Dollar-backed stablecoins: Not a threat in the EU

Despite rapid growth in terms of capitalization and rising cross-border flows, dollar-backed stablecoins face significant barriers in the Euro Area. Exchange rate and issuer risks, coupled with strict EU regulation, private initiatives and the digital euro project, limit their potential to disrupt European financial systems; however, regulators and traditional financial services providers should continue to pay close attention to the fast development of decentralized finance and key assets like stablecoins.

Abstract [1]: Dominated essentially by two players which control approximately 90% of total market capitalization, dollar-backed stablecoins have grown into a US$219 billion market, increasing their share of crypto trading and cross-border flows while gaining new momentum from recent U.S. regulatory initiatives. In Europe, however, their potential to become a mainstream instrument is limited. Users face exchange rate exposure and issuer-specific risks that are absent from the existing euro-based systems, and the EU’s Markets in Crypto-Assets Regulation (MiCA) has already discouraged major issuers from entering the market. At the same time, European efforts to upgrade payment services and advance a digital euro aim to strengthen autonomy and reduce reliance on non-EU providers. Although stablecoins could play a role in cross-border payments, and private and public sector actors should remain vigilant, their systemic relevance in the EU appears unlikely in the near future.

Introduction

This article examines several reasons why dollar-backed stablecoins are unlikely to gain a strong foothold in the Euro Area. Dollar-backed stablecoins are gaining attention amid recent efforts by the U.S. to promote and regulate them. This could help grow an alternative payments industry and strengthen the international role of the U.S. dollar. In Europe, the possibility of such stablecoins becoming widely used raises three key questions: 1) What are the financial stability risks?; 2) Is current regulation enough to manage those risks?, 3) Could dollar-backed stablecoins undermine the European Central Bank’s (ECB’s) goal of strengthening European autonomy over sovereign payments? It is unlikely that dollar-backed stablecoins will become systemic payment methods in the EU because users would have to bear both an exchange rate and an issuer risk that other domestic payment methods do not have. The EU’s Markets in Crypto-Assets Regulation (MiCA) regulation already appears to be discouraging dollar-backed stablecoin issuers from expanding in Europe, and regulatory efforts continue adapting to meet new challenges arising from innovation. The digital euro (the Euro Area’s central bank digital currency) project is a direct competitor to these stablecoins, which promises to improve the efficiency of payment systems by reducing costs, providing pan-European digital payment solutions, and supporting private sector innovation in payments.

The U.S. is making a push for stablecoins

Stablecoins, the second generation of cryptocurrencies, were intended to resolve the violent price fluctuations that made first-generation currencies like Bitcoin an unreliable form of exchange. By tying their value to a stable asset, predominantly U.S. Treasuries and dollar deposits, stablecoins aimed to provide price predictability and stability and therefore serve as a more useful payment instrument. However, until recently, stablecoin use has been limited and specific. Data suggest that in 2024, 88% of stablecoin transactions were related to crypto trading, and only 6% were payments. They have been tools for financial intermediation in crypto markets, not a form of payment in the real economy, as the average value of stablecoin transactions remains large: an average Visa or PayPal transaction is around $50 to $60, whereas an average stablecoin transaction is more than $4,100, according to K33 Research (2025) (based on 2023 numbers). But the recent U.S. push to provide a regulatory framework for stablecoins has restarted discussions about their broader use.

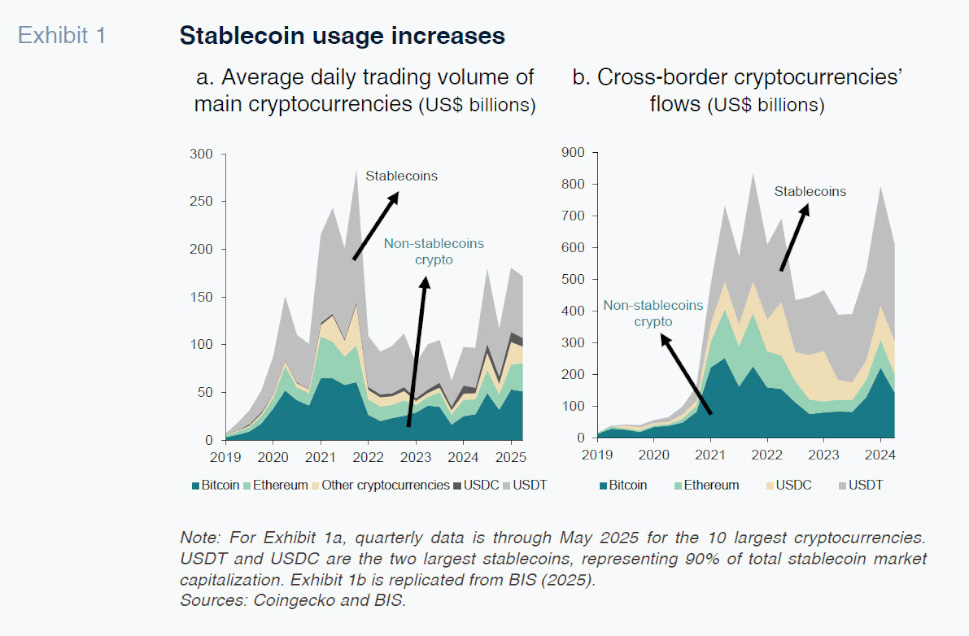

Regulatory certainty is one of the three main institutional ingredients for financial instruments to succeed in the long term, the other two being the possibility of legal recourse and reserve backing (Demertzis, 2023). Despite clearly lacking the first two, stablecoins’ market capitalization has increased substantially. The stablecoin market is dominated by two players, USDT and USDC, which together account for 90% of the total market capitalization. They currently have a combined market capitalization of US$219 billion, more than 45 times higher than their 2019 capitalization of US$5 billion. These two largest stablecoins have represented over 40% of total crypto trading volume during the last five years (Exhibit1a), and stablecoins’ cross-border flows have increased sharply, representing over 60% of total crypto flows as of Q2 2024 (Exhibit 1b).

Stablecoins accounting for 99% of the sector’s market capitalization are pegged to the U.S. dollar and support this peg by holding safe dollar assets (like U.S. Treasuries). They are issued by private institutions, and close to 80% of their transactions occur outside the US, making them subject to different (or no) regulatory frameworks. Euro-pegged stablecoins also exist but have a much lower market share: as of June 2025, EURC, the euro-pegged stablecoin issued by Circle, had a market capitalization of around US$200 million, 300 times lower than Circle’s dollar-pegged stablecoin, USDC (around US$60 billion).

Combined with a supportive regulatory environment in the US, this recent expansion has raised concerns in the EU about what a potential sudden uptake would mean for consumers, financial stability, and even monetary sovereignty. The EU is in the process of enforcing the MiCA regulation, which outlines a governance regime with strict reserve requirements and redemption rights as well as potential limits on large issuance of stablecoins to preserve financial stability. However, there is a new debate as to whether current regulation is sufficient to safeguard financial stability and monetary sovereignty.

U.S. initiatives are changing the landscape

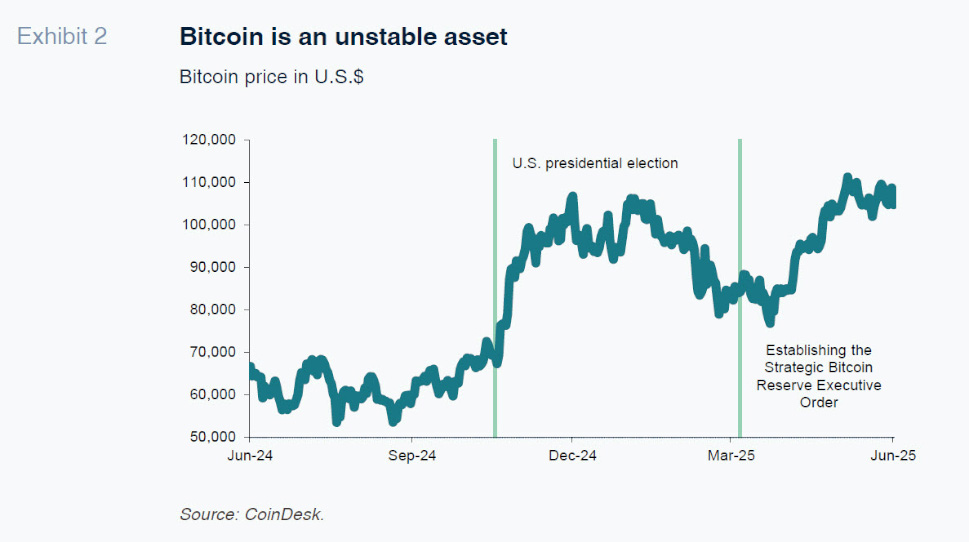

The recent push by the current U.S. administration has brought additional attention to crypto assets, with Bitcoin prices having increased by 70% over the past year (Exhibit 2).

In this space, stablecoins have taken a more central position in recent months. In addition to executive orders in the U.S. related to the role of crypto as a potential reserve asset and digital financial technology (Committee for Economic Development, 2025), legislative proposals focusing on stablecoins have been introduced and discussed in both the Senate and the House of Representatives. The Senate bill has now passed after one failed attempt, and while debate is still ongoing, these efforts have generated heightened market activity and increased discussions among European policymakers.

Crucially, the U.S. Federal Reserve’s role in recent policy proposals has been small, giving greater regulatory authority to other institutions, and the U.S. has moved away from exploring a retail central bank digital currency (CBDC), the government-based equivalent of stablecoins. Indeed, one executive order aims “to protect Americans from the risks of Central Bank Digital Currencies” with measures that include “prohibiting the establishment, issuance, circulation, and use of a CBDC within the jurisdiction of the United States.” This is in sharp contrast with efforts in the Euro Area to advance with a digital euro (retail CBDC) (the White House, 2025).

[2]

Can stablecoins boost the international role of the dollar?

A key implication of recent regulatory changes is the possibility of dollar-backed stablecoins further boosting the relevance of the dollar in international financial markets. Arguments supporting this view note that dollar-backed stablecoins could: 1) increase access to and demand for U.S. debt as a reserve asset commonly used to support the stable value of the currency; 2) compete with other digital fiat, namely, CBDCs; and,/or 3) reduce crypto volatility, boosting the digital asset market more broadly (Smith, 2025).

There is evidence that stablecoin flows volume is highly responsive to U.S. monetary conditions and that tighter regulation in certain jurisdictions can lead to shifts in cross-border flows and away from these jurisdictions. A more “crypto-friendly” or conducive regulation could solidify the U.S. dominance in this space.

What do U.S.–backed stablecoins mean for the euro?

In theory, the proliferation of stablecoins can impact both financial stability and monetary sovereignty in Europe. The ECB has said that dollar-backed stablecoins could lead to bank deposit substitution and even to currency substitution (dollarization) in countries with “weak fundamentals.” The ECB is also concerned about “euro deposits being moved to the US” and about a “further strengthening of the role of the dollar in cross-border payments.” Moreover, if stablecoins were to become “systemic,” a potential “run on redemptions” (i.e., a run on U.S. Treasuries) could have “repercussions for other parts of the global financial system” [3] (Banca d’Italia, 2025; ECB, 2025a).

Beyond financial stability concerns, the ECB has for some time emphasized the need for greater monetary and payment systems autonomy. In a 2019 report, the ECB warned that 70% of all payments made in the Euro Area are intermediated by non-EU companies. This, the ECB has suggested, was a sign of unhealthy concentration of power and of overdependence on nondomestic companies. If dollar-backed stablecoins were to become popular, they could push this external overdependence even further and interfere with European strategic priorities like monetary sovereignty and payment systems security.

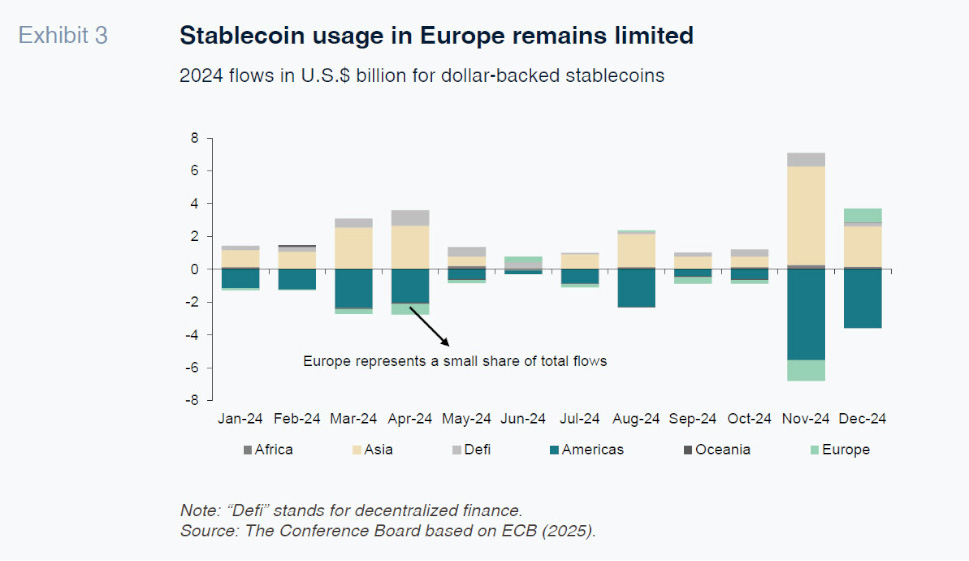

[4] However, the use of stablecoins in Europe remains well below that of other regions (Exhibit 3).

Little need for dollar-backed stablecoins for EU retail and wholesale use

In the EU, stablecoins have so far mostly been used to buy other crypto products as hedging instruments, and those who continue to use them will do so under the regulatory authority of MiCA. The question that remains is whether they could be more widely used as payment methods next to existing options.

On the retail side, we see no compelling reasons to expect the widespread use of dollar-backed stablecoins in the Euro Area. Such stablecoins carry both an exchange rate risk (from euro to dollar) and an issuer-specific (counterparty) risk: there is the exchange rate risk of holding an asset dependent on the value of the U.S. dollar and U.S. debt but also the solvency and liquidity risk of the issuer. Given that dollars are easily available in the EU and are not generally used for retail purposes, it is unlikely that consumers would switch to paying with stablecoins. Further, as the ECB notes, stablecoins have “higher transaction costs compared to centralized payment networks” and their price may fluctuate “in a similar manner to speculative assets” (ECB, 2025a).

Current payment services in the EU are going through a vast upgrade (Instant Payments Regulation) that will reduce the costs of transacting across the whole Euro Area. Also, the EU is rapidly advancing in terms of creating a digital euro, which would solve remaining obstacles within EU cross-country digital payments and encourage private initiatives to improve retail payments’ cross-border interoperability. These efforts could eliminate the technological gap with stablecoins in terms of transaction speed.

Wholesale payments using dollar-backed stablecoins inside the Euro Area are also unlikely to become popular for the same reasons; namely, the need to bear the FX and issuer risks. Where stablecoins might be of some interest is in cross-border dollar payments with countries outside the EU. As the dollar dominates international financial flows (in all jurisdictions and for all uses, from trade invoicing to international loans, debt, deposits and reserves), the provision of dollars on a distributed ledger may provide a quicker alternative (on average it takes several days for a SWIFT payment to clear). Naturally, the existence of issuer risk would need to be reflected in the cost of transaction, but one could envisage this cost decreasing as stablecoins become more popular.

Nevertheless, the international role of the dollar is currently being challenged by Europe’s need to diversify and strengthen strategic sovereignty (Demertzis, 2025). The EU, motivated by the desire for greater autonomy in its payment systems, will also aim to reduce its dependence on the dollar by providing competitive euro-based payment methods that are attractive to consumers and retailers as well as a wholesale digital euro.

Is EU regulation sufficient?

Despite extensive rules being introduced through the MiCA framework, the new interest in dollar-backed stablecoins has restarted the debate in Europe. The MiCA regulation will be fully operational by July 2026, but in the meantime, it is being implemented in a “transitional phase,” where member states’ jurisdictions maintain substantial discretion to apply simplified authorization procedures.

MiCA’s requirements focus on the European customer base, but the lack of alignment between regulatory frameworks (in the U.S. and other jurisdictions where stablecoins issuers may be based or functioning) introduces concerns about consumer protection and financial stability. For instance, since stablecoins act as digital fiat and are thus fungible, an issuer could introduce the same coin in Europe and in a secondary market. While MiCA’s capital and reserve requirements would be applicable to the European activity of such issuer, European customers would be exposed to the regulatory and macroeconomic risks of other jurisdictions where the stablecoin is issued (similar potential issues have been flagged in the US).

Beyond exposures to other jurisdictions’ risks, the lack of regulatory alignment in fungible assets creates scope for regulatory arbitrage. If stablecoins issued outside the EU are interchangeable with EU-approved versions, overseas holders could access EU-held reserves during market turmoil (Council of the European Union, 2025). This generates both unpredictability in risk and increases the cost of regulation asymmetrically, which itself is a risk to banks and financial stability. The European Commission is expected to announce new guidance on how to deal with this gray area.

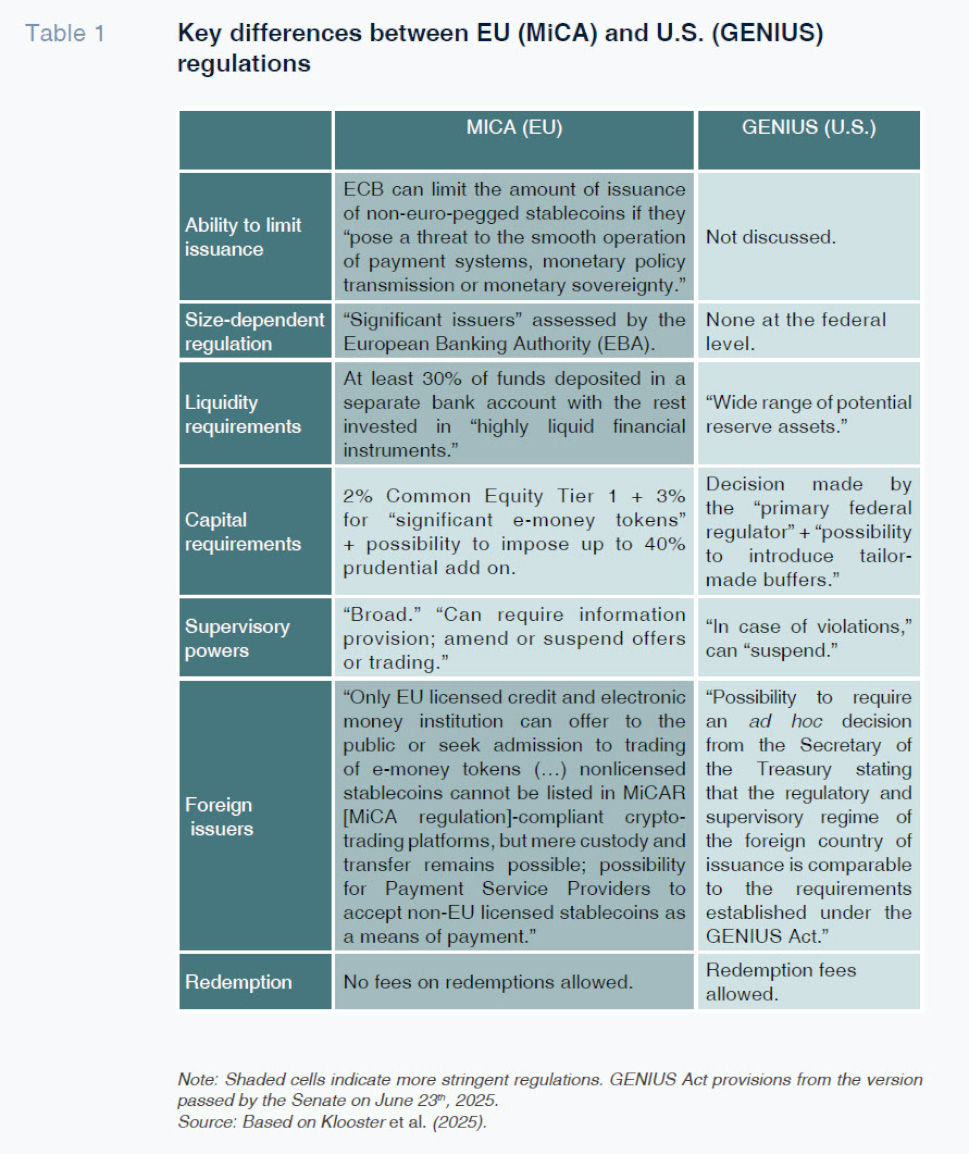

However, MiCA has acted as a deterrent for some stablecoin issuers. Earlier this year, Tether, the largest stablecoin issuer, representing close to two-thirds of total stablecoin market capitalization, was delisted from most European exchanges after refusing to comply with MiCA. Overall, it remains the case that compared to current U.S. regulation (GENIUS), MiCA is a lot more stringent, as the GENIUS bill, passed by the Senate in June, establishes a regulatory regime for stablecoin issuers in the U.S. with fewer requirements and consumer protections than MiCA (see Table 1 below for a comparison between both regulations (Klooster et al., 2025).

So far, the regulatory framework used in the EU has dissuaded the proliferation of these new and untested technologies—but technological improvements in payment systems are rapid and one should not assume that existing regulation has anticipated future risk appropriately. The ECB will continue to monitor such advancement with the objective of ensuring “same business, same risks, same rules.

Looking ahead: Public and private initiatives

The undeniable popularity of decentralized finance and stablecoins comes from the technology that supports them—and the potential of digital currencies is recognized by public and private institutions.

The international payment landscape is open to new players and new methods in ways that are difficult to predict. Recent news over Walmart and Amazon considering issuing their own stablecoins in the U.S. had a direct impact on the stock price of Visa and Mastercard, and financial giant J.P. Morgan launched a “deposit token” for institutional investors.

Meanwhile, the ECB’s push for a digital euro will provide an infrastructure and standardization of payments ready to be used by the private sector. European authorities expect that this will foster private innovation and accelerate the banking union and payment systems’ interoperability. Indeed, financial institutions are already increasing collaboration to improve interoperability for cross-border payments within the Euro Area, and the ECB is open to expanding the digital euro to enhance cross-border payments beyond Europe (ECB, 2024 and 2025b).

Questions persist around stablecoins’ use case for cross-border payments outside the Euro Area and whether viable public or private solutions will consolidate in the medium term. However, all relevant stakeholders, businesses, regulators, and policymakers should be aware of the risks and rewards of decentralized finance and closely monitor developments from both the public and private sectors.

Notes

This article has benefited from comments by Principal Economic Policy Analyst PJ Tabit and Vice President of Public Policy John Gardner of the Committee for Economic Development and Nicola Bilotta, Senior Research Associate of the European University Institute. This article was originally published by The Conference Board.

CBDCs, as publicly issued digital currency, are seen as an alternative or even a competitor to stablecoins. The ECB, however, has argued that the digital euro will promote private sector innovation.

Indeed, stablecoins as a whole are the tenth-largest holder of short-term US debt, surpassing countries like Switzerland and China.

Notably, 13 countries in the Euro Area currently rely on non-European providers for their payment systems. Also concerning for the ECB would be the fact that they would lose some of their settlement function, as decentralized finance does not require central bank settlement.

References

Maria Demertzis and Alejandro Fiorito. The Conference Board