Spanish public debt holdings at the end of the ECB’s purchase programme

The composition of Spain’s investor base has evolved over three distinct periods in the last 15 years, with Spanish banks now holding a smaller proportion of domestic sovereign debt than observed among banks in other eurozone countries. However, as the Spanish economy has continued to strengthen, data show that some of the most risk-averse foreign investors have discovered a fresh appetite for Spanish bonds, thereby contributing to the ongoing decline in Spain’s borrowing costs.

Abstract: The composition of the investor base for Spain’s sovereign debt has evolved significantly over the past 15 years and can be divided into three distinct periods. The most recent period began in 2012 and has been heavily influenced by the ECB’s public sector purchase programme (PSPP), which initiated a shift in demand for Spanish bonds from the domestic private sector to the Bank of Spain, encharged with implementation of the PSPP. In a reversal of the observable trend during the crisis, non-resident holdings of Spanish public debt have increased since and Dutch bonds held by foreign investors has diminished. This largely corresponds with data that show a correlation between non-resident holdings of sovereign bonds and the difference in borrowing costs between Spain and Germany. Also noteworthy is the increased appetite for Spanish bonds among Asian, and in particular, Japanese, investors, who tend to be risk-averse, thereby suggesting renewed confidence in the Spanish economy. Finally, it is also important to highlight that while Spain’s Target2 balances have widened as public debt has increased, these balances are merely accounting adjustments that reflect the decentralised implementation of monetary policy. Going forward, it will be necessary to continue to reduce Spain’s public debt levels and ring-fence the economy from the ongoing instability emanating from Italy’s financial markets.

The three shifts in the composition of Spanish public debt holdings

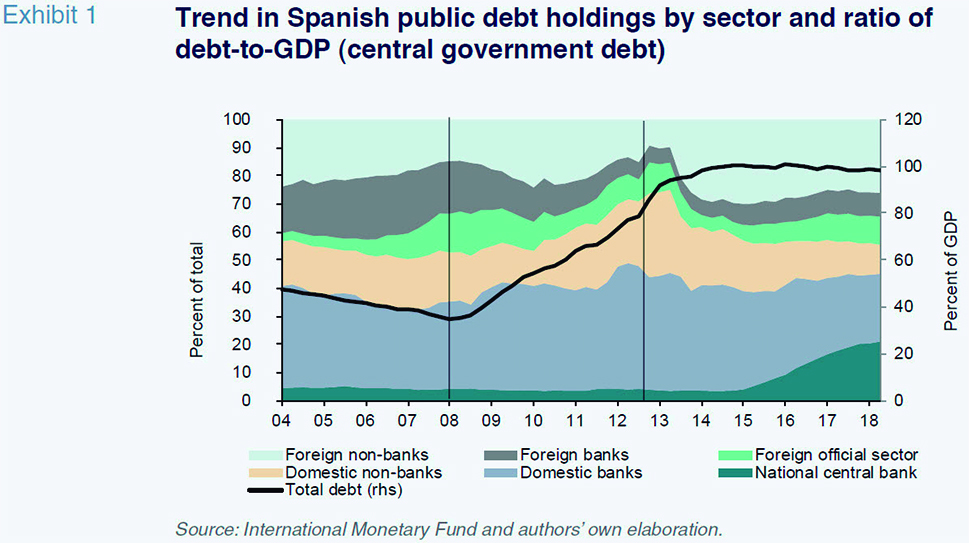

The movement in Spanish sovereign debt holdings over the last fifteen years falls into three clearly differentiated time periods. The first phase occurred between 2004 and 2008. Significantly, it coincided with the reduction in the ratio of debt-to-GDP, driven by strong economic growth, which ultimately earned Spain the highest credit ratings (AAA or Aaa, depending on the agency). Due to the perception that sovereign risk was uniform across the eurozone, foreign investors widely favoured those markets offering the highest sovereign bond yields.

Specifically, foreign banks and official investors spearheaded a significant expansion of non-resident holdings. In the context of strong credit growth and high interest rates, Spanish banks simultaneously reduced their holdings of Spanish sovereign bonds. Consequently, by the end of 2007, the percentage of Spanish bonds held by non-resident investors stood at nearly 50%.

The second phase unfolded between 2008 and 2012, a period marked by both the global financial crisis and the subsequent sovereign debt crisis. The debt crisis, which persisted in several peripheral eurozone countries, was characterised by sharp private sector deleveraging and rapid growth in public debt ratios. The latter sparked fear of the euro’s collapse and initiated a period of foreign capital outflows from those peripheral economies’ sovereign bonds. In Spain, the percentage of sovereign bonds held by foreign investors decreased by 20 percentage points to just below 30% by mid-2012. As foreign investors fled these sovereign debt markets and absolute public debt levels began to rise, home-market banks increased their purchases of government bonds.

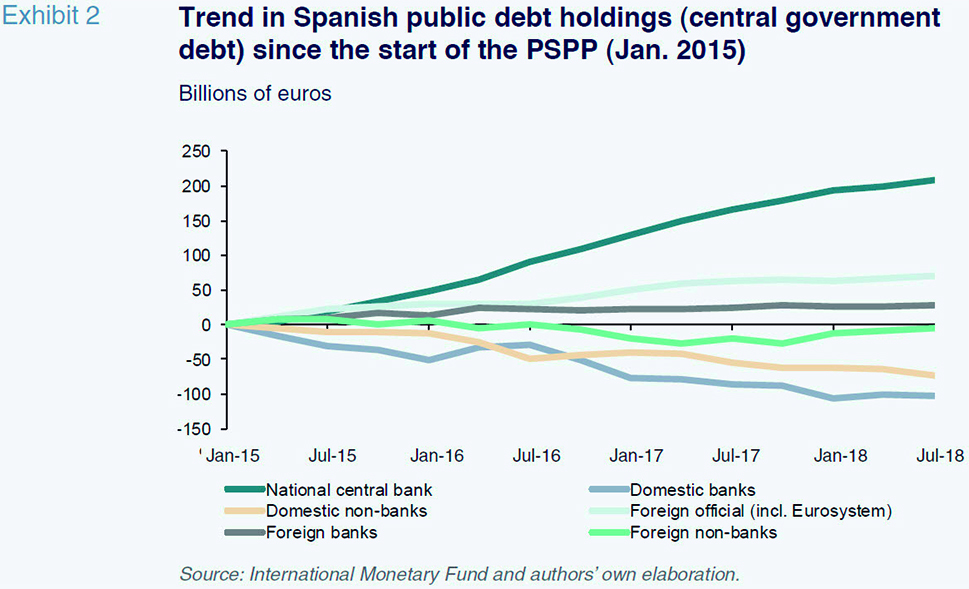

The summer of 2012 marks the beginning of the third shift in the composition of Spanish bond holdings, which occurred in the aftermath of Mario Draghi’s pledge to do “whatever it takes” to defend the euro. This phase can be divided into two sub-phases separated by the start of the ECB’s bond purchase programme in early 2015. Initially, the combination of the Spanish financial sector’s bailout, reforms implemented by the Spanish government and the gradual economic recovery in the eurozone nudged the Spanish economy towards growth. This expansion accelerated sharply from 2014, allowing for the stabilisation of Spain’s debt-to-GDP ratio. Around this time, foreign investors, led by the non-bank private sector, began to increase their holdings of Spanish bonds. The second sub-phase began with the introduction of the public sector purchase programme (PSPP) by the ECB at the start of 2015, which intensified the growth in the proportion of public debt held by non-residents. This initiated a shift in demand from the domestic private sector to the Bank of Spain, the national central bank responsible for the decentralised implementation of the PSPP in Spain.

At this point, the rating agencies began to raise Spain’s credit ratings, changing their outlooks or credit watches to ‘positive’. As a result, beginning in 2015, foreign official investors and the Euro system, via the Bank of Spain, emerged as the main net buyers of Spanish sovereign debt, while the domestic banks and other non-bank Spanish investors reduced their holdings. It is also worth highlighting the intensification of this trend with the recovery in investment by the most risk-averse segments of the foreign investor base. This dates from January 2018 when Fitch and Standard and Poor’s raised Spain’s sovereign debt ratings to ‘A’.

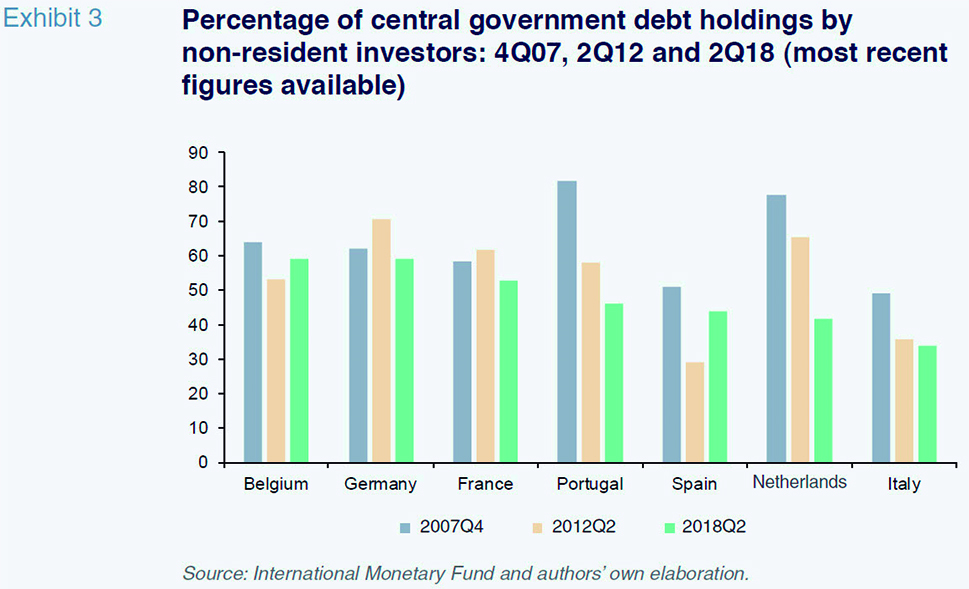

Non-resident holdings: A comparison with the core eurozone issuers

The years between 2008 and 2012 saw a notable decline in the funding by non-resident investors of debt issued by those countries most impacted by the sovereign debt crisis. At the same time, these investors increased their holdings of sovereign debt issued by Central and Northern European countries, such as France and Germany. Since 2012, this trend has largely reversed, with non-resident public holdings of Spanish and Belgian debt increasing, while the proportion of German, French and Dutch bonds held by foreign investors has diminished. Italy, however, is an exception, as non-resident investors have continued to decrease their holdings against a backdrop of heightened political volatility and economic stagnation.

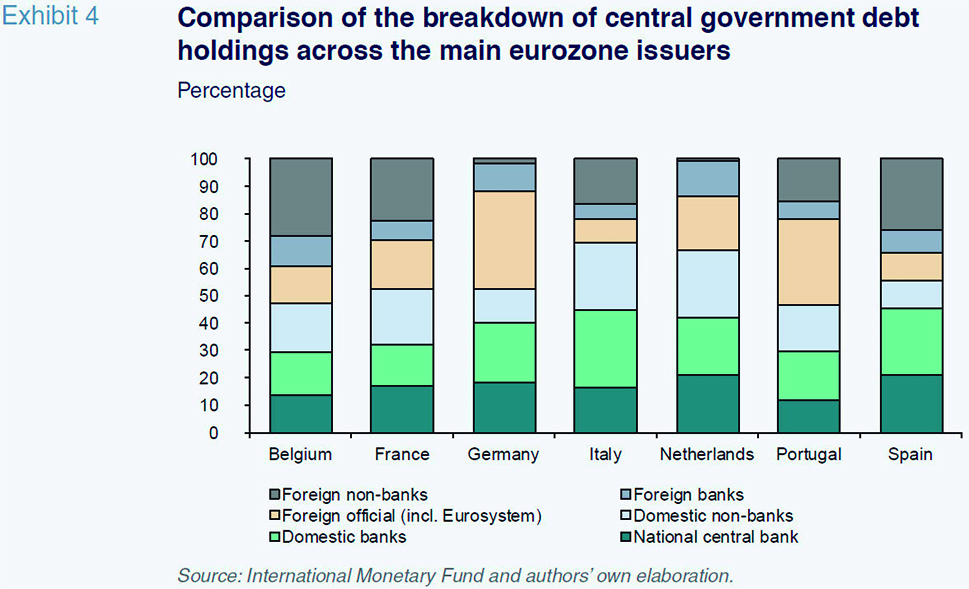

The most recent figures available (Exhibit 4) provide a breakdown of Spanish public debt holdings between foreign and resident investors, which broadly aligns with the composition of Belgian and French debt holders on the foreign side and German debt holders on the domestic side. Nevertheless, substantial differences remain within both the resident and non-resident categories. Despite reducing their holdings, the percentage of public bonds held by the Spanish banks remains higher than that of the other core eurozone issuers. Also, the percentage held by non-financial resident investors is the lowest of any of the major eurozone sovereigns. Turning to foreign investors, a smaller percentage of Spanish debt is held by foreign official investors (central banks from outside the eurozone and other official institutions) compared to the French, Dutch and German sovereign bond markets.

The close correlation between risk premium, credit ratings and non-resident holdings

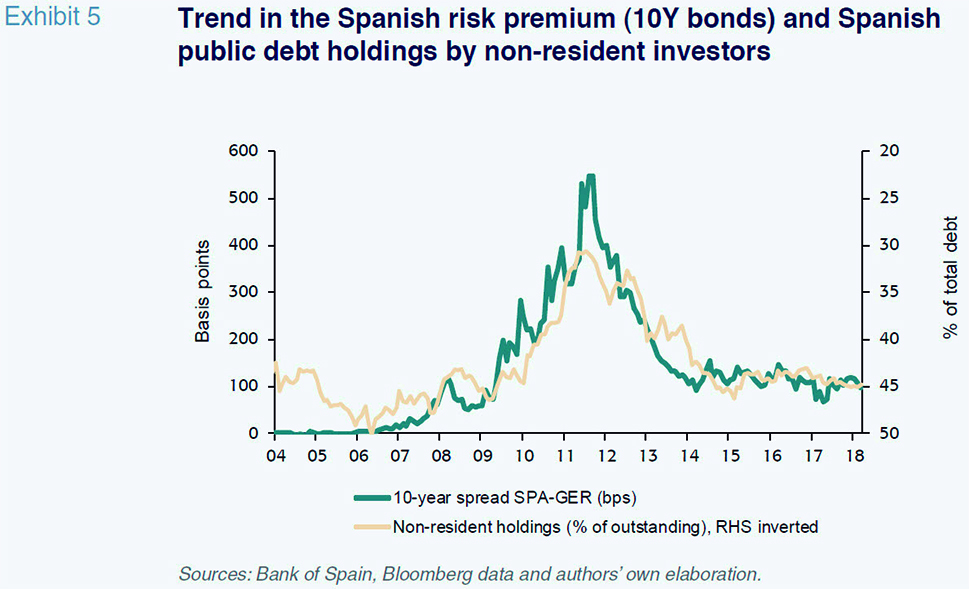

The pattern of non-resident investor holdings of Spanish sovereign bonds has been closely correlated over the past 15 years with the spread paid by Spanish bonds relative to their German counterparts, the yardstick for the lowest sovereign risk in the eurozone (Exhibit 5). The decrease in Spanish debt holdings by non-resident investors between 2008 and 2012 –of nearly twenty percentage points, concentrated among the foreign banks and non-resident official sector– was accompanied by an increase in the spread over German bonds of over 450 basis points in 10 years. During this same period, the yield on Spanish debt in the secondary markets widened from close to 4% at the end of 2008 to over 7.2% in the summer 2012. Since then, the opposite phenomenon has taken place. The holdings of non-resident investors have increased by nearly 15 percentage points, while the risk premium has narrowed to just over 100 basis points and the yield on 10-year bonds has fallen to 1%.

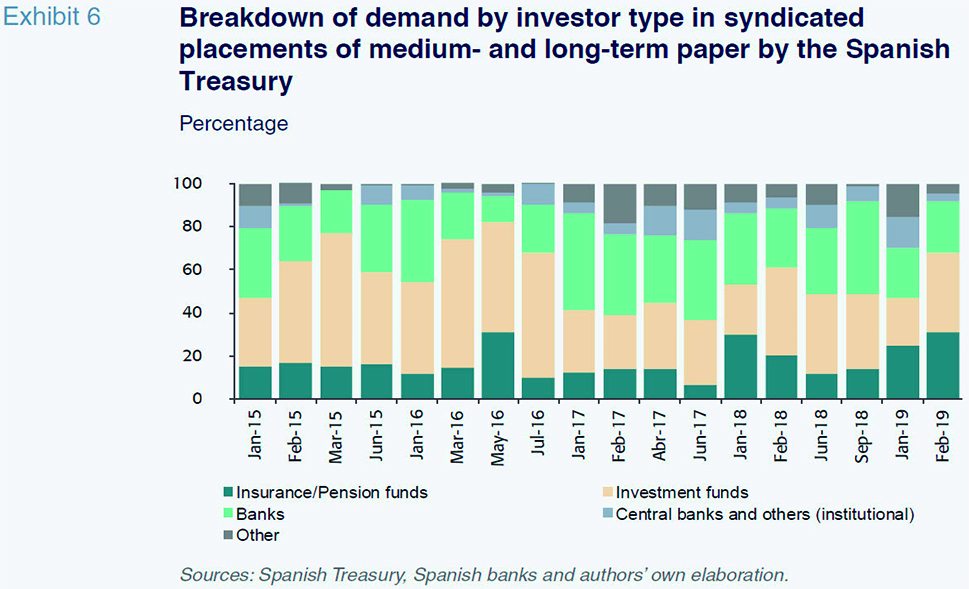

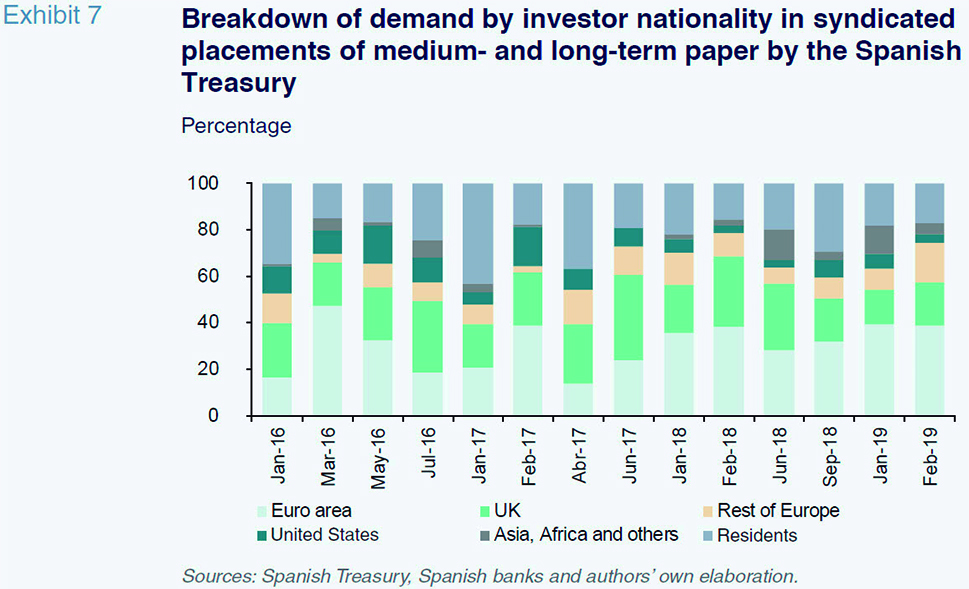

Looking at the demand for Spanish public debt among foreign investors since 2017, including risk-averse investors from Asia as well as central banks, foreign institutions and institutional investors, it becomes clear there has been a renewed appetite for Spanish bonds. Exhibits 6 and 7 illustrate these trends.

Asian investors, especially those from Japan, present an interesting case.

[1] The Japanese balance of payments data reveal a sharp increase in purchases of Spanish public debt by Japanese investors since the start of 2018, growth that is far more pronounced than in other eurozone sovereign bonds markets such as Italy.

The simultaneous growth in capital flows from Japan and the rating upgrades by Fitch and Standard & Poor’s serve as confirmation that for this class of highly risk-averse investors, Spanish debt has become a ‘bankable’ asset. Among the Japanese and other Asian investors from the public and private sectors, perceived default risk is crucial in assessing whether to buy or sell sovereign debt. The difference in the probability of default, measured using cumulative average five-year default rates, for local currency sovereign debt is much lower for A-rated versus BBB-rated bonds. While the additional yield obtained by Japanese investors who have hedged their exchange rate exposure alongside their investments in Spanish bonds is relevant, it does not drive the divergent trends of investment inflows to Spain and Italy among this group of investors.

The role of Spanish banks as investors in Spanish public debt compared with the Italian market

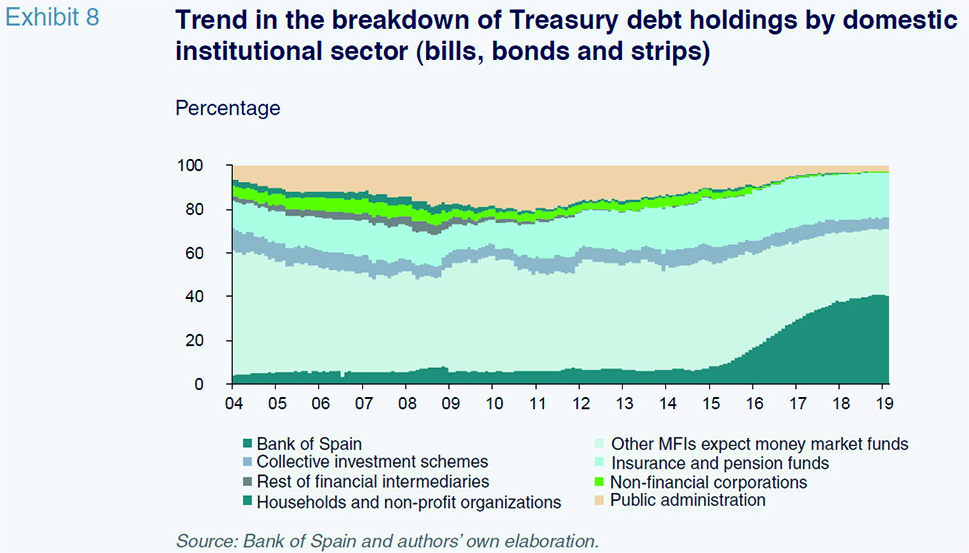

There are three groups of purely domestic investors who, over the past 15 years, have accounted for the bulk of resident debt holdings (Exhibit 8). Historically, the Spanish banks have been the predominant purchasers of Spanish Treasury bonds. They stepped up this activity between 2008 and 2012, when non-resident investors closed out their positions. At that time, domestic banks accounted for around 50% of all resident-held debt, resulting in a share of total outstanding debt of close to 29%. By February 2019, thanks to the repurchasing of bonds by the ECB initiated in 2015, Spanish banks held around 17% of outstanding Treasury bonds and just over 30% of all public debt held by resident investors. In contrast, the Bank of Spain has increased its share of domestic and overall public debt holdings to 40% and 22%, respectively. As a result, domestic banks are no longer the main investors in Spanish debt, having been usurped by the euro system, via the Bank of Spain.

The other two investor groups consist of the insurance and pension fund sectors (for which there are separate figures since 2016 only) and the government. Within the latter group, the Social Security Reserve Fund played a significant role in the early 2000s and at the height of the sovereign debt crisis when it concentrated its investments in Spanish public debt at the expense of other eurozone sovereign issuers.

Aside from the Bank of Spain, which was responsible for the execution of the ECB’s public sector purchase programme (PSPP), all other resident investors have continued to play a fairly minor role. The savings invested by collective investment undertakings represented a scant 5% of domestic debt holdings at the start of 2019 (3% of total outstanding debt), while the public debt held directly by corporations and households, which in the years prior to the crisis accounted for nearly 9% of total resident holdings, currently stands at just over 0.5%.

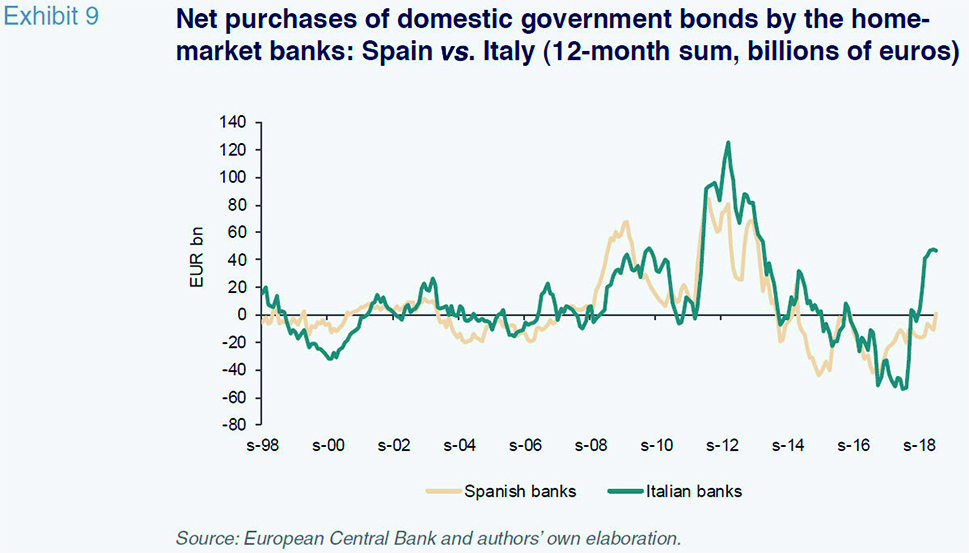

Beyond their percentage share of the total and steadily rising stock of outstanding debt (since October 2007), it is important to look at the pace of the banks’ net purchases or sales and compare the trend with the Italian banks’ situation in relation to that country’s debt model.

As shown in Exhibit 9, the Spanish banks were net purchasers of Treasury bonds between 2008 and mid-2013. During that period, the portfolio of Spanish central government debt held by the Spanish banks went from a little over 70 billion euros to 305 billion euros. Since then, the banks have been net sellers, reducing their portfolios by over 110 billion euros, so that their portfolio of Spanish debt stood at 193 billion euros as of October 2018. That said, as of March 2019, the size of their portfolio has increased slightly by 13 billion euros to 206 billion euros.

This structural downsizing of the banks’ Spanish debt portfolios has been directly and significantly influenced by the deleveraging effort initiated by the domestic sector in 2013. By reducing the size of their sovereign exposures, the weight of these portfolios over total assets moved in the same direction. The volatility observed in the accumulated 12-month net purchases figure is the result of the active management of structural fixed-income portfolios by the Spanish banks in recent years, which is most evident in the materialisation of sizeable gains on financial trades.

The slight growth in this portfolio between October 2018 and March 2019 may be due to the slowdown in lending activity and the banks’ attempt to prop up net interest income. However, it is our opinion that this should not be interpreted as a renewed need to finance the Treasury as a result of a dip in demand from the rest of its investor base. Although net purchases under the PSPP ended in December 2018, the ECB continues to reinvest the amounts received as the bonds mature and refinancing accounts for a significant part of the gross issues planned by the Treasury this year. As well, such an interpretation is inconsistent with the strong demand, particularly from non-residents, observed in the syndicated Spanish debt placements carried out in 2019, specifically the new 10-year bonds at the end of January and 15-year bonds issued the end of February.

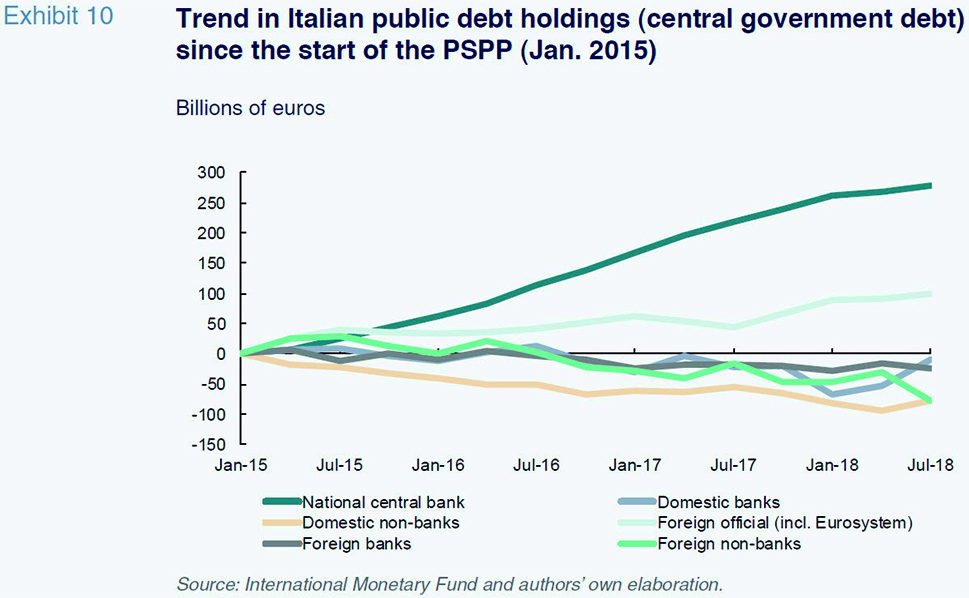

The comparison with Italy in terms of domestic banks’ purchase of sovereign debt over the past 12-18 months is stark. A similarly divergent trend is observed in the composition of the investment base since early 2015, which is when the ECB started to buy back sovereign bonds. As shown in Exhibit 9, Spanish banks’ purchase of debt on a net basis over the last 12 months (622 million euros to March 2019) has been negligible, while the Italian banks have added 47 billion euros worth of Italian Treasury debt securities to their balance sheets. Since 2015, the only investors to have increased their position in Italian debt have been the Bank of Italy, which has executed purchases under the PSPP, and official foreign investors (including the Euro system). The size of Italian banks’ sovereign debt portfolios have remained the same since 2015, whereas the foreign banks and non-banks have increasingly been net sellers. In the case of Spain, the difference lies with the fact that foreign investors, particularly foreign banks, have increased their exposure in parallel with the Bank of Spain’s buybacks, while the domestic banks and other domestic investors have reduced their positions sharply. These trends suggest a higher level of confidence among Spain’s investor base compared to Italy.

The role played by the PSPP in the shifting structure of Spanish debt holdings and Target2 balances

The ECB’s quantitative easing (QE) effort, specifically its public sector purchasing programme (PSPP), has had the effect of considerably increasing the amount of public debt held by the national central banks, which are tasked with the decentralised implementation of the programme. The Bank of Spain has gone from holding 35 billion euros of Spanish debt on its balance sheet to almost 244 billion in June 2018. This represents growth from 3.5% of total outstanding Spanish debt to 21.1%. As already discussed, the domestic banks have reduced their share of debt holdings substantially (by a little over 13pp), as have the rest of the private and public resident investors. The only investors, aside from the euro system, to have increased their share of Spanish debt holdings have been the non-resident investor base. This includes both private (foreign banks) and, to a lesser degree, public investors (official).

The comparison with the rest of the eurozone sovereign issuers sets Spain apart and casts it in a positive light (Table 1). Firstly, among the major eurozone markets in which the PSPP has made purchases, Spain has experienced the biggest decrease of domestic banks’ share of holdings. This has helped reduce sovereign debt linkages between the banks and the government (the so-called ‘doom loop’). Secondly, it is the only market in which domestic investors, private and public, have been substituted by non-resident investors. Conversely, Italy lies at the other extreme of this comparison, where there is hardly any reduction to the potentially dangerous nexus of sovereign debt linkages, with the foreign investor base showing little recovery.

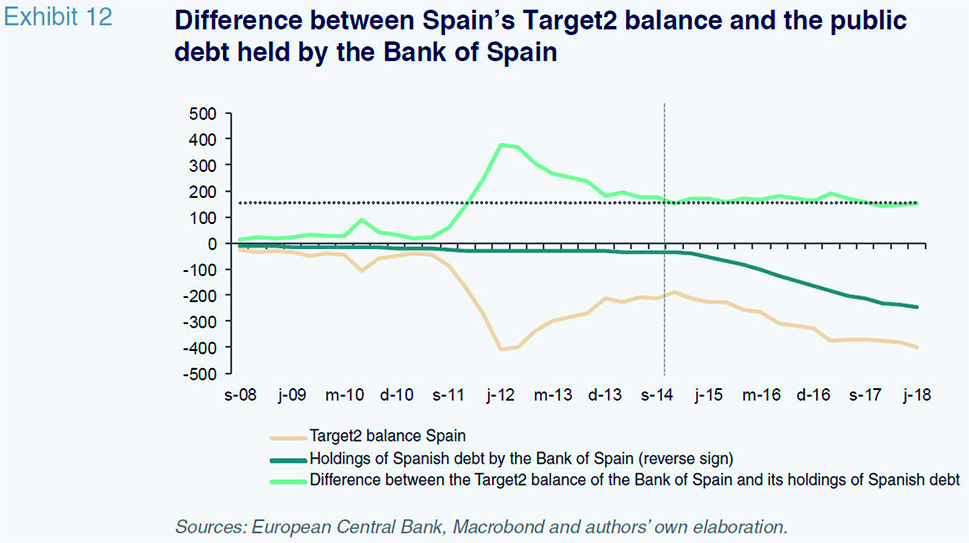

The decentralised implementation of the PSPP has had another consequence, namely the growth in the Target2 balance with the euro system. As in 2011-12, this expansion implies a sharp deterioration in Spain’s net position relative to the Euro system and the country’s net international investment positions (NIIP). However, precisely because the deterioration is attributable to the PSPP, it should be largely interpreted as an accounting effect and not a real worsening of Spain’s international exposure.

When Spain’s Target2 balance widened considerably at the start of 2011, it was related with a sharp outflow of capital fuelled by the euro crisis. Panic about the potential collapse of the euro prompted international investors to move from Spanish debt into that of core issuers. That Spanish debt was mostly bought by the domestic banks, which connect up to the Target2 system from the Bank of Spain. As a result, when it came time to settle those transactions, these banks’ reserves were lower at the Bank of Spain, implying the opening of a Target2 liability between the Bank of Spain and the Euro system bank in the member state where the bonds were sold. Those movements could be read as a deterioration in Spain’s NIIP, particularly if interpreted within the context of a possible break-up of the eurozone.

Since 2015, however, a different interpretation of this movement has emerged. The renewed widening of the Target2 balance has taken place in parallel with the growth in the public debt. This is due to the Bank of Spain (Exhibit 11), whose net position vis-a-vis the Eurosystem has weakened. That said, this has occurred by a smaller amount than the overall Target2 balance thanks to counterparty assets such as foreign reserves and net assets related with the assignation of euro notes in the Eurosystem to the Bank of Spain. This movement should not be read as a real obligation between Spain and the eurozone. Within a monetary area, these balances are merely accounting adjustments that reflect the decentralised implementation of monetary policy and the fact that reserves continue to be kept at each national central bank and not at the ECB.

Conclusion

The composition of the Spanish Treasury’s investor base has undergone major changes over the last 15 years, and these developments can be grouped into three clearly defined time periods. This article focuses on the period beginning in the summer of 2012, which includes the launch of the ECB’s public sector purchases program in January 2015. During this period, there have been many significant developments, which, by early 2019, led to a more robust and diversified investor base for Spanish sovereign debt. The economic recovery of the last five years has been stronger and longer than initially expected, allowing for the correction of several structural imbalances in the Spanish economy. Importantly, this recovery has continued without generating any of the excesses typical of prior periods of growth. The spread between Spanish and German sovereign bonds has trended downward over the past couple of years, thereby illustrating heightened confidence among Spain’s investor base.

Looking forward, there are three factors worth watching in the coming years. First, the Spanish economy’s performance in terms of growth and deficit consolidation. The continuity of the momentum in the sovereign debt ratings and, above all, investor confidence, depends largely on the continued reduction of public debt levels. The existence of a better capitalised, more efficient and profitable banking sector (albeit far less profitable than in the past), coupled with the absence of excessive leverage in the private sector, means that a potential cyclical slowdown should not culminate in a recession of the intensity experienced between 2009 and 2013.

The second factor is external and relates to ring-fencing the potential contagion from the Italian economy. The persistent economic stagnation observed in that economy has made its borrowing levels unsustainable outside the context of ultra-low rates that leave its refinancing costs very close to zero. In such circumstances, the emergence of internal political risk and the questioning of Europe’s fiscal rules are potential destabilising factors. The growing sovereign debt linkages between the Italian banks and its government, shaped by the exodus of private foreign investors, further complicates the situation.

So far, episodes of sharp spikes in the spread between Italian bonds and their German counterparts have had, with the exception of May 2018, limited knock-on effects for Spanish (and Portuguese) spreads. However, the probability that the deterioration in Italy will intensity is not negligible, even after accounting for reinforcement of defence mechanisms and firewalls since 2010, including the ECB’s ability to directly purchase sovereign debt.

The third and final risk factor is regulatory in nature and emanates from the possibility of changes in the prevailing treatment of banks’ exposure to sovereign bonds. Although Spanish banks have scaled back their domestic bond holdings considerably, a potential change in the status quo could trigger significant changes in the make-up of the investor base. This could have a possible knock-on effect on the cost of Spanish bonds in the secondary markets. Any such change should be analysed in the context of the reinforcement and completion of the Banking Union project, which should be tackled comprehensively rather than on a piecemeal basis.

Notes

There are no equivalent figures for China from either the Spanish or Chinese authorities. However the perception in the market is that this jurisdiction is playing a considerable and growing role in financing the Spanish Treasury in the last two years.

References

ALVES, P., MILLARUELO, A. and DEL RÍO, A. (2018). The increase in Target balances in the Euro Area since 2015.

Boletín Económico, diciembre. Banco de España.

AMOR, J. M. (2011). Vulnerability in the government debt markets of the Eurozone.

Información Comercial Española, ICE: Revista de Economía, 863.

https://dialnet.unirioja.es/servlet/articulo?codigo=3841981 AMOR, J. M. and ARREGUI, M. (2012). Evolution of Spanish government debt holdings.

Spanish Economic and Financial Outlook, May 2012.

https://www.funcas.es/Publicaciones/Detalle.aspx?IdArt=20639 ANALISTAS FINANCIEROS INTERNACIONALES. (2018).

Tenencias de deuda pública por las entidades financieras: situación en España, y posicionamiento ante posibles cambios regulatorios [The banks’ public debt holdings: the situation in Spain and positioning vis-a-vis possible regulatory changes]. Madrid: Funcas.

https://www.funcas.es/publicaciones_new/Sumario.aspx?IdRef=9-08019 — (2019). Spain: External financial vulnerability after QE. Spain Weekly 29

th March 2019.

http://research.afi.es/ros/descargas/1845013/1238813/External-financial-vulnerability-after-QE.pdf ARSLANALP, S. and TSUDA, T. (2012).Sovereign investor base estimates

. Sovereign Investor Base Dataset for Advanced Economies. IMF.

— (2014). Tracking Global Demand for Advanced Economy Sovereign Debt.

IMF Economic Review, Volume 62, Number 3. Washington DC.

BALTENSPERGER, M. and CALL, B. (2018).

Euro-area sovereign bond holdings: An update on the impact of quantitative easing. Bruegel.

http://bruegel.org/2018/11/euro-area-sovereign-bond-holdings-an-update-on-the-impact-of-quantitative-easing/

José Manuel Amor and David del Val. A.F.I.- Analistas Financieros Internacionales, S.A.