Spanish economic forecasts panel: November 2025*

Growth in 2025

2025 GDP growth is now forecast at 2.9%, up 0.3pp from the previous consensus

The preliminary third-quarter growth figure published by the INE, quarterly growth of 0.6%, was 0.1pp above the most recent Panel consensus forecast. That, coupled with the upward revision of the national accounts in the INE’s September statistical review, has prompted nearly all of the analysts to raise their projections for the year as a whole (with none lowering them).

The economic indicators to date point to ongoing strong momentum at the start of the fourth quarter, although the consensus forecast is for a slight slowdown, to 0.5%, unchanged from the last Panel (Table 2). This quarterly pattern leads to a forecast for growth of 2.9% for the year as a whole, which is 0.3pp above the previous consensus (Table 1).

Domestic demand is expected to contribute 3.3pp (up 0.4pp from the last Panel), while the external sector would detract 0.4pp (versus -0.3pp in September). The analysts have also raised their forecasts for investment (especially investment in machinery and equipment) and, to a lesser degree, household consumption. The forecasts for both exports and imports have been revised upwards, the latter by proportionately more (Table 1).

The analysts’ risk perception has shifted slightly since the last set of forecasts: whereas in the September survey, nine analysts believed the risks to the forecasts were balanced, with seven seeing more upside than downside and three perceiving more downside, this time around, 13 see the risks as balanced, with four perceiving more upside and just two thinking the downside risks outweigh the upside.

Growth in 2026

The projection for 2026 has been raised by 0.1pp to 2.1%

The majority of analysts have increased their forecasts for GDP growth in 2026, yielding a consensus forecast of 2.1% (+0.1pp from the last Panel). This figure remains slightly below the government’s forecast, is in line with AIReF’s estimate and is more optimistic than other organisations, including the Bank of Spain and the IMF (Table 1). Growth is forecast at around 0.5% each quarter in 2026, which is unchanged from the September survey (Table 2). Therefore, the upward revision for 2026 stems from a stronger carryover effect derived from the highest forecast for 2025.

Domestic demand is expected to contribute 2.3pp to next year’s growth (+0.2pp from the last Panel), with the external sector eroding that growth by 0.2pp (vs. -0.1pp in September). Investment and household consumption are expected to grow by less than in 2025, with public expenditure making a similar contribution. Imports are expected to grow by more than exports, as in 2025 (Table 1).

Inflation

Higher inflation expectations

The headline rate of inflation has ticked higher in recent months, reaching 3.1% year-on-year in October, reflecting the trend in energy prices and, to a lesser extent, food prices. Core inflation has also edged higher. In general, food products and services continue to register stubbornly high rates of inflation.

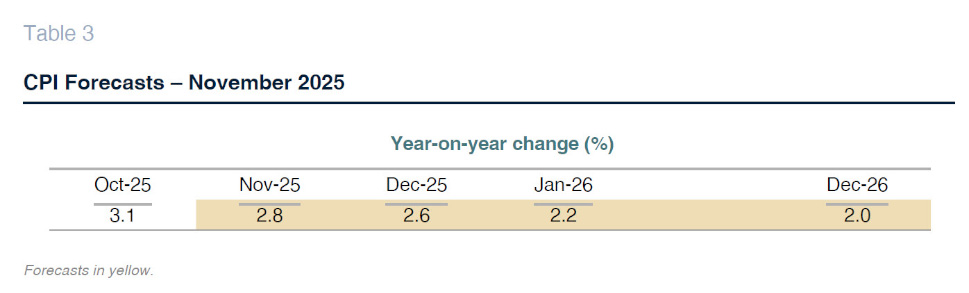

Headline inflation is expected to ease over the remainder of the year, to end in December at 2.6%. The consensus forecast for the annual average rates in 2025 are 2.6% for headline inflation (+0.1pp from the last Panel) and 2.3% for core inflation. For 2026, the average annual forecast is 2.1% for headline inflation and 2.2% for core inflation (both up 0.1pp from the September survey), with a year-on-year of 2% in December (Tables 1 and 3).

Labor market

Unemployment would dip to 10% in 2026

According to the Labour Force Survey (LFS), employment, adjusting for seasonality, grew by less in the third quarter than in the four preceding quarters. The unemployment rate increased by 0.2pp by comparison with the second quarter, which is nevertheless 0.7pp below the year-earlier figure. Elsewhere, Social Security contributors were more dynamic than gleaned from the LFS, depicting growth in line with previous quarters. Since then, the October figure was similarly healthy.

As a result, employment is currently forecast to increase by 2.4% this year and by a further 1.7% in 2026, with both forecasts marking an improvement of 0.1pp from September. The unemployment rate is expected to come down to 10.5% this year and to 10% in 2026, 0.1pp and 0.2pp better than forecast in the last Panel, respectively (Table 1).

Productivity and unit labour costs (ULCs) are calculated from the GDP forecasts, employee compensation and employment in LFS terms. The former is forecast to grow by 0.5% in 2025 and 0.4% in 2026, while ULCs are expected to increase by 2.9% this year and by 2.6% next year.

Balance of payments

Momentum in the balance of trade in services is largely offsetting the deterioration in the goods deficit

The current account surplus to August stood at 35.98 billion euros, which is the second best performance on record at this juncture of the year. That figure is just 5.4% below the surplus observed by August of last year, thanks to the fact that the increase in the goods deficit was almost entirely offset by the growth in the services trade surplus and, to a lesser extent, the reduction in the deficit in the primary and secondary income accounts.

Spain’s current account surplus is currently forecast at 2.6% this year and 2.4% in 2026, up 0.1pp from the consensus September figures in both instances (Table 1).

Public deficit

More favourable prospects for the public deficit in 2025 and 2026

The fiscal deficit, excluding local authorities, amounted to 27.48 billion euros in the first eight months of 2025, compared to 34.13 billion euros in the same period of 2024. Discounting the expenditure associated with last autumn’s flash flooding, the deficit would have decreased by 30% year-on-year. Growth in tax revenue has accelerated year-on-year, in part due to the elimination of certain tax relief introduced in prior years to tackle the fallout from the surge in inflation.

The current consensus forecast is that Spain’s public deficit, at all levels of government, will come down by more than was expected in September, to 2.7% and 2.6% of GDP in 2025 and 2026, respectively. Note that these figures point to a higher deficit than is currently being forecast by the Bank of Spain or AIReF (Table 1).

International context

Despite a better than expected firsth half, the outlook for the global economy remains uncertain

So far this year, the global economy has performed better than expected in light of the tariff onslaught set in motion by the U.S. In its autumn round, the WTO revised its global trade outlook for this year significantly higher, to 2.4%, compared to 0.9% back in the spring. The change is attributable partly to the front-loading of trade during the first half of the year, fuelled by the prospect of sharply higher tariffs and more stringent customs barriers. Another mitigating factor has been the conclusion of trade agreements with less punitive tariffs than contemplated in the most alarmist scenarios.

Similarly, the IMF has increased its forecast for global GDP growth this year slightly higher, to 3.2%, up 0.2pp from its previous projections. However, the uncertainties have not dissipated, as the trade restrictions have not yet had time to fully trickle through to the economy. Meanwhile, volatility is increasing once again in the financial markets due to the fear of a bubble in the tech sector, on the one hand, and public debt sustainability doubts, on the other.

Against this backdrop, the eurozone economy remains sluggish, with third-quarter GDP growth coming in at a meagre 0.2%. For 2026, the IMF is expecting the bloc’s economy to remain weak, growing by 1.1% (down 0.1pp from this year), which is half of the growth forecast for the U.S.

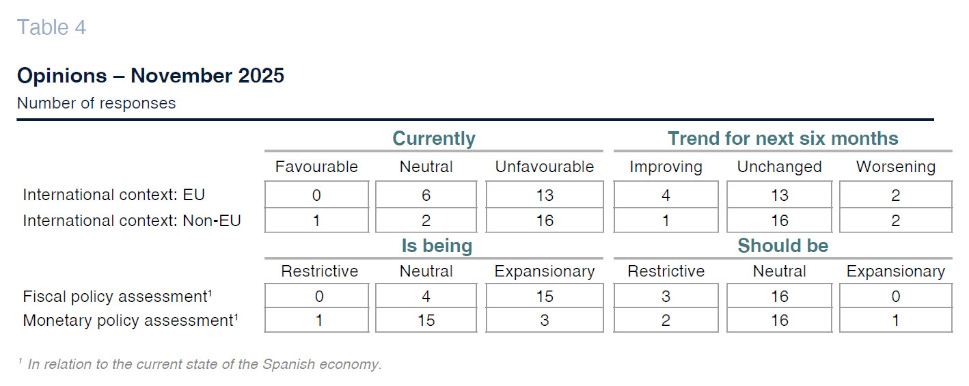

All of this explains the pessimism expressed by the analysts when asked to appraise the international context (Table 4). Thirteen of them currently believe that the international environment is unfavourable for the EU, with that figure rising to 16 when asked about the situation outside the EU (both assessments largely unchanged from the September Panel). Moreover, the majority believes that the international context, both within the EU and beyond, will continue to be marked by uncertainty in the coming months.

Interest rates

Higher forecast fot Euribor

Although growth in Europe remains scant, inflation is proving sticky at around 2%, with core inflation actually above that benchmark. The persistence of low unemployment rates could be contributing to anchor inflation expectations, keeping the ECB cautious and pushing out the prospect of new rate cuts. The Federal Reserve’s cautiousness, meanwhile, appears even more justified considering the time lag between the imposition of tariffs on imported products and their pass-through to the end prices paid by consumers, a development that could curb the extent of the easing expected by markets.

As a result, the ECB is expected to keep its main rates at current levels for the time being. The consensus forecast is that the deposit facility rate will stay at 2% until the end of the forecast horizon, which is a quarter point higher than in the previous consensus (Table 2). In line with these forecasts, Euribor is expected to come down only very slightly from current levels, and is projected at 2.05% by the end of 2026, which is 15 basis points above the last Panel.

The long-term sovereign debt markets continue to trade significantly above the interest rate levels observed at the shorter maturities, reflecting in part the prospect of massive public debt issuance volumes worldwide in the coming years. The consensus forecast is that the yield on the 10-year Spanish bond will range between 3.2% and 3.3% until the end of next year, which is similar to the levels forecast in September (Table 2).

Currency market

Slight appreciation of the dollar against the euro

The dollar has won back a small part of the ground lost since the start of the year, in line with the perception prevailing in markets that growth in the U.S. is relatively robust, in contrast to European economic weakness. Nevertheless, the analysts believe that portfolio adjustments could exert slight upward pressure on the single currency, especially if the Federal Reserve cuts its rates by more than the ECB. The analysts are projecting an exchange rate of $1.18 against the euro for year-end 2026, unchanged from the September Panel (Table 2).

*

The Spanish Economic Forecast Panel is a survey conducted by Funcas among the 19 analysis services listed in Table 1. The survey, which has been conducted since 1999, is published every two months in January, March, May, July, September, and November. Based on the responses to this survey, “consensus” forecasts are provided, which are calculated as the arithmetic mean of the 19 individual forecasts. For comparison purposes, although not part of the consensus, the forecasts of the Government, AIReF, the Bank of Spain, and the main international organizations are also presented.