earned by Spanish banks’ subsidiaries in third country places of business. This feature has become all the more impactful given the decline in eurozone interest rates. For example, consolidated groups’ net interest margin is more than twice (2.01%) that of the Spanish banking business (0.93%). While the level of international expansion of the Spanish banking system is high relative to that of many other systems (overseas investments accounted for 44% of the total), their geographic diversification is lower by comparison with the major European economies and the US. Notably, there are some ad-hoc risks to consider in countries where Spanish banks are active, such as Turkey and Argentina. Nevertheless, analysis shows that diversification has mitigated banks’ overall risk exposure. However, the benefits associated with diversification will remain limited within the eurozone until the EU completes its Banking Union.

[1]

Introduction

The still-recent crisis experienced by the Spanish banks has evidenced the benefits of international expansion and geographic business diversification. The banks that committed strategically to international operations weathered the crisis better than their domestic peers. Specifically, stronger performances in higher-margin overseas banking markets has enabled them to offset the issues faced in their home-market businesses. This is reflected in the higher profitability of consolidated groups (a measure which includes their foreign businesses) relative to that of individual banks (which measures the profitability of the domestic banks).The return on equity (ROE) achieved by Spanish banks in 2018 -5.7%- rises by 2.5 percentage points when the Spanish banks’ overseas business operations are considered. This result confirms that diversification mitigates risk and that Spanish banks as a whole are more profitable than the domestic Spanish banking business alone.

With this in mind, the goal of this paper is to analyse the advantages international expansion and geographic diversification have brought the Spanish banking sector. To do so, we first compare the Spanish banks’ international exposure and coverage with that of a broad sample of countries for which there is information available. Secondly, we highlight the advantages associated with international expansion by looking at several financial parameters for consolidated groups compared to those of the individual entities. The paper concludes with a section outlining the key takeaways from the Spanish banks’ experience with international expansion.

Banking business: International exposure

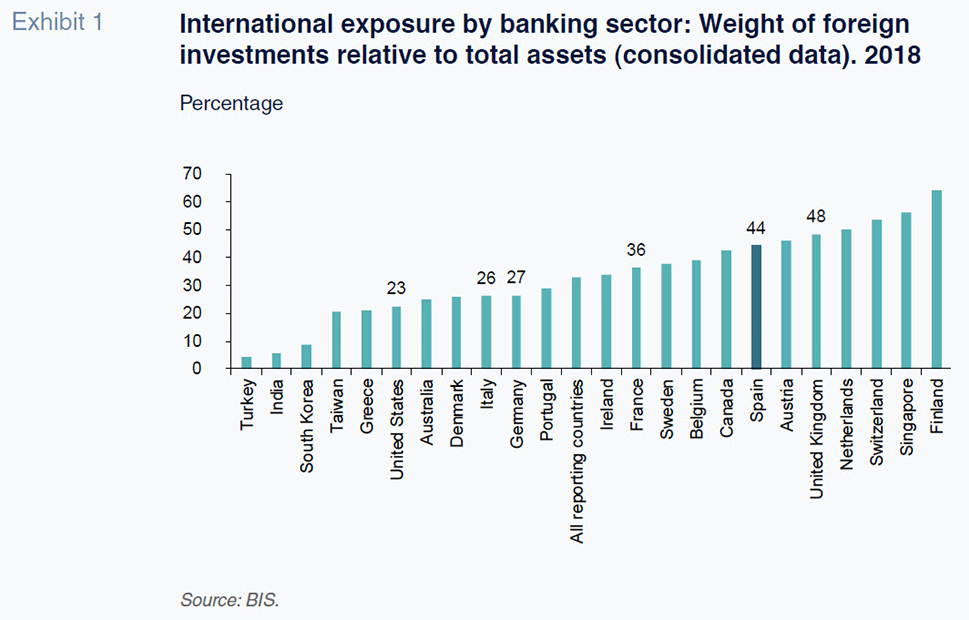

As shown in Exhibit 1, using Bank of International Settlements (BIS) data as of year-end 2018, the Spanish banking sector’s international exposure is relatively high. Overseas investments account for 44% of the investments total, which is above the levels observed for the other major European economies: 27% in Germany; 26% in Italy; and 36% in France. The US banks present lower international exposure (somewhat logical given the size and profitability of their home market): exposure to third countries accounts for 23% of sector assets, just over half of the Spanish level. On the other hand, the British banking sector boasts greater international exposure, at 48% of total assets, 4 percentage points above the Spanish level. Of the countries for which the BIS provides information, the level of international exposure varies widely from a low of 4% in Turkey to a high of 64% in Finland. Taiwanese banks do not present significant international exposure: overseas assets represent just 21% of their total investments.

Geographic business diversification

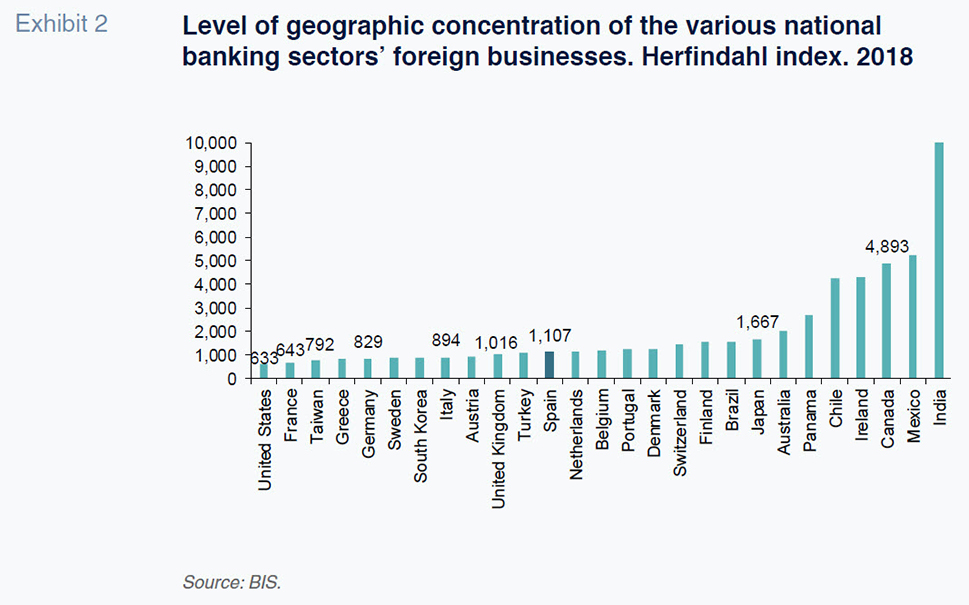

The level of geographic diversification of Spanish banks’ international footprint is small in relation to the US and other European economies such as Germany, Italy, France, and the UK. However, it is greater than that of Japan or Canada (Exhibit 2). Here, it is useful to consider the Herfindahl index, which is calculated by squaring the market shares in each country and ranges between 0 and 10,000, the latter indicating a situation in which 100% of assets are concentrated in a single country. Used as our proxy for concentration, the opposite of diversification, the reading produced for Spain is 1,107, compared to readings of 633 for the US, 643 for France, 829 for Germany, 894 for Italy and 1,016 for the UK. Note that the top 10 destinations for investments by the Spanish banks account for 82.3% of the total, compared to 64.2% in the US, 66.5% in Germany, 70.9% in Italy, 68.6% in France and 71.6% in the UK.

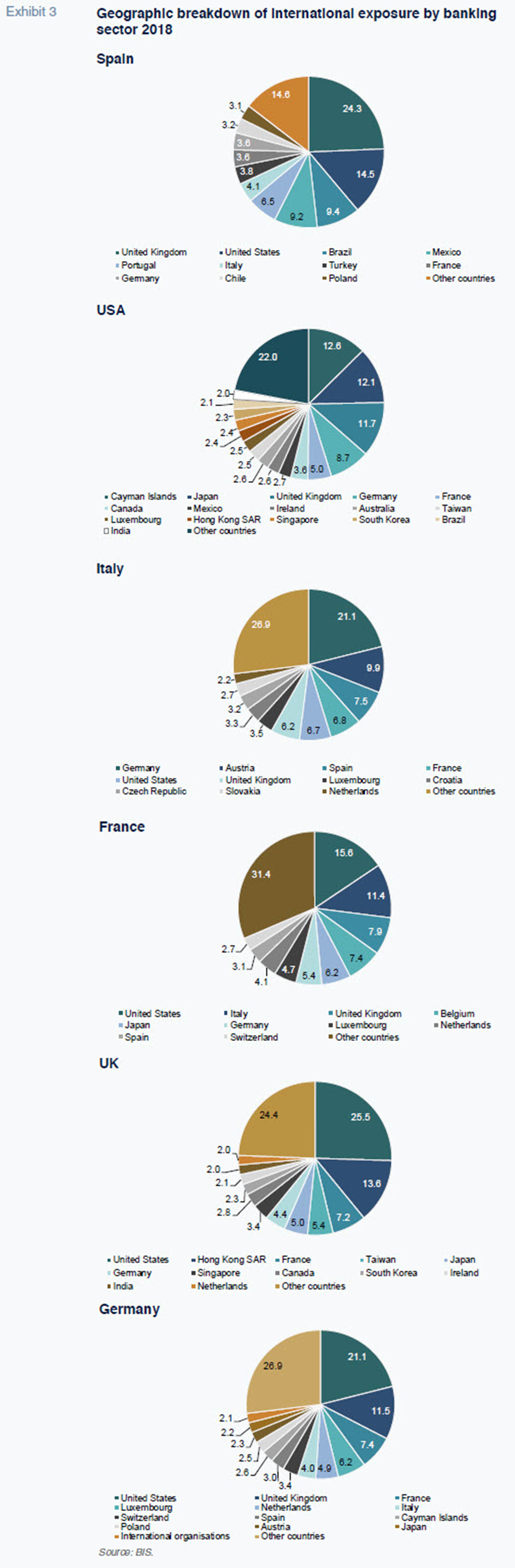

As shown in Exhibit 3, three countries account for nearly half of Spanish banks’ international business (the UK, US and Brazil), with five representing nearly two-thirds (adding in Mexico and Portugal). The breakdown of the Spanish banking sector’s exposure to these countries is as follows: 24.3%, UK; 14.5%, US; 9.4%, Brazil; 9.2%, Mexico; and 6.5%, Portugal. Additional jurisdictions with percentages of over 2% include Italy (4.1%); Turkey (3.8%); France (3.6%); Germany (3.6%); Chile (3.2%) and Poland (3.1%). The other countries (Spain has investments, albeit marginal in as many as 165 countries) comprise the remaining 14.6%. The eurozone accounts for 22.5% of Spain’s international investments.

Given that the UK is the country to which Spanish banks are most exposed, it is logical that uncertainty over Brexit has fed concerns over the potential impact on Spain’s economy in general and its banking sector in particular. The UK’s share of 24.3% of all of Spanish banks’ overseas business represents around 383 billion euros.

There are other countries where uncertainty has also spread to the banking sector. This includes Turkey, whose currency has depreciated sharply, and Argentina, which is in recession and the subject of an IMF bailout. However, at 59 billion euros in Turkey and 21 billion euros in Argentina, this exposure is much smaller than Spanish banks’ position in the UK.

Changes in the geographic breakdown of Spanish banks’ overseas investments

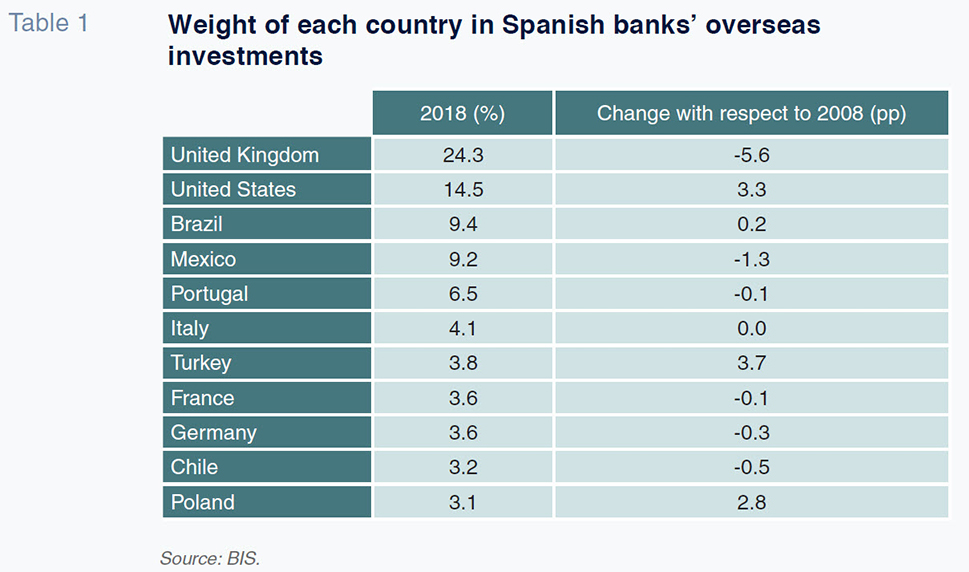

Has the geographic breakdown of Spanish banks’ overseas investments shifted in the wake of the crisis? If we compare the current breakdown with that of 2008, focusing on exposures of over 2%, we observe a significant reduction in exposure to the UK, which has gone from 30% in 2008 to 24.3% in 2018. Exposure to Mexico has also declined from 10.5% to 9.2%, while Venezuela has dropped off the 2% threshold list from 2.1% to 0.1%. On the other hand, Turkey has gained in importance. It now accounts for 3.8% of Spanish banks’ exposure compared to barely anything in 2008. Similar developments have occurred in the US (+3.3 percentage points) and Poland (+2.8 percentage points).

If we use the Herfindahl index once again to measure the geographic diversification of the banking industry, we note how diversification increased between 2008 and 2018, with the index decreasing by 229 percentage points.

International expansion and earnings performance

An intuitive way of analysing the benefits of international expansion for the banking sector is to compare the financial soundness indicators of the consolidated groups with those of the individual entities. The ECB offers the former figures for a sample of entities that includes virtually the entire Spanish banking sector. For the latter information, the Bank of Spain publishes the balance sheets and income statements of the deposit-taking entities for their domestic businesses.

In 2018, the consolidated assets of Spanish deposit-takers amounted to 3.55 trillion euros, which is 42% greater than the business in Spain. In absolute terms, that translates into a difference of around 1.05 trillion euros.

The best indicator of the benefits generated by international expansion and geographic diversification relates to profitability. Specifically, the consolidated groups consistently present higher profitability than the Spanish business in terms of both return on assets (ROA) and return on equity (ROE). In the first instance, the profitability gap was at one point very wide, particularly during the years of crisis in which Spanish banks, whose home market businesses were highly exposed to the real estate crash, had to write down millions of euros of impaired assets. The most recent figure dates from 2018 and points to an ROA for the consolidated groups 24% above that of the business in Spain (0.61% vs. 0.49%). As for ROE, the difference between the consolidated groups and the individual entities is similarly large, standing at 43% in 2018 (8.2%

vs. 5.7%).

Analysing the banks’ various income statement margins, it becomes clear that the net interest margin is the most significant factor in explaining the higher profitability of the consolidated groups. Whereas before the 2008 crisis the net interest margin including overseas businesses was 38% higher than that earned in the domestic business, since 2015, the consolidated groups’ margin has been over twice that of the individual entities. Notably, the margin in Spain has been heavily influenced by the decline in EURIBOR, the benchmark rate most widely used in loans extended in Spain, which has fallen significantly. As a result, the net interest margin has declined by 22% since 2008 to 0.93% in 2018. In contrast, the consolidated groups’ net interest margin has increased by 23% to 2.01% in 2018, which is 116% above the margin earned in the domestic business.

Although the net interest margin contracted in Spain between 2008 and 2013 in parallel with the downtrend in the EURIBOR, it has since remained relatively constant as EURIBOR has continued to fall. Moreover, since EURIBOR entered negative territory in 2016, the net interest margin has remained steady, even widening slightly in 2018. This suggests that Spanish banks have been able to navigate the complex terrain of ultra-low rates. The defence of their margins is a prerequisite for profitability recovery and business viability.

Turning to banks’ other revenue streams (dividends, fees and commissions, trading income, etc.), their weight in assets is not significantly different looking at the domestic business on a standalone basis and when factoring in the overseas business. Between 2009 and 2015, the weight of those revenue sources was somewhat higher in the case of the consolidated groups, but since then it has increased on the domestic business side, standing at 0.98% vs. 0.80% in 2018.

Given that the net interest margin increases sharply when the overseas business is considered and the fact that the weight of other sources of revenue is not very different between the consolidated groups and domestic business, the gross margin is much lower in Spain. Specifically, in 2018, the gross margin including banks’ overseas businesses was 47% higher (2.81% vs. 1.91%).

Similarly, there is no major difference in efficiency, using the cost-to-income ratio as our proxy. Efficiency has deteriorated in recent years in both cases. Despite efforts to reduce costs, the gross margin has been falling faster.

Takeaways from international expansion

- The crisis has had a much bigger impact on the Spanish banking business and the net interest margin in Spain has suffered the consequences of the downtrend in eurozone interest rates. Nevertheless, the sizeable difference in the net interest margin for those banks with overseas business (in 2018: NIM of 0.93% in the domestic business vs. 2.01% adding in the overseas business) has enabled the consolidated groups to consistently present higher profitability than they attain in Spain, evidencing the importance of their international strategies.

- In 2018, the ROE including the business of the overseas subsidiaries, was 43% higher than that of the domestic business (8.2% vs. 5.7%). Thus, although the banks are still not delivering the returns investors require in either instance (the cost of capital is estimated at 10%), the problem is greater in the domestic business, where margins are under tremendous pressure from the ECB’s long-standing, ultra-low benchmark rates. Having businesses exposed to different benchmark rates reinforces the benefits of geographically diversifying the banking business.

- Although ad-hoc risks have taken a toll on some of the banks, the diversification of their investments across several countries has mitigated that cost, providing strong evidence in support of the premise that diversification reduces risk, all this despite the fact that the Spanish banks’ overseas investments are less geographically diversified than the US or other major European banking sectors.

- The international expansion strategy pursued by Spanish banks through foreign subsidiaries that are independent of their parent has benefits for the home country banks by minimising and ring-fencing risks. Although this multinational banking strategy (via subsidiaries) is more costly than the alternative of pursuing business abroad via cross-border activities (conducted by the parent), it has proven more profitable on account of the higher margins earned abroad. [2]

- Looking forward, risk diversification via the internationalisation of the banking business requires, from the European perspective, completion of the Banking Union with a common deposit guarantee scheme. A single market for banking would also stimulate cross-border mergers within Europe, reinforcing the level of integration, which the recent crisis had stymied. Moreover, cross-border mergers avoid increasing concentration in home markets, making them more desirable from an anti-trust standpoint. What is evident is that the drop in cross-border activity in the European Union (including a decline in the number of cross-border mergers) is an indicator that the market is not integrated and that there are multiple barriers to such integration that need to be dismantled (tax, legal, bureaucratic, etc.), as expressed by the ECB. However, even if those barriers are eliminated, integration will not advance unless the differences in the health of the various European banking sectors are reduced (such as differences in NPL ratios, efficiency, profitability, capital adequacy, etc.), this perhaps being the main reason why some countries do not want to mutualise risks, a prerequisite for the completion of the Banking Union.

Notes

This paper falls under the scope of research project ECO2017-84828-R under the Spanish Ministry of the Economy, Industry and Competitiveness.

References

ARGIMÓN, I. (2019). Spanish banks’ international strategy: characteristics and comparison, Economic Bulletin, 1/2019. Analytical Articles. Bank of Spain.

EUROPEAN CENTRAL BANK. (2017). Cross-border banking in the euro area since the crisis: what is driving the great retrenchment? Financial Stability Review, November 2017 – Special features, pp. 145-157.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF