Fiscal consolidation: Favourable economic conditions threatened by political uncertainty

A constructive macroeconomic climate is helping Spain comply with near-term fiscal objectives. However, political tensions and lack of progress on revenue-enhancing measures will complicate the outlook for fiscal consolidation in the longer-term.

Abstract: Spain is largely on track to meet the deficit target of 3.1% of GDP for this year. The constructive fiscal outlook has been supported by macroeconomic improvement and the reduction in debt servicing costs on the back of lower interest rates. Not so positive, Spain’s consolidation process depends too heavily on cyclical, rather than structural, improvements as the main adjustment mechanism. In addition, potential downside risk from extended political tensions in Catalonia also threatens the outlook for a more ambitious deficit reduction over the medium to longer term. For 2018, meeting official targets may be feasible, but will depend on the ability of the State and Social Security deviations to be offset by the local administrations and for a resolution to the Catalonia crisis before the end of that year. Overall, there is a clear and urgent need for approval of the 2018 Budget to help ensure target compliance. Going forward, Spain’s fiscal system requires deep reforms, particularly on the revenues side, to be more sustainable, equitable, and efficient.

Introduction

Spain’s current fiscal backdrop is characterised by a combination of positive and negative factors, which have gathered momentum in recent months. On the upside, the chances of meeting this year’s deficit target (of -3.1% of GDP) have increased over the course of the financial year. Firstly, because growth has held up more robustly than expected, which has led to a reduction in transfers from the State to the Public Employment Service (SEPE) and a slight pick up in tax revenues. Secondly, due to a reduction in the interest bill on accumulated debt and public spending restraint; although in the case of the latter, current spending could accelerate in the second half of the year due to the late approval of the 2017 Budget in June. Spain’s public deficit is on the cusp of -3% of GDP. In addition, the autonomous regions are no longer a major part of the fiscal sustainability problem.

On the downside, fiscal consolidation has relied more heavily on automatic stabilisers than discretionary measures and elimination of the structural deficit. Moreover, the political uncertainty arising from the conflict with Spain’s largest economic region is particularly worrying for two reasons. Firstly, the crisis in Catalonia has drawn significant attention, marginalising discussion of a variety of reforms and outstanding problems that remain on the economic agenda, especially the pensions system; and, ultimately, it makes approving the 2018 State Budget even more challenging, leading to the paralysis associated with having to rollover the Budget. Secondly, the uncertainty and political tensions of recent months will take their toll on economic growth, which may extend beyond 2018 if the situation cannot be rapidly addressed.

The aim of this article is to review each of these questions in turn and is structured in three parts in addition to this brief introduction. The following section focuses on ongoing budgetary consolidation and compliance with the 2017 targets, drawing on the latest available information at the time this article was written. The subsequent section looks at the budgetary outlook for 2018, considering both the economic and political backdrop. Finally, the article finishes by reflecting on Spain’s fiscal prospects to 2020.

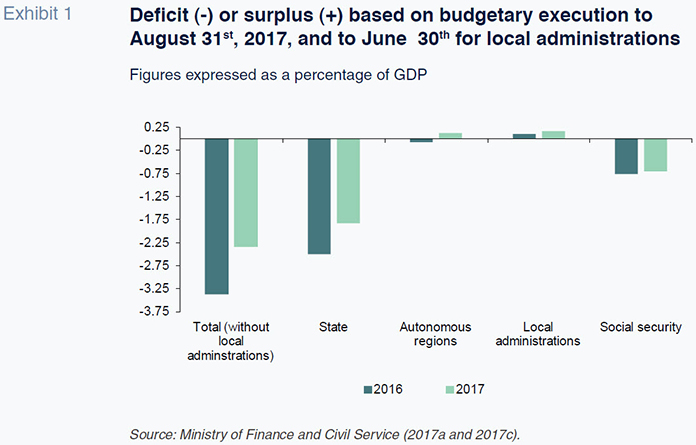

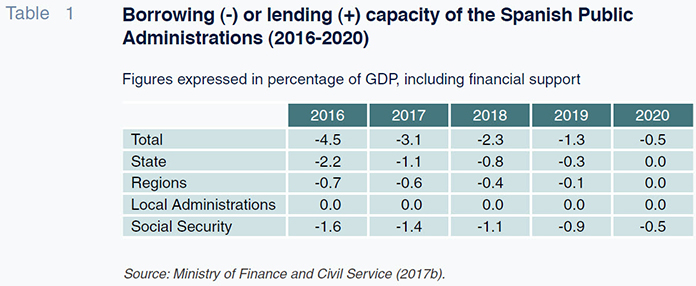

2017 adjustment: Mission (almost) accomplished Data on budgetary execution to August 31st indicate that there has been a significant adjustment in the deficit. Excluding the local administrations, the overall public sector deficit fell by 1.03 percentage points, led by the State, but also with the autonomous regions notably switching from a deficit of -0.08% to a surplus of +0.12%. Meanwhile the Social Security system improved very slightly (by 0.06ppts) and data for local administrations – available to June 30

th – points to a potential surplus in excess of their target of achieving a balanced budget. In fact, available forecasts suggest that the local administrations are on track to post a similar or larger surplus in 2017, which will help offset highly likely overshoots at the State and Social Security level. This is essentially a reflection of the fact that, despite the significant adjustment to date

[1], the target that has been set for 2017 is very ambitious. As shown in Table 1, 80% of the 2017 deficit (1.1 out of 1.4 percentage points) has been assigned to the State.

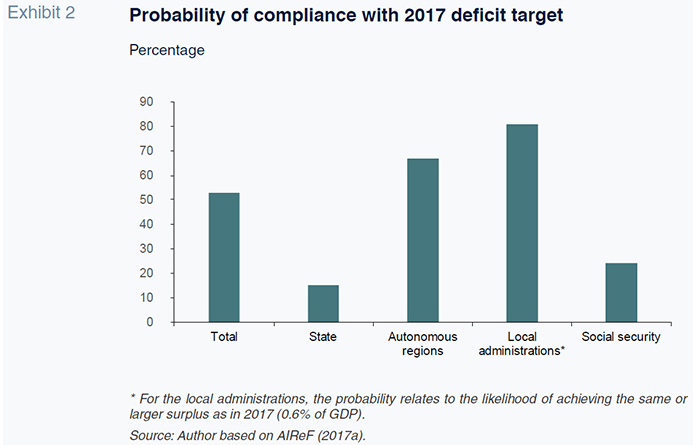

AIReF’s (2017a) monthly surveillance is enlightening in this regard. As can be seen in Exhibit 2, according to AIReF, the probability of meeting the deficit target based on data to July is 15% for the State and 24% for the Social Security system. Under AIReF nomenclature, the former is deemed to be “very unlikely” to comply, while the latter is classed as “unlikely.” On the opposite extreme, the autonomous regions are considered “likely” (67%) to comply, with the local administrations once again “very likely” to achieve a substantial surplus; the odds of them repeating or improving their 2016 outturn (+0.6% of GDP) are put at 81%. AIReF’s assessment for the overall public sector lies somewhere in between at 53%

i.e. “feasible”. This assessment is an improvement of 10 percentage points on the 43% estimate contained in the previous surveillance report – based on data to April 30

th– and is closing in on the 60% threshold under which AIReF considers compliance to be “likely”.

Most analysts agree with this assessment, believing that Spain’s 2017 public deficit will come in very close to target. Funcas (2017b) consensus predicts an outturn of -3.1% of GDP, with estimates ranging from -3.1 to -3.3%. Forecasts by The International Monetary Fund (IMF, 2017), the Bank of Spain (2017a) and Funcas (2017a) in reports published over the last two months are slightly higher (-3.2%).

Regardless of whether the final outturn is -3.2% or -3.1%, progress on fiscal consolidation in 2017 is set to be more impressive than 2016 when Spain’s overall deficit target had to be revised up two times over the course of the year to bring the goal into line with the reality revealed by monthly and quarterly outturns (Lago-Peñas, 2017). Initially, the 2016 deficit was set at -2.8% of GDP in September 2015 and then raised to -3.6% in April 2016 and, finally, -4.6% in August.

Scenario for 2018: Budget and macroeconomic forecasts The political crisis in Catalonia has various fiscal implications. Firstly, and most immediately, it has resulted in a failure to approve the 2018 State Budget on time and the consequent rollover of the 2017 Budget. Parliamentary arithmetic dictates that the minority government needs to have support from either nationalist and regionalist parties or from left-wing groups. On their own, Partido Popular and Ciudadanos muster 169 seats versus a majority threshold of 176. Specifically, the Basque Nationalist Party (PNV with 5 seats), which supported the 2017 Budget, is now reluctant to do so again given current political tensions in Catalonia

[2]. The central government believes that the 2018 Budget will eventually be approved in February 2018 but the political situation remains very fluid and will depend on the outcome of regional elections in Catalonia in December. A repeat of a parliamentary majority for pro-independence parties would prolong political uncertainty in Spain as a whole.

According to the latest surveys, the results attained by blocs in favour and against independence will be similar to 2015 elections

[3]. However, if this year’s elections do not see a return of the joint platform between the two largest pro-independence parties – as happened in 2015 with Junts pel Sí – their over-representation in terms of the seats assigned by the electoral system will be significantly watered down. As a result, it will be much more challenging for pro-independence parties to achieve a parliamentary majority, requiring them to attain a higher share of the vote

[4].

Secondly, the political situation in Catalonia has added further complexity to the political instability stemming from the fragmentation and polarisation of the Spanish Parliament following the great recession. Against this backdrop, tackling reforms which have a significant impact on the public accounts is even more difficult. A non-exhaustive list of issues that still need to be addressed includes dealing with the deficit in the Social Security system via the so-called “Toledo Pact” framework; reforming regional and local financing, where the necessary technical work has been done but formal political negotiations have yet to begin; and overhauling the Spanish tax system, where the 2014 Commission of Experts’ report is a useful reference point.

Thirdly, and more specifically, the political crisis in Catalonia has the potential to impact the economy through various channels. Principally, via a loss of household and business confidence, an impact on tourism and international investment decisions and an increase in market volatility and risk premia. This in turn has implications for public finances. Funcas (2017a), BBVA Research (2017), the Bank of Spain (2017b) and AIReF (2017d) have all attempted to estimate the potential impact. These estimations are inevitably subject to uncertainty regarding the duration of the instability, but provide an overall impression of the scale of the problem. Given that Catalonia accounts for a fifth of the Spanish economy (19% of Spanish GDP in 2016 according to the Institute of National Statistics), asymmetric shocks to this region have substantial implications for wider Spain.

Under the assumption of a progressive and relatively rapid normalisation of the situation, Funcas (2017a) sees the Catalan economy weakening in terms of GDP growth from an initial outlook of 3.1% between October 2017 and March 2018 to 1.6% due to the negative ramifications for tourism, investment and consumption. Thereafter, the Catalan economy is assumed to return to previous trends. This impact would in turn lead to an overall growth forecast for Spain as a whole of 2.6% in 2018, with half of the slowdown relative to 2017 (0.2-0.3ppts) stemming from the Catalan crisis. BBVA Research (2017) reaches a similar conclusion, estimating the impact as reducing the pace of Spanish GDP growth by 0.3ppts in 2018 under a central scenario based on a normalisation of political uncertainty in a short period.

The Bank of Spain (2017b) observes that up until the end of October, the impact on financial markets had been modest and that economic data for the fourth quarter is still very limited. As a result, the Bank of Spain prefers to draw up forecasts under various hypothetical scenarios, using previous historical episodes of high uncertainty as a benchmark. Assuming that the worst of the tension is confined to the fourth quarter of 2017 and that thereafter there is a progressive normalisation, the projected impact on Spanish GDP ranges from a 0.3ppts cumulative loss in GDP between 2018 and 2019 in the most benign scenario to a maximum of 2.5ppts in the worst case, which would be equivalent to the degree of uncertainty seen prior to the launch of the banking sector recapitalisation and clean-up programme in the second quarter of 2012.

Finally, AIReF (2017d) also considers a central scenario in which the political and institutional shock in Catalonia is short-lived, in line with the Bank of Spain and Funcas. They estimate a somewhat bigger impact on growth in 2018, with a decline in the Spanish economy’s overall GDP of -0.4%. However, they also note that prolonged political and institutional instability would lead to growing negative impacts and could subtract as much as -1.2% from Spanish GDP growth in 2018. For Catalonia, the figures would be even more pronounced, with the impact of overall uncertainty combining with an idiosyncratic shock resulting in a loss of confidence, which would lead to a reduction in Catalan GDP in 2018 of -0.7% in the central scenario and -2.7% in the worst case.

The Spanish government adopts this central scenario in its 2018 Draft Budgetary Plan (Ministry of Finance, 2017b), which combined with a projected slowdown in domestic demand, leads to expectations of a significant slowdown in GDP growth from 3.1% in 2017 to 2.3% in 2018, with political uncertainty accounting for around half of the slowdown. This forecast and the overall macroeconomic scenario are considered to be realistic by AIReF (2017b) and weaker than projected by Funcas (2017a), which forecasts growth of 2.6% next year, and the 2.5% projected by the Bank of Spain (2017b), IMF (2017) and BBVA Research (2017).

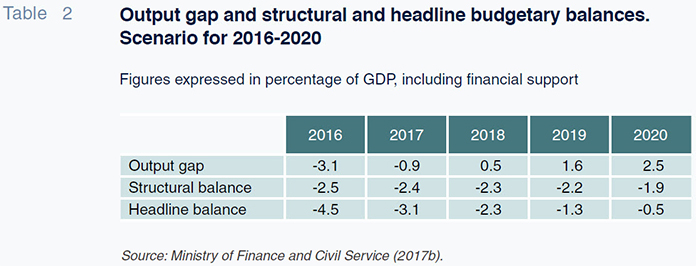

However, the government’s forecast has been received less positively when looking at the public finances. The government’s deficit target for 2018 (-2.3% of GDP) involves a reduction of 0.8 percentage points relative to the 2017 target (Table 1). This in turn is 0.1 percentage points less ambitious than envisaged by the Stability Programme 2017-20 and is expected to be delivered almost entirely by cyclical effects with a marginal adjustment in the structural deficit of 0.1ppts (Table 2). This scenario has been criticised by the European Commission, which in a letter to the Spanish government highlighted the danger of overshooting, in the absence of discretionary adjustment measures, and the need to approve the 2018 Budget as soon as possible. AIReF believes that the -2.3% target for the overall public sector deficit envisaged in the 2018 Draft Budgetary Plan is “feasible”. However, this assessment depends on the probable deviations by the State and the Social Security system being offset by a positive performance at the local administration level and the uncertainty resulting from the Catalan crisis attenuating before the end of 2018. In terms of the regions, taking account of the impact of the update to the macroeconomic scenario and its knock-on implications for payments on account, AIReF believes that it is feasible albeit touch-and-go for the government to reach its 2018 deficit target (AIReF, 2017c); while it is “unlikely” or “very unlikely” that Catalonia will do so depending on the duration of the current crisis (AIReF, 2017d). Other organisations are slightly less optimistic regarding the deficit outlook in 2018. Funcas (2017a) and BBVA Research (2017) put the deficit at -2.4%; while the IMF is forecasting -2.5% (IMF, 2017); and the Bank of Spain (2017a), -2.6% of GDP.

Overall, there is a clear and urgent need for a 2018 Budget to help reduce political and economic uncertainty and articulate a more ambitious budgetary strategy containing structural measures to ensure compliance with the path set out in the Stability Programme.

Fiscal outlook to 2020 Table 2 shows the expected evolution of the overall public sector deficit, structural deficit and output gap from 2016 to 2020 as envisaged by the government’s Draft Budgetary Plan (Ministry of Finance, 2017b). Against a backdrop of a rapid transition from a negative to positive output gap (6ppts swing over 2016-2020), the headline deficit is expected to improve by 4ppts but remain negative, with only a small reduction in the structural deficit (-2.5% in 2016 and -1.9% in 2020). This path is hardly ambitious and allows for the continuation of a structural deficit which will inhibit the functioning of automatic stabilisers and future recourse to discretionary stimulus measures in the event of another crisis; meanwhile, the reduction in the debt to GDP ratio is set to slow to a threshold of 60%.

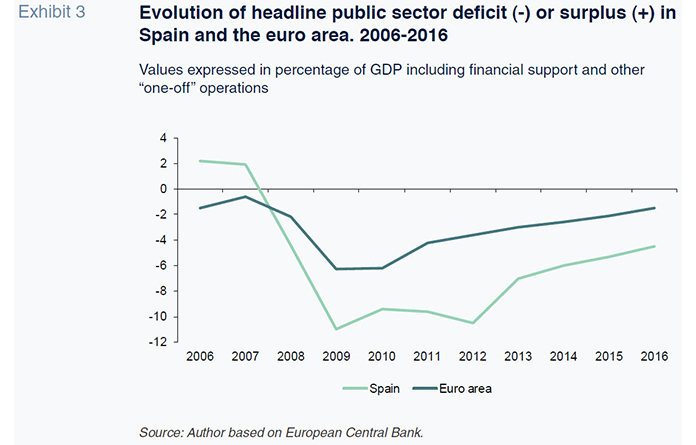

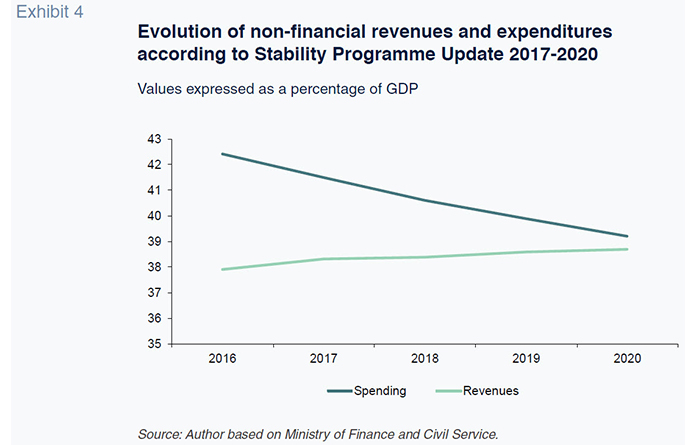

Exhibit 3 and the IMF’s recent report (IMF, 2017) point in the same direction. Spain’s fiscal system requires deep reforms in order to be more sufficient, fair and efficient. In the run-up to the crisis (2006 and 2007), Spain posted sizeable budget surpluses on the back of inflated tax receipts from the real estate bubble. But this was not sustainable. The economic recovery has arrived but not the bubble, which explains why the elasticity of tax revenue-to-GDP growth is consistently below budget (AIReF, 2017a). Recent (Lago-Peñas, 2017) and future (Exhibit 4) fiscal efforts focus solely on cutting or containing expenditure programmes and sidestep any form of tax adjustment. But this is not enough to eliminate the structural deficit. As the IMF has argued from the outside and various domestic reports have reiterated – such as Funcas (2014) or the Commission of Experts (2014) – action is need on the revenue side, where there is much greater scope for improvement.

Notes

An improvement which is partially explained by the measures increasing payments on account for Corporation Tax, taking effect from the last quarter of 2016 and which have generated an extra 2 billion euros (around 0.2 ppts of GDP) in revenues applicable for the payment on account in April 2017. However, this effect will be offset in the October payment on account, resulting in a deterioration of 0.2ppts GDP in the last quarter above that of the norm.

https://elpais.com/economia/2017/10/21/actualidad/1508612713_947484.html

https://politica.elpais.com/politica/2017/10/31/ratio/1509473738_467094.html

Specifically, in the 2015 Catalan elections, the coalition obtained 45.93% of seats on the back of 39.59% of the vote, a “prize” of 6.34%. Simulations for the Catalan electoral system show that the proportionality of votes-to-seats is much higher for vote shares of 10-20%.

References

AIReF (2017a),

Monthly surveillance of the stability objective for the combined public administrations, July 2018, 3-10-2017, available at

www.airef.es — (2017b),

Report on the macroeconomic forecasts contained in the Draft Budgetary Plan 2018, 18-10-2017, available at

www.airef.es — (2017c),

Report on the main headings in the 2018 regional budgets, 24-10-2017, available at

www.airef.es — (2017d),

Report on the main headings in Catalonia’s 2018 regional budget, 3-11-2017, available at

www.airef.es BANK OF SPAIN (2017a),

Quarterly report on the Spanish economy, 28-9-2017, available at

www.bde.es — (2017b),

Financial Stability Report, 2-11-2017, available at www.bde.es BBVA RESEARCH (2017),

Spain Economic Outlook, Fourth quarter 2017.

Commission of Experts (2014), Commission of Experts report on reform of the Spanish tax system, available at

http://www.minhafp.gob.es/es-ES/Prensa/En%20Portada/2014/Documents/Informe%20expertos.pdf Funcas (2014), “The tax system in Spain: Problems, challenges and proposal,”

Papeles de Economía Española, 139, available at

www.funcas.es — (2017a),

Economic forecasts for Spain 2017-18, 3-11-2017, available at

www.funcas.es — (2017b),

Spanish economic forecasts panel, 15-11-2017. Available at

www.funcas.es — (2017c), Article IV Consultation with Spain,

IMF Country report 17/319, 6-10-2017, available at

www.imf.org LAGO-PEÑAS, S. (2017), “Spain´s fiscal consolidation path: Slow but steady,”

Spanish Economic and Financial Outlook, 6(4).

MINISTRY OF FINANCE AND CIVIL SERVICE (2017a),

Quarterly accounts of the Public Administrations, second quarter of 2017, 27-9-2017, available at

www.minhafp.gob.es.

— (2017b),

2018 Draft Budgetary Plan and submission of quarterly information, 16-10-2017, available at

www.minhafp.gob.es.

— (2017c),

State budgetary execution to September 2017, 31-10-2017., available at www.minhafp.gob.es.

Santiago Lago Peñas. Professor of applied economics and director of the governance and economics research network (GEN), University of Vigo