The role of the Bank of Spain’s SME Circular in facilitating access to finance

The high degree of dependence on bank credit represents a key challenges for access to finance for Spain´s SMEs. Recent regulations adopted by the Bank of Spain are a necessary and welcome step towards addressing this and other issues related to facilitating SME financing.

Abstract: The percentage of micro enterprises, as well as their weight in the economy, is higher in Spain relative to other EU countries. For these and other small companies, the process of securing and maintaining credit has been historically cumbersome. In addition, their high degree of dependence on bank credit, lack of access to alternative financing sources and the lack of transparency over banks’ credit evaluation process has been problematic. The Bank of Spain’s new SME-Financial Information Circular aims to address some of these problems. By forcing banks to provide SMEs with feedback on their financial situation, quantitative variables and a risk rating, SMEs will have the opportunity to benefit from new tools, make changes to management policies and overall business conduct, as well as access new sources of funding. The approval of this circular could thereby represent a tipping point for SMEs’ access to finance, reducing information asymmetries, promoting greater standardisation and enhancing transparency for all actors involved in the business and credit cycle.

This articles studies in depth the importance of the new Bank of Spain Circular on the information banks must provide small companies. The Circular is of crucial importance in the current environment, despite the fact that the credit crunch facing businesses has largely dissipated, thanks to the forceful measures rolled out by the European Central Bank. Its importance lies with the effort to standardise the information provided to smaller sized companies in a bid to facilitate decision-making by financiers and foster the development of non-bank financing formulae such as securitisations.

The Business Financing Promotion Act and the SME Financial Information Circular: In search of greater standardisation

Bank of Spain Circular 6/2016 (of June 30th, 2016) was published in the Official State Journal on July 11th, 2016, specifying the contents and format of the document titled SME-Financial Information– and the risk classification methodology contemplated in Spanish Law 5/2015 (of April 27th, 2015) on the promotion of business financing.

Popularly known as the SME Circular, the Bank of Spain’s initiative is aimed at reducing the information asymmetries that have traditionally characterised the SME segment in order to enhance the flow of financing to these companies by means of better and more standardised analysis of their credit risk profiles.

As addressed in the following section, the fragmentation of the Spanish business landscape, populated by a large number of self-employed professionals and micro-sized (< 10 employees) and small companies (< 50 employees), has traditionally hindered these companies from seeking alternative sources of financing to bank debt, such as capital markets funding. It has also prevented both banks and investors from being able to conduct rigorous professional analysis on par with that performed on larger companies.

This has translated into tremendous dependence on bank financing, usually very short-dated paper, given the risk profile (or, rather, the difficulties in analysing the long-term risks), which has in turn exacerbated the ‘small scale’ issue by preventing companies from reinforcing their financial structure in order to invest significantly in growth.

With a view to partially mitigating this vicious circle, and fuelling the flow of bank financing to SMEs by making it more flexible, accessible and transparent, chapter one of the afore-mentioned Law 5/2015 obliges the banks to:

- Firstly, notify SMEs, [1] in writing and with at least three months’ notice, of any decision regarding the termination or reduction in the flow of financing granted to them;

- Secondly, to accompany such notification, free of charge, [2] with information about their financial situation and payment history in a document titled SME-Financial Information, which must include the assignation of a credit risk rating.

With these two measures, Law 5/2015 aims at giving SMEs enough time to look for financing alternatives without incurring significant liquidity issues and helping make this search more successful by ensuring a comparable and objective risk assessment underpinned by a combination of useful financial information, provided by the banks, and the tailored and standardised methodology stipulated in the Circular.

Risk assessments, or ratings, provide information about a company’s creditworthiness that goes beyond that which can be obtained from public databases. This is particularly importance in the case of SMEs, for which public information is virtually non-existent, these enterprises having traditionally been shrouded by opacity with respect to their business management. Indeed, the banks themselves, thanks to their long-standing relationships and local reach, are the best sources of information about these companies.

The idea is, therefore, to extract this SME knowledge and standardise it with the aim of using this ‘risk measurement’ know-how to simplify the search for alternative financing sources (e.g., instances in which a bank denies a loan due to excessive exposure to the sector rather than any company weakness per se), and pave the way, to an extent, for tailoring loan pricing and terms for a degree of SME risk classification.

Other advantages associated with the credit ratings, which can be taken from the experience with large corporates to the benefit of SMEs, are the following:

- A rating is an external assessment of a company’s quality. Companies with similar ratings should be able to aspire to funding on similar terms;

- Once a company is aware of its rating, it may be motivated to pursue prudent management policies aimed at maintaining or improving that rating;

- The report is akin to a positive report from a credit bureau as the company will have been assessed by banks and can provide the results to new potential financiers, facilitating the search for new funds;

- The credit report, in this case the ‘SME-Financial Information’ document, favours a longer-term vision of the business by means of alerts about liquidity positions, leverage, etc.;

- The report can be used not only by the company to secure financing at an explicit cost (bank debt/capital markets financing) but also as a tool for negotiating with its suppliers.

Factors shaping dependence on bank financing in Spain: Characteristics of the business landscape

In this section, we analyse three of the factors that have shaped the strong ties between Spain’s companies and banks:

- Relatively small average size.

- Financial indicator diversity.

- Motives for enterprising: Filling needs rather than searching for opportunities.

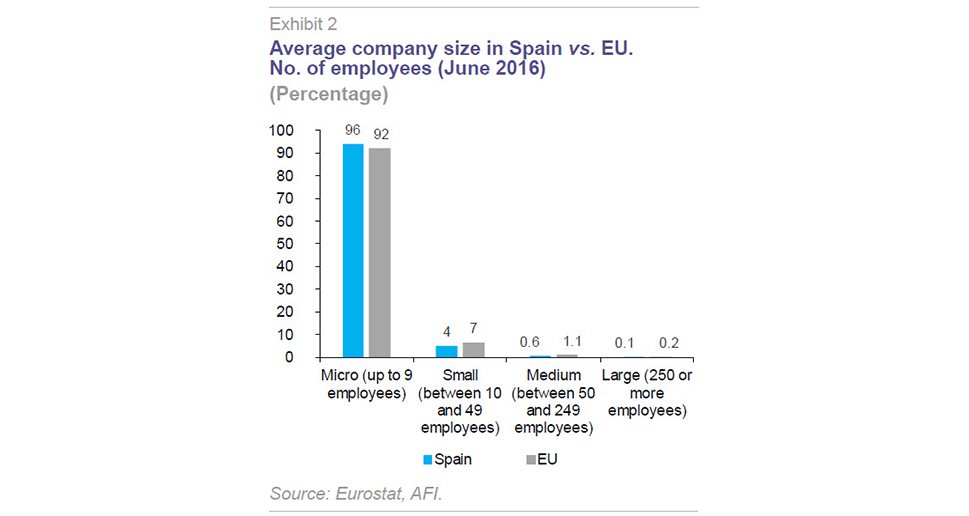

Relative average sizeOne of the main factors shaping the business landscape in Spain is the average size of its companies. According to information published by the Spanish statistics bureau, the INE, and Eurostat (June 2016), 95.7% of all companies in Spain are micro enterprises (between 0 and 9 employees), 3.6% are small-sized (between 10 and 49 employees) and 0.6% are medium-sized (between 50 and 249 employees), with just 0.1% of the total classifying as large (> 250 employees). Particularly noteworthy is the fact that there are 1.5 million self-employed professionals in Spain, which is substantially more than the number of salaried employees at companies (1.3 million).

The main differences with respect to Spain’s neighbouring economies relates to micro enterprises, which in the EU account for a smaller 92% of the total on average, and medium-sized enterprises, which account for over 1% of the EU total.

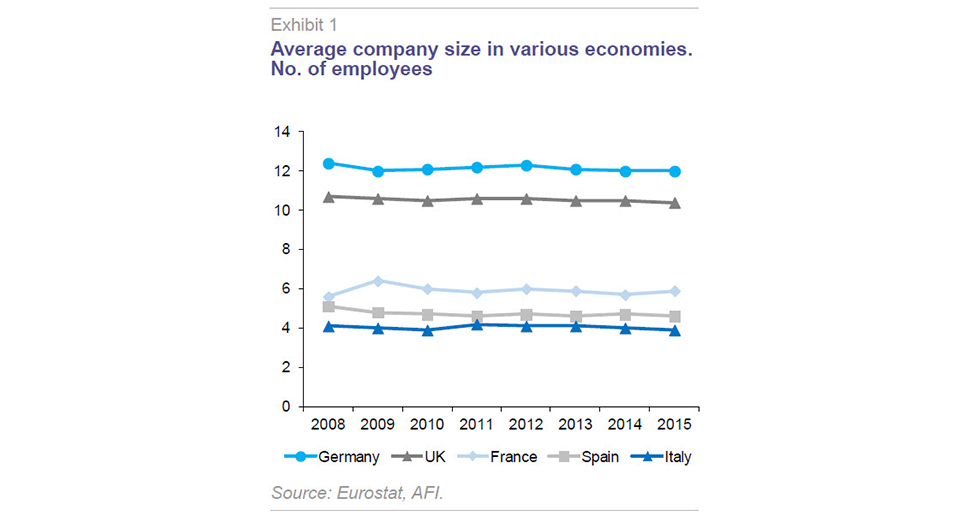

The relatively smaller weight of medium-sized and large companies in the business landscape also helps explain the differences in average size measured by the number of employees. In Spain, the average size stands at 4.7 employees, which is considerably smaller than the average company size in the main EU economies (6 in France, 11 in the UK and 12 in Germany), shaped by the above-mentioned small weight of medium- and large-companies.

These percentages help illustrate one of the sources of the heterogeneity that characterises the Spanish business landscape and, more specifically, the extraordinary dependence on bank financing. These business units lack the capacity to access financial markets on their own on account of their small scale and, therefore, their sole source of external financing come from banks, which are far more knowledgeable about the company and economic landscape than capital markets investors.

In addition, and although beyond the realm of this article, the small average company size leaves the Spanish economy highly vulnerable to job destruction during recessionary bouts, as smaller companies are more sensitive to the cyclicality of the growth cycle. This circumstance can alter, on occasion, the ability to secure bank financing.

Financial indicator diversity

The

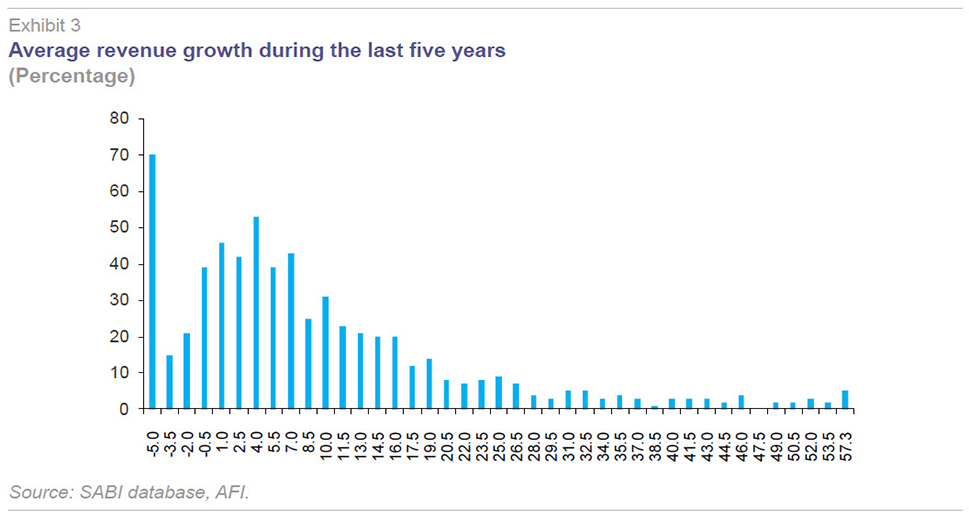

SME Financial Information Circular stipulates the calculation of certain benchmark credit risk ratios by financial institutions, including ratios related to business performance (revenue trend for the last five years), profitability, returns and solvency, among others. These indicators reveal another of the factors characterising the business landscape in Spain: tremendous heterogeneity in companies’ financial ratios and lags in the availability of updated financial information.

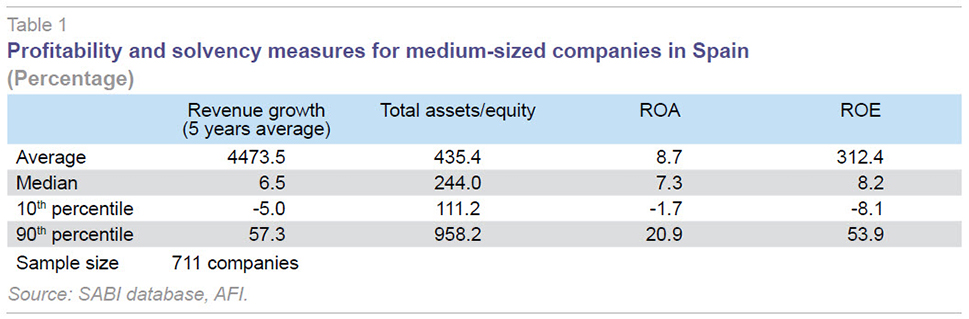

To calculate the statistical dispersion, we took a sample of medium-sized enterprises with:

- Revenue of between 6 and 21 million euros.

- Available financial information as of year-end 2015.

Using information filed with the Companies Register we pinpointed a total of 711 companies meeting these two requirements. Financial/business ratio dispersion can be observed in different ways:

- The average and median of the various indicators are very far apart, evidencing the existence of outliers in the sample, at both

the upper and lower ends of the ranges;

- If we strip out the outliers and reduce the sample to those falling within the 10th and 90th percentile, we find ourselves with a loss of information which on average represents 10% of the sample (approximately 70 companies); however, this figure rises to 30% in the case of the business profitability metrics. In short, the business and financial indicators are not uniformly distributed around a central value, a situation that often times complicates the task of calibrating internal credit risk measurement models.

It is worth noting that this dispersion exercise was calculated using medium-sized enterprises which are presumably capable of generating far more organised financial information than their smaller-scale counterparts (whether small or micro companies). Zooming in on the smaller-sized companies would presumably only reveal greater dispersion, further complicating decision-making and potentially triggering contradictory decisions by banks on the basis of financial information alone.

Motivation for setting up companies

Lastly, it is interesting to stand back and take a look at the reasons why entrepreneurs start up companies in Spain. It is true than entrepreneurship has flourished in Spain in recent years. However, it is worth pausing to ask whether what is behind this increased enterprising zeal is a change in the economic growth model and, by extension, the advent of new opportunities, or rather a response to a labour market problem justifying the search for economic sustainability on the part of those affected by unemployment.

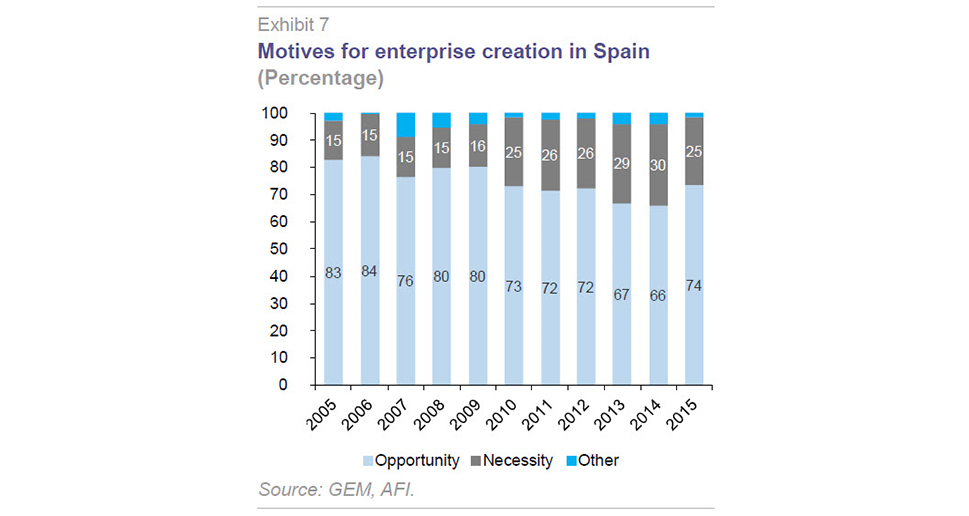

The annual survey compiled by the

Global Entrepreneurship Monitor yields compelling findings in this respect: although the identification of a perceived opportunity remains a key factor when starting up a new business (reason given over 70% of the time), its relative weight has fallen considerably in recent years (by 10 points), giving way to necessity as the justification for starting a business (25%).

This phenomenon is attributable to the fact that entrepreneurship is starting to been seen as a remedy for job market inability to absorb large segments of the unemployed population. This dynamic justifies banks’ approaches to risk measurement for the smallest companies, which are more akin to classical credit assessment for private individuals than the methodology used to assess established companies.

Risk rating methodology

As stated previously, with the aim of standardising risk ratings, under the scope of the provisions of Law 5/2015, banks will be obliged to furnish SMEs, in addition to the rest of the information contained in the ‘SME-Financial Information’ document, a risk rating, for which the Bank of Spain has developed a specific methodology and template.

As stipulated in the Circular, banks have three months from its effectiveness, i.e., until October 11th, 2016, to adapt their systems so as to be able to provide SMEs with this information.

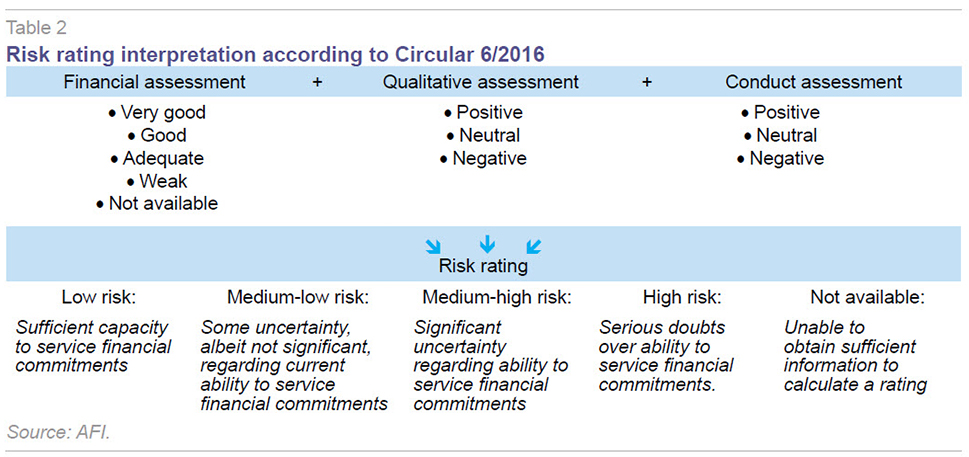

According to the proposed methodology, in order to assign a rating to their SME customers, the banks need to assess the borrowers’ information with respect to three main categories:

- Financial situation: based on analysis of their financial statements and/or latest income tax returns (in the case of self-employed professionals, based on available tax and/or net worth data);

- Qualitative variables: assessment of aspects related to the business or activity that the SME has developed;

- Conduct-related variables: analysis and assessment of the borrowers’ conduct as regards the contractual relationships to which the lender or potential lender has been party.

For each of these three categories, the regulator itemises the minimum aspects that the entities must consider, albeit allowing for a degree of flexibility so that the banks can use additional and/or alternative criteria in the event a specific item of information is not available.

For example, to analyse the borrower’s financial situation, the Bank of Spain proposes a battery of new ratios with the goal of assessing the SMEs’ business performance, profitability, liquidity, leverage and solvency. However, the Circular contemplates the use of other ratios deemed more suitable so long as they cover the same areas of analysis.

In the qualitative and quantitative areas, the regulator also specifies that, in addition to the criteria stipulated by it, banks may complement the analysis by including other variables specific to the business and the customer relationship, respectively, that they deem appropriate.

For each of the three main areas of analysis, banks are required to assign a rating using the scales defined by the Bank of Spain in its Circular. Banks will also have to use their best judgement to weight each category and, within the three categories, each variable.

The final result of the analysis must be presented on a scale similarly established by the Bank of Spain, which contemplates four levels of risk: low risk, medium-low risk, medium-high risk and high risk; in addition, in the event that there is not enough information about a given SME, a fifth category for information ‘not available’ is allowed.

Lastly, the banks are obliged to provide the SMEs, to the extent feasible, with information regarding their relative position within their sectors or businesses using the sector ratios for non-financial corporates designed by the Bank of Spain’s service, which analyses the financial information submitted voluntarily by Spanish non-financial corporates to enable enhanced familiarity with these enterprises.

Bank of Spain Circular 6/2016: Implications for the SME segment

Despite the relative simplicity of both the SME rating calculation and results presentation methodology introduced by means of Circular 6/2016, its implementation may have major implications for SMEs in the future, potentially marking a radical change in how self-employed professionals and small companies approach the process of securing credit.

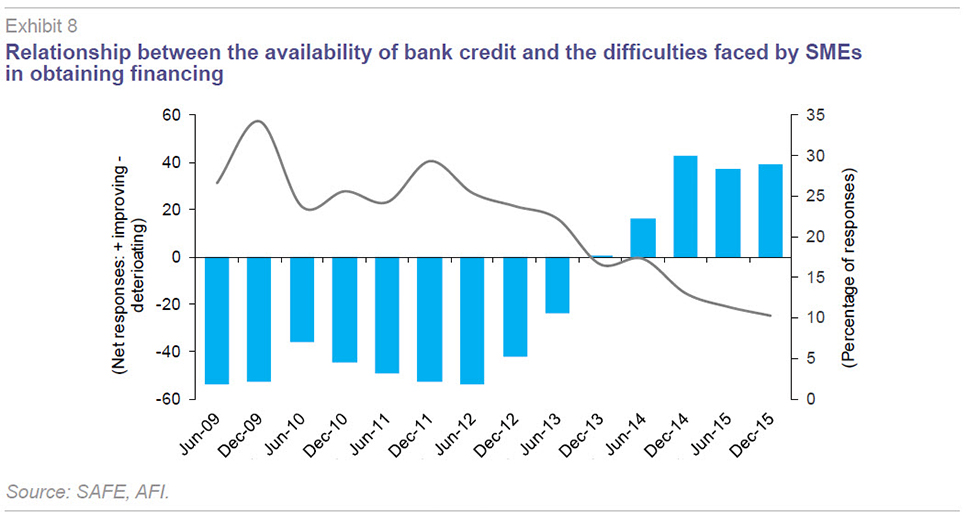

The recent financial crisis highlighted SMEs’ excessive dependence on bank financing, on the one hand, and greater vulnerability to credit shocks, on the other. As evidenced by certain empirical studies (Beck et al., 2008) the smaller and newer a company is, the harder it is for it to access financing, as these companies are perceived as higher-risk entities with relatively more scant information, making them harder to assess.

The methodology defined in the Circular, despite its apparent simplicity, implies considerable progress in this respect as it means reducing the information inequalities surrounding SMEs and provides a standard set of criteria for analysing their credit risk, enabling classification of these entities into four major risk categories.

The theory goes that the more information available, the fewer the barriers an SME will face in securing financing and the lower its vulnerability to credit shocks. This is particularly important for an economy in which SMEs account for 99% of the business landscape and in which it has been proven that the barriers these enterprises face when it comes to accessing financing have important economic ramifications in terms of growth and jobs.

Clearly this is not only a Spanish issue, but rather one that affects most European economies. That is why one of the main objectives set by the current European Commission presidency is the creation of a Capital Markets Union that, among other goals, will foster reduced dependency on banks in Europe and favour the development of alternative sources of financing that will bring SMEs and investors together.

As indicated by the Commission itself, the roots of SME over-dependence on bank financing lie with their long-standing relationships with banks. Indeed, until the recent financial crisis, the European economy had been experiencing a long spell of high liquidity in which abundant bank financing only meant that the companies did not have to look for alternative sources of financing. This has given banks a comparative advantage in terms of obtaining information about SMEs.

Now, given the information requirements established in the SME-Financial Information document, banks will be obliged to share their historical information about their SME customers, enabling companies themselves to build new relationships with other providers of finance (investors) and to participate in capital markets.

Against this backdrop, the availability of new financial information for SMEs should foster the consolidation of the alternative financing formulae (formerly known as ‘shadow banking’) that found their opportunity for development in the recent financial crisis in light of banks’ difficulties in intermediating in the credit process and have continued to grow in part thanks to the ongoing digitalisation of the economy, as many of these new financing channels are articulated around technology platforms (such as peer-to-peer lending or crowdfunding).

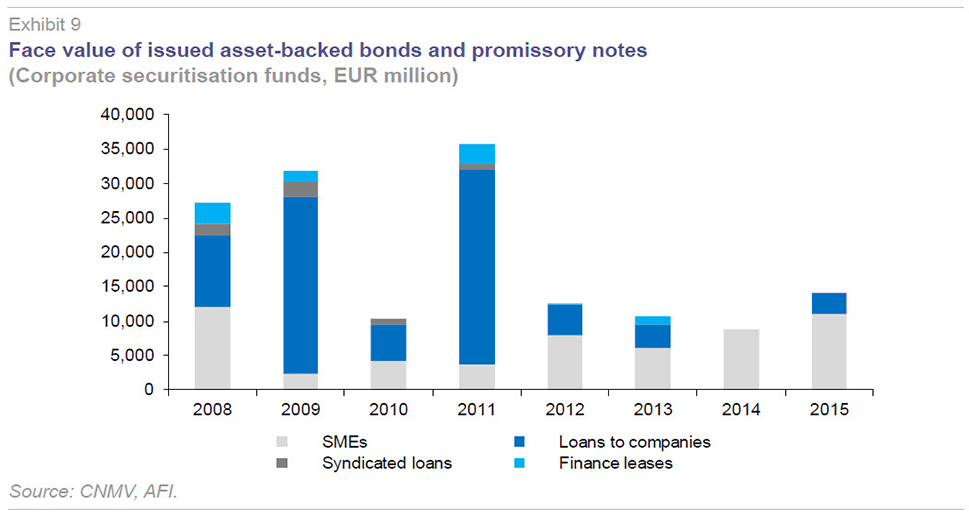

Lastly, SME financing also stands to benefit from the Circular by means of mechanisms, such as asset securitisation transactions which bring capital markets and traditional banks together. This financing mechanism, which can also be used by companies, has been widely used by banks to monetise their assets (usually securitising mortgage and SME loan books). However, the crisis has severely curtailed the asset securitisation business, precisely on account of issues deriving from asymmetric information about the collateral securitised.

For this very reason, one of the objectives of the European Commission’s Capital Markets Union initiative is to promote simple, standardised and transparent asset securitisation. Spain’s small companies may benefit indirectly from asset securitisation if banks manage to securitise the loans they grant to SMEs at a reasonable price, as this liquidity should translate into new loans at lower rates.

To this end it is vital, not only to restore confidence in the instrument, an issue that should gradually resolve itself via the new regulations contemplated by the EC, but also to resolve the information issues related to SMEs. Loans to SMEs are far harder to evaluate than collateral for a mortgage loan due to greater underlying business diversity, coupled with information limitations. Against this backdrop, the scope for grouping SMEs into similar risk categories and the provision of more abundant and comparable information fostered by the new Bank of Spain Circular should help reduce information disparity and enable a more homogeneous approach to SMEs for loan securitisation purposes.

Conclusions

The new SME Financial Information Circular addresses the requirements established by the Business Financing Act, a piece of legislation intended to re-establish business access to bank financing against the backdrop of a sharp credit crunch. Although the credit crunch has reverted very considerably in the last few months thanks to ECB intervention and the widespread improvement in the Spanish economy, we believe that the Circular is nevertheless of vital importance for the business landscape. This is because, looking beyond bank lending dynamics, the Circular lays the foundations for making progress on an aspect of critical importance: standardisation of information available about small-sized companies.

The report contemplated by the Bank of Spain should help to generate very useful information in terms of facilitating decision-making on the part of these enterprises’ customary financiers (banks), as well as promoting alternative sources of financing, such as the securitisation of these companies’ collection rights, an initiative framed by the European Commission’s Capital Markets Union strategy. Lastly, companies themselves will avail of a tool that will help them develop prudent management policies aimed at maintaining or improving the credit ratings assigned to them by the banks, ratings that will also mark progress in terms of the development of credit bureau type reports in Spain.

Notes

SMEs: Micro companies, small- and medium-sized enterprises, including self-employed professionals and freelancers.

In addition, banks are obliged to furnish the SME-Financial Information file upon request by their SME customers. Failure to do so would make them subject to payment of the corresponding fee, which may be capped by the Bank of Spain.

References

BANK OF SPAIN (2016), Circular 6/2016 (of June 30th, 2016) was published in the Official State Journal in July 2016, specifying the contents and format of the document titled SME-Financial Information and the risk classification methodology contemplated in Spanish Law 5/2015 (of April 27th, 2015) on the promotion of business financing.

BECK, T.; DEMIRGÜÇ-KUNT, A., and V. MAKSIMOVIC (2008), Financing patterns around the world: are small firms different?

COMMISSION STAFF WORKING DOCUMENT (2015), “Action Plan on Building a Capital Markets Union,” September.

GLOBAL ENTREPRENEURSHIP MONITOR (2016), Spain 2015.

IMF STAFF DISCUSSION NOTE (2015), “Revitalizing Securitization for Small and Medium-Sized Enterprises in Europe,” May.

SPANISH LAW 5/2015 (of April 27th, 2015) on the promotion of business financing.

Irene Peña and Pablo Guijarro. A.F.I. - Analistas Financieros Internacionales, S.A.