Beyond the 2016 stress tests for European banks

The 2016 EU-wide stress tests represent a positive, initial step towards further restoring confidence in the European banking sector. However, the implementation of swifter, more forceful disciplinary tools is needed if the sector’s reputation is to be preserved and progress is to be made on banking union.

Abstract: Friday, July 29th, marked the publication of the results of the ECB/EBA European stress tests for 51 major banks. The results were positive for Spanish banks and only some Italian, Irish and Austrian banks clearly showed capital shortfalls. However, European stock markets fell in August and bank securities were particularly hard hit. Against this backdrop, it appears necessary to reflect on the limitations of the stress test exercise, which has not succeeded in reassuring financial markets. If progress is to be made towards banking union and restoring confidence in the banking sector, efforts must be redoubled to discipline those European countries with financial institutions that are less transparent and less diligent in their restructuring processes. Otherwise, good news will be eclipsed by warning signs and all the efforts made to publicise the stress test results will not resolve doubts over the European banking sector. The publication of the results is a good start, but there is also a need to implement more powerful disciplinary tools and greater, swifter adjustments, otherwise asymmetries will hamper the achievement of objectives.

The recent financial crisis has fostered a societal debate over the pros and cons of different bank restructuring processes. Globalization has resulted in growing interdependence between financial systems, and various governments have tried to coordinate policies to offer clearer signals to the market and restore investor and taxpayer confidence. However, proposed solutions remain divergent.

Moreover, the recent crisis has brought about increased concentration in financial systems and a reduction in the number of institutions, raising many questions about systemic instability and about too-big-to-fail banks.

There exist differences across financial institutions’ corporate governance and accounting structures that merit a detailed analysis. There are certain asymmetries in the allocation of liabilities and income generated in the bank restructuring processes and the various restructuring roadmaps involve significant differences in costs (as regards both time and money) and in the distribution of costs between governments and citizens (Giménez, 2015).

On Friday, July 29th, the results of the European stress test for large banks were published (for greater comparison, 51 banks compared to the 140 in previous years), conducted by the European Banking Authority (EBA) and the European Central Bank (ECB) with 2015 data for scenarios in 2018. The results were positive for Spanish banks and only an Italian (MPoS), Irish (Allied Irish Banks) and Austrian (Raiffeisen Landesbanken Holding) bank showed clear capital shortfalls.

Despite these outcomes, the Spanish stock market fell at the start of August, and bank securities were particularly affected. Against this backdrop, it appears necessary to reflect on the limitations of this kind of exercise, which, following the publication of the results, has not succeeded in reassuring financial markets.

The 2008 financial crisis and stress tests

The depth and duration of the recent crisis led many banks and supervisory authorities to question whether stress tests were sufficient prior to the crisis, and whether they are still indispensable and adequate to deal with the changes in banking models.

Banking is extremely reputational, for numerous reasons, the first being because a bank is worth the value of its “brand” or franchise to its present and future clients. In addition, the valuation of any bank will be affected by the valuation of its loan portfolio, linked to the economic (and real estate) cycle. Hence it is very important for any bank to pursue a prudent and meticulous risk management policy, and to put in place early warning systems to prevent malfunctions and pathologies before the bank has liquidity problems. If not, liquidity problems could become solvency problems, of a much more serious nature, requiring supervisory and government intervention (Giménez, 2010).

Bank stress tests are risk management exercises that are often integrated in the risk departments themselves as internal policy, and since Basel II, they have been promoted as a very useful tool. These tools generate alerts that can help banks to react early enough to avoid a more serious crisis, and among the alerts is included a risk map and the quantification of the capital needed to handle losses generated by internal or external shocks.

The most common bank tools for internal risk control are as follows:

- Forward looking risk assessment techniques.

- Quantification of limits to the models and historical data.

- Support of internal and external reporting with updated information.

- Information on future capital and liquidity needs.

- Specific and recurring information on the evolution of the risk tolerance level.

- Implementation of risk mitigation techniques and contingency plans under stress conditions.

Stress tests are especially important after periods of economic growth and increasingly important for market players. In expansionary cycles, there can be a loss of perspective with regard to previous adjustments and complacency or an underestimation of the risk assumed by bank loan portfolios. They are also a key preventative tool in expansionary phases, when financial innovation generates new bank products without historical precedent in business models.

Historically, the main objective of stress tests was to evaluate and assess the loss-absorbing capacity (resistance) of a specific financial system. However, given the scale and externalities of the recent crisis, these exercises have been used with the additional objective of helping restore confidence in the banking sector, and at the same time, they enable investors, analysts and other market players to form more informed judgements over the situation of the banks.

Stress tests and, therefore, their methodologies, may differ greatly, although they can be grouped into two major categories: sensitivity analyses and the more complex tests that analyse the effects of external shocks based on scenarios.

They have multiple uses: on one hand, that of each individual analysis, and on the other hand, that of the sectoral analysis. Well managed stress tests should combine objectives to be met in the micro- and macroeconomic spheres, so that in the microeconomic sphere, they limit idiosyncratic risk (potential bankruptcy of one individual institution) and in the macroeconomic sphere they reduce systemic risk (probability and costs of systemic instability for the entire European banking system).

In the case of the EBA and the ECB, since the stress tests are conducted for most European banks, and because of the considerable depth of the analysis (number of variables analysed), the tests make it possible to ascertain the financial stability of the continent as a whole, and to enable comparisons to be made between countries. Also, once a common methodology has been established, and weaknesses identified, it will be possible to carry out more detailed analyses and historical comparisons and to observe gradual improvements.

However, the recent crisis has revealed the shortcomings of bank stress tests, due to their questionable validity in quantifying, at the individual level, the aggregate risk exposure of each bank, because of the scant effectiveness of the risk management tools (and of the stress test itself). The main criticisms levelled at stress tests relate to their justification and methodology. Firstly, because banks claim that their reputational nature exacerbates financial vulnerability and that the cure can be worse than the disease, and secondly, because their methodology is poor. In this regard, one of the most frequent criticisms of stress tests is that they are too lightweight, due to their inability to foresee changes in cycle or crises, since their analysis only includes the effect of mild short-lived shocks, underestimating correlations between different positions, types of risk and markets.

Most of the banking risk management models used historical series that generated vulnerable analyses and, therefore, they did not serve to improve current management, let alone foresee future downturns. In the face of long-lasting bullish cycles, historical models predict that the boom will continue, without preparing for changes or shocks.

Moreover, the financial crisis has also shown how, under difficult conditions, financial markets –and with them, business conditions and bank business risk characteristics– overreact, amplifying the initial shocks. Although extreme reactions are by definition infrequent, historical models remain fully in force, but possible future shocks should be monitored to calibrate the financial vulnerability of each institution and, therefore, the strength of the Banking Union itself (Giménez, 2015). The traditional bank risk management models continue to be fully in force, but they should be supplemented with other tools to improve their predictive power and to reduce some kinds of vulnerability.

For example, before the crisis financial institutions scarcely shared stress test data between departments, hindering the proper functioning of credit risk systems for the market and in relation to liquidity risk in each line of business. Back then, the views of risk analysts on the worsening of market conditions could have been very useful for bullish asset traders.

Before the crisis, many banks did not conduct stress tests, and those that did so were not necessarily more discerning or diligent in their risk management policies. In fact, banks were not capable of foreseeing future illiquidity tensions in financial markets related to their future sources of financing in these same markets.

In this context, the EBA and the ECB have worked hard since the crisis to implement an annual European bank stress test and, to improve the test’s quality –along the lines of the World Bank guidelines– they have attempted to achieve international standardisation of the most sensitive accounting terms, for example NPLs, with a higher number of participants in their annual review. All of this is designed to avoid historical prejudices and to promote a pro-transparency culture to make their analyses more representative.

The main objectives of the stress tests conducted by the EBA and the ECB are, at least, the following (Pérez and Trucharte, 2011):

- Show European banks the benefits of comprehensive (internal and external) risk monitoring models as a means to improve decision-making by regulators.

- Detect sources of error in the stress tests (non-comparable data, areas not analysed), incorporate the appropriate changes and generate more robust statistical analyses.

- Show European banks the benefits of transparency in risk management as a means of restoring market confidence.

- Initiate a powerful, statistical risk management archive that can generate tools to improve and guide future legislation and supervision.

- Conduct a comprehensive diagnosis of risk management in European banks.

- Conduct an individual diagnosis of banking risk management.

- Prevent future crises through the implementation of improved macroprudential supervision.

- Flag liquidity problems, through early warning systems, in order to implement the necessary tools to avoid solvency problems.

Also, the main phases in the preparation of stress tests tend to be the following (Pérez and Trucharte, 2011) :

- Establishment of assumptions about the adverse macroeconomic scenario.

- Calculation of the hypothetical impairments caused by the adverse scenario.

- Listing of the items available to absorb the hypothetical impairment in terms of capital.

- Capital ratio that institutions should maintain after the stress.

- Measures to ensure that institutions that do not meet this capital ratio have, as necessary, access to additional capital to achieve it (barriers).

The July 2016 stress tests for large banks

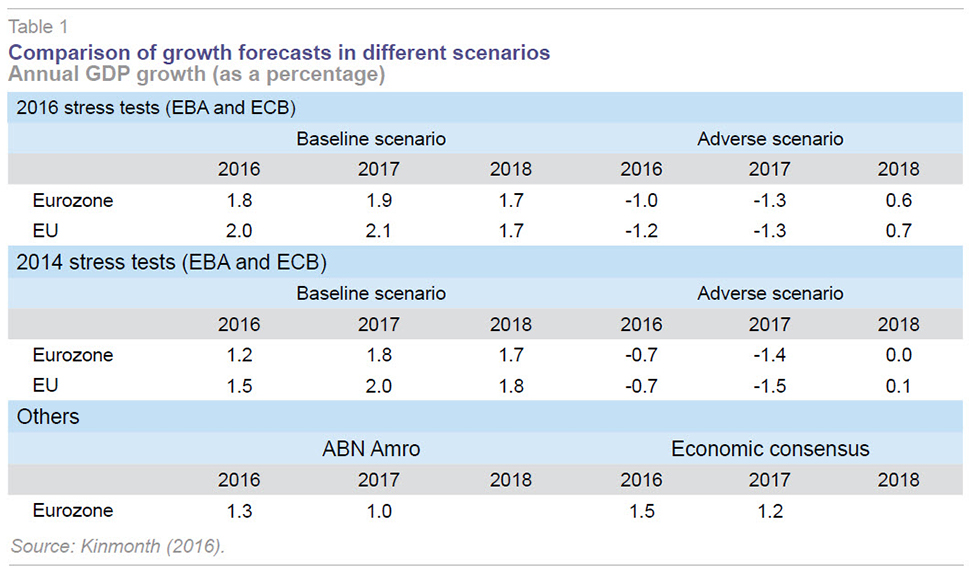

The July stress tests this year (EBA and ECB, 2016) were carried out based on two scenarios, the baseline scenario (provided by the European Commission) and the adverse scenario (provided by the European Systemic Risk Board, ESRB). In the latter case, an adverse mortgage scenario was forecast for the next three years with GDP growth in the eurozone for 2016 of -1.0%, recession in 2017 of -1.3% and slower growth in 2018 of 0.6%; and an unemployment rate of more than 12%.

Unlike the overall evaluation of 2014, in which all significant Spanish banking groups took part, in 2015 and 2016, supervision (which was taken over by the ECB since November 2014) only included the six largest Spanish banking groups (Santander, BBVA, BFA-Bankia, Criteria-Caixa, Popular and Sabadell).

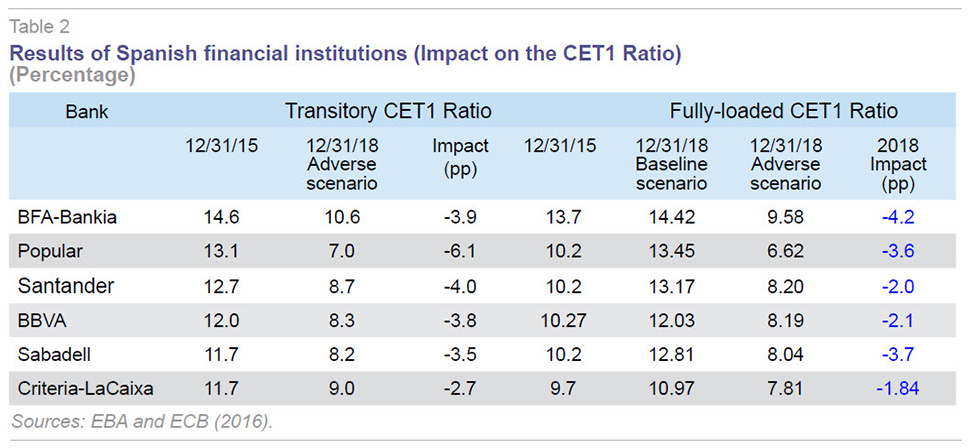

In the case of Spain, the six large banks analysed passed the test. Although there was no official threshold for passing the test, the ECB and analysts expected that these institutions could maintain a capital ratio in excess of 5.5% of their risk-weighted assets in 2018 to demonstrate their solvency, once the potential losses from the adverse scenario were taken into account (see Table 2).

Banco Popular was the Spanish bank that passed the test with the smallest margin, showing a 6.62% ratio after applying the hypothetical scenario. But this figure does not take into account the capital increase of 2,500 million euros carried out in 2016, since the EBA took as a reference for the starting point banks’ balance sheets at year-end 2015. With the above-mentioned increase, the solvency measurement for Popular would rise significantly.

Criteria had a 7.81% ratio after undergoing the stress test. CaixaBank conducted an internal simulation applying the same EBA criteria which, under the most stressed scenario, resulted in a regulatory ratio of 9.8% and a fully-loaded ratio of 8.5%. Taking into account that CaixaBank transferred to Criteria its ownership interests in the Bank of East Asia and Inbursa in the first half of the year, CaixaBank’s phase-in or regulatory ratio improves to over 10.1% and its fully-loaded ratio to over 9.1%. Sabadell would stand at 8.04%, while BBVA would be 8.19%, Santander 8.2% and Bankia 9.58%.

These ratios take into account the capital accounting rules that would be in force in 2018, which analysts call the “fully-loaded ratio.” The average for Spanish banks would therefore be 8.6%, according to the EBA.

As the market expected, the institution with the worst test result was the Italian bank Monte dei Paschi di Siena, which would have a negative capital ratio of 2.44% in 2018. The institution received the approval of the Single Supervisory Mechanism (SSM) for its plan to reinforce its equity by about 5,000 million euros. This should dispel any doubts that the market had about the survival of the Italian institution.

Allied Irish Banks, part-owned by the Irish Government, achieved a ratio of 6.14% applying transitional capital calculations, but with the fully loaded method this would fall to 4.31%, below the official minimum ratio.

Another bank that only just passed the test was Raffeisen, with a ratio of 6.12% in 2018. Its poor performance, according to analysts, is due to the sharp decline in the economies of Austria and the Eastern European countries forecast by the regulator for the exercise.

Several investment banks also showed results that the market could interpret negatively, also taking into account that this kind of institution must have a greater capital buffer than other institutions.

The Italian bank UniCredit’s capital ratio would drop to 7.1% in 2018, while the capital ratios of Barclays would fall to 7.3%, Commerzbank to 7.42%, Société Générale to 7.5%, Deutsche Bank to 7.8% and RBS to 8.08%. The strong negative impact on these banks’ own funds is due to the fact that the EBA’s adverse scenario envisages high losses due to litigation and irregularities for these institutions.

This is evident in the case of Italy, the fourth largest country in the European Union and the one that presents the most weaknesses. Public debt exceeds 135% of GDP and its employment rate is among the worst in Europe. Amid this deflationary landscape, its banking sector is going through a profound crisis with clear overcapacity (more than 600 institutions) and a volume of problematic assets of around 300,000 million euros on banks’ balance sheets, equivalent to a fifth of GDP. Collectively, provisions have been recorded for scarcely 45% of this amount. In a best-case scenario, the weakest banks would hamper the growth of the Italian economy, and in the worst-case scenario, they would go bankrupt and, therefore, the reputation of the entire sector would be in question.

Although the results of the five banks included in the stress test were positive (and better than expected), there is a large number of Italian banks that have not been analysed, and the news to date on their restructuring process is worrisome and dangerous for the banking union.

The Italian bank reprimanded in the stress test, Monte dei Paschi, had previously submitted a restructuring plan comprised of a capital injection and the sale of problematic assets; whether this will happen in practice is yet to be seen.

Given the fall in the market valuation of Italian banks throughout the first half of 2016 (and taking into account that the stress test was conducted on the basis of 2015 data), according to the rules of the Banking Union and the European Bank Recovery and Resolution Directive (BRRD), if Italian banks fail to obtain sufficient capital from an appeal to the markets, their bondholders and shareholders would be the first in line to assume the costs on an adjustment, although the Italian Government opposes this.

Conclusions

Well managed stress tests should combine objectives to be met in the micro– and macroeconomic spheres, so that in the microeconomic sphere they limit idiosyncratic risk (potential bankruptcy of one individual institution), and in the macroeconomic sphere they reduce systemic risk (probability and costs of systemic instability for the entire European banking system).

Any criticism of a stress test is comparable to that made in relation to audit reports, but in both cases, it is better to make criticisms than to commit bigger errors arising from lack of information. Clearly, any improvement in data quality and the spectrum of risks covered is desirable, generating quantitative and qualitative returns for the banking sector.

As far as the banks are concerned, refusing to participate in stress tests and denying the publication of its results are both harmful tactics, because they could be misinterpreted as even worse. In any company, especially if it is listed, transparency is the basis of trust. Depositors and investors must know punctually and frequently the accounting and financial situation of each bank in order to trust and to support it with their investments and savings.

The distrust in the financial markets arises from the publication of other reports on the banking sector that warn of signs of alarm and exhaustion in banks’ business models and tensions in their income statements due to prolonged low interest rates. Furthermore, the heterogeneity across European banks as regards balance sheet composition, the rigour of risk management and the speed of the bank restructuring processes is also a source of concern; a distrust that is very much linked to the process of banking union.

A separate issue is the design of the specified methodology for extracting data from the banks analysed. The repetition of the exercises since their initiation in 2011 has meant that most of the indicators can be obtained directly by the EBA, a contribution from each bank only being necessary for a residual minority. This process allows greater autonomy for the European supervisor (ECB) and better performance of macroprudential work, so that liquidity, and its interaction with solvency and systemic risk, can be analysed.

With regard to the scenarios chosen for the simulations, which are always questionable, the adverse scenario envisages a higher number of shocks and is somewhat harsher than that of the three previous years, but it could also have been more so. However, the baseline scenario is perhaps too optimistic, especially when compared to other forecasts published in July for eurozone GDP, such as those of some banks (ABN Amro) or economic consensus itself (Kinmonth, 2016).

In addition, the importance of the publication of results is key because of its timing, since they are made public when there is negative market sentiment towards banks, and because it is the first publication since the ECB became the single European supervisor, showing adequate levels of capital requirements, incorporating results to its comprehensive scorecard, and sending a signal of transparency and responsibility and, therefore, of diligence and good work.

However, if the historical evolution of the stress tests conducted by the EBA since its creation is analysed, the balance is critical in that the number of banks analysed has fallen: since 2015, only the so-called “large banks” (70% of the sector) have been analysed, reducing the precision of the analysis.

Analysing the 123 institutions included in the 2014 stress test (with 10 fails and 14 partial non-compliances) using the parameters of the 2016 stress test, only one of them would be deemed below the minimum threshold and another with partial non-compliance, and so it seems that the sectoral situation has improved. However, financial markets appear to discount that institutions´ have been too slow to adjust (BIS, 2015) (as regards the speed of reducing the volume of NPLs or assets at risk of default).

However, the use of the stress test results, directly incorporated as input for the ESRB annual report as a support tool for macroprudential supervision, to safeguard financial stability and help construct the Banking Union is commendable.

In this connection, it seems clear that if progress is to be made towards Banking Union and restoring confidence in the banking sector, efforts must be redoubled to effectively penalise those European countries with financial institutions that are less transparent and less diligent in their restructuring processes. Otherwise, good news will be eclipsed by warning signs and all the efforts made to publicise the stress test results will not disseminate doubts about the sector, which can be severely damaging to a reputational-based business such as banking.

The publication of the stress tests results by the European Supervisor (ECB) is a good start, but banks’ income statements, strained by low interest rates, reveal that more swiftly executed, forceful disciplinary tools, such as Asset Management Companies (AMCs) or bad banks, or transnational mergers, will be needed, and with increasing urgency.

The 2016 stress test results have been favourable, but the warning signs show the need for further adjustments (taking into account individual viability, case by case) despite the considerable reduction in the number of institutions. Moreover, action is to be taken more swiftly if there is to be progress on Banking Union and the reputation of the sector and of the supervisor (ECB) is to be preserved. Otherwise, asymmetries may overshadow the goals already achieved.

A broader issue is the restoration of the banking sector’s reputation. The recent financial crisis has generated certain scepticism among market players with regard to the accuracy of banks’ accounting statements, not only in Europe, but also on the international level, which will require a continuous stream of good news, as well as numerous displays of rigour and exemplary conduct. The regular publication of results by the ECB is just one example of the degree of awareness of the European supervisory authorities of the seriousness of the situation, but the road is likely to be long.

References

BIS (2015), “Making supervisory stress tests more macroprudential: Considering liquidity and solvency interactions and systemic risk,”

WP nº 28, Basel Committee on Banking Supervision.

EBA and ECB (2016),

EU-Wide stress testing (

http://www.eba.europa.eu/risk-analysis-and-data/eu-wide-stress-testing/2016).

GIMÉNEZ, I. (2010), “El sector bancario y la crisis subprime,”

Revista análisis financiero, IEAF: 100-104.

— (2015),

Actividad bancaria, reestructuración, y creación de bancos malos: perspectiva histórica y desarrollos recientes en Europa, Universidad de Valencia, doctoral thesis.

KINMONTH, T. (2016), “Failure of bank stress tests?,”

ABN Amro Financials Watch, 26

th July.

PÉREZ, D., and C. TRUCHARTEe (2011), “Los ejercicios de estrés test: experiencia reciente y reflexiones sobre su futuro,” Bank of Spain,

Financial Stability Journal, 21: 65-82.

Isabel Giménez Zuriaga. General Manager of the Foundation for the StockMarket and Financial Studies