Momentum in bond placement by the Spanish private sector

Spanish private-sector bond issuance in 2019 has already surpassed 2018 levels, underpinned by low sovereign yields and credit spreads. Especially noteworthy are the profiles of these bond issues, which have longer maturities and include new products, such as CoCos, green, social and sustainable bonds.

Abstract: After muted activity in 2018, this year has seen intense growth in private fixed-income issuance by Spanish issuers. Specifically, bond issuance by the Spanish private sector during the first 10 months of 2019 is 23% higher year-on-year and already above the volume issued in all of 2018. This can be attributed to several factors, including the collapse in sovereign yields and the persistence of record-low credit spreads. The banking sector is spearheading the growth in issuance and a shift in the types of debt instruments issued. Non-financial corporate debt issuance is growing at a slower pace, albeit faster than in 2018, in an environment that continues to be shaped by diversification of sources of financing, interest rate refinancing and term lengthening. Particularly noteworthy is the expansion of foreign bond issuance among this segment and the fact that almost all bonds issued this year had maturities of at least 5 years. Lastly, data show the gradual maturing of the fixed-income market for medium-sized enterprises (known as MARF) and sharp growth in the issuance of green, social and sustainable bonds, segments in which the Spanish issuers are emerging as global pioneers.

Strong momentum in Spanish private fixed-income issuance in 2019

The primary fixed-income market for private sector issuers (plain bonds issued by non-financial corporates and banks)

[1] in Spain is exhibiting strong momentum in 2019, compared with low issuance volumes throughout 2018. Last year’s market weakness was attributable to several factors. The first relates to intense issuance volumes in prior years. This was due to strong investor demand in an environment of growing liquidity and the corporate sector’s desire to diversify its sources of financing. Second, heightened uncertainty, prompted by the onset of the trade war between the US and China, the populist coalition government formed in Italy and the Brexit negotiations between the UK and the European Union brought the primary market to a virtual standstill

in the last quarter of 2018.

The Spanish debt capital market has benefitted this year from intense easing of financial conditions in the eurozone. This is due to a sharp change in policy direction towards additional monetary accommodation by the European Central Bank (ECB) relative to its message the year before. In the secondary market, the yields demanded in the corporate and bank segments have narrowed substantially, which is attributable to the collapse in sovereign bond yields, as well as a sharp drop in credit risk spreads.

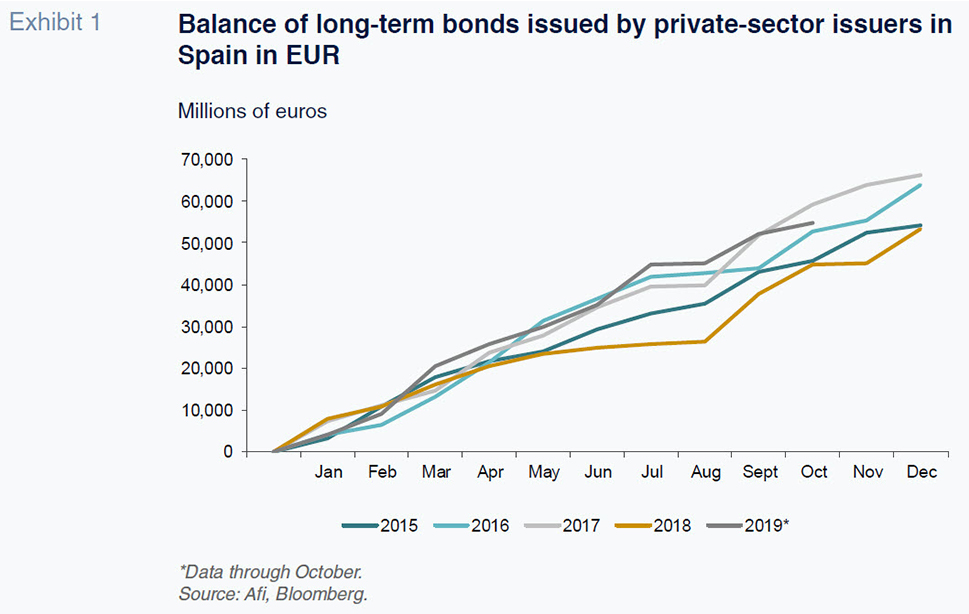

Spain’s corporate and financial issuers have taken advantage of these circumstances to finance themselves on very favourable terms (pricing and maturities) in the capital markets. Looking at the data to September, the volume of long-term bonds issued by the private sector in Spain was above the nine-month averages for the last four years. In October, issuance activity slowed slightly, as a result of some volatility in credit spreads. While on a smaller scale, there are parallels with the standstill observed during the summer, intensified this year by a reduction in investor appetite in the face of escalation of the trade war between the US and China and signs of growing weakness in the European economy. However, in the first 10 months of 2019, bond issuance in the private sector in Spain (54.9 billion euros) is 23% higher year-on-year and is already above the volume issued in all of 2018 (Exhibit 1).

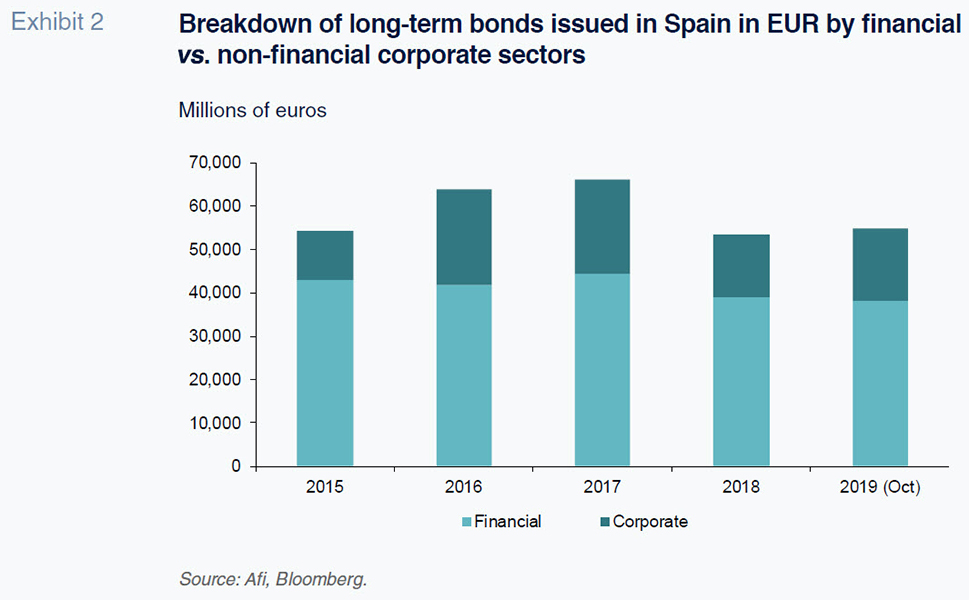

Issuance in the financial sector, mainly by banks, is dominating the private primary market in 2019 (Exhibit 2), accounting for 70% of total issuance volumes. That in turn reflects the banks’ high financing requirements (particularly the need to issue liabilities with loss-absorbing capacity), as well as the still-low weight of wholesale market funding in Spain’s corporate sector, which remains highly dependent on bank loans. Indeed, despite having increased in recent years, the number of companies with the ability to raise financing through the debt capital markets is small in comparison with the other major eurozone economies.

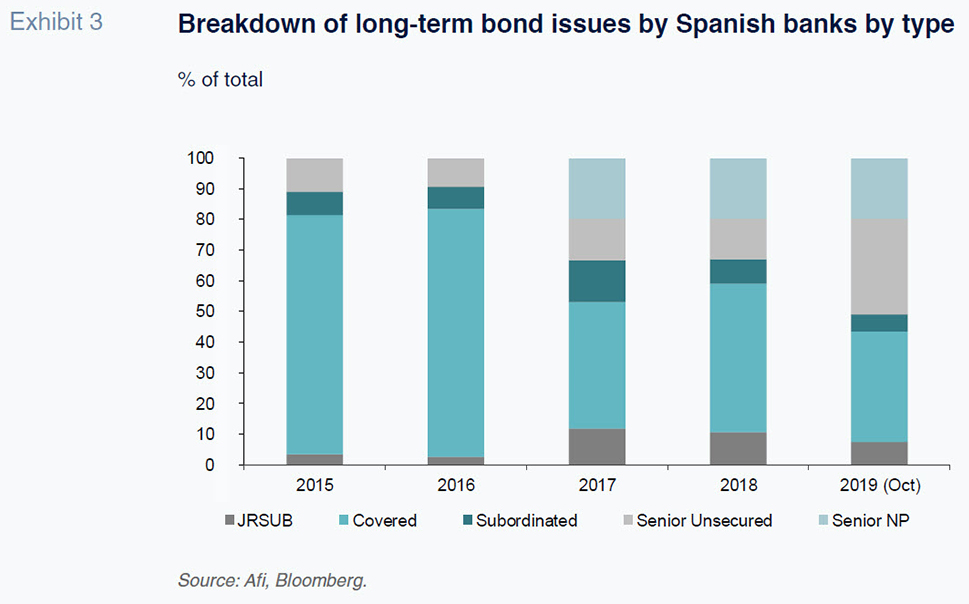

Spanish banks have issued over 38 billion euros of bonds in the first 10 months of the year, compared to a little under 31 billion euros in the same period of 2018, translating into year-on-year growth of 24%. Beyond the incentive of record-low financing costs, the main reason for the sharp increase in the banks’ use of the primary fixed-income markets is a shortfall of organic capital generation vis-à-vis their capital and total loss-absorbing capacity requirements. Those requirements are similarly responsible for the shift in the issuance mix by banks in recent years. In 2015, covered bonds accounted for nearly 80% of total funds raised in the primary market, whereas so far in 2019, that segment represents a scant 36% of total issuance (total issuance volumes have also fallen). Contingent convertible bonds, known as CoCos, have also lost significance. Their share of total issuance volumes has declined from 11.7% in 2017 to 7.4% so far in 2019. That downtrend reflects the fact that Spanish banks were the entities with the highest asset volumes, which meant they faced the most pressing need to issue this type of security in order to quickly meet the regulators’ demands. In recent quarters, we have seen smaller-sized entities tapping the capital markets for assets of this kind, resulting in smaller issuance volumes. It is also worth highlighting the role played by another class of fixed-income securities with the capacity to absorb losses, namely senior non-preferred debt. These bonds rank senior to subordinated bonds but junior to senior unsecured bonds (also known as senior preferred). Since 2017, the first year in which Spanish banks began to issue this type of security, senior non-preferred debt has accounted for 20% of all wholesale funding issued by the banking sector each year.

The negative impact of uncertainty on non-financial corporates last summer

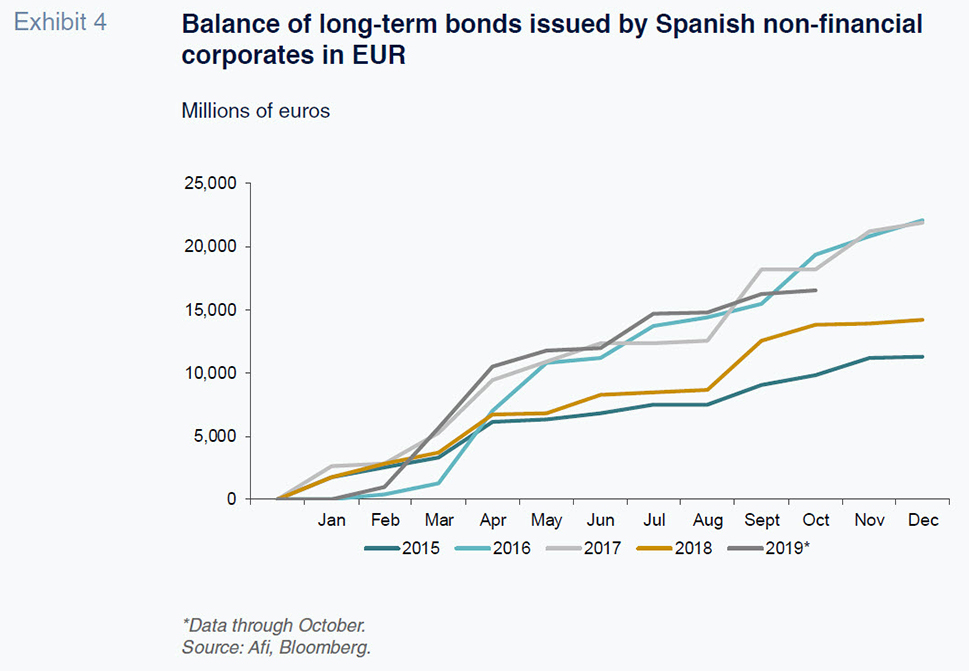

Bond issuance by non-financial corporates is also running 19% higher measured year-on-year (16.5 billion euros

versus 13.9 billion euros in 10M18). Until the summer months, the pace of new issuance was even stronger, nearing levels seen in 2016, a year of record issuance, in parallel with the increase in debt repurchases by the ECB to a monthly figure of 80 billion euros (Exhibit 4). The slump in issuance observed in July, and more intensely in August, is a result of the markets’ increased risk aversion, which dampened corporate bond investors’ risk appetite (along with appetite for other asset classes such as equities). This has meant that despite renewed momentum in September and October, the volume of bonds placed so far this year is 9% lower than in the same period of 2017 and almost 15% lower than in the first

10 months of 2016.

It is still uncertain whether a strong enough recovery in the last couple of months of the year will support total issuance volumes similar to those of 2016 and 2017. Such a recovery may be buoyed by new repurchases by the ECB (at a monthly pace of 20 billion euros, nearly 3 billion euros of which is expected to correspond to the Corporate Sector Purchase Programme (CSPP)), as well as an improvement in market sentiment as a result of the reduced probability of a no-deal Brexit, progress on trade talks between the US and China, and some signs of stabilisation in the global economy.

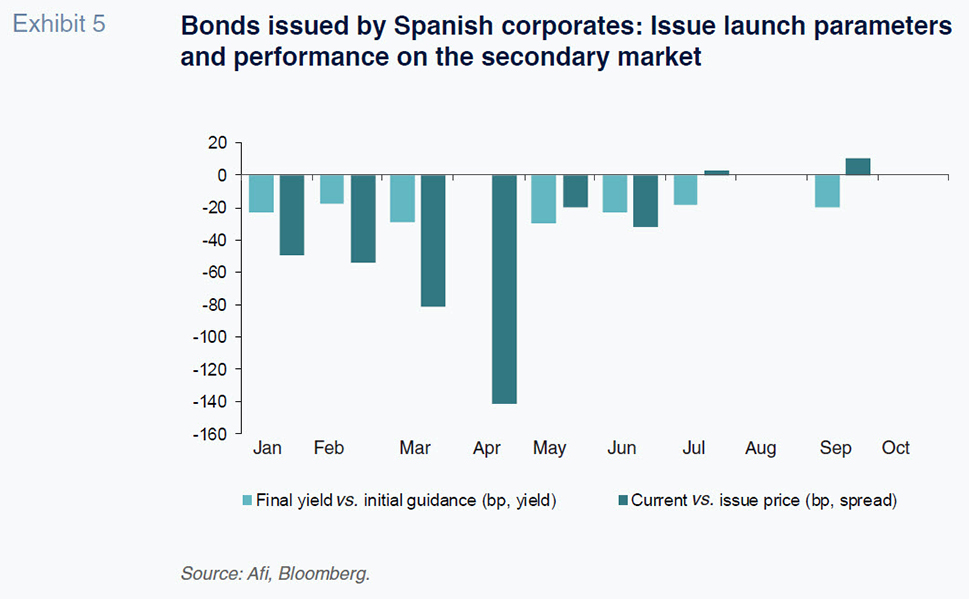

The intensity of investor demand is a key aspect underpinning the strong momentum observed in the primary market for bond issues by non-financial corporates in 2019. Exhibit 5 shows how, on a recurring basis throughout the year, most of the offers have been placed at a final cost (reoffer yield) substantially lower than the initial price guidance provided during the placement process. That intensity of demand has translated to the secondary market, where the spreads on most issues have tightened relative to the yields at which they were placed.

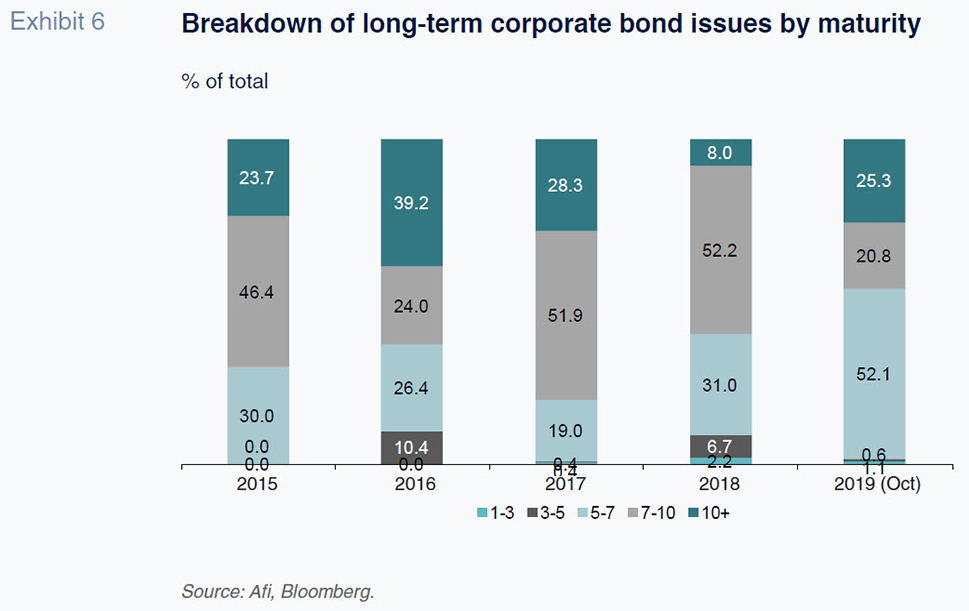

Looking at issuance volume by maturity, nearly all non-financial corporate bonds issued in 2019 have been placed at a term of five years or longer, with over 25% of the total placed at more than 10 years (Exhibit 6). That is a direct consequence of sovereign yields at record lows and flattening of sovereign yield curves. As well, strong investor appetite for credit risk has compressed the credit risk premium right along the curve. Credit spread curves have also flattened, prompting corporate issuers to seek longer-term financing.

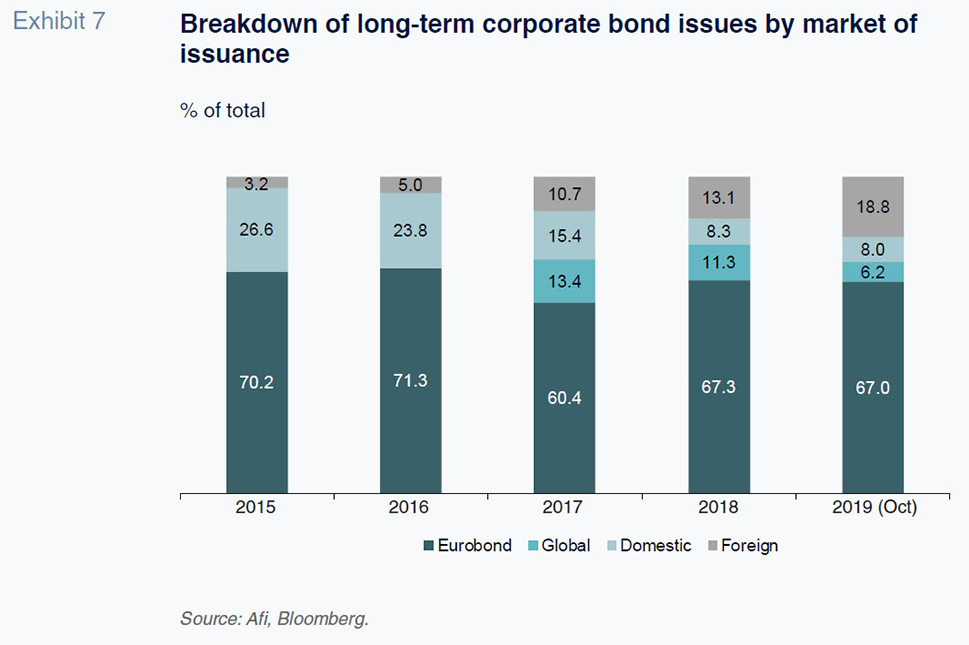

Lastly, another important factor is the issuance structure (or market) chosen by Spanish corporates for their bond placements. Exhibit 7 shows how the strong growth in issuance activity since 2016 has increasingly taken the form of foreign bond placements (those placed in currencies other than the euro and in that currency’s domestic market) and global bonds, the latter primarily by the major Spanish multinationals and generally in US dollars. Although the bulk of issuance remains eurobonds and domestic bonds mainly issued in euros, the market and currency diversification trends are noteworthy.

MARF, Spain’s alternative corporate bond market, gains traction

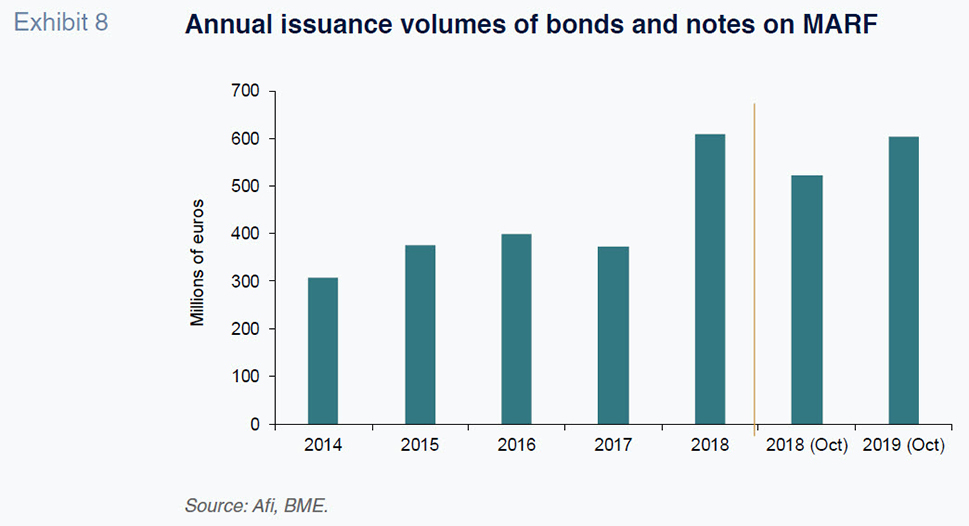

Spain’s large-cap companies are not the only active issuers at present. Medium-cap enterprises have also been able to tap the extraordinary market conditions to improve their capital structures in recent years. Most of the issues by companies in this size segment, in contrast to the norm for the larger issues, have been traded in Spain on the Alternative Fixed-Income Market known as the MARF. This was established in 2013 with the goal of providing Spanish corporates with a more agile and flexible issuance environment.

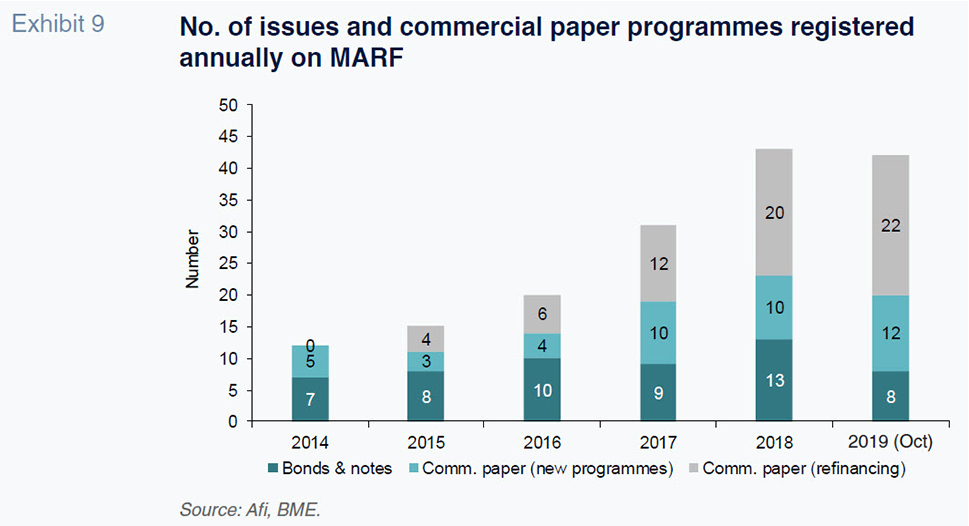

Between 2013 and October 2019, the MARF has channelled 2.67 billion euros of bonds, notes and commercial paper for an aggregate outstanding balance of 12.23 billion euros. Even more noteworthy than the issuance volumes is the number of issuers, which include 78 new names, issuers which until the creation of this market had not participated in the fixed-income capital markets.

This market has displayed consistent growth momentum and an ability to draw new companies and types of securities. The factors driving this momentum include better knowledge on the part of management teams of the benefits of diversifying their sources of financing as well as the increased appetite for these products among the institutional investor community, mainly the Spanish segment.

As for the characteristics of the issues, most of the bonds issued (46%) cover terms of over five years, while 30% are issued at maturities of up to 10 years and 23% longer than 10 years (this longer-dated paper tends to be associated with the financing of infrastructure or energy projects). By type of instrument, the MARF has admitted bonds and notes with an average issue size of 34 million euros, project financing bonds with an average size of 62 million euros and commercial paper programmes with an average maximum outstanding balance of 113 million euros to trading. The financial institutions also list secured and subordinated debt securities for capital purposes.

One last aspect of note with respect to the trend in issuance volumes on the MARF is the growing breadth in the use of proceeds. Although growth funding has always been an objective, in the first few years after its creation, the approach was more conservative, with issuers tending to refinance existing debt, particularly bank debt, in order to switch to longer-dated bonds. In recent years, however, the bonds are increasingly being placed to finance new investment projects. The growing openness can be attributed to the MARF’s rising prestige among issuers, combined with higher investor confidence in the projects they bring to the market.

Spanish corporates: Meaningful players in the green, social and sustainable bond market

Green, social and sustainable bonds are those whose proceeds are used exclusively to finance environmental and/or social projects. Worldwide, the outstanding balance of these bonds accounts for a scant 700 billion dollars, compared to an overall global bond market of 92 trillion dollars. Nevertheless, this segment has been registering exponential growth in recent years and is expected to increase in importance. A growing number of investors are factoring socially responsible investment criteria into their portfolio allocation decisions, while climate change related priorities are increasingly gaining the attention of both companies and governments.

Spanish issuers are playing a prominent role in this market, consistently ranking in the global top 10 in terms of primary market issuance. That performance is all the more striking considering the fact that Spain’s biggest issuer, the Public Treasury, has yet to issue bonds of this nature, in contrast to some of its peers in other European economies, such as Poland, France, Belgium, Ireland and the Netherlands. That said, it is expected to do

so in 2020.

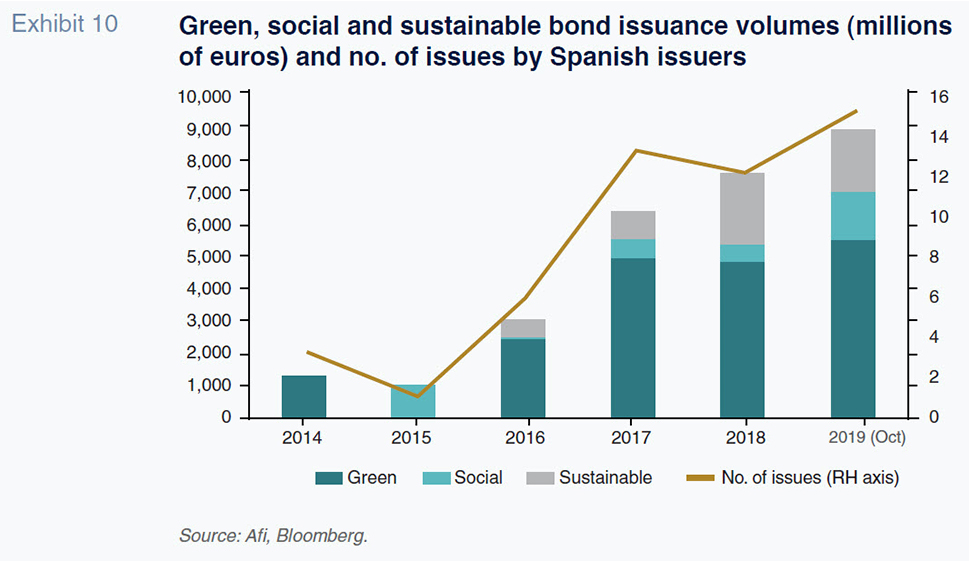

Exhibit 10 illustrates the gradual growth in issuance volumes and number of issuers since 2015. In 2019 (to October), 12 different issuers have issued nearly 9 billion euros of these bonds via 15 different placements. The average issue size has risen to 600 million euros.

A unique characteristic of the Spanish market is the relative importance of social and sustainable bonds compared to green bonds. Since 2018, the former have accounted for over 35% of the total, compared to levels of just over 15% in Europe. That trend reflects the fact that some of the most important issuers in this market in Spain are the regional governments and the state credit institution, the ICO, agents whose activity is fundamentally social.

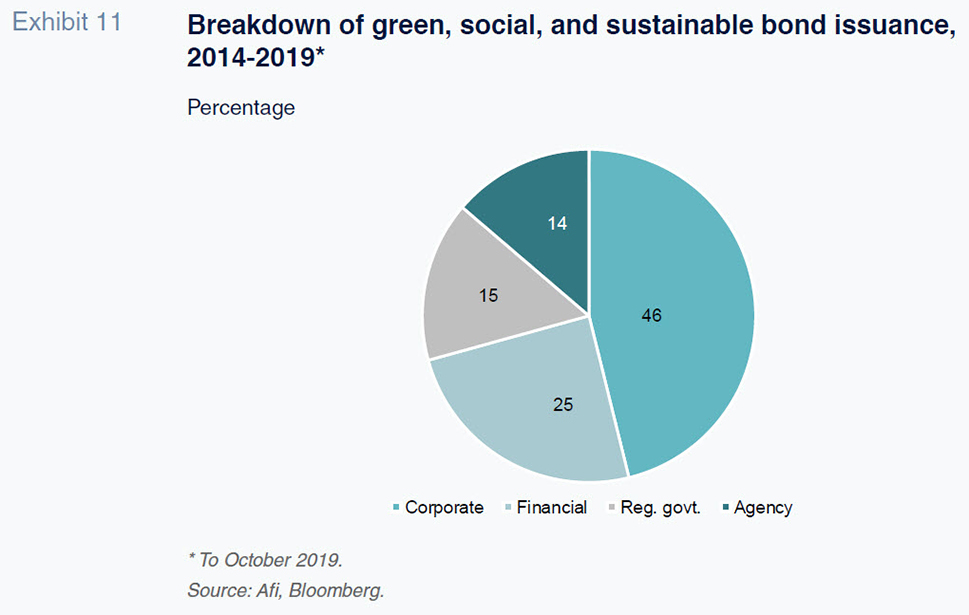

Exhibit 11 also reveals the greater significance of the corporate sector relative to the banks, despite the latter’s larger presence in the overall bond market in Spain. This dynamic can be attributed to a large non-financial corporate in the energy sector, which has become a leader in green bond fund-raising, having issued nearly 10 billion euros of green bonds.

Entities are not limiting their issuance to just senior unsecured debt. One of Spain’s largest banks, for example, has issued several senior non-preferred bonds and one of its largest energy companies has been issuing subordinated green bonds every year since 2017.

That tells us that it is a market whose diversity, in terms of issuer and issue type, is set to increase, along with its importance within the fixed-income universe. Some of the factors expected to underpin that growth include increasing involvement by the central banks in trying to actively foster this type of financing and a growing number of investment funds that factor environmental, social and governance (ESG) criteria into their investment decision-making.

Conclusion

A series of factors are expected to fuel continued strong momentum in the primary bond markets for Spanish banks and corporates: (i) ultra-low rates that are highly likely to remain low for a protracted period of time; (ii) ample liquidity, which has an associated cost in the current negative rate climate, nudging investors to assume greater credit risk; (iii) the banks’ need to continue to meet their regulatory capital requirements (liabilities with loss-absorbing capacity); (iv) a slow but steady shift from bank to capital markets financing, ushering in new issuers; and, (v) new financing instruments, such as sustainable alternatives, which could prompt certain issuers to finance their eligible projects using green, social and/or sustainable bonds rather than bank credit. Nevertheless, for such momentum to occur, it will be necessary to dispel existing uncertainty and doubts over the cyclical outlook. The expectations of future support from those European governments that have fiscal space could help counter these doubts at a time when monetary policy is showing clear signs of having run its course.

Notes

Securitisations are not analysed in this paper.

José Manuel Amor, Salvador Jiménez, Irene Peña and Javier Pino. A.F.I. - Analistas Financieros Internacionales S.A.