Spain’s current slowdown: Reduced real estate and financial risks

The Spanish economy is entering a period of slower growth compared to the rate of expansion experienced in recent years. Nevertheless, close analysis shows that growth in credit and real estate risks is not accompanying this economic slowdown, with both types of risks having eased considerably since 2009.

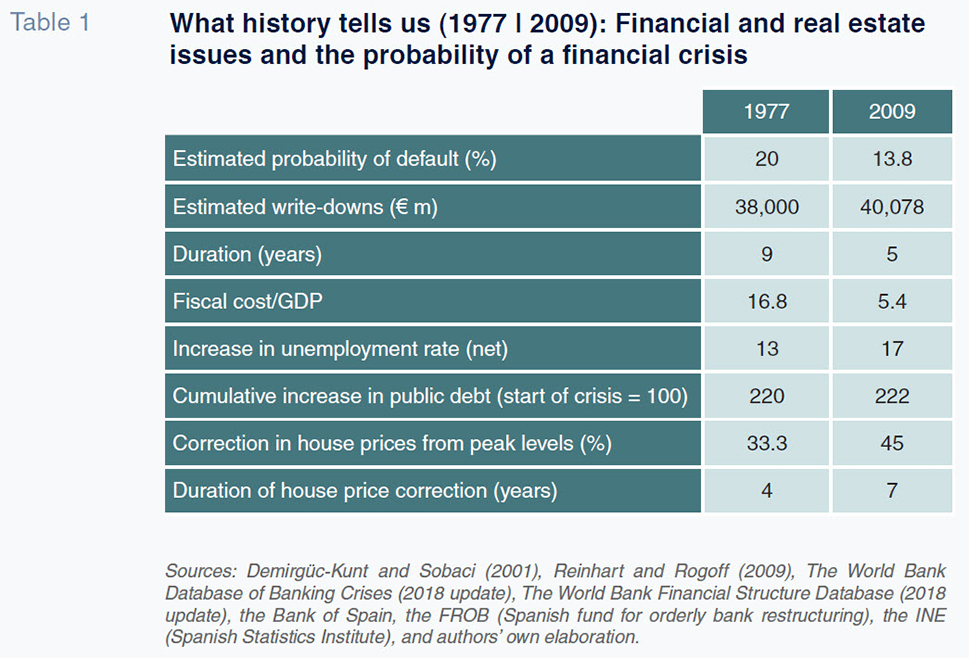

Abstract: In its World Economic Outlook report in October 2019, the IMF noted a considerable slowdown in the eurozone, with growth in Spain expected to ease to 1.8% in 2020. While there is no indication that a recession is looming, emerging economic dynamics suggest credit and real estate risks should be watched closely. Typically, growth in both these risks has accompanied financial crises in Spain. For example, the estimated probability of default in 1977 and 2009 was 20% and 13.8%, respectively, while the correction in house prices from peak levels stood at 33.3% and 45% for both those years. Interestingly, contemporary data show moderate price level growth in Spanish real estate compared to the run-up to the recent financial crisis, suggesting the real estate market does not pose a risk of amplification in the face of the anticipated cyclical slowdown of the Spanish economy. Furthermore, lending to both businesses and households has remained timid since 2017. Still, concerns have focused on Spain’s public debt, which is equivalent to 98% of GDP. Taken together, these data suggest Spain is headed for a soft landing alongside that of the global economy.

Introduction

In a global economic environment dominated by monetary flows and the memory of the recent financial crisis, any reference to terms such as “contraction” or “recession” sparks fear and weighs adversely on household and corporate expectations. However, semantic nuances are extraordinarily important in this context, both in interpreting the main global macroeconomic projections and predicting what could happen in each country. In the case of Spain, most of the estimates suggest a looming slowdown, without any signs, for the time being, of risks indicative of a contraction or recession. Nevertheless, slower growth with GDP headed to below 2% does raise a series of questions: How prepared is the economy for finding its way back to stronger growth? What pace of job creation can we expect to see with easing economic activity? And, above all, are there risks of a darker economic outlook or fresh crisis? Assuming the probability of the latter scenario materialising is very low, this paper outlines the financial and real estate conditions that have typically spurred episodes of intense financial instability (most notably the crises of 1977 and 2009), comparing them with those prevailing in Spain today.

[1]

The IMF published its latest World Economic Outlook report on October 15th. It states that: “After slowing sharply in the last three quarters of 2018, the pace of global economic activity remains weak. Momentum in manufacturing activity, in particular, has weakened substantially, to levels not seen since the global financial crisis. Rising trade and geopolitical tensions have increased uncertainty about the future of the global trading system and international cooperation more generally, taking a toll on business confidence, investment decisions, and global trade. A notable shift toward increased monetary policy accommodation-through both action and communication-has cushioned the impact of these tensions on financial market sentiment and activity, while a generally resilient service sector has supported employment growth. That said, the outlook remains precarious.”

In that context, the IMF cut its forecasts for global GDP growth for 2019 to 3%, the lowest level since 2008 and a 0.3 percentage point downgrade from April 2019. Nevertheless, the IMF expects that growth will “pick up to 3.4% in 2020 (a 0.2 percentage point downward revision compared with April), primarily reflecting a projected improvement in economic performance in a number of emerging markets in Latin America, the Middle East, as well as both emerging and developed markets in Europe that are under macroeconomic strain”. However, the Fund is not ruling out a weaker scenario, noting that: “with uncertainty about prospects for several of these countries, a projected slowdown in China and the United States, and prominent downside risks, a much more subdued pace of global activity could well materialise”.

Taking a closer look at the eurozone, the IMF is projecting growth of 1.2% in 2019 and 1.4% in 2020. The report notes that: “the outlook is also slightly weaker for Spain, with growth projected to slow gradually from 2.6% in 2018 to 2.2% in 2019 and 1.8% in 2020 (0.1 percentage points lower than in April)”. Overall the figures point to a considerable slowdown in the eurozone, which will also be felt in Spain, albeit somewhat less intensely.

The IMF also refers to room for fiscal manoeuvring relative to debt levels, stating that: “In countries with high debt, including France, Italy, and Spain, fiscal buffers should be rebuilt gradually while protecting investment”. Those debt issues risk becoming more dangerous –in the context of downside risk to GDP growth– when they spread to the private sector. In that regard, Spain appears to have made significant progress. On October 15th, the Bank of Spain published its financial accounts for the economy, highlighting in its press release that: “the consolidated debt of Spanish companies, households and non-profit institutions serving households stood at 1.62 billion euros as of the second quarter of 2019, which is 132.1% of GDP, 5.2 percentage points below the previous year. The consolidated debt of the non-financial firms was equivalent to 73.4% of GDP and that of households and NPISHs 58.6%.” One day later, the IMF published its Global Financial Stability Report, in which it said the following with respect to Spain: “In some countries that were hit the hardest by the global and euro area financial crises, such as Ireland and Spain, household debt has now moderated, and house prices have fallen in real terms.”

It is worth highlighting the fact that prolonged contractionary episodes which involve credit and real estate issues are the most damaging and

those most likely to generate more severe crises. Those problems are absent today. By way of reference, Table 1 provides a series of indicators from the last two major financial crises in Spain, those of 1977 and 2009, gleaned from several international databases used in various studies about global financial instability.

Using non-performing loans (NLP) as a proxy, data show that during the last two major crises in Spain, the probabilities of default were high (particularly in 1977). The NPL ratio in Spain has been trending lower for six years in a row now and the outlook is for further improvement. Moreover, the fiscal cost (including bailouts, aid and other contingent or quasi-fiscal liabilities, such as guarantees) reached 16.8% in 1977 and an estimated 5.4% during the last crisis (according to the World Bank). The economic consequences were more diverse. The unemployment rate shot up a net 17 percentage points during the last crisis, while house prices corrected by 45% over a six-year period. However, all of these risks (unemployment, credit quality and house prices) have since dissipated. Public debt levels are perhaps the most pressing concern, as well as posing the biggest challenge going forward

Recent trends in the sources of financial and real estate risk

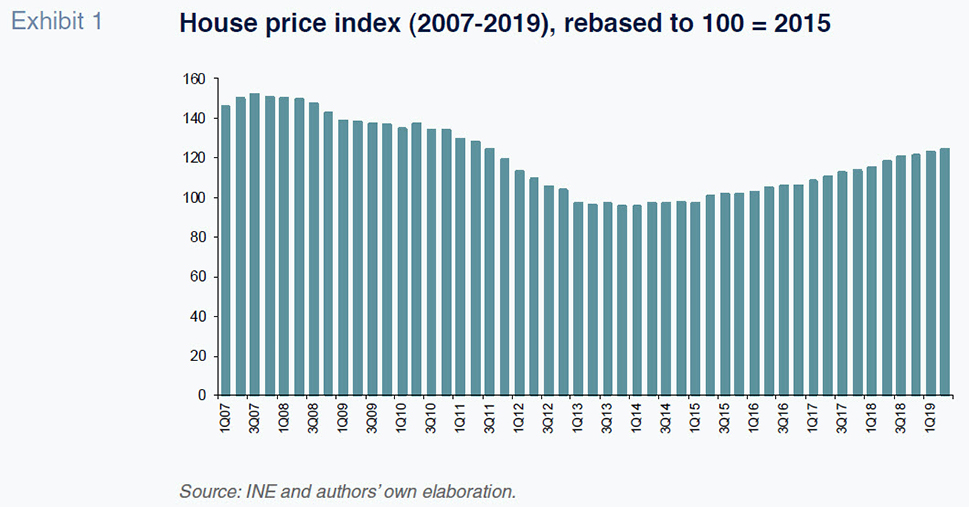

If there is one common denominator in the recent major financial crises in Spain, it is the build-up of imbalances in the real estate sector. Exhibit 1 depicts the trend in the National Statistics Institute’s house price index between 2007 and 2019 (until 2Q19, the latest figure available), rebased to 2015 levels. It reveals a considerable correction in house prices between 2007 and 2013, followed by a phase of normalisation, with prices holding at moderate levels until 2015. Since then, prices have been trending moderately higher. Evidence available for 2019 points to a slowdown in price growth, suggesting that demand for housing is easing. This indicates considerably more moderate price levels compared to those observed in the run-up to the crisis. It does not appear that the real estate sector is producing risks that could jeopardise the outlook for a soft landing for the economy as a whole.

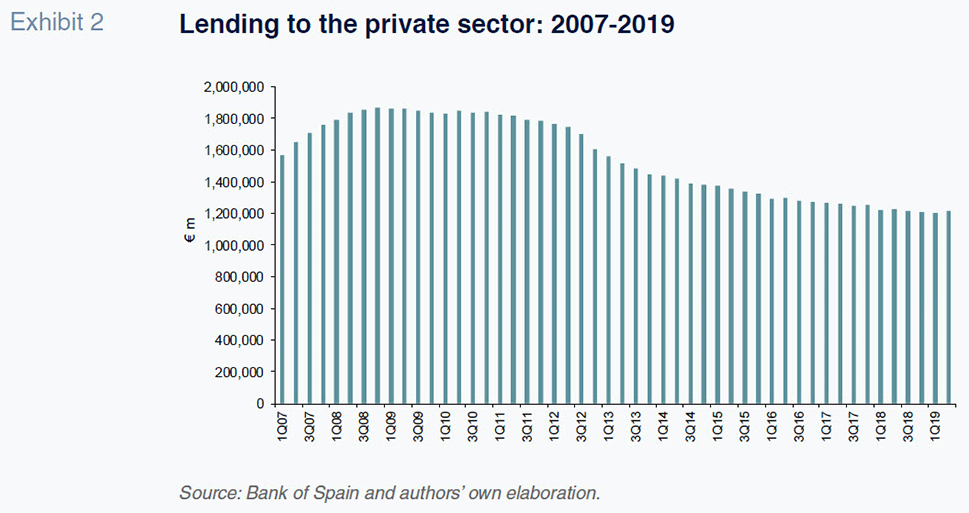

If moderation is the word that best describes the Spanish real estate market’s situation, stagnation is the term that captures the state of health in the lending industry, as depicted in Exhibit 2. The volume of loans extended to households and companies fell almost continually between 2010 and 2017. Since then, there has been timid growth in business lending (particularly to SMEs) and only scant growth in loans to households (driven mainly by consumer finance). Those trends suggest we are a long way from a credit bubble. Indeed, funding markets have not shown a great degree of liveliness. This situation constitutes a source of concern for the monetary authorities, due more to the lack of activity than any excess thereof.

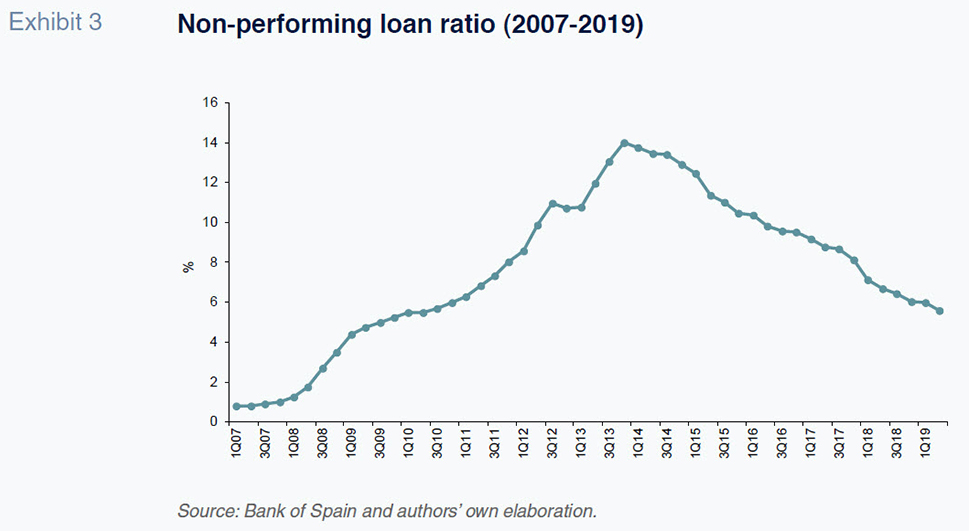

Regardless, the risks on the credit side are more related to quality than volume. Exhibit 3 shows how financial institutions’ NPL ratio has come down significantly from the peak of 13.9% in 2013 to 5.6% by the second quarter of 2019. The size of the reduction evidences both the effort made to reduce exposure to impaired assets, the legacy of the last crisis, as well the improving creditworthiness of new loans.

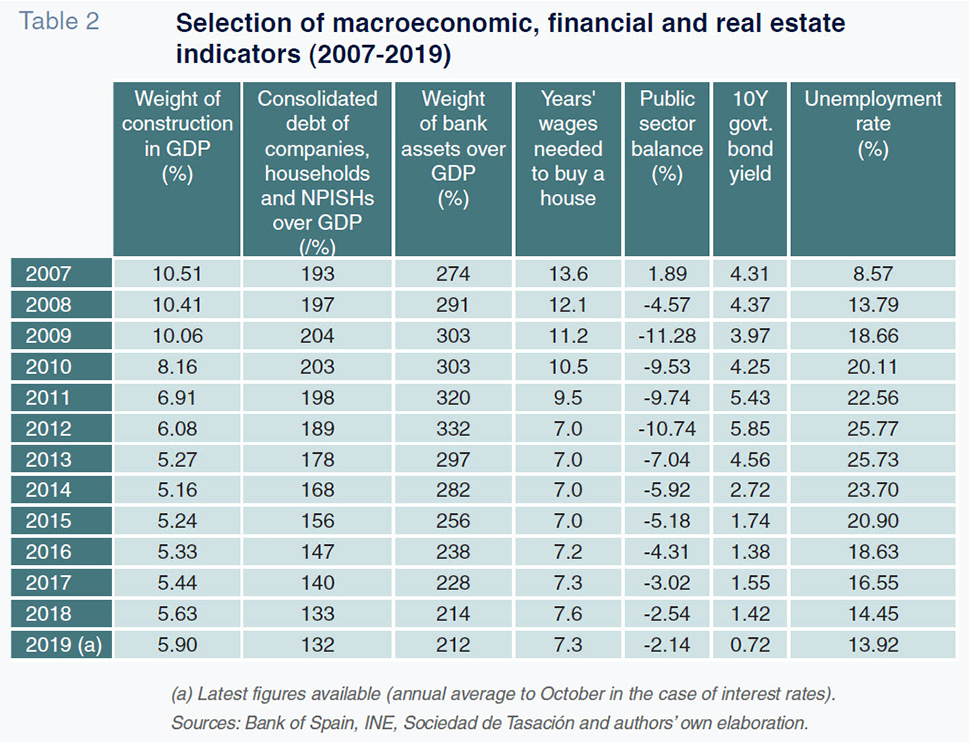

How have the main financial and real estate risks evolved between 2009 and 2019? Table 2 shows the trend over time for a universe of relevant indicators. Note that the construction sector accounted for over 10% of GDP when the crisis reached Spain. In 2019, it represents 5.90%, a level at which it has been fairly stable in recent years.

As for corporate and household borrowings over GDP, the figures show significant deleveraging by the private sector, from 204% of GDP in 2009 to 132% as of the second quarter of 2019.

In parallel with the deleveraging undertaken by households and companies, the banking sector has downsized: consolidated assets have gone from the equivalent of 332% of GDP in 2012 –in the midst of the sovereign debt crisis– to 212% in 2019.

The moderation in real estate prices is also obvious in the housing affordability indicators. Although this aspect requires looking at a broad spectrum of indicators (including the geographic location of the stock of housing and prices by region), the average wage requirement for buying a house has declined from 13.6 years in 2007 to 7.3 in 2019.

Spain’s public debt burden must still be addressed. Following a surplus in 2007, the fiscal requirements generated by the crisis drove a wedge in the public finances, with the public deficit peaking at above 10% in 2012. Although considerable progress has been made on reining in the deficit, Spain’s public debt is equivalent to 98% of GDP, according to the Bank of Spain (as of August, latest figure available). For the time being, that debt is being financed at a low cost, as the bond repurchases by the ECB and prevailing low interest rates in general have driven the yield on public debt down to 0.72% on average in 2019 (to October).

It is also worth highlighting that the unemployment rate, a leading indicator of credit quality, continues to come down in Spain, 13.92% by the third quarter of 2019. This is after having peaked at over 25% during the sovereign debt crisis in 2012 and 2013.

Barring the scant margin for fiscal stimuli as a result of the public debt burden, Spain appears to be headed for a soft landing as anticipated for the global economy, unrestrained by the key amplifying risk factors: credit and real estate.

Conclusion: A slowdown marked by fewer real estate and credit risks

This paper analyses the financial and real estate risk factors characteristic of the last two major crises in Spain compared to today. The main conclusions are:

- The anticipated economic slowdown is expected to be less pronounced in Spain than in the rest of the eurozone and is unlikely to be accompanied by exacerbating credit or real estate risks.

- The last two major crises in Spain (1977 and 2009) were marked by credit (private sector) and house price bubbles. The slowdown currently unfolding in Spain does not indicate the presence of similar risks. In fact, lending activity is stagnant, with growth, albeit scant, in just a few specific segments (SMEs, consumer loans). Additionally, the weight of the construction sector in GDP has been reduced and remains stable and real estate prices are increasing along a very moderate path.

- One of the main reasons for the reduction in financial risks since the last crisis is the considerable delveraging effort made by the household and corporate segments, whose borrowings have declined by 72 percentage points of GDP since 2010.

Overall, the Spanish economy is heading into a cyclical slowdown in which neither credit nor house price risks appear to represent potential sources of amplification. Nevertheless, the relationship between public and private debt and possible changes in borrowing costs as a result of a shift in monetary policy in the medium and long term probably remain the biggest challenges and sources of uncertainty for both Spain and the global economy.

Notes

Note that the analysis contained in this paper cannot and does not purport to encompass the possibility of episodes of financial instability in the international arena in the coming months or years. There are well-documented risks, primarily associated with accumulation of debt and both its riskiness and sustainability, which need to be duly managed and monitored. However, they are not the direct subject of the analysis performed in this article.

References

Santiago Carbó Valverde. CUNEF, Bangor University and Funcas

Pedro Cuadros Solas. CUNEF and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas