Public revenue and expenditure forecasts for 2024 under a no policy change scenario

Growth in total state revenue is expected to slow in 2024, while growth in public expenditure is forecast to slow over the same time frame. Given that wage and pension increases will continue to put upward pressure on the deficit, achievement of the 3.0% of GDP target required under EU fiscal rules will be difficult.

Abstract: Growth in total state revenue is expected to slow from 6.7% to 5.8% in 2024, despite: (i) expiration at the end of 2023 of tax breaks on energy and food products worth 8.4 billion euros; and, (ii) a 6 billion euro boost from temporary taxes (on the financial and energy sectors and large fortunes) and a reduction in parent-subsidiary loss offsetting in 2024. Growth in public expenditure is forecast to slow from 5.0% to 3.8% in the coming year, also supported by the expiration of over 9.1 billion euros of professional and sector-specific assistance and fuel subsidies. However, wage and state pension increases will raise structural spending by around 12 billion euros in 2024. In short, delivery of the targeted budget deficit of 3.0% of GDP will prove a challenge for the new government in the year of reinstatement of the EU fiscal rules, severely limiting its ability to introduce new measures to support households or corporations in 2024 without running the risk of missing its deficit target. Moreover, the government will have to overcome additional obstacles on its path towards fiscal consolidation, including maintaining a cap on public spending in line with EU recommendations, servicing the higher interest burden on public debt, and financing growing pensions expenditure under the current inflationary climate, resulting in a greater opportunity cost for other necessary policies.

Snapshot of revenue and expenditure in 2024

The political impasse in Spain since the general elections on 23 July has forced the carryover of the general state budget for 2023 (2023 GSB). Despite being an exceptional measure, budget carryover has – sub-optimally – become somewhat the norm in recent years on account of a fragmented parliament. [1] In this context of intense political uncertainty, on 16 October, Spain’s caretaker government sent Brussels its draft budget for 2024 (2024 Draft) assuming no changes in current policies (Government of Spain, 2023). In other words, a budget that does not contemplate any new spending or revenue measures, which would have to be designed and approved by the incoming government, other than the scheduled increases in public pensions and wages. The caretaker government is forecasting a deficit of 3.0% of GDP in 2024, the level required under the European fiscal rules. Delivery of that target looks highly challenging having failed to previously embark on the kind of medium-term fiscal adjustment roadmap repeatedly called for by Spain’s independent fiscal institution, AIReF, the Bank of Spain, the IMF, and the OECD, among others. The sharp growth in revenue in 2021 and 2022, fuelled largely by high inflation levels, created a window of opportunity for combining, with relatively little sacrifice, a deficit-reduction effort with well-designed support measures for households and corporations. Note that tax revenue increased by 15.1% in 2021 and 14.4% in 2022, compared to an annual average rate of 3.3% between 2011 and 2019, during which time growth peaked at 7.6% in 2018 (AEAT, 2023a).

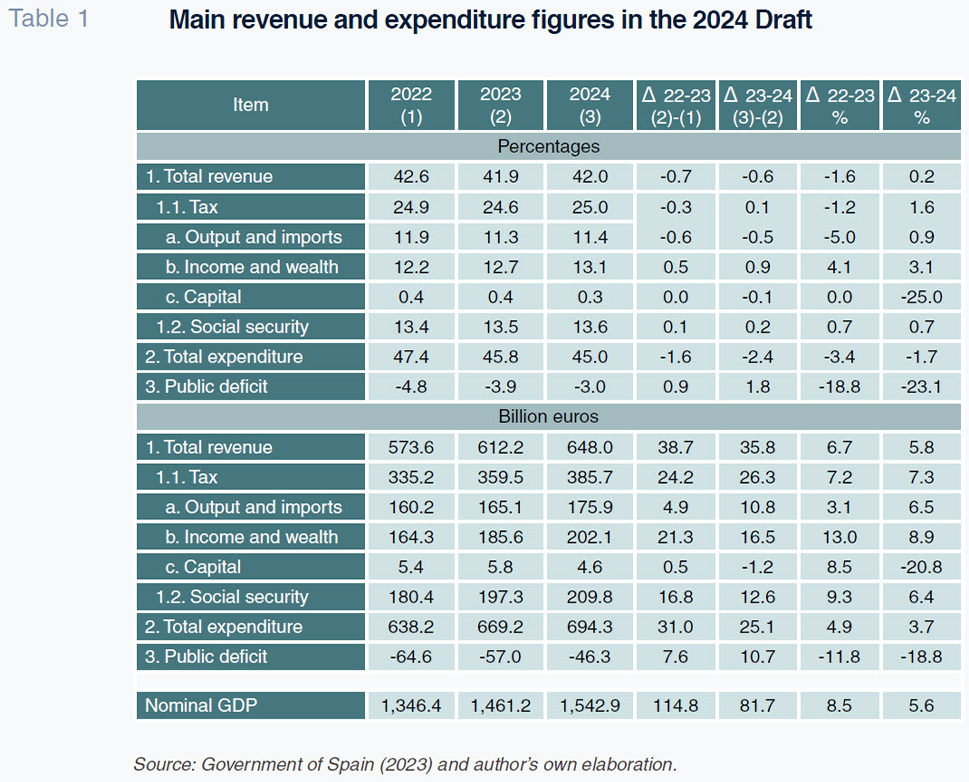

The forecasts set down in the 2024 Draft assume real GDP growth of 2%, a figure endorsed by AIReF (AIReF, 2023). However, that forecast is a little more optimistic than the current projections at other benchmark institutions and think tanks (including the 1.9% forecast by the OECD (2023a), 1.8% by the Bank of Spain (2023), 1.5% by Funcas (2023a) and a consensus of 1.6% by the Funcas Panel (2023b)). As shown in Table 1, the government is forecasting revenue of 648 billion euros compared to expenditure of 694.3 billion euros, which would leave a public deficit of 46.3 billion euros. Total revenue growth is forecast at 5.8% in 2024, compared to 6.7% in 2023, suggesting momentum is set to slow after the sharp growth of the last two years. The growth in 2024 would be even lower were it not for the expiration of tax breaks, the new temporary taxes introduced in 2023 (with effect in 2024) and the effect of inflation:

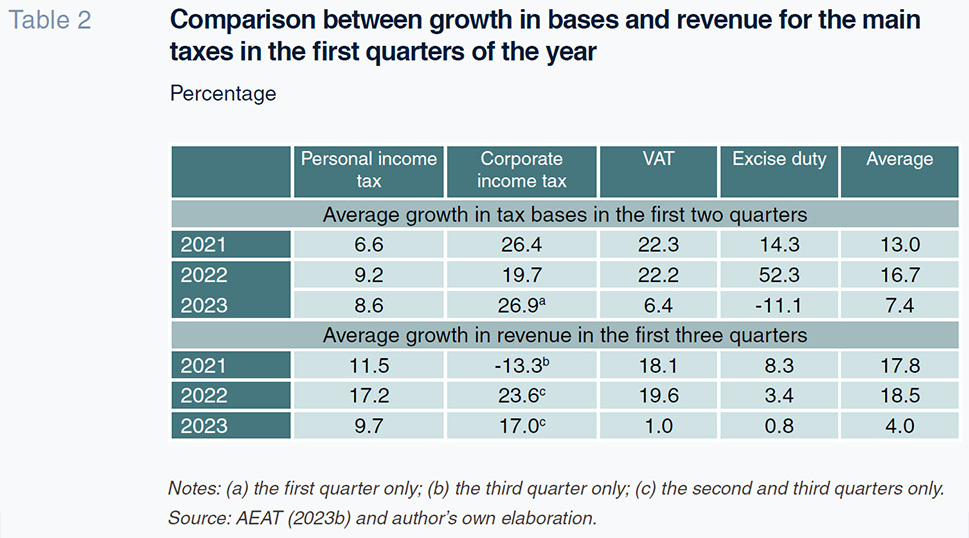

- The 2024 Draft assumes that the VAT and excise duty relief on food and energy products, with an estimated cost of over 8.4 billion euros, will expire on 31 December 2023. Nevertheless, the caretaker government has left the door open to extending these measures before the end of the year, so long as it can effectively form a new government and tax revenue improves in the last quarter of 2023. As shown in Table 2, the average growth in revenue in the first three quarters of 2021 and 2022 was close to 18% in the main taxes levied on income, profits, and consumption (personal income tax, VAT, corporate income tax and excise duties). In 2023, that growth dipped to 4% (AEAT, 2023a,b). [2] The aggregate of the tax bases of those four taxes increased by a commensurate 13.0% and 16.7%, on average, in the first two quarters of 2021 and 2022, respectively, a figure that eased to 7.4% in 2023. Although the 2023 data are partial and therefore should be read with caution, they appear to show that the trend in revenue from the taxes levied on consumption is proving weaker than that in those levied on personal and corporate income.

- A considerable amount of the increase in revenue in 2024 will be temporary as a result of the application of a package of measures passed in 2023. According to the forecasts set down in the 2023 GSB: (i) 2.44 billion euros will stem from a decrease in loss offsetting between parent and subsidiary companies; (ii) 1.5 billion euros will originate from the levy on financial institutions; (iii) 2 billion euros will originate from the levy on energy companies; and, (iv) 1.37 billion euros will come from the new tax on high net worth individuals or so-called ‘large fortunes’ (Romero-Jordán, 2022). The initial revenue estimate for those four measures combined is approximately 7.3 billion euros. However, it is likely that the final figure will come in under 6 billion euros judging by the revenue generated in 2023 from the new levies on wealth and the financial and energy sectors. [3] Note in this respect that the caretaker government has raised the possibility of making the levies on the financial and energy sectors and the new tax on “large fortunes” permanent. Recently, moreover, the caretaker government announced its intention of introducing a minimum corporate tax rate of 15% in 2024, to be calculated over large corporations’ accounting profit, rather than their taxable income. [4]

- The various deflators estimated in the 2024 Draft suggest inflation will ease in 2024. In consumer products, for example, inflation is expected to ease by 0.5 points from 4.4% to 3.9%. The impact of inflation on revenue will therefore tend to ease, albeit remaining considerable. AIReF (2022) estimated that of the tax revenue growth recorded in 2022 and 2023, 49.0% and 71.4% was attributable to inflation (years in which CPI was 3.1% and 8.4%, respectively).

Public spending is forecast at 694.3 billion euros in 2024, growth of 3.7%, compared to 4.9% in 2023. Those figures imply curbing the growth in nominal spending from 31 billion euros in 2023 to 25.1 billion euros in 2024. Behind that tighter fiscal discipline is the obligation to limit the growth in spending to under 2.6% (excluding debt servicing). As discussed in the next section, that public expenditure forecast includes the cost of increasing public wages and pensions by a combined amount of approximately 12 billion euros in 2024. It should be noted, moreover, that the increase in spending on wages and pensions is structural and comes on the heels of an increase of approximately 25 billion euros in 2023 (Romero-Jordán, 2022).

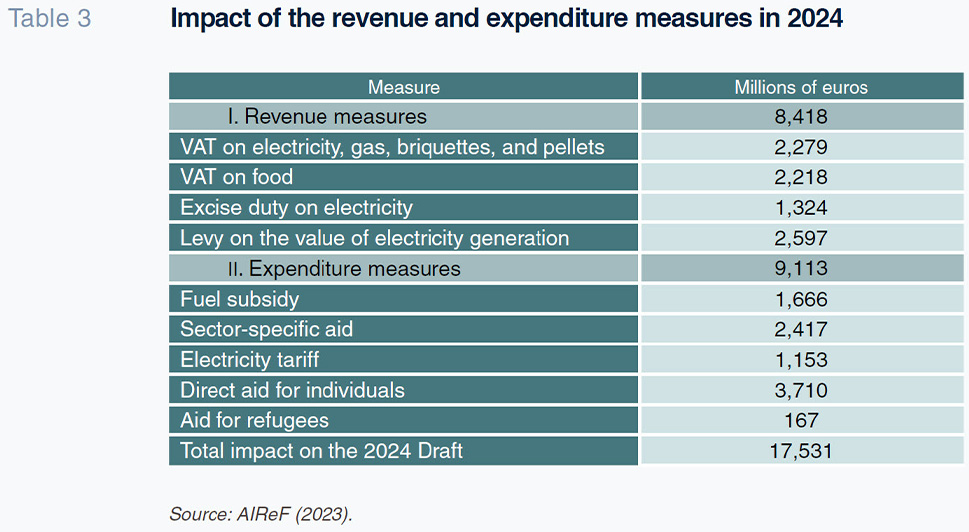

As already noted, the 2024 Draft aims to deliver a public deficit of 3.0% of GDP in 2024, compared to an estimated 3.9% of GDP in 2023. For that forecast to materialise, Spain’s deficit would have to decrease by close to 11 billion euros, from approximately 57 billion euros in 2023 to 46.3 billion euros in 2024. The reduction is underpinned by the elimination of a number of tax breaks, aid programmes and subsidies in play in 2023 which together imply a 17.53 billion euros reduction in spending in 2024 according to AIRef (2023): around 8.42 billion euros due to elimination of the various tax cuts and 9.11 billion euros due to the elimination of various deductions and direct aid measures.

As a result, the new government will have very little room to introduce new measures to support households or corporations in 2024 (if, for example, energy prices were to surge again) without running the risk of missing its deficit target. In fact, the main institutions and leading think tanks’ current forecasts point to a deficit of as much as 0.6 points of GDP above the government’s forecast (AIReF: 3%; the European Commission: 3.3%; Bank of Spain: 3.4%; Funcas: 3.6%; and the OECD: 3.5%). Put another way, with no change in policies, the adjustments needed to deliver the target deficit of 3.0% of GDP could reach 8 billion euros in the least favourable scenario.

Measures in force in 2023 that are not included in the 2024 Draft

With the exception of public wage and pension increases, the caretaker government cannot embark on new measures that affect public spending or income. The cost of those two items is estimated at approximately 12 billion euros in 2024. Specifically: (i) the 2024 Budget assumes wage indexation costs of 4.75 billion euros, [5]; and, (ii) although there are no figures for the cost of restating pensions, the increases are likely to amount to around 7.2 billion euros assuming inflation of 4% (roughly 1.8 billion euros for every point of inflation) (Bank of Spain, 2022). In addition, non-contributory pensions and the minimum income scheme will get restated in 2024, as will the minimum size of the contributory retirement pension for people over the age of 65 with a spouse in their care. [6] However, the 2024 Draft does not provide specific estimates of the cost of those measures.

A host of tax cuts on energy and food products, direct aid for specific sectors and companies and fuel subsidies are in effect this year. According to the figures provided in Table 3, the cost of these measures will be 17.53 billion euros (AIReF, 2023). These public spending and revenue measures essentially seek to mitigate the impact of the war in Ukraine and ensuing energy crisis on prices. On the revenue side, the tax breaks on energy products account for 73.7% of the measures, with the remaining 26.3% represented by the VAT relief on food. On the spending side, the measures with the biggest impact are the direct aid for individuals (40.7%), followed by sector-specific aid (26.5%) and fuel subsidies (18.3%).

By way of simple comparison, the permanent elimination of all these measures (on both the revenue and spending sides) in 2024 would: (i) finance the indexation of public wages and pensions; and, (ii) generate a surplus of around 5.5 billion euros with which to reduce the deficit. As already noted, the 2024 Draft contemplates a reduction in the deficit of close to 11 billion euros to deliver the target of 3.0% of GDP.If that target is really a firm commitment, the government’s freedom to introduce new measures in 2024, or extend some of those already in place, is genuinely very limited.

Indeed, the new government will face a series of obstacles in delivering its deficit target of 3.0% of GDP. A first obstacle, as already noted, will be keeping the growth in nominal public spending below 2.6%, in line with the European Commission’s recommendations. A second impediment is the growth in interest expense which, at a cost of approximately 4%, will climb to 2.5% of GDP in 2024, which is approximately 39 billion euros more than the cost of 30.2 billion euros in 2022. A third problem is the pressure being exerted by expenditure on CPI-indexed pensions in the current inflationary environment. That situation is translating into significant growth in public resources for retired generations at the cost of policies around education, employment, housing or child-bearing targeted at younger generations. Indeed, the OECD (2023b) emphasised this issue in a recent report on the Spanish economy.

Notes

With various delays implementing the new budgets, prior-year budgets were carried over in 2012, 2017, 2018, 2019 and 2020.

[2]

The government is expecting a higher overall rate of growth in 2023 as tax reimbursements are expected to slow in the final months of the year.

[3]

In the end, revenue from the tax on large fortunes amounted to 623 million in 2023, which is 45.4% of the amount budgeted. Revenue from the new levies on financial institutions and energy companies was 2.9 billion euros, 83% of the initial forecast.

[4]

This design would appear to eliminate the possibility of adjusting for dividends received from overseas companies or gains on assets generated outside of Spain. The governing agreement recently hammered out between the political parties, PSOE, and Sumar, estimates this impact at 10 billion euros but does not publish any supporting calculations.

The 2023 GSB contemplates a fixed increase of 2% with scope for an additional 0.5% increase depending on the trend in the harmonised consumer price index (HCPI).

[6]

Royal Decree-Law 2/2023 of 16 March 2023.

References

Desiderio Romero-Jordán. Professor of Applied Economics, Rey Juan Carlos University and Funcas