Rebuilding momentum in Europe’s IPO pipeline

IPO markets remain subdued in Europe despite strong secondary-market performance and private equity dynamism. Structural fragmentation, compliance burdens, and limited liquidity windows constrain the pipeline even in the face of reforms that seek to lower execution risk and expand issuer participation.

Abstract: The European IPO market continues its multi-year slowdown, with Spain mirroring the regional decline despite strong equity returns, record private equity dry powder, and favourable liquidity conditions in 2025. Globally, around 1,300 IPOs raised USD 170 billion in 2025, the vast majority in the United States, while Europe recorded just 105 deals, alongside net delistings in Spain. This disconnect reflects structural impediments: narrow liquidity windows, heavy regulatory and reporting obligations, and fragmented capital markets that amplify execution risk for mid-caps. At the corporate level, European firms often avoid the scrutiny and governance constraints of public markets, instead raising capital privately. Spain’s new BME Easy Access mechanism seeks to reduce timing and execution frictions by decoupling admission to trading from fund-raising, potentially easing free-float buildup under volatile conditions. Yet going public remains a strategic transformation rather than a financing event, requiring changes in governance, internal controls, culture, and long-term capital markets strategy. Building a more dynamic European IPO ecosystem will require EU capital markets integration, proportionate listing regimes, broader investor participation, and a shift in corporate perceptions toward public markets.

Capital markets: Situation and outlook

In recent years, the geopolitical, macroeconomic and financial environments have experienced episodes of pronounced volatility. Nevertheless, the public markets have digested them relatively rapidly and performed well. In 2025, despite the general uncertainty generated by U.S. trade policy, the capital markets demonstrated a clearly positive performance, underpinned by moderate to high nominal growth, expansionary fiscal policies and monetary policy easing as inflation neared the central banks’ target rates, leaving behind the tension in financing conditions observed in 2022.

Although 2025 was a year of indiscriminate growth in the supply of capital, the dissipation of uncertainty did help improve investor appetite for risk and gradually reactivate market activity, striking a reasonable balance between the cost of capital, corporate discipline and investor appetite.

As a result, the equity markets have notched up several very good years, buoyed by sharp growth in corporate earnings. The fixed-income markets were characterised by normalisation in general terms of the sovereign yield curve and corporate credit spread tightening in 2025.

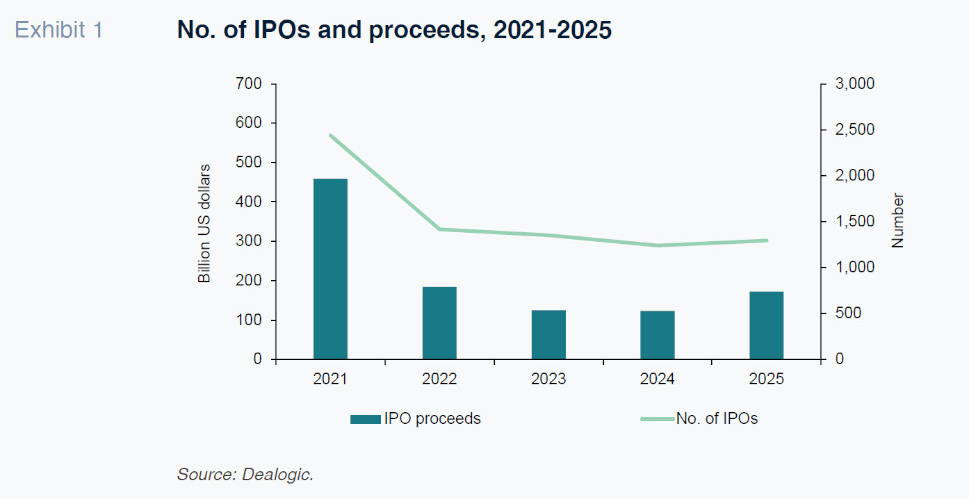

Turning to the equity markets, global initial public offerings (IPOs) numbered close to 1,300 in 2025, raising around 170 billion dollars, according to Dealogic. The U.S. remained one of the most active markets in the world, largely thanks to its ability to offer access to large volumes of capital and a wide and diversified investor base capable of capturing the interest of foreign issuers. As a result, the number of IPOs and proceeds increased by close to 30% and 40%, respectively, by comparison with 2024.

In Europe, on the other hand, the situation remained downcast. Indeed, both the number of IPOs in Europe and the volume of proceeds raised shrank in 2025. Specifically, the number of transactions decreased by 20% to 105 IPOs (from 131 in 2024), while the volume of proceeds raised contracted by around 10%.

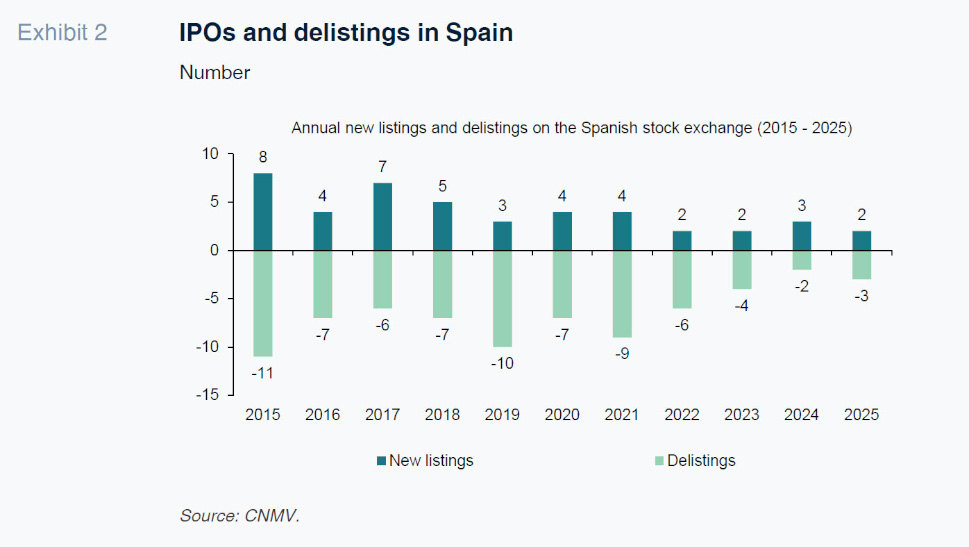

In Spain, the pattern clearly mimicked that of the European markets. The number of IPOs continued to fall and the overall number of companies listed on the Spanish stock exchange actually fell, as delistings outnumbered IPOs.

This sluggish IPO activity contrasts with how well listed companies performed in Europe, which would be expected to draw other unlisted players to this growth opportunity, and dynamism in private equity, where IPOs constitute a traditional exit mechanism.

The main European stock indices hit new records throughout 2025. The Euro Stoxx, Europe’s blue chip index, gained a little over 20% last year, outperforming its U.S. counterpart, the S&P 500, which rose by around 18%. Although the financial sector played an important role in this performance, the majority of sectors, particularly services and manufacturing, demonstrated clearly positive performances.

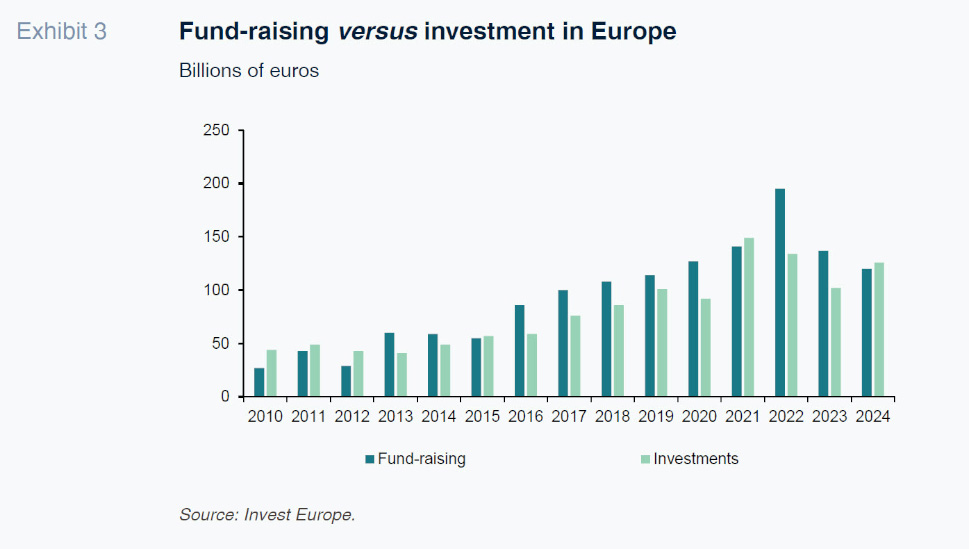

In parallel, over the past decade, Europe has been enjoying a cycle of sharp growth in private equity, which has emerged as one of the main sources of financing for corporate growth. Private equity fund-raising doubled between 2014 and 2024, to around 120 billion euros, locking in investment capacity for the years to come.

However, the boom in private equity has not translated into more vigorous IPO activity. Far from proving the main exit mechanism for private equity firms, the role of IPOs is clearly residual: in 2024, just 4% of exits in Europe took the form of a public listing. In fact, delistings actually outnumbered new listings, with the trend in taking public companies private gathering traction.

Looking to 2026, the economic horizon is once again considerably uncertain. The consensus forecast is for moderate global economic growth of around 3%, accompanied by inflation, which, while still above the central banks’ targets, should continue to converge towards 2.5%. Against this backdrop, monetary policy may well become a more limited and data-driven support factor, whereas fiscal and geopolitical risks could increase the probability of episodes of volatility.

The market is likely to remain selectively receptive to IPOs, favouring companies with diversified business models that are cycle-resilient and offer clear strategies for value creation. In terms of investor demand, it is reasonable to expect the U.S. to continue to reap the rewards of the depth and liquidity of its capital markets, allowing it to absorb a significant number of new issues.

In Europe, on the other hand, despite a solid business fabric replete with companies well positioned to go public, momentum in the IPO market is likely to depend more on the effectiveness of the structural reforms designed to reduce capital markets fragmentation and facilitate the IPO route for companies.

Factors detracting from IPO dynamism

Market factors: Timing risk and liquidity windows

The traditional IPO process is characterised by significant rigidity in terms of timing derived from the need to set the forecast placement and listing date several months ahead of time. From the early stages (mandating the underwriters, drafting the prospectus and having it approved by the regulator, preparing for the roadshow and defining the indicative price range), the entire transaction pivots around a specific point of time in the market which, at the planning stages, is uncertain by definition and highly dependent on liquidity conditions.

During this interval, the issuer assumes the market risk associated with potential adverse changes in the financial environment. Beyond the issuer’s business and earnings performance, it is exposed to episodes of volatility, geopolitical tensions and harsher financing conditions. A deterioration in the environment not only affects valuations, it can jeopardise the IPO’s entire viability.

The combination of timing risk and narrow liquidity windows creates uncertainty that discourages companies from embarking on an IPO at times when visibility is limited. Issuers face sizeable costs (financial, organisational and reputational) with no guarantee that the window will stay open until the listing is complete. As a result, IPOs tend to be concentrated around very specific moments of time, reinforcing a markedly procyclical trend.

Regulatory and compliance factors

Accessing the regulated markets via an IPO means having agreed to abide by a stringent and complex regulatory framework designed to ensure transparency, investor protection and market integrity. Key requirements include drafting an offering prospectus and having it authorised, complying with market abuse regulations, embracing advanced corporate governance standards and complying on an ongoing basis with financial and non-financial reporting requirements in accordance with the International Financial Reporting Standards (IFRS) and other applicable European standards.

For many companies, the obligation to operate under strict reporting and control standards brings crucial credibility and access to a wider investor base. However, for some companies, especially smaller ones, these requirements can also be perceived as an additional barrier to accessing the market. Internal adaptation for these requirements entails sizeable investments in human and technological resources and outside advisors.

The costs of complying with the host of regulations that comes into play as a listed company can be disproportionate to the size of the company and expected benefits of the listing, at least initially.

Although these requirements are essential to preserving investor confidence and ensuring the markets work smoothly, their relative impact on certain types of issuers can have a significant impact on the decision as to whether or not to proceed with an IPO.

The comparative experience suggests that while these requirements are similarly stringent in the U.S., their relative impact on issuers is considerably different. In the U.S., the greater depth and liquidity of the market, coupled with its wider and more diversified institutional investor base, make it easier to absorb issues of different sizes with less execution friction and greater stability.

The U.S. market also yields significant economies of scale in terms of the cost of IPOs and ongoing listings. Wide coverage by research analysts, the standardisation of market practices and the concentration of trading facilitate more efficient price formation and reduce the marginal cost of regulatory compliance. Against this backdrop, the costs associated with issuers’ transparency, reporting and corporate governance requirements tend to get diluted in higher market values.

In Europe in contrast, and especially in the national markets, the companies face structurally lower liquidity and significant fragmentation. The coexistence of different regulatory frameworks, supervisory authorities and market practices increases operational complexity along with the costs of going and remaining public. On top of that, analyst coverage is more limited, particularly for mid-caps, reducing visibility vis-a-vis investors and amplifying the impact of compliance costs on the IPO decision.

This comparison highlights the fact that the absolute level of regulatory requirements and the market context in which they apply are both key. Whereas in the U.S., scale, liquidity and market depth cushion the impact of transparency requirements, in Europe these same requirements can become a barrier to listing and continuing to trade in the public securities markets.

Corporate factors and the boom in private markets

Numerous OECD and ECB studies underline the fact that many European firms prefer to avoid the public exposure, market discipline and partial loss of control that comes with going public. According to the ECB, these corporate preferences go a long way to explaining the European listing gap: A listing is seen as costly (one-off and recurring costs can prove disproportionate relative to issuers’ size and the expected listing benefits), transparency as intrusive and reinforced corporate governance as demanding.

In tandem, the “competition” posed by the private markets is reducing the flow of IPOs and fuelling delistings by offering companies the chance to access high volumes of funds and scale up their businesses without having to deal with the commitment that comes with a public listing.

Easy Access: A disruptive mechanism designed to facilitate IPOs

In order to circumvent some of the restrictions implied by the traditional IPO process, in Spain, BME Easy Access, an initiative already approved by the securities market regulator, introduces an important change to how issuers access the regulated markets. The main novelty is the reversal of the order of the IPO process. Instead of concentrating prospectus approval, share placement and the start of trading around a single point in time, this model allows issuers to start with the prospectus approval process after their shares are admitted to trading, even if they have yet to attain the minimum free float. The placement with investors can take place later, in one or more transactions, within a timeframe of 18 months, which can be extended depending on market conditions.

This approach significantly reduces execution risk. By separating the listing from the fund-raising event, the issuer does not have to speculate about what the markets will be like on a specific date months ahead of time. Issuers can build their free float in a gradual and flexible manner, shielding them more from volatility.

Easy Access: Advantages

- Reduced market risk by allowing issuers to plan placements at much shorter notice and tap real liquidity windows.

- Flexibility around timing, as the issuer decides when, in what manner and how much to raise within a defined framework.

- Improved pricing power by not having to fix a set price when registering the prospectus, alleviating downward pressure on valuations.

- Transparency and visibility from the start as the issuer trades on a regulated market from day one.

- A tool for financial sponsors and private equity investors by facilitating staggered and orderly exits without distorting the market.

From the regulatory standpoint, Easy Access does not dilute investor protection standards. Issuers remain fully bound by all of the obligations incumbent upon listed companies from as soon as their shares are admitted to trading. The innovation here is limited to a more efficient reorganisation of the steps in the process, in line with current developments in the European framework and the future Listing Act.

Although not a valid solution for all companies, Easy Access is a particularly useful tool for bigger companies in search of long-term financing that are ready to assume more stringent transparency and corporate governance standards.

Strategic and legal implications of going public

The decision to list on a regulated market via an IPO has many ramifications beyond the immediate fund-raising goal. A listing constitutes, above all, a corporate transformation process with profound implications for the issuer’s corporate governance, internal controls systems and organisational culture. From that perspective, an IPO needs to be viewed as a long-term strategic decision and not just a one-off financial transaction.

Corporate transformation and organisational discipline

A stock market listing implies a qualitative leap in management and control standards. Some of the most important changes include the professionalisation of the board of directors, reinforcement of the supervisory and internal control roles and adoption of a culture of transparency and accountability. Financial discipline gets reinforced by the obligation to report at regular intervals and the constant scrutiny of the market, stimulating more rigorous management and long-term thinking.

The requirements associated with a public listing should not be seen solely as a regulatory burden. To the contrary, the implementation of high corporate governance standards helps to strengthen the organisation, improve decision-making quality and reduce operating, financial and reputational risks. In this sense, a listing can provide a catalyst for better practices and greater corporate resilience.

Legal requirements around transparency and corporate governance

From as soon as their shares are admitted to trading, listed companies become subject to a stringent legal framework designed to ensure transparency with the market and protect investors.

The most important obligations include the periodical and ongoing reporting of financial and non-financial information; compliance with market abuse regulations, including the requirement to manage inside information properly; and the implementation of corporate governance structures in line with international standards and best practices. This compendium of obligations requires a solid organisational structure and a compliance function that is fully embedded into the corporate strategy.

Strategic benefits of going public

Beyond the legal requirements, a listing ushers in significant strategic benefits, notably including reinforced credibility and corporate reputation, easier and recurring access to the capital markets and greater visibility

vis-a-vis institutional and global investors. A public listing can also generate liquidity for shareholders and provide an effective currency for corporate transactions, such as M&A activity or buy-and-build strategies.

In sum, an IPO creates a stable framework for growth and discipline, which, despite requiring a considerable effort in terms of compliance and transparency, provides the companies willing to take up that gauntlet with a solid platform for embarking on a long-term capital markets strategy.

Conclusions: Action needed to create a more dynamic IPO ecosystem

Analysis of the market, regulatory and structural factors that facilitate or hinder IPOs reveals that the reactivation of the primary equity market in Europe requires a coordinated, ambitious and systemic response. It is not enough to fine-tune the existing procedures. It is necessary to take action to create an environment that balances investor protection, operating efficiency and strategic appeal for issuers.

One essential line of action is to definitively complete the integration of the European capital markets, in line with the objectives of the Capital Markets Union and its evolution towards a Savings and Investments Union. The current fragmentation, at the regulatory, supervisory and infrastructure levels, limits market depth and liquidity, increases listing costs and impinges Europe´s ability to compete with other more integrated jurisdictions, like the U.S. Harmonising requirements and strengthening a truly pan-European market would unlock economies of scale, widen the investor base and enhance price formation, facilitating larger transactions, as well as access to the primary market for mid-sized companies with growth ambitions.

In parallel, it is vital to continue to adapt the requirements for accessing the regulated markets, without in any way jeopardising existing transparency and integrity principles. Initiatives like Easy Access, coupled with the reforms emanating from the Listing Act, represent meaningful progress towards a more proportionate and efficient approach by reducing procedural rigidities and execution risk without diluting investor protection. The goal is not deregulation but rather the elimination of unnecessary entry costs and the creation of a more flexible and predictable listing framework.

Moreover, consolidation of a dynamic IPO ecosystem means having to widen and diversify the institutional and retail investor bases. Revising the regulatory, fiscal and prudential biases that have historically favoured debt financing, in addition to channelling more savings into equity instruments, would help reinforce liquidity and the market’s ability to absorb new issues.

Lastly, in addition to these regulatory and market reforms, it is essential to forge a change of perception around listings in the corporate sector where many firms, particularly family-run businesses, continue to see an IPO as a loss of control or regulatory burden. Education around strong corporate governance, professional management and reinforced internal control systems should focus on their potential to drive business sustainability, better decision-making and long-term risk mitigation.

A listing can also play a key role in succession planning by providing an orderly and transparent framework for facilitating shareholder transitions, while ensuring the continuity of cherished business endeavours. In parallel, recurring access to capital and continuous scrutiny by investors and analysts help boost productivity, the efficient allocation of resources and more sophisticated risk management.

In short, a combination of tighter European integration, more efficient and proportionate listing processes, a wider investor base and corporate culture shift is key to building a more dynamic, competitive and resilient IPO ecosystem capable of channelling savings into productive investments and fuelling the long-term growth of Europe’s businesses.

Patricia Muñoz González-Úbeda and Irene Peña Cuenca. Afi