Spain’s revised national accounting statistics: Positive and negative takeaways

September’s annual revision of Spain’s national accounts data for the years 2020 to 2022 resulted in an upward adjustment to the initially forecast GDP growth figures for 2021 and 2022, underpinned by substantial revisions to the components of GDP growth. While the revisions reveal a better-than-expected performance of the manufacturing sector, worse than anticipated investment figures are worrisome in the context of the high degree of potential funding resources available to Spain under Next Generation EU (NGEU).

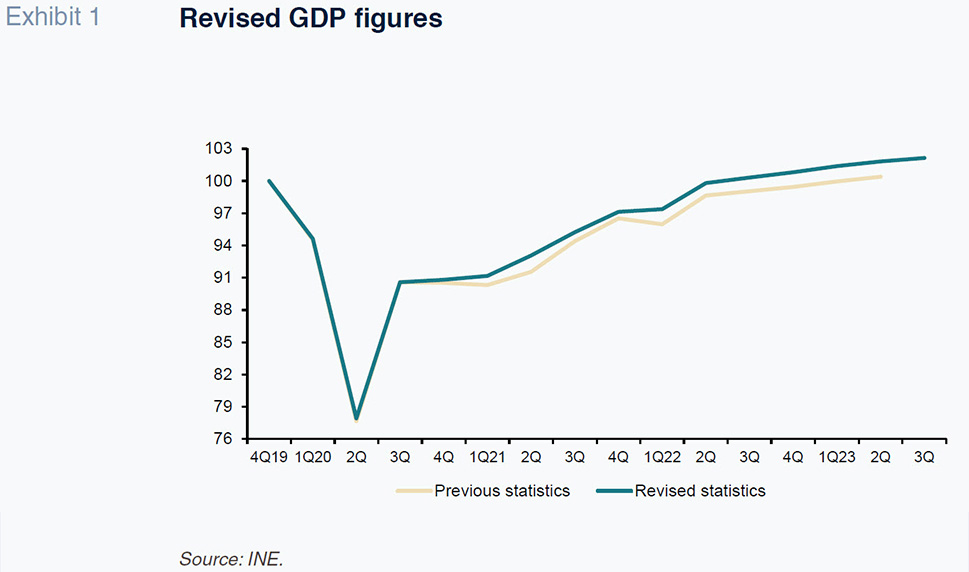

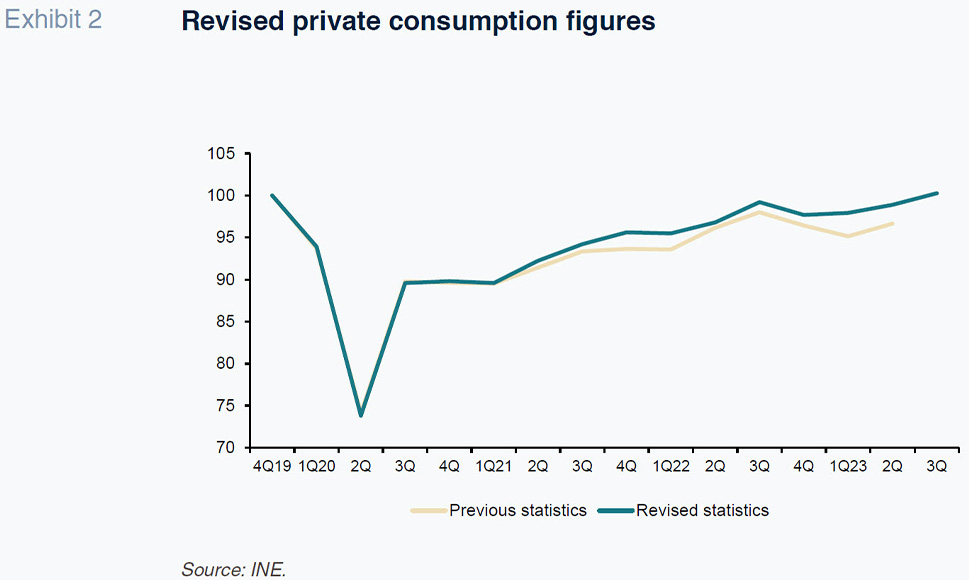

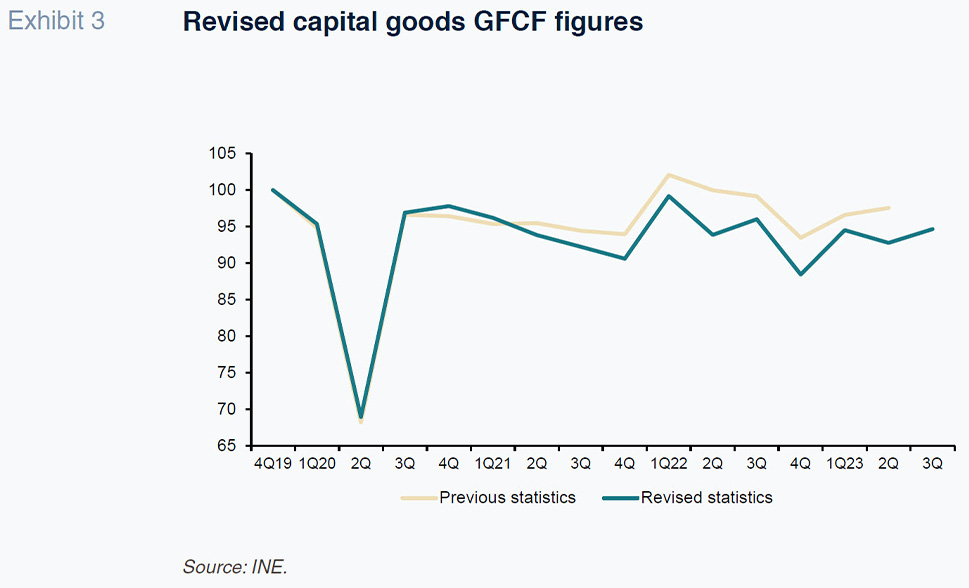

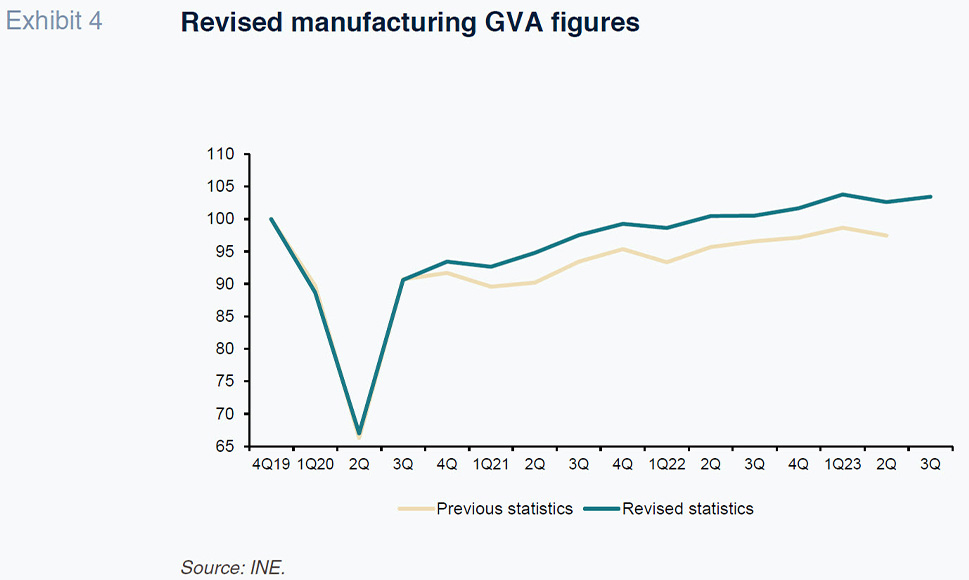

Abstract: September’s annual revision of Spain’s national accounts data for the years 2020 to 2022 resulted in an upward adjustment to the initial forecast for GDP growth figures for 2021 and 2022, underpinned by substantial revisions to the components of GDP growth. The revised figures show that Spain reached pre-pandemic growth levels in the third quarter of 2022, and not the first quarter of 2023, as previously estimated. Indeed, as of the second quarter of 2023, Spanish GDP was actually 1.8% above the pre-crisis threshold, compared to the 0.4% improvement gleaned from the prior statistics. On the demand side, private consumption played a bigger role in underpinning GDP growth than initially expected. Meanwhile, export performance and investment in capital goods were less supportive than previously anticipated. On the supply side, the manufacturing sector made a stronger contribution than previously thought and wage compensation rose to a higher degree than originally estimated. On the positive side, it is worth highlighting the Spanish manufacturing sector’s strong performance, in particular relative to the eurozone average. On the downside, the weakness observed in investment, in particular capital goods investment, is concerning, especially given Spain’s sizeable funding allocation under the NGEU program.

Forward

In September, Spain’s statistics office, the INE, carried out its annual review of the national accounting results for the previous three years, this time from 2020 to 2022. The result was an upward revision of the GDP figures for all three of the years assessed, most notably in 2021 and 2022. The 2020 figure was revised from a contraction of 11.3% to one of 11.2%, now the definitive figure. The 2021 figure, considered preliminary until now, was increased from 5.5% to 6.4% and is now classified as provisional. The 2022 rate, which is still preliminary, was increased from 5.5% to 5.8%. The quarterly series going back over that entire period was also revised.

The revised figures show that Spain actually reached its pre-pandemic GDP level in the third quarter of 2022, and not the first quarter of 2023, as suggested by the previous estimates. As of the second quarter of 2023, Spanish GDP was actually 1.8% above the pre-crisis threshold, compared to the 0.4% improvement gleaned from the prior statistics (and by 2.1% by the third quarter, for which there is no pre-revision equivalent to compare with) (Exhibit 1). In nominal terms, 2022 GDP was revised upwards by €19.27 billion.

Comparison with the EU

The GDP figures for the eurozone as a whole were also revised upwards, so that the gap as of the first quarter of this year between the recovery in GDP since the pandemic in Spain versus the eurozone average did not change as a result of the revised Spanish statistics. However, that gap has since closed considerably in the second and third quarters thanks to faster growth in Spain relative to the European average. As a result, Spanish GDP was 2.1% above the 4Q19 figure as of the third quarter, compared to an improvement of 3% in the eurozone as a whole. Excluding Ireland, [1] however, the eurozone gap falls to 2.2%, which is just 0.1pp above the Spanish post-pandemic recovery.

Components of the national accounts

The upward revision to the growth figure for 2021 derived from higher than initially estimated national demand (both public and private spending) and gross fixed capital formation (GFCF), while the contribution by external demand was corrected from positive to negative. Private consumption was also revised upwards in 2022, as was the contribution by the foreign sector, but the GFCF figures were revised downwards. The picture which emerged as a result of all of those changes is considerably more upbeat in terms of consumption, especially private consumption, but gloomier as regards investment, particularly investment in capital goods (Exhibits 2 and 3).

The weakness in demand for capital goods contrasts with stronger dynamics in the eurozone even though the factors that theoretically drive this variable would appear, in theory, to be more favourable for Spain. For example, the impact of the supply and energy crises derived from the war in Ukraine on the manufacturing sector has been smaller in Spain. The rise in interest rates should also have affected the Spanish companies’ earnings to a lesser degree as they are relatively less leveraged. Staff shortages, another factor that could curtail or delay investment decisions, are a more pressing issue in other European countries with significantly lower unemployment rates than Spain. Lastly, Spain is the second biggest recipient of the NGEU funds, another factor that should have given Spain’s investment figures a boost.

As for exports, goods exports registered stronger growth according to the new national accounting figures, whereas services exports –tourism and non-tourism exports– registered lower growth than initially estimated. However, the downward revision to the export figures for non-tourism services does not detract from the very positive assessment of their performance throughout the post-pandemic period: between the end of 2019 and the third quarter of 2023, this component registered real growth of 22.3%. The recovery in expenditure by non-residents (tourism service exports) was also smaller than initially estimated, albeit still back above pre-pandemic levels this year.

Productivity, manufacturing, and wages

The number of hours worked has also been revised upwards, although by less than GDP, which implies that with the new figures, productivity per hour worked was 0.6% above the year-end 2019 figures by the second quarter of 2023, having initially been thought to have been still flat by comparison (in the eurozone as a whole, productivity per hour worked increased by 0.9% during the same period, but that figure falls to 0.1% if Ireland is excluded from the data).

As for GVA by sector, it is worth highlighting the significant upward adjustment made to the value generated by the manufacturing sector, an increase of 5.3% as of the second quarter, to leave this sector 2.6% above its pre-pandemic level (Exhibit 4). That performance is above the eurozone average excluding Ireland,

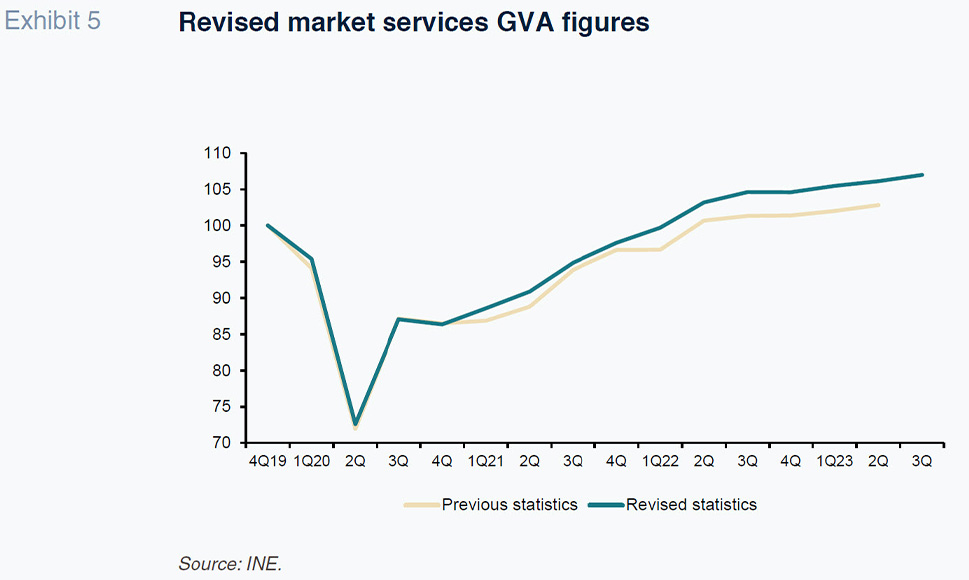

[2] with manufacturing 1.1% above pre-pandemic levels in the region on average over the same timeframe. GVA in the services sector excluding government, health, and education services (

i.e., excluding basic non-market services) was also revised sharply higher (Exhibit 5). Construction GVA was revised downwards but that effect is concentrated in the figures for the last quarter. In contrast, GVA in the non-manufacturing industry (mining and energy) was cut sharply, as was that in the primary sector.

By comparison with the eurozone, the post-pandemic recovery has been relatively more intense in Spain in manufacturing and market services and slower in the non-manufacturing industry, the primary sector, construction, and basic non-market services.

The GDP deflators for 2020 to 2022 have been revised both upwards and downwards with the upshot that between 2019 and 2022 growth was 8.1%, up just 0.1pp from the previous figure. Average growth in the eurozone over the same timeframe was 8.9%. The figures for the first two quarters of 2023 were also revised upwards, signalling acceleration with respect to 2022, a phenomenon also observed in the eurozone average.

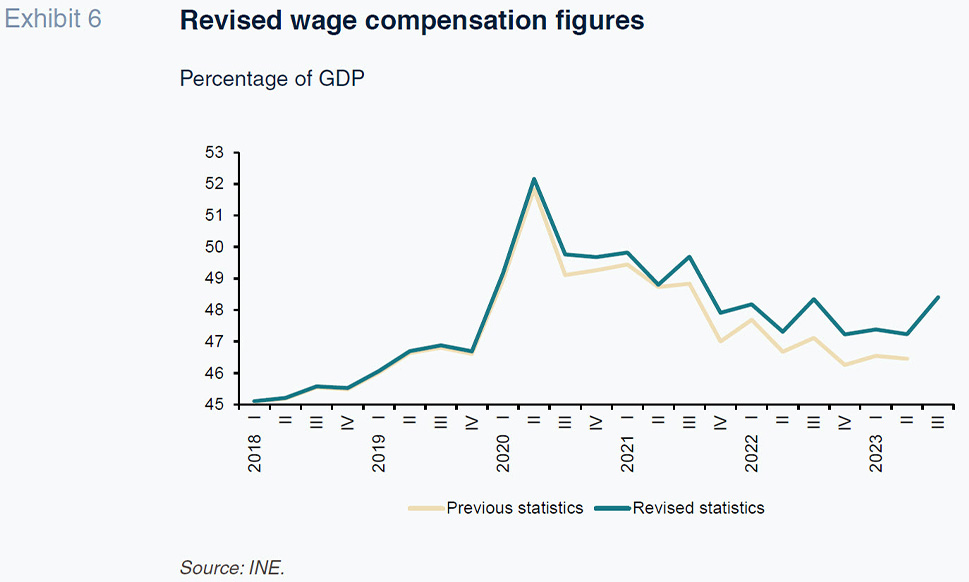

Lastly, from the income perspective, the upward adjustment to GDP stemmed from wage compensation, whose nominal stock was 3.3% higher in 2022 than was initially estimated, whereas the gross operating surplus (GOS) was 0.2% lower. As a result, the growth in unit labour costs was ultimately higher, and that in the unit GOS was slightly lower, than initially estimated. By the same token, wage compensation accounted for 47.8% of GDP in 2022, compared to the initially estimated 46.9% (Exhibit 6). There were barely any changes to net taxes on production and imports.

Conclusion

In short, the annual revision of Spain’s national accounts yielded somewhat higher than initially forecast GDP growth figures, primarily in 2021 and 2022, underpinned by significant changes in the composition of that growth. On the demand side, the Spanish economy’s growth was driven more by private spending and less by exports and investment in capital goods than initially estimated; on the supply side, the manufacturing and market services sectors made considerably higher contributions than previously thought; and from the income standpoint, the GDP generated was funnelled into wage compensation to a somewhat greater degree than originally calculated. On the basis of the revised figures, on the plus side, it is worth highlighting the Spanish manufacturing sector’s strong performance: it has withstood the impact of the successive crises of recent years better than the eurozone on average. On the downside, the weakness observed in investment in capital goods is worrying, especially in the context of Spain’s sizeable funding via the NGEU mechanism.

Notes

Ireland’s figures often distort the overall eurozone figures given the significant statistical effects on its macroeconomic indicators as a result of its unique status as the European base for numerous multinational enterprises. That is why it sometimes makes sense to exclude Ireland from the figures to obtain more like-for-like comparisons.

[2]

Ireland’s manufacturing GVA as of the second quarter was 70% above pre-pandemic levels due to the above-mentioned statistical effects, distorting the eurozone average significantly.

María Jesús Fernández. Senior Analyst at Funcas