Spanish economic forecasts panel: November 2017*

Funcas Economic Trends and Statistics Department

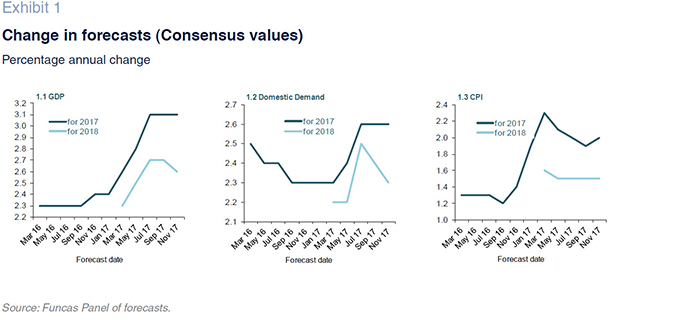

The consensus forecast for GDP growth in 2017 is unchanged at 3.1%

GDP grew by 0.8% QoQ in the third quarter of 2017. This was in line with expectations and represents a slowdown of 0.1 percentage points on the previous quarter. The latest available indicators suggest there was a reduction in the external sector’s contribution to growth, which may even have turned negative, alongside a moderation in consumption growth and a possible acceleration in capital goods investment.

Consensus forecasts growth of 3.1% for the year, unchanged from the September panel despite a slight downward revision to the outlook for the fourth quarter to 0.7% QoQ. The expected composition of growth is unaltered with domestic demand set to contribute 2.5 percentage points and the external sector 0.6 percentage points, albeit with downward revisions to expected export and import growth.

Downward revision to 2018 forecast by 0.1 percentage points

Consensus forecasts GDP growth of 2.6% in 2018, down 0.1 percentage points, in part because of the political crisis in Catalonia. Thirteen out of the seventeen panellist have lowered their forecasts for 2018, the bulk - completely or partially - reflecting the impact of tensions in the autonomous region.

The remaining panellists believe it is still too early to quantify the potential effect. Should the stand-off perpetuate, it is possible that more panellists will reflect the situation in their forecasts included in future panels. Either way, the 2018 forecast is subject to significant uncertainty reflecting the difficulties in estimating the economic impact of such an unprecedented event and will depend on how developments unfold over the coming months.

Spike in inflation in 2017 and moderation in 2018

Headline inflation rebounded to 1.8% in September due to an increase in the price of some unprocessed foods, but dropped back to 1.6% in October. This is in line with inflation rates during the middle of the year and well below the 3% reached in January-February. The oil price climbed to 65 dollars per barrel at the end of October and beginning of November. This represents a potentially substantial change to the scenario underpinning the forecast in the panel and if sustained would have a potentially significant impact not only on the expected outlook for inflation but also consumption and investment.

Headline inflation is now forecast to come in at an average annual rate of 2% in 2017, 0.1 percentage points more than the September panel, and to ease to 1.5% in 2018. Core inflation is forecast to be 1.2% in 2017 and 1.4% in 2018, as in the previous Panel. Year-on-year inflation rates in December are predicted to be 1.2% this year and 1.6% in 2018 (Table 3).

Slowing employment growth

According to Social Security registrations data, employment growth slowed significantly in July and August but rebounded strongly in September and October. Overall, employment slowed in the third quarter relative to the previous three months, as evidenced by both Social Security and LFS figures.

Consensus forecasts employment growth of 2.8% for 2017 - up 0.1ppts - while the outlook for 2018 has been revised down 0.2ppts to 2.2%. An implicit forecast for productivity and ULC growth can be obtained from the forecasts for GDP, employment and wage remuneration growth. Productivity is set to grow by 0.3% this year and 0.4% next year, while ULCs are implicitly forecast to rise by 0.2% in 2017 and 0.7% in 2018.

The annual unemployment rate is on track to fall to 17.1% in 2017 and 15.3% in 2018; the latter is an upward revision relative to the previous Panel.

Downward revision to current account surplus

The current account registered a cumulative surplus of 10.3 billion euros to August; down 750 million euros on the same period last year. The deterioration in the surplus reflects a worsening of the trade balance, which according to Customs data was due to both an increase in the energy deficit and a reduction in the non-energy surplus fuelled by a pick up in import growth.

Consensus forecasts a surplus of 1.7% of GDP for the year and 1.6% in 2018; this is a downward revision to both figures.

Deficit target to be met in 2017

The public deficit, excluding local corporations, to August was 10.3 billion euros smaller than the same period last year, thanks to an increase in revenues and stable spending. The state and autonomous regions posted an improved performance – the latter even registering a surplus – while the social security system deteriorated.

Consensus forecasts the deficit to come in at 3.1% of GDP, in line with the deficit target. A deficit of 2.4% of GDP is forecast for 2018, which would be 0.2ppts above the current target.

The global economic outlook is favourable

The external outlook is one of the most favourable seen in recent years. Some of the main challenges facing the global economy have so far failed to materialise (bursting of the credit bubble in China, end of expansive cycle in the US). The euro area is growing more robustly than expected, including countries, such as Greece and Italy, which were in recession until recently. However, new tensions have emerged in the Middle East with an impact on oil prices.

Nearly all panellists consider the EU backdrop to be favourable and are upbeat regarding the international environment outside of Europe. The prevailing view is that that it will remain this way over the coming months. None of the panellists expect the situation to deteriorate in the EU. However, two panellists believe the global environment could weaken, as in the previous Panel.

Long-term interest rates ticking up

The European Central Bank left interest rates on hold (main refinancing operations, marginal lending facility and deposit facility). This stability is reflected in 3-month Euribor (cost of short-term interbank lending) which remains historically low at around -0.33%. All panellists agree that current levels are low and most expect the favourable conditions to be maintained over the coming months.

Despite the situation in Catalonia, the yield on Spanish long-term debt (10-year sovereign) remains at similar levels to the previous Panel, at around 1.53%, while the risk premium has fluctuated without any clear direction. The panellists regard current long-term interest rates as low, but foresee a pick up in debt yields over the coming months.

The euro is set to stabilise against the dollar

The euro has lost some ground against the dollar in the face of a tightening of Federal Reserve monetary policy and the extension of the ECB’s expansionary stance, with a withdrawl of stimulus more gradual than expected. The euro is trading at around 1.18 against the dollar, compared to 1.20 in the previous Panel.

Most panellists continue to believe the euro is close to equilibrium with the exchange rate likely to trade around current levels over the coming months.

Fiscal policy is neutral and monetary policy expansive

The panellists have not changed their opinion on the macroeconomic policy stance from the last panel. A majority see fiscal policy as neutral and judge this to be appropriate. Some panellists argue in favour of more restrictive fiscal policy while nobody recommends a more expansive stance.

All panellists regard monetary policy as expansive. As in the last Panel, none of the panellists envisage more restrictive monetary policy in the coming months.

The Spanish Economic Forecasts Panel is a survey run by Funcas, which consults the 18 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 18 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.