Spain’s structural reforms: Remaining challenges for budget stability and the labour market

2012 marked a year of much-needed progress on Spain’s structural reform agenda, particularly in the areas of budget stability and the functioning of the labour market. However, in the wake of the reforms, a current snapshot of the country’s public finances and job market reveals outstanding issues that still need to be addressed.

Abstract: Based on an analysis of the main economic reforms recently undertaken in Spain, the budget stability act and the labour market reform, this paper attempts to pinpoint some of the outstanding issues which should be tackled in additional reforms already undertaken in these two areas. In terms of the sustainability of the country’s public finances, the stability act, understood as the fiscal discipline rules, still faces issues in terms of its ability to achieve stipulated outcomes. It is also important to control the increase in certain public liabilities that fall outside the scope of excessive deficit procedure (EDP) definitions. As for the labour market, future reforms need to pay more attention than has been paid thus far to certain key variables and trends. More specifically, action needs to be taken, inter alia, with respect to the ageing of the working population, the drop in the number of economically-active men and the rise in long-duration unemployment and the resulting shortfall in safety net.

Introduction

Spain’s tenth legislature, which ran from December 2011 to October 2015, was characterised by a parliamentary stability which paved the way for the passage of important structural reforms, namely three: the budget stability act, the restructuring and recapitalisation of the financial system and labour market reform. The next two terms of office, the first from January to May 2016 and the second which began in July of that same year, in contrast, have not been marked by a similar degree of political stability. Spain had a caretaker government for much of 2016 and since then has had a minority one. Looking forward, as recently acknowledged by the AIReF (2017), Spain is also facing a period of political instability, in part as a result of the political and institutional uncertainty prevailing in Catalonia, which is making it hard to make medium-term predictions. The tenth legislature was thus characterized by a period of political stability, which enabled the passage of reforms of substantial significance.

For all these reasons, this paper attempts to take a retrospective look at that period in order to analyse two of the three mentioned areas of reform: budget stability and labour market reform. The goal is to contribute to the debate about their effects and reflect on the challenges remaining in these areas. In sum, the idea is to flag certain issues which need to be addressed as soon as political and institutional stability allows for renewal of the reform agenda.

For an analysis of the reforms undertaken in the Spanish financial system and of the key challenges looming, issues not addressed in this article, the reader is referred to recent studies by Ocaña and Faibishenko (2016) and Carbó and Rodríguez-Fernández (2016).

This paper is related with earlier analyses (Xifré, 2014, 2015 and 2016) but on this occasion takes a deeper look at these two specific areas of economic policy reform. For each of the two areas, we first briefly summarise the contents of the reforms before going on to analyse related data of interest.

Budget Stability Act

Spanish Organic Law 2/2012 on Budget Stability and Financial Sustainability (the Act) was passed to comply with the changes made in August 2011 by the prior government to Article 135 of the Constitution. The amendment to the Constitution consisted of the introduction of a fiscal rule limiting the structural public deficit, a novel initiative for Spain, and a limit on public borrowings tied to the benchmark value stipulated in the Treaty on the Functioning of the European Union (TFEU). Because it is an organic law, it regulates budget stability and financial sustainability at all levels of government: the State, the autonomous regions, local administrations and the social security administration.

Borrowing from Hernández de Cos and Pérez (2013), the quantitative limits imposed by the Act are the following:

- The Act stipulates that neither the State nor the autonomous regions may incur a structural deficit. The structural deficit is the part of the overall public deficit remaining after elimination of the cyclical deficit, i.e., the portion caused directly by the prevailing economic environment. Refer to Hernández de Cos and Pérez (2013) for further information about this concept. Local administrations and the social security must maintain a balanced budget or budget surplus in current and not just structural terms.

- The Act also stipulates that public debt may not exceed 60% of GDP from 2020. It also establishes a breakdown for this cap: 44% corresponding to the State; 13% to the autonomous regions as a whole; and 3% to local administrations. Within this regime, the Act entitles the autonomous regions and local administrations to ask the State for access to extraordinary resources in order to generate liquidity.

- The Act also provides that all levels of government must approve annually an increase in their non-financial spending that is lower than the medium-term growth in GDP estimated by the Ministry of the Economy and Competitiveness in keeping with the European Commission’s methodology.

The Budget Stability Act has been analysed by Domínguez Martínez and López Domínguez (2012), Hernández de Cos and Pérez (2013 and 2015) and Lago Peñas (2015), among others. From a broader perspective, the work by Cuenca (2016), Lago Peñas (2017) and Aguerrera and Borraz (2017) has recently examined the sustainability of Spain’s public finances and its fiscal consolidation efforts in latter times.

Building on these studies’ findings, this paper attempts to round out the analysis by providing additional tools for assessing the Act and the remaining challenges in the budget stability arena.

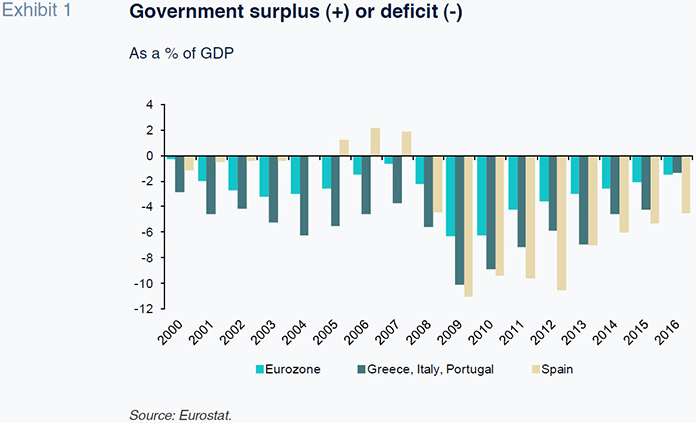

Exhibit 1 represents the budget surplus or deficit of the general government in relation to GDP in Spain, the average for Italy, Greece and Portugal (the three Eurozone states to have experienced the greatest fiscal stress since the Great Depression) and in the eurozone as a whole between 2000 and 2016.

The exhibit shows that the deficit had narrowed significantly, to less than half of what it was between 2009 and 2012, by 2016, going from 10% to 4% of GDP. Nevertheless, the pace of deficit correction in Spain has been slower than in the eurozone as a whole and than in the three countries (on average) under strong fiscal pressure. This last comparison is particularly relevant and worrying as it casts doubts over the Act’s ability to bring about fiscal correction of the calibre of that achieved by Greece (which was consistently reporting much higher deficits than Spain until 2013) and Portugal (whose deficit approached that of Spain in 2009 and exceeded it in 2010). In fact, the modest correction in the overall public deficit (observed) suggests the existence of serious obstacles to correction of the structural public deficit, the variable stipulated in the Act, irrespective of the methodology used to calculate it.

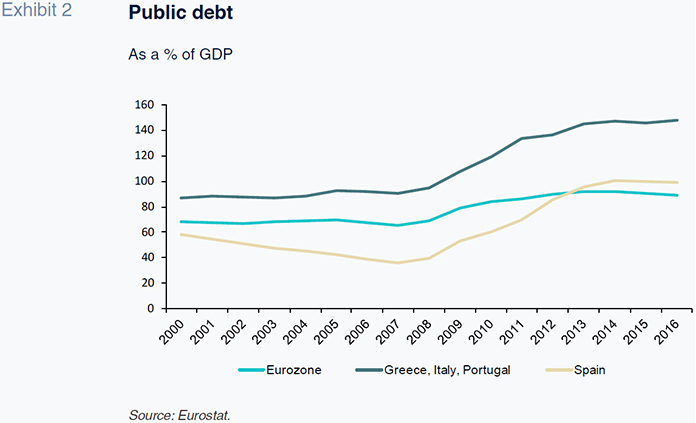

Exhibit 2 represents public debt over GDP for these three countries over the same timeframe.

It shows how Spain’s public debt stopped rising in 2014, hovering between then and 2016 at levels of around 100% of GDP. Although the end of the increase in debt, which had started in 2007, is naturally welcome news, it is worth noting two importance nuances.

Firstly, it does not show public debt decreasing since 2012, as it should if the public finances were trending towards compliance with the Act’s stipulation that borrowings not exceed 60% of GDP by 2020. Therefore, the Act would also appear to be compromised in this respect.

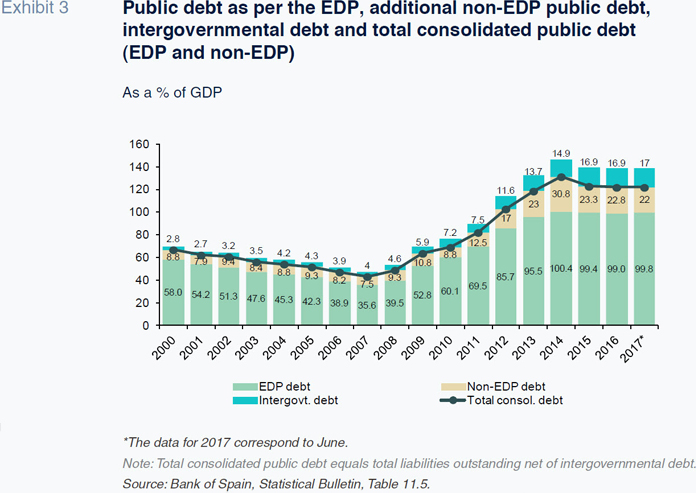

Secondly, Exhibit 3 shows the trend over time in more broadly defined public debt measures. On the one hand, it presents Spain’s public debt as calculated using the European Commission’s excessive deficit procedure (EDP) (which is the same as the series depicted in Exhibit 2). In addition to this definition, this exhibit also depicts the additional public sector liabilities that are not included in the EDP criteria (non-EDP debt). The sum of these two headings yields total liabilities in the hands of the consolidated public sector (

i.e., eliminating intergovernmental debt). Thirdly, the exhibit depicts these intergovernmental debts, which are mainly credit facilities and loans granted by the state to the autonomous regions and local administrations in the form of special liquidity funds. These liabilities are already counted in the first two headings and therefore cannot be added to total borrowings.

Exhibit 3 enables us to observe the relative trend in the various types of borrowing between 2000 and 2017. Non-EDP debt doubled from 15% of EDP debt in 2000 to 31% in 2014, settling at around 22% in 2016 and 2017. The increase in the relative importance of intergovernmental debt is even more pronounced. These liabilities, which accounted for just 5% of EDP debt in 2000, have been climbing continuously, tripling to represent over 17% of EDP debt in 2017. These trends reveal another of the Act’s limitations: its failure to establish limits on non-EDP debt. It could be the case that we are witnessing a more or less deliberate transfer of borrowing transactions from within the scope of EDP debt-raising to other kinds of borrowing arrangements that do not compute as EDP debt. In the case of the intergovernmental debt, it is worth highlighting the additional risk that a regional or local government will not be able to service part of its payment obligations vis-a-vis the state.

Labour market reform

The labour market reform was initially approved in 2012 as Royal Decree-Law 3/2012 and was later validated by Law 3/2012. Borrowing from García-Pérez and Jansen (2015), the main points of the reform are as follows:

- Internal flexibility: The reform makes it easier for companies to unilaterally change the duties carried out by their employees and their terms of employment, including their salaries;

- Decentralisation of negotiations: Collective bargaining agreements are given priority in certain areas and a time limit is established on the period of time these agreements can remain in force after they expire;

- Termination benefits and other redundancy costs: Generalisation of the 33 days per year worked with a cap of 24 months’ pay; elimination of the need to pay interim wages while layoffs are being legally processed; elimination of the express layoff formula; suspension of the need to obtain governmental authorisation for group redundancies; and,

- Employment contract types: Introduction of a new contractual formula (permanent contract in support of entrepreneurs) for companies with fewer than 50 employees with an initial trial period of one year; ban on stringing temporary contracts together for more than 24 months in a row.

The goal of this reform was to facilitate job creation and deliver smoother management of labour relations. The labour market reform and its impact on the Spanish economy have been studied in the following papers, among others: Dolado (2012), OECD (2013), García Pérez and Jansen (2015), García Pérez and Mestres (2016), Doménech, García and Ulloa (2016), Boscá et. al. (2017) and Cuerpo, Geli and Herrero (2017).

Below we present data related to the job market which add new information with respect to the studies mentioned above and point to outstanding issues in the reform agenda in this area.

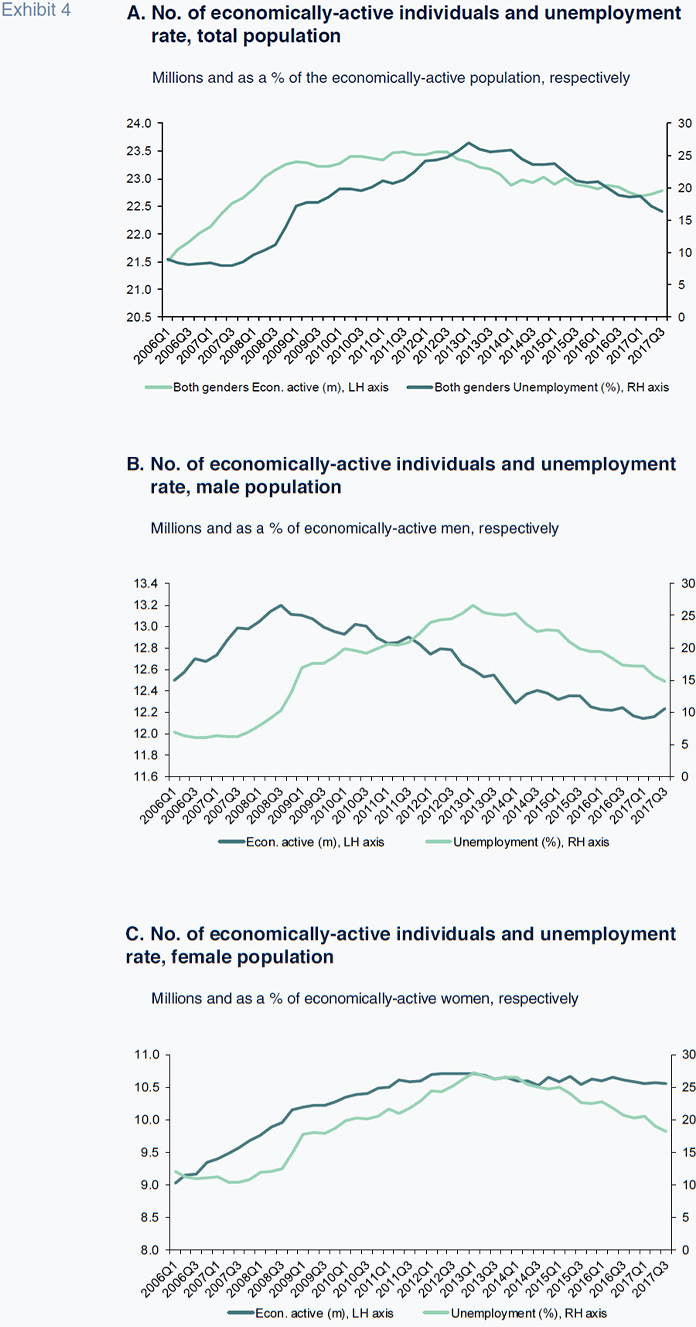

Exhibits 4.A, 4.B and 4.C depict the number of economically-active individuals and the unemployment rate for the total population, the male population and the female population, respectively.

The exhibits show that the economically-active male population has decreased by around one million individuals between mid-2008 (when it peaked) and 3Q17 and there is no evidence that this process has run its course (Exhibit 4.B). The trend in the economically-active female population is different, having risen sharply between early 2006 and 2013 (when the number of economically-active women increased by 1.7 million), going on to stabilise between 2013 and 2017 (Exhibit 4.C). The combined effect of these two trends is seen in the total economically-active population, which increased until the end of 2012, when it reached 23.5 million people, since which time is has lost 750,000 members (by 3Q17) (Exhibit 4.A). The unemployment dynamics are similar in both segments of the population, with both rates starting to come down from around the second quarter of 2013.

These figures suggest that the labour market reform has not managed to reverse the sharp decline in the economically-active population in Spain, particularly in the male segment.

To further this, Exhibits 5.A, 5.B and 5.C break the total number of job holders down into three age categories – under 35; between 35 and 49; and over 50 – again for the same three groupings: The total population, the male population and the female population, respectively. In both the male and female segments, the data clearly reveal the continuous ageing of the labour force.

In early 2006, for the total population the most populated age category was the under 35s, followed closely by the middle age category, with almost 40% of job holders falling into each of these two groups. The older workers accounted for the remaining 20%, a little less in the case of the women, the segment which had the most young job holders, at close to 43% of the total.

2006 marked the start of a downtrend in the percentage of young employees in both segments of the market and there are no clear indicators that this process has run its course. As a result, in 2008 the number of working middle-aged women outnumbered young female job holders, while middle-aged men outnumbered younger male job holders since the beginning of the series. This trend has been ongoing and 2014 was marked by a very noteworthy development: that year, in both segments, there were more job holders aged 50 or more than aged 35 or less. As of the third quarter of 2017, the most recent data available, the breakdown of job holders in both segments was similar: the most populated age segment was the middle-aged segment (almost 45% of the total), followed by the older job holders (~30% of the total), while the number of young job holders had become the least representative category.

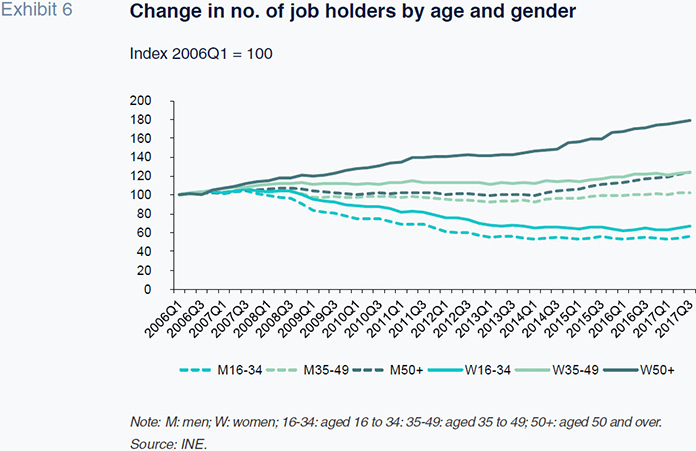

Exhibit 6 analyses these same data presented differently. This exhibit represents the number of men and women employed in these three age segments rebasing the readings to the first quarter of 2006. This double classification generates six different series of job holders by age and gender and Exhibit 6 shows how they have varied between 2006 and 2017.

As the exhibit shows, the group which has grown the most is the segment of women aged 50 and over, which has increased in size by 80% during the period. Next are two groups which have trended very similarly, increasing by around 20%: the middle-aged women (aged 35 to 49) and the older men. The number of middle-aged men, which has been hovering around 4.5 million and is the largest of the six groups analysed, has been largely stable, if anything increasing very slightly. In contrast, as we have already mentioned, the youngest segments have been declining constantly in both segments. The result is that, by 2017, the number of young female job holders had fallen by 33% and the number of young male job holders by 43% with respect to 2006. In all three age categories, the number of female job holders has increased by more (or decreased by less in the case of the youngest segment) than the number of male job holders.

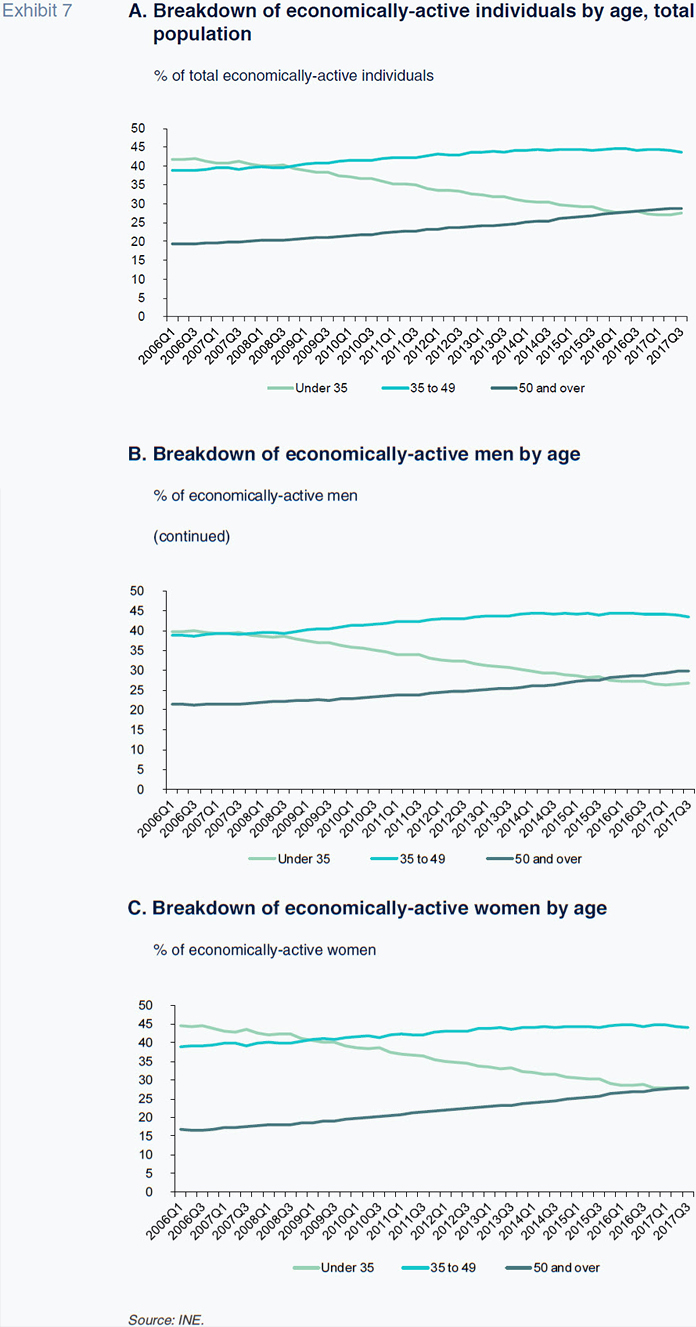

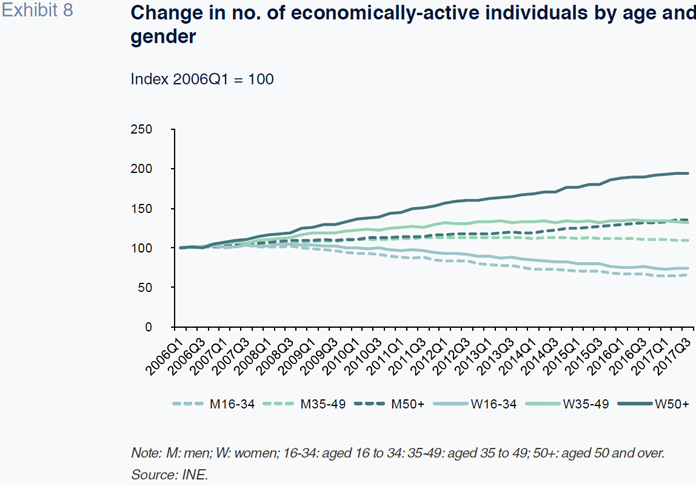

To get a better picture of the ageing of the Spanish labour force, Exhibits 7.A, 7.B, 7.C and 8 conduct a similar analysis for the economically-active population.

They support that the conclusions drawn earlier continue to hold. The number of young economically-active individuals has fallen very substantially and is now the smallest age category in both segments of the labour market, whereas the number of economically-active individuals aged 50 or more has registered the greatest growth. Very noteworthy is the fact that the number of older economically-active women has doubled between 2006 and 2017. Exhibit 8 also reveals that the female segment of the market has outperformed the male segment for all age categories.

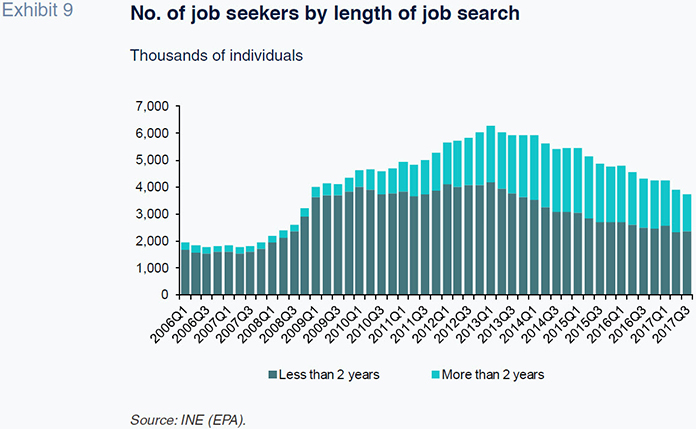

To round out the analysis of the labour market in the wake of the market reforms we study the situation among the unemployed. Exhibit 9 depicts the number of job seekers, distinguishing between the length of time they have been searching for work.

It shows that the number of people unemployed escalated rapidly from 2008, peaking in the first quarter of 2013 at 6.2 million. Since then, it has been coming down and stood at 3.7 million as of the third quarter of 2017, implying a reduction in the number of unemployed of 2.5 million between 2013

and 2017.

To assess this improvement properly, however, it is important to consider two trends. Firstly, as shown earlier, the economically-active male population has been declining since the third quarter of 2008 (Exhibit 4.B) and the overall economically-active population since mid-2012 (Exhibit 4.A). In fact, the economically-active population declined by over 700 thousand individuals between the second quarter of 2012 and the third quarter of 2017. This means that nearly 30% of the reduction in the number of people unemployed is attributable to the reduction in the size of the economically-active population, i.e., to people abandoning the labour market.

Secondly, Exhibit 9 reveals that the percentage of long-duration job seekers, i.e., those who have been looking for work for more than two years, shot up in 2010, peaking in 2014 and 2015 and declining only slightly since then. Whereas the long-duration job seekers accounted for an average of almost 11% of the total between 2006 and 2009, this percentage had quadrupled by 2014 and 2015, to over 43%. As of the third quarter of 2017, the most recent figure available, the number of people that had been seeking work for more than two years accounted for 36% of all job seekers. It is well known that long-term unemployment can have adverse consequences for the job prospects of its sufferers as well as for their physical and mental well-being. To this end, the reduction of this form of unemployment should be one of the top priorities of any meaningful labour market reform. The data suggest, however, that the 2012 reform has not successfully tackled this problem.

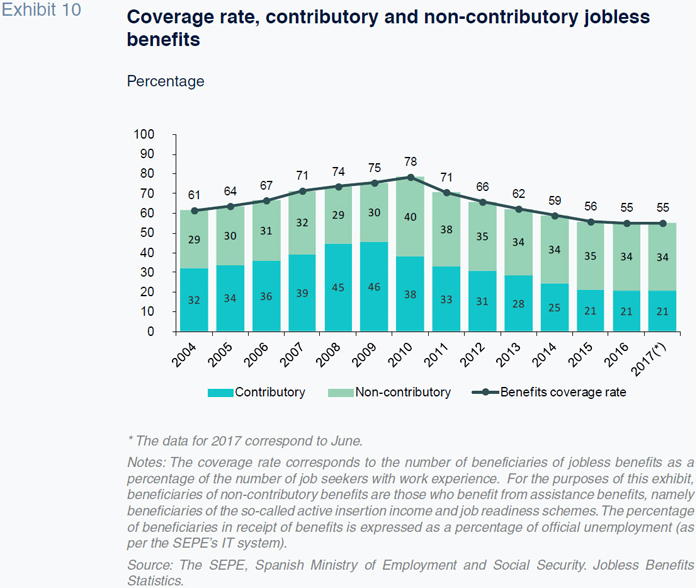

Lastly, we analyse the situation and trend in unemployment by the types of benefits received. Exhibit 10 provides the benefits coverage rate based on the data published by the state’s public employment service (SEPE for its acronym in Spanish), which is part of the Ministry of Employment and Social Security. The coverage rate is defined as the percentage of job seekers receiving some form of unemployment benefits (whether contributory or non-contributory) over total job seekers.

The exhibit shows that the unemployment benefits coverage rate peaked in 2010 at 78%, since which time is has fallen by over 20 percentage points to stand at 55% in 2017. That means that nearly half of all jobless individuals receive no benefits at all. Moreover, within the group of jobless individuals who do receive benefits, since 2013 the majority have been receiving a non-contributory benefit, i.e., an assistance or quasi-assistance benefit (such as the so-called active insertion income scheme or the job readiness programme). This is yet another manifestation of the incidence of long-duration unemployment; as the period of time a person is looking for work stretches on, the (more generous) contributory benefits run out and the job seekers start to receive assistance benefits instead. Once again this doubly precarious aspect of the conditions faced by job seekers raises questions about the suitability and effectiveness of the reform undertaken in 2012 in terms of the support offered to the most vulnerable people in the job market.

Conclusions

Based on an analysis of a series of data related with the sustainability of Spain’s public finances and the state of the labour market, this paper aims to raise certain issues which should be tackled in upcoming structural reforms in these two areas of economic policy.

In the case of the sustainability of the public finances, the data suggest that the Budget Stability Act faces two major challenges. On the one hand, the credibility of the fiscal discipline aspect is compromised. It is extremely difficult to envision that Spain will deliver on the target of cutting public borrowings to 60% of GDP by 2020 and it is not at all clear whether the structural deficit can be eliminated. Given the complicated issues at the EU level surrounding the Stability and Growth Pact, the regulation which inspired the Spanish legislation of 2012, it would seem more prudent to foster budget regimes which prioritise credibility over budget-cuts. On the other hand, it is unclear how the borrowings not included in the public debt calculations for excessive debt procedure purposes or intergovernmental borrowings will evolve. Both classes of public liabilities have registered extraordinary growth since the crisis and it remains to be seen how they will be reined in.

As for the labour market, the unemployment rate has fallen significantly since 2013 but two adverse developments are worth highlighting. First of all, there is as of yet no conclusive evidence regarding the extent to which the reform has contributed to the overall improvement in the big picture. Secondly, the analysis suggests that future reforms should pay more attention than has been paid thus far to other labour market aspects. For example, the apparently unstoppable ageing of the working population is worrying. Also urgently needed are measures that could revert or stall the loss of economically-active men. Lastly, another top priority should be to combat long-duration unemployment, which has quadrupled its share of total job seekers. One of the consequences of this trend is an increasing lack, or shortfall, of benefits coverage for a growing number of job seekers.

In all, the analysis provided in this paper underscores the need to overcome as soon as possible the prevailing climate of political uncertainty in order to attend to a series of fundamental social and economic problems.

References

AGUERRERA, A., and S. BORRAZ (2017), “Spain’s 2017 budget: Lacking reforms to meet the deficit target,” Spanish Economic and Financial Outlook, 259: 35–46.

AIReF (2017), “Executive Summary of the Report on the Macroeconomic Forecasts in the Draft General Government Budget for for 2018,” Report dated 16 October 2017.

BOSCÁ, J. E.; DOMÉNECH, R.; FERRI, J., and J. R. GARCÍA (2017), “Los desplazamientos de la Curva de Beveridge en España y sus efectos macroeconómicos,” [Shifting of the Beveridge Curve in Spain and its macroeconomic effects], BBVA Research Working Paper, 17/12.

CARBÓ, S., and F. RODRÍGUEZ-FERNÁNDEZ (2016), “The Spanish financial system in the new political era,” Spanish Economic and Financial Outlook, 250: 101-115.

CUENCA, A. (2016), “Spain’s public accounts: Analysing stability and sustainability,” Spanish Economic and Financial Outlook, 252: 43-55.

CUERPO, C.; GELI, F., and C. HERRERO (2017), “Some Unpleasant Labour Arithmetics: A Tale of the Spanish 2012 Labour Market Reform,” Economic Crisis and Structural Reforms in Southern Europe: Policy Lessons, (Routledge Studies in the European Economy.

DOLADO, J. J. (2012), “The Pros and Cons of the Latest Labour Market Reform in Spain,” Spanish Labour Law and Employment Relations Journal, Vol. 1, No. 1-2: 22-30.

DOMÉNECH, R.; GARCÍA, J. R., and C. ULLOA (2016), “The effects of wage flexibility on activity and employment in the Spanish economy,” BBVA Research Working Paper, 16/17.

DOMÍNGUEZ MARTÍNEZ, J. M., and J. M. LÓPEZ DOMÍNGUEZ (2012), “La reforma de la política de estabilidad presupuestaria en España: análisis de la Ley Orgánica de Estabilidad Presupuestaria y Sostenibilidad Financiera” [Reforming budget stability policy in Spain: analysis of the Organic Law on Budget Stability and Financial Stability]. Serie Documentos de Trabajo, 09/2012.

GARCÍA PÉREZ, J. I., and M. JANSEN (2015), “Reforma Laboral de 2012: ¿Qué sabemos sobre sus efectos y qué queda por hacer?” [Labour market reforms of 2012. What we know about the effects and what remains to be done], Fedea, Policy Papers, 2015/04.

GARCÍA PÉREZ, J. I., and J. MESTRES (2016), “The Impact of the 2012 Labour Market Reform on Unemployment Inflows and Outflows: a Regression Discontinuity Analysis using Duration Models,” Fedea Policy Papers, 2016/27.

HERNÁNDEZ DE COS, P., and J. PÉREZ (2013), “The new budgetary stability law,” Economic Bulletin of the Bank of Spain, April 2013: 65-78. — (2015), “Reglas Fiscales, Disciplina Presupuestaria y Corresponsabilidad Fiscal” [Fiscal Rules, Budget Discipline and Shared Budget Responsibility], Papeles de Economía Española, 143: 174–184.

LAGO, S. (2015), “Remaining challenges to budgetary stability in Spain,” Spanish Economic and Financial Outlook, 245: 55-62. — (2017), “Spain’s fiscal consolidation path: Slow but steady,” Spanish Economic and Financial Outlook, 259: 27-34.

OCAÑA, C., and A. FAIBISHENKO (2016), “Challenges ahead for the banking industry,” Spanish Economic and Financial Outlook, 250: 87-99.

OECD (2013), The 2012 labour market reform in Spain: A preliminary assessment.

XIFRÉ, R. (2014), “Four years of economic policy reforms in Spain: An analysis of results from an EU perspective,” Spanish Economic and Financial Outlook, 242: 49-57.

— (2015), “Recent reforms in Spain’s business climate: Assessment and pending issues,” Spanish Economic and Financial Outlook, 245: 63-82.

— (2016), “Spain’s business landscape: Structure, recent developments and remaining challenges,” Spanish Economic and Financial Outlook, 252:

21-29.

Ramon Xifré. ESCI-Universitat Pompeu Fabra and the Public-Private Sector Centre at IESE