Mergers and acquisitions in defence: A paradigm shift for Europe

The defence sector in Europe is experiencing renewed momentum in investment and consolidation, driven by structural challenges, strategic imperatives, and institutional initiatives. While structural and regulatory barriers persist, the sector’s strong fundamentals and strategic relevance are expected to sustain momentum in consolidation and investment going forward.

Abstract: Europe’s long-standing investment gap relative to the U.S. has been especially pronounced in the defence sector, where fragmented demand, limited interoperability, and dependence on foreign technology have constrained competitiveness. Recent geopolitical developments and the ReArm Europe initiative have shifted the focus toward scaling and consolidating defence capabilities, supported by policy incentives and multilateral coordination. Past consolidation trends in the U.S. and Europe reveal a growing role for cross-border transactions, alliances, and dual-use technologies in today’s defence M&A environment. Despite global M&A activity weakening in 2025, the defence sector has remained resilient, with transaction volumes rising in Europe and supported by investor interest, margin expansion, and limited sensitivity to interest rates. While structural and regulatory barriers persist, the sector’s strong fundamentals and strategic relevance are expected to sustain momentum in consolidation and investment going forward.

Foreword

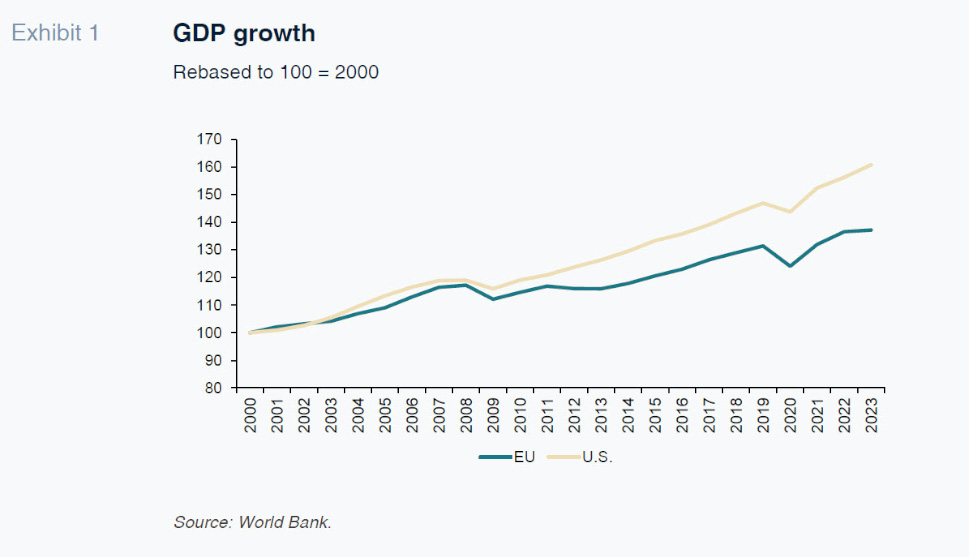

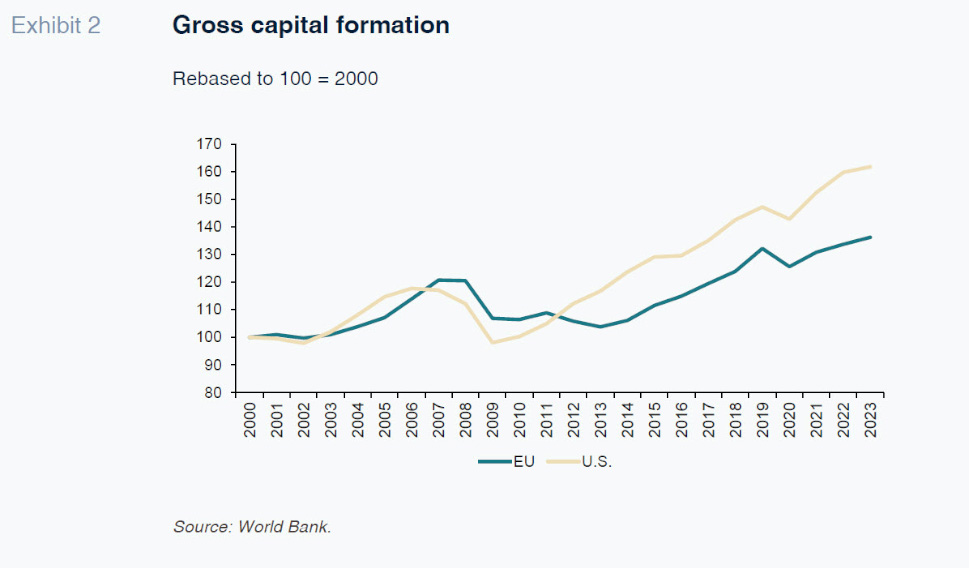

One of the factors that has set the U.S. and EU economies’ performance apart in recent decades has been the trend in corporate investment. In the EU, it has been weaker, translating into poorer growth prospects.

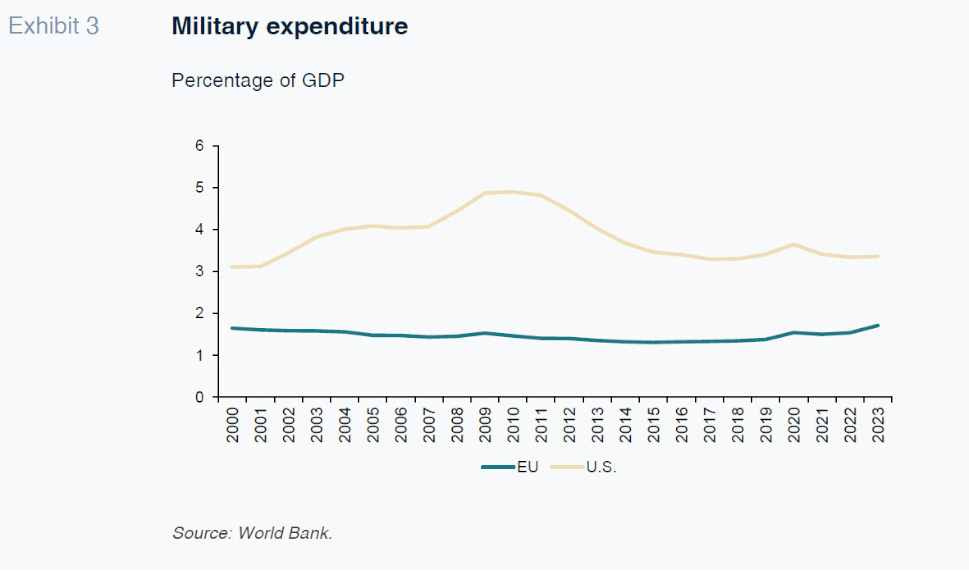

This situation has affected all sectors in general and the defence sector in particular, which has garnered a far smaller share of spending and investment in Europe than in the U.S. The impact of the new geopolitical context unfolding since the second half of 2024 on the need to invest in defence has changed this situation and likely outlook.

This shift, coupled with European defence players’ need to gain scale without compromising the ability to uphold national interests, is likely to spur growth in mergers and acquisition (M&A) activity in the coming quarters. From the economic standpoint, the downtrend in interest rates in most economies in a bid to spark economic activity as inflation eases could offset or mitigate the increase in uncertainty observed in the global context throughout the first quarter.

In this paper, we analyse this combination of structural and circumstantial dynamics and how they could bring about a paradigm shift in gross fixed capital formation in the European Union.

Gross fixed capital formation: A 20-year lag

The period of economic history that began with the financial crisis of 2008 has been marked by clear bifurcation in gross fixed capital formation dynamics between the EU and U.S. This is reflected generally in the share of investment over GDP and has forcefully impacted the two regions’ capacity for growth, as is evident in the average and cumulative gap in recent years.

The defence sector has not been immune to this uneven performance across the two economic blocs. The statistics reveal a very significant difference in the rate of spending and investment in defence in the U.S. compared to Europe, a topic the new U.S. administration has become fixated with, calling on other Western nations to step up their commitment to security in order to reduce dependence on foreign partners and tackle the current geopolitical challenges.

Notwithstanding the observations made by the U.S., it is true that the report led by Mario Draghi (2024), published in September 2024, already emphasised the need to spur economic growth and corporate investment as key elements of regional competitiveness in the medium term, arguments that are hard to question in light of the macroeconomic metrics. In the area of defence strategy, the Draghi report acknowledges the urgent need to reinforce the sector in the EU to achieve strategic autonomy, address growing security threats and reduce dependence on non-EU solutions, particularly U.S. technology.

In this respect, as is the case in many other areas, the challenges facing the European bloc are closely related with: (i) the difficulties in aggregating demand; and (ii) the lack of interoperability across the member states, two factors that foster fragmentation and undermine the ability to compete and build an industry capable of responding to the challenges posed by the current environment in terms of security autonomy. The growing gap between defence systems’ operational needs and available public budgets has spurred the search for more innovative and affordable solutions. In parallel, the trend of combining commercial, civil and military technologies such as artificial intelligence, data analytics and satellite infrastructure has created multiple opportunities for investors and startups.

There are two clear paths for responding to the current challenges: either internal development or acquisition of the tools and technology needed from third parties. In theory, organic growth is slower, requiring far longer maturity periods, limiting the scope for this strategy to respond to what the EU needs at present.

Defence sector M&A: Idiosyncrasies

Against this backdrop, M&A-led sector growth may be able to address this challenge sooner. However, the idiosyncrasies of this sector, specifically its classification as a critical activity for national security, means that the challenge needs to be approached not only from the economic and financial angles, but also the regulatory standpoint. It is vital to understand the dynamics shaping the defence sector throughout the last 80 years, a period that has been marked by major geopolitical cycles, this being simply the latest chapter.

After the Second World War, the Western countries championed the creation of strong national contractors and international consolidation was scant. It was not until the Cold War and ensuing reduction in military spending that we saw a spate of mergers, particularly in the U.S., giving rise to giants such as Lockheed Martin (merger between Lockheed and Martin Marietta in 1995), Northrop Grumman (in 1994) and the merger of McDonnell Douglas into Boeing (in 1997).

In Europe, although the scale of sector M&A activity was smaller, significant players emerged, such as BAE Systems (1999) and MBDA (2001), the latter as result of the merger of the missile divisions of companies from France, the UK and Italy. From 2001, the conflicts in Iraq and Afghanistan opened the door to acquisitions focused on technology services and cybersecurity.

In this latest chapter of world history we are seeing a leap that transcends national strategy: multilateral collaboration, in which cooperation and coordination are more important factors than interest rates or growth expectations, is coming to the fore. This dynamic is not only taking shape in Europe, although this is the region where it is manifesting most clearly. The ReArm Europe Plan is an ambitious roadmap for the mobilisation of up to 800 billion euros to reinforce the member states’ military capabilities. The ultimate aim of this programme, which includes specific incentives for intra-European acquisitions, is to consolidate an integrated industrial defence base.

A specific example of this transnational thrust is the proposed merger of the satellite divisions of Airbus, Thales and Leonardo. The rationale for this transaction is the creation of a pan-European player capable of competing with initiatives like Starlink and constitutes a clear exponent of the effort to recover technological sovereignty in the space sector.

Aside from major M&A transactions, we are also seeing industrial alliances. A case in point is the Leonardo Rheinmetall Military Vehicles joint venture set up to codesign and manufacture combat vehicles adapted for national and international programme needs. Alliances of this nature reinforce industrial cooperation in high value-adding sectors while unlocking economies of scale, sharing technological risks and responding more swiftly to the European armies’ operational requirements.

Lastly, NATO has intensified its effort to tighten procurement coordination through the NATO Defence Planning Process (Nato, 2025), a tool designed to harmonise operational requirements, foster joint purchases and reinforce interoperability among allies.

The combination of these factors depicts a panorama that is favourable from different angles, increases the scope for M&A activity in the coming months. The next step is to analyse the defence players’ stock market performance in recent months to determine whether there has also been a shift in investor perception.

A sector attracting investment

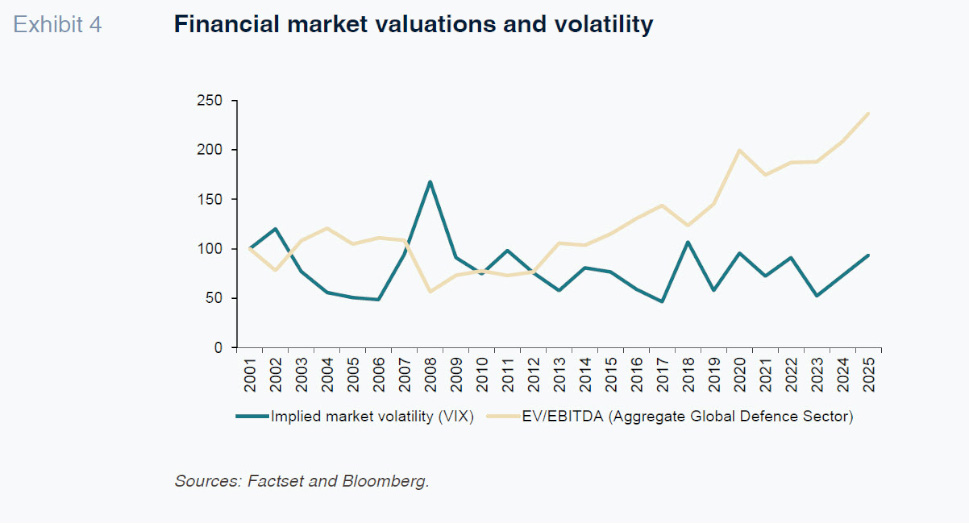

Despite or in light of all of the above structural factors, the sector has been receiving attention from the market. And the dynamics observed in recent years suggest that sector valuations could continue to consolidate. So we see if we look at the companies’ market cap-to-EBITDA trading multiples.

These multiples have been expanding on a sustained basis since 2008, surviving episodes of uncertainty in the international markets and global economy of varying intensity. The sector’s performance has demonstrated a tremendous ability to resist negative market events, illustrating a structural support floor that is clearly different from earlier episodes of crisis, such as the financial crisis of 2008.

Both the crisis induced by COVID-19 and the current climate reflect the sector’s resilience and reveal momentum in valuations in challenging circumstances for investors. Investors have committed to security and defence consistently since 2008, reinforcing the countercyclical nature of defence investments, something we think will increase going forward thanks to the various initiatives underway.

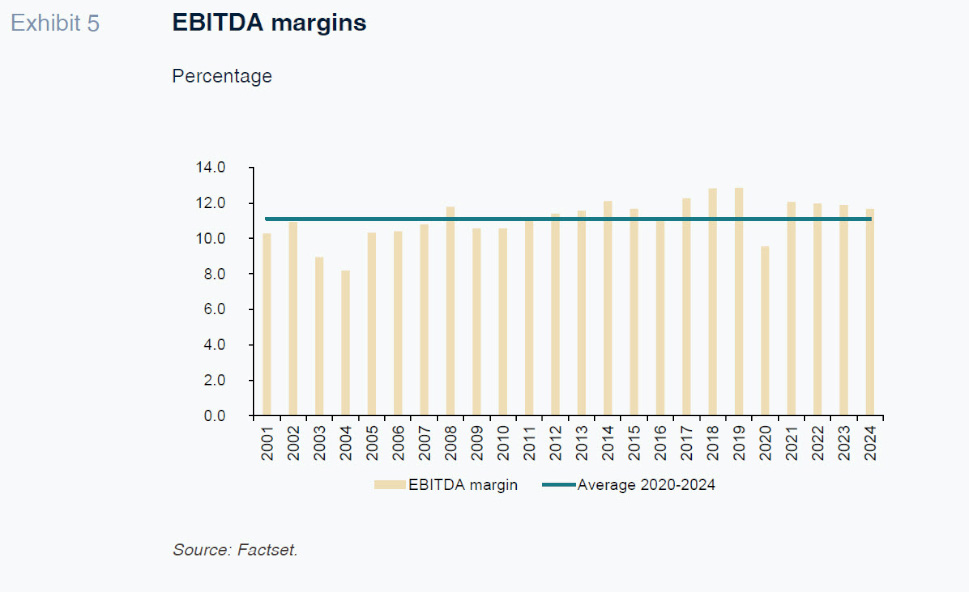

Perhaps most telling is the fact that this multiple expansion has coincided with a period of sustained growth in margins. The sector’s share price performance, coupled with the above-mentioned structural and circumstantial factors, is conducive to strong momentum in M&A activity in the short and medium term.

The sector has also proven relatively immune to borrowing costs, as valuation dynamics have been favourable in multiple rate environments. This only enhances its status as a target in the current environment in which visibility around the sector players’ earnings may be boosted by the different institutional initiatives underway.

M&A in the defence sector: Recent developments and outlook

Lastly, to test how these structural and circumstantial factors are affecting M&A dynamics, we take a look at global M&A activity in the last three years in general and in the defence sector in particular.

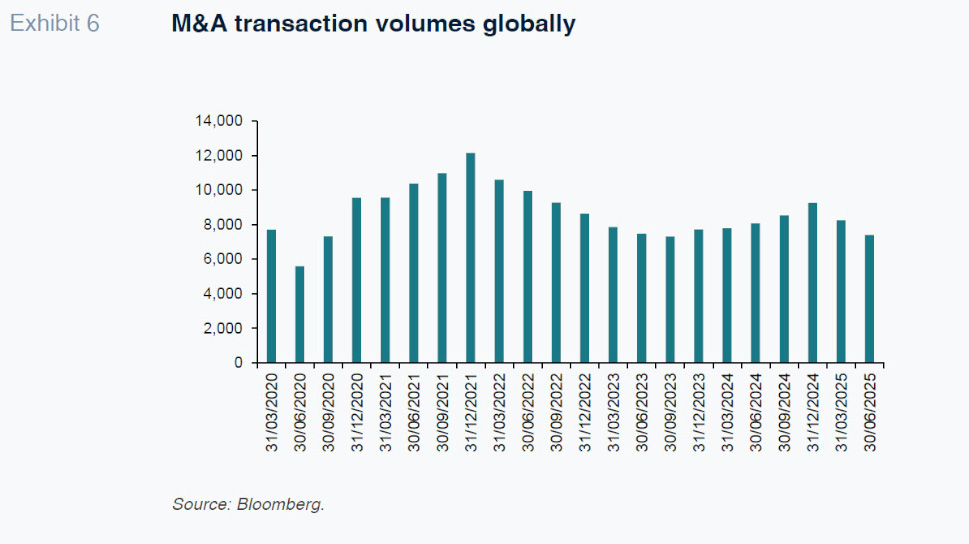

The global M&A market has been somewhat lethargic for the last decade, with uncertainty around the outlook for economic growth, inflation and general financial conditions underpinning, at different time, weak transaction volumes. Since 2020, developments such as armed conflicts, the energy crisis, global supply chain frictions and surges in inflation have in turn spoiled investor appetite, making it harder to get deals closed.

The significant intensification in uncertainty and misgivings in recent months has interrupted the recovery in M&A activity, with transaction volumes hitting a high for the last five years in 2024 (excluding 2021). The slowdown is tangible in both the first and second quarters of this year, with volumes falling by comparison with the same periods of 2023 and 2024.

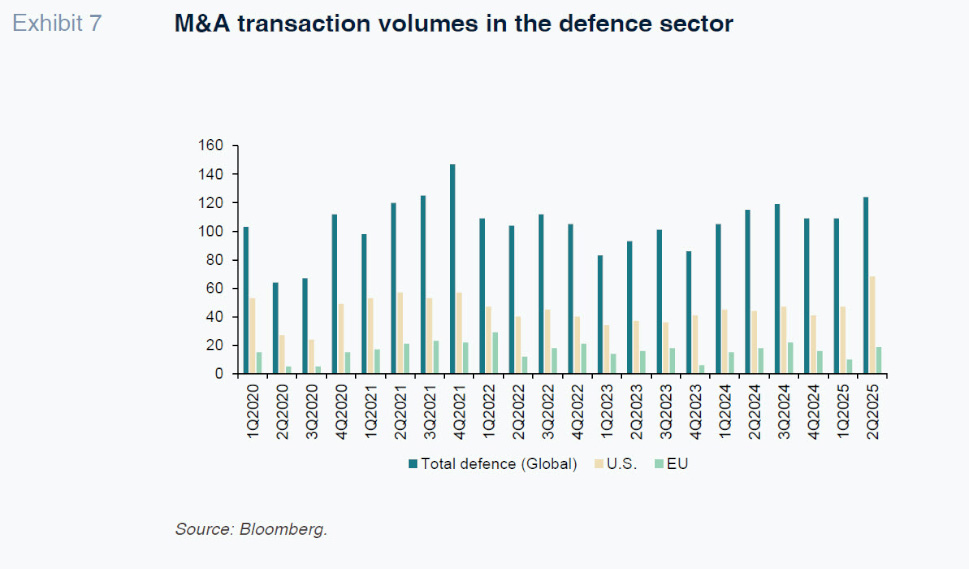

However, this slump has not affected the defence sector, which is beginning to take stock of the favourable structural factors outlined above. An analysis of M&A activity in the defence sector reveals that, in addition to the sector’s stable financial fundamentals and the regulatory boost, the context of heightened uncertainty is already translating into sector consolidation in all countries. In the EU, where M&A activity in the sector has tended to lag that of the U.S., volumes are also picking up: the number of transactions closed in the second quarter of 2025 marked a four-year high.

Although it is too soon to draw conclusions with respect to the market’s outlook for the coming quarters, we think sector M&A activity will gather traction in the next few months, an outlook further underpinned by strong visibility around profitability. Certainly, in the current context it is critical to discriminate between the different technologies. Projects such as SpaceX or Palantir

[1] have intensified the perception that much of the sector’s future and growth potential resides with the integration of commercial innovation with military applications. It is likely that companies devoted to satellite systems, advanced microelectronics, secure communications, autonomous systems and anti-drone technologies will be the object of investor interest, as will those with technology conducive to dual applications (military and commercial) and direct exposure to specific space projects (Bain & Company, 2025; Kroll, 2025).

Regulatory developments will inevitably have a role to play in momentum in sector M&A activity. A key initiative under analysis in the European Commission is the relaxation of regulatory controls over M&A transactions.

As noted above, the structural challenges facing the sector will be hard to surmount via organic development alone,

i.e., as a result of the sector players developing technology, products or services internally. The response will require consolidation in which non-organic growth is already playing a key role. However, this thrust raises questions for the national authorities, particularly in areas deemed strategic. Although this issue is not exclusive to the defence industry, growing interrelationships with other sectors like the telecommunications sector mean that any attempts at easing regulations around M&A transactions may come up against a degree of resistance from the EU member states, particularly if they impact market and competition structures.

[2]

Our opinion is that in a market in which scale, agility and technological integration mark the difference, M&A transactions are more than a financial tool, they are also a core component of nations’ security architecture. This window of opportunity also brings risks which should not be underestimated. Changes in government policies, new regulatory requirements, particularly in terms of foreign investment controls, and movements in national strategic priorities could abruptly change the rules of the game. In addition, rapid technological progress, while a source of competitive advantage, means that the players have to invest continually to adapt and update their technology.

Conclusions

Europe’s defence sector faces a unique opportunity to consolidate its position and reduce dependence on non-EU solutions. The combination of a shifting geopolitical environment and the need to reinforce strategic autonomy is fuelling investment in defence. Mergers and acquisitions, along with multilateral alliances, could accelerate this process, allowing Europe to develop an integrated and competitive industrial base.

Despite the opportunities, the defence sector also faces considerable risks. Government policy changes and new regulatory requirements could alter market conditions suddenly. Moreover, rapid technological development requires the players to work tirelessly to stay up to speed. Fragmentation and a lack of interoperability among the member states remain considerable impediments to sector consolidation.

In short, the European defence sector is poised to benefit from a favourable climate for investment and consolidation. To fully leverage these opportunities, however, it is crucial to tackle the structural and regulatory challenges. Industrial cooperation and technological integration will be key to bolstering the sector’s responsiveness to current and future threats, so endowing Europe with a robust and autonomous defence platform.

Notes

Financial Times. (14 April 2025). NATO acquires AI military system from Palantir. Space News. (2024, June). Pentagon embracing SpaceX’s Starshield for future military satcom.

References

BAIN & COMPANY. (2025). Global M&A Report 2025: How leaders are adapting to meet the moment.

DRAGHI, M. (9 September 2024). The Future of European Competitiveness.

KROLL. (2025). Aerospace Defense Government Services.

NATO. (2025, April). NATO Defence Planning Process.

Pablo Guijarro Segado and Pilar Gómez Estefanía. Afi