Opening up of the Spanish economy: Recent performance and pending reforms

Economic growth in Spain has been accompanied by a marked increase in trade and openness. Nevertheless, there are challenges associated with the internationalisation of Spain’s economy, including a deteriorating trade balance within the context of a slowdown in global growth and trade, together with increased protectionism and uncertainty over the fate of existing trade relationships.

Abstract: The international expansion of Spanish companies as well as the broader Spanish economy between 2000 and 2018 is generally viewed as a success. In relative terms, Spanish exports kept pace with the growth in German exports over the same period, while significantly outperforming export growth in Italy and France. Data also indicate that the Spanish economy is now more open than either the Italian or French economies. Nevertheless, there are risks and challenges associated with the internationalisation of Spain’s economy. Some challenges, such as the deficit in the balance of trade in goods and the tendency for micro-enterprises (fewer than 10 employees) to dominate the export market, have been longstanding. However, new risks have also recently emerged. While export indicators are slowing sharply, many of the world’s largest economies are turning inwards and questioning the pre-existing model of international trade based on predefined and predictable rules. It is in this context that it becomes essential for Spain’s companies to improve their level of competitiveness and overcome barriers to further international expansion.

Introduction

Foreign trade has made a vital contribution to overcoming the economic and financial crisis which broke out in Spain in 2008. Notably, in the period since the crisis, we have witnessed a phenomenon not observed in nearly five decades. Since 2014, the Spanish economy has registered growth of over 3% without incurring a trade deficit (Myro, 2018). That trend suggests a degree of structural improvement in the Spanish economy. Insofar as the economy’s sources of growth become more diversified and external demand relatively more important, the economy becomes less dependent on internal demand, thus etching out a more sustainable growth trajectory.

Such a scenario is consistent with an increase in the economy’s openness. The role of the international markets as a source of growth has been consistently increasing for both the Spanish and European economies (Torres, 2019). For this reason, it is important to analyse the recent trend in the Spanish external sector and consider the main barriers to further expansion abroad.

This analysis comes at a time when the international economic environment, and more worryingly, the international institutional architecture itself, are showing significant signs of instability (Feás and Steinberg, 2019; Torres, 2019). The forecasts for growth in global GDP and trade have been revised downwards and significant questions about the basic rules of international trade linger. In this uncertain environment, it is all the more important to analyse the recent trend in and outlook for the Spanish external sector, along with the corresponding reforms that remain outstanding.

Recent trends

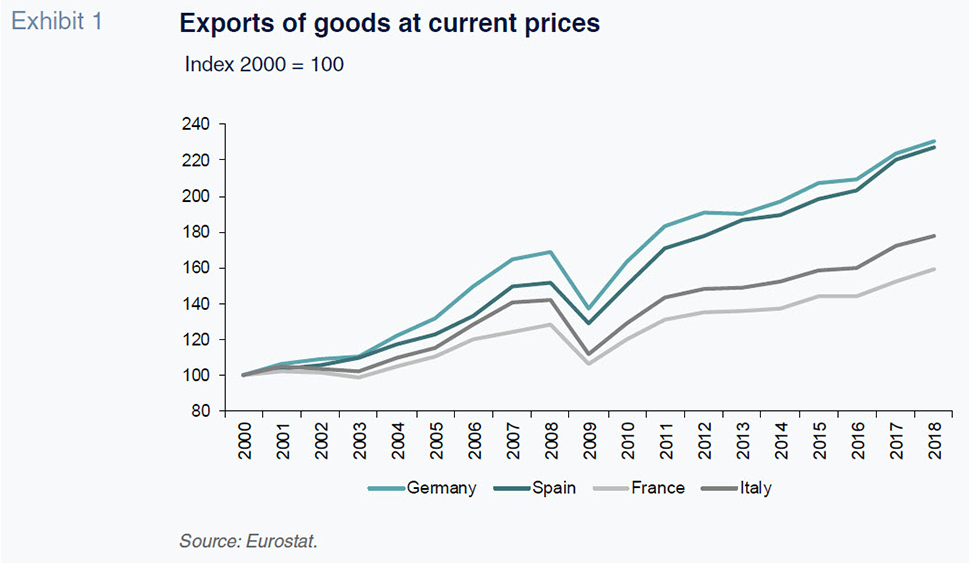

Spanish exports have performed exceptionally well since 2000 in comparison with the four major eurozone economies (Germany, France, Italy and Spain). Exhibit 1 shows total exports of goods at current prices rebased to 2000 values. It reveals that Spanish exports have grown the second fastest (behind only Germany, Europe’s export powerhouse), with growth taking off from 2010. In fact, at current prices, Spanish exports grew by nearly as much as German exports between 2000 and 2018.

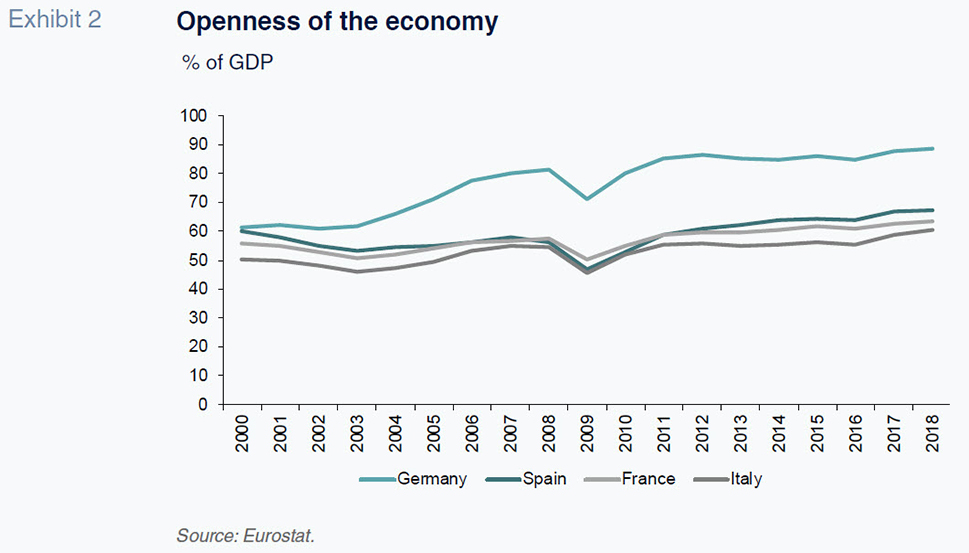

The expansion of international trade is also evident in the increased level of openness of the Spanish economy. Exhibit 2 depicts that openness (exports plus imports measured over GDP) for the same group of four countries. It shows that Spain is the second most open country among the major eurozone economies. The Spanish economy increased its openness by just over 7 percentage points of GDP between 2000 and 2018, from 60.1% to 67.5%.

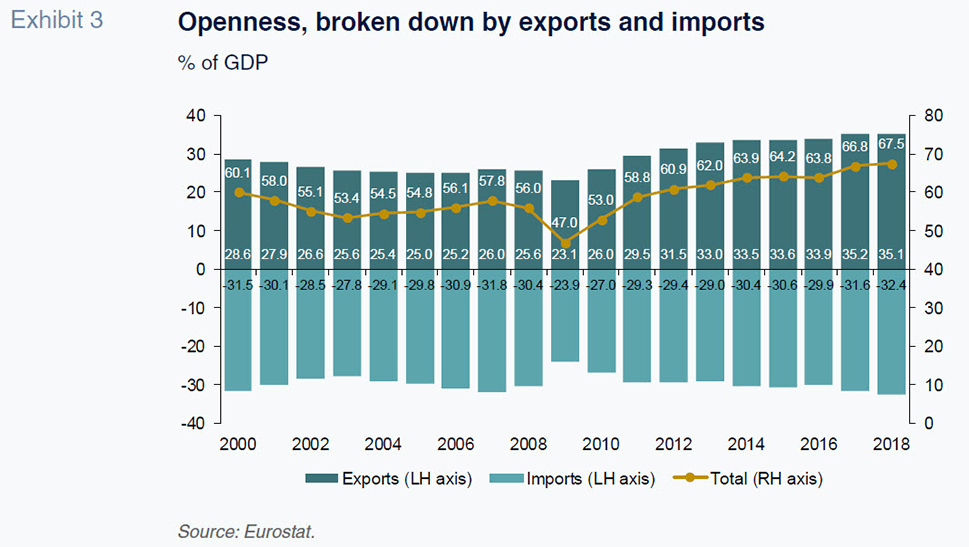

Exhibit 3 breaks down this openness into two components (exports and imports over GDP).

It shows that of the more than seven percentage point increase in its openness, less than one percentage point corresponds to the increase in imports; the bulk corresponds to the increase in exports.

These figures suggest that the international expansion of the Spanish economy has had a positive impact from a macroeconomic perspective. Next, we analyse other components of Spain’s expanding trade activity.

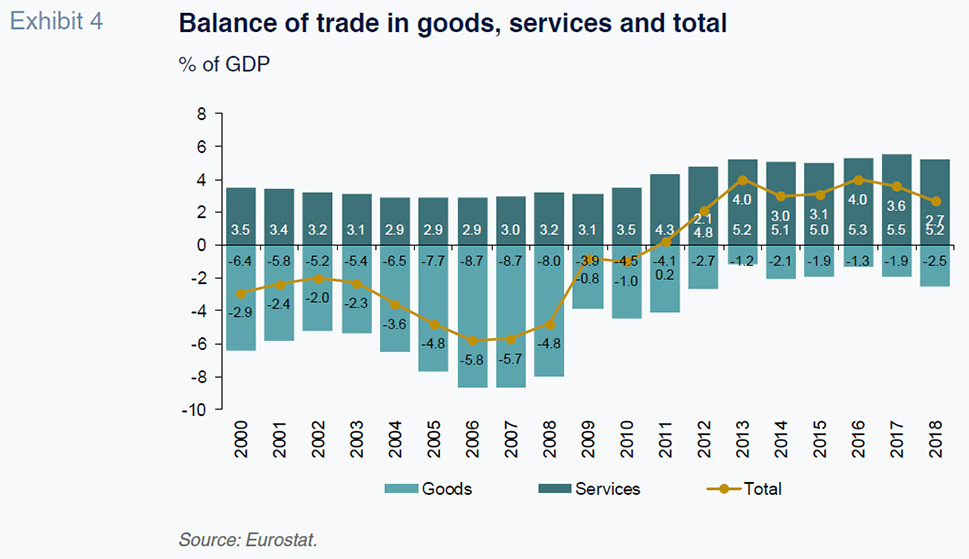

Exhibit 4 shows the overall balance of trade and the balances for goods and services.

Firstly, it is worth noting that although the trade balance (exports less imports) improved substantially between 2006 and 2013, moving from a deficit of 6% of GDP to a surplus of 4%, that trend halted in 2013. In fact, for the last two years for which these data are available (2017 and 2018), the trade balance has deteriorated year-on-year.

Secondly, as shown in Exhibit 4, the balance of trade in goods has never been in surplus. This is mainly due to the energy trade deficit. As a result, the overall trade surplus relied entirely on the strong contribution by service exports (tourism and related sectors).

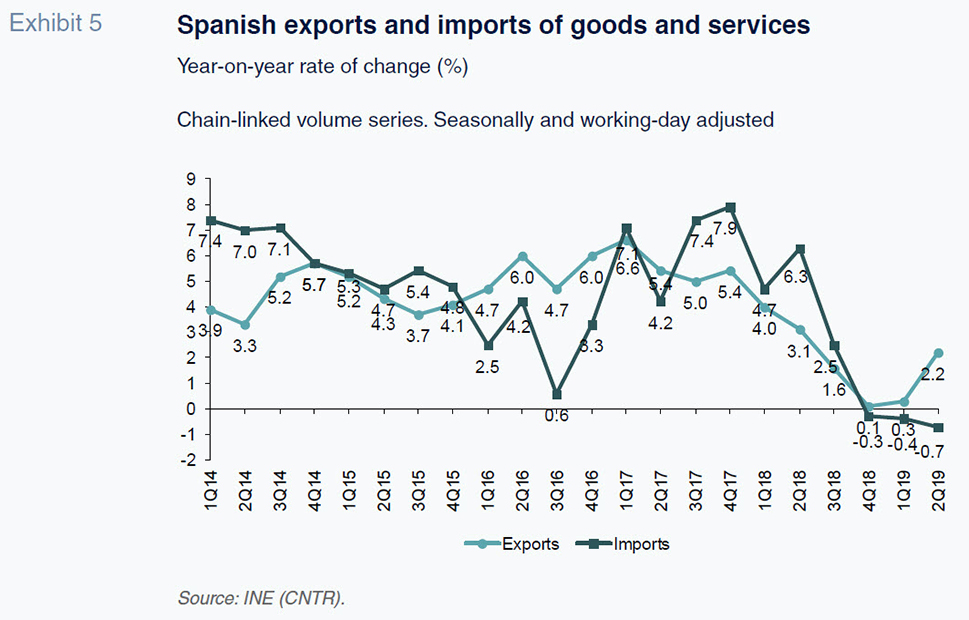

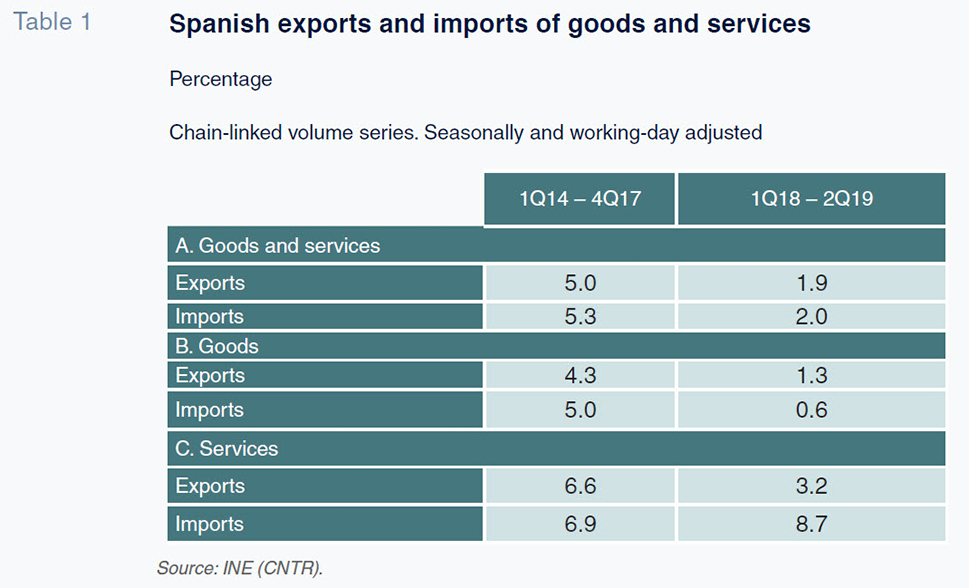

Thirdly, Exhibit 5 analyses the year-on-year trend in exports and imports in real terms (movements in the chain-linked volume series) between the first quarter of 2014 and the second quarter of 2019 (latest figures available). Table 1 presents the average year-on-year growth in two consecutive sub-periods: from the first quarter of 2014 to the fourth of 2017; and from the first quarter of 2018 to the second of 2019.

This analysis shows the rate of real growth in exports having slowed sharply during the second sub-period, with the pronounced slump in growth in goods exports especially noteworthy. After posting average year-on-year growth of 4.3% between 2014 and 2017, goods exports have grown at less than a third of that rate (1.3%). This loss of exporting momentum has driven the overall rate of growth in goods and service exports down from 5% to 2%. As shown in Exhibit 5, for the last two quarters for which we have information (the first two quarters of 2019), growth in exports has picked up again. Equally significant is the fact that since mid-2018, the rate of growth in imports has fallen steadily, so that in the first two quarters of 2019, Spanish imports declined in real terms for the first time since their post-crisis recovery.

It is highly likely that the economic environment and international political climate are at least partially responsible for these fluctuations. Thus, it will be important to pay attention to the trend in real export growth over the coming months.

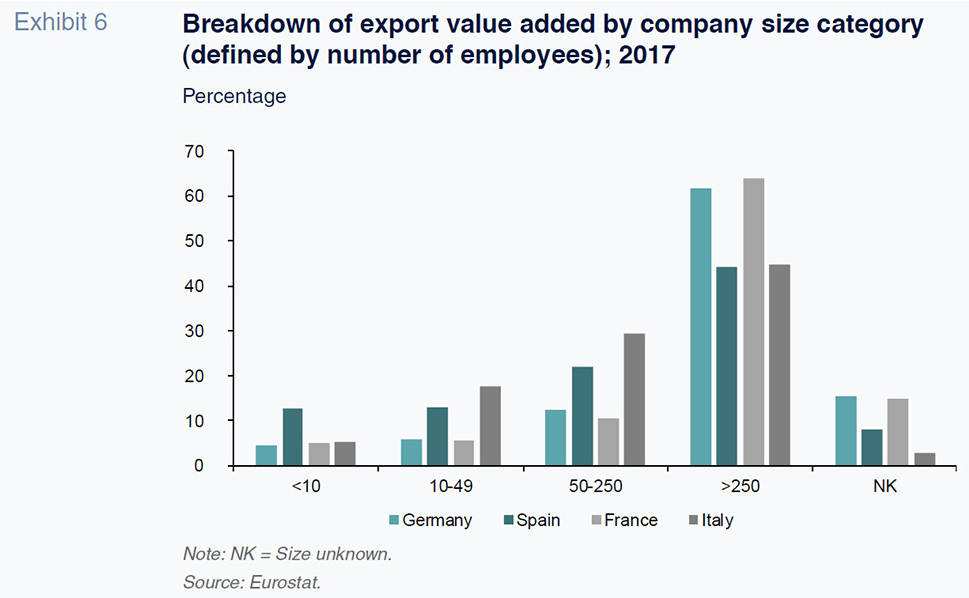

Lastly, the landscape of exporting firms in Spain is markedly different in structure in comparison with the main eurozone economies. Exhibit 6 provides the breakdown of the value added of exporting firms by company size, measured by the number of employees. That breakdown shows that micro-enterprises (firms with fewer than 10 employees) are over-represented in Spain. While in the other three economies, micro-enterprises account for a share of between 3% and 5% of value added in exports, in Spain these small-sized companies account for 13%. Micro-enterprises tend to face a series of issues in terms of competitiveness and the ability to innovate and/or raise funding. The over-representation of (relatively) small-sized companies in the export chain is similarly displayed in the next two company size categories.

Internationalisation today: Context and barriers

As already noted, the loss of export momentum in Spain is largely attributable to the new international context. In the first part of this section, we outline the contributing macroeconomic or environmental factors. In the second part, we allude to the various barriers to international expansion facing Spanish companies. These may weigh more heavily on the smaller-sized enterprises which, as we have shown, contribute an atypically high share to the value added in exports. We consulted a range of sources for this section (Xifré, 2014, 2017, 2018; Ministry of Industry, Commerce and Competitiveness, 2017; De Lucio et al., 2018; Feás and Steinberg, 2019; Torres, 2019).

Factors defining the new international and institutional landscape in which Spanish exporting firms are operating

- A crisis, or at the very least uncertainty, regarding the outlook for multilateralism and international trade relations based on relatively stable and predictable rules.

- The growing importance of decision-making that factors in the global value chains (GVCs) and the growing complexity of those chains, with the dividing line between manufacturing and services becoming increasingly blurred.

- New formulae for doing business internationally and new competitiveness factors, often based on digital platforms and online commerce.

- A diversity of players invested in supporting the international expansion of the Spanish economy and its companies: the central government, the regional governments, certain EU initiatives and even the occasional private or public-private initiative. A growing need for coordination among these players.

Key barriers to international expansion by Spanish enterprises

- Internal barriers – These can be summed up as the scarcity or weakness of two types of factors:

- Resources: human resources, knowledge, skills and financing.

- Competitiveness, specifically price-cost competitiveness (productivity, efficiency and all manner of costs, including energy, labour, utilities, etc.) as well as other drivers of competitiveness (product quality, differentiation, technology intensity levels, post-sales service, etc.).

- External barriers – Although these factors have a very significant effect on exporting success, companies have limited influence over them, at least when acting alone:

- Ability to obtain reliable, relevant and up-to-date information about destination markets; ability to pinpoint value-adding business opportunities.

- Ability to overcome barriers to accessing destination markets; business negotiations.

- Access to a network of reliable and value-adding business relationships: customers, suppliers, trade partners, etc.

Conclusion

The opening up of the Spanish economy since the advent of the euro in 2000 can, judging by the trend in certain key metrics, be described as a success. Between 2000 and 2018, Spanish exports, measured at current prices, grew by nearly as much as German exports. This is almost 30% more than

Italian exports and 40% more than French exports. Of the four major eurozone economies, the Spanish economy presents the second highest level of openness to international markets. The increase in the level of openness of the Spanish economy between 2000 and 2018 is mainly attributable to relative growth in exports, and only very marginally to growth in imports.

Nevertheless, both the Spanish economy and Spanish firms face several challenges. For one, the aggregate trade surplus is still reliant on receipts from tourism, as the balance of trade in goods remains chronically negative (largely due to the perennial deficit in energy goods). As for the corporate landscape, Spanish micro-sized exporting firms (with fewer than 10 employees) continue to generate 10 times more value added than the companies in this size category in other major eurozone economies. Lastly, in recent quarters, real growth in exports and imports has slowed perceptibly.

The slump in Spanish trade comes at a time when globalisation is in question, in part due to the protectionist measures taken by certain states. Unfortunately, there are signs that these changes may amount to more than a cyclical slowdown. It is plausible that the very model of trade relations based on stable and predictable rules is in crisis. All of this makes it more important than ever for the Spanish companies that do business abroad to modernise by overcoming long-standing challenges but also by striving to position themselves strategically vis-à-vis emerging trends. There is also a growing need for a more meaningful contribution and coordination by all actors, including the public sector, as well as public and private entities.

References

FEÁS, E. and STEINBERG, F. (2019). Elcano Report 26. La política comercial europea ante un entorno internacional cambiante [European trade policy vis-a-vis a shifting international environment]. Elcano Royal Institute.

DE LUCIO, J., MÍNGUEZ, R. and MINONDO, A. (2018). Is Spain experiencing an export miracle? Spanish and International Economic Outlook, 7 (4), July.

MINISTRY OF INDUSTRY, TRADE AND COMPETITIVENESS. (2017). La estrategia de internacionalización de la economía española 2017-2027 [The Spanish economy’s international expansion strategy, 2017-2027].

MYRO, R. (2018). The sustainability of Spain’s trade surplus. Spanish and International Economic Outlook, 7(6), November.

TORRES, R. (2019). Volume-led growth in the euro area: Benefits and costs. Spanish and International Economic Outlook, 7(6), November.

XIFRÉ, R. (2014). La internacionalización en la base de la pirámide empresarial española : análisis y propuestas [Spanish internationalisation from the perspective of company size: Analysis and proposals]. Working Papers, 189. Fundación Alternativas.

— (2015). The internationalisation of the Spanish economy: Progress, limitations and best practices. Spanish and International Economic Outlook, 4(6).

— (2017). Non-price competitive factors and export performance: The case of Spain in the context of the Euro area. Spanish and International Economic Outlook, 6(3), pp. 55-66.

— (2018). The role of competitiveness in eurozone exports: Spain from a comparative sector perspective. Spanish and International Economic Outlook, 7(6).

Ramon Xifré. ESCI – Universitat Pompeu Fabra; Barcelona School of Management (BSM); Public-Private Sector Centre, IESE Business School