Spanish versus European bank exposure to sovereign risk

Spanish banks’ exposure to public debt has increased more sharply than the EU average, reaching 15.4% of total assets in 2024. Amortised cost accounting and international diversification help risk mitigation, while higher interest rates on public debt holdings have significantly boosted returns for the domestic business.

Abstract: The share of public debt in the Spanish banks’ asset mix has been increasing in recent years, reaching 15.4% in 2024, in tandem with the run-up in interest rates. That is 2.5pp above the EU average. Forty-eight percent of this debt is Spanish public debt. This share is below the European average, reflecting the Spanish banks’ strong international footprint. A point in favour of the Spanish banks is the growing volume of public debt carried at amortised cost (67.2% vs. 58.6% in the EU), ring-fencing it from market fluctuations. In the Spanish banks’ domestic businesses, public debt has increased its share of total assets from 6.66% in 2019 to 7.79% in 2024, and from 76.4% of total fixed-income holdings to 90.7%, with the interest earned on these investments multiplying 2.5x.

Foreword

The banks’ exposure to sovereign debt risk is a topic of interest and debate. As signalled by the BIS (2017), banks invest in public debt for several reasons, including liquidity management (public debt is one of the most liquid assets), credit risk mitigation or as an investment option, whether holding the debt for trading or more as a long-term investment. The fact that such a high percentage of public debt is in the hands of the banks explains the importance of the banks when articulating both fiscal and monetary policy. This is why the matter of how these sovereign exposures are treated for regulatory purposes is so important.

The banks’ exposure to sovereign debt risk poses a range of risks, including risks associated with movements in interest rates and credit risk itself. Recall that not long ago certain American banks faced severe problems on the heels of rate increases that forced them to sell off debt at heavy losses. When these problems reach a certain scale, a vicious bank-sovereign risk loop can take hold, where a problem that starts with a bank (state) ends up becoming a problem for the state (bank). [1]

Against this backdrop, the aim of this paper is to analyse the weight of public debt in the European banks’ balance sheets, focusing on the Spanish banks. Our analysis spans the years elapsing since the inflexion point in the cycle induced by the pandemic until the most recent data, as of the end of 2024. However, as we will show, it is the sudden change in the central banks’ benchmark interest rates in 2021 (sharp increases to curb inflation) that triggered the shift in the weight of public debt in the banks’ asset structures. In addition to the trend in the share of sovereign risk exposure, we also analyse the holdings by country of issue, maturity structure and valuation method. For Spain, we also look at the significance of the income from that debt (interest collected) relative to the banks’ total financial income in their domestic businesses, along with its share of total assets and of their total fixed-income investments.

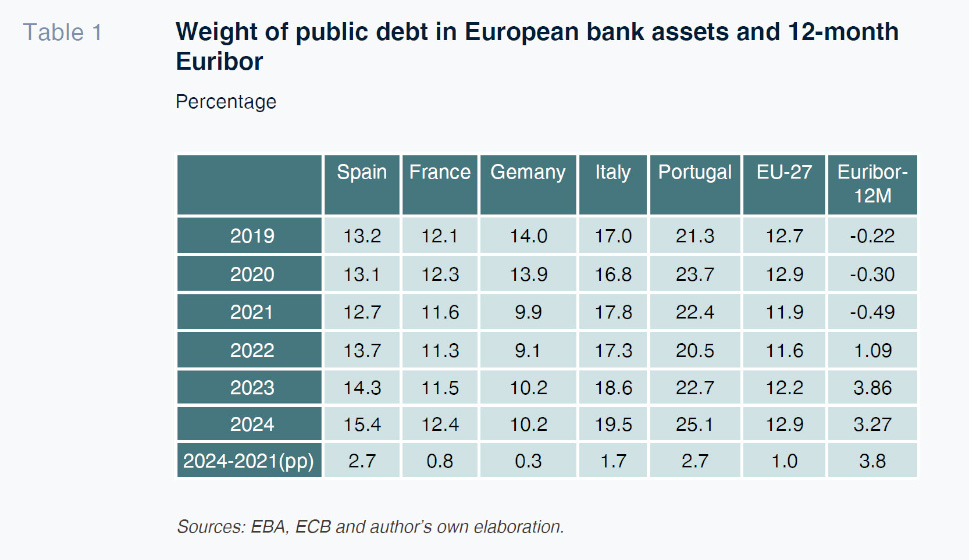

Bank exposure to sovereign risk

According to the information published by the European Banking Authority (EBA) for the consolidated groups, public debt holdings have increased as a percentage of the Spanish banks’ total assets from 13.2% in 2019 to 15.4% in 2024 (Table 1), totalling 589.6 billion euros as of 2024. This share has been increasing since 2021 (growth of 2.7pp), coinciding with the change in the central banks’ benchmark rates, which spilled over to interbank rates and also public debt rates. Taking 12-month Euribor as our benchmark, the annual average was in negative territory until 2021 (-0.49% that year), before entering a new period of positive and rising rates, with the annual average peaking at 3.86% in 2023. In 2024, Euribor fell back a little (3.27%), once inflation had been tamed, allowing the central banks to start to lower their rates. Between 2021 and 2024, 12-month Euribor increased by 3.8pp.

The share of public debt held by the European banks’ has also increased, albeit by less: by 1.0pp between 2021 and 2024. This increase is common to the main European banking sectors, although varying in intensity: 2.7pp in Portugal, 1.7pp in Italy, 0.8pp in France and 0.3pp in Germany.

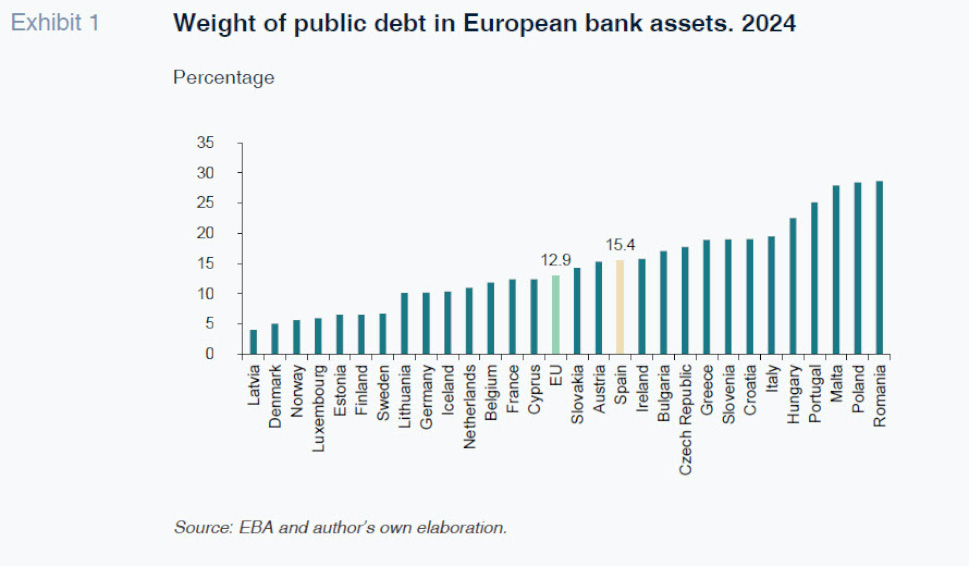

Turning to the snapshot as of the end of 2024 (Exhibit 1), the weight of public debt in total assets at the Spanish banks was 2.5pp above the EU average (15.4% vs. 12.9%), and also above the shares in Germany (10.2%) and France (12.4%), but smaller than those commanded by public debt in Italy (19.5%) and Portugal (25.1%). The interval within the EU is wide, ranging from a low of 4.6% to a high of 28.7%. In general, there is a positive correlation between public sector leverage (measured using the debt/GDP ratio) and the banks’ exposure to sovereign debt. This is true, for example, of Spain, whose public debt/GDP ratio is 22pp above the EU average, just as the share of public debt in the banks’ asset mixes is above the European banking sector average. It also holds in Germany, where public debt is 19pp below the European average, and its sovereign debt/assets ratio is similarly 2.7pp below the average. And in Italy, where public indebtedness is 55pp above the average and the percentage of public debt in its banks’ asset bases is 6.6pp higher.

Characteristics of the banks’ public debt portfolios

As for the geographic composition of the public debt holdings, as of year-end 2024, 48% of the debt held by the Spanish banks was Spanish public debt, which is slightly above the European domestic public debt exposure average of 46.6%. However, the share of public debt issued by other eurozone countries held by the Spanish banks is lower (20.3% vs. 28.4%). As a result, the share of debt issued by other countries is higher in Spain (31.6% vs. 25%). These results are shaped by the fact that the Spanish banks are very diversified geographically, with a significant presence in non-EU markets, including the UK, U.S. and Latin America (Maudos, 2024).

Whereas the geographic composition of the Spanish banks’ sovereign debt holdings has barely changed since 2019, the European banks have increased their exposure to domestic public debt and public debt issued by other eurozone countries.

As for the term structure of these holdings, as of 2024, compared to the EU-27 average, Spain held a smaller share of very short-term debt (<3 months): 8% of the total vs. the EU-27 average of 13.3%. Another 11.3% matures within 3 to 12 months, 38.7% between 1 and 5 years, 27.9% between 5 and 10 years and the remaining 14.2% in more than 10 years. The share of the longest-dated paper is 5.9pp smaller than the European average. Compared to 2019, the share of long-term debt has decreased across the Spanish banks, both 5-10 year and >10 year exposures.

Analysing, lastly, the rationale for the banks’ public debt investments, the share held by the Spanish banks for trading has increased by 3.4pp since 2019, to 15.8% in 2024. In this respect, it has converged towards the EU-27 average, having been 6pp below it in 2019. The share of sovereign exposures measured at amortised cost by the Spanish banks is above the EU average and has increased sharply (18pp) since 2019 to 67.2%, compared to 58.6% in the EU. This is a point in favour as this debt is not exposed to market fluctuations. The composition of sovereign debt holdings by rationale for the investment varies significantly from one country to the next. For example, the share of held-to-maturity investments ranges from a low of 6.4% to a high of 93%.

The importance of public debt in the domestic banking business

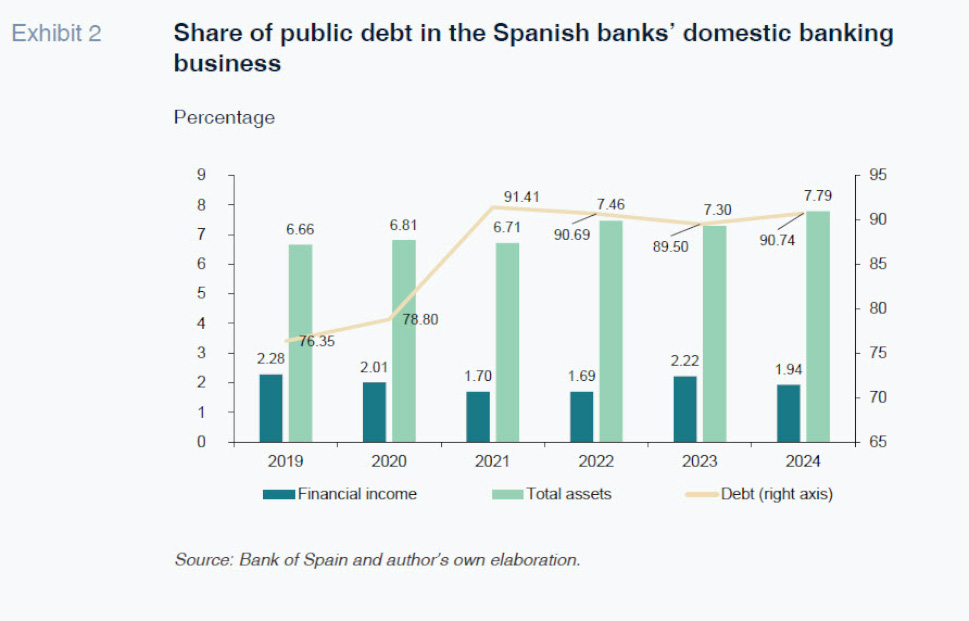

Focusing on the domestic banking business in Spain, we have sufficient data to analyse the importance of public debt investments for the banks’ financial income. Note that during the period analysed (2019 to 2024), the share of public debt in the Spanish banks’ balance sheets has increased from 6.66% to 7.79% (a high for the period) and stood at 231.31 billion euros as of 2024. Measured instead in terms of its weight in total fixed-income investments, the share has increased by 14.4pp since 2019, to 90.74% in 2024 (Exhibit 2).

The volume of interest income generated by these investments has multiplied by a factor of 2.5 between 2019 and 2024 to 1.87 billion euros. However, the weight of this income in the banks’ total financial income has decreased from 2.28% to 1.94%. This income increased most significantly in 2023 as a result of the increase in interest rates. In that year alone, income from public debt holdings tripled, remaining at that high level in 2024, contributing 1.87 billion euros, as mentioned, to the banks’ earnings.

Role of the banks in Spanish government funding

One last matter of interest is the role played by the banks in terms of funding the Spanish public authorities. The Spanish Treasury shares information about the breakdown of its borrowings by holders, the banks being one of the categories. In 2024, 13.97% of total Spanish public debt was in the hands of the resident credit institutions, below that held by non-resident institutions (43.92%) and by the Bank of Spain (27.16%). The percentage held by the Spanish banks has been oscillating around 13.5% since 2019, having peaked at 15.22% in 2020. Between 2023 and 2024, the percentage of Spanish public debt in the hands of the resident banks increased to 14.3%, in contrast with decreases of 6.3% and 17.2% in the case of the Bank of Spain and investment funds, respectively.

Conclusions

The banks’ exposure to public debt is a key element of the banking-sovereign nexus. The banks hold public debt for several important reasons, including liquidity management, portfolio diversification and the generation of investment returns.

In the period elapsing from before the pandemic (2019) until the end of 2024, the Spanish banks have increased their exposure to public debt, to 15.4% of total assets, which is 2.5pp above the EU average and a more pronounced increase than observed across the European banks as a whole. Of the total, 67.2% is carried at amortised cost (18pp more than in 2018 and 8.6pp above the European average in 2024), isolating it from market fluctuations. As signalled by the Bank of Spain (2024) in its Financial Stability Report, the recent increase in the share of public debt holdings and the increase in the volume measured at amortised cost are consistent with the current climate of rising interest rates.

Another differential trait of the Spanish banking system is higher exposure to the public debt issued by their own country, at 48%, somewhat higher than the European average (46.6%). In contrast, the share of debt issued by other eurozone countries is 8pp lower in the case of the Spanish banks (20.3% vs. 28.4%). However, in interpreting these figures it is important to consider the geographic distribution of the banking business and the fact that the Spanish banks’ command a significant presence in Latin America, as well as the UK and U.S.

Notes

Refer to Bergés et al. (2018) for an analysis of the Spanish situation from the bank perspective.

References

BANK OF SPAIN. (2024). Financial Stability Report. August 2024.

BERGÉS, A., PELAYO. A. and ROJAS, F. (2018). Spain’s bank-sovereign nexus (II): Perspectives from the banking sector. Spanish Economic and Financial Outlook, Vol. 7, No. 6, November 2018.

BIS. (2017). The regulatory treatment of sovereign exposures. Discussion paper.

MAUDOS, J. (2024). Spanish banks’ international footprint: Recent developments. Spanish Economic and Financial Outlook, Vol. 13, No. 5, September 2024.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF