Spanish economic forecasts panel: July 2025*

Growth in 2025

GDP growth forecast for 2025 is reduced by one tenth of a percentage point to 2.4%, with downside risks

The most recent indicators point to a certain resilience of the Spanish economy in the face of trade and geostrategic challenges, albeit with signs of a slowdown. On the one hand, the number of Social Security affiliates grew by 0.6% in the second quarter, the same as in the previous quarter, and the manufacturing PMI also recorded, on average in the second quarter, the same result as in the first. On the other hand, however, the services PMI has declined, and tourist inflows have slowed significantly in recent months.

In line with these results, the consensus forecast for GDP growth remains unchanged at 0.5% in the second quarter, one tenth of a percentage point lower than in the first quarter (according to revised figures from INE). GDP is expected to grow at the same rate in the third quarter before slowing down to 0.4% in the last part of the year (Table 2).

All this would leave GDP growth at 2.4% for 2025 as a whole, a tenth of a percent lower than in the previous Panel. Eight panelists have modified their forecast downward, while none have done so upward. From the point of view of the composition of growth, the downward revision stems from a lower contribution from domestic demand (Table 1).

Eight panelists consider the forecast risk to be on the downside (i.e., GDP could grow less than anticipated), compared to two panelists who consider the risk to be on the upside. For the remaining nine panelists, the risk is balanced, with a similar probability of upside and downside deviation.

It is important to note that most of the panelists have made their forecasts under the assumption that the average U.S. tariff on Europe will be between 10% and 15%.

Growth in 2026

The forecast for 2026 remains unchanged at 1.9%

The forecast for GDP growth in 2026 remains unchanged at 1.9%. This figure is slightly higher than that expected by the Bank of Spain, AIReF or the IMF, while it is below that contemplated by the Government, the European Commission or OECD (Table 1).

The deceleration would be caused by the lower expected vigor of domestic demand, which would reduce its contribution to 1.9 percentage points, while the contribution of the foreign sector would be nil (both unchanged with respect to the previous Panel). Quarter-on-quarter GDP growth rates would be around 0.5% throughout the year (Table 2).

Inflation

Few changes in inflation forecasts

After starting the year close to 3%, headline inflation has fallen in recent months to around 2.2%. The core inflation rate, meanwhile, after registering a low of 2% in March (the lowest since the end of 2021), stood at 2.2% in May and June. Persistent food price pressures are hampering the disinflation process.

The panelists expect the overall rate to rise in the coming months, although it is expected to end the year at 2.2% in December, with an annual average of 2.4% (one tenth less than in the previous Panel). For 2026, an annual average of 2% and a year-on-year rate of 2% in December (unchanged from the previous consensus forecast) are expected. As for the core rate, it has been revised down by one tenth to 2.2% in 2025, and the 2026 rate has been maintained at 2.1% (Tables 1 and 3).

Labor market

The unemployment rate is projected to fall to 10.4% in 2026

Job creation has remained stable so far this year, according to Social Security enrollment figures, although the pace of growth has moderated compared to last year. Consensus forecasts have undergone few changes: for the current year as a whole, with employment expected to grow by 2% (one tenth of a percentage point more than in the previous panel), and by 1.4% next year. The unemployment rate is expected to fall to 10.7% in 2025 and 10.4% in 2026, unchanged from the previous assessment (Table 1).

As for productivity and unit labor costs (ULC), calculated on the basis of GDP, wage compensation and employment growth forecasts in LFS (Labour Force Survey) terms, their growth is forecast at 0.4% for 2025 (two tenths of a percentage point less than in the previous Panel) and 2.9% (four tenths of a percentage point more), respectively. By 2026, productivity would grow by 0.5% and ULCs by 2.3%.

Balance of payments

External surplus shrinks, but remains high by historical standards

In the first quarter of this year, the current account balance recorded a surplus of €10 billion, which is 3.6 billion less than in the same period of last year. This worsening was caused by the contraction in the trade balance surplus (due to a larger deficit in trade in goods, which more than offset the improvement in the services surplus) coupled with a similar result in the income balance. In relation to GDP, the current account surplus stood at 1.8% of GDP for the quarter, which in terms of the historical series continues to be a comfortable result.

Consensus forecasts point to a surplus of 2.4% of GDP for this year (unchanged) and 2.2% for 2026, one tenth less than the previous forecast (Table 1).

Government deficit

Slight cut in the estimated public deficit for 2025

Public administrations recorded a deficit of €4.7 billion in the first quarter, a reduction of 12.3% compared to that recorded in the same period last year. The improvement came from the regional administration, local administrations and Social Security funds, only the central administration worsened its result. It is worth mentioning that, after incorporating the month of April, all administrations excluding local corporations (for which there is no data) reduced their improvement due to a worse performance of the regional administration.

The estimate of the general government deficit for the year as a whole has been revised down slightly, by one tenth of a percentage point, to 2.8% of GDP, while the forecast for 2026 remains unchanged at 2.7%. The latter is above the figures contemplated by the Bank of Spain and AIReF or international bodies such as the European Commission and the IMF (Table 1).

International context

Uncertainties surrounding U.S. tariff policy continue to weigh on the global economy

U.S. economic policy continues to set the international agenda. The deadline set by the Trump Administration to reach a trade agreement with the European Union (and other trading partners) has been extended to August 1st, after which, by default, a “reciprocal” tariff of 30% would apply, in principle. All this perpetuates the sense of uncertainty, particularly in sectors exposed to specific tariffs such as aluminum, steel and automobiles. A tariff of up to 17% on European agri-food exports is also on the horizon.

U.S. fiscal policy has also come to the forefront since the previous Panel, with the approval of a multi-year plan of tax and spending cuts. According to the Congressional Budget Office, this plan could increase public debt by 3 trillion dollars over the next ten years, generating a significant expansion in the supply of bonds in the international markets. Another relevant decision since the previous Panel is the European commitment to increase defense spending within the NATO framework.

In this context, qualitative indicators, such as business sentiment and consumer confidence indices, point to a sharp deterioration in the economic situation. These expectations have not yet been passed on to the real economy, which is showing some resilience. In the U.S., the Atlanta Fed’s GDPnow index shows an upturn, while employment continues to grow, albeit at more moderate rates than last year. In Germany, there is also a slight recovery in industrial production. But other European countries do not share this improvement, with the PMI for the eurozone as a whole pointing to persistent stagnation (the index stood at 50.4 in the second quarter, the same as in the first quarter).

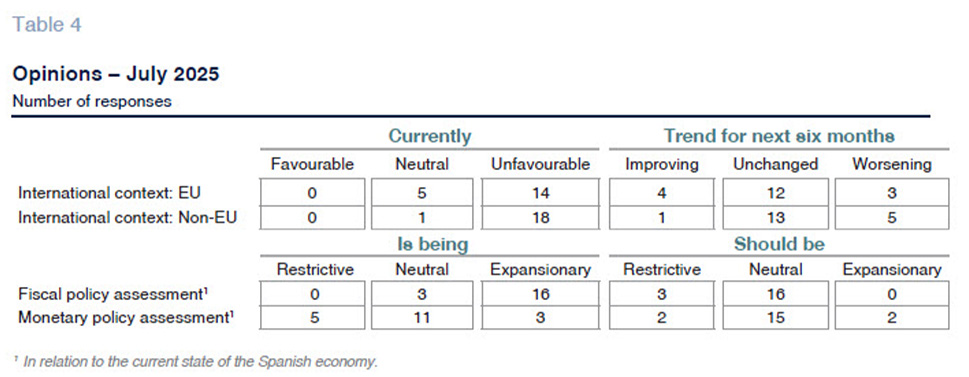

Panel assessments reflect the climate of uncertainty. Virtually all panelists believe that the global environment is unfavorable, and that this situation will continue to prevail in the coming months or deteriorate, with little change from the previous Panel. Views regarding the European environment are somewhat less pessimistic, as in the May consensus (Table 4).

Interest rates

The ECB is expected to make a final rate cut at the end of the year

The protectionist turn has complicated the Fed’s task. On the one hand, tariffs will be passed on to prices, raising the risk of inflation. But at the same time, trade restrictions tend to slow the economy, moving it away from full employment, which is the other objective of monetary policy along with price stability. Faced with doubts about the respective magnitude of the various impacts, and given the delays in trade policy itself, the Federal Reserve has opted to maintain interest rates unchanged, not yielding to pressure from the executive, which advocates a rapid easing.

In the eurozone, monetary policy has more room for manoeuvre, since the risk of stagflation is lower than in the U.S. (generalized countervailing import tariffs have not been activated). This situation, together with the appreciation of the euro, has paved the way for the ECB to cut its main interest rates: the deposit facility stands at 2%, a quarter of a point lower than in the previous Panel.

According to the consensus forecast, the ECB will further tighten the deposit facility rate to 1.75% by the end of the year and maintain that level for next year, in line with the May consensus (Table 2). Markets appear to have discounted these adjustments, such that the one-year Euribor would barely decline from around 2%-2.1% today to 1.9% by the end of 2026, little changed from the previous Panel (Table 2). Similarly, valuations offer little change with respect to Spanish 10-year bonds (the main market benchmark), whose yield is anticipated to remain in the vicinity of 3.2% throughout the forecast period (Table 2).

Foreign exchange market

Appreciation of the euro against the dollar

The portfolio adjustment that began after “liberation day” has continued, generating a rapid appreciation of the euro against the dollar (and also against the yuan and other currencies whose exchange rates are pegged to the dollar). At the time of writing, the common currency was trading at around $1.17, or 4% higher than in May and 13% above the values seen at the beginning of the year. Analysts predict that the exchange rate will hover around current levels until the end of 2026 (Table 2).

*

The Spanish Economic Forecast Panel is a survey conducted by Funcas among the 19 analytical services listed in Table 1. The survey, which has been carried out since 1999, is published bimonthly in January, March, May, July, September and November. Based on the responses to the survey, “consensus” forecasts are provided, which are calculated as the arithmetic mean of the 19 individual forecasts. By way of comparison, although not forming part of the consensus, the forecasts of the Government, AIReF, the Bank of Spain and the main international organizations are also presented.