Assessment of support schemes promoting renewable energy in Spain

Spain´s 2013 reform of the renewable energy support mechanism was essential to reducing the tariff deficit, which arose as a consequence of shortfalls in the previous subsidy regime. However, the new support mechanism inherent to the post-reform regime is already increasing investor uncertainty, and endangering Spain´s ability to meet EU renewable energy installed capacity and output targets.

Abstract: As part of an effort to comply with EU renewable energy targets, Spain has relied on various renewable energy support mechanisms over the last few decades. From 1998-2013, Spain essentially used various versions of the feed-in-tariff (FIT) to successfully promote renewable energy installed capacity and generation, in line with EU objectives. By 2013, the overly generous FIT regime had overstimulated investment and resulted in a large electricity sector deficit. With a view towards fiscal consolidation, the government undertook a necessary reform of the subsidy regime, replacing FIT with compensation based on obtaining a reasonable return for the project. While the new regime put into place in 2013 was an improvement as regards financial sustainability, its interventionist and discretionary character is generating significant investor uncertainty, possibly hindering compliance with the goals of the EU Renewable Energy Directive going forward.

Renewable energy has become one of the main tools to combat global warning. To promote it, countries have been using support mechanisms aiming to cover the differences in cost between renewable and conventional power plants. Spain used various versions of the feed-in tariff (FIT) system between 1998 and 2013. However, in 2013, constrained by a burgeoning deficit, the government switched over to a compensation system that tops up market income to ensure a reasonable return on “standardised” renewable facilities. This article describes both systems of incentives, analyses the effects of the former system on installed capacity, energy output, and the cost of support, and studies the features of the new mechanism. While FIT has been highly effective but somewhat inefficient, the new mechanism should ensure the financial sustainability of the system but likely at the cost of reduced effectiveness. This may put compliance with EU directives on renewables at risk if additional incentives are not introduced.

Introduction

Renewable energy has become one of the main tools countries are using to cut their greenhouse gas (GHG) emissions, which climate scientists regard as being one of the main drivers of global warming. To stimulate investment in these technologies and accelerate their development, governments have been using support mechanisms geared towards covering the differences in cost between renewable plants and conventional, fossil fuel plants.

The success of these promotion programmes can be seen from the spectacular increase in installed renewable energy (RE) capacity in recent years, and the growing share in energy production from renewable energy sources (RES). Worldwide renewable capacity has risen from 880 GW in 2004 to 1,712 GW in 2014, when it accounted for 58.5% of new installed capacity, and allowed 22.8% of electricity generated that year to be from renewable sources (REN21, 2015). Additionally, investment in renewables mobilised a flow of approximately 270 billion euros in 2014 (not counting large hydroelectric projects) (REN21, 2015; IEA, 2014).

However, these promotion policies have often suffered from serious errors of design and implementation. Firstly, because the incentives were not linked to any emission-reduction indicators, and only their effects on the volume of investment was considered. Secondly, because insufficient attention was paid to the risk of creating speculative bubbles in the investment process, due to the high returns on some renewable projects, as a consequence of the generous public subsidies granted, exceeding that on alternative investments by a wide margin.

[1]

In Spain’s case, renewable energy promotion policies allowed installed renewable capacity to rise by more than 200% between 1990 and 2014, from 15,662 MW to 50,017 MW. The percentage of primary energy consumption from renewable sources rose from 7% in 1990 to 14.6% in 2014, and the production of electricity from renewable facilities came to account for 41.4% of total net output in 2014, compared with 18% in 1990. These policies also made it possible to reduce the amount of electricity generated using fossil fuels, avoiding atmospheric emissions of close to 300 million tonnes of CO2 (APPA, 2015). But, at the same time, subsidies for renewable projects have grown enormously, reaching a cumulative figure of over 43 billion euros in 2014. This support, together with overcompensation to certain utilities, such as nuclear and large hydro power generators (European Commission, 2012), resulted in a deficit in the electricity sector of over 40 billion euros in the period 2000-2014. Therefore, in 2013, constrained by the tariff deficit, the Spanish government modified the renewable energy promotion mechanism to switch from a feed-in tariff (FIT) system to one based on compensation to cover the cost of “standardised” renewable plants, and allow them to obtain a “reasonable” return, equivalent to that on ten-year government bonds plus 300 basis points.

This article describes the incentive systems employed in Spain to promote renewable energy, both old and new, analyses the effects of the former mechanism on installed capacity, the technology mix, energy production, and the cost of the support given, and studies the main features of the new mechanism. It highlights how the specific design of FIT used over the period 1998-2013 was more effective at promoting investments, but too generous in its payments for certain technologies, leading to peaks in investment that undermined the system’s financial stability. Moreover, the mechanism lacked instruments with which to update and revise the subsidies depending on each technology’s learning curve, the installed renewable capacity, and the overall volume of support provided. The new support mechanism implemented in 2013 substantially improves financial sustainability and enhances efficiency somewhat by periodically updating the compensation granted. However, it rests on a technically complex procedure, which is highly interventionist and somewhat lacking in transparency. This results in considerable uncertainty among investors, which may reduce the mechanism’s effectiveness and jeopardise the achievement of the stated renewable targets.

There is extensive international literature analysing how renewable energy support mechanisms operate (Konidari and Mavrakis, 2007; Ragwitz et al., 2007; Held, et al., 2014). There is also a long list of studies looking at the characteristics and impacts of FIT used in Spain (see, for example, Río, 2008; Sáenz de Miera et al., 2008; Costa and Trujillo, 2014; Ciarreta et al., 2014; Río and Mir-Artigues, 2014). The aim of this article is firstly to complement the foregoing research into the FIT system applied in Spain using more up-to-date information, and secondly, to assess quantitatively the characteristics of the new incentive mechanism.

The article is structured as follows. The next section presents the renewable energy objectives for Spain over the period 2000-2020 deriving from European Directives and national energy plans. Then, it describes the renewable energy promotion policies in place since 1998 to achieve the proposed objectives. Subsequently, it analyses the effects of the policies implemented in the period 1998-2013 regarding installed capacity, electricity production, and the cost of subsidies. What follows is an examination of the possible effects of the new promotion instrument put in place with the 2013 reform. Finally, the last section presents the study’s conclusions.

Renewable energy objectives for Spain

The renewable energy objectives for Spain have been shaped by community policy on renewable energy, which began with the publication in 1997 of the white paper on renewable energy sources entitled: Energy for the future: Renewable Energy Sources (European Commission, 1997). This document was the basis for Directive 2001/77/EC on the promotion of electricity produced from renewable energy sources in the internal electricity market. This Directive set an overall target for electricity from RES in the EU of 21% of total gross electricity consumption by 2010 with individual indicative targets for Member States. In Spain’s case, this was 29.4%. Member States were allowed to choose their support system themselves. For its part, Directive 2003/30/EC on the promotion of the use of biofuels or other renewable fuels for transport established indicative targets for the EU of 2% at the end of 2005, and 5.75% at the end of 2010.

Subsequently, Directive 2009/28/EC, amending Directives 2001/77/EC and 2003/30/EC, implemented a common framework to promote energy from renewable sources and set compulsory national targets for 2020 in relation to the share of energy from renewable sources in final gross energy consumption (20%) and the share of energy from renewable sources in transport (10%).

[2] The national targets for 2020 were set based on each country’s starting point and its renewable energy generation potential. For Spain the target is for 20% of the energy consumed in 2020 to be from renewable sources. At the same time, Directive 2009/28/EC also proposed an indicative trajectory for the share of renewables in gross final energy consumption up to 2020 for each Member State. Table 1 shows the indicative trajectory for Spain as biennial averages over the period 2011-2020.

European policy on renewable energy and climate change was subsequently expanded with the publication of a roadmap defining the stages on the way to achieving emissions reductions from 1990 levels of 40% in 2030, 60% in 2040, and at least 80% in 2050 (European Commission, 2011).

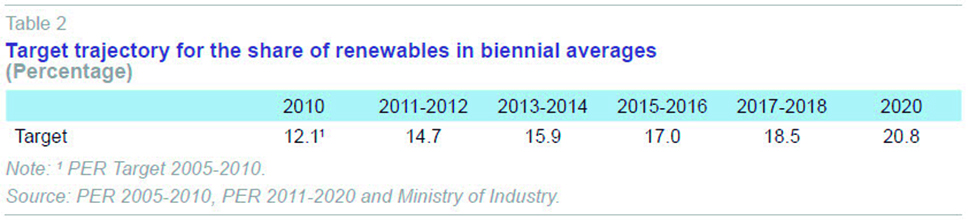

With a view to complying with European Directives, the Spanish authorities drew up three plans which have set the targets for renewable energy across the various periods and sectors, and the amount of the planned subsidies to achieve them. In 1999 the Renewable Energy Promotion Plan (PFER 1999-2010) was enacted. This was substituted in 2005 by the Renewable Energy Plan (PER 2005-2010) to comply with the objectives set for 2010. In 2011 a new Renewable Energy Plan (PER 2011-2020) was enacted, which is currently in force, setting targets in line with Directive 2009/28/EC. This plan is based on the Renewable Energy National Action Pla++n (PANER), which the government drew up in 2010 to comply with the requirements of Directive 2009/28/EC. Table 2 shows the target trajectory for renewables as a share of gross energy consumption proposed for Spain by PER 2011-2020. This is slightly less ambitious than the EU Directive’s indicative trajectory and the target for 2010 set by PER 2005-2010.

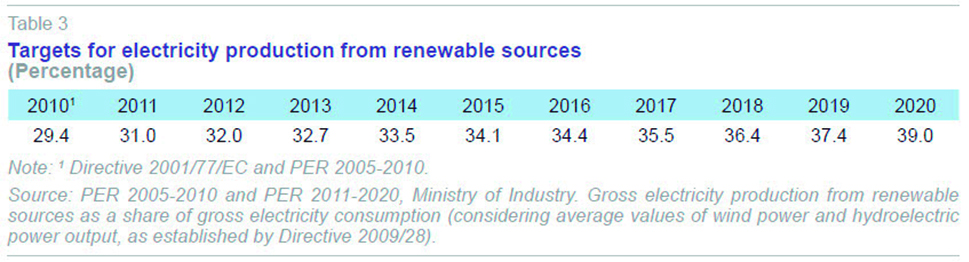

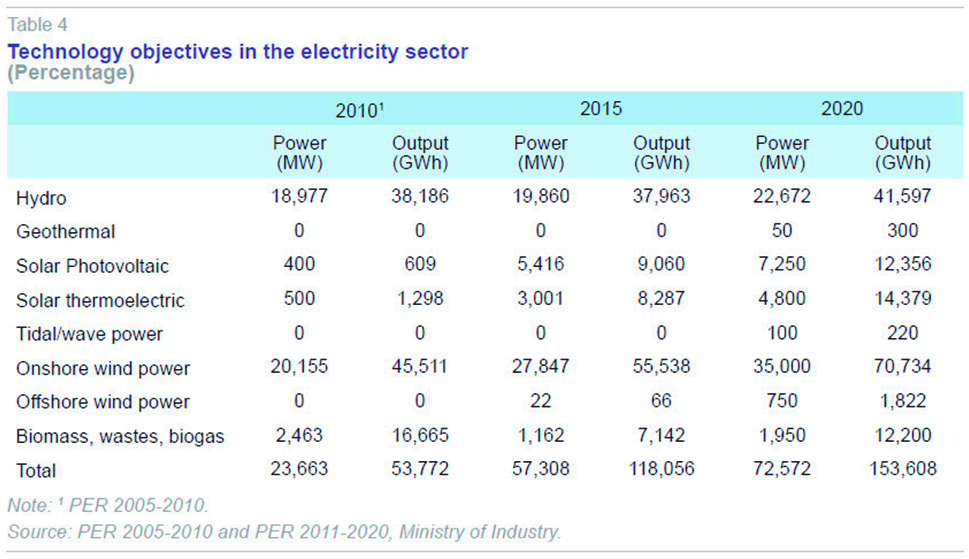

In the specific case of the electricity sector, Table 3 shows the renewable energy production targets, and Table 4 the installed capacity and energy generation targets for the various different renewable energy technologies over the period 2010-2020. The proposal of PER 2011-2020 was that by 2020 39% of gross electricity consumption should be supplied from renewable sources, with an installed capacity of over 70,000 MW. This is to be distributed such that 48% is from onshore wind power, 31% hydraulic power, 17% solar, and the remaining 4% from the various other renewable sources.

Instruments to support renewable energy in Spain

1998-2013

Although there were various versions, and changes were made during the period, the main instrument used to support renewable energy in Spain from 1998 to 2013 was based on premiums and tariffs for renewable energy, applying the feed-in tariff mechanism. In particular, renewable facilities had two ways of selling their electricity, which shaped the way in which it was paid for. The first option was to sell directly to the market obtaining market price plus a regulated supplement (feed-in premium, FIP). Alternatively, producers could sell to a distributor for a regulated tariff per kWh produced (feed-in tariff, FIT). This type of intervention instrument set the price and left the market to determine the quantity. Moreover, the payment facilities received depended on their actual production.

At the structural level, premiums and tariffs varied with technology and plant size, and were independent of plant location. Remuneration followed a continuously upward trend: first it was updated by government decision R.D. 2018/1998, then the reference tariff was updated (R.D. 436/2004), subsequently it was linked to the CPI (R.D. 661/2007), and finally, based on the underlying CPI at constant taxes (as of R.D. Law 2/2013).

In all the forms of the support instrument used in Spain up until the 2013 reform, the level of remuneration was determined in a centralised manner following the principles of Law 54/1997 on the Electricity Sector, with a view to guaranteeing the owners of renewable energy facilities a reasonable return on their investment. Remuneration was reviewed at intervals (generally every four years) to factor in the lower cost of the technology as knowledge was acquired and as the technology developed, although this was not conditional on the level of cumulative investment. Only in R.D. 1578/2008, which set a new compensation framework for PV installations, a pre-established rule was introduced revising tariffs based on pre-registered power and the power quota established by the regulator. Electricity consumers financed this tariff support, which formed part of the regulated costs of the system under the name of premiums. Renewable facilities have always been given priority in grid access.

Reform to the incentive mechanism

In 2013, with a new political party in government and pressure from the European Commission to reduce the public deficit, a thorough reform of the legal and economic system applicable to facilities generating power from renewable sources was embarked upon in order to guarantee facilities a reasonable return and ensure the financial sustainability of the electricity system.

The reform began with the promulgation of Royal Decree-Law 9/2013 of July 12th, 2013, abandoning the feed-in tariff incentive model, which remunerated the amount of electricity generated (via premiums), in favour of a compensation system that allows the costs necessary for renewable plants to compete in the market on an equal footing with other technologies, and obtain a reasonable return on the project as a whole. Specifically, a reasonable return on a project was defined as being approximately the average return on ten-year government bonds on the secondary market incremented by an appropriate spread for the investment.

Subsequently, Law 24/2013, regulating the electricity sector, was passed, substituting for Law 54/2007, and incorporating new operating and financing conditions for renewable energy sources. Firstly, it eliminated the special system such that all plants, whether renewable or not, came under the same regulations. Secondly, it established that the compensation facilities received should be equal to their income from the market plus specifically regulated remuneration sufficient to cover their costs and ensure a reasonable return.

To determine the specific remuneration for each plant, according to its characteristics in terms of power output, technology and age, a standard facility type is assigned, defined by a series of remuneration parameters calculated taking an efficient and well-managed company as the reference. These parameters make it possible to calculate the income from the sale of energy, valued at market price, operating costs, and the value of the initial investment. The specific remuneration comprises two terms: one, per unit of installed capacity, to cover the investment cost that cannot be recouped from the sale of power on the market (return on investment); and a second to cover the difference between the operating costs and income from participation in the market (remuneration for operations). At the end of their regulatory lifetime, facilities cease to earn specific remuneration. Moreover, if facilities achieve a reasonable return during their regulatory lifetime, they will receive no remuneration for the investment, although they will still continue to receive remuneration for operations during their regulatory lifetime. New renewable facilities will access the specific remuneration system by means of a competitive process in which the initial value of the investment will be determined. Moreover, bids from renewable energy plants will have dispatch priority in the market on equal economic conditions.

The parameters determine the value of the relevant variables for each standard facility type, such as initial investment, average annual price in the daily and intraday market, number of hours of operation, regulatory lifetime, rate of return, and operating costs.

[3] These parameters in general, and the remuneration derived from them, will be reviewed every six years, except the initial value of the investment and project lifetime. There will also be an interim review of these values every three years, except in the case of operating costs, which depend on the price of fuel, which will be reviewed annually. The level of remuneration is set so that operators earn a return equivalent to ten-year government bonds plus an adequate spread, which will be 300 basis points during the first regulatory period for facilities existing when RD 9/2013 came into effect (until December 2019). Standard facility types are differentiated by technology, size and climatic zone.

The value of this remuneration is set within upper and lower bounds on the estimate of market energy prices. When the daily market’s average annual price is outside these limits, a positive or negative balance accrues, which will be compensated over the facility’s lifetime. Remuneration also depends on the facility’s hours of operation and is set to zero when a given threshold is not passed. Once facilities pass their regulatory lifetime, they cease to receive the specific remuneration and their income is solely that obtained from the sale of power on the market.

Political effects of promoting renewable energy over the period 1998-2013: A major boost but at high cost

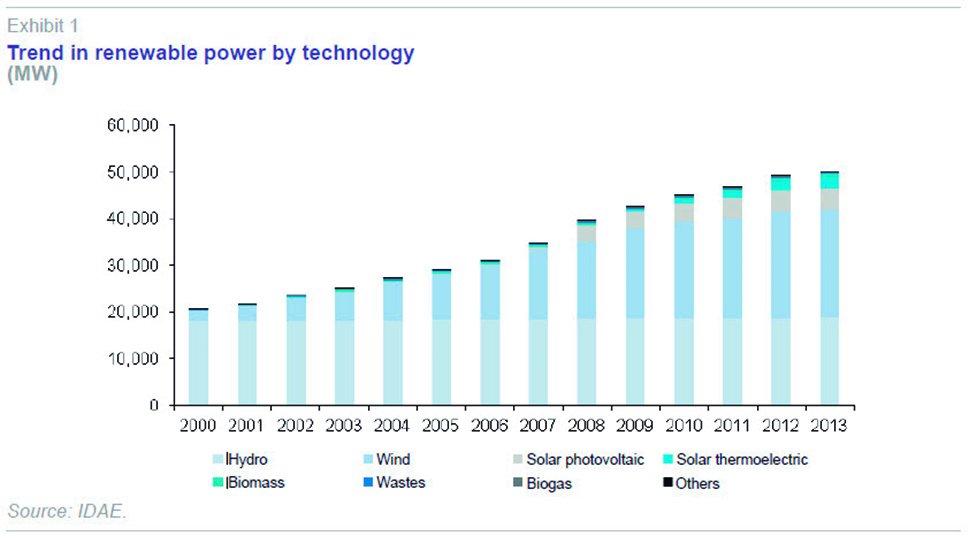

The renewable energy support instrument used in Spain up until 2013 was highly effective. Exhibit 1 shows the strong growth in renewable installed capacity over the period, rising by almost 150% from 20,503 MW in 2000 to 49,995 MW in 2013, and placing Spain second in the EU in terms of the level of installed renewable power, behind only Germany. This increase was basically due to the continuous investment in wind farms throughout the period and the strong growth in photovoltaic facilities in the later years of the period.

Similarly, the targets set for electricity generation from renewable energy sources were also met. As Table 6 shows, the targets have been met practically every year since 2010, although this has been conditional upon the availability of hydroelectric resources in each year. In 2014, the most recent year for which data are available, the target was exceeded by almost 25%.

As regards fulfilment of the targets for individual technologies, the results vary. As Table 7 shows, except for biomass, all the technologies achieved their plans for 2010, and in the case of photovoltaic the level of investment was much higher than the proposed objective. As regards fulfilment in 2015, using the actual figures from 2014 as an approximation, the results look less satisfactory. This is particularly so in the case of solar and wind technologies, where levels of investment have been substantially below those required. This was possibly a result of the change in renewable energy promotion incentives since 2008, and in particular, the 2013 reform.

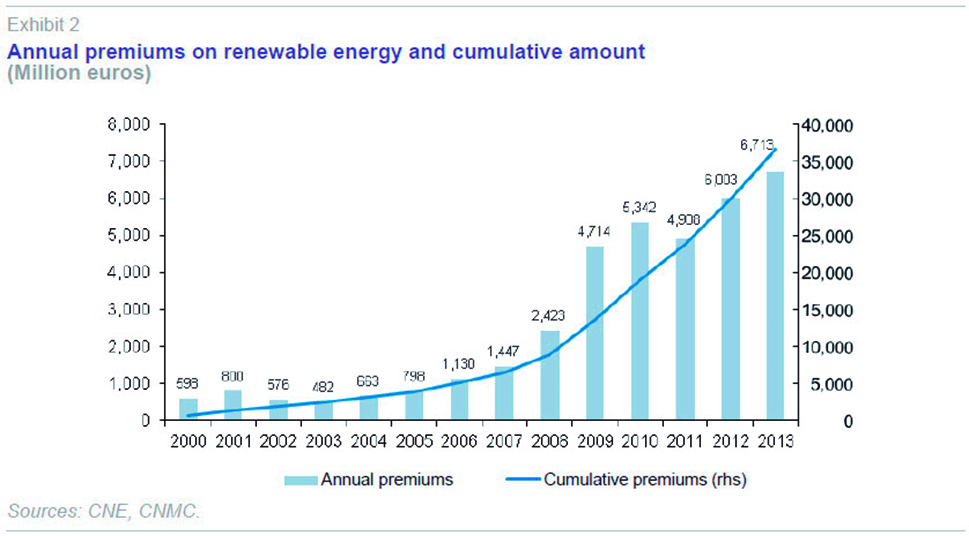

To help meet the targets, the Spanish government granted renewable energy operators over 35 billion euros over the period 2000-2013. Exhibit 2 shows the trend in this support over the period. Moderate growth was apparent in an initial phase up until 2007, with a strong increase in 2008, and above all in 2009, in which there was 95% growth on the previous year as a result of the expansion of the number of PV facilities. After 2010, financial support continued to rise, but more slowly, with the exception of 2011, when it declined as a consequence of the drop in wind power generation caused by the scarcity of wind that year.

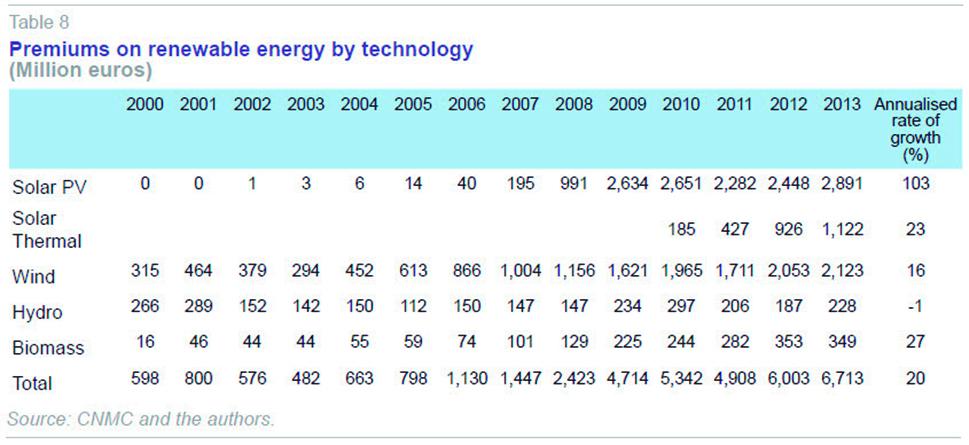

Analysing the trend in premiums by technology, as shown in Table 8, reveals 20% growth per year between 2000 and 2013. Premiums for photovoltaic energy grew particularly strongly during the period, rising at an annualised rate of more than 103%.

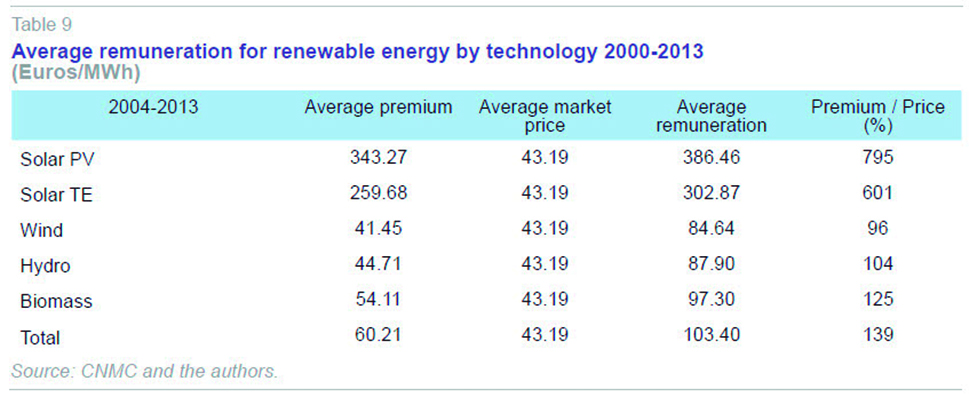

Table 9 shows the implicit average premium per technology, calculated as the difference between the total average compensation less the average market price. Over the period 2000-2013, when average remuneration for renewable energy was 103.4 euros/MWh, the implicit average premium was 60.21 euros/MWh. This table also reflects the extraordinary premium paid for solar energy –principally photovoltaic– which, at 386.46 euros/MWh, was more than eight times the market price in the period. As Rio and Mir-Artigues (2014) point out, this meant that projects investing in solar photovoltaic energy achieved rates of return of between 10% and 15%, well above the economy’s reasonable rates of return for investments with similar risks, which were around 7%.

The mix of renewable technologies was inefficiently configured as premiums skewed investments towards more profitable facilities, without taking into account the level of maturity or the real contribution of output to the system. There was particularly strong investment in PV energy thanks to the generous premiums granted to this technology. This big increment in photovoltaic capacity, representing around 60% of the increase in renewable capacity in 2008, caused the volume of premiums to double in 2009.

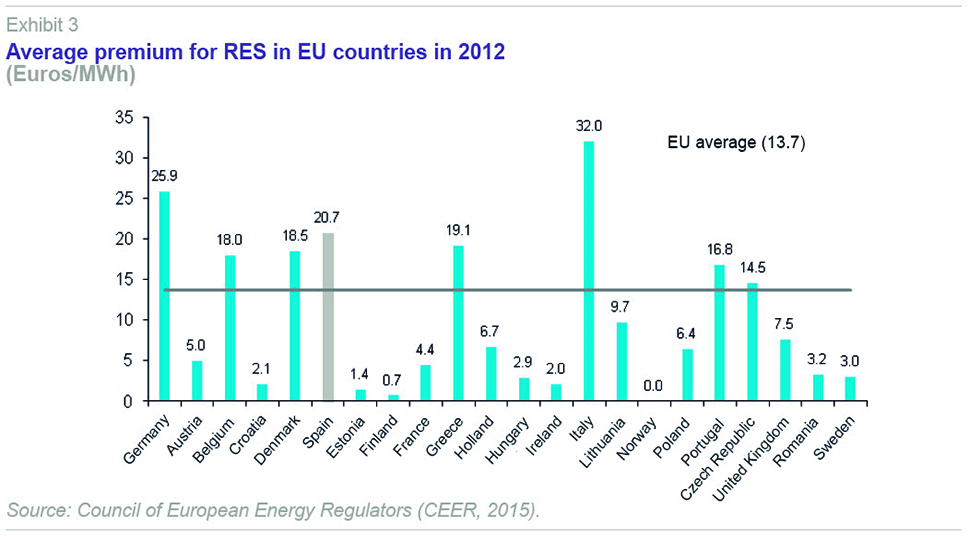

It may, therefore, be concluded that the incentive mechanism used in Spain to promote renewable energy in the period 1998-2013 was somewhat inefficient, paying for excessive output, and resulting in an inappropriate mix of technologies. Exhibit 3 confirms this. The average premium obtained by RES in Spain in 2012 was one of the highest in the EU, behind only Germany and Italy, with a value of 20.7 euros/MWh compared with an EU average of 13.7 euros/MWh.

In terms of efficiency, the only positive feature of the RES promotion instrument used up until 2013 was its contribution to the development of immature technologies, such as photovoltaic. However, the generous and fluctuating remuneration mechanism stimulated excess investment in production systems for which learning gains have still to be made. This meant that the biggest investments in renewable plants were not made when the costs were lowest. Therefore, the system cannot be considered successful from the point of view of dynamic efficiency either.

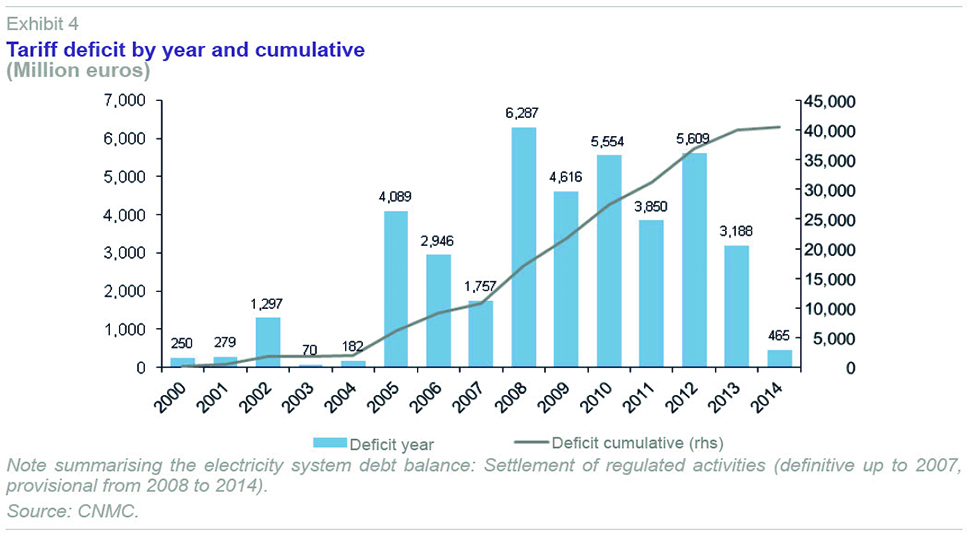

This exponential increase in premiums on renewables, together with the extraordinary profits obtained by hydro and nuclear plants, which received energy prices well above their production costs (European Commission, 2012), has been one of the main drivers of the substantial rise in electricity generating costs Spain has experienced. This cost increment and the mismatch in electricity tariffs, the only mechanism covering the cost items on the electricity bill, has led to a budget deficit jeopardising the very stability of the Spanish electricity system. Exhibit 4 shows the annual deficit and its cumulative level, which exceeded 40 billion euros in 2014.

Moreover, the support instrument used has also influenced market operation in several ways. Firstly, renewable plants have displaced many conventional plants due to their dispatch access priority. This has particularly affected combined cycle power stations, which have reduced their hours of operation considerably, putting many of them in a delicate financial position. Meanwhile, the shift in the supply curve caused by the entry of renewable plants with lower marginal costs has pushed down prices in the wholesale market (Sáenz de Miera et al., 2008; Gelabert et al., 2011; Ciarreta et al., 2014). Furthermore, the intermittent and variable nature of production from RES has made it harder to balance the system. This has made it necessary to use complementary adjustment services to avoid imbalances between production and demand (Pérez-Arriaga and Batlle, 2012).

Cutting premiums and limiting the number of hours during which renewable facilities set up since 2009 are entitled to subsidies, along with the suspension of incentives for new facilities in 2012, was insufficient to eliminate the deficit, making the 2013 reform necessary.

The 2013 reform: Better financial sustainability but heightened uncertainty

The new instrument to support renewable energy put in place with the 2013 reform greatly improved the financial sustainability of the incentive system by introducing rigid control over the installed generating capacity and level of support. However, this came at the cost of arbitrary intervention, which had a negative impact on investor confidence. The retroactive downgrade to remuneration for plants already in operation

[4] considerably heightened uncertainty, damaging the general investment climate and jeopardising the achievement of the stated objectives. This, together with the characteristics of the new instrument, which is complex and lacking in transparency on many points, may put many projects in serious financial difficulties and has triggered a flood of lawsuits in national and international courts.

The new remuneration mechanism for renewable facilities is based on various parameters characterising an efficient and well managed standard facility. To the extent that these parameters reflect real trends in plant earnings and costs, their remuneration and profitability will remain under control. That is to say, companies will have incentives to operate their plants efficiently and the cost cuts they achieve will translate into lower subsidies through the updating and revision of the parameters. This will ensure that facilities are remunerated at the lowest cost (static efficiency). Moreover, the value of new facilities will also be adjusted, as it is determined by a competitive process.

At the same time, as the new system of incentives guarantees the same profitability to various standard installations, differentiated by technology, size, age and geographical location, it does not bias investment decisions towards any specific technology. It is therefore fostering the configuration of an efficient stock of renewable facilities by incorporating technologies according to their levels of maturity, thus allowing the learning curve gains to be leveraged. However, on the other hand, by not incentivising investment in emerging technologies with large potential improvements, it could be jeopardising the future configuration of the RES generating stock by weakening dynamic efficiency.

Moreover, being entirely interventionist, the new mechanism leaves little room for the market. Whereas in the previous model, the premium was set and companies had freedom to determine their profitability based on their performance, under the new model, subsidies and profitability are restricted. This discourages any action that might raise profitability. Moreover, the role of the wholesaler price as an investment or operation signal has disappeared, given that income will remain tied to the standard facility type. On the positive side, however, a competitive procedure has been put in place for the selection of new facilities, and facilities are obliged to participate in the market.

With the new instrument, companies also lack incentives to introduce technological improvements in their facilities, for example, via rerating, as the productivity gains do not translate into increased earnings, given that profitability is capped and the revision periods are short. Similarly, plants also have no interest in extending their operating hours beyond the maximum number remunerated. This implies lower output than would be the case if this restriction did not exist, in detriment to compliance with European renewable energy targets.

However, the biggest weakness of the new mechanism is that various aspects of its design cause uncertainty among potential investors. Firstly, the process of configuring standard facilities and their allocation to each plant, which has an important influence on future income from renewable facilities, is not transparent, thus increasing the investment risk. Secondly, the rate of return that is guaranteed with the support is arbitrarily tied to the return on government bonds plus a spread, without taking the specifics of investments in renewable assets into account. It would be more appropriate, as the CNE report (2013) suggests, for this spread to be determined by a more appropriate measure of the cost of capital for this type of investment, such as the weighted average cost of capital (WACC). Thirdly, the criteria by which the parameters and rate of return will be updated and revised are not sufficiently clear. This means that investors applying for or renegotiating bank loans will face capital cost increments to compensate for the higher risk premium. Finally, the investment risk is also increased by the fact that renewable energy is not guaranteed dispatch priority, but has to compete with non-renewable technologies under similar economic conditions.

In short, the new mechanism’s heightened uncertainty and the fear of future retroactive changes is affecting Spain’s regulatory and legal reputation, heralding a slowdown in investments in RES and higher costs for existing projects. This seems to be supported by data. In 2014, the first full year with the new mechanism, installed renewable potential in Spain was just 51 MW. On top of this are the restrictions that will be imposed on distributed generation by the introduction of a back-up toll, which will significantly reduce its development.

The new regulatory rules may hinder compliance with the European Commission’s directives on renewable energy. This was already mentioned by the European Environment Agency in one of its reports (EEA, 2014), which considered it unlikely, in light of the current data, that Spain would meet its target of 20% of final energy consumption being produced from RES by 2020. It points out that to do so, the Spanish government will have to make major investments and design new measures to meet the targets. Also, in its report on the position of renewable energy, the European Commission warns that Spain needs to assess whether its policies and tools are adequate and effective means of meeting its renewable energy targets (European Commission, 2015).

Concluding remarks

For many years, Spain’s RES promotion policies focused on achieving the targets set by the EU rapidly, while seeking to benefit from the other advantages associated with promoting renewables (industrial and economic development, job creation), but paid little attention to how installed capacity evolved and the size of the subsidies. When the subsidies soared as a result of the investment bubble in the mid-2000s, each government in turn struggled to keep the mechanism effective enough to meet the EU’s requirements while introducing modifications to make it financially sustainable and more efficient. Over the period 2008-2013 various measures were implemented to contain the cost of premiums and avoid increasing the tariff deficit, including changes to some of the eligibility conditions for incentives, reducing tariffs, deferring the tariff deficit to future years, and eliminating the financial incentives for new facilities as of January 2012 (R.D.L. 1/2012). However, these measures were insufficient to correct the growing tariff deficit, which, among other factors, led to the reform of the renewable energy support mechanism.

This reform was, therefore, essential. The recommendations prepared by the European Commission to guide the design of support mechanisms set out the appropriate lines for change (European Commission, 2013). The modification to the design of FIT mechanisms used up until that time would have been sufficient to adapt to these recommendations and resolve the problems of financial sustainability. Firstly, including transparent revision and updated procedures for the main parameters to adapt to advances in technology, avoiding discretionary revisions that can affect the legal security of investments. Secondly, introducing measures to contain the level of subsidies linked to the evolution of variables such as installed capacity, share of renewable output, or the amount of subsidies (degression mechanisms). Thirdly, establishing a carbon tax to finance the RES subsidies and at the same time penalise fossil fuels relative to renewables.

However, under pressure from a persistently high public deficit, the government focused on designing a support instrument that was financially sustainable. To that end, it introduced an excessive level of control over the relevant parameters of the mechanism (rate of return, output) and proposed discretionary mechanisms for revising returns, which has led to considerable uncertainty among investors. Unless additional mechanisms are included offering greater regulatory security, there is a substantial risk that the renewable energy requirements established in Community Directive 2009/28/EC will not be met.

In order to enhance the new mechanism, it is first advisable to set a reasonable rate of return over the lifetime of the project, adequately reflecting the opportunity cost of the investment at the time it is made. To calculate this, a more appropriate measure of costs should be used, such as the present value of the total cost of building and operating a plant over its entire lifetime, using the concept of the weighted average cost of capital (WACC) as an approximation for the cost of capital. Second, it is essential that incentives to make full use of productive capacity be introduced, given that with the new mechanism, plants do not obtain more profit by generating more electricity than the reference output. Third, updating and review processes for the main parameters (operating costs, hours of operation, value of investment) need to be governed by transparent rather than discretionary principles. To avoid financial instability in the support system it is only necessary to impose limits on subsidies conditional on stated installed capacity targets, share of production, or volume of subsidies. In other words, the support mechanism needed to have a degree of flexibility to adapt to changing circumstances, but in a predictable way to avoid unnecessary uncertainty for potential investors. Fourth, the power distributed needs to be properly regulated to help meet European renewables targets, and create competition to offset the strong market power of the large, vertically integrated, electricity companies. Fifth, the wholesale market needs to be redesigned to take into account the growing importance of intermittent RES and to enable the fixed costs of conventional plants that supply the system’s standby capacity to be recouped. Finally, a major effort needs to be made to restore legal security and reduce the regulatory risk resulting from the retroactive measures adopted with the change in support mechanism.

Notes

First of all, it is necessary to ask whether renewable energy is the best tool governments have available to reduce GHG emissions. Some authors, such as Novan (2015) and Cullen (2013) address this question.

These requirements form part of the “2020 Climate and Energy Package,” an EU action plan against climate change that contains a triple objective for 2020: reducing GHG emissions by 20% from 1990 levels; achieving a share of primary energy from renewable sources of 20%; and reducing energy consumption by 20% (see European Council, 8 and 9 March 2007, and “Energy 2020 - A strategy for competitive, sustainable and secure energy,” European Commission (2010) 639 November 2010). In October 2014 the European Council approved the new 2030 Climate and Energy Package, replacing the 2020 Package. This set targets for combating climate change taking into account the various economic difficulties the Member States were facing. Specifically, it proposed for 2030 a cut in CO2 emissions of at least 40% from 1990 levels, a share of renewables of at least 27%, and an energy saving of 27%. However, these last two targets, unlike their equivalents in the 2020 Package, are not binding at the national level. See EUCO 169/14, European Council (23 and 24 October 2014), Conclusions. 2030 Climate and Energy Policy Framework.

Royal Decree 413/2014 implements the calculation method for the specific remuneration, and Ministerial Order IET/1045/2014 establishes the remuneration parameters for the standard facility types.

The reform entailed a cut of approximately 1.7 billion euros in the remuneration for facilities entitled to premiums. The impact on each technology varied, such that hydroelectric suffered worst, losing between 50% and 90% of its previous remuneration (CNMC, 2014).

References

APPA (2015), “Estudio del Impacto Macroeconómico de las Energías Renovables en España 2014,” Asociación de Empresas de Energías Renovables.

CIARRETA, A; ESPINOSA, M. P., and C. PIZARRO-IRIZAR (2014), “Is green energy expensive? Empirical evidence from the Spanish electricity market,” Energy Policy, 69: 205-215.

CNE (2013), “Informe 18/2013 de la CNE sobre la propuesta de Real Decreto por el que se regula la actividad de producción de energía eléctrica a partir de fuentes de energía renovables, cogeneración y residuos,” Comisión Nacional de Energía [National Energy Commission], September 4th, 2013.

CNMC (2014), “Informe sobre la propuesta de Orden por la que se aprueban los parámetros retributivos de las instalaciones tipo aplicables a determinadas instalaciones de producción de energía eléctrica a partir de fuentes de energía renovables, cogeneración y residuos, y se establece la metodología de actualización de la retribución a la operación,” Comisión Nacional de los Mercados y la Competencia [National Markets and Competition Commission], April 2014.

COSTA, M., and E. TRUJILLO-BAUTE (2014), Retail Price Effects of Feed-In Tariff regulation, Documents de Treball de Institut d’Economia 2014/29, Universitat de Barcelona.

CULLEN, J. (2013), “Measuring the Environmental Benefits of Wind Generated Electricity,” American Economic Journal: Policy, 5(4): 107–133.

EEA (2014), “Energy support measures and their impact on innovation in the renewable energy sector in Europe,” EEA Technical Report, No 21/2014.

EUROPEAN COMMISSION (1997), “Energy for the future: renewable sources of energy,” White Paper for a Community Strategy and Action Plan, COM (97) 599 final.

— (2011), “Roadmap for moving to a competitive low carbon economy in 2050,” Commission Staff Working Document, SEC (2011) 288 final, 8 March.

— (2012), “Assessment of the 2012 national reform programme and stability programme for Spain,” SWD (2012) 310 final, May 2012.

— (2013), “European Commission guidance for the design of renewables support schemes,” SWD (2013) 439 final.

— (2015), “Renewable energy progress report,” COM (2015) 293 final.

GELABERT, L.; LABANDEIRA, X., and P. LINARES (2011), “An ex-post analysis on the effect of renewables and cogeneration on Spanish electricity prices,” Energy Economics, 33: S59-S65.

HELD, A.; RAGWITZ, M.; GEPHART, M.; VISSER, E. de, and C. KLESSMANN (2014), “Design features of support schemes for renewable electricity,” ECOFYS, European Commission, DG ENER.

IEA (2014), Medium-Term Renewable Energy Market Report 2014, Market Analysis and Forecasts to 2020, International Energy Agency, Paris.

KONIDARI, P., and D. MAVRAKIS (2007), “A multi-criteria evaluation method for climate change mitigation policy instruments,” Energy Policy, 35: 6235–6257.

NOVAN, K. (2015), “Valuing the Wind: Renewable Energy Policies and Air Pollution Avoided,” American Economic Journal: Economic Policy, Vol. 7, Nº 3: 291-326.

PÉREZ-ARRIAGA, I. J., and C. BATLLE (2012), “Impacts of Intermittent Renewables on Electricity Generation System Operation,” Economics of Energy & Environmental Policy, 1(2): 3–18.

RAGWITZ, M. et al. (2007), OPTRES – Assessment and optimisation of renewable energy support measures in the European electricity market; Final report of the research project OPTRES, with support from the European Commission, DGTREN under the Intelligent Energy for Europe – Programme.

REN21 (2015), “Renewables 2015 Global Status Report,” Renewable Energy Policy Network for the 21st Century.

RÍO, P. DEL (2008), “Ten years of renewable electricity policies in Spain: An analysis of successive feed-in tariff reforms,” Energy Policy, 36: 2917-2929.

RÍO, P. DEL, and P. MIR-ARTIGUES (2014), A cautionary tale: Spain’s solar PV investment bubble, International Institute for Sustainable Development.

SÁENZ DE MIERA, G.; RÍO, P., and i. Vizcaíno, (2008), “Analysing the impact of renewable electricity support schemes on power prices: The case of wind electricity in Spain,” Energy Policy, 36: 3345-3359.

Fidel Castro-Rodríguez. Department of Economic Analysis and ECOBAS, University of Vigo

Daniel Miles-Touya. Department of Applied Economics and ECOBAS, University of Vigo