Digitalisation of Spanish companies: An EU comparison

In contrast to the Spanish economy’s relatively low productivity levels, overall, Spanish companies are relatively highly digitalised. However, a high percentage of Spanish companies use digital technology to control worker performance (relative to alternative uses in companies in more productive countries) and have relatively low levels of organisational capital (complementary to digital capital).

Abstract: The European Company Survey (ECS) 2019 data show that business digitalisation is a multidimensional phenomenon marked by heterogeneous patterns. Differences in digitalisation at the firm level across Europe are attributable to country factors (productivity differences), sector–market factors (technology and demand) and company factors (size, competitive advantage, organisational capital). Public policies designed to support digitalisation across Europe need to take these factors into consideration. In contrast to the Spanish economy’s relatively low productivity levels, overall, Spanish companies are relatively highly digitalised. In fact, they rank among the highest in the EU. However, a high percentage of Spanish companies use digital technology to control worker performance (relative to alternative uses in companies in more productive countries) and have relatively low levels of organisational capital (complementary to digital capital). This, together with the lower incidence of delegation among the Spanish companies, could mean that they are missing out on the opportunity created by their investments in digitalisation to lift productivity.

Introduction

The major inroads made in information and communication technology development have not translated into the expected gains in productivity in developed economies (Andrews, Nicoletti and Timiliotis, 2018; Brynjolfsson, Hitt and Yang, 2018). One of the explanations proffered, coined the ‘productivity paradox’ (whereby productivity has proven relatively insensitive to the innovation embodied by investments in computers and analogous digital technology), shines the spotlight on differences in the adoption, use and application of information technology across companies. The ability to explain the differences observed in firm–level digitalisation would help identify barriers to pathways to innovation that could be alleviated via public policy (the European Union’s Next Generation – NGEU – investment programme includes digitalisation of the region’s economies, along with environmental sustainability and social inclusion, among its strategic goals for the coming decade).

This paper synthesises the results of a broader study (Rivera–Torres and Salas Fumás, 2022b) on firm–level digitalisation across the European Union (EU) and United Kingdom (UK) based on data gleaned from the European Company Survey 2019, ECS2019 (European Foundation for the Improvement of Living and Working Conditions, European Centre for the Development of Vocational Training, 2020). The ECS2019 sample includes close to 22,000 companies–establishments with 10 or more employees headquartered in the various EU member states and the UK. The information was gathered in 2019, i.e., before Brexit and COVID–19.

The study equates the business decision as to whether or not to digitalise to an investment decision with costs and benefits. The general hypothesis is that if a company adopts or uses a specific digital technology, it is because that investment has a positive net present value and if it does not implement or use it, it is because the net present value of that investment is negative. The research selects observable variables from the ECS2019 which can be associated with differences in the cost and benefits of company digitalisation; each digitalisation variable is then explained using a multivariate model with proxy cost and benefit variables as explanatory variables.

Brief overview of the study

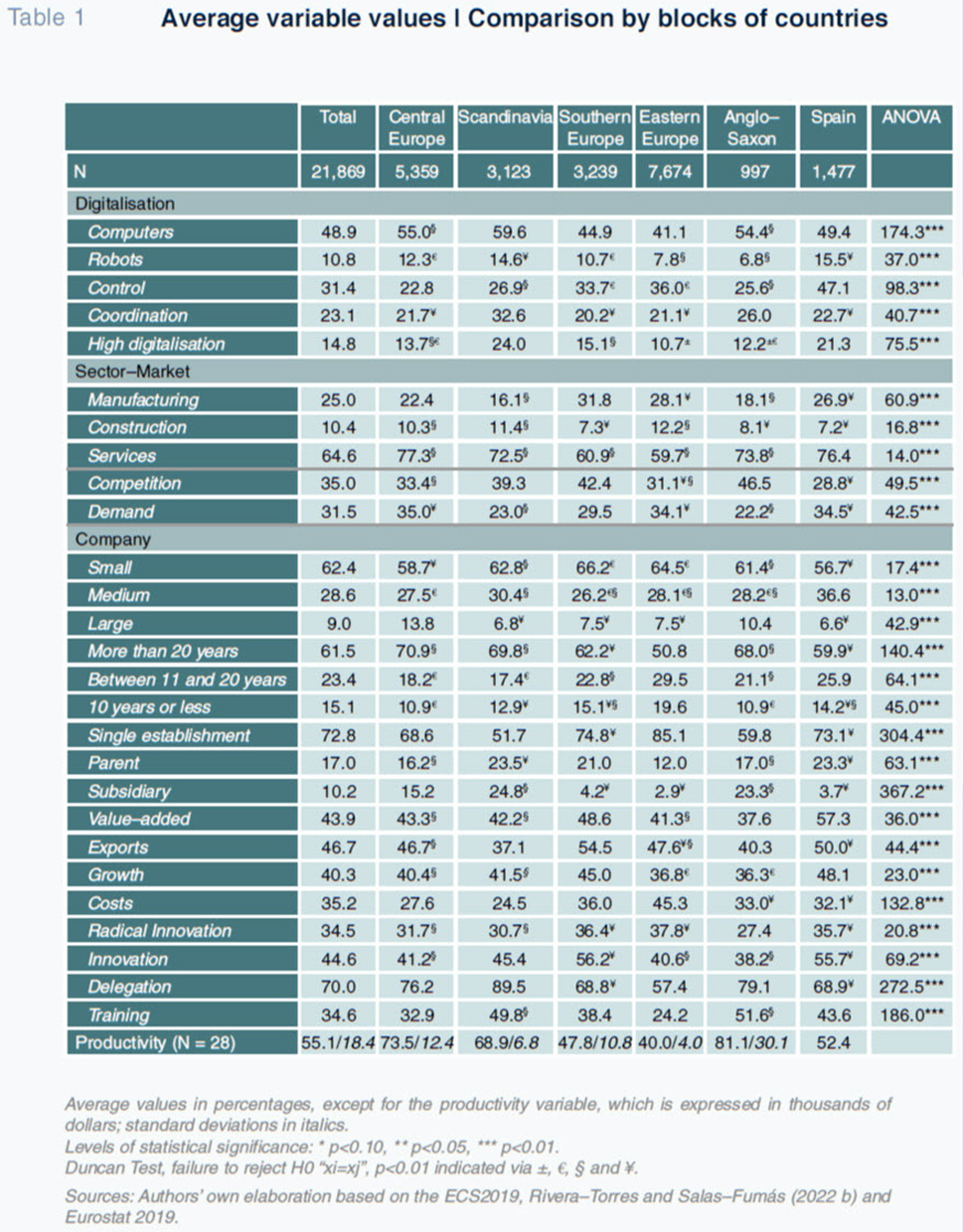

The study variables are grouped into four categories: digitalisation indicators (explained variables), institutional–economic environment variables, sector–market variables and company variables (explanatory variables). The digitalisation category includes five indicators, four of which are taken directly from the ECS2019, with the fifth formulated by the authors. Specifically, they are: the percentage of employees who regularly use computers to do their jobs (computers or the digitalisation of people); whether or not the company has installed robots (robots or the digitalisation of machines); whether or not the company uses data analytics to control worker performance (control); whether or not the company uses an intranet for internal communication among employees and/or between the latter and the people they report to (coordination); and whether or not the company belongs to the latent high digitalisation class (high digitalisation), using the latent class classification defined by Rivera–Torres and Salas–Fumás (2022a). Table 1 summarizes comparative descriptive information about the level of digitalization across EU blocks of countries, including Spain, as well as descriptive information on the relevant explanatory variables.

In the EU as a whole and the UK, 48.9% of employees use computers to do their jobs; 10.8% of the companies have deployed at least one robot; 31.4% use data analytics to control employee performance; 23.1% use intranet to coordinate their employees; and 14.8% of all companies rank as ‘high digitalisation’ firms. The companies in Eastern Europe and Southern Europe other than Spain present lower levels of digitalisation, although the comparisons vary depending on the digitalisation variables used. For example, the people digitalisation yardstick (computers) is lower in Spain than in Central Europe, Scandinavia or the Anglo–Saxon markets, but Spain stands out for the percentage of companies that have digitalised their machines (robots). Spain presents relatively high digitalisation levels according to the synthetic indicator, with 21.3% of the pool of companies qualifying as high–digitalisation firms, surpassed only by Scandinavia (24%). That is partly attributable to the fact that the Spanish firms use data analytics to control their employees’ performance far more frequently than those in the other countries in the sample.

Seventy per cent of respondents said that company management gave employees autonomy to do their jobs, with 30% reporting that work was done with little autonomy on the part of employees. At a little over one–third of the companies in the sample (34.6%), over 60% of employees had received on–the–job training. The percentage of Spanish companies that ‘delegates’ decision–making is similar to that of the other Southern European countries and higher than the percentage reported in Eastern Europe. The more than 20–point difference between the percentage of companies that delegate in Scandinavia – 89.5% – relative to Spain is eye–catching. The percentage of Spanish companies where at least 60% of employees are receiving on–the–job training is lower than in Scandinavia and the Anglo–Saxon markets but higher than in the other regions identified.

Main findings

The results of the study suggest that corporate digitalisation is a multidimensional phenomenon and as such should be studied separately for each of the variables contemplated. Indeed, the digitalisation variables are scantly correlated among each other and the cost and benefit proxy variables have different impacts – quantitatively and qualitatively – on the various costs and benefits in question, varying, for example, between the digitalisation of people (computers) or machines (robots) or depending on the digital tools used to control job performance or coordinate their efforts.

Specifically, average national labour productivity is correlated significantly and positively with the use of computers and robots, negatively with control over employees’ performance and insignificantly with work coordination. Therefore, in the more productive countries (Central Europe and Scandinavia in this study), leaving all other variables constant, all of the companies share conditions that favour, comparably, the return on their investments in computers and robots, whereas in the less productive countries (Southern Europe and especially Spain), conditions are relatively propitious to digitalisation of employee controls. Insofar as intensified use of computers and robots contributes to productivity gains (Gal et al., 2019), the comparative advantage of the companies in the initially more productive countries in terms of investing in computers and robots is bound to further increase the productivity gap between Central Europe and Scandinavia and the rest of the continent.

The study also highlights how, controlling for the remaining explanatory variables, the manufacturing sector is at a comparative advantage in terms of digitalisation via robotisation (digitalising machines), while the services sector, especially the business services segment, presents a competitive advantage in terms of intensifying use of computers by employees (digitalising people). Apparently, the technology, machinery and equipment capital intensity and process design involved in manufacturing activities, in comparison with the technology and processes used in the performance of services, given the current state of digital technology, determine the comparative advantages of each sector of the economy in terms of digitalising machines or people. In principle, both forms of digitalisation can help lift productivity.

Elsewhere, the numbers reveal that the differences in comparative advantage in the use of computers in the services sector relative to the manufacturing sector diminishes as a country’s labour productivity increases, whereas the comparative advantage of industry relative to services in robotisation is apparently higher in the more productive countries than in their less productive counterparts. It is conceivable that the manufacturers perform relatively more service activities (R&D, design, marketing, etc.) in the more productive countries than in the less productive ones and that gives them more opportunities to drive the digitalisation of their people towards the levels reported by the service providers. Secondly, the relatively more intense use of tangible capital in production at industrial companies in more productive countries, by comparison with those in less productive countries, could lead to relatively propitious conditions for robotisation at companies located in the former relative to the latter (e.g., with companies more capital intensive due to bigger differences between the cost of labour versus capital). The empirical results demonstrate that in explaining the differences in corporate digitalisation across countries, it is not sufficient to look at productivity levels and sector specialisation separately. The differences among sectors vary according to national productivity.

They also reveal bigger differences in robotisation than in the use of computers between large and small companies (in favour of the former), controlling for all other variables. It is likely that the installation of robots requires investments and results in fixed costs that are much higher than the investments and fixed costs associated with investments in computers. Only the companies with relatively high turnover are in a position to generate a return on so big an investment and cover such high fixed costs. Exporting is another way of reaching larger markets and that would explain why the companies that export are relatively more digitalised than those that do not. Among the large companies, the return on using digital resources for personnel control and work coordination functions is higher than at smaller companies, probably because the need for formal control and coordination procedures increases in tandem with company size. More competitive markets favour digitalisation of uses – control and coordination –, but the perceived intensity of competition does not influence the decision to invest in digital technology, controlling for all other variables. Elsewhere, the perception that demand for a company’s products or services is highly volatile does not on its own increase the return on digitalisation compared to the companies who see their demand as predictable. In contrast, the propensity to use digital technology in control and coordination tasks is lower among companies that see their demand as scantly or not at all predictable, by comparison with the rest of the sample.

Controlling for the other explanatory variables, the companies with more value–adding and innovating activities are more digitalised, in means and uses, than the companies with less value–adding activities and those whose competitive edge is predicated on keeping prices low. According to the results of the study, the gains from digitalisation do not stem from lowering costs but rather leveraging that digitalisation to innovate more and further differentiate companies from their competitors. Corporate digitalisation is clearly positively correlated with the companies’ levels of organisational capital, measured using the decision–making delegation and on–the–job employee training variables. That result lends support to the widespread hypothesis regarding the complementary nature of digital and organisational capital (Brynjolfsson, Hitt and Yang, 2002): the return on investment in digitalisation increases with the volume of organisation capital, which is why it is more likely to find digitalised firms, in means and uses, among the companies that delegate onto their employees and those that train more employees during working hours (specific training) than at those that do not delegate or train fewer employees.

The comparison between the level of digitalisation of the Spanish companies and those from the other countries considered reveals comparatively strong positioning in terms of general digitalisation levels across the cohort of companies in Spain. In fact, they rank among the highest in the EU. That is attributable above all to the fact that the Spanish companies analyse data to control their employees’ performance far more frequently than the other companies, and also because the percentage using robots is relatively high. That comparatively high level of robots and worker performance control digitalisation offsets Spain’s relatively less intensive use of computers and of technology for coordination functions.

Elsewhere, among the Spanish companies, the correlation between organisational capital (delegation and training) and digitalisation levels is weaker than across the companies in Central Europe and Scandinavia. Considering both the lower incidence of delegation among the Spanish companies (perhaps due to lower returns by comparison with firms from other countries) and the lower impact of organisational capital on digitalisation decisions, it looks as if the Spanish companies are missing out on the opportunity created by their investments in digitalisation to lift productivity. In other words, the level of digitalisation via computers and robots could be ‘excessive’ for the low incidence of complementary resources. In the internal organisational model commonplace among the Spanish companies, the use of digital tools appears to be more profitable in employees’ performance control functions than in the task of coordinating employees who do their jobs with relatively high levels of autonomy. In the more productive countries in Central Europe and Scandinavia, the pattern is just the opposite: lower use of digital technology to control employees’ performance and more intense use in coordination and delegation tasks.

Conclusions and implications

The EU has embraced digitalisation in general and that of its companies in particular as a strategic objective. That decision needs to be underpinned by two premises: firstly, that digitalisation has a positive effect on social wellbeing (greater productivity, better work, etc.) and, secondly, that there are market failures whose ultimate outcome are levels of digitalisation shaped by the individual rationality of the agents that are below socially desirable levels (perhaps because within the EU, heterogeneity in technological and institutional conditions leads to multiple equilibriums).

As a result, public policy needs to differentiate between firm–level digitalisation that has a positive impact on productivity, employment and labour market inclusion and that which has no influence or a negative influence. Although the data at hand do not allow for cause–and–effect analysis, the study shows how the digitalisation variables most commonplace in companies from the more productive countries (computers and robots) are different to those most entrenched in the less productive countries (data analytics for the control of worker performance). Elsewhere, the evidence shows that adoption of digital technology and its use is as or more prevalent at companies increasing their headcounts as at those not increasing in numbers (although the differences in digitalisation levels between the two groups diminishes as the average productivity of the countries increases). There is also evidence, particularly among the Scandinavian firms, that high levels of digitalisation are accompanied by more participative forms of working.

Regarding the multiplicity of equilibriums, digitalisation across the EU’s firms could follow different patterns in the more productive countries of Central Europe and Scandinavia than in the less productive Southern European countries, without signs of potential convergence. According to the ECS2019, the companies in Central Europe and Scandinavia are digitalising in conjunction with relatively high levels of organisational capital (employee job autonomy and high levels of specific human capital). Companies from those countries are leveraging the complementary nature of digital and organisational capital to drive growth in productivity. In Southern Europe, including Spain, and Eastern Europe, digitalisation is taking hold in companies with low levels of organisational capital which are leveraging digitalisation to reinforce management’s hierarchical control over their employees’ performance. As a result, their digitalisation thrusts are not encountering the conditions most conducive to unlocking their full potential in terms of productivity gains. Public policies in support of digitalisation in the EU need to be designed to ensure that the companies from the south and east of the continent have the incentive to change their organisational design by delegating more and providing their employees with specific training in order to close the productivity gap via digitalisation.

In the sample as a whole, the digitalisation of people (use of computers in their day–to–day work) is higher or similar at small– and medium–sized companies as at their larger counterparts, whereas the percentage of firms using robots (digitalisation of machinery) is considerably higher at the larger companies than at smaller firms, providing yet another example of the need to segment and target public policies in support of business digitalisation. It does not seem as if differences in employee knowledge and skills at large versus small companies are the reason for the gap in digitalisation levels by company size but rather their relative ability to absorb fixed costs (presumably higher in the case of robots) the higher their revenue.

The results indicate that, among the various types of companies represented in the sample, the highest levels of digitalisation, in means and uses, are located at subsidiaries. The digitalisation of Europe’s companies is not only a question of market forces (prices, monetary incentives) but is also a matter of management arising from decisions about ownership, organisation and control within companies and, in particular, in dealings between parent undertakings and their subsidiaries. In light of the ease of relocating subsidiaries within the EU, business digitalisation support policies, among many others, need to be designed and coordinated across the various levels of community and national governance.

References

ANDREWS, D., NICOLETTI, G. and TIMILIOTIS, C. (2018). Digital technology diffusion: A matter of capabilities, incentives or both?

OECD Economics Department Working Papers, No. 1476. Paris: OECD Publishing. Retrievable from:

http://dx.doi.org/10.1787/7c542c16–enBRYNJOLFSSON, E., HITT, L. M. and YANG, S. (2002). Intangible assets: Computers and organizational capital. Brookings

Papers on Economic Activity, 2002(1), pp. 137–198.

BRYNJOLFSSON, E., ROCK, D. and SYVERSON, C. (2018). The productivity J–curve: How intangibles complement general purpose technologies.

NBER Working Paper, No. 25148. Retrievable from:

http://www.nber.org/papers/w25148EUROPEAN FOUNDATION FOR THE IMPROVEMENT OF LIVING AND WORKING CONDITIONS, EUROPEAN CENTRE FOR THE DEVELOPMENT OF VOCATIONAL TRAINING. (2020). European Company Survey, 2019. [data collection]. UK Data Service. SN: 8691,

DOI: 10.5255/UKDA–SN–8691–1GAL, P., NICOLETTI, G., RENAULT, T., SORBE, S. and TIMILIOTIS, C. (2019). Digitalization and productivity: In search of the Holy Grial. Firm–level empirical evidence from European Countries.

OCDE WP, No 1533.

RIVERA-TORRES, P. and SALAS-FUMÁS, V. (2022a).

Digitalización y organización del trabajo en las empresas europeas: Análisis y comparación para España a partir del European Company Survey 2019 [Digitalisation and organisation of work at European companies: Analysis and comparison of Spain’s situation based on the European Company Survey 2019.] Funcas.

https://www.funcas.es/documentos_trabajo/digitalizacion-y-organizacion-del-trabajo-en-las-empresas-europeas-descripcion-y-analisis-comparado-para-espana-a-partir-de-la-european-company-survey-2019/RIVERA-TORRES, P. and SALAS-FUMÁS, V. (2022b).

El valor económico de la inversión digital de las empresas europeas y sus determinantes [The economic value of investment in digitalisation by European companies and its determinants.] Funcas.

https://www.funcas.es/documentos_trabajo/el–valor–economico–de–la–inversion–digital–de–las–empresas–europeas–y–sus–determinantes/

Pilar Rivera-Torres. University of Zaragoza

Vicente Salas-Fumás. University of Zaragoza and Funcas