Spanish economic forecasts panel: September 2025*

Growth in 2025

The GDP growth estimate has been revised upward by two tenths to 2.6%

According to provisional data from the INE, GDP grew by 0.7% in the second quarter, which is two tenths more than anticipated by the panelists. Domestic demand contributed almost nine tenths and the external sector subtracted just over one tenth from growth.

The consensus forecast of analysts for 2025 has been raised by two tenths of a percentage point to 2.6%, as a result of the good second quarter performance, coupled with a reduction in risk appreciation and the maintenance of quarter-on-quarter growth forecasts of around 0.5% for the rest of the year (Table 2). Fourteen panelists revised their forecasts upwards, while none revised them downwards (Table 1).

In terms of the composition of GDP growth for this year, domestic demand will contribute 2.9 percentage points —four tenths more than in the previous forecast— while the external sector will subtract three tenths—compared to -0.1 percentage points in the July forecast. The forecast for investment growth and, to a lesser extent, private consumption have been revised upwards, while the forecast for public consumption has been revised downwards. As for

exports and imports, the consensus forecast is for growth of four and eight tenths of a percentage point, respectively, higher than that envisaged in the July Panel (Table 1).

There has been a substantial shift in the panelists’ assessment of risk: while in the previous Panel, 17 of them considered the risk to the forecasts to be balanced or on the downside, and only two considered the risk to be on the upside, on this occasion, 16 panelists believe that the risk is balanced or on the upside, and only three think that the risk is on the downside.

It should be noted that the forecasts included in this Panel are consistent with the National Accounts figures, both annual and quarterly, in force on the date of publication. The INE will soon publish the revised figures for the Annual National Accounts, which could render some of these results more or less out of date.

Growth in 2026

GDP could grow by 2% in 2026

The consensus forecast for GDP growth in 2026 has been revised upward from the previous Panel by one-tenth of a percentage point to 2%. This forecast is slightly higher than the figures projected by the main international and national organizations but is below the government’s expectations (Table 1).

With regard to the composition of growth for 2026, domestic demand will contribute 2.1 percentage points (two tenths more than in the previous Panel), while the external sector will subtract one tenth of a percentage point (compared to a zero contribution in the previous forecast). Both investment and private consumption are expected to grow at a slower pace than in 2025, while public consumption would grow at a similar year-on-year rate (Table 1).

Quarter-on-quarter GDP growth rates are expected to be around 0.5% throughout 2026 (Table 2).

Inflation

Inflation is expected to average 2% in 2026

The overall inflation rate began the year at around 3%, subsequently falling to 2% in May. It then rose to 2.7% in July and August. Core inflation, meanwhile, has remained in the range of 2.2%-2.4% for most of the year. Food inflation continues to show strong resistance to moderation, and services remain at high rates.

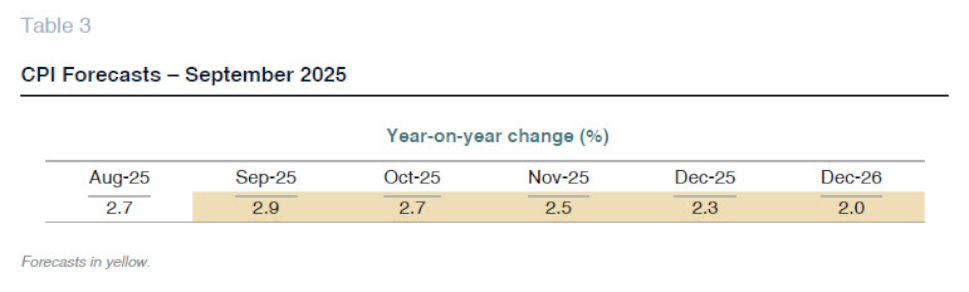

For the coming months, panelists expect the overall index to remain at July and August levels or higher, and to decline in the last two months of the year, closing December at 2.3%. The estimate for the average annual rate in 2025 is 2.5% for the overall index and 2.3% for the core index, which is one-tenth of a percentage point higher for both than the previous consensus forecast. As for 2026, the forecast remains unchanged at 2% for the overall rate and 2.1% for the core rate. The year-on-year rate for December 2026 would be 2% (Tables 1 and 3).

Labor market

The unemployment rate will fall to 10.2% in 2026

According to Social Security enrollment figures, the seasonally adjusted month-on-month growth rate of employment so far this year is slightly lower than that recorded in 2024. However, it should be noted that, on the one hand, the labor market continues to show strength and, on the other, that the weakness observed in the service sector is practically offset by greater vigor in industry and, above all, in construction.

For the year as a whole, panelists expect employment to grow by 2.3% year-on-year, which is three-tenths of a percentage point more than in the previous Panel, and by 1.6% (two-tenths of a percentage point more) for next year. The unemployment rate, meanwhile, is expected to stand at 10.6% this year and fall to 10.2% in 2026, which is one and two tenths of a percentage point lower, respectively, than in the July forecast (Table 1).

As for productivity and unit labor costs (ULC), calculated on the basis of GDP growth forecasts, wage remuneration, and employment in terms of the EPA, their growth would be 0.3% for 2025 and 3.4%, respectively. By 2026, productivity could grow by 0.4% and ULC by 2.7%.

Balance of payments

The balance of services will allow the surplus to remain high in terms of the historical series

In the first quarter of this year, the current account balance recorded a surplus of €10 billion, which is 3.6 billion less than in the same period of last year. This worsening was caused by the contraction in the trade surplus (due to a larger deficit in trade in goods, which more than offset the improvement in

the services surplus) coupled with a similar result in the income balance. In relation to GDP, the current account surplus stood at 1.8% of GDP for the quarter, which in terms of the historical series continues to be a comfortable result.

Consensus forecasts point to a surplus of 2.5% of GDP for this year (unchanged) and 2.3% for 2026, one tenth less than the previous forecast (Table 1).

Public deficit

The public deficit forecast for 2025 and 2026 remains unchanged

The aggregate deficit of the public administrations, excluding local corporations, up to May (the latest data available at the time of closing this report) increased by €640 million compared to January-May 2024, due to the worsening of the central government’s deficit, which more than offset the improvement in the regional governments and Social Security. If we exclude the costs of the DANA, which amounted to €3.4 billion in this period, the result was a reduction in the deficit of €2.8 billion. Tax collection slowed compared to the same period in 2024.

The consensus expects a reduction in the deficit of the general government during 2025 and 2026, with the same figures as in the previous forecast: 2.8% for this year and 2.7% for next year. The figure for 2025 is in line with the expectations of the main national bodies, such as the Bank of Spain (at the date of publication of this report), and international bodies, such as the European Commission and the OECD, while the figure forecast for 2026 is higher (Table 1).

International context

The trade “agreement” between the U.S. and the EU does not seem to have dispelled the uncertainties

The trade “agreement” between the U.S. and the EU sealed during the summer includes the application of a general tariff of 15% on European products, along with higher specific tariffs for certain sectors. The EU believes that the agreement will help to curb protectionism. However, a sense of uncertainty still prevails, particularly in key industries such as the automotive sector, which are subject to intense international competition.

Nevertheless, indicators point to a somewhat less pronounced slowdown in the U.S. than was anticipated at the start of the tariff offensive. The European economy, for its part, is showing some resilience, as evidenced by the slight upturn in the eurozone PMI. European industry appears to be entering a phase of stabilization after a period of weakening, while services continue to grow, albeit at a more moderate pace. All of this has led to an upward revision of the ECB’s GDP growth forecast for this year to 1.2%, three tenths higher than in June. The situation of the French economy, however, is a source of concern.

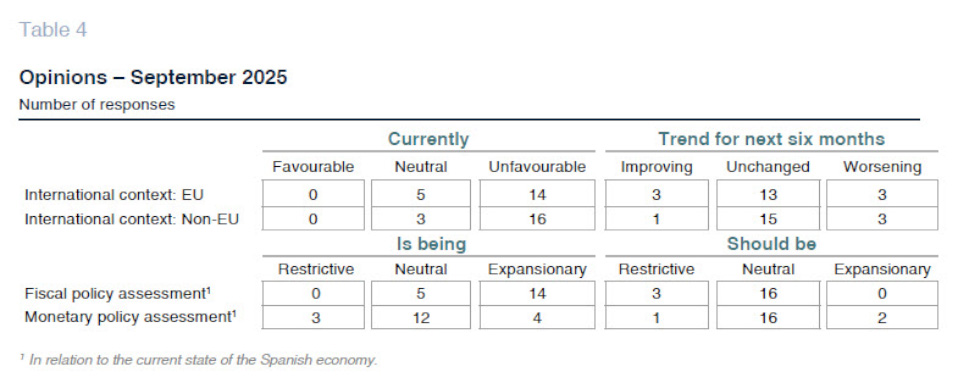

Given the high degree of uncertainty that continues to prevail, panelists remain cautious about the international context. Of the 19 panelists, 14 consider the European context to be unfavorable, the same as in the previous Panel (Table 4). As for the non-European environment, there are 16 negative opinions, one less than in July. In general, few changes are anticipated in the international context for the coming months, so that business uncertainty could continue to weigh on the economic situation.

Interest rates

The margin for a fall in the Euribor is now very small

Following the period of trade negotiations, the debate is now focused on the Federal Reserve, faced with, on the one hand, pressure from the Republican administration to drastically reduce interest rates, and on the other hand a complex economic situation that calls for caution. The labor market points to a sharp slowdown in the U.S. economy in the coming months, which in principle would justify monetary easing. Conversely, prices continue to exert upward pressure, probably due to the delayed effect of tariffs: inflation rose to 2.9% on a year-on-year basis in August, two tenths of a percentage point higher than in July, a circumstance that could limit the extent of the easing.

As for the eurozone, the ECB is in a more comfortable position, with inflation hovering around 2% and an economy that is holding up, albeit without brilliance. In addition, the risk of a rebound in inflation is lower than in the U.S., due to the strength of the euro and the non-activation of trade retaliation measures.

All of this could pave the way for an additional cut in the deposit facility to 1.75%, according to the consensus forecast (responses were collected before the ECB’s last meeting on September 11). This position would be maintained until the end of the forecast period, as anticipated by the previous Panel (Table 2). The markets seem to have discounted these adjustments, so that the one-year Euribor would barely fall from the current 2%-2.1% to 1.9% at the end of 2026, with no major changes from the previous Panel (Table 2).

As for public debt markets, attention focused on France, with investors demanding a higher risk premium in the absence of a political agreement to contain budgetary imbalances. More generally, the prospect of a huge volume of global public debt is reflected in bond yields. According to the panelists’ assessments, the yield on 10-year Spanish bonds would be around 3.3% at the end of next year, one tenth higher than in the July consensus (Table 2).

Currency market

The euro remains strong against the dollar

Following the sharp appreciation of the euro during the first part of the year, its exchange rate appears to have stabilized at around $1.17. Portfolio adjustments could continue to exert slight upward pressure on the single currency, especially if the Federal Reserve adjusts its rates more than the ECB. Analysts forecast that the euro exchange rate could reach $1.18 at the end of 2026, one cent higher than in the previous assessment (Table 2).

Considerations on fiscal and monetary policy

The good economic situation does not justify fiscal expansion

There has been little change in assessments of macroeconomic policy. For a majority of panelists, monetary policy is neutral, which broadly fits with the Spanish economic cycle (Table 4). Meanwhile, the majority view is that fiscal policy is expansionary, when a more neutral stance would be desirable given the strength of growth and the relatively positive economic prospects.

*

The Spanish Economic Forecast Panel is a survey conducted by Funcas among the 19 analysis services listed in Table 1. The survey, which has been conducted since 1999, is published every two months in January, March, May, July, September, and November. Based on the responses to this survey, “consensus” forecasts are provided, which are calculated as the arithmetic mean of the 19 individual forecasts. For comparison purposes, although not part of the consensus, the forecasts of the Government, AIReF, the Bank of Spain, and the main international organizations are also presented.