Spanish banks: Renewed strength and credibility in wholesale markets

Spanish banks have cemented their status as consistent and credible issuers in wholesale markets, reflecting stronger fundamentals and investor confidence, with lower spreads and broader participation marking a new phase of stability for the sector. However, continued reliance on wholesale funding underscores the importance of maintaining high profitability and resilient balance sheets in an environment of still-elevated rates and evolving regulation.

Abstract: Spanish banks have become increasingly active and reliable players in fixed-income markets, consolidating the progress achieved since the financial crisis. Recent issuance patterns show that refinancing operations and regulatory adaptation, particularly to meet MREL requirements, have replaced the liquidity-driven issuance of previous years. The funding mix has shifted decisively toward unsecured instruments, signaling both restored market trust and improved capitalization. Smaller and medium-sized institutions have also expanded their footprint, achieving a level of market access that was previously reserved for the largest entities. The decline in spreads across senior and subordinated debt confirms the sector’s regained credibility, though continued reliance on wholesale funding underscores the importance of maintaining high profitability and resilient balance sheets in an environment of still-elevated rates and evolving regulation.

Spanish banks’ recurring presence as fixed-income issuers

The issuance of fixed-income securities in the wholesale markets has become a common and recurring practice in the Spanish banking sector over the past 10-plus years. This process coincided with the rollout of the Single Supervisory Mechanism, injecting renewed credibility into the wholesale markets, which had been shut down by the severe financial crisis.

The banks’ systematic presence as debt market issuers has been conducive to the development of a highly agile and proactive management approach aligned with both the entities’ needs under their regulatory compliance schedules (particularly the gradual implementation of the Minimum Requirement for Own Funds and Eligible Liabilities, or MREL) and unfolding market conditions. This has translated into constant fine-tuning of the most suitable combination of instruments and maturities, as well as the participation of a growing number of issuers, particularly smaller-sized issuers, marking a departure from the predominance of the larger entities in the initial years of the banking union.

To illustrate that proactive management and market adaptiveness, we take the period from 2020 to 2025, which is marked by three distinct phrases comprising a full cycle in terms of both benchmark rates and the specific terms and conditions applied to the banks by the markets.

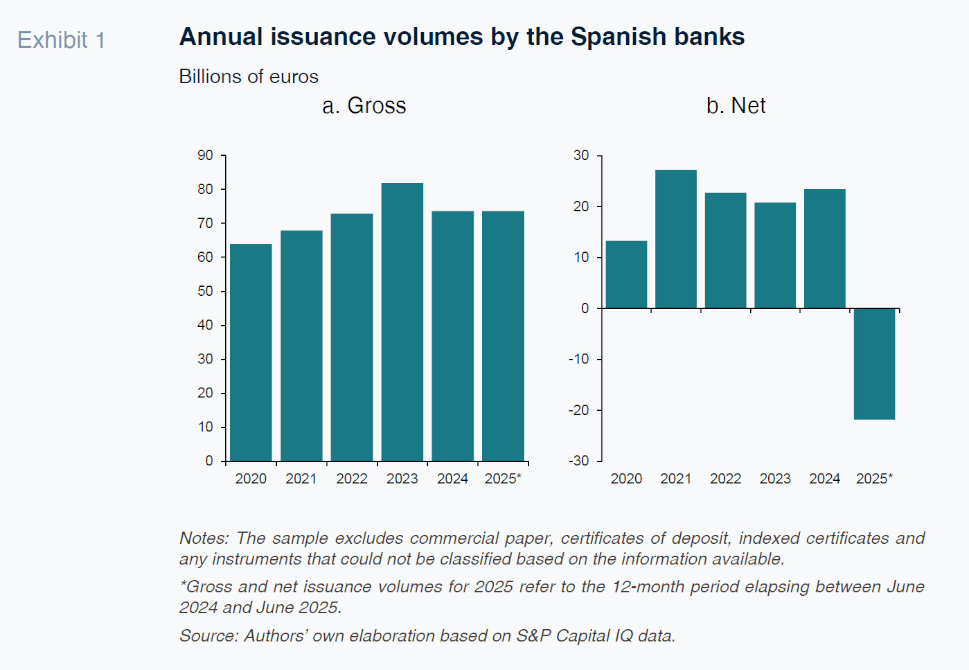

Exhibit 1a shows how the Spanish banks have issued fixed-income instruments very intensely during the period analysed, within a range of between 64 and 82 billion euros, with peak issuance taking place in 2023. [1] This gross issuance volume contrasts with the net volume, which is far smaller, at around 13 to 27 billion euros per year, with the net balance even turning negative in the last 12 months (Exhibit 1b). The marked difference between the two metrics reflects the significant volume of debt falling due and the banks’ active refinancing policies.

This refinancing effort is particularly pronounced in the case of the so-called CoCos, or additional Tier 1 instruments (AT1). CoCos do not have explicit maturity dates; rather, the issuer has a series of call windows. The market considers it a very good sign when an issuer exercises those call options insofar as it denotes good issuer health.

Regardless, whether exercising CoCo call options or refinancing other debt instruments as they fall due or in the form of prepayments, the significant volume of gross issuance relative to net issuance (a ratio of roughly three to one) evidences the markedly proactive approach taken by the banks. The issuers have therefore been tapping the markets on a recurring basis, helping to keep a permanent line of supply and liquidity open and, more importantly, staying constantly exposed to market scrutiny.

Issuer dynamics: Breakdown by instruments, issuers and maturities

Within the Spanish banks’ recurring presence in the primary markets, there is considerable variety in terms of the types of instruments issued, maturities and the profiles of the issuers coming to market.

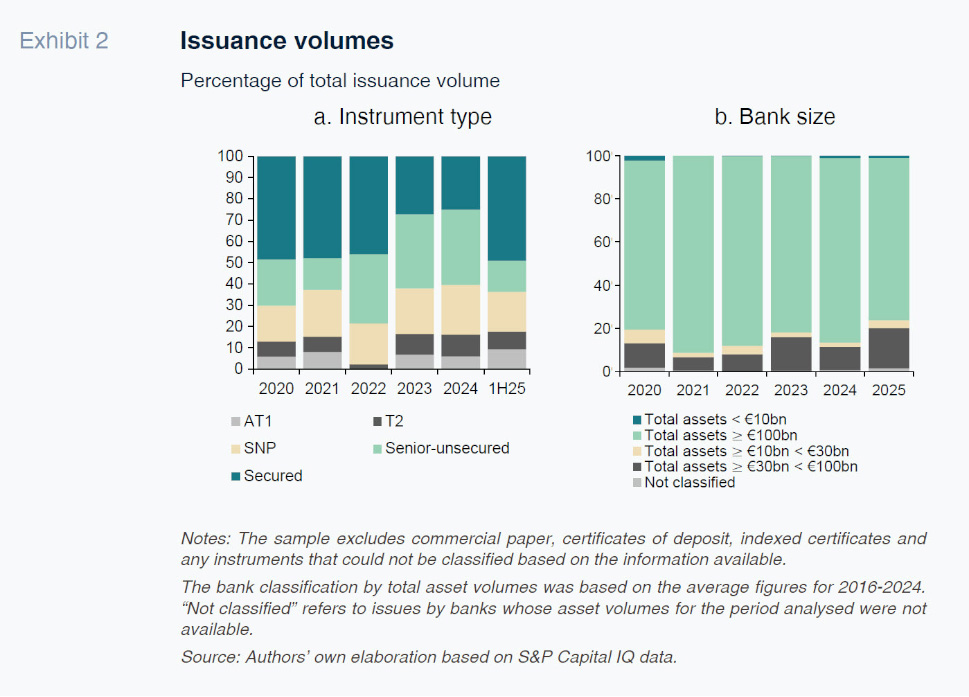

In terms of instrument type, we have seen a shift from clearcut predominance of secured paper, which accounted for around 75% of issuance volumes during the first few years of the banking union and 50% in 2020-2022, to a more prominent share of unsecured paper. In 2024, secured issues accounted for a mere 25% of the total (Exhibit 2a). This transition has been shaped by the entities’ need to issue instruments eligible for MREL calculation purposes, a mandatory requirement

[2] for the European credit institutions since 1 January 2024.

Elsewhere, there was a considerable drop in the share of hybrid or more subordinated instruments (AT1 and Tier 2) in 2022, which is when rate tightening began. That new rate paradigm pushed up the cost of issuing these instruments, with investors demanding higher coupons in exchange for the risk assumed on account of their reduced protection and loss-absorption function. The markets for these subordinated instruments (AT1 and Tier 2) were initially hit following the crisis associated with Credit Suisse and other regional bank failures in the US in March 2023; however, they went on to gradually reopen that year and throughout 2024, when the volume of AT1 instruments issued accounted for 3% of the total, with Tier 2 instruments representing 15%. The first half of 2025 was characterised by an increase in the volume of AT1 instruments issued, of 16% year-on-year, implying growth in their share of the total issuance mix to 6% (Exhibit 2a).

As for issuers, in recent years the market has been characterised by the gradual incorporation of smaller-sized banks, particularly mid-sized banks (between 30 and 100 billion euros of assets). This trend consolidated during the first half of 2025, when mid-size banks accounted for 19% of total issuance volumes, with the cohort of banks with under 100 billion euros of assets representing 25% of the total (Exhibit 2b).

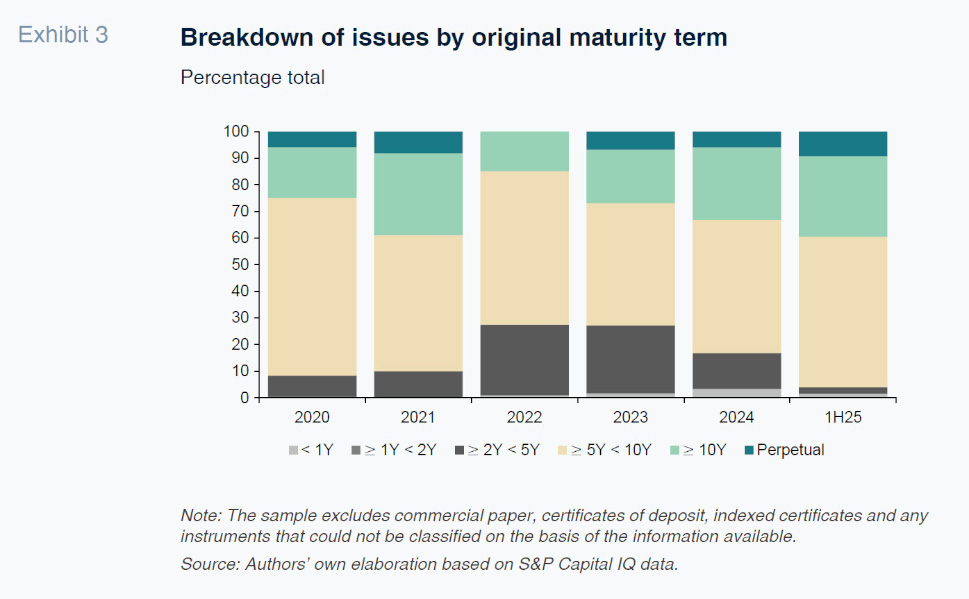

Analysing the issues by their original maturities, we see that in 2022 and 2023, the weight of longer-dated paper (≥ 5 years) decreased by comparison with 2020, in parallel with an increase in the share of shorter-dated paper (between 2 and 5 years), as rising rates prompted the banks to try and minimise their borrowing costs (Exhibit 3). With the reduction in borrowing costs in 2024, this trend reversed, with the share of longer-date issues increasing once again.

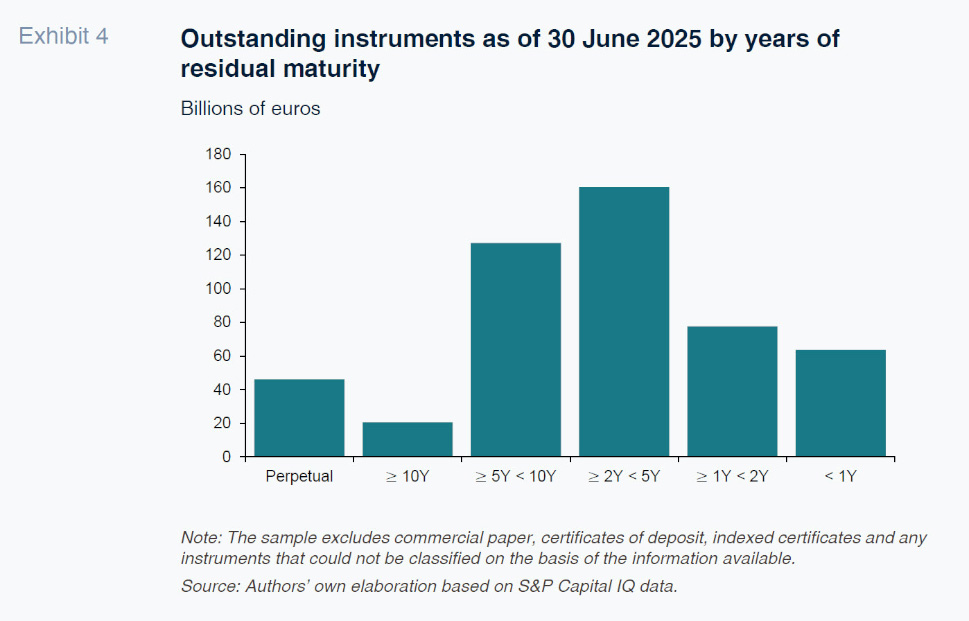

In the first half of 2025, this preference for longer-dated paper intensified, in keeping with the environment of lower coupons and an absence of any particular pressure at the long end of the curve. More specifically, the weights of instruments maturing between 5 and 10 years and those falling due in more than 10 years both increased and there was an uptick in perpetual bonds. In tandem, the issuance of paper due within 2 to 5 years decreased, as did that dated less than one year, albeit by proportionately less. This trend suggests that the banks are taking advantage of the current favourable borrowing terms and conditions to lock in costs for the long term out of concern that geopolitical and trade-related uncertainty could potentially push rates higher. This pattern may also be related with a financial structure management strategy, particularly considering that 61% of the outstanding balance falls due within the next five years, with 87% doing so before 2035, increasing the medium-term refinancing requirement (Exhibit 4).

Issuance costs: Falling spreads

The cost of these issues is closely correlated to the trend in benchmark rates (interbank rates for short-term paper and the public debt markets in the case of long-dated paper), so that financing costs have been cyclical: very low in 2020-2021, considerably higher in 2022-2023 and lower once again in 2024-2025.

Aside from the trend associated with the movements in benchmark rates, it is worth highlighting a reduction in spreads along three dimensions: (i) relative to sovereign bonds; (ii) relative to secured issues; and (iii) between larger- and smaller-sized issuers.

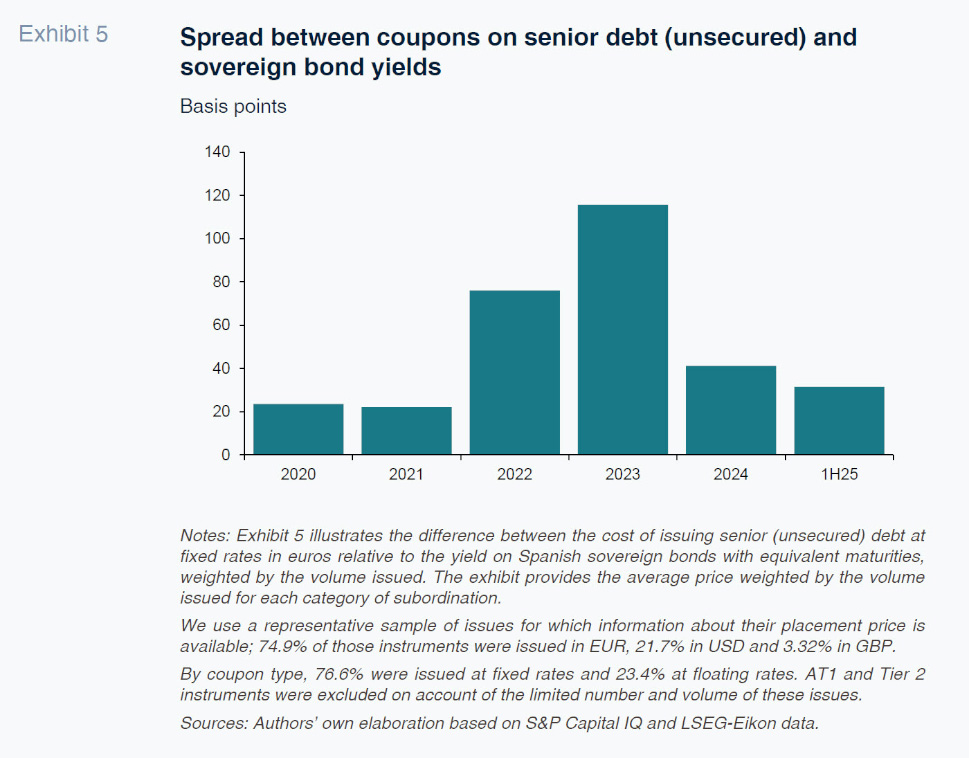

Firstly, the spread between bank bonds (specifically unsecured paper) and Spanish sovereign bonds has decreased considerably since 2024 to around 30 basis points in the first half of 2025, which is down 84 basis points from 2023 (Exhibit 5).

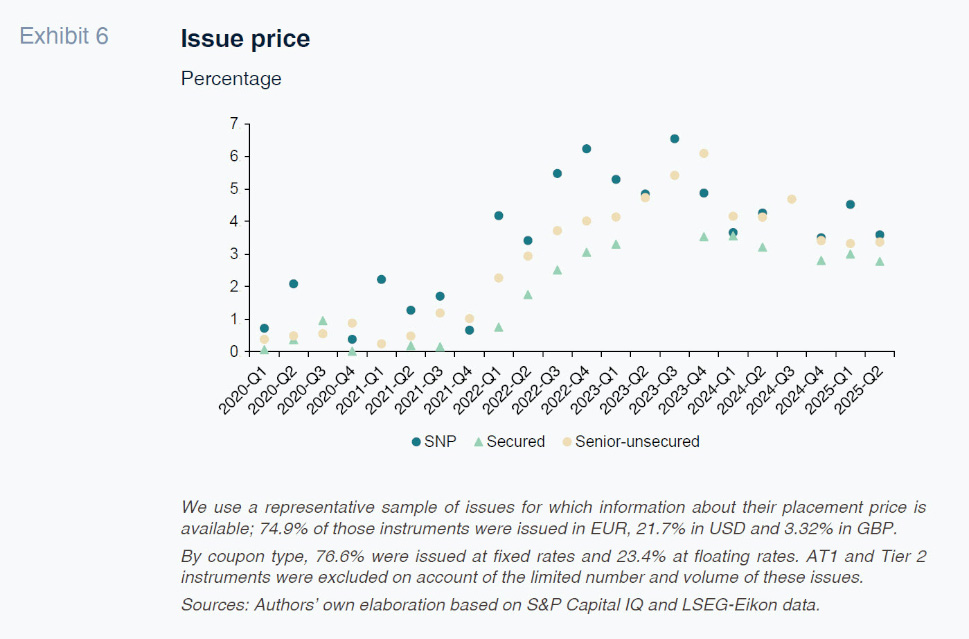

Secondly, within the debt issued by the banks, there has been a noteworthy reduction in the spread between secured and unsecured paper (Exhibit 6), reflecting a clear recovery in confidence in the solvency and creditworthiness of the Spanish banks.

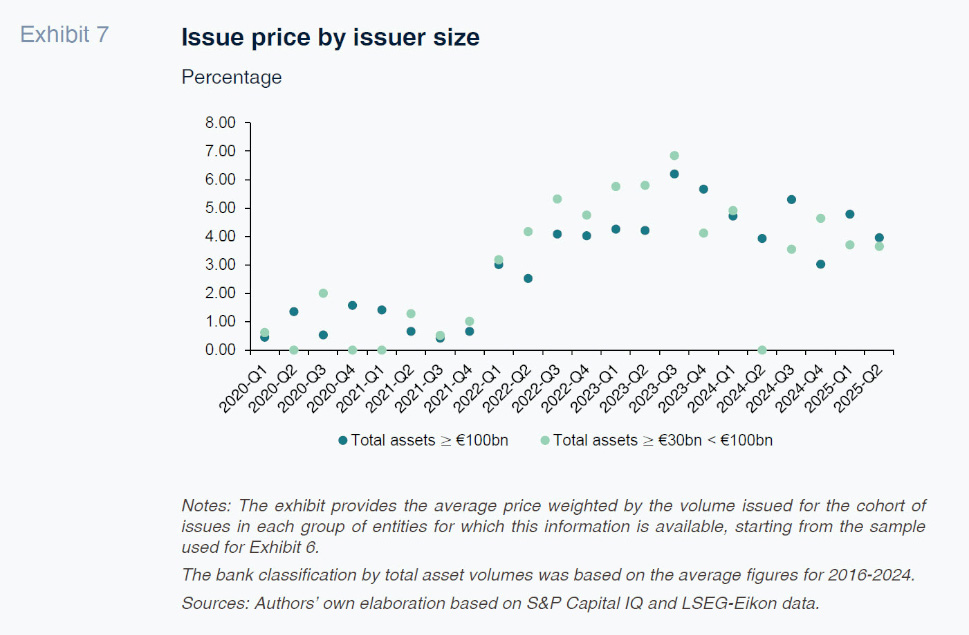

This improvement in how the debt markets perceive bank risk has also extended to a growing number of entities, notably including smaller-sized banks. As seen in Exhibit 7, the spread between the coupons obtained by larger-sized entities (assets of > 100 billion euros) relative to those of medium-sized issuers (30 to 100 billion euros), which peaked when interest rates were at their highest, has corrected substantially, illustrating how the improvement in perceived bank risk has been widespread across all bank sizes.

Conclusions

Albeit with variations around the types of instruments issued, the maturities of the paper issued and issuer size, over the last five years, the Spanish banks have had a significant and recurring presence in the wholesale debt markets, with gross issuance volumes tripling net volumes. This recurrence, coupled with constant exposure to market scrutiny (as well as the robust improvement in the Spanish banks’ fundamentals), has undoubtedly helped boost market appetite for these issues.

The upshot has been a reduction in spreads along three dimensions: (i) between bank and sovereign bonds; (ii) between secured and unsecured paper; and (iii) between the spreads paid by medium-sized issuers relative to their larger counterparts.

Notes

Note that the 2025 figures correspond to the 12-month period elapsing between June 2024 and June 2025 in order to maintain like time intervals.

Except for limited instances under the scope of article 12, paragraphs 1 and 7 of Regulation (EU) No. 806/2014.

Ángel Berges, Lucía Ibáñez and María Rodríguez. Afi