The resurgence of insurance products in Spain

In what looks to be the tail end of the monetary policy tightening cycle, the insurance business in Spain is staging spectacular growth in revenue (premiums), fuelled by life insurance products. With rates now looking more likely to stay high for longer, momentum in these products is expected to continue; however, from a broader perspective, the sector is likely to suffer, particularly in the non-life business, from the economic slowdown and high costs of claims in the motor insurance segment.

Abstract: In what looks to be the tail end of monetary policy tightening by central banks, the insurance business in Spain is staging spectacular growth in revenue (premiums), fuelled by life insurance products. Yield curve normalisation over the past year has created the conditions, previously absent, for renewed development of traditional life and savings products, having languished for many years against the backdrop of zero or negative rates. These products have also benefitted from the banks’ strategy of keeping rates on their deposits low until now. With rates now looking more likely to stay high for longer, momentum in these products is expected to continue. While further tightening is not anticipated, the slow reduction in inflation from current levels means the ECB is now expected to keep its benchmark rates at current levels until mid-next year, creating optimum conditions for business development in the life segment for the coming quarters. As a result, total annual premiums across all insurance businesses could hit a range of 75-80 billion euros in 2023 and 2024, which would mark growth of 15%-20% from 2022 levels. Moreover, business conditions look set to remain attractive for even longer, having left behind the era when interest rates of zero per cent thwarted any chance of growth. Nevertheless, from a broader perspective, the sector is likely to suffer, particularly in the non-life business, from the economic slowdown and high costs of claims in the motor insurance segment.

Economic and monetary policy backdrop

The economic and financial scenario took a radical turn around 18 months ago, when central banks accelerated their interest rate tightening (an increase by between 4 and 5 percentage points) to a pace not witnessed in recent history, prompting an upward shift in the rate curve, while dimming economic growth prospects in parallel. The reason for the sudden shift in expectations lay with runaway inflation in all developed countries, which had reached levels not seen in recent decades. The key factors fuelling inflation were the economic reopenings in the wake of the pandemic, which entailed restarting value chains and rolling out expansionary fiscal policies, and the subsequent onset of the war in Ukraine, which triggered a surge in energy and other commodity prices.

The result of all of this monetary tightening has been a considerable economic slowdown (uneven and far softer in the US than in Europe), stopping short of a recession for now, and curtailment of inflationary pressures, albeit at an apparently insufficient pace.

Current expectations are that rate tightening by the central banks has run its course and that we are in for several quarters of high rates before seeing initial cuts during the second half of next year. Logically, the thinking also goes that inflation will have come down towards the targeted rate of 2% (albeit without reaching it) within that same timeframe. There is less consensus around the (inevitable) cost of the current monetary strategy in terms of economic growth, particularly in Europe. The most recent indicators are not encouraging, especially and relevantly in Germany. The outlook is also decidedly lacklustre in China, which has shouldered a large share of global growth over the past decade.

Spain will not be immune to the slowdown looming in the coming quarters although there is consensus that, as has been the case in the past, the adverse impact on growth of monetary tightening will be less pronounced than on some of its neighbours. The situation naturally has implications for the fate of the insurance business in Spain, a business which, as we will see below, has been undergoing considerable changes in recent quarters.

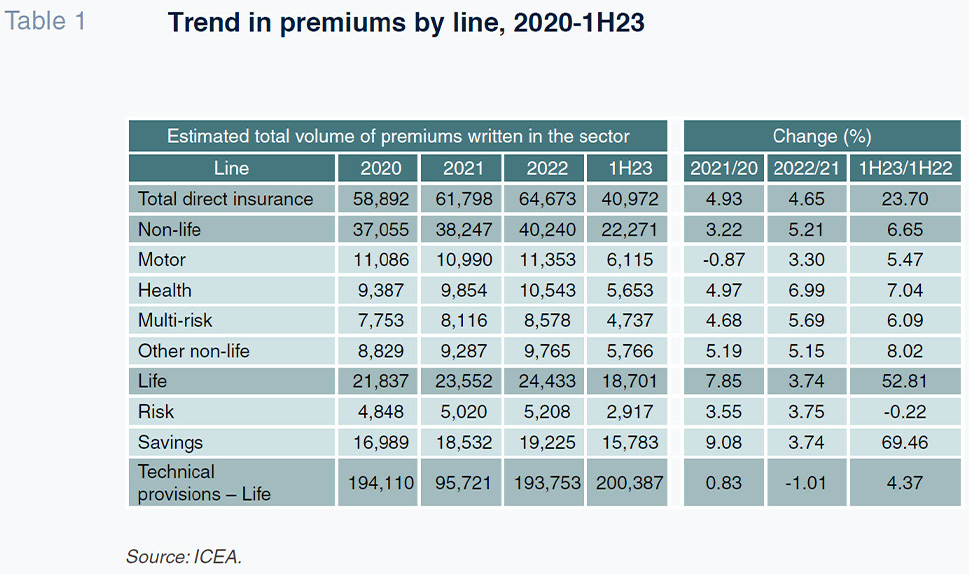

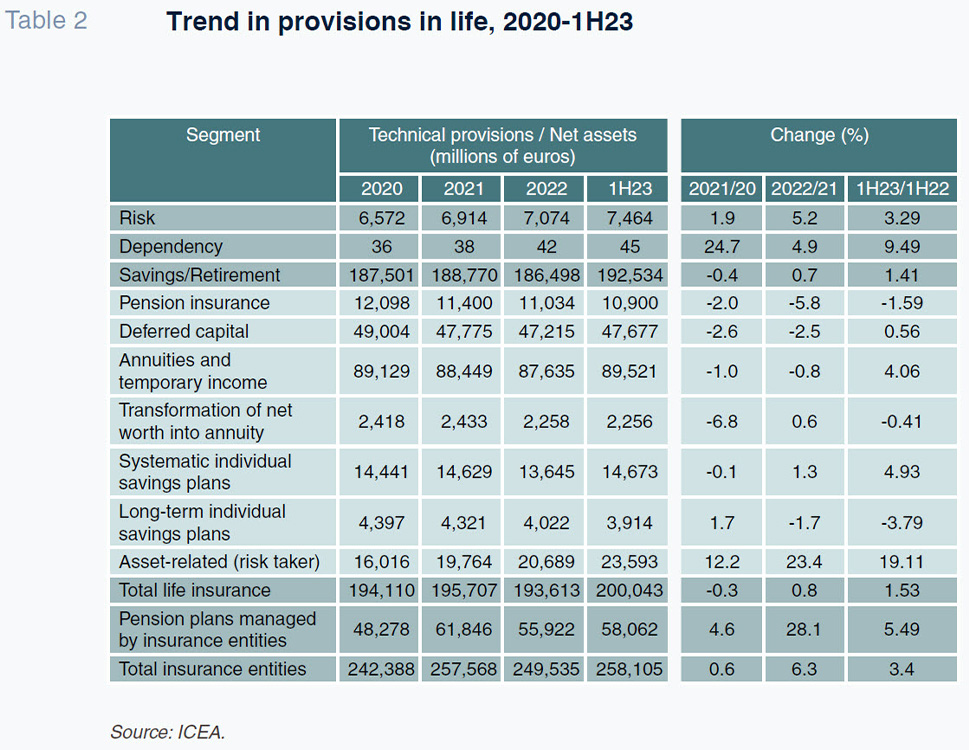

The information available until mid-summer (Tables 1 and 2) shows how the trends we foreshadowed at the start of the year have been borne out. Clearly the non-life business continues to register solid revenue growth, with the life business growing at spectacular rates. The latter, after a long spell of stagnation and regression, has been unlocked by the rapid normalisation of interest rates after so many years of zero or negative rates.

Recent performance of the Spanish insurance sector

During the first half of this year, the non-life business posted a robust performance, marked by accelerating rates of year-on-year nominal growth in premiums across all lines relative to those recorded over the same period in 2022. Specifically, slight increases in health (+7.04%) and multi-risk insurance (+6.09%), with growth accelerating more considerably in motor insurance (+5.47%), up from subdued rates of growth, and the other lines of non-life insurance (+8.02%). Although the significant overall growth in the non-life business in the first half of this year (+6.65%) is partly attributable to the current inflationary context, its expansion is well above price growth in Spain at present.

In life insurance, the fact that the volume of premiums sold probably matched the full 2022 figure by the end of the third quarter says it all. Despite the stagnation in the life-risk line, which is being hurt by the slowdown in mortgage lending (in the context of sharply rising borrowing costs), to which the sale of new policies is meaningfully linked, the volume of life insurance premiums increased by over 50% year-on-year in the first half of 2023, thanks mainly to the extraordinary growth in life-savings products (almost 70%). Yield curve normalisation over the past year has created the conditions, previously absent, for the renewed development of traditional life and savings products, having languished for many years against the backdrop of zero or negative rates.

Also worth highlighting is the rebound in traditional life-savings products, which have additionally benefitted from the banks’ strategy of keeping the rates they offer on their deposits low, lifting the sale of unit-linked (policyholder risk) products, to levels that remain at or above the sharp pace observed in recent years.

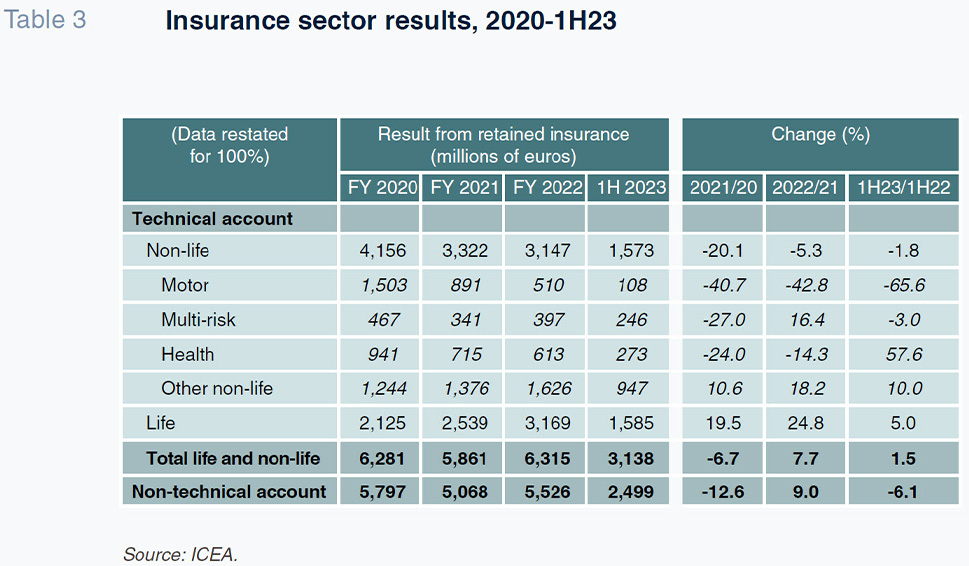

The extraordinary growth in revenue in the insurance sector as a whole in the first half of the year had differing fates in terms of margins and profits. In fact, as shown in Table 3, the technical account in the non-life business, despite robust topline growth of close to 7%, contracted by nearly 2% in the first half. The growth in claims in multi-risk and motor insurance (nearing a worrisome 80%), largely because of the cost of damage remediation associated with the inflation phenomenon, and less so to the effect of the changes made to the payout scales in motor coverage, were the main drivers. The impact on the motor insurance line, which has been dragging on since the pandemic, is very significant. In 1H23, the technical result in the motor insurance line came to just over 100 million euros, down by over 66% year-on-year. Moreover, the motor insurance segment had already notched up annual contractions in its technical margin of over 40% during the previous two years (2021 and 2022). This adverse trend in earnings in the motor insurance line naturally has an impact on the aggregate earnings of the non-life business.

At the other extreme, the life business has continued to report excellent earnings performance, leveraging the business’ sharp growth. The business already reported strong results in its technical account last year (of almost 25%) fuelled by two main drivers: (i) the positive impact of the rapid rise in rates on the returns on some of the assets in which the insurers had invested (up from returns of close to zero); and (ii) the extraordinary release of provisions recognised on some older product portfolios by certain specific insurers. Nevertheless, earnings increased a further 5% year-on-year in the first half of this year, suggesting that this year, as was the case in 2022, the life business will offset the downturn in earnings in the non-life business, shaped mainly by the motor insurance line. The main source of the momentum we are seeing in life insurance is the banking sector (which holds the key to its performance) having been openly used (as has the investment funds channel) to address demands for remuneration not channelled via bank deposits.

Outlook

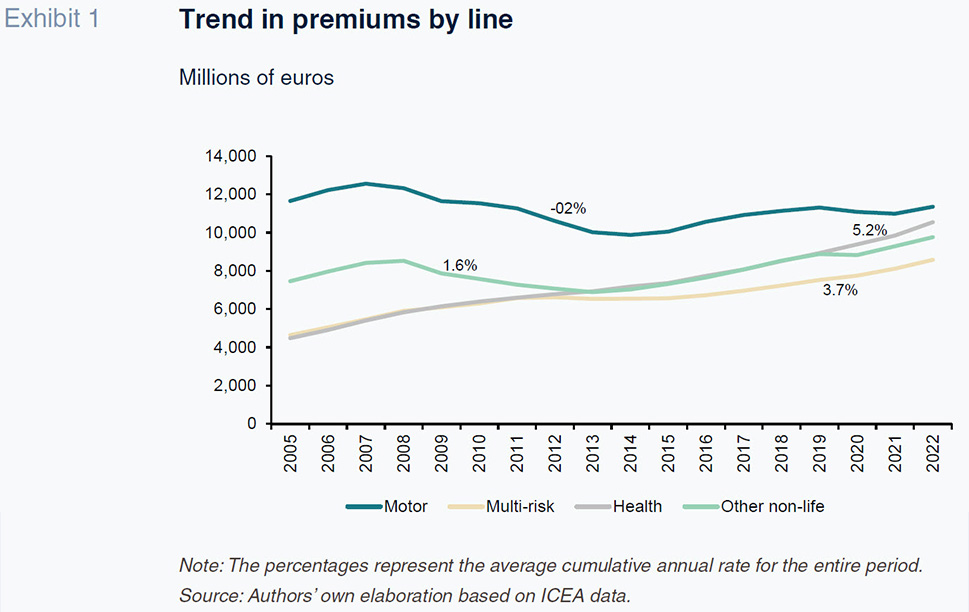

At this juncture, looking to the quarters ahead, it is clear, as signalled at the start of this piece, that the current economic and financial conditions are bound to modify the business framework. Without a doubt, the slowdown anticipated in the wake of the monetary tightening will hurt growth prospects in the more cyclical lines such as motor insurance (Exhibit 1). The health insurance line’s proven inelasticity over time should, however, keep it at its current cruising speed. Inflation is set to continue to play a key role on account of its relevance in both claims and astute management of policy prices. However, it is likely that it will trend towards the ECB’s target (albeit still slowly), so that inflation should wane as a risk factor for the non-life business.

The ECB is now expected to keep its benchmark rates at current levels until mid-next year, creating optimum conditions for business development in the life segment for the coming quarters. As a result, total annual premiums across all insurance businesses could hit a range of 75-80 billion euros in 2023 and 2024, which would mark growth of 15%-20% from 2022 levels. Moreover, business conditions look set to remain attractive for even longer, having left behind the times when interest rates of zero per cent thwarted any chance of growth.

Daniel Manzano. Partner at Afi