The impact of low interest rates on the insurance sector

The protracted period of low-interest rates is undermining interest income in the insurance sector in Spain and in Europe. As part of the adaptation to this new paradigm, the search for profitability has forced entities to reallocate their portfolios towards higher-risk/higher-yield assets, as well as recalibrate their product ranges, alongside other efforts to diversify risk and boost underwriting results.

Abstract: The uncertainty generated from the prolonged episode of low interest rates is one of the main issues affecting the insurance sectors in Spain and in the rest of Europe, particularly for insurers with guaranteed long-term commitments. (The impact is proving less severe in Spain, where assets and liabilities are well matched in terms of duration, reducing insurers’ exposure to exchange rate volatility.) Despite an overall increase in the volume of premiums, the contraction in investment income is exerting upward pressure on expectations for underwriting results. Insurance companies are taking action to adapt to this new environment through attempts to boost income and streamline pay-outs, including: portfolio reallocation towards higher risk, higher yield and longer duration assets; shifts in product offerings; cost cutting measures; and, geographic diversification.

2015 in review: Increase in premium volumes in contrast to decline in profitability

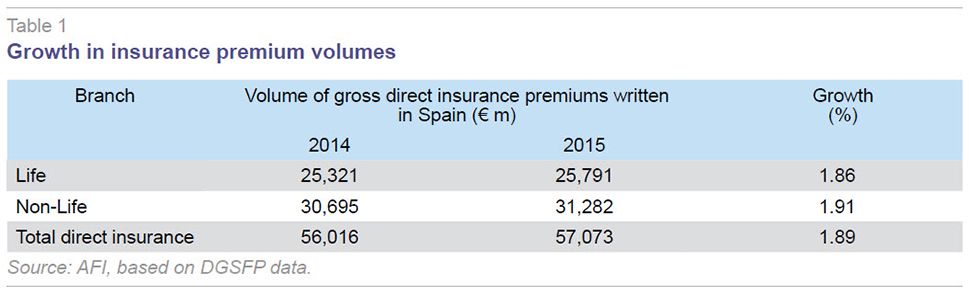

The Spanish insurance sector experienced growth in overall premium volumes in 2015 for the first time since 2012: volumes registered growth of 1.89% according to data compiled by Spain’s insurance and pension watchdog (DGSFP according to its acronym in Spanish).

The positive trend in premiums contrasts with the profits reported by the Spanish insurers, which contracted by 27.3% year-on-year in 2015.

The sector’s ROE was just 8.8%, down from 12% in the fourth quarter of 2014.

Both branches of the insurance sector, life and non-life, sustained growth. However, growth in the life segment was undermined by life savings products due to the low yields on offer against the backdrop of low interest rates, coupled with the need to put more capital aside for certain products under the Solvency 2 regime. Non-guaranteed life insurance products fared remarkably well however.

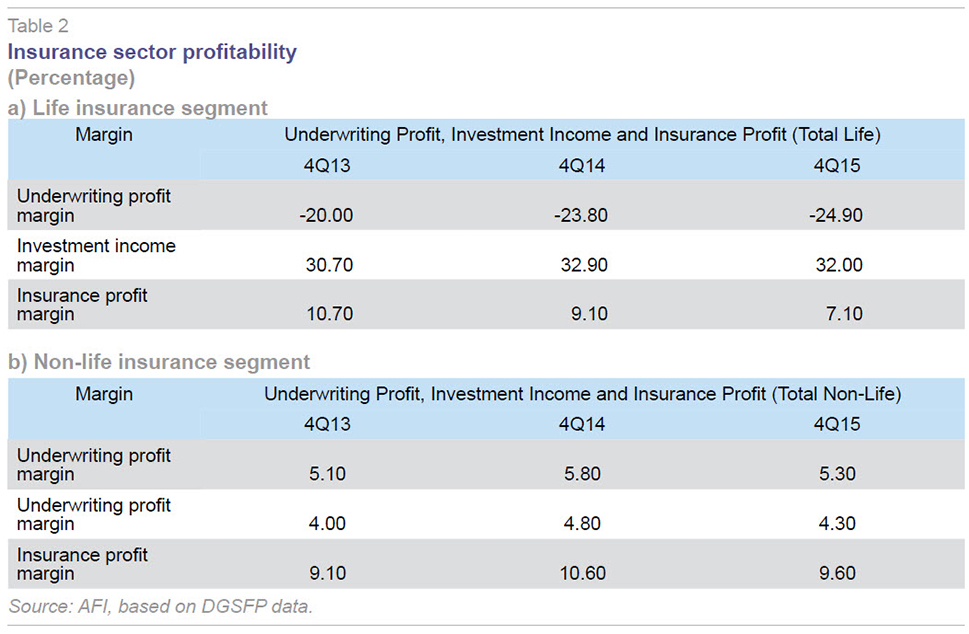

Insurance profit (investment income + underwriting profit) fell in both the life and non-life segments in 2015 due to deterioration in both underwriting results and interest income on the back of low interest rates.

The protracted episode of low interest rates is undermining insurers’ profits, particularly for entities that have underwritten life insurance with guaranteed long-term commitments.

This phenomenon is more pronounced in other European markets such as Germany; in Spain assets and liabilities are well matched in terms of duration, substantially immunising insurers from movements in exchange rates. Moreover, the fallout is more gradual, as the higher-yielding assets mature and are replaced by new securities acquired at lower rates; also, the impact is prolonged in time.

In parallel, the companies that had been financing themselves from their investment income, as their underwriting results were negligible or even negative (e.g., motor) are also facing difficulties in light of low returns.

Spanish insurers predominantly invest in fixed-income securities

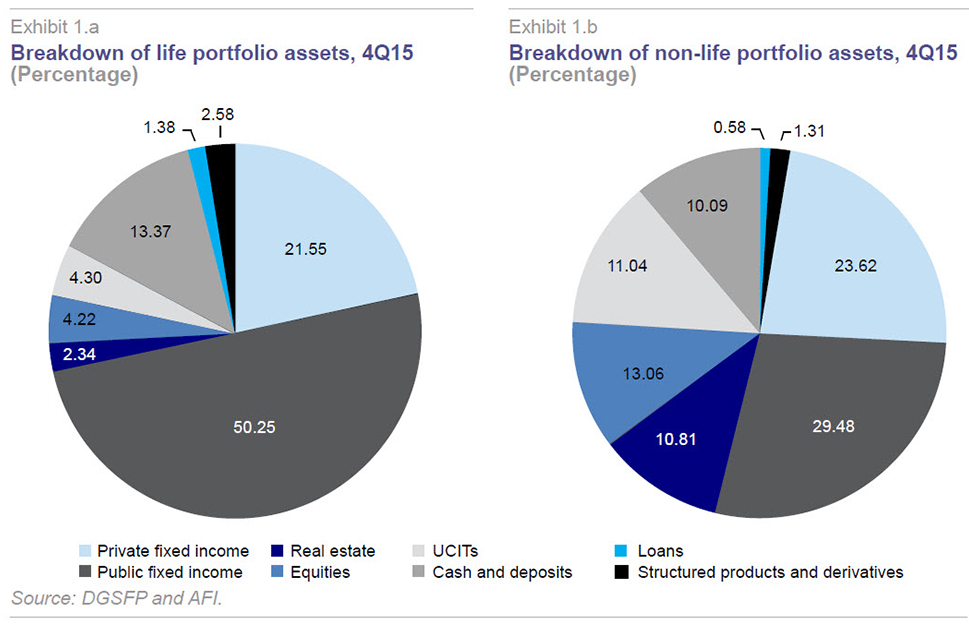

The Spanish insurance sector’s investment portfolio is mostly made up of fixed-income investments: 71.8% and 53.1% of the total in life and non-life, respectively, in 2015.

In recent years, it is worth highlighting the gradual reduction in the weight of private fixed-income paper in the life segment in favour of public debt, due mainly to the favourable treatment afforded EU sovereign debt relative to other higher-yielding and higher-risk assets under the Solvency 2 regime (zero capital allocation).

Allocations to deposits and loans are also higher in the life segment. In contrast, investment in real estate, equities and mutual funds is relatively lower.

The composition of the life segment’s investment portfolio implies greater vulnerability to low rates.

Europe: Shift towards more credit and longer duration

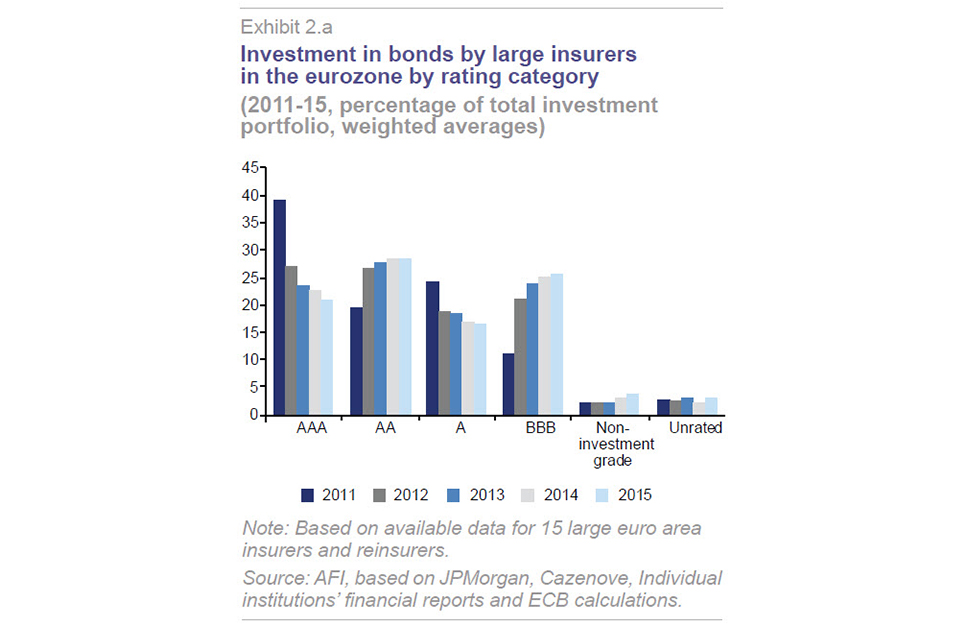

The latest developments evidence the fact that rates are set to remain very low for the coming years. This will foster a shift in investment policy and in the insurance companies’ asset mixes, fostering growth in the relative weight of equities and other higher-risk assets. Even within the fixed-income portfolios, we are seeing a shift towards higher-risk and higher-yielding paper (Exhibit 2.a).

All of this is increasing the insurance companies’ risk exposure and capital allocation requirements.

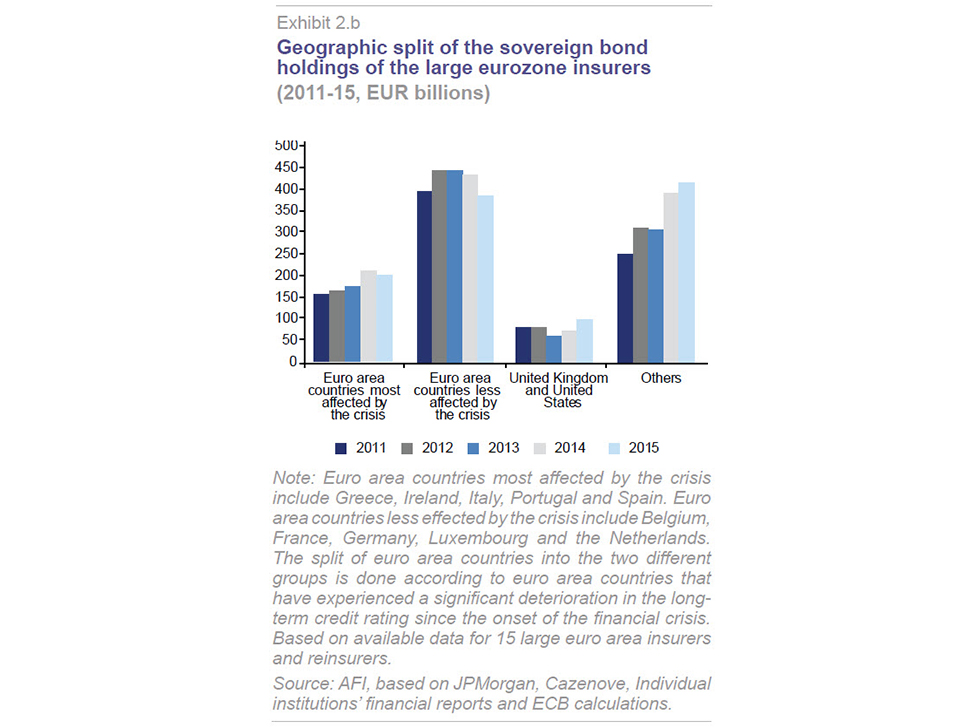

However, in the countries most affected by the crisis, including Spain (Exhibit 2.b), we are witnessing growth in exposure to sovereign bonds due to their preferential treatment (no capital allocation requirement) under Solvency 2 relative to other higher-yielding but higher-risk assets.

How are the players adapting to the new low-rate paradigm?

On the income side, the uncertainty deriving from volatility in the equity markets, coupled with the prolonged episode of low interest rates, is one of the areas to watch in the insurance sector.

Current estimates point to contracting investment income, placing upward pressure on expectations for underwriting profit, which needs to start ‘making money’ in its own right.

With the aim of adapting to this new paradigm, life insurers are shifting their portfolio investments into higher-returning and higher-risk assets. Specifically, assets are being shifted into lower-rated and longer-term fixed-income securities (even unrated paper), equities and alternative assets and infrastructure, underpinned in the latter instance by a relatively favourable capital treatment under Solvency 2. Asset managers are also taking a look at new geographic areas.

These shifts in exposure warrant analysis of the risk-reward trade-off associated with each kind of investment, particularly for those entities suffering capital constraints, as they will find it very hard to recalibrate their portfolios in search of higher yield, making them the candidates likely to face the biggest challenges in adapting to the new paradigm.

As part of their efforts to adapt to the new context, life insurers are also finding themselves forced to reconfigure their product ranges, offering lower guaranteed rates, shorter terms and/or periodic rate resets. Some entities have stopped selling annuities altogether on account of the substantial amount of capital that has to be put aside for these products under Solvency 2.

We are also seeing an uptick in the marketing of unit-linked products for long-term savings schemes in which the policyholder assumes some or all of the risk and products without interest rate risk (e.g., non-life and risk life) in an effort to diversify.

In parallel, insurers are rushing to pare back product costs, cutting commissions, eliminating products whose cost structures are not compatible with the low-rate environment and launching new savings product formulae with cost structures tailored for the new context.

Meanwhile, non-life insurers, in addition to trying to boost their investment income (with shorter-term investments relative to the life segment), are focusing primarily on lifting their underwriting results, particularly in motor insurance, in an attempt to avoid having to pass the low rate fallout on to premiums. The health insurers have gone to lengths to tailor their coverage and prices to the needs of lower-income policyholders (e.g., low-cost health insurance policies with reduced coverage, group policies for companies).There is also a clear-cut shift towards prevention (e.g., multi-risk home insurance associated with home automation) in the insurance sector in general.

Lastly, although the low-rate environment is squeezing entities’ margins, it is also prompting them to look for profitability in new markets, particularly in Latin America, thereby accelerating their international expansion processes. Not just the large insurers but also the medium-sized entities have decided to hunt for business outside of Spain. One of the destinations selected for expansion in Latam has been Chile, due to its social, economic and political stability. In Chile, motor insurance is not mandatory but it is estimated that civil liability motor coverage will become compulsory within the next five to ten years, a requirement likely to become widespread in the rest of Latam, foreshadowing very significant growth in this segment.

Conclusions

Low interest rates are taking a heavy toll on insurers’ margins in Spain and broader Europe, as evidenced by the contraction in sector profits in 2015 despite the growth in premiums. The P&L impact is proving more significant for life insurers with guaranteed long-term commitments.

The impact is proving severe in countries such as Germany, where, unlike in Spain, assets and liabilities are not well matched in terms of duration, leaving insurers exposed to movements in exchange rates.

The companies that had been financing themselves from their investment income ‒ as their underwriting results were negligible or even negative (e.g., motor) – are also facing difficulties in light of low returns.

The sustained, low-rate environment is driving a shift in investment policy and the insurance companies’ asset mixes, boosting the relative weight of equities and other assets with higher risk, higher yields and longer duration. This is in turn increasing the insurance companies’ risk exposure and capital allocation requirements. As a result, insurers faced with capital restraints will encounter greater difficulty in guaranteeing their obligations to their policyholders.

Similarly, in the course of adapting to this new paradigm, entities have been forced to recalibrate their product offerings (reducing guaranteed interest rates and boosting other products such as unit-linked, risk life and non-life policies), cut costs and, generally, boost their underwriting profits.

Lastly, in a bid to restore the profits battered by the prevailing low rates, insurers are accelerating their international expansion, focusing especially on Latin America, with a view to diversifying sources of income outside of Spain.

References

DGSFP (2016), Informe Seguros 2015 [2015 Insurance Sector Report.]

ECB (2016), Financial Stability Review.

S&P GLOBAL (2016), Negative interest rates.

Iratxe Galdeano and Pablo Aumente. A.F.I. - Analistas Financieros Internacionales, S.A.