Banks poised for the ECB’s debut climate risk stress tests

The ECB’s climate stress tests slated for 2022 will differ from traditional stress tests in terms of governance, objective, methodology, scenarios and scope. Nevertheless, the ECB’s deep engagement with this issue suggests a high probability that climate risks will be integrated into conventional stress tests in the future.

Abstract: The ECB’s first round of climate stress tests in 2022 will consider two classes of risks stemming from climate change –physical risks and transition risks. To the extent that climate risks impact banks’ ability to meet their capital requirements and execute their strategic plans, it is necessary to assess banks’ resilience to different climate change scenarios. Importantly, these tests differ in several ways from the conventional biannual stress tests. Firstly, the ECB and not the EBA will design the tests, engage with banks and report the results. The climate tests will provide the supervisor with an initial assessment of the state of play in the banking system and an idea of its capital sufficiency in the event of adverse climate scenarios. Although the climate tests will apply to all significant institutions, there will be some variation. Notable changes are also anticipated, mainly affecting the banks’ ability to identify relevant information related with the climate impact of their investment portfolios. Lastly, the scenario used will be determined by the Network for Greening the Financial System (NGFS). Given the novelty of the tests, coupled with data insufficiency and heterogeneity, it is likely that the results for the banks tested will vary widely based both on geographical location and sectors. Looking forward, the future integration of climate risks into the mainstream stress tests is a distinct possibility.

Introduction

In 2022, the European Central Bank (ECB) will spearhead the design and launch of the first set of climate risk stress tests for the banking union’s significant institutions.

The tests mark a fresh challenge for financial institutions. European banks will have to identify their climate risks and integrate them into their stress tests, while also developing methodologies that meet the supervisor’s requirements.

In this paper, we analyse: (i) the nature of the cross-cutting climate risks as they trickle down via the existing Basel III risk categories; (ii) access to counterparty information, the construction of databases and the generation of adequate proxies when explicit data are not available; (iii) the ECB’s initial estimate of the stress tests’ impact on European banks; and, (iv) the role climate risks could play in the conventional stress tests going forward, particularly in the context of ongoing discussions regarding the reform of existing methodology.

Climate risks in banking: Definitions and transmission channels

Environmental sustainability has a real and quantifiable impact on lenders and the financial markets. Consequently, banks must take a holistic approach, aligned with their risk appetite frameworks, when measuring and managing their environmental, social and governance (ESG) risks.

The European Banking Authority (EBA) [1] defines ESG factors as “environmental, social or governance characteristics that may have a positive or negative impact on the financial performance or solvency of an entity, sovereign or individual”. And it defines ESG risks as “the negative materialisation of ESG factors” i.e., the risk of any negative financial impact (on financial performance or solvency) to an institution stemming from the current or prospective impacts of ESG factors on its counterparties.

Without underestimating the social and governance aspects, it is the environmental dimension, particularly climate change, that has fuelled the most progress in ESG conceptualisation and analysis for the banks’ risk management efforts and the work of banking regulators and supervisors.

Key to those developments was the wake-up call sounded by the Financial Stability Board in 2015 when it acknowledged that the risks associated with climate change could have very adverse consequences for financial stability. In the wake of that warning, the Basel Committee, specifically the Network for Greening the Financial System (NGFS), made up of over 100 central banks and supervisors, has provided inputs for climate scenario analysis and, most importantly, uniform guidelines for supervisors in different jurisdictions.

The regulators and supervisors have agreed on the existence of two classes of risks stemming from climate change:

- Physical risks: The probability of incurring losses as a result of adverse climate phenomena, including the most frequent environmental events (e.g., floods and droughts) and gradual changes in climate.

- Transition risks: The probability of incurring losses as a result of the shift towards a low-carbon and more environmentally-sustainable economy.

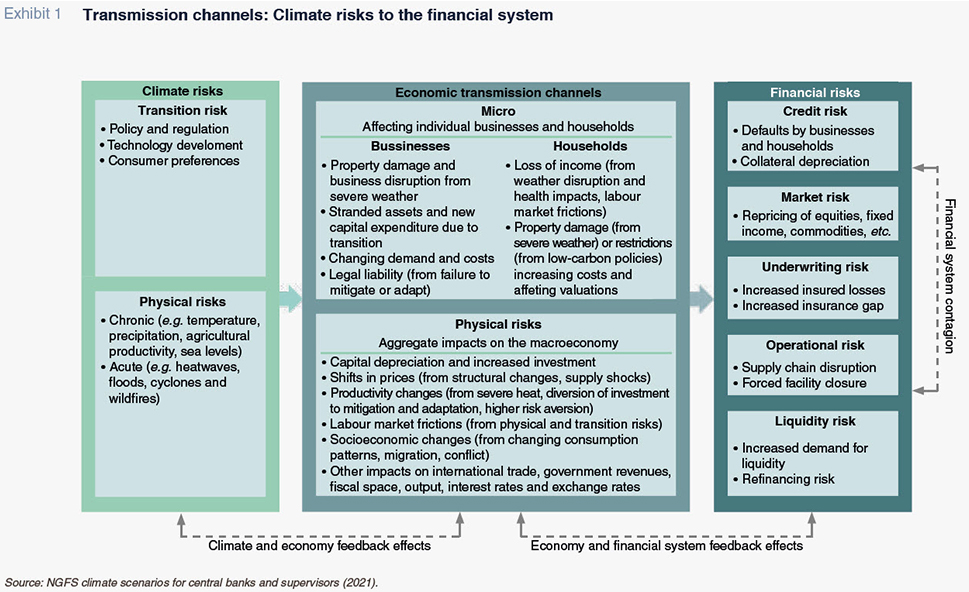

The Basel Committee on Banking Supervision expanded this line of thinking in April 2021 when it published “Climate-Related Risk Drivers and Their Transmission Channels”, in which it concluded that climate risks are cross-cutting risks that intertwine with traditional banking risks (on- and off-balance sheet) through a number of transmission channels. In that same vein, the NGFS, framed by its commitment to disseminating best practices in the management and oversight of climate risks in the financial sector, has created a table itemising the financial contagion transmission channels (Exhibit 1).

The transmission channels explain how climate risks impact economic activities which, in turn, affect the financial system: (i) directly, by undermining profitability or asset value; or, (ii) indirectly, via aggregate impacts on the macroeconomic situation.

To the extent that climate risks are cross-cutting risks, thereby impacting banks’ ability to meet their capital requirements and execute their strategic plans, it is necessary to assess banks’ resilience to scenarios in which such risks could materialise. Such analysis should also consider how these risks are intertwined.

The stress tests therefore serve as a toolkit to diagnose vulnerabilities using a forward-looking approach. Indeed, several central banks, including the French and Dutch monetary authorities, have already conducted their first stress tests, while the European Central Bank and the supervisors in Australia, Canada, the UK and Singapore have announced forthcoming environmental stress tests under the basis of their financial stability protection mandates.

The eurozone’s maiden climate risk stress tests: Methodological challenges

On July 8th, 2021, in tandem with the review of monetary policy strategy in the eurozone, Christine Lagarde, President of the ECB, announced the launch of the first stress tests designed to assess the climate change risks facing the euro area’s banking system. The tests, proposed and designed by the ECB, mark a paradigm shift with respect to the stress tests undertaken bi-annually since 2014 to assess European banks’ resilience vis-à-vis adverse events. The main changes with respect to the conventional stress tests include:

- Governance: The EBA will not lead the design of climate change stress-testing methodology. Rather, the ECB has been tasked with sizing and rolling out the tests, engaging with the entities and reporting the results. As discussed later, it is conceivable we will see a growing interplay and, eventually, full integration of the climate risks tests within the regular stress testing dynamic as an addition to the oversight toolkit (as part of the Basel Pillar 2 requirements).

Elsewhere, the ECB is expected to recycle many of the rules used to measure credit, market, operational and reputational risks, with an eye to adapting those rules that require greater flexibility to generate a realistic estimate of the banks’ climate risks, e.g., the need to estimate long-term transition risks using dynamic balance sheet assumptions currently not contemplated in the EBA methodology.

- Objective: While the results of the conventional stress tests are used as an input for the Supervisory Review and Evaluation Process (SREP) for the banking union’s significant institutions, the intention is not for the climate risk tests to directly impact banks’ capital requirements. The climate tests will provide the supervisor with an initial assessment of the state of play in the banking system and an idea of its capital sufficiency in the event of adverse climate scenarios.

- Scope: Since 2014, all entities supervised directly by the Single Supervisory Mechanism (SSM) have had to submit to stress tests, with the odd exception (e.g., during ongoing M&A processes that make it harder to gather information and compare results). The climate tests will similarly apply to all the significant banks under the scope of the SSM, with some variation. Only those institutions that, in the opinion of the supervisor, can adequately certify their ability to generate projections based on their internal models will be allowed to present their own estimates using a bottom-up approach. The remainder will simply report their starting points while the ECB generates the projections, taking a top-down approach.

- Methodology: As already noted, the goal of the climate tests is to assess the banks’ ability to withstand the consequences of transition and physical risks beyond the scope of the traditional stress test methodology. Important changes are therefore anticipated, mainly affecting the banks’ ability to identify relevant information related with the climate impact of their investment portfolios.

It will also be essential for banks to identify the location and business sector (for corporate loan exposures) of their counterparties to map the impact of certain environmental scenarios, as defined by the NGFS, that vary by geography and industry. By the same token, it will be essential to include information about greenhouse gas emissions, or, if that is not possible, use proxy variables to generate robust statistical models for determining borrower risk parameters, which depend on variables related with their carbon footprints.

The Dutch central bank, which pioneered the performance of climate stress tests, flagged limitations related with the availability and granularity of climate information as the main data quality shortcoming, a factor that is more important the greater the level of detail sought by asset type and geography; it also noted the importance of developing tools for modelling vulnerability factors based on GHGs and for capturing second-round effects.

- Scenarios: In the conventional stress tests, the adverse scenarios are provided to the EBA by the European Systemic Risk Board (ESRB) and are characterised by the materialisation of plausible but unlikely episodes of stress in key macroeconomic parameters (GDP, unemployment, inflation), the financial markets (interest rates, yields, share prices, currencies, commodity prices) and the property market.

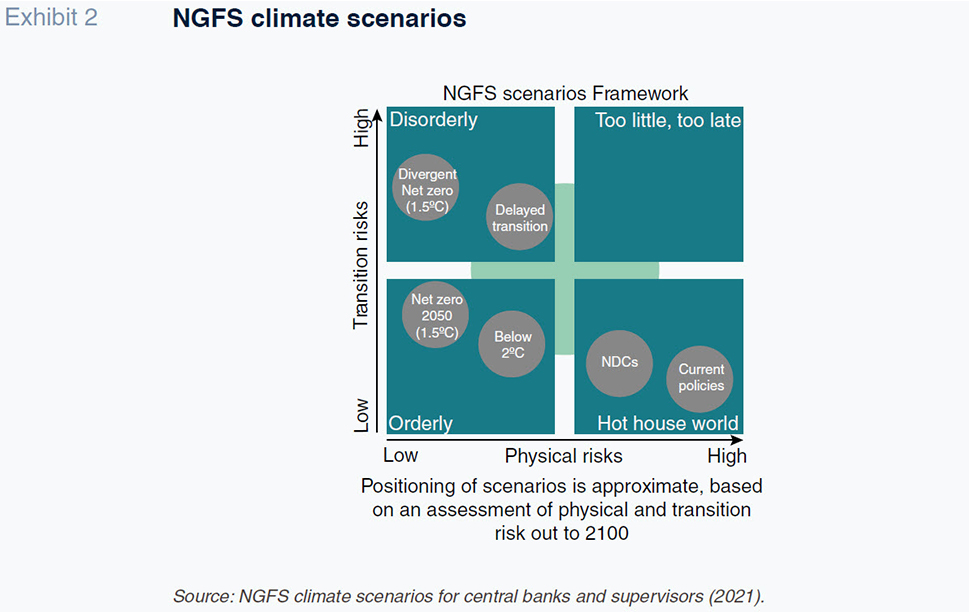

In contrast, the ECB’s climate tests will be fed by the scenarios defined by the NGFS in an attempt to model two key effects: (i) the impact of environmental catastrophes (physical risks) on the value of real estate collateral and the productive capacity of the sectors hit hardest by such episodes; and, (ii) the impact of a potentially disorderly execution of the plans for transition to a low-GHG economy (transition risks) on macroeconomic, financial and environmental variables (emissions).

Specifically, the NGFS has defined three climate scenarios (one baseline scenario and two adverse scenarios, the latter somewhat contradictory to each other) that depend on the ambition of governmental measures and the ability to implement them, the level of carbon emissions and the pace of technological change:

- Orderly transition: Assumes climate policies are introduced early and become gradually more stringent; physical and transition risks are relatively low.

- Disorderly transition: Assumes late climate action, potentially uneven across different countries and sectors, resulting in higher transition risk.

- Hot house world: Assumes climate policies are introduced in some jurisdictions only and global efforts are insufficient to halt global warming. Physical risks are severe and include irreversible changes, such as sea level rise.

What the ECB’s top-down tests might reveal

Given the novelty of the tests, coupled with data insufficiency and heterogeneity, it is likely that the results for the banks tested will vary widely. Because of uncertainty surrounding these tests, it is worth considering the ECB’s initial assessment of climate change risk for the sector as a whole as those results provide a firm-level snapshot of climate vulnerability by sector and geography.

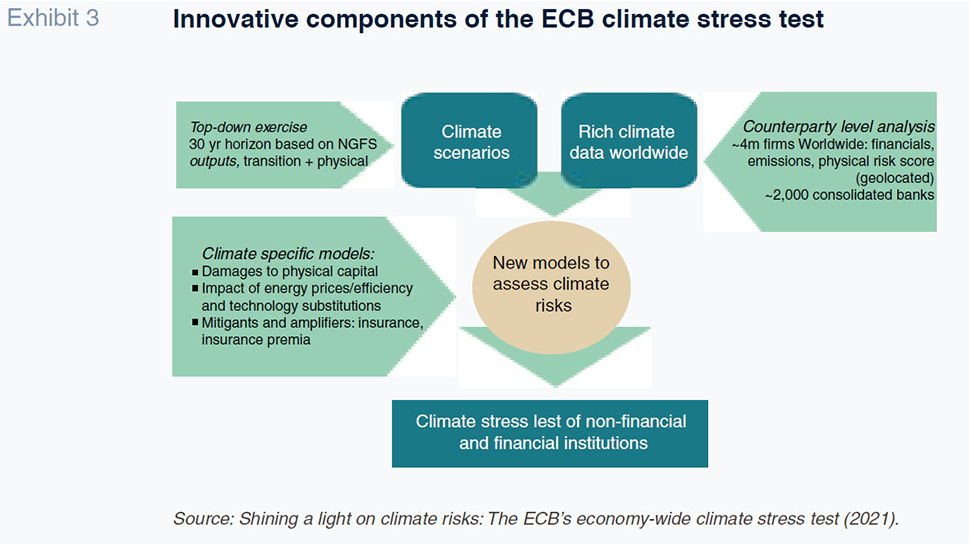

In March, the ECB published the results of a pilot test for its appraisal of the resilience of the economy as a whole to climate change. In generating its projections, the European supervisor used a deep financial and climate dataset comprising over four million companies worldwide and over 2,000 banks, modelling a time horizon of 30 years and a range of environmental scenarios (those designed by the NGFS), making them the most ambitious tests conducted in the eurozone to date.

As supervised entities did not participate, the tests are not a real self-assessment. However, the ECB’s stress test, which encompasses banks and non-financial corporates, is the frontrunner for the climate stress tests slated for 2022. As such it provides initial insight into the scenarios’ design, assumptions and assessment of the impact of climate risks on the financial system.

The results published by the ECB show that in the absence of early political action to mitigate the effects of climate change, the probability of default (PDs) by counterparties will be higher due to the expected increase in the frequency and magnitude of natural hazards. Climate risk is, therefore, ultimately a systemic risk and it is a higher risk for the banks with greater exposure to potentially vulnerable sectors and markets.

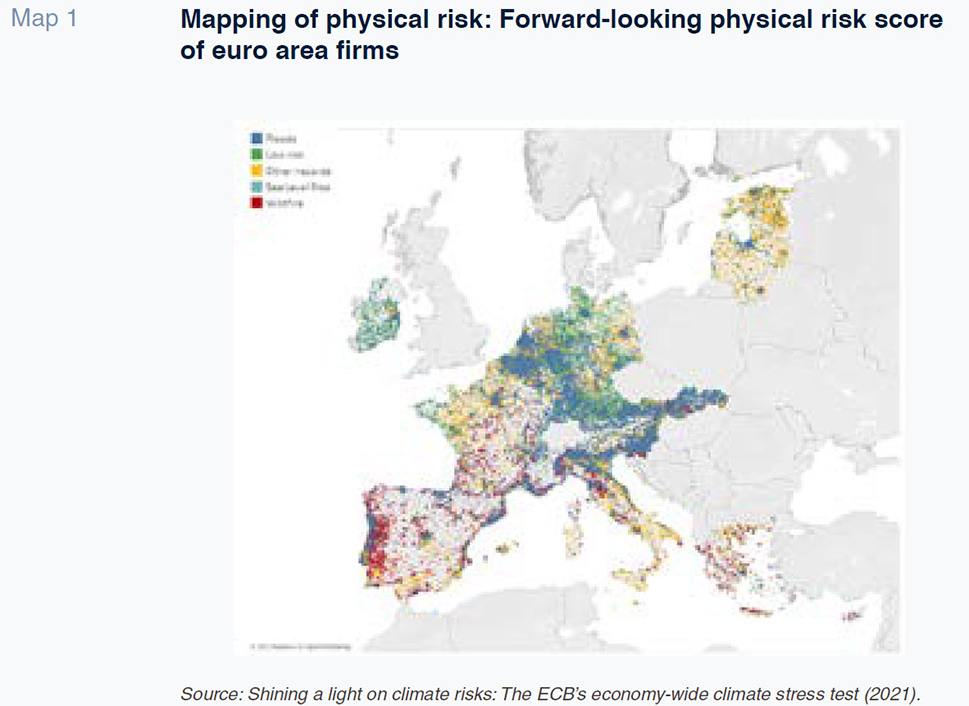

The ECB clearly distinguishes regions that are more exposed to physical risks, such as the risk of more frequent heatwaves and wildfires in southern Europe and the risk of flooding in central and northern Europe. Its assessment of transition risk is similarly discretionary with carbon-intensive industries, such as mining, energy generation and manufacturing, highly exposed to carbon-cutting policies, particularly if the transition to a green economy is more disorderly.

Similar divergences are also displayed in the analysis of banks’ corporate counterparties’ probabilities of default under different climate scenarios. While the probability of default increases initially in the orderly transition scenario as a result of the costs of adapting to green policies, that increase is offset in the medium- and long- term by a substantial reduction in the costs of physical risks (in disorderly transition scenarios: destruction of physical capital and increase in insurance premiums). Elsewhere, the use of new technologies is expected to lead to more efficient and sustainable production that, in the long term, will translate into cost savings that boost business profitability and creditworthiness.

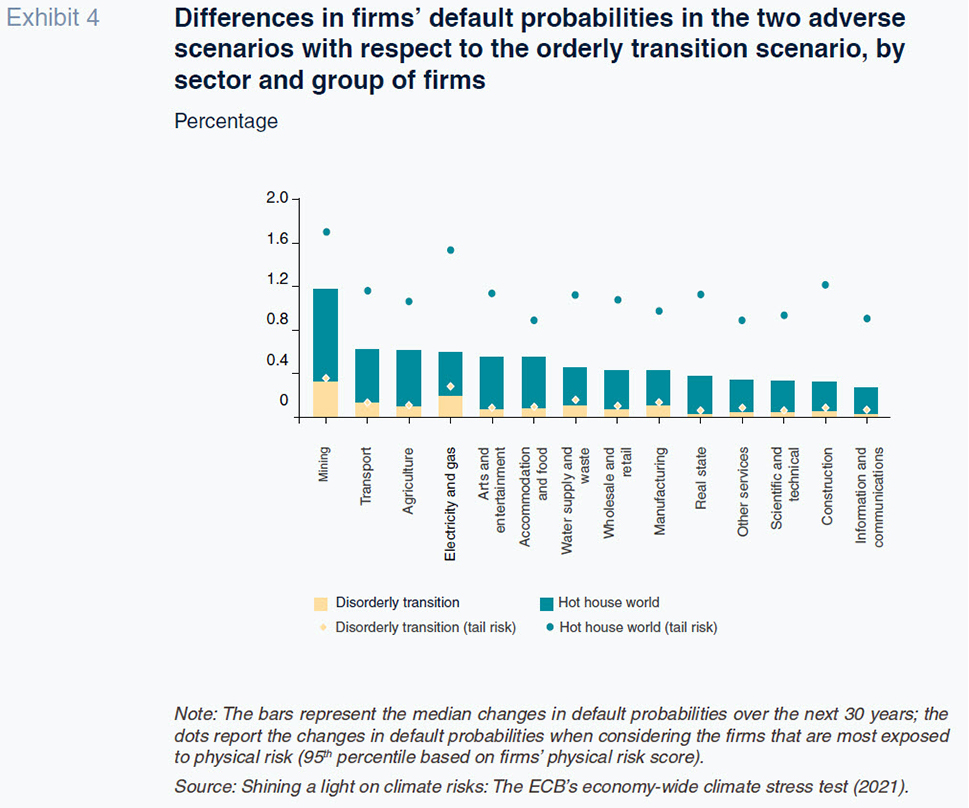

Exhibit 4 depicts the smaller increase in counterparty firms’ default probabilities by sector in the orderly transition scenario

versus the adverse scenarios. It reveals that in all sectors the impact of a disorderly transition is negative and leads to higher credit impairment. This should be more pronounced in carbon-intensive industries and, above all, in the hot house world scenario, where, in the absence of green policies, the physical risks are more severe.

Across sectors, exposure to climate risks varies considerably, with scope for PDs to increase by up to four times for the average firm over the next 30 years for those companies with the highest physical risk scores (95th percentile).

The future is green for the European stress tests

The ECB’s top-down assessment of climate risks in the banking union is more than just an intellectual exercise. The implications for banks (including for the less significant institutions judging by the strategy being taken by some of the national central banks, including the Bank of Spain) are irreversible and are framed by the supervisory authorities’ commitment to contributing to the delivery of climate change targets within the context of financial stability.

This analysis comes at an inflexion point for the European stress tests. Already debate is underway within the EBA about the future of the tests. This debate is focused on a paper published in 2020 whose conclusions and, ultimately, adjustment mechanisms, will inform the 2023 stress tests.

Some of the criticisms of exercise that the EBA will address include: (i) their ability to predict bank resolution episodes; (ii) the representativeness of certain assumptions underpinning the methodology, specifically the static balance sheet approach, which fails to factor in decision-making in situations of stress and the second-round effects that exacerbate crises and make the whole simulation more realistic; (iii) the use of the stress tests as a strategic planning and management tool (particularly by investment committees and for lending policy-setting purposes); (iv) the operational difficulties posed by templates, generating projections and engaging with the supervisors; and, (v) coverage of all of the risks and scenarios likely to compromise bank solvency.

Against that backdrop, the future integration of climate risks into the mainstream stress tests is a distinct possibility. Such integration could be tackled in one of the following ways:

- On an ad-hoc basis, such as those tests the ECB will conduct in 2022, isolated in time, and following procedures designed by the EBA bi-annually using a relatively similar forecasting methodology to facilitate entities’ understanding and use of their internal models.

- Layering climate risks into integrated stress tests, presumably from 2023. This is in line with the debate sparked by the EBA and would assess entities’ vulnerability to stressed macroeconomic and financial scenarios as well as environmental scenarios in the best case scenario, identifying potential spillover effects.

In our opinion, the second option is the more advisable route. It would bolster the stress tests’ value as an input for calculating the minimum amount of capital required by the supervisor as part of the SREP exercise by considering all relevant vulnerabilities, including environmental exposure, and factoring in the interplay between risks. It would also facilitate the entities’ and supervisors’ work by requiring a single procedure with common rules. Admittedly this would necessitate some variability to integrate longer-term scenarios into the climate risk assessment, irrespective of the frequency with which the tests are ultimately performed.

The fact that it is the EBA that has sparked the debate about the tests’ weaknesses is grounds for optimism. The tests are vital to supervision and should be an increasingly fundamental tool for bank management. In that context, and in an economy increasingly committed to environmental sustainability, the future of bank management requires assessing the banks’ ability to withstand the worst consequences of climate change and to adapt their strategies accordingly. The stress tests are, without a doubt, essential to facilitating that analysis.

Notes

EBA Discussion Paper on the management and supervision of ESG risks.

Referencias

Ángel Berges and Jesús Morales. A.F.I. – Analistas Financieros Internacionales, S.A.