The Spanish economy in slowdown mode

While the solid recovery continued in recent months, the ongoing slowdown in domestic demand along with a less favourable external environment is expected to result in slower growth in both 2018 and 2019. Looking forward, of particular concern for the Spanish economy are the relatively high levels of unemployment and government debt, which policymakers should address during the current period of economic expansion –otherwise the imbalances will bear a disproportional impact on future generations.

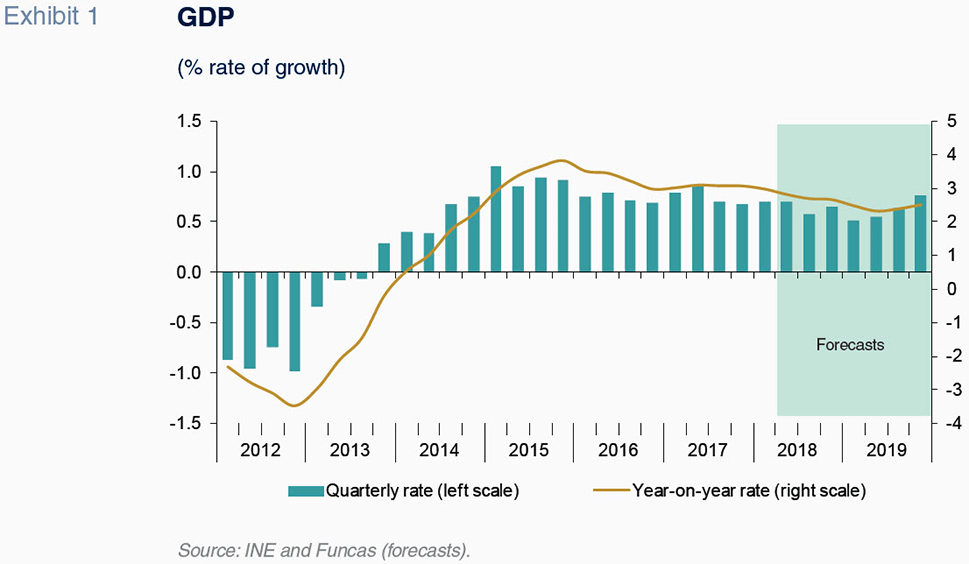

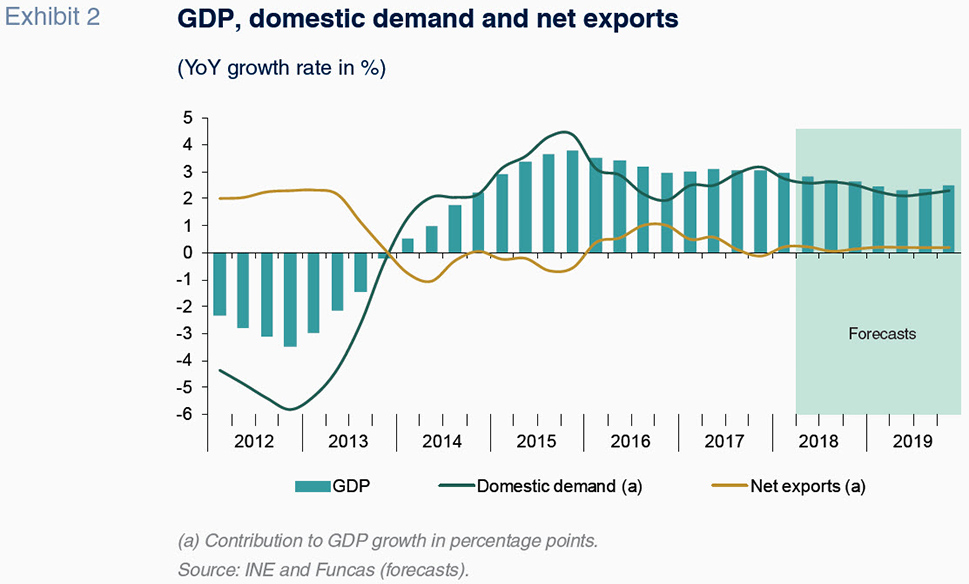

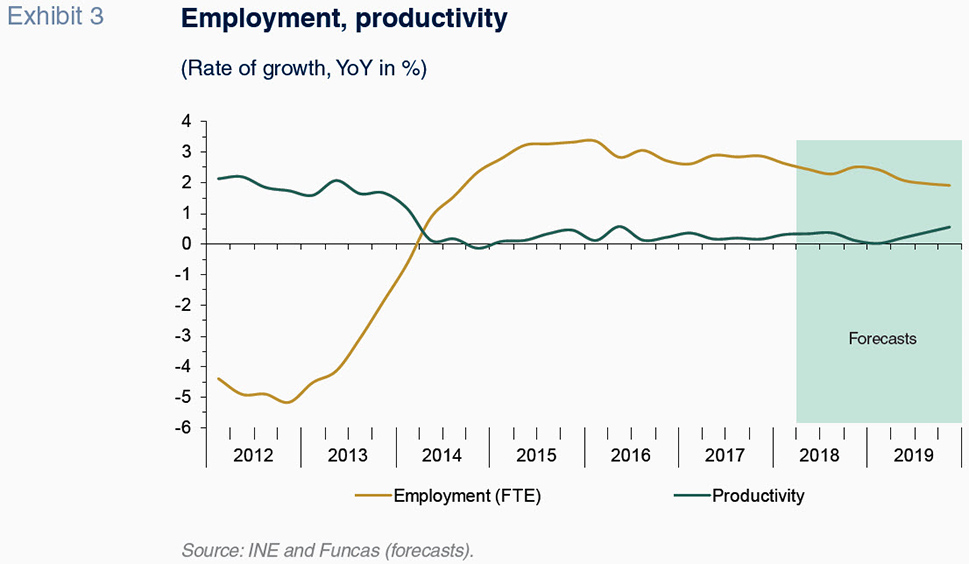

Abstract: On a year-on-year basis, the Spanish economy expanded by 3% during the first quarter of 2018, 0.1 percentage points less than 4Q2017. This growth was underpinned by stronger than expected private consumption, a buoyant construction sector and moderate growth in both employment and productivity rates. That said, some unexpected developments included a decline in manufacturing activity and investment in capital goods. While the Spanish economy is projected to expand vigorously in 2018 and 2019, the pace will be slower than in 2017, primarily due to weaker domestic demand, but also to the expected normalisation of ECB policy, a slowdown in external demand and an increase in energy prices. Spain’s relatively high unemployment and public debt levels are also key sources of potential vulnerability. As such, policymakers should take advantage of the current period of growth to tackle these outstanding weaknesses.

Recent performance of the Spanish economy

Despite the slowdown experienced across the eurozone as a whole, the Spanish economy grew at the same rate during the first quarter of 2018 as in the two previous quarters, 0.7%. Year-on-year, it recorded growth of 3%, 0.1 percentage points less than the previous quarter (Exhibit 1). That growth was driven essentially by domestic demand, with a small contribution made by net exports (Exhibit 2).

Although the headline number was in line with forecasts, its composition diverged from expectations. Specifically, the strength of private consumption, which registered an accelerated growth rate in real terms, took the market by surprise. In nominal terms, however, growth slowed due to a lower rate of inflation that quarter. Growth in government spending gathered pace.

In contrast, investment in capital goods was weaker than forecast, contracting quarter-over-quarter. This is mainly a reflection of its volatile nature. Indeed this investment category has continued to expand, although at a declining pace. Investment in house construction remained buoyant. The real estate market continues to grow, supported by low interest rates and low returns on alternative investments. For the fourth year in a row, house transaction volumes and prices are on an upward trend. However, the stronger price increases are limited to a few large cities, specifically Madrid, Barcelona and Palma.

Growth in exports of goods slowed as a result of the less than favourable external environment; however, this was offset by strong growth in service exports. The contribution by net exports to quarter-over-quarter growth was similar to that of the previous quarter.

On the supply side, another unexpected development was the decline in manufacturing activity, which recorded significant growth during the previous quarter. The fastest-growing sector was construction. Thanks to a positive trend in tourism, the service sector recovered from the slowdown sustained during the previous quarter. This sector registered growth once again after the slump experienced at the end of 2017, albeit at a considerably slower pace than that observed in previous years.

Employment (in national accounting terms) growth continued in the first quarter of 2018, albeit at a moderate pace in comparison with the data observed since the start of the recovery (Exhibit 3). However, the growth in the number of social security contributors was higher than the national accounting figures or the

Labour Force Survey (

EPA for its acronym in Spanish). According to the survey, the rate of unemployment stood at 16.7%, two percentage points below that of 1Q2017.

Productivity increased during the first quarter. However, the pattern remains one of slow gains, in line with the readings since the start of the recovery. Growth in gross operating surplus continued to outpace that of employee compensation. Growth in average pay and productivity were similar so that unit labour costs remained stable during the quarter (year-on-year growth of just 0.1%). In the manufacturing sector, unit labour costs are trending higher, albeit not as fast as the growth in its deflator.

As for the second quarter, the indicators released so far point to GDP growth on par with previous quarters, shaped by easing consumption which has been offset by a recovery in investment. However, the contribution by net exports is expected to be stronger.

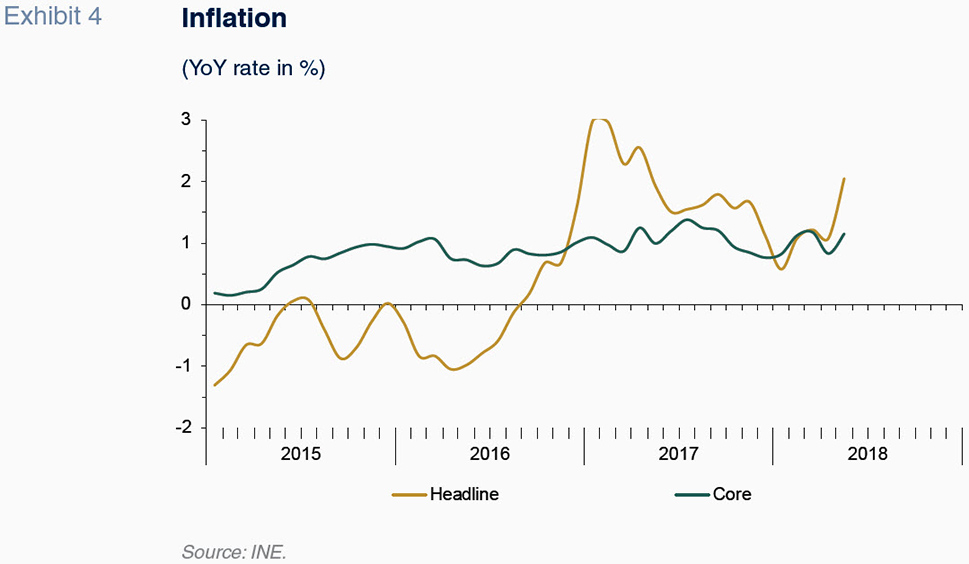

Lastly, the inflation rate, which hovered at around 1% between January and April, spiked above 2% in May and June, driven by higher energy and fuel prices. The core rate of inflation, however, was steady at around 1% (Exhibit 4). The differential with respect to the eurozone, which had been favourable for Spain during the first months of the year, changed sign in May. The difference between the eurozone and Spanish core inflation rates was also favourable to Spain for most of the period.

Projections for 2018-2019 and main risks

The projections for the next two years were drawn up assuming no major changes on the macroeconomic policy front and in the absence of additional information about the new government’s strategy.

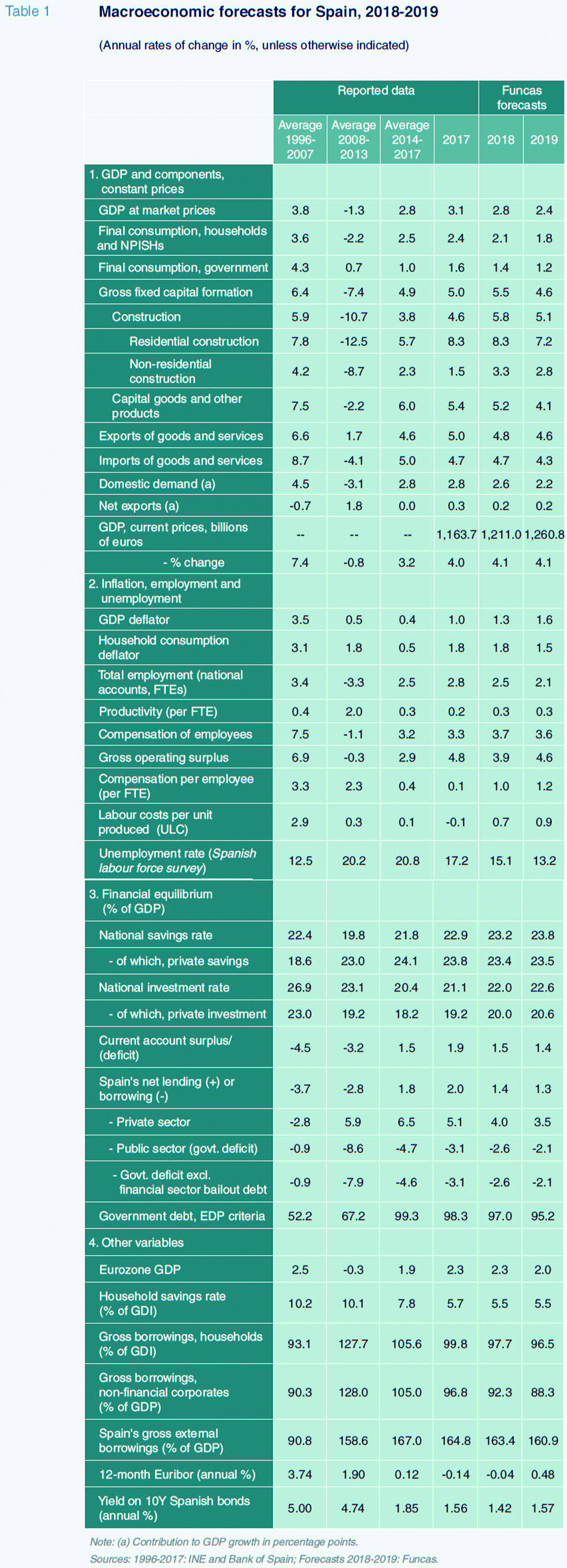

The prevailing growth trend is expected to continue over the next two years thanks to the financial health of the corporate sector, favourable competitive positioning paving the way for market share gains and the momentum intrinsic to the present growth rate. This combination of factors would normally have led to an upward revision of forecasts. Other factors have worked in the opposite direction, however, which is why growth is expected to lose steam, in line with earlier forecasts (Table 1).

The forecasted slowdown reflects a more uncertain external climate. Rate hikes in the US and the normalisation of monetary policy in Europe will nudge financing costs higher for public treasuries and the private sector alike. Elsewhere, the upward trend in oil prices will weaken the terms of trade and put pressure on consumer prices. This upshot will reduce household purchasing power and, by extension, expenditure. Lastly, some of Spain’s export markets are also expected to slow due to uncertainty in Italy and the constraints posed by near full employment in Germany.

The loss of momentum is also attributable to internal factors. In 2017, the household savings rate hit an all-time low, fuelling growth in private consumption despite wage stagnation. However, the savings rate is expected to stabilise over the next few quarters, owing to the absorption of both latent demand leftover from the crisis and precautionary savings, as well as less buoyant consumer credit. Elsewhere, the boom in tourism is likely to ease as a result of saturation in certain destinations, particularly during the peak season, as well as competition from other Mediterranean markets, such as Tunisia and Turkey.

All things considered, the Spanish economy is projected to grow 2.8% in 2018, unchanged from the last set of forecasts (Table 1). This is slower than the average growth rates recorded between 2014 and 2017. The slowdown is expected to be shaped above all by weaker domestic demand. This will be driven by lower growth in household consumption, which is expected to ease by 0.3 percentage points compared to 2017. Public consumption is also expected to ease in real terms due to the delays in passing the budget for this year, coupled with an uptick in inflation.

The recovery in investment should continue, particularly in the construction sector, underpinned by the rebound in house prices and healthy growth in housing transaction volumes. The upward trend in corporate profits and favourable credit terms should prop up investment in capital goods, which is forecast to increase its contribution to GDP by 5.5%.

Trade is expected to remain a growth driver. However, growth in exports, albeit positive, is likely to suffer the effects of slower growth in the eurozone, Brexit and international trade tensions. Offsetting this, recent indicators point to weaker growth in imports, which is why net exports are expected to maintain their 0.2 percentage point contribution to growth (unchanged from the last set of forecasts).

In 2019, the economy is expected to grow by 2.4%, in line with the last round of forecasts. The growth in oil and gas prices, coupled with wage moderation, is expected to curtail purchasing power and spending in both the private and public sectors. In addition, the effects of normalisation of monetary policy are likely to be felt in the cost of financing investments, contributing to a slowdown in this category. However, net exports, thanks to Spain’s strong competitive positioning, are expected to make a positive contribution once again.

Despite more expensive imports, the external balance is expected to remain in a comfortable surplus in 2018 and 2019, serving as one of Spain’s key growth factors.

In light of the growth in the prices of imported energy products and a weak euro, inflation is expected to be considerably higher than previously anticipated. The consumption deflator is forecast to increase at an annual rate of 1.8% in 2018 and 1.5% in 2019, three and two percentage points more, respectively, than previously forecast. In 2018, growth in the GDP deflator (the reflection of core inflation) is expected to trail that of the consumption deflator considerably. Both deflators are expected to exhibit similar trends in 2019.

The forecasted growth will translate into job creation. For 2018, the number of jobholders is expected to increase by 2.5% (up 0.1 percentage points from our last set of forecasts). In 2019, the forecast is for growth of 2.1% (unchanged). During the two-year projection horizon, Spain is expected to create around 800,000 jobs, which would drive the unemployment rate down to 13.2% by the end of 2019. However, the downtrend in unemployment is expected to have only a limited impact on wages and the high incidence of temporary contracts in Spain.

The key measures contemplated in the general state budget will have a positive impact on the public deficit. The deficit is expected to decline to 2.6% of GDP in 2018 and 2.1% in 2019, 0.4 and 0.3 percentage points up from the previous set of forecasts. However, despite the expansionary bias of the budget, those levels should be sufficient to bring Spain out from under Europe’s excessive deficit procedure. Government debt is estimated at 95% of GDP in 2019, which is relatively high compared to other countries.

Heightened trade tensions pose a real challenge for the global economy in general and for the Spanish economy in particular. The import tariffs introduced by the US for national security reasons have not been well received, prompting complaints before the World Trade Organisation, as well as retaliatory measures. A full-blown trade war, if it were to materialise, would have a significant impact on the Spanish economy considering that exports account for 35% of GDP, which is 10 percentage points more than before the crisis.

The increase in interest rates in the US and normalisation of monetary policy in Europe pose issues for highly leveraged economies like Spain. This risk could be mitigated by a strategy for addressing the prevailing imbalances within a reasonable time period. Unfortunately, this has not been possible so far on account of the political situation in Spain. These matters should be addressed by the new government.

Debt and unemployment in Spain: An international comparison

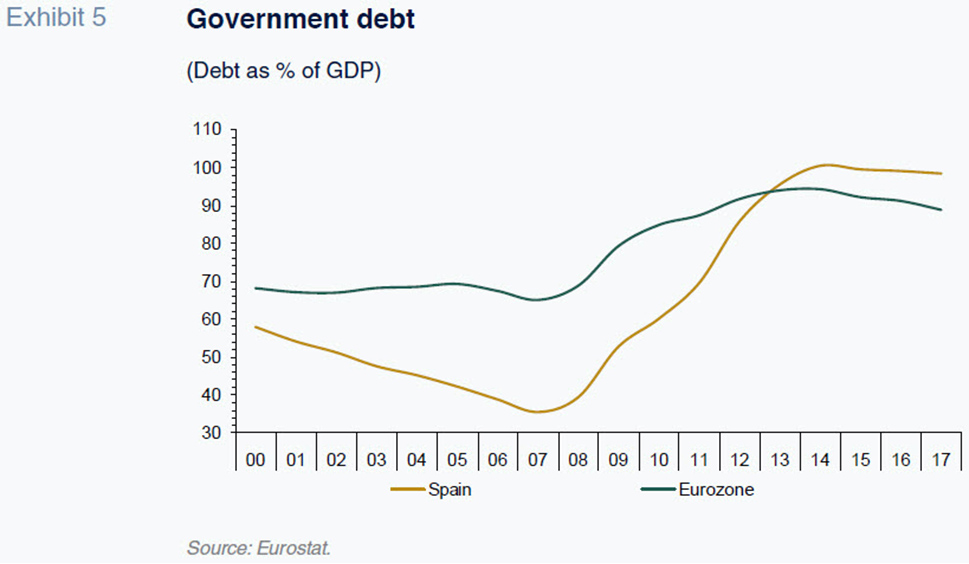

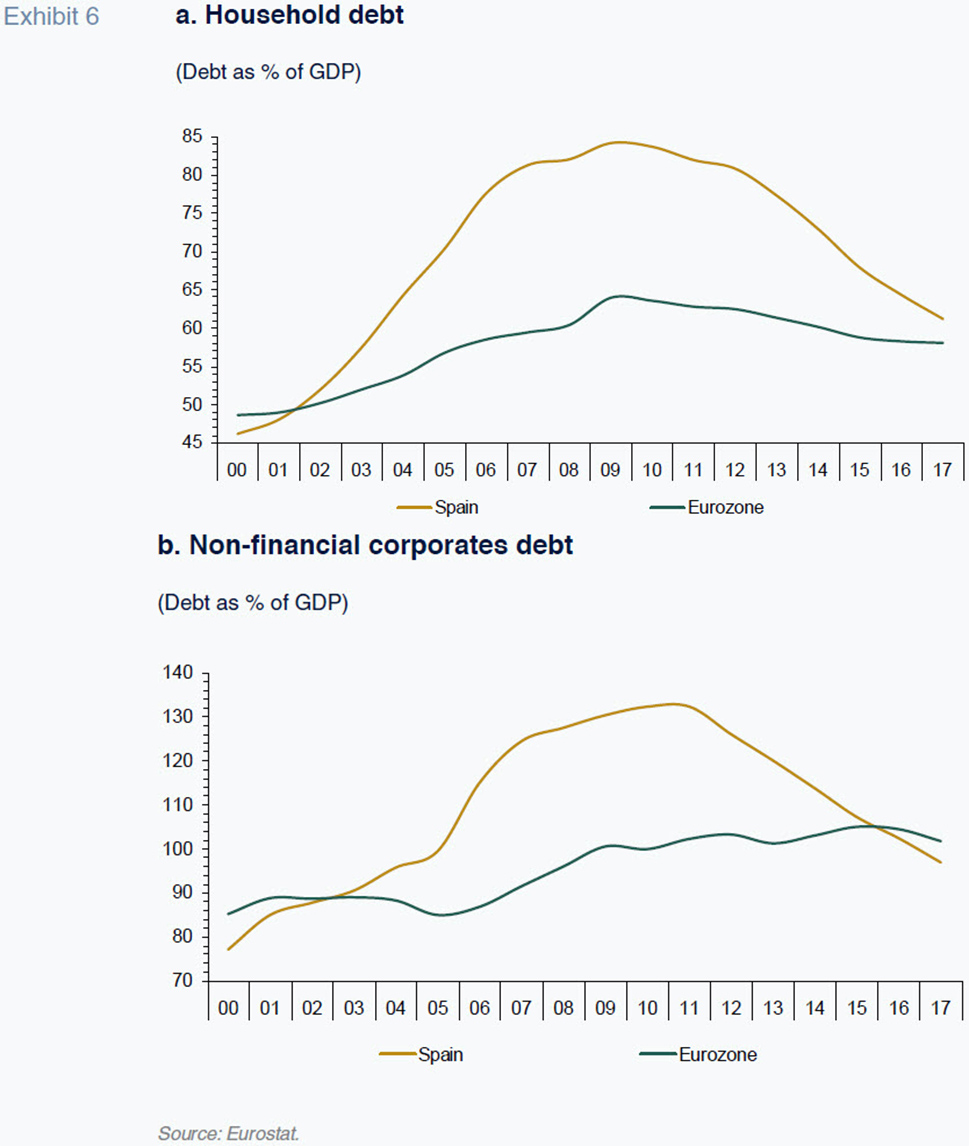

During Spain’s previous growth phase (prior to the crisis), the ratio of government debt to GDP declined to one of the lowest in the eurozone, whereas leverage in the private sector rose above the eurozone average. In contrast, the trend since the start of the crisis has been the opposite: public debt has risen to one of the highest in the region, while private sector debt has fallen substantially (Exhibits 5, 6a and 6b).

By the end of 2017, household debt had fallen to 61% of GDP, which is very close to the eurozone average, down from a high of 84% in 2009. Borrowing by non-financial corporates dropped from a peak of 132% of GDP to 97%, which is below the eurozone average. In nominal terms, private indebtedness (in consolidated terms) has been reduced by 566 billion euros. This, coupled with the drop in interest rates, has significantly restored the financial health of Spain’s household and corporate sectors, thereby underpinning the Spanish economy’s recovery, which has been underway since the middle of 2013.

As mentioned previously, deleveraging in the private sector has been accompanied by the opposite trend in government borrowing. Indeed, government borrowing was equivalent to 98.3% of GDP at year-end 2017, compared to 35.6% in 2007. In nominal terms, government debt has increased by nearly 760 billion euros as a result of the accumulation of deficits, totalling 710 billion euros during the period, in addition to the injection of nearly 50 billion euros of aid into ailing Spanish banks.

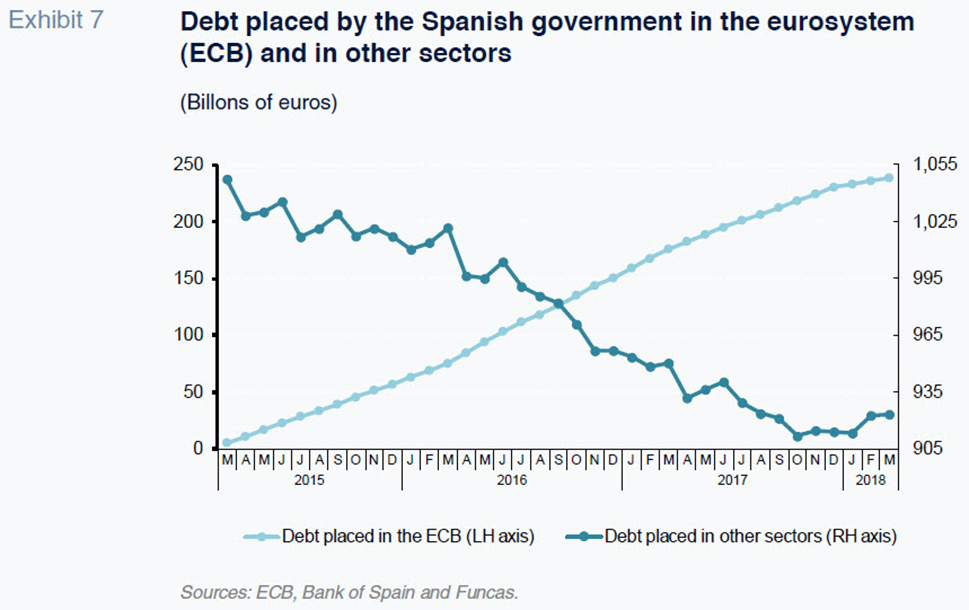

Such a high level of government borrowing leaves the Spanish economy vulnerable. Every year, the Spanish Treasury has to issue around 230 million euros just to meet its deficit and refinancing obligations. A drop in investor confidence that unleashes tension in the financial markets (

e.g. a fresh euro crisis or the end of bond buybacks by the ECB; refer to Exhibit 7) could make it harder or more expensive to place such large volumes of debt in the market. In addition, the upward trend in interest rates as a result of the normalisation of ECB monetary policy will increase the debt servicing burden. Another weakness resulting from the high level of government borrowing is the limited room for manoeuvre it leaves in terms of counter-cyclical fiscal policy to combat a potential economic slowdown, an issue of particular concern in light of the high structural public deficit in Spain.

It is therefore necessary to formulate a strategy for eliminating the structural deficit. Deleveraging should occur on a gradual basis, albeit at a rate deemed both sufficient and credible, in order to maintain investor confidence and prevent market jitters. The strategy of leaving a structural deficit in place without a clear time frame for reform and letting the debt-to-GDP ratio come down slowly by itself due to growth in the denominator is not sufficient and could have grave consequences when the current business cycle starts to dip.

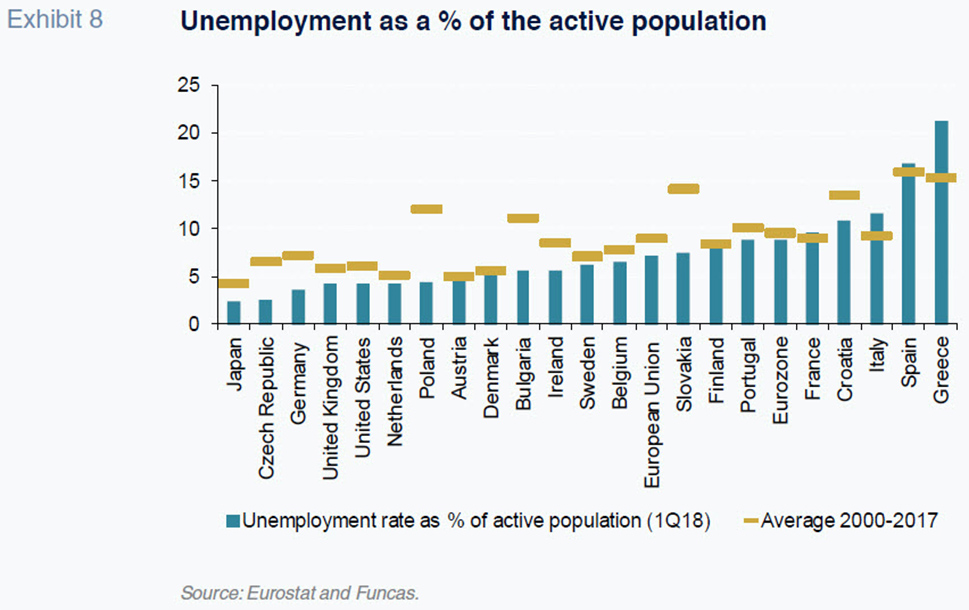

As for the labour market, despite strong growth in jobs since the start of the recovery, unemployment in Spain remains among the highest in Europe, second only to Greece (Exhibit 8). Even factoring in a complete business cycle, the international comparison remains unflattering. Between 2000 and 2017, unemployment in Spain averaged 16%, compared to 9% in the European Union and 6.1% in the US.

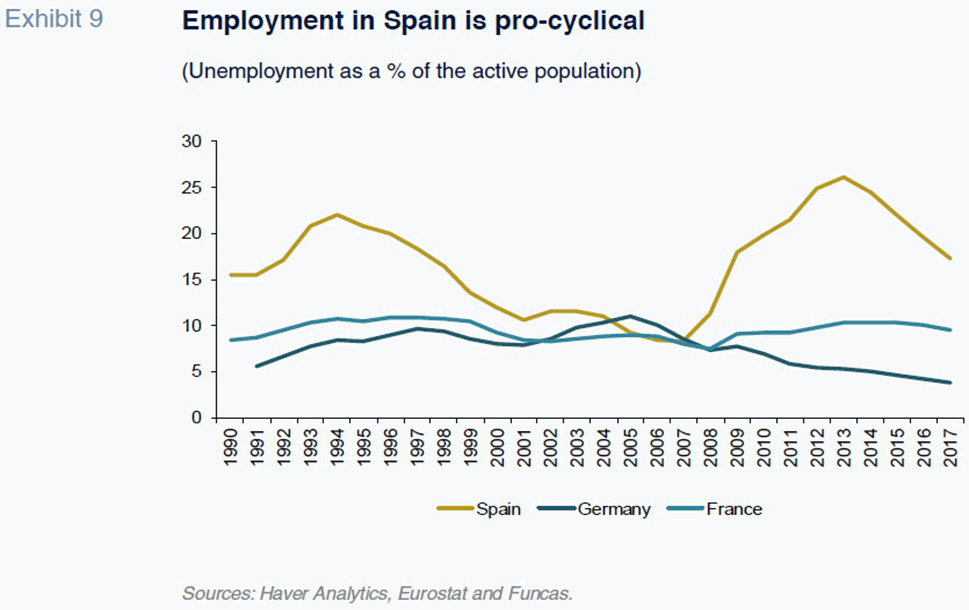

An analysis of the trends observed during the past two decades pinpoints some of the main factors responsible for this situation. The first is the remarkably pro-cyclical nature of the Spanish labour market (Exhibit 9). During episodes of recession, more jobs are destroyed in Spain than in its neighbouring economies. For example, during the recession of 2009, employment contracted by more than GDP, whereas in other countries such as Germany and even Italy, proportionately fewer jobs were lost. Similarly, during episodes of growth, more jobs are created in Spain than in these same economies. The current growth phase is proving no exception.

However, the net impact over a given business cycle as a whole is negative. During the growth phases, fewer jobs are created than are lost during a recession. Moreover, many of the people who lose their jobs, in addition to spending a relatively long period of time out of work, cannot find new work with the same level of pay. This also implies a loss of human capital and helps explain the weak growth in productivity observed over the last two decades.

The main source of job market volatility is the high incidence of temporary jobs created in Spain (Exhibit 10). This situation reflects multiple realities, among which is the abuse of certain hiring regulations, a phenomenon which not only contributes to a lack of job security but also unfair competition vis-a-vis the firms that do comply with standard employment regulations. Elsewhere, Spanish labour law is itself a source of uncertainty, particularly in the event of legal conflict. The labour courts are weighed down by a heavy workload and are given considerable room for legislative interpretation. Consequently, the courts take a relatively long time to rule on cases, which is why some companies, particularly the smaller ones, are reluctant to create permanent jobs. In Germany and Italy, where the cost of firing employees is relatively high, the legislation is predictable and facilitates the rapid resolution of legal disputes. As a result, the incidence of temporary contracts is also lower in these countries.

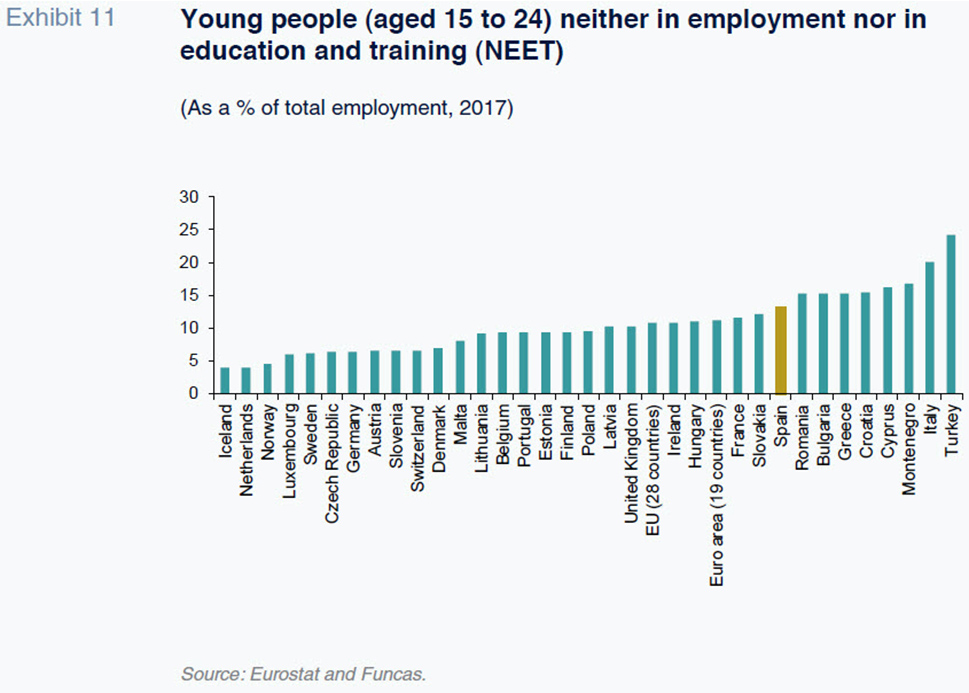

The situation faced by job-seekers and other groups outside the traditional labour market also contributes to the high rate of unemployment, particularly among young people. The transition from education to work is among the longest in Europe, as is evident in the percentage of young people neither employed nor enrolled in school (NEET; refer to Exhibit 11). The shortcomings in certain areas of training are compounded by the ineffectiveness of active labour market policies. Particularly problematic is the fact that public employment services are short-staffed. In Scandinavia and the UK, where these services work relatively well thanks to multiple reforms, each counsellor is tasked with placing between 80 and 100 job-seekers, which is half the target in Spain. As well, counsellors are given the responsibility of actually going out to meet with companies in order to identify vacancies and prepare the candidates for filling them.

In short, government debt and the job market are the main challenges facing the Spanish economy. In both cases, Spain compares unfavourably to its neighbouring economies. A concrete strategy for correcting these imbalances would strengthen Spain’s resistance to possible economic and financial shocks and facilitate more inclusive growth. The current phase of growth is the ideal time for embarking on such as journey.

Raymond Torres and María Jesús Fernández. Economic Perspectives and International Economy Division, Funcas