Outlook for the Spanish economy in the face of falling energy prices

The combination of labour market resilience and an easing of inflationary pressures arising from lower energy prices, coupled with higher than anticipated natural gas storage levels in Europe, means that the economy is likely to perform better than initially thought. Albeit economic uncertainty weighs heavily on forecasting, in 2024, the Spanish economy is expected to reach pre-pandemic growth levels, with fiscal indicators improving in tandem with recovery; however, fiscal sustainability will depend on the credibility of the targets set for correcting current imbalances and the transformational nature of the investments financed using the NGEU funds.

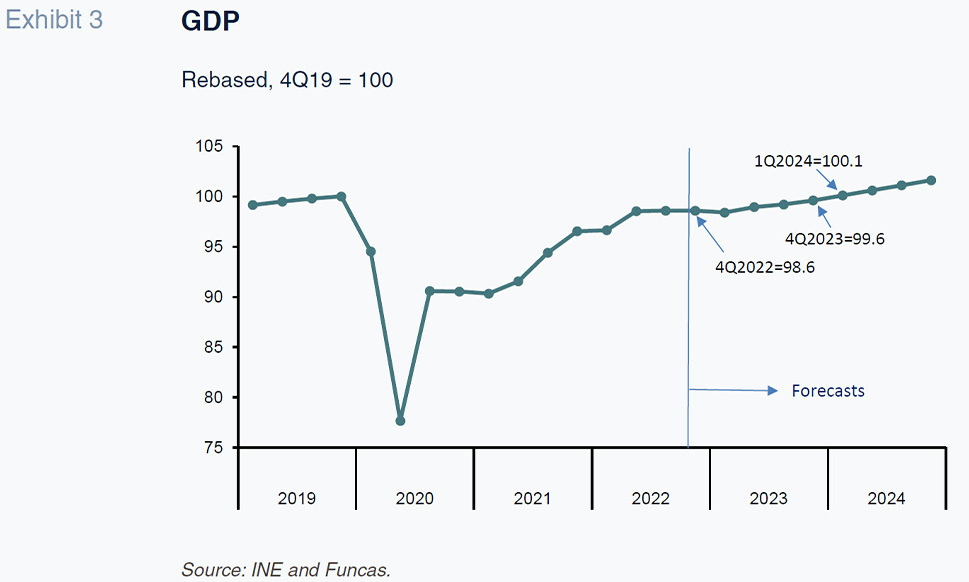

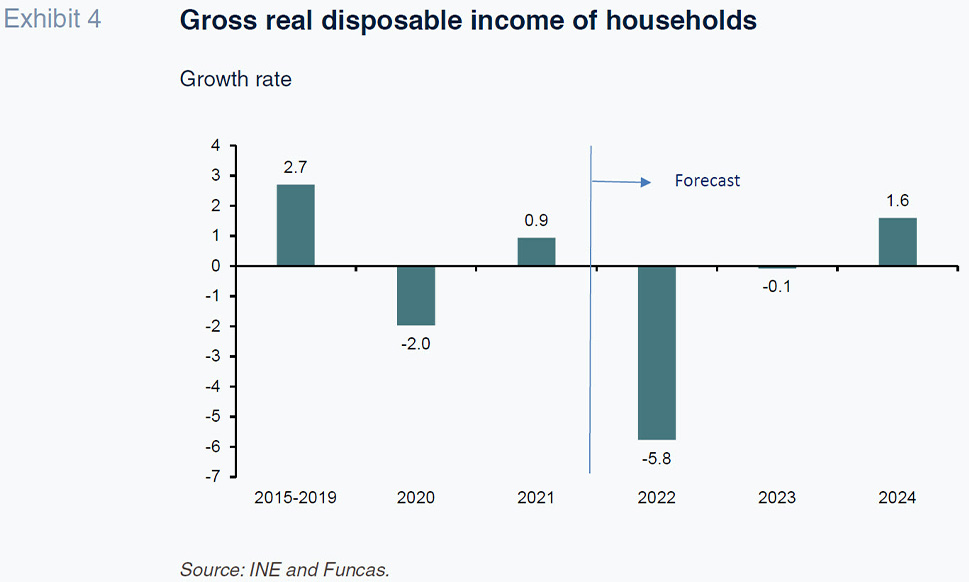

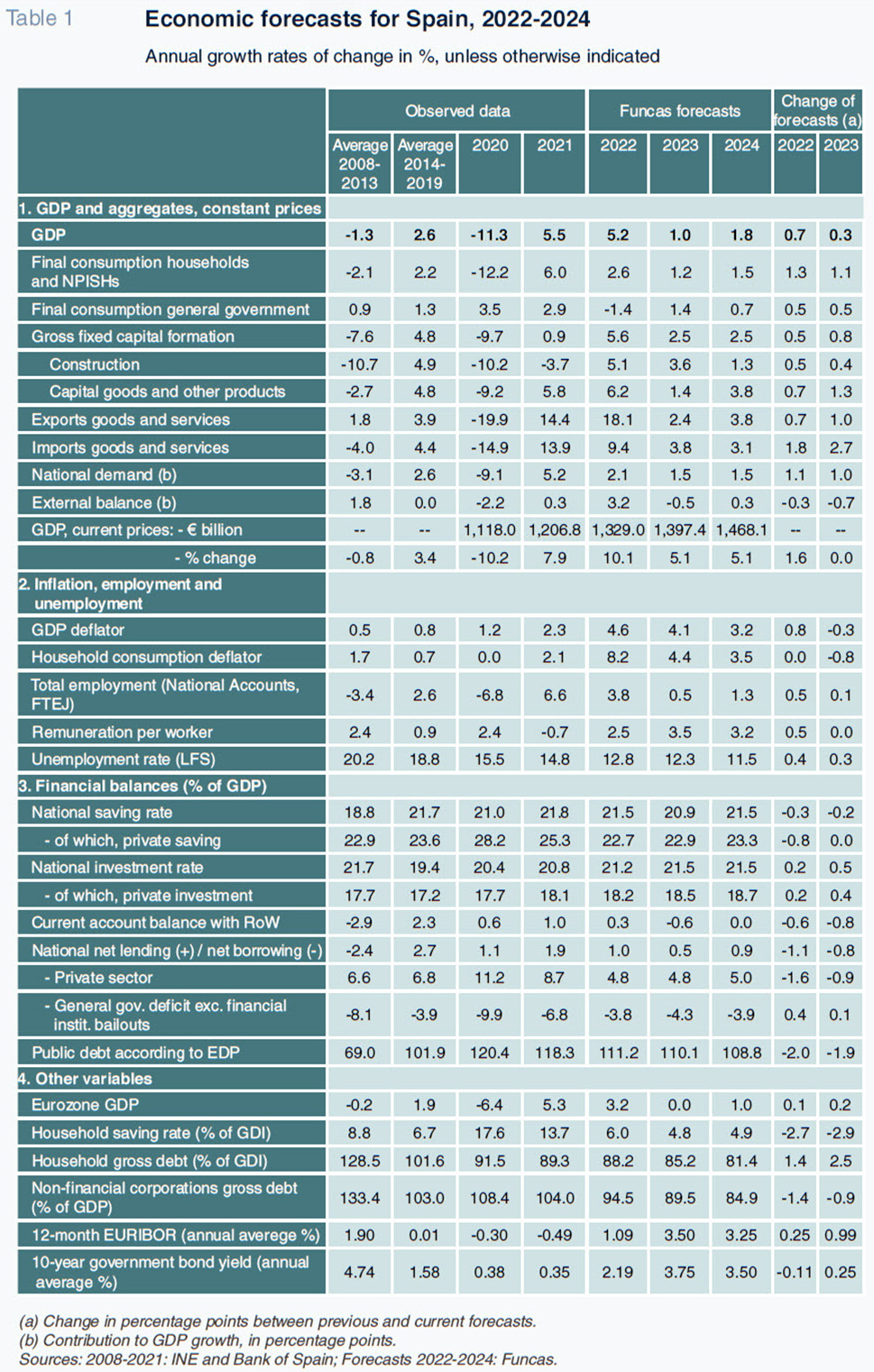

Abstract: After upward revisions in the first and second quarter GDP figures, growth in the first half of last year stood at 7.3% year-on-year, up from the initially published 6.7%, while GDP rose just 0.1% in the third quarter of 2022. The combination of labour market resilience and an easing of inflationary pressures arising from lower energy prices, coupled with higher than anticipated natural gas storage levels in Europe, means that the economy is likely to have performed better towards the end of the year than initially thought. Meanwhile, the public deficit continues to beat expectations, once again thanks to higher than forecast tax revenue. As of September, the overall deficit was running at 2.3% of GDP, compared to 6.3% in 9M21. The adjustments made by the National Statistics Office to the initially reported GDP figures, coupled with the let-up in energy prices, have prompted an upward revision to our growth forecasts. In 2022, we are now expecting GDP growth of 5.2%, up 0.7pp from the last forecast, as a result of the new official figures. Growth is expected to fall back to 1% in 2023, mainly because Spanish households no longer have a savings buffer to prop up their consumer spending. With the broader European economy gradually rebounding, growth is forecast at 1.8% in 2024, which would finally put the Spanish economy back at pre-pandemic levels. The government deficit is forecast at 4.3% of GDP in 2023, with public debt at 110%. Those readings should improve in 2024 in tandem with the economic recovery. These forecasts remain subject to a significant level of global uncertainty. But fiscal sustainability will depend on the credibility of the targets set for correcting current imbalances and the transformational nature of the investments financed using the NGEU funds.

Recent economic performance in Spain

According to the revised quarterly national accounts, GDP rose by a mere 0.1% in the third quarter of 2022. However, the first and second quarter figures were revised considerably higher to put GDP growth in the first half at 7.3% year-on-year, up from the initially published 6.7%.

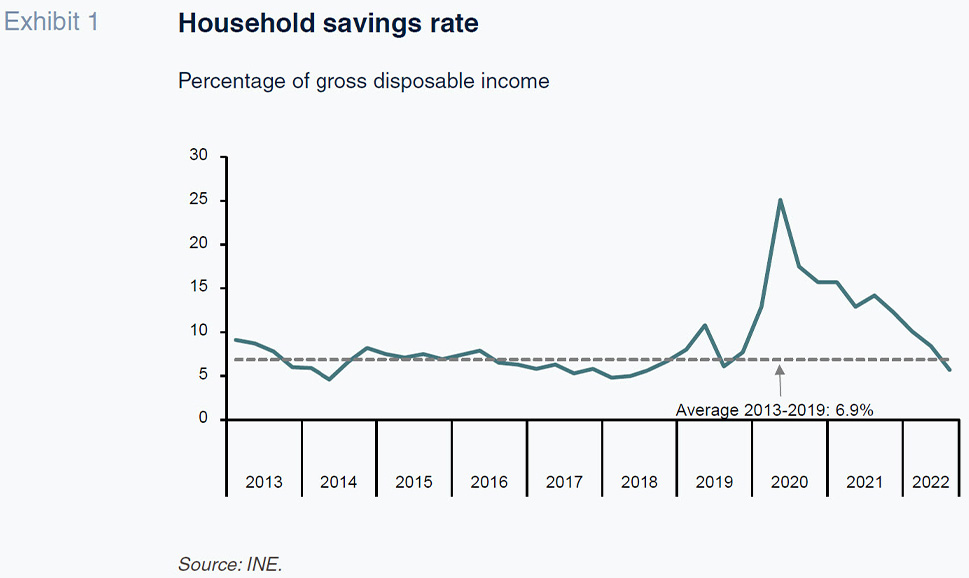

Consumer spending was virtually stagnant in real terms, albeit rising 1.8% in current terms. In other words, the volume of goods and services purchased by households was stable despite the growth in prices, which translated into higher expenditure in current terms. That, coupled with a 1.1% drop in gross disposable household income, drove the savings rate considerably lower, to 5.7%, which is below the average of 6.9% observed between 2013 and 2019 (Exhibit 1). Growth in the buffer built up between 2020 and 2021 has, therefore, ceased, although it is likely that its existence, together with healthy employment dynamics, is what propped up consumption in spite of the loss of household purchasing power, to the detriment of the savings rate.

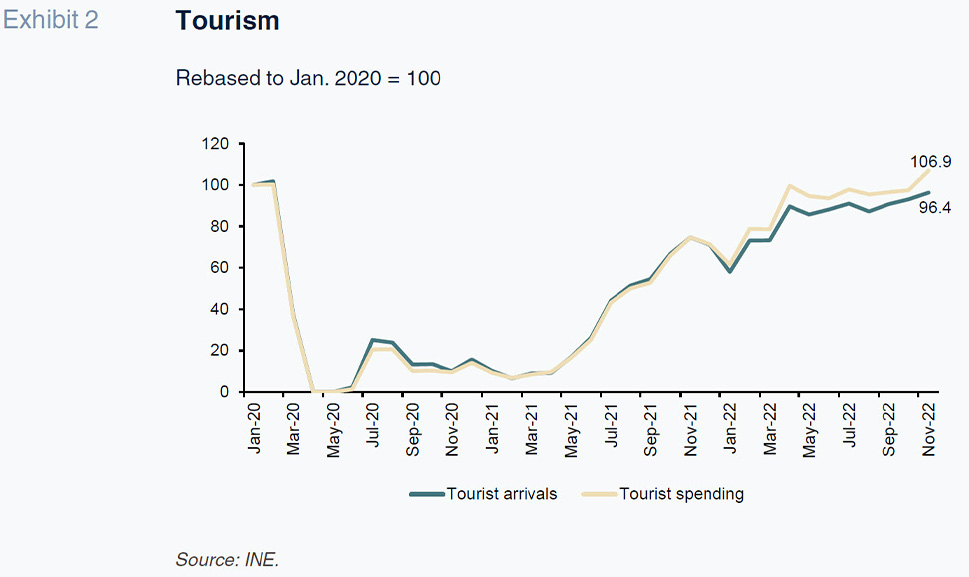

Investment in capital goods increased slightly but it was the government spending component of domestic demand that made the biggest contribution to third-quarter GDP growth. Foreign trade detracted from growth: real tourist spending barely budged, having normalised and even topped pre-pandemic levels in previous quarters (Exhibit 2), while the modest growth in exports was insufficient to offset the bigger increase in imports.

As for the fourth quarter, the manufacturing PMI points to a sector contraction, albeit smaller than expected. Indeed, the manufacturing industrial production index to November deteriorated just a little –it was worse in the energy-intensive segments. The confidence indicators also lost ground and capacity utilisation fell back. In services, however, the PMI reading remained in growth territory, albeit just barely. Overnight stays in hotels rose, as did air and rail passenger numbers.

The number of Social Security contributors increased by 0.6% in the fourth quarter, which is very close to prior-quarter levels, pointing to continued labour market resilience. Although seasonally-adjusted employment fell in December, the contraction is not, for now, significant, as it came on the heels of an exceptionally strong November result. Something similar took place in June and July, possibly suggesting a mere change in seasonal patterns. Private sector non-farming employment increased by 0.6% in the fourth quarter, down from growth of 0.8% in the third quarter. There are signs of a slowdown, therefore, but it is too soon to talk about a change in the employment trend. Overall in 2022, Social Security contributors increased by 3.8% from 2021, with the private non-farming sector registering growth of 4.8%.

Headline inflation peaked at 10.8% in July. Since then, the downward trend in energy product prices has pushed that indicator down to 5.7% as of December. Core inflation, on the other hand, having stabilised at around 6.3% between August and November, unexpectedly jumped to 7% in December. The biggest concern is the sustained growth in processed food prices, where inflation stood at 16.4% in December.

On the cost side, inflationary pressures have eased considerably. For example, against expectations, oil prices have corrected from an average of $117.5 per barrel in July to $81.5 in December. Gas prices, meanwhile, which peaked in August, at over €200/MWh, dropped to €60 in October and November before going on to head back to almost €100 in December, which is still considerably above pre-war and pre-pandemic levels. Industrial commodity prices have also come down but remain at relatively high levels, while shipping costs are nearly back at pre-pandemic registers and the global supply chain bottlenecks seem close to resolution.

All of which is beginning to trickle through to the industrial price index. Excluding energy prices, the index has virtually stopped rising, suggesting that industrial prices are stabilising all along the production chain, albeit marked by certain differences from one product to the next. The prices of intermediate goods are actually falling but food product prices continue their upward trend, suggesting that the pressure being exerted by food prices on CPI still has a way to go.

All of the above, coupled with higher than anticipated natural gas storage levels in Europe (which, together with seasonably mild weather, has allayed the spectre of supply cuts this winter), means that the economy is likely to have performed better towards the end of the year than initially thought.

Spain reported a current account surplus of 0.2% of GDP in the first nine months of 2022. The trade surplus in tourist services has fully recovered to pre-pandemic levels but the goods deficit has deteriorated sharply, to its highest level since 2008. That development is the result of a burgeoning energy deficit and a shift in the non-energy goods balance of payments from surplus to deficit.

Meanwhile, the public deficit continues to record better than expected figures, once again thanks to higher than forecast tax revenue. As of September, the overall deficit was running at 2.3% of GDP, compared to 6.3% in 9M21.

Forecasts for 2022-2024

The adjustments made by the National Statistics Office to the initially reported GDP figures, coupled with the let-up in energy prices, have prompted us to revise our growth forecasts upwards. In 2022, we are now expecting GDP growth of 5.2%, up 0.7pp from our last forecast.

Growth is expected to fall back to 1% in 2023, mainly because Spanish households no longer have a savings buffer to prop up their consumer spending. That figure is, however, up 0.3pp from our October forecast, shaped by lower energy price assumptions than we were using before. We are now forecasting gas prices at €90/MWh (a conservative assumption, as it is higher than the Mibgas forward price), down from our last estimate of €120. That scenario is conducive to a continued reduction in CPI, alleviating the loss of households’ purchasing power and the impact of energy costs on the business sector. The resulting expansionary impact should offset the contractionary shift in monetary policy, becoming more apparent from the spring.

We have revised all components of internal demand upwards, most particularly private consumption, which is now expected to register slight growth (and not the stagnation previously foreseen). Investment, also revised upwards, is expected to be the main driver of demand over the projection period with the impetus generated by the NGEU funds more than compensating for the negative impact of higher interest rates. Foreign trade, however, is expected to detract from growth as a result of the outlook for weak growth across Europe (the eurozone economy as a whole is expected to register zero growth this year, with some important export markets like Germany expected to contract).

The quarterly growth pattern forecast for this year is markedly heterogeneous. After a small contraction in the first quarter, the economy is expected to expand at a quarterly pace of close to 0.4% the rest of the year. Carrying over from there, and with the broader European economy gradually rebounding, growth is forecast at 1.8% in 2024, which would finally put the Spanish economy back at pre-pandemic levels (Exhibit 3). All components of both domestic and external demand are expected to make a positive contribution next year.

The downtrend in consumer inflation initiated towards the end of 2022 is expected to continue, despite the stickiness of core inflation (i.e., controlling for volatile energy and unprocessed food prices). The private consumption deflator is currently forecast at 4.4%, down 0.8pp from our last set of forecasts, shaped by the reduction in energy prices. The GDP deflator, which best reflects the underlying dynamic, is forecast at 4.1% (down 0.3pp). That forecast assumes containment of potential second-round effects. Indeed, we are forecasting moderate growth in average wage-earner pay and corporate profits per unit produced of 3.5% and 3.9%, respectively. Inflation is expected to come down further in 2024. We are forecasting consumption and GDP deflators of 3.5% and 3.2%, respectively, the former still above the ECB’s target, however.

The anticipated slowdown in global growth, particularly in Europe, will undermine Spain’s trade deficit, eroding the current account in 2023. On the flip side, the global recovery forecast in 2024 by the IMF should turn that tide, helped by the Spanish companies’ strong competitive position. Overall, thanks to the Next Generation EU funds, the external balance is expected to remain in surplus territory (net lending position) throughout the entire forecast horizon.

The labour market is likely to feel the slowdown but not to give back the gains notched up in recent months. We are forecasting net job creation of 100,000 in 2023 and another 250,000 in 2024 (in FTE terms). If so, unemployment would come down to 11.5% by the end of the projection horizon, which would still be the worst figure in the EU.

The public deficit has come down significantly thanks to the interplay of the automatic stabilisers, coupled with inflation dynamics. However, little progress is expected on addressing prevailing imbalances in 2023 on account of the economic cooling and indexation of pensions. The deficit is forecast at around 4.3% of GDP in 2023, with public debt at 110%. Those readings should improve in 2024 in tandem with the economic recovery.

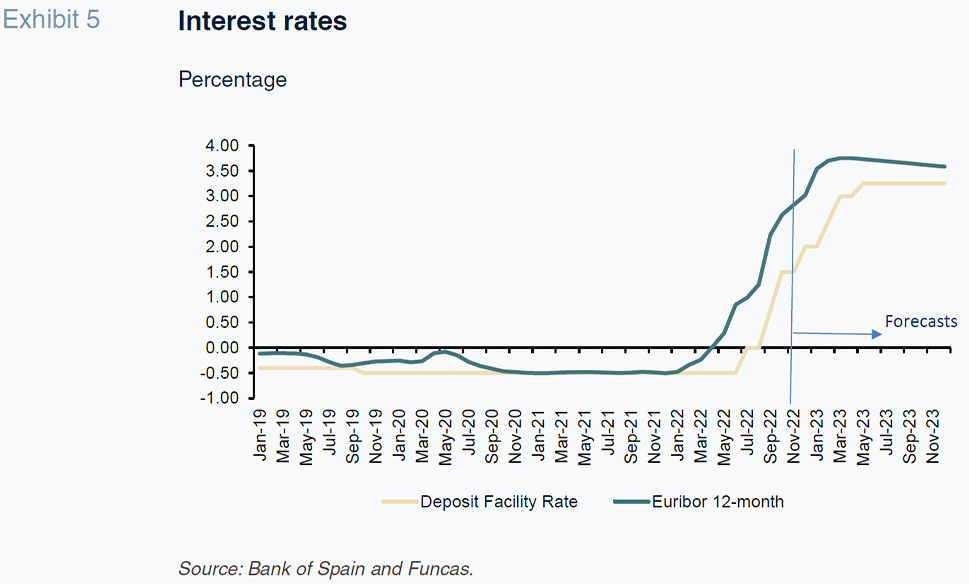

Lastly, in light of the inflation dynamics, the main central banks have embarked on a path of rate tightening with the aim of cooling demand and thereby mitigating the risk of second-round effects. Our forecasts contemplate additional increases in the ECB’s Deposit Facility Rate up to a terminal rate of 3.25% in the second quarter of 2023, from which point we expect rates to be largely stable until early 2024, when they could start to come down (Exhibit 5). Monetary policy will be echoed in market interest rates. We are forecasting EURIBOR at close to 3.75% over the coming months, before starting to drop slightly as market expectations for additional ECB rate hikes dissipate. As a result, mortgaged households with floating-rate loans could see their debt service burden increase by a total of 6.3 billion euros over the next two years. The trend in public bond yields is expected to be similar, increasing the country’s interest payments by around 9 billion euros in total between now and 2024.

Risks

These forecasts remains subject to a significant level of global uncertainty. Energy prices could conceivably collapse by more than currently forecast judging by the forward markets, which would accelerate the reversal of inflation and boost growth considerably. Conversely, having done away with its zero-COVID policies, China could embark on rapid recovery, tightening markets for oil and liquid gas prices. Elsewhere, geopolitical risks appear to have waned (the most pessimistic scenarios for the war in Ukraine are looking less probable at the time of writing) but have not gone away.

On the economic front, the pace of rate hikes by the ECB poses a challenge to the most indebted agents. Financial risks look moderate today, thanks to private sector deleveraging and healthy labour market dynamics (essential to avoiding a prolonged recession). However, overly aggressive monetary tightening could complicate that scenario.

Lastly, the persistence of a significant structural public deficit is a threat at a time when the ECB is rolling back its support via lax rates and public debt repurchases. The state will have to place massive amounts of debt securities on the market. Fiscal sustainability will depend, therefore, on the credibility of the targets set for correcting current imbalances and the transformational nature of the investments financed using the NGEU funds.

Raymond Torres and María Jesús Fernández. Funcas