Spanish economic forecasts panel: January 2026*

Funcas Economic Trends and Statistics Department

Growth in 2025

Spanish GDP is estimated to have grown by 2.9% in 2025

The consensus is that the Spanish economy registered growth of 2.9% in 2025, as also anticipated in the November survey. Domestic demand is thought to have contributed 3.4 percentage points to GDP growth (up 0.1pp from the November consensus forecast), with foreign demand detracting by 0.5 percentage points (versus -0.4pp in November). Investment and its main components are now believed to have performed better, with the public and private consumption forecasts unchanged. Within the foreign sector, the forecast growth in exports has been revised downwards by 0.1 percentage points, while growth in imports has been adjusted upwards by 0.3 points (Table 1).

Growth in 2026

The forecast for 2026 has been raised by 0.1pp to 2.2%

The consensus forecast for GDP growth in 2026 has increased by 0.1 points to 2.2%, which is in line with the growth forecast by the government and other organisations, other than AIReF, which is forecasting growth of 2.4% (Table 1). As for the quarterly pattern, growth is forecast at around 0.5% each quarter in 2026, which is unchanged from the November survey (Table 2).

Domestic demand is expected to contribute 2.5 points of that growth (up 0.2pp from the November survey), while the foreign sector is expected to detract 0.3 points. The slowdown by comparison with 2025 stems from investment (especially investment in machinery and equipment) and, to a lesser degree, household consumption. Although public consumption is forecast to continue to drag on growth, it is expected to do so by less than in 2025 (Table 1).

The majority of analysts (11) see a similar amount of upside as downside risk to their forecasts, with five of them seeing more upside risk and just three, greater downside.

Inflation

Inflation now expected to be higher in 2026

Having hit a high for the year in October, of 3.1%, headline inflation headed downwards to end the year at 2.9%, implying an average annual rate of 2.7%. Core inflation gathered pace in the second half of the year, rising from 2.2% in June to 2.6% in December, implying an average annual rate of 2.3%. As noted in previous reports, food products and services continue to register stubbornly high rates of inflation.

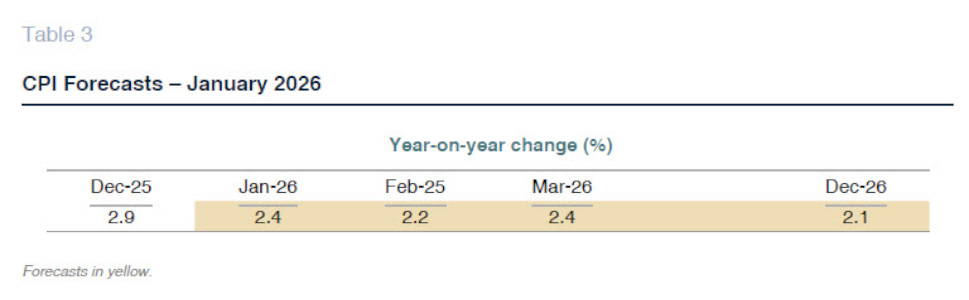

The consensus forecast for average headline inflation in 2026 has increased by 0.1 percentage points to 2.2%,with the year-on-year rate forecast for December at 2.1%. The consensus forecast for core inflation has similarly increased by 0.1 points to 2.3% (Tables 1 and 3).

Labor market

Unemployment expected to dip to 10% in 2026

According to the Social Security contributor numbers, fourth-quarter job creation kept pace by comparison with the first nine months of the year. In 2025, contributors increased by nearly half a million people, which is similar to the 2024 figure.

The consensus in labour force survey (LFS) terms is that employment increased by 2.5% in 2025, up 0.1 points from the November consensus, and that it will increase by a further 1.7% in 2026 (unchanged from November). Productivity and unit labour costs (ULCs) are calculated from the GDP forecasts, employee compensation and employment in LFS terms. The former is forecast to have grown by 0.4% in 2025 and to increase by 0.5% in 2026, while ULCs are expected to have increased by 2.9% last year and rise another 2.4% this year.

The consensus forecast for the average annual rate of unemployment in 2025 is 10.5%, a figure expected to trend down to 10% in 2026 (Table 1).

Balance of payments

Record current account surplus thanks to services

The current account surplus to October 2025 stood at 46.71 billion euros, which is the best performance on record at this juncture of the year. This healthy figure reflects the fact that the slight deterioration in the goods deficit was more than offset by the solid surplus in services and reduction in the deficit in the primary and secondary income accounts.

The analysts expect Spain to record a current account surplus of 2.6% of GDP in 2025 and one of 2.4% in 2026, both forecasts unchanged from the last survey (Table 1).

Public deficit

Public deficit estimated at 2.5% in 2026

The fiscal deficit of the public administration excluding local authorities, amounted to 10.25 billion euros in the first 10 months of 2025, compared to 15.28 billion euros in the same period of 2024. Tax receipts have continued to grow at a similar pace year-on-year, buoyed by faster growth in receipts from VAT and other indirect taxes due to the reversal of cuts introduced in prior years. On the other hand, growth in revenue from Social Security contributions has slowed somewhat.

The consensus forecast is for a deficit of 2.7% in 2025 (unchanged from November) and of 2.5% in 2026 (compared to 2.6% in November). The forecast 2026 deficit is above the levels currently forecast by the Spanish government, Bank of Spain, OECD or European Commission (Table 1).

International context

The European economy is among the hardest hit by global uncertainty

The fate of the global economy remains shrouded in uncertainty, marked by the transition from a rules-based multilateral system to an asymmetric power-based order. The latest episode is the conflict over Greenland, which could lead to new threats for trade and transatlantic relations in general. As of yet, the European Union has not managed to build consensus around a strategy for counteracting the onslaught of U.S. threats. Meanwhile, the progress on strengthening the single market is proving limited compared to the scale of the global challenges, according to the assessment set down by Mario Draghi in his report on European competitiveness.

In its January round of projections, the IMF described the global economy as “resilient” in the face of the various disturbances, forecasting growth of 3.3% for this year –almost unchanged with respect to the past two years. The eurozone, however, is projected to grow by 1.3%, well below the 2.4% expected for the U.S. One powerful differential force driving the U.S. economy is investment, especially in sectors related with AI. Nevertheless, the IMF flags several risks, from geopolitical upheaval, fragmentation of the multilateral system and the bursting of a potential technology bubble.

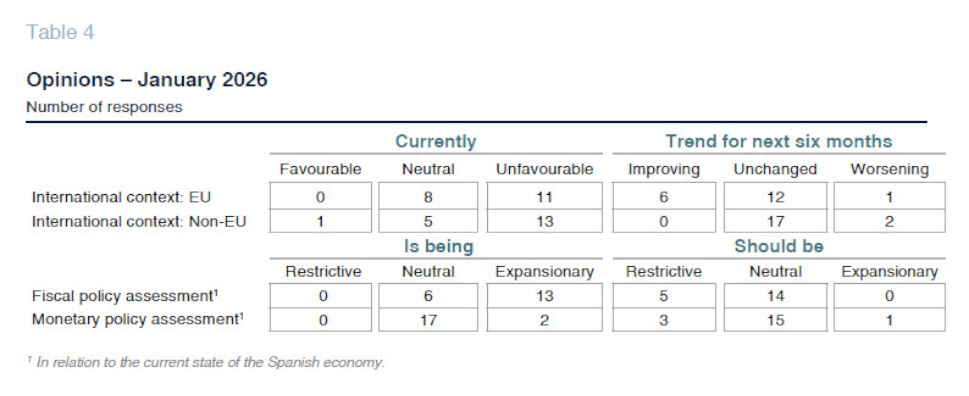

Despite the global economic resilience forecast by the IMF, panellists consider that global uncertainty will prevail (Table 4). Eleven analysts view the current climate as unfavourable for the EU and 13 hold a similar opinion of the global situation, assessments which are slightly less pessimistic than those expressed in November. The majority believe that the European and global environments will remain adverse in the short term.

Interest rates

The prospect of a fresh interest rate cut has faded

Inflation has stabilised or is converging towards target in the main advanced economies but at different speeds and in an environment of uncertainty that is complicating monetary policy. Tariffs initially interrupted the disinflation process in the U.S., although pressure has eased again in recent months. In the eurozone, overall CPI is already close to 2%, with core inflation converging towards that same marker.

Looking ahead, the outlook for inflation depends on complex factors such as the influence of mercantilist strategies on mineral prices, the impact of AI or the financial markets’ reaction to the political pressure exerted on central bank independence (pressure which has parallels in the U.S. Treasury’s growing financing requirement). Given the current uncertainty, where risks can go in either direction, both the Federal Reserve and the ECB have opted to leave their interest rates unchanged.

Echoing this, the consensus forecast is that the ECB will leave its deposit facility rate at 2% throughout the projection horizon, unchanged from the last assessment (Table 2). The forecast for Euribor has increased slightly and is now expected to end the year at 2.17% (up 12 basis points from the November consensus).

In light of the high level of global public debt and the prospect of significant public deficits in some of the largest advanced economies, yields on long-term bonds are trading significantly above the benchmarks set by the central banks. The consensus is that the yield on the 10-year Spanish bond will hover at around 3.3% until the end of the year —a similar path to the November Panel (Table 2).

Currency market

Volatility in the dollar-euro exchange rate on account of global uncertainty

Currency markets are particularly sensitive to global uncertainty. Having appreciated against the euro last month, the dollar has since reversed course on account of the diplomatic crisis unleashed around Greenland and the measures Europe could take in retaliation for the threats being reiterated by President Trump. This development, in constant flux, has yet to be reflected in the analysts’ feedback (certain events have taken place after carrying out the survey underlying this Panel). For now, the consensus forecast is that the dollar will appreciate slightly against the euro, to end 2026 at close to $/€1.19, a little above the level anticipated in November (Table 2).

*

The Spanish Economic Forecast Panel is a survey conducted by Funcas among the 19 analytical services listed in Table 1. The survey, which has been conducted since 1999, is published bimonthly in January, March, May, July, September, and November. Based on the responses to the survey, “consensus” forecasts are provided, which are calculated as the arithmetic mean of the 19 individual forecasts. By way comparison,although not forming part of the consensus, the forecasts of the Government, AIReF, the Bank of Spain, and the main international organizations are also presented.