Economic insights for a more integrated European defence industry

Despite rising defence budgets across the EU, limited integration continues to constrain industrial efficiency and innovation. Coordinated production and collaborative investment could significantly enhance output without increasing overall spending.

Abstract [1]: The European Union is the second-largest global spender on defence, but its effective military capacity has lagged. The current industrial model, marked by overlapping capabilities, limited economies of scale, and modest levels of collaborative innovation spending, has contributed to high production costs and missed opportunities for technological spillovers. Drawing on a simple modelling exercise, estimates show that full integration of the EU defence market could have raised industrial output by 22 percentage points in 2022 above observed growth, equivalent to roughly €46 billion or 14% of total EU defence spending. Most of the potential gain is tied to scale effects, with a smaller but important share linked to increased knowledge transfers. While countries with larger industrial bases would benefit most in absolute terms, smaller member states would experience stronger relative growth, supporting more balanced development. Unlocking these gains would require addressing long-standing institutional and financial barriers, and ensuring that benefits are distributed equitably across the bloc. At a time of heightened geopolitical pressure, improving industrial coordination offers a credible path to stronger strategic autonomy and more effective defence capacity.

Foreword

The European Union is the second-largest bloc in terms of defence spending. However, its effective military capacity has lagged, evidencing a mismatch between the resources invested and the capabilities developed.

The defence industry plays a fundamental role in nations’ military protection, as was underscored at the NATO summit of June 2025, which focused on the need to uplift production in line with the growth in spending. [2]

In recent decades, the European defence industry has focused on the manufacture of specialist equipment at a small scale, against the backdrop of scant collaboration. However, recent events have exposed the limits of this approach to face high-intensity threats.

This lack of coordination is reflected in the current productive map, characterised by the coexistence of multiple national capabilities and limited coordination among countries, generating overlap and curbing economies of scale. This fragmentation is not exclusive to the EU’s defence sector, but its idiosyncrasies introduce additional complexity.

Against this backdrop, we ask how the defence industry would be affected by greater integration and closer collaboration on innovation spending among the member states.

This paper approaches this question quantitatively, with the aim of sizing up the potential impact from the perspective of industrial production.

European defence industry: Assessment and challenges

The end of the Cold War marked a turning point in the European defence sector’s development. The contraction in defence spending that characterised the so-called “peace dividend” prompted the reorientation of the industrial ecosystem around the production of specialised equipment at a small scale, while maintaining high standards of quality (IISS, 2025).

The European defence industry transcends the production of weapons, also encompassing the provision of services and research and development efforts. A case that illustrates this idea is its participation in the manufacture of dual-use goods (i.e., products with military and civil applications), mainly intermediate goods like electronic equipment and mechanical machinery. In the twentieth century dual-use technology has produced high-impact civil innovations such as the internet and GPS technology. Currently, they are facilitating accelerated industry development and acting as inputs for military goods in other areas.

The role of dual-use goods in the EU defence industry’s configuration is two-fold. On the one hand, they could help accelerate industrial development in Europe and propel technological innovation, as the transfer of know-how between the two sectors increases the probability of success around new technologies, as well as reducing their cost (Martí Sempere, 2024). On the other hand, dual-use goods are closely related with EU trade policy, as borne out by the recent tightening of regulations by the European Commission (Alekseev and Lin, 2025).

From a geographical perspective, industrial production is concentrated in France, Germany, Italy, Sweden and Spain. However, countries like Poland and Romania have stepped up their sector positioning considerably in recent years. Since the invasion of Ukraine in 2022, productive capacity has been steady in some areas (guided weapons and main battle tanks), but the bloc remains utterly dependent on non-EU countries in others such as multiple rocket launchers and blue-water anti-submarine warfare aircraft (IISS, 2025).

Financial restrictions are one of the main obstacles facing the sector. European companies have reduced access to equity financing compared to their competitors from the U.S. and other countries (European Commission, 2024). In parallel, uncertainty around future demand limits the expansion of capabilities by impeding a correct identification of investment areas and volumes.

The sector’s business structure is very heterogeneous. It is characterised by the existence of just a few large-scale companies that compete in the global markets, alongside numerous small- and medium-sized enterprises playing a key role in the value chains. Calcara (2020) maintains that domestic market size contributes to this differentiation, creating two tiers. Companies focused on complete systems operate in the tier-one markets (France and Germany), larger in size, while the tier-two market (Spain, among others) players operate in specialist niches, supplying the former. This segmentation in turn determines the patterns of cooperation among European companies and contributes to the fragmentation that characterises the sector.

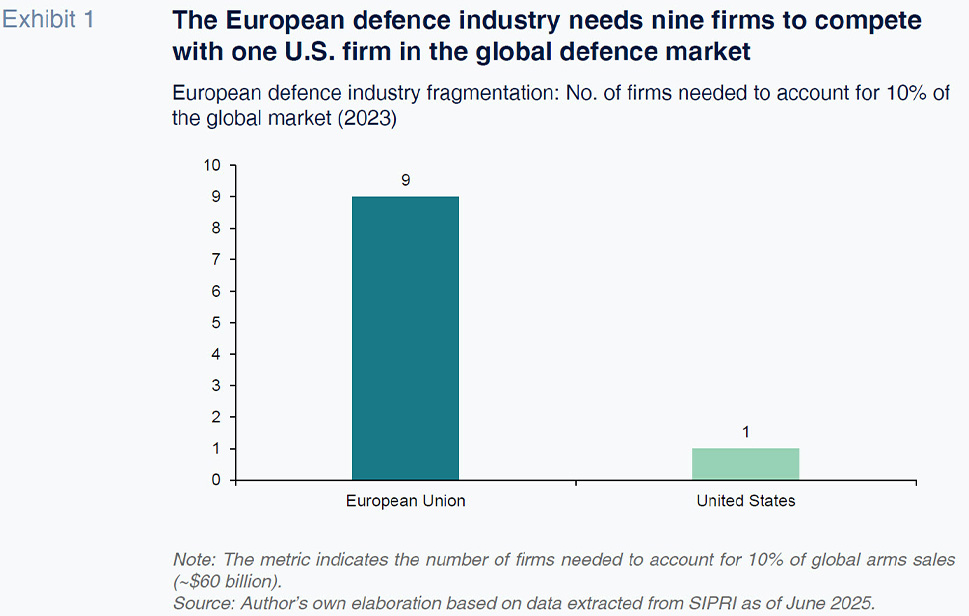

This fragmentation is particularly pronounced when compared with industrial production capabilities in the U.S. (Exhibit 1). In 2023, as many as nine European firms were needed to account for 10% of global weapons sales, compared to just one U.S. firm. This fragmentation is exacerbated by the structure of the supply chains across the various member states. A Commission task force documented that the prime manufacturers for the 46 most urgently needed components were located in 23 different member states (EU Defence Joint Procurement Task Force, 2024).

Sector fragmentation is also attributable to the specific characteristics of demand. The productive process is articulated around a ‘build-to-order’ system and depends essentially on the public sector. The preference for national sovereignty, in a context of underinvestment, has left the productive system less dynamic, narrowed opportunities for investment and limited the scope for tapping economies of scale.

Globally, the EU is the second largest geographical region in terms of defence spending, albeit spending only around half of what the U.S. spends (SIPRI, 2025). [3] The EU’s defence spending target [4] is dictated by NATO guidelines, which currently sets that target at 2% of GDP. [5] In 2024, the European average was below that target (1.9%). However, spending has been increasing as a percentage of GDP since 2015, with joint European defence spending taking off in 2022, albeit still very small in size (0.1% of GDP). These figures mask significant heterogeneity. Some countries, including Denmark, Greece and Poland, spend more than 2% on defence, with some even outspending the U.S., whereas others, such as Luxembourg and Belgium, are well below that threshold.

The defence spending fiscal multiplier in the EU is shaped significantly by the capital intensity of procurement (Sarasa-Flores, 2025). The difference in research and development (R&D) expenditure compared to the U.S. resides primarily in the public sector, where the gap amounted to approximately €60 billion in 2022 (Centrone and Fernandes, 2025). The structure of procurements also plays a role. In the EU, a high percentage of purchases come from outside the bloc, particularly from the U.S. (Maulny, 2023), limiting the effect of the multiplier on the European productive landscape.

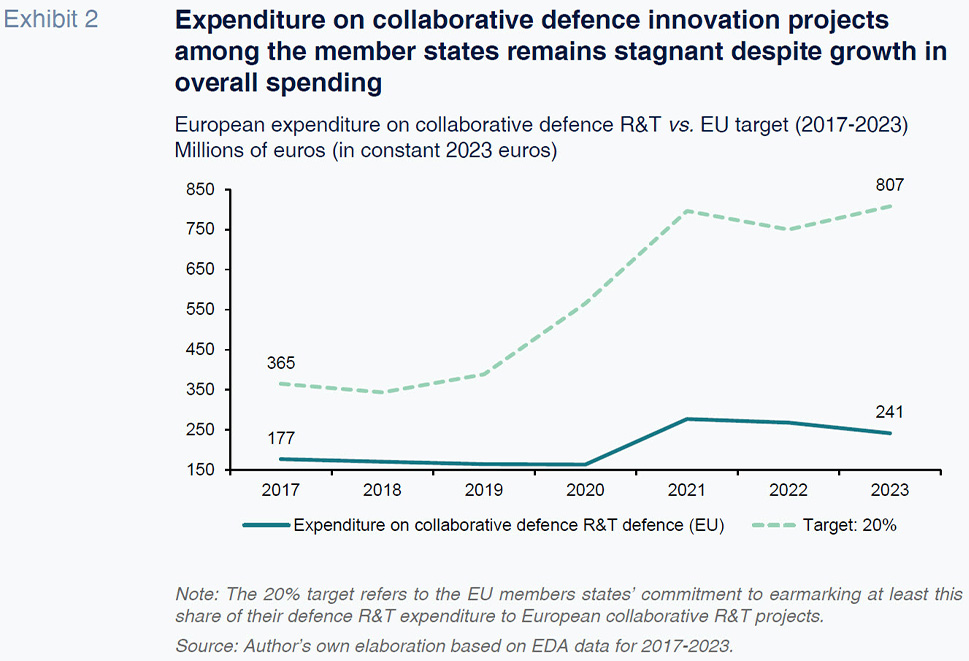

These shortcomings are evident in the gap between real expenditure on collaborative research and technology (R&T) projects, a subset of R&D,

[6] and the target of 20% set by the EU (Exhibit 2). Since 2017, real expenditure on this heading has increased sharply (121%). However, the growth in collaborative spending has not matched this pace (37%). Between 2017 and 2023, the gap tripled in absolute terms (from €188 to €566 million).

This dynamic reflects persistent national preferences and a shortage of joint EU projects. In addition, the increase in R&T expenditure is concentrated among just a few member states (European Defence Agency, 2024).

Since 2017, real expenditure on innovation has increased sharply. However, the growth in collaborative spending has not matched this pace.

This organisational structure has at least three fundamental consequences. Firstly, overlap in production. For every system produced in the U.S., six are produced in the EU, with significant differences from one sector to the next (for main battle tanks, the ratio increases to 17). Secondly, higher production costs. A main battle tank (Leopard 2A8) in Germany costs €12 million more than an equivalent American tank (M1A2 Abrams), the higher unit cost being correlated with lower annual productive capacity (Mejino-López and Wolff, 2024). Thirdly, smaller production runs, which limit the scope for leveraging economies of scale and discourage industrial investment.

This assessment highlights how integration of the European market could create catalysts for industrial production in the defence sector. We look deeper into the potential impact in the next section.

A quantitative assessment of a more integrated European defence industry

There is consensus across the literature on the impact of European market integration that the benefits exceed the transition costs (Durá and Pasimeni, 2025), despite differing by sector and country (Harrison et al., 1994 and Yotov y Fontagné, 2025). Characteristics specific to the defence sector, including its intense use of technology and the scope for economies of scale, could amplify these positive effects.

The current limits of the European defence sector restrict the scope for rapid expansion, so reaching the desired production levels will take time (IISS, 2025). In the context of restricted space for fiscal manoeuvre, greater integration and more collaboration around innovation constitute an alternative route for reinforcing the defence-industrial sector.

In order to quantify this counterfactual, we carry out a simple exercise to approximate the impact of greater integration of the EU defence market. The aim is to illustrate the potential increase in European production of defence goods [7] that would result from a more integrated single market.

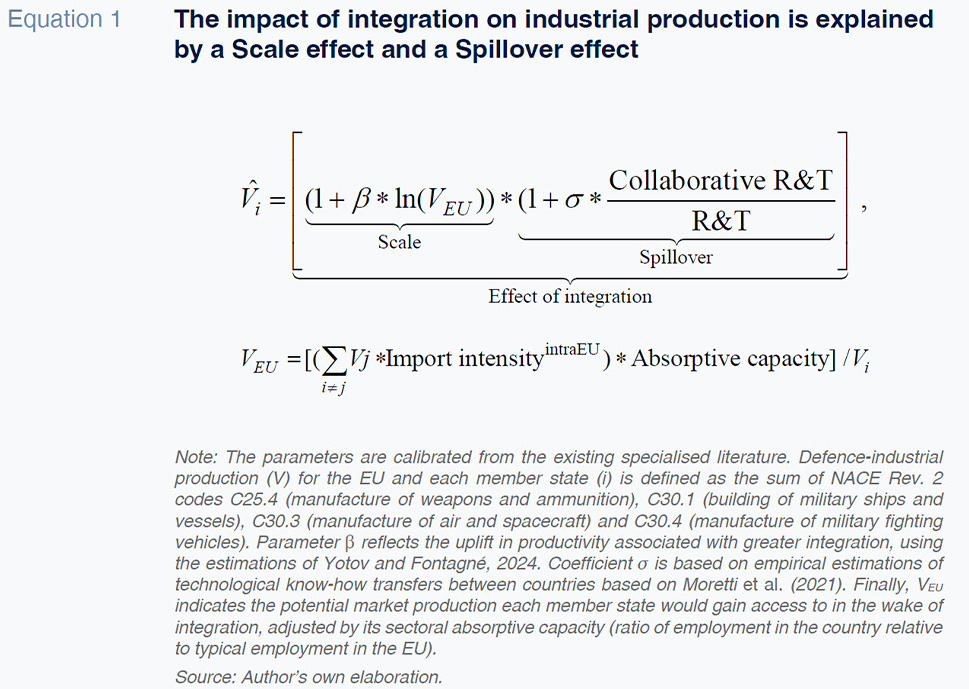

The analysis captures two different channels. Firstly, the gains derived from access to a larger market (Scale), which would unlock available economies of scale. Secondly, the transfer of know-how among member states induced by higher expenditure on collaborative projects (Spillover), which would facilitate technological dissemination and improve productivity.

The model (Equation) compares observed production with that which would occur in a scenario of greater European integration

. A central component of this methodological framework is defining the potential market to which each member state would have access (V

EU). To calculate it, we consider production in the rest of the member states weighted by the intensity of imports from those countries and their absorptive capacity, measured as the distance to the volume of employment typical of the sector in the EU.

The parameters used are underpinned by econometric estimates taken from the existing literature. The Scale channel coefficient (β) reflects the uplift in production resulting from a larger market, in line with Yotov and Fontagné (2024) for those same sectors. Elsewhere, the parameter associated with the Spillover channel (σ) provides the average intensity with which technology is transferred among countries, based on Moretti et al. (2021).

The estimation uses the most recent data available (2022) and assumes the closure of the gap in collaborative R&T spending relative to the 20% target set by the EU, modelling a scenario of full integration and target achievement. This approach means the results indicate the maximum upside of hypothetical full integration.

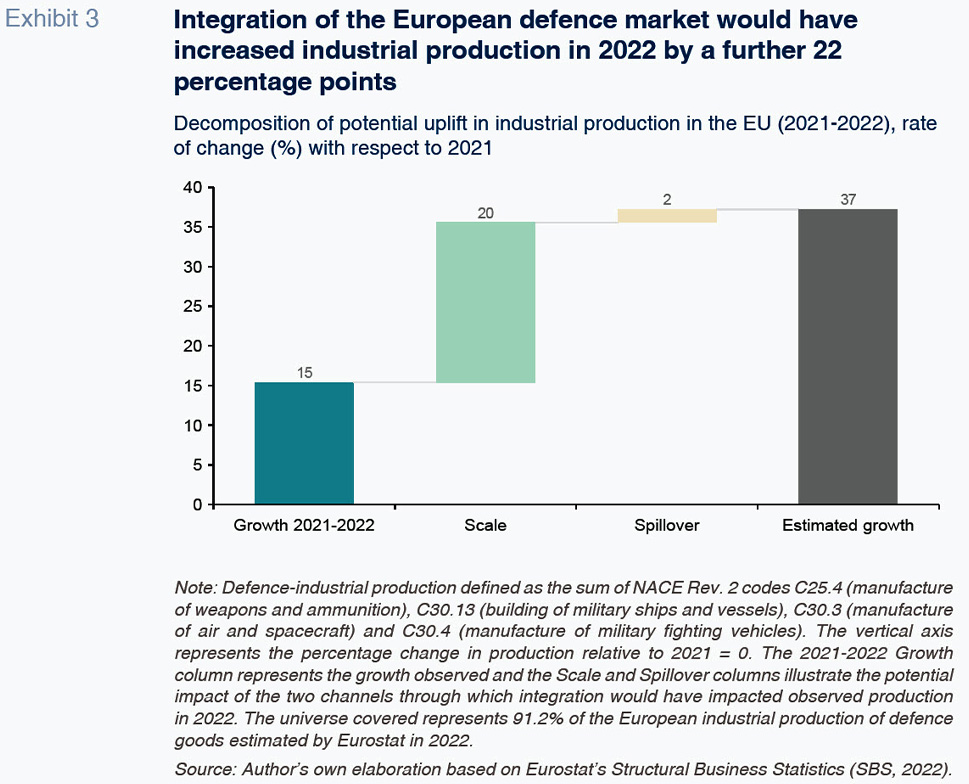

The model results (Exhibit 3) allow us to decompose the effects on industrial production of defence goods. Between 2021 and 2022, observed industrial production increased by 15%. However, in a scenario of European integration, industrial production growth would have reached 37%.

This difference suggests that EU defence-industrial sector fragmentation would imply an opportunity cost of 22% of production growth observed in 2022, equivalent to approximately €46 billion.

This figure is attributable mainly to the Scale channel, which would explain around 20 percentage points of the potential increase. Its magnitude highlights the opportunity cost of current European productive landscape fragmentation. Meanwhile, collaborative expenditure on innovation among the member states (Spillover) would explain almost two additional percentage points of growth foregone, indicating that technology transfers among countries would contribute to increasing the sector’s industrial output.

This potential growth would be uneven across member states (Exhibit 4). The analysis classifies the countries into three categories by their percentiles of observed production in 2022, that is, their defence-industrial capabilities. The High category, which includes countries with the largest industrial capabilities (above the 66

th percentile, Including France and Spain), would garner over 17 percentage points of the estimated impact, therefore benefitting the most in absolute terms. The Medium category (percentiles 33-66, including the Czech Republic and Finland), and the Low category (below the 33

rd percentile, including Portugal and Denmark) would account for around 5 percentage points of the potential growth in production over that observed in 2022.

The results suggest that the countries in a stronger starting position would be better placed to tap larger markets. However, countries with smaller industrial bases would register a relatively greater uplift. Growth in production in countries with higher shares could propel industries in other countries indirectly through specialisation in relevant market niches and reinforcement of European value chains.

However, it also highlights the need to design compensation and industrial governance mechanisms to ensure fair distribution of the gains. It is essential that the boost in production combines the speed required with a structure designed to leverage the comparative advantages of member states, and provides sufficient incentives to ensure an encompassing European approach.

The results are, nevertheless, conditioned by certain methodological limitations which warrant their interpretation with caution. A precise contrafactual would require more extensive econometric studies and a peer review. The impact, for example, of the fiscal multiplier in defence is dynamic (Ilzetzki, 2025), can vary in the short and medium term (Antolín-Díaz and Surico, 2025) and its effects may not be linear (Linnemann and Winkler, 2016). The results may also be conditioned by the model’s specification, as different methodologies may yield different effects.

In sum, the results suggest that the EU could expand its industrial base by up to 22% by means of greater integration, without having to increase overall spending. Countries with smaller production bases would enjoy relative convergence, while those with greater capabilities would benefit more in absolute terms. All member states would benefit, albeit through different channels. This evidence provides grounds for advancing towards greater integration and enhanced productive efficiency.

Economic implications of the findings

The estimations reveal that an increase in defence-industrial production does not rely exclusively on higher spending but also on its organisation. A more integrated European market would improve the defence industry’s situation for the EU as a whole.

These figures need to be properly contextualized. Fragmentation of the European defence market would represent an opportunity cost of 22% in annual growth foregone in 2022 (around €46 billion), equivalent to roughly 14% of total EU defence spending.

This outcome complements the literature on the cost of non-Europe from a productive perspective. Centrone and Fernandes (2025) find that limited use of potential economies of scale in defence spending has an annual cost of between €18 and €57 billion, depending on the degree of integration modelled.

Mueller (2024), in a meta-synthesis of the quantitative literature on integration of the European defence market, concludes that greater cooperation among member states could save the EU up to 30% in defence spending. For 2024, that figure would be equivalent to approximately €98 billion for the defence sector as a whole, including effects beyond just the production of industrial goods.

Mejino-López and Wolff (2024) note that in the short term, reliance on non-EU suppliers may make economic sense. They argue, however, that in the long run, European integration is fundamental to preserving industrial capabilities and keeping strategic autonomy intact.

The ultimate aim of increasing defence-industrial production in member states is to enhance effective protection. Marsh et al. (2024) argue that integration and interest alignment are prerequisites for guaranteeing that increased spending translates into greater military capabilities.

Industrial production is just one dimension of the challenge at hand. The technological composition and interoperability between armed forces also play a meaningful role. The European Court of Auditors (2025) flags military mobility as one of the main challenges facing the continent, underscoring the importance of tackling the challenges from a holistic perspective.

Materialisation of these potential benefits would run up against barriers in practice. This industry’s idiosyncrasies explain why member states show preference for national over European sovereignty, protected under article 346 of the TFEU since the Treaty of Rome of 1957. The EU countries have taken remarkably different positions on armed conflicts, impeding the industry’s coordinated progress. From an economic perspective, this protectionism reduces possibilities for expansion and competitiveness, especially relative to the U.S.

Financial restrictions are another important limiting factor. In the public sector, [8] most member states have little space to increase their expenditure on defence, thus diluting the impact of the fiscal multipliers (Sarasa-Flores, 2025).

Nevertheless, private financing has a bigger role to play than public financing in this integration scenario. Private companies, due to the sector’s specific characteristics and European capital markets fragmentation, face greater difficulties in accessing capital than their U.S. counterparts (European Commission, 2024). Enhanced market integration would have to be accompanied by broader financial instruments and reduced entry barriers.

Completion of the market also raises competition-related risks. [9] The redistribution of production among the member states needs to be based on leveraging comparative advantages, considering the specifics of the defence industry, so as to prevent the creation of an outsized sector concentrated in a small number of firms from certain countries.

In short, maintaining the defence industry’s current productive structure implies an opportunity cost of €46 billion, or around 22% of potential production growth foregone in 2022, equivalent to 14% of EU defence spending. These consequences extend beyond the defence sector, as they affect the EU economy as a whole due to the potential loss of strategic relevance in the global system. Integration would unlock benefits, but their realisation would require tackling the identified political and financial barriers in a coordinated manner.

Notes

[1] The author would like to thank Raymond Torres for his input. However, the opinions and any possible errors contained in this document are the sole responsibility of the author.

[2] For further details, refer to the keynote speech by NATO’s Secretary General:

https://www.nato.int/cps/en/natohq/opinions_236429.htm[3] DOI:

https://doi.org/10.55163/cqgc9685[4] With the exception of Austria, Cyprus, Ireland and Malta, which are not NATO members.

[5] An agreement was reached at the NATO meeting held in June 2025 whereby its members have agreed to increase the threshold to 5% of GDP, with nuances around composition.

[6] R&T expenditure covers expenditure for basic research, applied research and technology demonstration for defence purposes.

[7] The defence goods industry is defined as that encompassing the following NACE Rev. 2 codes: C25.4 (manufacture of weapons and ammunition), C30.1 (building of military ships and vessels), C30.3 (manufacture of air and spacecraft) and C30.4 (manufacture of military fighting vehicles). This classification is representative of the production of goods related to military security. However, it does not totally exclude from the analysis the portion of production devoted to civil uses.

[8] For a more detailed analysis of the debate around public financing for the defence sector, refer to Scazzieri and Tordoir (2024) and Guttenberg and Redeker (2025).

[9] For a description of the recent mergers and acquisitions in the defence sector and the prospects for sector M&A activity going forward, refer to Guijarro and Gómez (2025).

Referencias

ALEKSEEV, M., and LIN, X (2024). Trade Policy in the Shadow of Conflict: The Case of Dual-use Goods.

Working Paper, October 2024.

ANTOLÍN-DÍAZ, J., and SURICO, P. (2025). The Long-Run Effects of Government Spending.

American Economic Review, 115(7).

CALCARA, A. (2020). Cooperation and non-cooperation in European defence procurement.

Journal of European Integration, 42(6), 799-815. DOI:

https://doi.org/10.1080/

07036337.2019.1682567 CENTRONE, M., and FERNANDES, M. (2025). Improving the quality of European defence spending. Cost of non-Europe report. European Parliamentary Research Service. European Parliament.

https://www.europarl.europa.eu/RegData/etudes/

STUD/2024/762855/EPRS_STU(2024)762855_EN.pdf CLAPP, S. (2024). European defence industrial strategy. European Parliamentary Research Service.

https:/www.europarl.europa.eu/RegData/etudes/BRIE/2024/762402/EPRS_BRI(2024)762402_EN.pdf COMISIÓN EUROPEA. (2024). Study results: Access to equity financing for European defence.

https://defence-industry-space.ec.europa.eu/study-results-access-equity-financing-european-defence-smes-2024-01-11_en DURÀ, P., and PASIMINI, P. (2025). The economic impact of the European Single Market.

Single Market Economics Papers. European Commission.

https://single-market-economy.ec.europa.eu/publications/economic-impact-european-single-market_en EUROPEAN DEFENCE AGENCY. (2024). Defence data 2023-2024 report.

https://eda.europa.eu/docs/default- source/brochures/eda—-defence-data-23-24—-web—-final.pdf FONTAGNÉ, L., and YOTOV, Y. V. (2024). Reassessing the impact of the Single Market and its ability to help build strategic autonomy.

Single Market Economics Papers. European Commission.

http://www.lionel-fontagne.eu/uploads/9/8/3/3/98330770/lfyy.pdf FONTAGNÉ, L., and YOTOV, Y. V. (2025). The Low-Hanging Fruit of the Single European Market: New Methods and Measures.

Working Paper, N° 2025 – 20.

https://pse.hal.science/hal-05048951/file/WP_2025-20.pdf GUTTENGERG, L., STIFTUNG, B., and REDEKER, N. (2025).

How to defend Europe without risking another euro crisis. Jacques Delors Centre.

https://www.delorscentre.eu/fileadmin/2_Research/1_About_our_research/2_

Research_centres/6_Jacques_Delors_Centre/Publications/20250221_Policy_Brief_Defence

_Spending_Fiscal_ Rules_Lucas_Guttenberg_Nils_Redeker.pdf HARRISON, G., RUTHERFORD, T., and TARR, D. (1994). Product Standards, Imperfect Competition, and Completion of the Market in the European Union.

World Bank Policy Research Paper, 1293. Washington D. C.: World Bank.

https://documents1.worldbank.org/curated/en/

871461468744326568/pdf/multi0page.pdf ILZETZKI, E. (2025). Guns and growth: The economic consequences of defense buildups.

Kiel Report, No. 2. Kiel Institute for the World Economy (IfW Kiel), Kiel.

THE INTERNATIONAL INSTITUTE FOR STRATEGIC STUDES (IISS), (Ed.). (2025).

Building Defence Capacity in Europe: An Assessment (1

st ed.). Routledge.

https://doi.org/10.4324/9781003640844

LINNEMANN, L., and WINKLER, R. (2016). Estimating nonlinear effects of fiscal policy using quantile regression methods.

Oxford Economic Papers, 68(4), 1120–1145.

MARSH, N., MARTINS, B. O., MAWDSLEY, J. (2024). European defense spending: Trade-offs and consequences of non-alignment.

EconPol Forum. CESifo GmbH, Munich, 25(4), 20-23. ISSN 2752-1184.

MARTÍ SEMPERE, M. (2024).

Estrategias industriales de defensa y tecnologías duales. Real Instituto Elcano.

https://media.realinstitutoelcano.org/wp-content/uploads/2024/10/ari137-2024-martisempere-estrategias-industriales-de-defensa-y-tecnologias-duales.pdf MAULNY, J-P (2023).

The impact of the war in Ukraine on the European defence market. IRIS.

https://www.iris-france.org/wp-content/uploads/

2023/09/19_ProgEuropeIndusDef_JPMaulny.pdf MEJINO-LOPEZ, J., and WOLFF, G. B. (2024). A European defence industrial strategy in a hostile world. Policy Brief. Bruegel.

https://www.bruegel.org/policy-brief/european-defence-industrial-strategy-hostile-world MORETTI, E., STEINWENDER, C., and VAN REENEN, J. (2021). The Intellectual Spoils of War? Defense R&D, Productivity and International Spillovers.

Working Paper, 26483. NBR.

https://www.nber.org/system/files/working_papers/w26483/w26483.pdf MUELLER, T. (2024). Drivers and Impact of European Defence Market Integration: A Literature Meta-Synthesis with Economic Focus, Defence and Peace Economics. DOI:

10.1080/10242694.2024.2396416 SARASA-FLORES, D. (2025). Buy guns or buy roses?: EU defence spending fiscal multipliers.

WP BBVA Research.

SCAZZIERI, L., and TORDOIR, S. (2024). European common debt: Is defence different? Centre for European Reform.

https://www.cer.eu/sites/default/files/pb_LS_ST_defence_bonds_5.11.24.pdf TRIBUNAL DE CUENTAS EUROPEO. (2025). Movilidad militar en la UE. Informe Especial.

https://www.eca.europa.eu/ECAPublications/SR-2025-04/SR-2025-04_ES.pdf

Miguel Ángel González Simón. Funcas