Spanish electricity market reform: Positive effects but more competition needed

Recently adopted reforms have helped to address some of the operating problems of the electricity sector in Spain. While these much-needed reforms represent a step forward, there is still room for improvement to increase competition necessary to bring down retail prices.

Abstract: New regulation in the electricity sector (2013-2014) has modified the functioning of Spain´s electricity market and addressed some of its traditional shortcomings. Specifically, two important changes have been introduced: i) the new system for calculating the cost of electricity for the final consumer, which leverages the availability of smart meters and is based on the hourly price at the pool; and, ii) the new incentive scheme for renewable generation. The new measures have solved some of the operating problems related to the consumer price setting system in the retail segment. In addition, the regulation introduced to amend the renewable energy incentive regime has proven effective in controlling the tariff deficit. However, additional measures should be considered to increase competition and bring down retail prices. Looking ahead, the introduction of measures aimed at achieving the Energy Union will be the key determinant factor to form a clear perspective on the future of the energy market.

The Spanish electricity system underwent profound transformation in the wake of the passage of Spanish Law 24/2013, of December 26th, 2013, the Electricity Sector Act (the Act). The Act essentially strives to ensure the system’s sustainability, which had been jeopardised by the debt built up as a result of successive tariff deficits. To this end, the new legislation focuses on two major reforms that affect both the supply and demand sides of the electricity market: (i) the new electricity pricing system in the wake of Spanish Royal Decree 216/2014, which stipulates the method for calculating the Voluntary Price for Small Consumers; and, (ii) the renewable energy remuneration regime enacted by means of Royal Decree 413/2014.

The new regulations have modified how the market works to a substantial degree. In this article, we analyse the changes and impact that the new regulations have had in two key areas: control over the tariff deficit and the pricing system in the retail segment, linking this aspect with the level of effective competition among suppliers or retailers.

The characteristics of the electricity market, in which natural monopolies, such as distribution and transmission, live side by side with other activities that lend themselves to free competition, such as generation and retailing, warrant sector-specific regulation. The Electricity Sector Act continues to distinguish between regulated and non-regulated activities, as prescribed by European Community regulations. In the case of the system operator, Spain has opted for structural separation or ownership unbundling, forbidding generators from holding significant shareholdings in the transmission system operator. In contrast, the road taken vis-a-vis the distribution grid operators has been conduct-related redress, requiring costly supervisory measures that are not always effective in terms of fostering the optimal level of competition for pushing down the rates ultimately paid by end consumers.

Elsewhere, the regulations introduced in 2013 and 2014, amending the renewable energy incentive regime, have proven fairly effective in controlling the tariff deficit. The new system has entailed a reduction in subsidies but has also driven a drop in output from renewable sources.

The new consumer pricing regime introduced by means of Royal Decree 216/2014 and the progressive installation of smart meters have paved the way for new competitive tools for retailers. However, competition in the retail segment would not appear to have reached the ideal level, dampened by the presence in this segment of companies belonging to large vertically-integrated groups.

Taking a far longer-term perspective, the introduction of measures directed at energy union will surely be the key determinant of how the electricity market will look in the future. In 2015, the European Commission passed a series of measures designed to foster the development of interconnections which in the case of Spain will translate into increased interconnection capacity with France and, by extension, the rest of Europe. Elsewhere, the Multi-Regional Coupling (MRC) project for connecting Europe’s wholesale markets lays the groundwork for unifying the market rules and uses a single algorithm (EUPHEMIA), in operation since 2014, as the precursor of a single market.

As a whole, the recent reforms have resolved some of the market’s operating problems, specifically the tariff deficit and consumer price-setting system, although on the latter point there is room for improvement in striking the level of competition needed to bring end prices down in the retail segment.

This article is structured as follows: Firstly, it analyses the general objectives of the Electricity Sector Act (Spanish Law 24/2013). Next, it outlines and assesses the trend in the tariff deficit. Finally, it examines the new electricity pricing system and the degree of real competition among retailers in the wake of introduction of Royal Decree 216/2014.

General objectives of the Spanish Electricity Sector Act

Electricity is a good whose output cannot be stored except on a very small scale; it is a basic necessity for the population as a whole; demand for electricity is relatively inelastic; and there are elements constituting natural barriers to entry that prevent free competition in the marketplace. In light of these characteristics, the preamble to the Electricity Sector Act establishes five major objectives for fulfilment over the ensuing five years: (1) guaranteeing electricity supply while maintaining the necessary quality standards; (2) fostering effective competition such that power is supplied to the end consumer at the lowest cost; (3) protecting consumers; (4) ensuring the system’s financial sustainability; and, (5) duly protecting the environment.

This paper analyses how the new legislation is faring in terms of delivery of two of the above-listed targets: reduction and control of the tariff deficit and delivery of a competitive pricing regime capable of fostering end prices that are in sync with retail consumer needs. Law 24/2013 repeals Law 54/1997 (of November 27th, 1997), which was drafted to create the regulatory regime needed to implement Directive 96/92/EC, of the European Parliament and of the Council, of December 19th, 1992, concerning common rules for the internal market in electricity. The need to tackle new sector challenges prompted implementation of a new electricity system revenue and expense regime with the aim of correcting the then-existing financial imbalances (the so-called tariff deficit) and adapting the legal framework to the new market structure. The reforms undertaken affect both the demand and supply sides of the equation.

On the demand side, recent technological developments are enabling the implementation of smart meters. This paves the way for hourly pricing which will in turn allow consumers to observe how their consumption costs vary at different times of the day. This enables the retailers to introduce new competitive tools (tailored pricing packages) and could change the nature of demand on the daily market. Spanish Royal Decree 216/2014, of March 28th, 2014, establishing the methodology for calculating voluntary prices for small consumers and the related contracting regime, is the regulator’s response to the need to systematise end consumer pricing. This opens the door to greater effective competition among the players by means of the various power supply contracting formulae and the possibility of switching supplier.

On the supply side, the significant increase in the tariff deficit and the resulting debt burden (close to 3% of GDP) called for the adoption of deficit-reduction measures against the backdrop of a sharp credit crunch. Specifically, the approach taken was to offer subsidies for the various renewable energy sources so as to guarantee a ‘standard return’. Royal Decree 413/2014 (of June 6th, 2014), which regulates the production of electric power using renewable sources, co-generation and waste, legislates this approach. The goal of containing the deficit was attained in 2015. However, Spain also faces greenhouse gas emission targets that will require fine-tuning the power generation mix, an issue which has yet to be tackled.

Deregulation of the electricity market in Europe has been boosted by various European Community Directives and has been implemented in stages. Initially, Directive 1996/92/EC stipulated (i) full unbundling of ownership of generation and transmission network; (ii) creation of an independent system operator to guarantee non-discriminatory access to the transmission network by all participating agents; (iii) privatisation of the generation and retail businesses; and, (iv) creation of an independent market operator to set the prices and amounts consumed over a specific time horizon (hourly, half-hourly, quarter-hourly, etc.).

This legislative process marked radical changes for the vertically-integrated companies with a presence in both the generation and distribution businesses. The new rules obliged functional segregation of vertically-integrated activities albeit without forcing separate ownership of each. This has since been reinforced by the creation of regulatory bodies independent of the governments and, more recently, regulations that lay the foundations for integration of Europe’s electricity markets. The European regulations have offered the various member states several options for deregulating. This, coupled with natural differences in market characteristics or objective circumstances in each country, has meant that the results of the deregulation process have been heterogeneous.

The deregulation process has been more complex than in other markets as it implied more than mere elimination or redefinition of existing regulations.

Although the goal is to open up the segments whose market circumstances are most suited to free competition, the intrinsic characteristics of electricity require a certain degree of regulation. There are four major segments with different regulatory characteristics and needs: production or generation, transmission, distribution and retailing.

The power transmission and distribution activities are natural monopolies and this must be factored into market regulations. The transmission of electricity requires complex and costly infrastructure with considerable environmental ramifications as it comprises networks, transformers and other electric facilities with nominal voltages of 380 kV or above (primary network) and 220 kV (secondary network). The existence of more than one transmission network (one per company) would not only be environmentally unsustainable but also economically unviable and inefficient. This endows it with the characteristics of a natural monopoly and means that care is required to make sure that the transmission network operator invests enough in network maintenance and growth to ensure service supply and efficiency, while guaranteeing equal and non-discriminatory access to the network by all interested companies.

This situation in the distribution segment is somewhat similar, as this business consists of transmitting the power from the high-voltage networks to the points of consumption or other distribution networks. This requires power lines, stations, transformation equipment and electric facilities with voltages of less than 220 kV. This segment therefore presents analogous environmental and cost considerations warranting the existence of a single company or distribution grid per geographic region, preventing overlapping networks in the same region. It is also necessary to ensure efficient operations and sufficient investments in each regional network as well as the provision of grid access to all interested parties.

In contrast, the power generation and retail activities do not present objective or natural market conditions implying the need for a monopoly, which is why the retail and generation activities are termed deregulated activities, in contrast to the above-mentioned transmission and distribution activities, classified as regulated activities. In the strictest sense, all the activities are regulated: even in the production and retail segments, the existence of a staple good subject to technical complexities and, by extension, considerable safety considerations means that a prior business permit is required. Directive 2009/72/EC stipulates, however, that the requirements imposed in exchange for this permit do not go beyond those strictly necessary in order to ensure such safe and effective supply and do not add unnecessary burdens that limit access to the market for potential entrants. The Directive further stipulates that the process for obtaining the permit be neither protracted nor impose requirements other than those strictly necessary, as some countries have availed of measures of this kind as delay tactics or as a means to hinder the advent of potential entrants to these deregulated yet permit-restricted businesses.

Note that although the capital required to enter the market can be considerable for certain generation technologies, this is not the case in the retail business, an activity which only requires the purchase of energy for sale to consumers or other system users. The electricity retailers are intermediaries of which a sufficiently high number is advisable from the standpoint of introducing competition into this segment. Hence the importance of guaranteeing non-discriminatory access to the transmission and distribution grids, i.e., the provision of equal terms of access and information to all competitors.

In light of the characteristics of each of these activities, EC regulations also require the existence of an independent transmission system operator, known as the TSO (article 30 of the Act),

Red Eléctrica Española (REE) in the case of Spain, which must moreover be the only operator to intervene in the network unless, exceptionally, the ministry authorises the operation of certain secondary transmission networks by the regional distributor so appointed (article 34). The functions of the distribution and transmission system operators are precisely to oversee that the systems work as intended so as to adequately satisfy demand at all times and to invest in their upgrade so that it is technically feasible to provide access to them and, by extension, to provide more competitors access to the electricity market on equal terms. To this end it is crucial that the operators take their decisions independently and have no vested interests in any of the generators or distributors. If they did share interests, there would be a clear-cut risk of temptation to hinder the efforts of other companies in which they did not have a vested interest from approaching and accessing the market, so that they would not compete with the same information or therefore on equal terms, eventually harming competition in the market in question.

[1] A vertically-integrated TSO or DSO would also be less motivated to upgrade or invest in its network as this would enable grid access by potential entrants that would then compete with the companies with which the operator had shared interests.

[2]

The market structuring regulations are rounded out with the creation of the so-called ‘market operator’, in Spain OMIE for its acronym in Spanish, whose remit is to

manage the deregulated purchase and sale of electric energy in the daily market…upholding the principles of transparency, objectivity and independence (article 29 of the Act). This independence is essential if we consider that this entity must organise the market for trading in energy among generators, distributors and retailers and guarantee satisfaction of effective demand at any point in time. Such independence presupposes a lack of vested interests in or relationships with the market’s suppliers and bidders (producers, distributors and retailers). In its absence, all the market players might not have access to the same information, potentially adulterating the free interplay between supply and demand matching in the daily and intra daily energy markets. Regardless, for the system to work properly, it is necessary to guarantee a sufficient number of suppliers (generators) and bidders (distributors, retailers and direct consumers) with truly separate economic interests,

i.e., that do not form part of the same group of companies.

[3]

In short, given existing market circumstances, particularly the need for a monopoly in the transmission and distribution activities, the ideal or most competitive market structure among the available options is to limit vertical integration or at least the scope for carrying out regulated as well as deregulated activities (production and retailing). This is why the European Electricity Directive mandates the legal separation (ownership unbundling) of the system operators (TSOs) from the other activities and the same for their distribution system counterparts (DSOs). The transmission and distribution networks cannot be controlled by one of more companies that engage in the other activities.

[4] The reason is that if they remained bundled, the distortionary effects of the natural monopoly would be extended to the rest of the activities in which competition can exist,

[5] which is why sector regulations stipulate effective separation of regulated and deregulated activities and of transmission and distribution activities.

[6]

The following sections look at the recent regulations in more detail and some of the implications for how the sector works in relation to the tariff deficit and the establishment of a competitive pricing system that meets the needs of end users.

Trend in the tariff deficit in the wake of Law 24/2013

The financial sustainability of the electricity system required, first and foremost, controlling the tariff deficit and then financing the debt accumulated in recent years. The tariff deficit is the result of several years in which the regulated costs recognised in the Spanish electricity system exceeded the revenue generated. The resulting deficit is a debt owed by the electricity system to the generation companies which ended up having to finance it temporarily.

The tariff deficit was largely driven by the subsidies awarded for the generation of energy from renewable sources, which were included within system costs (see Ciarreta, Espinosa, and Pizarro-Irizar, 2014; Ciarreta, Pizarro-Irizar, 2014).

The accumulated debt gets transferred to future generations of consumers via the recognition of collection rights. Royal Decree-Law 6/2010 (of April 9th, 2010) created the electricity deficit amortisation fund (FADE for its acronym in Spanish) with the goal of financing and amortising the debt accumulated by the public system in respect of the settlements owed to the generators (maximum fund size: 26 billion euros). The deficit holders ultimately transferred their collection rights to the FADE which transformed them into fixed-income securities suitable for trading in the securities markets (securitisation), see De los Llanos (2013) for a more detailed study of the incorporation, workings and performance of the FADE.

One of the key objectives laid down in the Electricity Sector Act was to put an end to the tariff deficit. The Act’s recitals state that “one of the main reasons for the reforms was the accumulation during the past decade of imbalances every year between the electricity system’s revenue and costs, giving rise to the apparition of a structural deficit. The roots of the imbalances lie with the excessive growth in certain cost items due to energy policy decisions made without guaranteeing corresponding revenue for the system. All of which aggravated by a lack of growth in demand for electricity, due mainly to the economic crisis. Although access tolls increased by 22% between 2004 and 2012, putting electricity prices in Spain well above the European Union average, this was insufficient to cover system costs.” The financial sustainability of the system entails ensuring that it is financed for the most part by the grid access tolls and other charges and only exceptionally from state budget allocations. Corrective mechanisms – somewhat automatic – were introduced to offset the potential generation of temporary mismatches.

Passage of the Electricity Sector Act largely reduced the scope for earmarking public financing to the deficit while limiting the mismatches triggered by revenue shortfalls in a given year to 2% of estimated revenue for that year and the debt accumulated to finance prior-year mismatches to 5% of estimated revenue for that year. Note that any mismatches that do arise (within the above-mentioned thresholds) between costs and revenue will be corrected by means of automatic revisions of tolls and charges and any amounts not offset in this manner will be financed by all the settlement system parties in proportion to each one’s collection rights. This means that any deficit generated in the future will no longer have to be borne exclusively by the five major players, as was the case until 2013. In addition, the possibility of selling these tariff deficit collection rights to the FADE was eliminated from 2013.

In its definitive settlements for 2014 and 2015, the CNMC (Spain’s anti-trust authority and the energy sector regulator) reported surpluses of 550 million euros and 251 million euros, respectively, thereby breaking the trend of prior years’ deficits. However, at December 31st, 2015, the electricity system’s debt still amounted to 25.0 billion euros, down 7.01% from the year-end 2014 balance (26.95 billion), and in 2015, the total annual sum payable in respect of securitised tariff deficit collection rights amounted to 2.89 billion euros; the annual payment due in respect of 2016 based on year-end 2015 information is estimated at 2.87 billion euros.

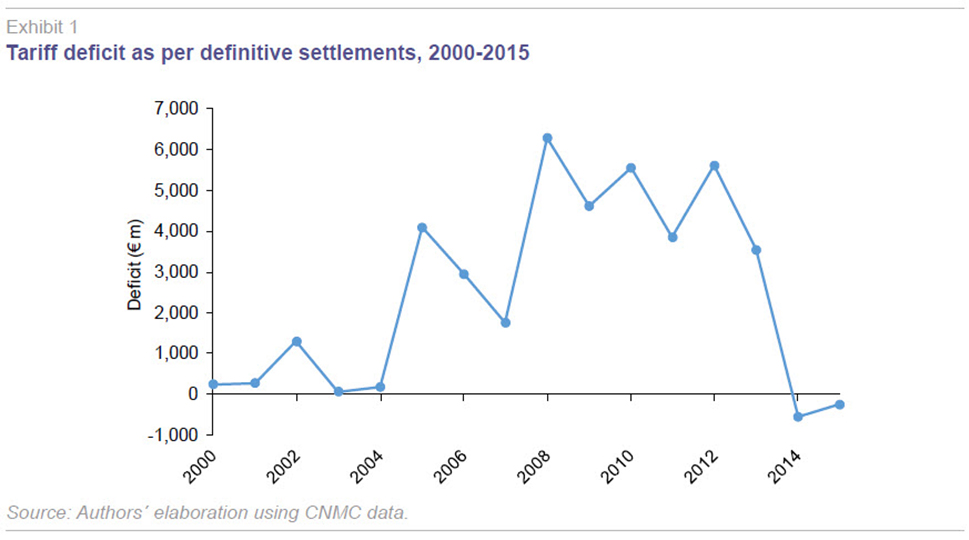

Exhibit 1 summarises the trend in the tariff deficit between 2000 and 2015. It is worth highlighting its persistence and absolute size until the legislative reforms were pushed through, evidencing how it jeopardised the financial stability of the electricity system as a whole by increasing the system’s debt burden.

The increase in revenue and reduction in system costs in the wake of the reforms are accountable for this trend. Relative to 2013, demand fell slightly in both 2014 and 2015 (-0.2%) despite renewed economic growth (+1.4%). In parallel, the average daily market price fell (-4.8%). As a result, the improvement was driven primarily by the cost side of the equation: costs have fallen considerably, particularly capacity payments and renewable energy subsidies. Generation from wind power and combined heat and power (CHP) plants fell by 6.8% and 20.1% year-on-year, respectively, in 2014, unlocking considerable savings in subsidies.

In 2015, demand firmed by 1.9% year-on-year, in line with the broader economic recovery (+2%). In tandem, demand growth pushed the average daily market price higher (+19.4%), sparking clear-cut recovery in electricity system revenue. As for the generation mix, power generation from coal-fired stations rose sharply that year (+25%), as wind power (-5%) and CHP generation (-12.62%) fell, translating into significant savings in subsidies.

In short, the cost savings achieved in 2014 and 2015 are attributable to a reduction in subsidies but also to a reduced share in the generation mix of renewable energies. Accordingly, although the effect of the Act on the tariff deficit has been undoubtedly beneficial, the longer-term impact will be a reduced contribution by renewable sources of energy to the overall mix.

Lastly, it is worth noting that the use intended in the Act for revenue surpluses, namely repayment of the electricity system’s debt, which stood at 25.06 billion euros, has yet to be implemented (CNMC, Report on the proposed ministerial order establishing electric energy access tolls for 2016).

The new electricity pricing regime and competition among retailers. Royal Decree 216/2014

The new electricity pricing regime

On December 20th, 2013, the Secretary of State for Energy (under the Ministry of Industry, Tourism and Energy) proceeded to annul the outcome of the twenty-fifth CESUR auction (auction of electricity for consumption during peak and off-peak hours) convened on November 20th, 2013, which meant that the result of this auction was not to be included in determining the estimated cost of the wholesale contracts. The reason for cancelling the results was evident manipulation on the part of the participants in an attempt to boost electricity prices (abuse of dominant position).

The so-called CESUR auctions had been running since 2009, defining each quarter close to 40% of the end price used to determine the electricity bills of consumers. The auction system has since been replaced by a new system articulated around daily consumption and the electricity price on the wholesale market. Royal Decree 216/2014 (of March 28th, 2014) stipulated the precise methodology for calculating the so-called Voluntary Price for Small Consumers.

Article 17 of the Act defines the Voluntary Price for Small Consumers as the maximum price that the ‘benchmark retailers’ (retailers that sell electricity at the various regulated tariffs) can charge consumers signed up for this regime. Unless expressly stated otherwise by the consumer, this voluntary price is the default contracting formula with the benchmark retailers. The Act also defines the ‘vulnerable consumer’ concept, related to certain social, consumption and purchasing power characteristics, stipulating the adoption of the opportune measures for guaranteeing adequate protection of these consumers. Specifically, article 45 and Transitional Provision Ten of the Act define who these consumers are and stipulate their entitlement to a rate that is lower than the Voluntary Price for Small Consumers. This reduced price, coined the ‘social voucher’, is calculated by discounting 25% from all the elements comprising the Voluntary Price. As for how it is financed, article 45 of the Act states that the cost of the social voucher shall be borne by the parent companies of the various groups or, as warranted, the companies that engage simultaneously in electric power generation, distribution and retailing activities.

Elsewhere, Royal Decree 216/2014, regulates the legal framework governing the benchmark retailers and establishes the rate calculation methodology and the associated contracting regime. This system took effect on April 1

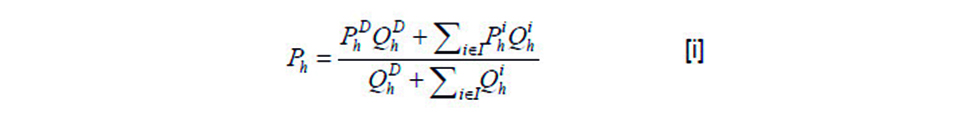

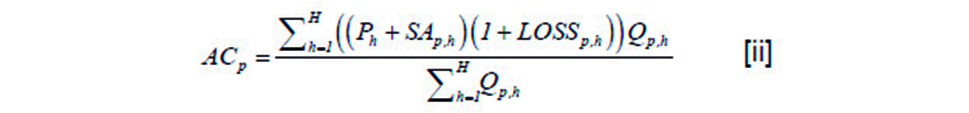

st, 2014. Article 10 of Royal Decree 216/2014 stipulates that the average hourly price

(Ph) shall be calculated as the average (weighted by quantities) of the average daily price,

, and the outcome of the various intraday market sessions,

:

The total acquisition cost during the billing period shall be the sum of the following concepts: (i) acquisition cost in the daily market; (ii) the cost of adjustment services (the cost of overcoming technical restrictions) and capacity payments; and (iii) the access tolls set by the authorities. Accordingly, the total acquisition cost per megawatt hour (MWh) during a given billing period (

P) is the weighted average of the average hourly price,

Ph, the cost of adjustment services per MWh,

SAp,h, and the loss coefficients,

LOSSp,h:

H being the number of hours during the billing period.

Prior to effectiveness of Royal Decree 216/2014, the CNMC issued a report dated February 25

th, 2014 (CNMC, 2014) on the decree, indicating some of the advantages and disadvantages of the new system. The main advantage identified was the fact that it transmits to end consumers a price signal (hourly cost of consumption), helping them become more energy efficient by planning and scheduling their consumption over the course of the day. It also allows the development of new and more efficient demand management mechanisms by the retailers. Among the stated disadvantages, the fact that although prices are known the day before, they are not readily accessible.

[7] Secondly, consumer price variability is higher as a result of variability in the hourly pool price.

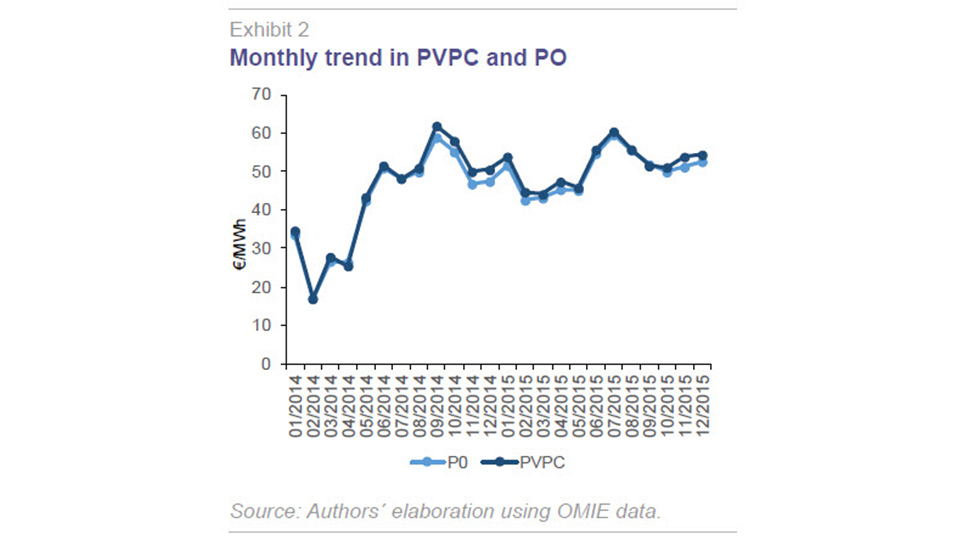

Exhibit 2 depicts the trend in the average monthly Voluntary Price built in accordance with (i) and the trend in the daily market price (PO) in 2014 and 2015.

Exhibit 2 yields three main conclusions: (1) as expected, the two price variables are closely correlated; (2) the Voluntary Price (PVPC) is always higher than the daily market price (P0), by €1/MWh on average; and (3) after a sharp spike of 101% between April (when the new system became effective) and June 2014, prices have been more stable.

Competition in the electricity retail segmentOne of the ways of measuring the level of competition in the electricity market is the elasticity of demand to changes in prices. The deployment of smart meters and the new hourly pricing system are expected to spark more intense rivalry among the retailers which can now articulate price regimes around end users’ hourly usage profiles. Consumer sensitivity to the prices offered by the various retailers should imply switching between one price proposition and another. In its Oversight of Retailer Switches report, the CNMC discloses a quarterly supplier switching rate, an indicator of potential relevance as a measure of the level of competition among retailers in the retail market. In 4Q15, the supplier switching rate was 2.8%,

i.e., 2.8% of users applied to switch, a notable figure considering it refers to just one quarter.

[8] If these applications to switch retailer were indicative of demand price elasticity and evidence that the retailers are rolling out lower price packages in order to win new customers, these figures would be encouraging in terms of assessing the level of competition. However, according to the regulator, they are not accompanied by significant changes in the prices on offer for basic electricity services, suggesting that the high switching rates may be associated with a high level of customer dissatisfaction with these services, as suggested by the Market Consumer Scoreboard figures.

As for the cost of switching, in addition to the costs associated with the process and paperwork, it is important to factor in the time taken to execute the switch. According to the regulator’s figures, electricity supplier switch lag times averaged 13.1 days in 2015. The number of switch requests submitted by the aspiring retailers and received by the distributors, which are tasked with approving the applications, was 913,067. The retailers submitting the highest numbers of switch requests were: Endesa Energía (271,102 applications submitted to the distributors), Iberdrola Clientes (267,324) and Gas Natural Servicios (136,714). The distributors can reject a switch on several grounds. The rejection rate was 8.4% in 4Q15; the distributor rejection rate was 8.7% when the candidate retailer did not belong to the same vertically-integrated group of companies, 8% when it did belong to the same group and 9.3% in the case of independent retailers.

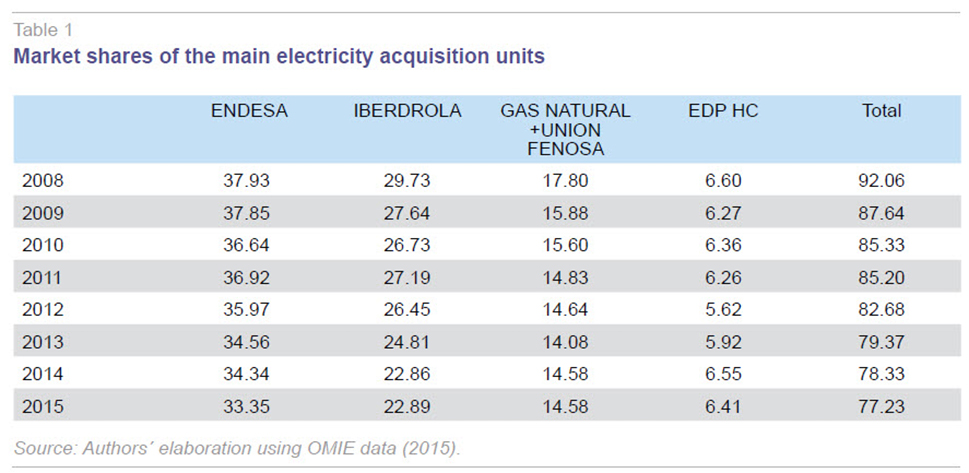

Elsewhere, the number of distributors is high (> 300), as is the number of retailers (> 250), potentially indicating a high level of market competition. However, the market shares commanded by those belonging to a vertically-integrated group are very high (Table 1).

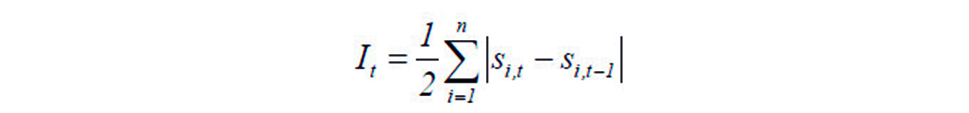

Although the market share of the electricity acquisition units belonging to the major vertically-integrated companies has been declining gradually, these groups still commanded 77% of the market in 2015. In addition to the number of competitors and their market share, which provide us with a static snapshot at a given moment of time, it is important to look at how easy or difficult it is to enter or exit the market. An indicator commonly used to measure the level of competition resulting from the lack of market entry and exit barriers looks at changes in the companies’ market shares over time; it is called the market share Instability Index:

where

si,t represents the market share of company

i during period

t. Stability is at its highest level when the index reading is zero. Building

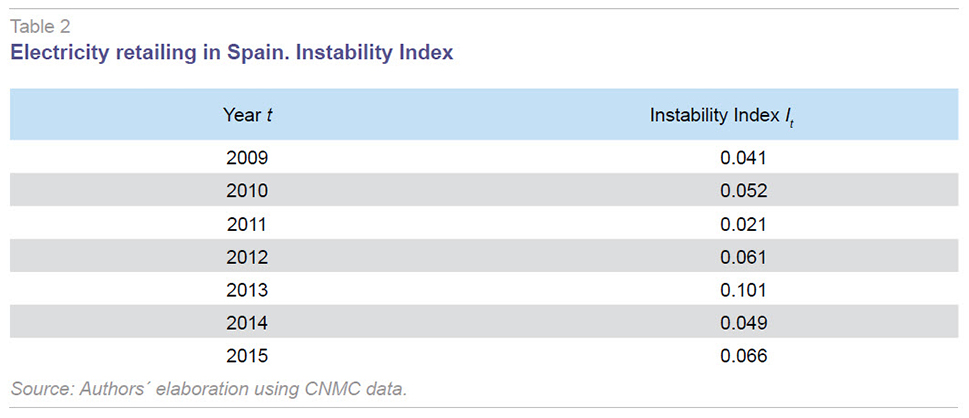

si,t using the market shares of each company (considering all the units belonging to a the same corporate group), the results for 2009 to 2015 are summarised in Table 2.

As shown in Table 2, the It reading is steady at levels that are fairly close to zero, indicating that despite high switch rates among retailers, detailed above, market shares are very stable. This suggests that the smaller retailers are encountering difficulties in picking up market share. These difficulties may be associated with the brand image of the vertically-integrated groups as well as a differential treatment by the distributors depending on whether or not aspiring retailers belong to their corporate group.

Notes

Note, by way of example, resolutions issued by the energy sector regulator, the CNC for its acronym in Spanish (CNC Resolutions 24/2/2012 and 11/6/2012), which outline how the two main vertically-integrated groups of companies use information derived from their position as distributors to reduce rival retailers’ potential market.

“Prospects for the internal gas and electricity market,” Communication from the Commission to the European Council and the European Parliament dated 10/1/2007 and “An energy policy for Europe,” Communication from the Commission to the European Council and the European Parliament dated 10/1/2007. Consideration 9 of the prevailing Directive 2009/72/EC addresses “effective separation.”

Note in this respect what happened in December 2013 when the CNMC annulled the twenty-fifth CESUR (last-resort suppliers) auction.

By way of example, see CNC Resolutions 8/11/2011, 20/9/2011 and 21/2/2012.

On the economic consequences of vertical integration, see Zurimendi, Las restricciones verticales a la libre competencia [Vertical restrictions on free competition], Madrid (2006), pages 67 to 103, and earlier references. And more concretely, López Milla, La integración vertical de los negocios de gas y electricidad: posibles efectos sobre la competencia en los mercados afectados [Vertical integration in the gas and power businesses: potential effects on competition in the affected markets], Tendencias y aspectos administrativos, no. 364, pages 129 and 130.

So aims the European Union: “Prospects for the internal gas and electricity market,” Communication from the Commission to the European Council and the European Parliament dated 10/1/2007, and “An energy policy for Europe”, Communication from the Commission to the European Council and the European Parliament dated 10/1/2007. Consideration 9 of the prevailing Directive 2009/72/EC addresses “effective separation.”

Against this backdrop, the market operator, OMIE, publishes hourly daily and intraday market prices on its website. And the TSO, REE, publishes the hourly energy price curve for consumers taking advantage of the Voluntary Price for Small Consumers on its website.

References

CIARRETA, A., and C. PIZARRO-IRIZAR (2014), “La nueva reforma del mercado eléctrico español: eficiencia y austeridad,” [Latest electricity sector reforms in Spain: efficiency and austerity], ICE Economic Journals, 88: 97 -127.

CIARRETA, A.; ESPINOSA, M. P., and C. PIZARRO-IRIZAR (2014), “Is green energy expensive? Empirical evidence from the Spanish electricity market,” Energy Policy, 69: 205-215.

CNMC (2014), Report on the draft legislation establishing the methodology for calculating voluntary prices for small consumers and the related contracting regime, dated February 25, 2014.

— (2015), Report on the definitive electricity sector settlements for 2014, dated November 24, 2015. Analysis of the results of the annual income and cost projections for the monthly electricity system and trend in the annual income and cost projections for the electricity sector settlement system 13/2013.

DE LOS LLANOS, R. (2013), “El fondo de titulización del déficit del sistema eléctrico,” [The electricity system deficit securitisation fund,] ICE Economic Journals, 3039: 15-23.

EUROPEAN COMMISSION (1996), Directive 1996/92/EC of the European Parliament and of the Council, of December 19, 1996, concerning common rules for the internal market in electricity.

— (2007a), Communication from the Commission to the European Council and the European Parliament dated 10/1/2007, Prospects for the internal gas and electricity market.

— (2007b), Communication from the Commission to the European Council and the European Parliament dated 10/1/2007, An energy policy for Europe.

— (2009a), Directive 2009/28/EC of the European Parliament and of the Council, of April 23, 2009, on the promotion of the use of energy from renewable sources and amending and subsequently repealing Directives 2001/77/EC and 2003/30/EC.

— (2009b), Directive 2009/72/EC of the European Parliament and of the Council, of July 13, 2009, concerning common rules for the internal market in electricity and repealing Directive 2003/54/EC.

LÓPEZ MILLA, J., “La integración vertical de los negocios de gas y electricidad: posibles efectos sobre la competencia en los mercados afectados,” [Vertical integration in the gas and power businesses: potential effects on competition in the affected markets,] Tendencias y aspectos administrativos, no. 364.

SPAIN. Law 57/1997, of November 27, 1997, on the Electricity Sector.

— Royal Decree 661/2007, of May 25, 2007, regulating the production of electric power under the so-called special regime.

— Royal Decree-Law 6/2010, of April 9, 2010, on measures for fostering economic recovery and job creation.

— Law 24/2013, of December 26, 2013, on the Electricity Sector.

— Ministerial Order IET/1045/2014, of June 16, 2014, enacting the standard facility remuneration parameters applicable to certain electricity-producing facilities that use co-generation, renewable energy sources or waste.

— Royal Decree 216/2014, of March 28, 2014, establishing the methodology for calculating voluntary prices for small consumers and the related contracting regime.

— Royal Decree 413/2014, of June 6, 2014, regulating the generation of electricity by means of renewable energy sources, co-generation and waste.

ZURIMENDI, A. (2006), Las restricciones verticales a la libre competencia [Vertical restrictions on free competition].

Aitor Ciarreta, María Paz Espinosa and Aitor Zurimendi. Universidad del País Vasco UPV/EHU, BRiDGE